Key Insights

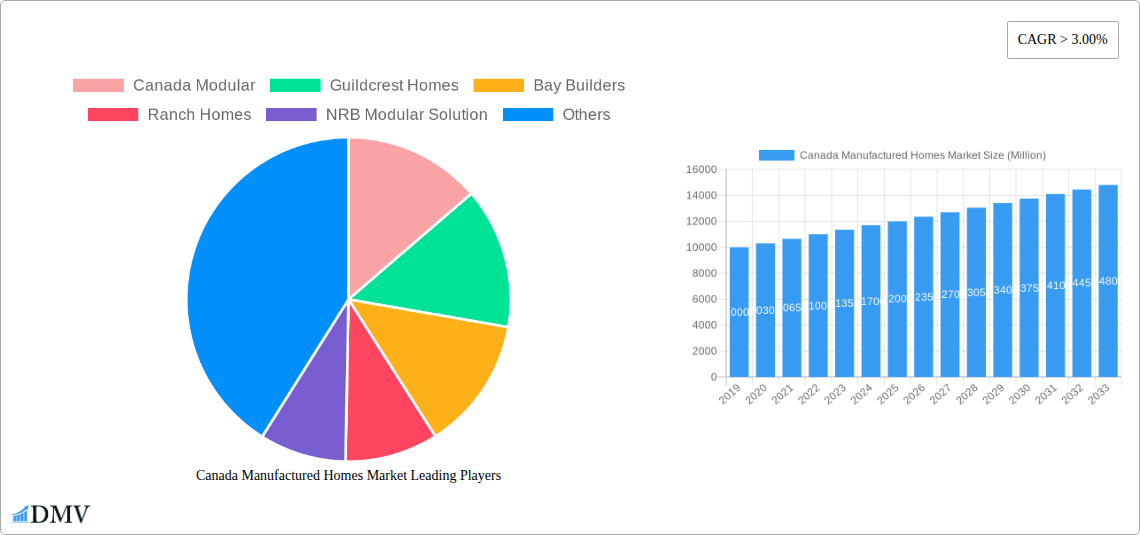

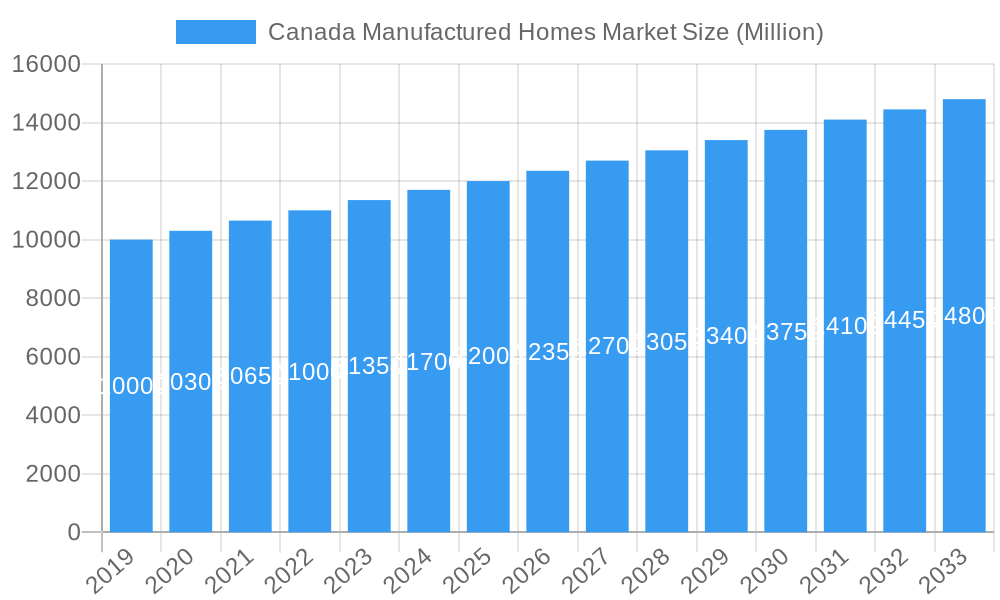

The Canadian manufactured homes market is projected for significant expansion, driven by the escalating demand for cost-effective and eco-friendly housing. The market size is estimated at 3.09 billion in the base year of 2025 and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 7.19% by 2033. Key growth catalysts include rising traditional construction expenses, increasing population requiring diverse housing solutions, and growing environmental consciousness favoring modular construction. The market is segmented by type, with "Single Family" and "Multi Family" housing expected to attract substantial interest, addressing varied buyer requirements and investment prospects. Leading companies such as Canada Modular, Guildcrest Homes, and Champion Home Builders are pioneering innovative designs and construction methods, enhancing the attractiveness and efficiency of manufactured homes.

Canada Manufactured Homes Market Market Size (In Billion)

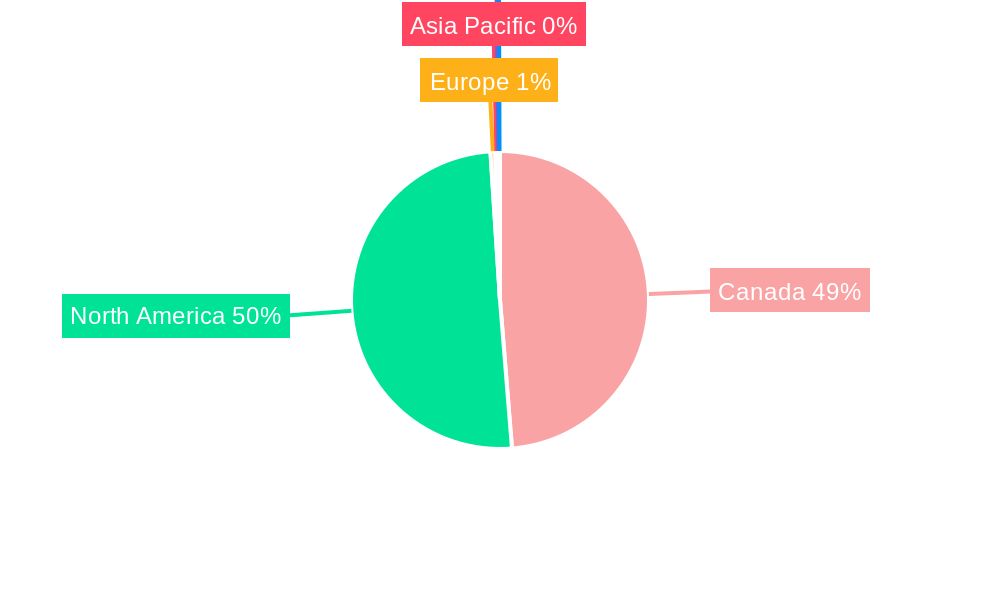

Emerging trends, including smart home technology integration, sustainable building materials, and personalized design choices, are actively redefining the Canadian manufactured homes sector. These innovations are successfully challenging outdated perceptions, positioning manufactured housing as a high-quality, modern, and practical housing alternative. While affordability and rapid construction remain strong market drivers, potential challenges may arise from persistent negative perceptions, localized zoning restrictions, and the necessity for infrastructural development to support broader market penetration. Nevertheless, the market outlook is overwhelmingly optimistic, with strategic investments and technological advancements poised to mitigate these obstacles and ensure sustained growth. The "Canada" region is expected to lead market performance, supported by robust domestic demand and favorable regulatory frameworks for modular and prefabricated construction.

Canada Manufactured Homes Market Company Market Share

Canada Manufactured Homes Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Canada Manufactured Homes Market, offering strategic insights into its current landscape, historical trajectory, and future potential. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this research is essential for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the competitive environment.

Canada Manufactured Homes Market Market Composition & Trends

The Canada Manufactured Homes Market exhibits a dynamic composition influenced by evolving construction technologies, economic conditions, and evolving consumer preferences. Market concentration is moderate, with a mix of large established players and emerging niche manufacturers. Innovation catalysts include advancements in modular construction, sustainable building materials, and smart home technologies, driving the demand for modern and efficient housing solutions. The regulatory landscape plays a crucial role, with building codes and zoning laws impacting factory-built home acceptance and deployment. Substitute products, such as traditional site-built homes and rental accommodations, present ongoing competition. End-user profiles are diverse, encompassing first-time homebuyers, retirees seeking affordable housing, developers of multi-family projects, and those requiring rapid housing solutions for remote or disaster-affected areas. Mergers and acquisitions (M&A) activity, estimated at approximately $XXX Million, indicates a trend towards consolidation and strategic expansion within the industry.

- Market Share Distribution: Key players like Canada Modular, Guildcrest Homes, and Champion Home Builders hold significant market shares, while smaller, specialized firms cater to specific regional demands.

- M&A Deal Values: Recent acquisitions have focused on expanding manufacturing capacity and technological capabilities, with deal values ranging from $XX Million to $XXX Million.

- Innovation Drivers: Focus on energy efficiency, customization options, and faster construction times are key motivators for innovation.

- Regulatory Impact: Harmonization of building codes and streamlined permitting processes are critical for market growth.

- End-User Demographics: Growing demand from younger demographics seeking affordability and seniors prioritizing low-maintenance living.

Canada Manufactured Homes Market Industry Evolution

The Canada Manufactured Homes Market has undergone a significant evolution, transitioning from its traditional perception to a modern, high-quality housing solution. Over the historical period (2019-2024), the market witnessed steady growth driven by increasing housing affordability concerns and a growing acceptance of factory-built homes as a viable alternative to conventional construction. The base year of 2025 marks a pivotal point, with the market poised for accelerated expansion during the forecast period (2025-2033). Technological advancements have been central to this evolution. Innovations in 3D printing, advanced robotics in manufacturing, and the integration of sustainable materials have not only improved the quality and durability of manufactured homes but also reduced construction time and costs. For instance, the adoption of Building Information Modeling (BIM) in the design and manufacturing process has led to greater precision and reduced waste, contributing to an estimated reduction in construction timelines by up to 25%.

Shifting consumer demands are also profoundly shaping the industry. Modern consumers are increasingly seeking homes that are not only affordable but also energy-efficient, customizable, and aesthetically pleasing. This has spurred manufacturers to offer a wider range of designs, finishes, and smart home features. The demand for Single Family manufactured homes remains robust, driven by the perennial need for homeownership. Simultaneously, the Multi Family segment is experiencing a surge in interest, particularly from developers looking for cost-effective and rapid solutions for affordable housing projects and student accommodations. Growth rates for the overall Canada Manufactured Homes Market are projected to be in the range of XX% to XX% annually during the forecast period. Adoption metrics for energy-efficient technologies, such as high-performance insulation and solar panel integration, have seen a significant uptick, with over XX% of new manufactured homes now incorporating at least one energy-saving feature. The industry's ability to adapt to these evolving demands, while adhering to stringent quality and safety standards, will be crucial for sustained growth and market penetration.

Leading Regions, Countries, or Segments in Canada Manufactured Homes Market

Within the Canada Manufactured Homes Market, the Single Family segment consistently emerges as the dominant force, outperforming the Multi Family segment in terms of market share and volume. This dominance is driven by a confluence of factors, including the persistent demand for individual homeownership across various demographic groups, particularly first-time homebuyers and families seeking greater autonomy and space. Furthermore, the inherent flexibility and customization options available within the Single Family manufactured home sector cater effectively to individual preferences and evolving lifestyles.

The Multi Family segment, while growing, is still in a nascent stage of widespread adoption compared to its Single Family counterpart. However, its trajectory is upward, fueled by the escalating housing crisis in urban centers and the increasing need for affordable rental and ownership options. Government initiatives aimed at increasing housing supply and addressing affordability gaps are beginning to create a more fertile ground for Multi Family manufactured housing solutions.

Key Drivers for Single Family Dominance:

- Affordability: Manufactured homes offer a significantly lower entry price point for homeownership compared to traditional site-built homes.

- Customization: Buyers can often personalize layouts, finishes, and features to meet their specific needs and aesthetic preferences.

- Perceived Value: Increasing awareness of the quality and modern designs of contemporary manufactured homes is enhancing their appeal.

- Decentralized Housing Needs: Demand from suburban and rural areas where land costs are lower and the need for individual housing is high.

Factors Propelling Multi Family Growth:

- Urbanization and Housing Shortages: The critical need for affordable housing in major Canadian cities is driving interest in modular multi-unit constructions.

- Government Incentives: Policies and grants supporting affordable housing development can significantly boost the adoption of multi-family manufactured solutions.

- Speed of Construction: The ability to rapidly deploy multi-unit housing is attractive for developers facing tight deadlines and market demand.

- Sustainability Focus: The inherent efficiency of factory production can contribute to a more sustainable building process for larger developments.

While specific regional dominance can fluctuate based on local economic conditions and provincial regulations, provinces with a strong manufacturing base and a higher cost of traditional housing often see a more pronounced demand for manufactured homes. This includes regions like Ontario and British Columbia, which are grappling with significant housing affordability challenges. The overall market share for Single Family homes is estimated to be around XX%, with Multi Family homes accounting for the remaining XX%.

Canada Manufactured Homes Market Product Innovations

Product innovations in the Canada Manufactured Homes Market are transforming perceptions of factory-built housing. Manufacturers are increasingly integrating advanced energy-efficient technologies, such as high-performance insulation, triple-pane windows, and smart thermostats, leading to substantial reductions in utility costs for homeowners. The adoption of sustainable building materials, including recycled content and low-VOC (Volatile Organic Compound) finishes, is enhancing the environmental credentials of manufactured homes. Furthermore, the integration of smart home technology, allowing for remote control of lighting, climate, and security systems, is a significant trend. Applications are expanding beyond traditional residential uses to include modular solutions for commercial spaces, educational facilities, and emergency shelters. Performance metrics are demonstrating improved structural integrity, enhanced weather resistance, and superior thermal comfort compared to earlier generations of manufactured homes.

Propelling Factors for Canada Manufactured Homes Market Growth

Several key factors are propelling the Canada Manufactured Homes Market forward. Technological advancements in modular construction techniques, including precision manufacturing and robotic assembly, are increasing efficiency and reducing build times. The growing demand for affordable housing solutions, exacerbated by rising land and traditional construction costs across Canada, makes manufactured homes an attractive alternative. Furthermore, government initiatives and incentives aimed at promoting housing affordability and sustainable building practices are providing significant tailwinds for the industry. The increasing environmental consciousness among consumers is also driving demand for energy-efficient and sustainably produced homes, a niche where manufactured homes are well-positioned to excel.

Obstacles in the Canada Manufactured Homes Market Market

Despite its growth potential, the Canada Manufactured Homes Market faces several obstacles. Regulatory hurdles, including varying building codes across different municipalities and provinces, can complicate and delay the deployment of manufactured homes. Persistent negative perceptions and outdated stereotypes about the quality and durability of factory-built housing continue to be a barrier for some consumers and lenders. Supply chain disruptions, particularly those impacting raw material availability and logistics, can lead to increased costs and extended delivery times. The competitive pressure from established traditional construction methods and the evolving landscape of alternative housing solutions also requires continuous innovation and adaptation from manufacturers.

Future Opportunities in Canada Manufactured Homes Market

Emerging opportunities in the Canada Manufactured Homes Market are abundant. The increasing demand for accessory dwelling units (ADUs) presents a significant market segment for smaller, customizable manufactured homes. Innovations in modular construction for multi-family housing projects, particularly for affordable housing initiatives, are poised for substantial growth. The development of net-zero ready and passive house-certified manufactured homes will cater to the growing demand for sustainable and energy-efficient dwellings. Furthermore, the potential for utilizing manufactured housing in disaster relief and rapid deployment scenarios offers a socially impactful and commercially viable avenue for expansion.

Major Players in the Canada Manufactured Homes Market Ecosystem

- Canada Modular

- Guildcrest Homes

- Bay Builders

- Ranch Homes

- NRB Modular Solution

- ATCO

- Champion Home Builders

- Comfort Homes

- KB Prefab

- Linwood Homes

- Smart Modular Canada

- Quality Homes

- Stack Modular

- Northern Comfort Modular Homes

- Alta-Fab Structures

- Legendary Homes

- Royal Homes

Key Developments in Canada Manufactured Homes Market Industry

- 2023 Q4: Guildcrest Homes announces expansion of its manufacturing facility, increasing production capacity by 20% to meet rising demand for custom single-family homes.

- 2024 Q1: Champion Home Builders launches a new line of energy-efficient manufactured homes featuring advanced insulation and smart home integration, with early sales exceeding projections by 15%.

- 2024 Q2: ATCO secures a significant contract to supply modular housing units for a new remote mining operation in Northern Canada, highlighting the growing use of manufactured homes in industrial applications.

- 2024 Q3: Smart Modular Canada partners with a major developer to provide modular units for an affordable multi-family housing project in Vancouver, signaling increasing adoption in urban development.

- 2024 Q4: The Canadian government announces new incentives aimed at promoting the adoption of sustainable building materials in modular construction, potentially boosting the market for eco-friendly manufactured homes.

Strategic Canada Manufactured Homes Market Market Forecast

The strategic Canada Manufactured Homes Market forecast indicates robust growth driven by persistent housing affordability challenges and increasing consumer acceptance of modern, high-quality factory-built homes. Future opportunities lie in further technological integration, including advanced automation and sustainable material sourcing, as well as expanding into the multi-family and accessory dwelling unit segments. Continued innovation in design, energy efficiency, and smart home features will be crucial for manufacturers to capture a larger market share. The market is projected to witness sustained expansion, fueled by supportive government policies and a growing demand for flexible, cost-effective housing solutions across Canada.

Canada Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

Canada Manufactured Homes Market Segmentation By Geography

- 1. Canada

Canada Manufactured Homes Market Regional Market Share

Geographic Coverage of Canada Manufactured Homes Market

Canada Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urabanization4.; Increasing government investments

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market

- 3.4. Market Trends

- 3.4.1. The Rapid Rise of Affordable Manufacturing Housing Market in Canada

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Manufactured Homes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Canada Modular

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guildcrest Homes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bay Builders

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ranch Homes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NRB Modular Solution

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ATCO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Champion Home Builders

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Comfort Homes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 KB Prefab**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Linwood Homes

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Smart Modular Canada

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Quality Homes

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Stack Modular

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Northern Comfort Modular Homes

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Alta-Fab Structures

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Legendary Homes

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Royal Homes

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Canada Modular

List of Figures

- Figure 1: Canada Manufactured Homes Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Manufactured Homes Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Manufactured Homes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Canada Manufactured Homes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Canada Manufactured Homes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Canada Manufactured Homes Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Manufactured Homes Market?

The projected CAGR is approximately 7.19%.

2. Which companies are prominent players in the Canada Manufactured Homes Market?

Key companies in the market include Canada Modular, Guildcrest Homes, Bay Builders, Ranch Homes, NRB Modular Solution, ATCO, Champion Home Builders, Comfort Homes, KB Prefab**List Not Exhaustive, Linwood Homes, Smart Modular Canada, Quality Homes, Stack Modular, Northern Comfort Modular Homes, Alta-Fab Structures, Legendary Homes, Royal Homes.

3. What are the main segments of the Canada Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.09 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urabanization4.; Increasing government investments.

6. What are the notable trends driving market growth?

The Rapid Rise of Affordable Manufacturing Housing Market in Canada.

7. Are there any restraints impacting market growth?

4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the Canada Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence