Key Insights

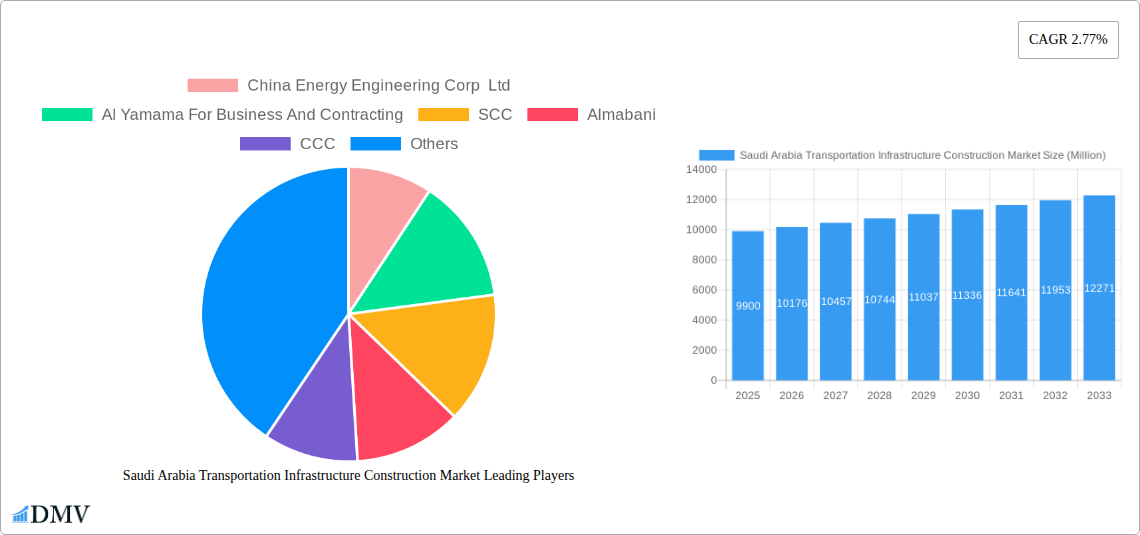

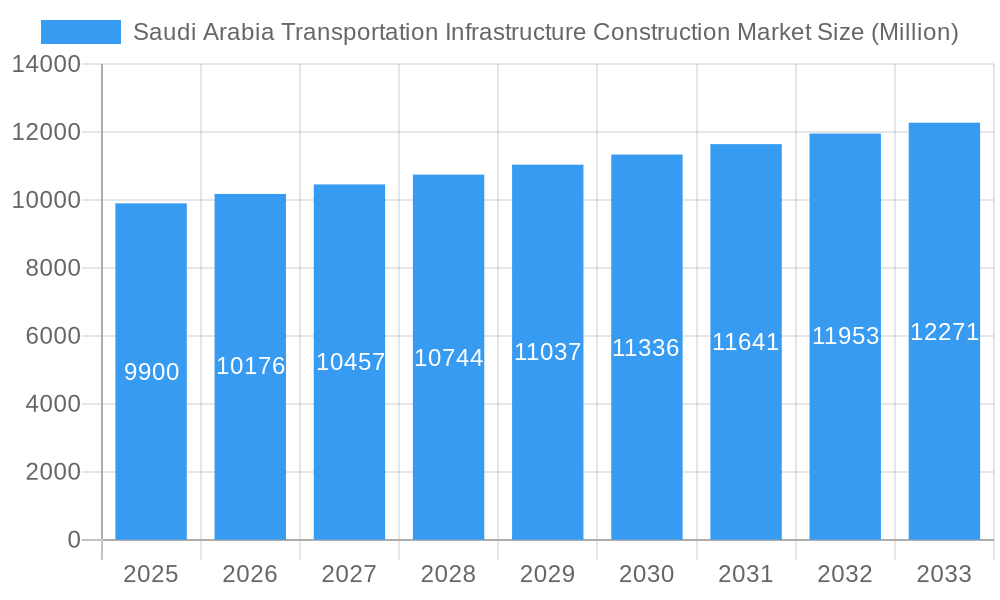

The Saudi Arabia transportation infrastructure construction market is experiencing robust growth, projected to reach a market size of $9.90 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 2.77% from 2025 to 2033. This expansion is driven by the Kingdom's Vision 2030, a comprehensive national development plan prioritizing infrastructure development to diversify the economy and improve quality of life. Significant investments in road networks, railway expansion (including the Haramain High-Speed Railway and other projects), airport modernization and expansion (like the expansion of King Abdulaziz International Airport), and port development are key contributors to this growth. Government initiatives promoting private sector participation through Public-Private Partnerships (PPPs) are further accelerating investment and construction activity. The market is segmented by mode of transportation, with roads currently holding the largest share, followed by railways and airports. Competition is intense, with both international and domestic players vying for projects. The market faces challenges such as fluctuating oil prices, potential supply chain disruptions, and the need for skilled labor. However, the long-term outlook remains positive, fueled by sustained government commitment to infrastructure upgrades and the continuous influx of foreign direct investment.

Saudi Arabia Transportation Infrastructure Construction Market Market Size (In Billion)

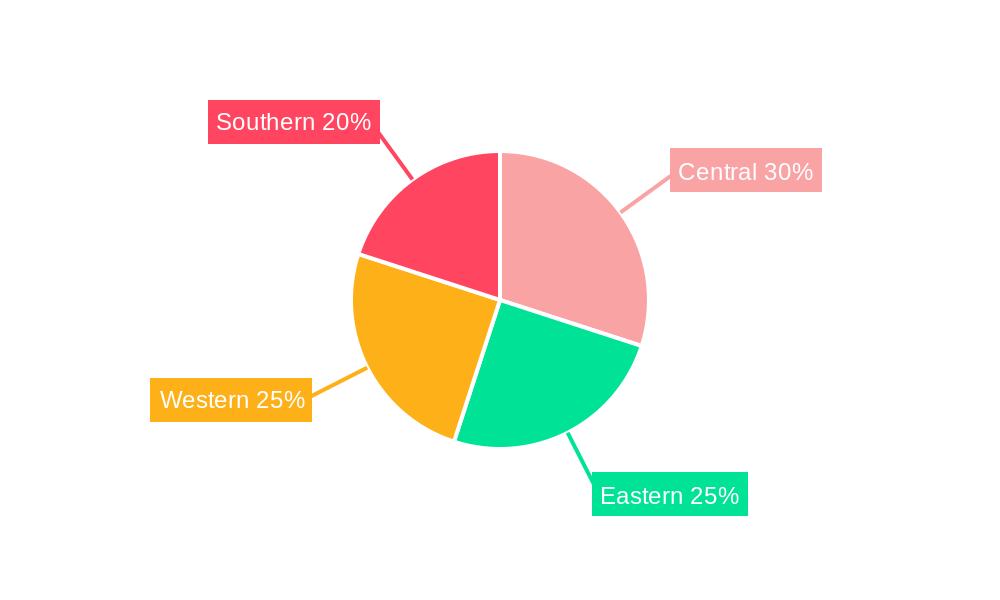

The regional distribution of projects within Saudi Arabia reflects the national development strategy's focus on connecting various regions. Central, Eastern, Western, and Southern regions all contribute significantly to the market’s overall growth. While the precise market share for each region isn't specified, it's reasonable to anticipate higher concentration in regions with major population centers and industrial hubs. The forecast period (2025-2033) will see considerable expansion, with further diversification into sustainable transportation solutions and smart city initiatives likely to shape future growth trajectories. Key players like China Energy Engineering Corp Ltd, Saudi companies (SCC, Almabani, etc.), and international firms (Jacobs, Bechtel, Fluor Corp) are actively shaping the market landscape through their project wins and technological contributions.

Saudi Arabia Transportation Infrastructure Construction Market Company Market Share

Saudi Arabia Transportation Infrastructure Construction Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Saudi Arabia Transportation Infrastructure Construction Market, covering the period from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this study offers invaluable insights into market dynamics, growth drivers, and future opportunities for stakeholders. The report meticulously examines market segments by mode (Roads, Railways, Airports, Waterways), revealing key trends and highlighting leading players. The total market value is projected to reach XXX Million by 2033, showcasing significant growth potential.

Saudi Arabia Transportation Infrastructure Construction Market Composition & Trends

The Saudi Arabian transportation infrastructure construction market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller and specialized contractors ensures a competitive environment. Innovation is driven by government initiatives promoting sustainable and technologically advanced solutions, while the regulatory framework, while supportive of development, requires navigating complex permitting and approval processes. Substitute products are limited, given the necessity of physical infrastructure. End-users primarily comprise government entities, private developers, and concessionaires. Recent M&A activity has involved strategic acquisitions by international firms seeking access to this burgeoning market. Market share distribution is estimated as follows: Top 5 players account for approximately XX% of the market in 2025, while smaller players contribute the remaining XX%. M&A deal values have exceeded XXX Million in the last five years.

- Market Concentration: Moderately concentrated with a blend of large international and domestic players.

- Innovation Catalysts: Government support for sustainable infrastructure and technological advancements (e.g., smart city initiatives).

- Regulatory Landscape: Supportive but complex, requiring careful navigation of bureaucratic procedures.

- Substitute Products: Limited due to the inherent nature of physical infrastructure projects.

- End-User Profile: Primarily government agencies, private developers, and concessionaires.

- M&A Activity: Significant activity in recent years, with increasing foreign investment.

Saudi Arabia Transportation Infrastructure Construction Market Industry Evolution

The Saudi Arabian transportation infrastructure construction market has experienced robust growth, fueled by Vision 2030's ambitious infrastructure development plans. From 2019 to 2024, the market witnessed a compound annual growth rate (CAGR) of approximately XX%. This growth is attributed to massive investments in road networks, railway expansion projects like the Haramain High-Speed Railway, and the modernization of airports. Technological advancements like Building Information Modeling (BIM) and the adoption of sustainable construction practices are transforming the industry. Shifting consumer demands, reflected in the need for efficient, reliable, and sustainable transportation solutions, further drive growth. This trend is expected to continue, with a projected CAGR of XX% during the forecast period (2025-2033), leading to a market value of XXX Million by 2033. The increasing focus on public transportation and the adoption of smart mobility solutions will further shape market evolution.

Leading Regions, Countries, or Segments in Saudi Arabia Transportation Infrastructure Construction Market

The Roads segment currently dominates the Saudi Arabia transportation infrastructure construction market, driven by extensive road network expansion and modernization projects across the kingdom. This dominance is fueled by significant government investments in highway infrastructure and the increasing demand for efficient connectivity within and between cities. Investment in railway projects is also substantial, albeit currently holding a smaller market share, with considerable expansion planned under Vision 2030, promising significant future growth. Airports continue to witness substantial investment for capacity expansion and upgrades, while the waterway segment represents a smaller but strategically important portion.

- Roads:

- Key Drivers: Massive government investment in highway construction, expanding road networks to support economic growth.

- Dominance Factors: High volume of projects, relatively shorter project timelines compared to railways or airports.

- Railways:

- Key Drivers: Vision 2030's focus on developing high-speed rail networks and improved intercity connectivity.

- Dominance Factors: Long-term contracts, technological sophistication driving high project value.

- Airports:

- Key Drivers: Increasing passenger traffic and the need for modernization and capacity expansion at existing and new airports.

- Dominance Factors: Large-scale infrastructure projects, long-term operational contracts.

- Waterways:

- Key Drivers: Strategic importance for trade and logistics, and potential expansion driven by maritime industry growth.

- Dominance Factors: Specific niche projects and strong government support for maritime infrastructure.

Saudi Arabia Transportation Infrastructure Construction Market Product Innovations

The market is witnessing increasing adoption of innovative materials, such as high-performance concrete and advanced composite materials, improving durability and reducing construction time. Digital technologies, including BIM and 3D printing, are enhancing design efficiency and construction accuracy. Sustainable construction practices, like the utilization of renewable energy and the reduction of carbon emissions, are gaining traction, driven by government regulations and environmental concerns. These innovations contribute to improving project efficiency, reducing costs, and minimizing environmental impact.

Propelling Factors for Saudi Arabia Transportation Infrastructure Construction Market Growth

The Saudi Arabian transportation infrastructure construction market’s growth is driven by several factors. Vision 2030's ambitious plans for infrastructure development constitute a major catalyst, allocating significant funds for transportation projects. Economic diversification initiatives necessitate improving logistics and transportation networks, further boosting demand. Favorable government policies and regulations support private sector participation and foreign direct investment, facilitating market expansion. Furthermore, technological advancements continue to increase efficiency and productivity within the construction sector.

Obstacles in the Saudi Arabia Transportation Infrastructure Construction Market

The market faces challenges such as potential supply chain disruptions affecting material availability and cost, especially given global volatility. Competition among contractors can put downward pressure on pricing. Securing skilled labor remains a key concern, and stringent regulatory compliance adds complexity to project execution. These factors can impact project timelines and profitability. For example, recent global supply chain issues have led to an estimated XX% increase in material costs in 2024.

Future Opportunities in Saudi Arabia Transportation Infrastructure Construction Market

Future opportunities lie in the continued expansion of high-speed rail networks, the development of smart city infrastructure incorporating intelligent transportation systems, and the growth of sustainable transportation solutions. The construction of new airports and the expansion of existing ones offer significant potential, along with the development of more resilient and sustainable infrastructure to address climate change challenges. The increasing adoption of innovative technologies presents further opportunities for market players.

Major Players in the Saudi Arabia Transportation Infrastructure Construction Market Ecosystem

- China Energy Engineering Corp Ltd

- Al Yamama For Business And Contracting

- SCC

- Almabani

- CCC

- Al-Rashid Trading & Contracting Company

- Jacobs

- Binyah

- Gilbane Building Co

- Mohammed Al Mojil Group Co

- CB&I LLC

- Afras For Trading And Contracting Company

- Fluor Corp

- Al Latifa Trading and Contracting

- Bechtel

- Tekfen Construction and Installation Co Inc

- Al-Ayuni

- Al-Jabreen Contracting Co

- China Railway Construction Corp Ltd

- AL Jazirah Engineers & Consultants

Key Developments in Saudi Arabia Transportation Infrastructure Construction Market Industry

- October 2022: Alstom announced plans to open a new regional office in Riyadh, signaling increased commitment to the Saudi Arabian railway market. This strengthens their position and potentially increases competition.

- January 2023: RATP Dev secured a contract with the Royal Commission for AlUla for '360 Mobility' services, indicating a focus on integrated and smart transportation solutions in developing areas. This demonstrates a shift toward integrated mobility systems.

Strategic Saudi Arabia Transportation Infrastructure Construction Market Forecast

The Saudi Arabia transportation infrastructure construction market is poised for significant growth throughout the forecast period (2025-2033). Continued government investment, technological advancements, and a focus on sustainable solutions will drive market expansion. The focus on Vision 2030 initiatives will further stimulate growth. The market's potential is substantial, with opportunities in various segments, particularly in high-speed rail, smart city development, and sustainable infrastructure projects. The overall positive outlook for the kingdom's economy supports a continued strong trajectory for this sector.

Saudi Arabia Transportation Infrastructure Construction Market Segmentation

-

1. Mode

- 1.1. Roads

- 1.2. Railways

- 1.3. Airports

- 1.4. Waterways

Saudi Arabia Transportation Infrastructure Construction Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Transportation Infrastructure Construction Market Regional Market Share

Geographic Coverage of Saudi Arabia Transportation Infrastructure Construction Market

Saudi Arabia Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for New Dwellings Units; Government Initiatives are driving the market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Lack of Skilled Labour

- 3.4. Market Trends

- 3.4.1. Increased investment in air infrastructure driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roads

- 5.1.2. Railways

- 5.1.3. Airports

- 5.1.4. Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Energy Engineering Corp Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Al Yamama For Business And Contracting

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SCC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Almabani

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CCC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al-Rashid Trading & Contracting Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jacobs

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Binyah

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gilbane Building Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mohammed Al Mojil Group Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CB&I LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Afras For Trading And Contracting Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Fluor Corp

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Al Latifa Trading and Contracting

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Bechtel

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Tekfen Construction and Installation Co Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Al-Ayuni

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Al-Jabreen Contracting Co**List Not Exhaustive

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 China Railway Construction Corp Ltd

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 AL Jazirah Engineers & Consultants

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 China Energy Engineering Corp Ltd

List of Figures

- Figure 1: Saudi Arabia Transportation Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Transportation Infrastructure Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 2: Saudi Arabia Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Saudi Arabia Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 4: Saudi Arabia Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Transportation Infrastructure Construction Market?

The projected CAGR is approximately 2.77%.

2. Which companies are prominent players in the Saudi Arabia Transportation Infrastructure Construction Market?

Key companies in the market include China Energy Engineering Corp Ltd, Al Yamama For Business And Contracting, SCC, Almabani, CCC, Al-Rashid Trading & Contracting Company, Jacobs, Binyah, Gilbane Building Co, Mohammed Al Mojil Group Co, CB&I LLC, Afras For Trading And Contracting Company, Fluor Corp, Al Latifa Trading and Contracting, Bechtel, Tekfen Construction and Installation Co Inc, Al-Ayuni, Al-Jabreen Contracting Co**List Not Exhaustive, China Railway Construction Corp Ltd, AL Jazirah Engineers & Consultants.

3. What are the main segments of the Saudi Arabia Transportation Infrastructure Construction Market?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for New Dwellings Units; Government Initiatives are driving the market.

6. What are the notable trends driving market growth?

Increased investment in air infrastructure driving the market.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Lack of Skilled Labour.

8. Can you provide examples of recent developments in the market?

January 2023- RATP Dev announced that it has signed a contract with the Royal Commission for '360 Mobility' services for Al Ula. Under this contract, RATP Dev will assist RCU in developing the plans, policies, governance, and infrastructure, as well as the transportation assets, of AlUla's cutting-edge mobility network for residents and visitors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence