Key Insights

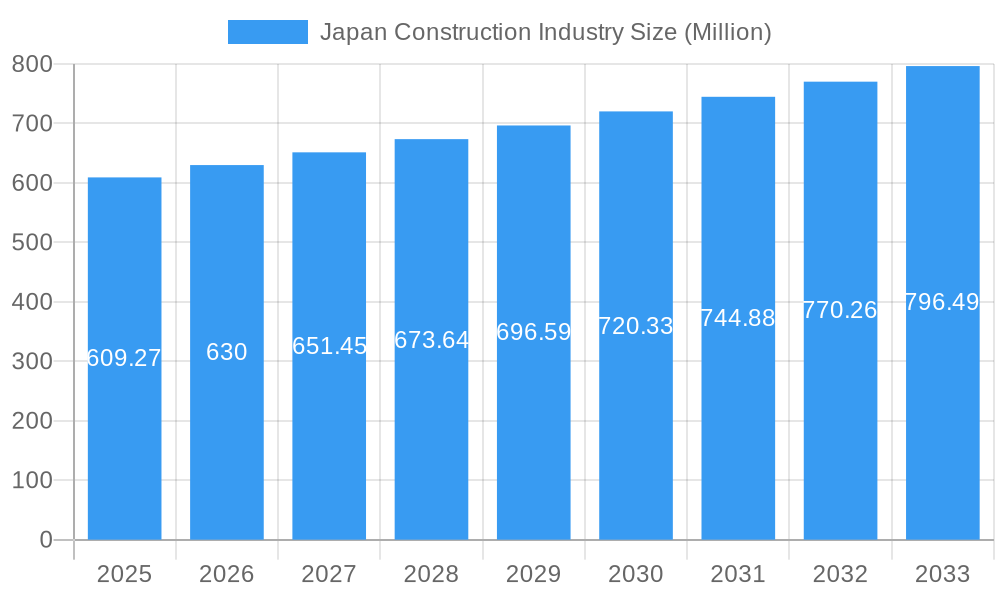

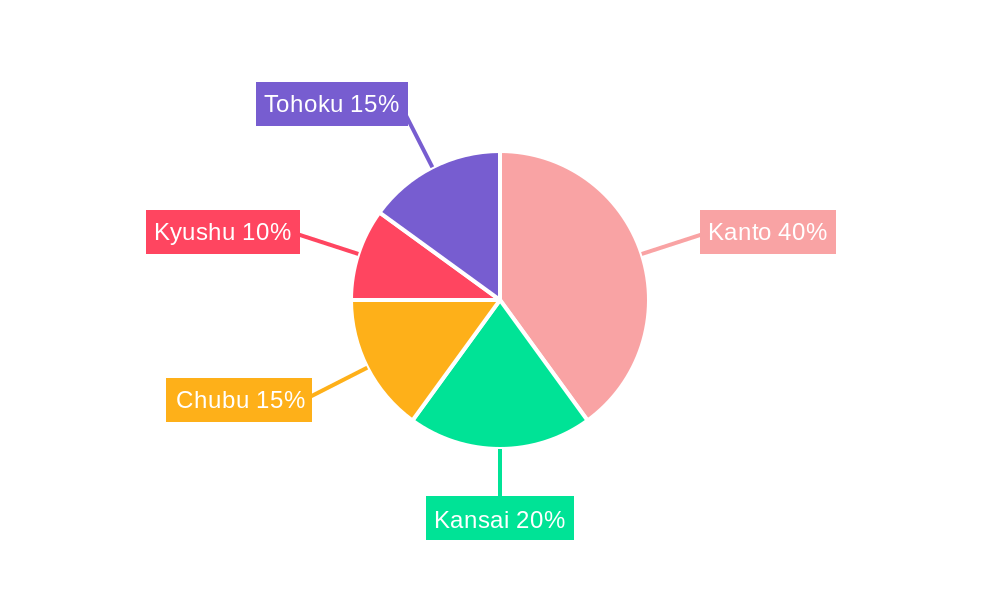

The Japan construction industry, valued at $609.27 million in 2025, is projected to experience steady growth with a compound annual growth rate (CAGR) of 3.30% from 2025 to 2033. This growth is fueled by several key drivers. Government infrastructure investments, particularly in transportation networks (high-speed rail, improved roads, and smart city initiatives), are a significant contributor. Furthermore, increasing urbanization, particularly in major metropolitan areas like Tokyo, Osaka, and Nagoya, is driving demand for residential and commercial construction. The aging infrastructure in many regions necessitates substantial renovation and redevelopment projects, further stimulating market growth. While land scarcity and stringent building regulations present challenges, innovative construction technologies, such as prefabrication and modular construction, are helping to mitigate these constraints. The sector is segmented across residential, commercial, industrial, infrastructure (transportation), and energy and utilities, with infrastructure and residential likely leading growth. Major players like Obayashi Corp, Kajima Corp, and Shimizu Corp dominate the market, exhibiting a high degree of experience and expertise. Regional variations exist, with the Kanto region (including Tokyo) expected to maintain the largest market share due to its high population density and economic activity.

Japan Construction Industry Market Size (In Million)

The forecast period (2025-2033) anticipates continued growth, albeit at a moderate pace. This reflects a balance between ongoing infrastructure development and the inherent cyclical nature of the construction industry. While specific growth rates for individual segments are not readily available, we anticipate the infrastructure sector, particularly transportation, to experience higher growth compared to other segments due to government policies focused on improving connectivity and resilience. The energy and utilities segment, driven by the transition towards renewable energy sources and modernization of grids, is also poised for significant growth. Competitive pressures from both established players and new entrants specializing in sustainable and innovative construction practices will likely shape the industry landscape in the coming years. Successful companies will need to adapt to emerging technologies and shifting regulatory frameworks to maintain market share.

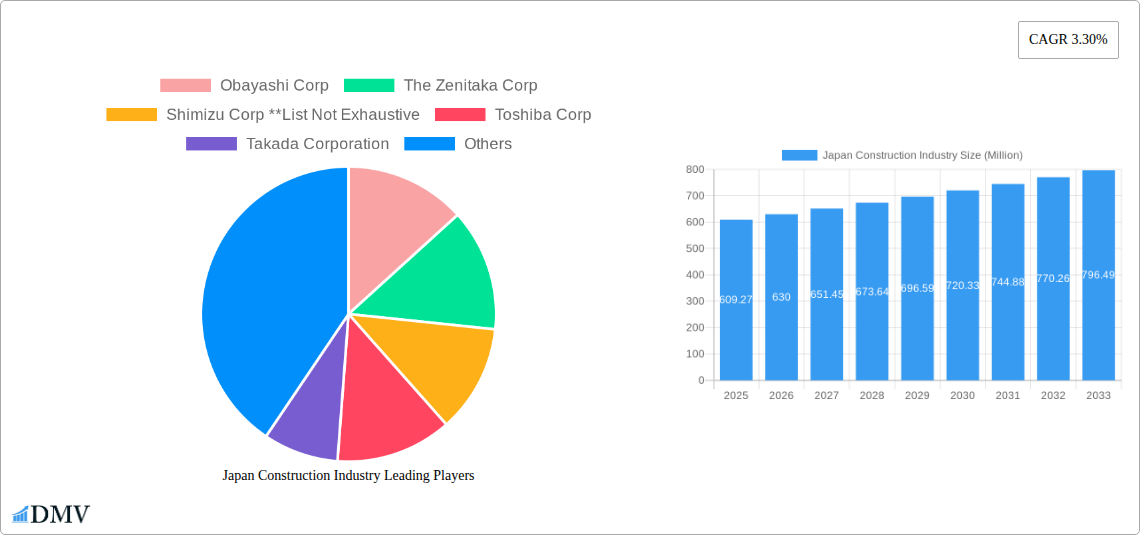

Japan Construction Industry Company Market Share

Japan Construction Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Japan Construction Industry, forecasting market trends and growth opportunities from 2025 to 2033. Based on rigorous research and data analysis covering the historical period (2019-2024), base year (2025), and estimated year (2025), this report is an invaluable resource for stakeholders seeking to understand and capitalize on the evolving dynamics of this vital sector. The market size is expected to reach xx Million by 2033, driven by significant infrastructure projects and technological advancements.

Japan Construction Industry Market Composition & Trends

This section delves into the competitive landscape of the Japanese construction market, examining market concentration, innovative drivers, regulatory frameworks, substitute materials, end-user behavior, and merger and acquisition (M&A) activity. We analyze the market share distribution amongst key players, including Obayashi Corp, Kajima Corp, Shimizu Corp, and others, revealing a moderately concentrated market with significant potential for consolidation. M&A activity in the period 2019-2024 totaled an estimated xx Million, indicating a strategic shift towards larger, more diversified entities.

- Market Concentration: High, with the top 5 players accounting for approximately xx% of the market in 2024.

- Innovation Catalysts: Government initiatives promoting sustainable construction and digitalization.

- Regulatory Landscape: Stringent building codes and environmental regulations influence material choices and construction practices.

- Substitute Products: The increasing adoption of prefabricated components and modular construction presents a competitive challenge to traditional methods.

- End-User Profiles: A diverse mix including residential developers, commercial real estate firms, industrial companies, and government agencies.

- M&A Activity: Significant consolidation is observed, with larger firms acquiring smaller companies to expand their market share and diversify their service offerings. Average deal value in 2019-2024: xx Million.

Japan Construction Industry Industry Evolution

This section details the evolution of the Japan Construction Industry from 2019 to 2033, analyzing growth trajectories, technological advancements, and changing consumer preferences. The market witnessed a compound annual growth rate (CAGR) of xx% between 2019 and 2024. We project continued growth, albeit at a slightly moderated pace, driven by factors such as increasing urbanization, aging infrastructure, and the government's emphasis on sustainable development goals. Key technological advancements, including Building Information Modeling (BIM) and the integration of robotics and AI, are transforming construction processes and boosting efficiency.

- Growth Trajectories: A CAGR of xx% from 2019 to 2024, projected to decline to xx% from 2025 to 2033 due to economic and regulatory factors.

- Technological Advancements: BIM adoption rate increased from xx% in 2019 to xx% in 2024. Robotics and AI implementation is expected to accelerate in the forecast period.

- Shifting Consumer Demands: Increased focus on sustainability, energy efficiency, and smart building technologies.

Leading Regions, Countries, or Segments in Japan Construction Industry

The Japanese construction market is geographically diverse, with varying levels of activity across different regions and sectors. However, the infrastructure (Transportation) segment has consistently dominated the market, driven by substantial government investment in upgrading and expanding transportation networks. Residential construction also maintains a significant share, fuelled by urbanization and population growth.

- Infrastructure (Transportation): Key Drivers: Government investment in high-speed rail projects, airport expansions, and road infrastructure upgrades. This segment is projected to account for xx% of the total market value by 2033.

- Residential: Key Drivers: Population growth in urban centers and government policies promoting affordable housing. This sector is expected to witness a steady growth rate due to ongoing urbanization.

- Commercial: Steady growth due to rising demand for office spaces and commercial developments in major cities.

- Industrial: This sector shows moderate growth, largely influenced by manufacturing activity and industrial infrastructure development.

- Energy and Utilities: Significant investment in renewable energy projects and upgrades to existing power grids.

Japan Construction Industry Product Innovations

Recent innovations in the Japanese construction industry center on prefabricated building components, sustainable materials (e.g., cross-laminated timber), and advanced construction technologies like 3D printing and robotics. These innovations improve efficiency, reduce construction times, minimize waste, and enhance building performance. Unique selling propositions focus on speed, cost-effectiveness, and environmental sustainability.

Propelling Factors for Japan Construction Industry Growth

Government investment in infrastructure projects, particularly in transportation and renewable energy, acts as a major catalyst for industry growth. Technological advancements, such as BIM and prefabrication, boost efficiency and reduce costs, thereby stimulating market expansion. Favorable demographics, with a focus on urban renewal, also contribute to the sector's growth.

Obstacles in the Japan Construction Industry Market

The industry faces significant challenges including labor shortages, rising material costs, stringent regulations, and intense competition. Supply chain disruptions related to global events can impact material availability and increase costs. Regulatory hurdles and bureaucratic processes can delay project timelines, impacting profitability.

Future Opportunities in Japan Construction Industry

Emerging opportunities lie in green building technologies, sustainable materials, smart building integration, and the adoption of advanced digital technologies like AI and IoT. The construction of resilient infrastructure to withstand natural disasters offers further growth potential. Expansion into overseas markets could also provide additional revenue streams for Japanese construction companies.

Major Players in the Japan Construction Industry Ecosystem

- Obayashi Corp

- The Zenitaka Corp

- Shimizu Corp

- Toshiba Corp

- Takada Corporation

- Kajima Corp

- Nippon Concrete Industries

- Sumitomo Mitsui Construction Co Ltd

- Mori Building Co Ltd

- Mitsubishi Heavy Industries Ltd

Key Developments in Japan Construction Industry Industry

- 2022 Q4: Government announces increased funding for infrastructure projects related to renewable energy.

- 2023 Q1: Kajima Corp launches a new prefabricated building system, reducing construction time by xx%.

- 2024 Q2: Shimizu Corp partners with a technology firm to integrate AI into construction management systems.

Strategic Japan Construction Industry Market Forecast

The Japanese construction industry is poised for continued growth, driven by sustained government investment, technological innovation, and the need for sustainable infrastructure development. The market's future success hinges on addressing labor shortages, managing material costs, and adapting to evolving regulatory landscapes. Opportunities for growth lie in specialized niches, such as green building and smart city development. The market is forecast to reach xx Million by 2033.

Japan Construction Industry Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastruture (Transportation)

- 1.5. Energy and Utilities

Japan Construction Industry Segmentation By Geography

- 1. Japan

Japan Construction Industry Regional Market Share

Geographic Coverage of Japan Construction Industry

Japan Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Education Sector; Rising Demand for Quality Accomodation

- 3.3. Market Restrains

- 3.3.1. Enrolment Fluctuations

- 3.4. Market Trends

- 3.4.1. Increase in Infrastructure Developments Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastruture (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Obayashi Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Zenitaka Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shimizu Corp **List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toshiba Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Takada Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kajima Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nippon Concrete Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sumitomo Mitsui Construction Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mori Building Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mitsubishi Heavy Industries Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Obayashi Corp

List of Figures

- Figure 1: Japan Construction Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Construction Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Japan Construction Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Japan Construction Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Japan Construction Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Construction Industry?

The projected CAGR is approximately 3.30%.

2. Which companies are prominent players in the Japan Construction Industry?

Key companies in the market include Obayashi Corp, The Zenitaka Corp, Shimizu Corp **List Not Exhaustive, Toshiba Corp, Takada Corporation, Kajima Corp, Nippon Concrete Industries, Sumitomo Mitsui Construction Co Ltd, Mori Building Co Ltd, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Japan Construction Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 609.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of Education Sector; Rising Demand for Quality Accomodation.

6. What are the notable trends driving market growth?

Increase in Infrastructure Developments Boosting the Market.

7. Are there any restraints impacting market growth?

Enrolment Fluctuations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Construction Industry?

To stay informed about further developments, trends, and reports in the Japan Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence