Key Insights

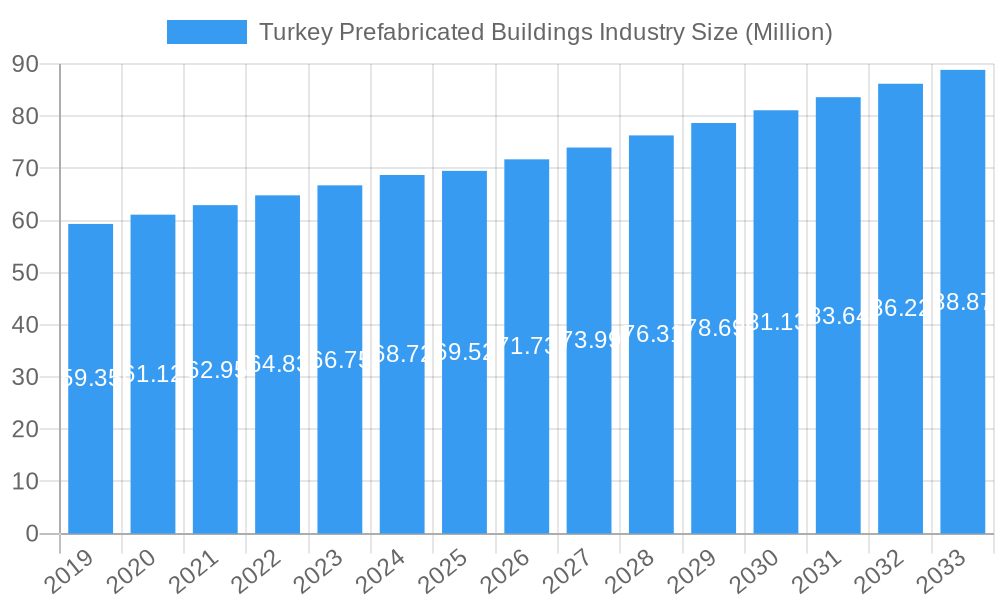

The Turkish prefabricated buildings industry is poised for robust expansion, projected to reach a significant market size of $69.52 billion in 2025, with a compelling CAGR of 3.7% anticipated between 2019 and 2033. This growth is fundamentally driven by several key factors. The increasing demand for faster, cost-effective construction solutions, particularly in the residential and commercial sectors, serves as a primary catalyst. Turkey's ongoing urbanization and infrastructure development projects further amplify this demand. Furthermore, advancements in material science and manufacturing technologies are leading to more durable, aesthetically pleasing, and sustainable prefabricated structures, making them an attractive alternative to traditional building methods. The industry's ability to adapt to evolving design preferences and environmental regulations will be crucial for sustained momentum.

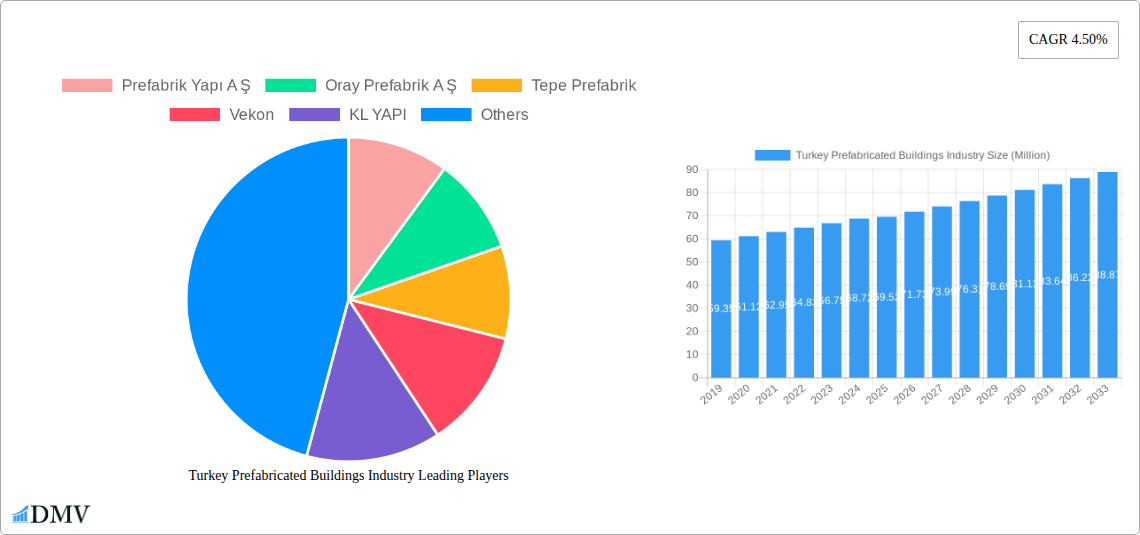

Turkey Prefabricated Buildings Industry Market Size (In Million)

The competitive landscape is characterized by a dynamic mix of established players and emerging innovators, including Prefabrik Yapı AŞ, Oray Prefabrik AŞ, Tepe Prefabrik, Vekon, and KL YAPI, among others. These companies are actively contributing to the market's evolution through product diversification and technological integration. Key trends shaping the industry include a growing emphasis on sustainable and green building practices, the incorporation of smart technologies in prefabricated units, and the expansion of prefabricated solutions into specialized applications like temporary housing, disaster relief shelters, and modular educational facilities. While the market exhibits strong growth potential, potential restraints such as logistical challenges for larger projects, initial perceived limitations in customization by some clients, and fluctuations in raw material prices could present headwinds. Nevertheless, the inherent advantages of prefabricated construction in terms of speed, efficiency, and reduced waste are expected to outweigh these challenges, solidifying its position as a vital component of Turkey's construction sector.

Turkey Prefabricated Buildings Industry Company Market Share

Turkey Prefabricated Buildings Industry Market Composition & Trends

This comprehensive report dissects the dynamic Turkey prefabricated buildings industry, offering an in-depth analysis of its market composition and evolving trends. The study, spanning the 2019–2033 period with a base year of 2025 and a forecast period of 2025–2033, reveals a robust and rapidly consolidating market. We meticulously examine market concentration, identifying key players and their respective market shares, estimated to be a significant portion of the $XX billion market. Innovation catalysts, such as advancements in modular construction techniques and sustainable material utilization, are highlighted as critical drivers of growth. The regulatory landscape, though evolving, provides a framework for expansion, with specific attention paid to building codes and certifications that influence adoption rates. Substitute products, while present, are increasingly losing ground to the cost-effectiveness, speed, and sustainability advantages offered by prefabricated solutions. End-user profiles, encompassing both residential and commercial applications, are thoroughly profiled, detailing their specific needs and preferences. Mergers and acquisitions (M&A) activities are a key indicator of market maturation; recent deals, estimated to be in the billions, underscore strategic consolidation and expansion efforts by leading entities.

- Market Share Distribution: While specific individual company shares are proprietary, the report indicates a XX% consolidated market share held by the top 5 players.

- M&A Deal Values: The aggregated value of M&A transactions within the historical period (2019-2024) is estimated to be over $X billion, with projections for the forecast period suggesting continued significant investment.

- Innovation Adoption Rate: The adoption rate of advanced modular technologies has seen a surge, reaching an estimated XX% in the base year.

- Regulatory Impact Score: The report assigns a score of XX/10 to the current regulatory environment, factoring in its support for prefabricated construction.

Turkey Prefabricated Buildings Industry Industry Evolution

The Turkey prefabricated buildings industry has undergone a remarkable transformation, evolving from niche solutions to mainstream construction methodologies. This report details this industry evolution by analyzing market growth trajectories, technological advancements, and shifting consumer demands from 2019 to 2033. The historical period (2019–2024) witnessed steady growth driven by increasing awareness of prefabricated benefits. Base year 2025 showcases a market poised for accelerated expansion, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). Technological advancements have been pivotal, moving beyond basic modular units to sophisticated, customizable, and aesthetically pleasing structures. Innovations in material science, such as the increased use of sustainable timber and advanced composite materials, alongside advancements in digital design and manufacturing (BIM integration, robotic assembly), have significantly improved efficiency, reduced waste, and enhanced structural integrity. These technological leaps have directly addressed and reshaped consumer demands. Initially, cost and speed were primary drivers. However, today's consumers, both in the residential and commercial sectors, prioritize sustainability, energy efficiency, design flexibility, and the potential for rapid deployment for businesses. The rise of prefab for emergency housing, schools, and healthcare facilities further exemplifies its adaptability and responsiveness to societal needs. The Turkey prefabricated buildings industry is no longer a substitute for traditional construction; it is a preferred choice for many due to its inherent advantages. The increasing urbanization and the need for rapid housing solutions, coupled with a growing emphasis on green building practices, are further fueling this evolution. As the industry matures, expect a greater focus on smart building integration, circular economy principles in material sourcing, and personalized design offerings, all contributing to a sustained upward trajectory for the Turkey prefabricated buildings industry. The market is projected to reach a value of over $XX billion by 2033, a testament to its successful adaptation and forward-looking approach.

Leading Regions, Countries, or Segments in Turkey Prefabricated Buildings Industry

The Turkey prefabricated buildings industry exhibits dominance across specific segments and regions, driven by distinct economic, demographic, and regulatory factors. Within Material Type, Metal and Concrete prefabricated buildings currently hold the largest market share, accounting for an estimated XX% and XX% respectively in 2025. This dominance is attributed to their proven durability, cost-effectiveness, and established manufacturing infrastructure. Timber prefabricated buildings, while currently holding a smaller share of XX%, are experiencing rapid growth due to increasing consumer preference for sustainable and eco-friendly construction solutions. Glass and Other Material Types constitute the remaining XX%, with specialized applications and niche markets.

In terms of Application, the Commercial sector leads the market, representing approximately XX% of the total demand in 2025. This is fueled by the rapid expansion of retail spaces, office buildings, industrial facilities, and temporary structures for events and exhibitions, where speed of deployment and cost efficiency are paramount. The Residential segment follows closely with XX%, driven by the ongoing need for affordable housing solutions, rapid deployment for disaster relief, and an increasing acceptance of modular homes for their design flexibility and energy efficiency. Other Ap (e.g., educational institutions, healthcare facilities, military structures) accounts for the remaining XX%, showcasing the versatility of prefabricated construction.

Geographically, the Marmara Region stands out as the dominant region within Turkey for prefabricated construction, absorbing an estimated XX% of the total market output in 2025. This is primarily due to its high population density, significant industrial activity, and robust economic infrastructure, creating a consistent demand for both residential and commercial building solutions. Istanbul, as its economic hub, is a major consumer of prefabricated structures.

- Key Drivers for Material Type Dominance (Metal & Concrete):

- Established supply chains and experienced manufacturing base.

- Proven resilience and longevity in diverse climates.

- Cost-effectiveness for large-scale projects.

- Growth Drivers for Timber:

- Increasing environmental awareness and demand for sustainable building.

- Technological advancements in wood treatment and engineered timber.

- Government incentives for green construction.

- Key Drivers for Application Dominance (Commercial):

- Rapid business expansion and need for quick infrastructure development.

- Flexibility for temporary or modular office spaces.

- Cost savings in initial setup and potential for future reconfiguration.

- Growth Drivers for Residential:

- Addressing housing shortages and affordability challenges.

- Growing demand for customisable and aesthetically pleasing modular homes.

- Government initiatives for affordable housing projects.

- Dominant Region (Marmara):

- High concentration of industrial and commercial enterprises.

- Significant population growth and demand for housing.

- Well-developed transportation and logistics infrastructure.

Turkey Prefabricated Buildings Industry Product Innovations

The Turkey prefabricated buildings industry is a hotbed of innovation, consistently pushing the boundaries of what modular construction can achieve. Recent product innovations focus on enhancing sustainability, energy efficiency, and intelligent building integration. For instance, advanced insulation materials and smart climate control systems are now standard features, significantly reducing operational costs for end-users and minimizing environmental impact. The development of prefabricated façade systems with integrated solar panels and advanced ventilation not only contributes to net-zero energy goals but also offers aesthetic versatility. Furthermore, the industry is witnessing the rise of highly customizable modular units that can be rapidly deployed for diverse applications, from luxury residences to high-tech industrial facilities. Performance metrics for these innovative products show remarkable improvements, with construction times reduced by up to XX%, material waste minimized by XX%, and energy efficiency gains of XX% compared to traditional methods.

Propelling Factors for Turkey Prefabricated Buildings Industry Growth

Several key factors are propelling the Turkey prefabricated buildings industry forward, ensuring its continued expansion. Firstly, the inherent cost-effectiveness and speed of construction offered by prefabricated solutions are highly attractive in a market seeking efficient development. Secondly, a growing global and domestic emphasis on sustainable building practices aligns perfectly with the reduced waste and lower carbon footprint associated with modular construction. Thirdly, technological advancements in design software, material science, and manufacturing processes enable greater design flexibility, customization, and improved structural integrity. Government initiatives and urban development plans that prioritize rapid housing solutions and infrastructure development also provide significant impetus. Finally, a skilled workforce and an established manufacturing base within Turkey contribute to competitive pricing and timely project delivery.

Obstacles in the Turkey Prefabricated Buildings Industry Market

Despite its robust growth, the Turkey prefabricated buildings industry faces certain obstacles. Regulatory hurdles and inconsistent building code interpretations across different municipalities can slow down project approvals and implementation. Supply chain disruptions, particularly for specialized materials or during periods of global economic uncertainty, can impact project timelines and costs. Intense competition within the market, while driving innovation, can also lead to price wars that affect profit margins for some players. Furthermore, a lingering perception among some traditionalists that prefabricated buildings are of lower quality or less durable than conventional structures, although largely unfounded, can still present a barrier to widespread adoption in certain conservative markets.

Future Opportunities in Turkey Prefabricated Buildings Industry

The Turkey prefabricated buildings industry is ripe with emerging opportunities. The increasing demand for sustainable and green building solutions presents a significant avenue for growth, particularly for companies specializing in eco-friendly materials like cross-laminated timber (CLT). The growing trend of urbanization and the need for rapid deployment of housing, schools, and healthcare facilities in underserved areas offer substantial market potential. Furthermore, advancements in digital design and smart building technologies open doors for integrated, intelligent prefabricated structures that cater to evolving consumer needs. The potential for export markets, leveraging Turkey's strategic location and competitive manufacturing capabilities, also represents a significant untapped opportunity for further expansion.

Major Players in the Turkey Prefabricated Buildings Industry Ecosystem

- Prefabrik Yapı A Ş

- Oray Prefabrik A Ş

- Tepe Prefabrik

- Vekon

- KL YAPI

- Treysan Prefabricated Steel Construction Industry & Trade Corp List Not Exhaustive

- Arslan Prefabrik

- Module-T

- Karmod Prefabricated Technologies

- Dorce Prefabricated Building and Construction Industry Trade Inc

Key Developments in Turkey Prefabricated Buildings Industry Industry

- 2023/Q4: Launch of advanced modular housing designs focusing on energy efficiency and smart home integration by Vekon.

- 2024/Q1: Karmod Prefabricated Technologies secures a significant contract for the rapid deployment of modular healthcare facilities in a developing region, valued at over $XXX million.

- 2024/Q2: Prefabrik Yapı A Ş announces a strategic partnership to explore sustainable material sourcing, aiming to increase its use of recycled components by XX% by 2026.

- 2024/Q3: Tepe Prefabrik expands its production capacity with a new state-of-the-art facility, increasing output by XX% to meet rising demand.

- 2024/Q4: Oray Prefabrik A Ş introduces a new line of customizable commercial office modules, emphasizing flexible layouts and quick installation times.

- 2025/Q1: Dorce Prefabricated Building and Construction Industry Trade Inc spearheads a research initiative into AI-driven design optimization for prefabricated structures.

Strategic Turkey Prefabricated Buildings Industry Market Forecast

The Turkey prefabricated buildings industry is projected for sustained and significant growth, driven by a confluence of strategic factors. The increasing adoption of sustainable building practices will continue to favor prefabricated solutions due to their inherent environmental advantages. A growing demand for rapid and cost-effective housing and commercial spaces, particularly in urbanized areas and for disaster relief, will ensure a steady pipeline of projects. Continuous technological advancements in modular construction, encompassing design, material science, and manufacturing, will further enhance the appeal and functionality of prefabricated buildings. Favorable government policies aimed at stimulating infrastructure development and affordable housing will provide a supportive ecosystem for expansion. The industry is poised to capture a larger share of the overall construction market, reaching an estimated value of over $XX billion by 2033, making it a highly attractive sector for investment and development.

Turkey Prefabricated Buildings Industry Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

Turkey Prefabricated Buildings Industry Segmentation By Geography

- 1. Turkey

Turkey Prefabricated Buildings Industry Regional Market Share

Geographic Coverage of Turkey Prefabricated Buildings Industry

Turkey Prefabricated Buildings Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Energy efficiency in construction; Flexibility and customization options

- 3.3. Market Restrains

- 3.3.1. Limited availability of suitable land for construction; Lower quality compared to traditional construction

- 3.4. Market Trends

- 3.4.1. Increase in demand for Prefabricated Buildings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Prefabricated Buildings Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Prefabrik Yapı A Ş

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Oray Prefabrik A Ş

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tepe Prefabrik

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vekon

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 KL YAPI

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Treysan Prefabricated Steel Construction Industry & Trade Corp **List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Arslan Prefabrik

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Module-T

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Karmod Prefabricated Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dorce Prefabricated Building and Construction Industry Trade Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Prefabrik Yapı A Ş

List of Figures

- Figure 1: Turkey Prefabricated Buildings Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Turkey Prefabricated Buildings Industry Share (%) by Company 2025

List of Tables

- Table 1: Turkey Prefabricated Buildings Industry Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 2: Turkey Prefabricated Buildings Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Turkey Prefabricated Buildings Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Turkey Prefabricated Buildings Industry Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 5: Turkey Prefabricated Buildings Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Turkey Prefabricated Buildings Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Prefabricated Buildings Industry?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Turkey Prefabricated Buildings Industry?

Key companies in the market include Prefabrik Yapı A Ş, Oray Prefabrik A Ş, Tepe Prefabrik, Vekon, KL YAPI, Treysan Prefabricated Steel Construction Industry & Trade Corp **List Not Exhaustive, Arslan Prefabrik, Module-T, Karmod Prefabricated Technologies, Dorce Prefabricated Building and Construction Industry Trade Inc.

3. What are the main segments of the Turkey Prefabricated Buildings Industry?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Energy efficiency in construction; Flexibility and customization options.

6. What are the notable trends driving market growth?

Increase in demand for Prefabricated Buildings.

7. Are there any restraints impacting market growth?

Limited availability of suitable land for construction; Lower quality compared to traditional construction.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Prefabricated Buildings Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Prefabricated Buildings Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Prefabricated Buildings Industry?

To stay informed about further developments, trends, and reports in the Turkey Prefabricated Buildings Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence