Key Insights

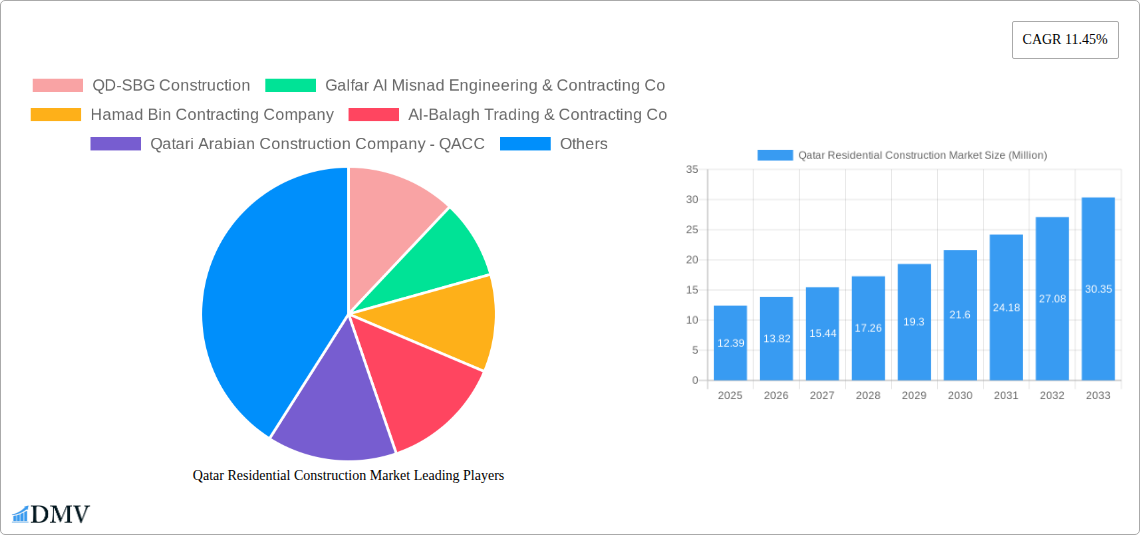

The Qatar Residential Construction Market is poised for significant expansion, with a projected market size of USD 12.39 million in 2025 and a robust Compound Annual Growth Rate (CAGR) of 11.45% anticipated over the forecast period. This growth is primarily fueled by substantial government investment in housing infrastructure and the nation's commitment to developing sustainable urban living environments. The market is seeing strong demand across various residential segments, including apartments and condominiums, as well as villas, catering to both local families and expatriate populations. The prevalence of new construction projects, alongside a notable trend towards renovation and upgrading of existing properties, further underpins this expansion. Key drivers include increasing population, urbanization, and a burgeoning real estate sector driven by economic diversification initiatives. The market's trajectory indicates a dynamic landscape where innovation in construction techniques and materials will play a crucial role in meeting evolving consumer preferences for modern, eco-friendly housing solutions.

Qatar Residential Construction Market Market Size (In Million)

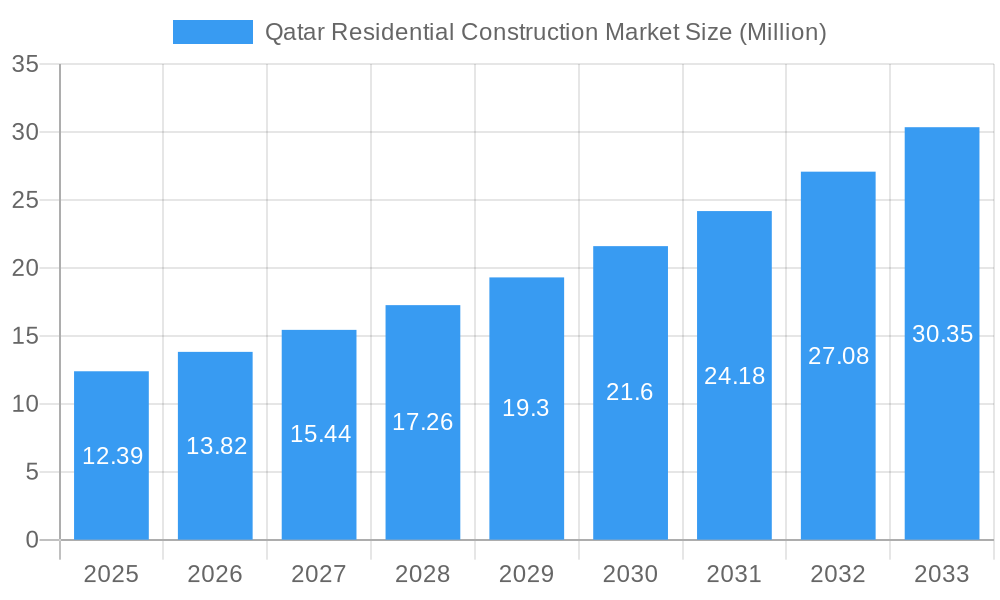

The competitive landscape for the Qatar Residential Construction Market is characterized by the presence of prominent local and international players, each contributing to the sector's development. Companies such as QD-SBG Construction, Galfar Al Misnad Engineering & Contracting Co, and Hamad Bin Contracting Company are at the forefront, undertaking large-scale residential projects. The market is also influenced by evolving consumer preferences, with a growing emphasis on smart homes, energy-efficient designs, and community-oriented living spaces. While the market presents considerable opportunities, it also faces potential restraints such as fluctuating material costs and evolving regulatory frameworks. Nevertheless, the strong underlying demand, coupled with strategic government policies aimed at enhancing the quality of life and attracting foreign investment, positions the Qatar Residential Construction Market for sustained and vigorous growth throughout the study period, extending to 2033.

Qatar Residential Construction Market Company Market Share

Gain unparalleled insights into the dynamic Qatar residential construction market with this comprehensive report. Covering the study period of 2019–2033, with a base and estimated year of 2025, this analysis delves into the critical trends, growth drivers, and future trajectory of Qatar's booming residential sector. We provide an exhaustive breakdown of key segments, including Apartments & Condominiums, Villas, and Other Types, as well as New Construction and Renovation activities. Discover the strategic landscape shaped by leading companies and pivotal industry developments, essential for stakeholders navigating this lucrative real estate market.

Qatar Residential Construction Market Market Composition & Trends

The Qatar residential construction market exhibits a dynamic composition influenced by robust economic growth and strategic investment. Market concentration is notable, with several key players holding significant market share. Innovation catalysts are primarily driven by the demand for sustainable and smart living solutions, responding to evolving end-user profiles. The regulatory landscape, while evolving, supports development through clear zoning laws and investment incentives, fostering a predictable environment for construction projects. Substitute products are emerging in pre-fabricated housing and modular construction, offering faster build times and cost efficiencies. M&A activities, while not yet at peak levels, are anticipated to increase as larger entities seek to consolidate their presence and acquire niche expertise. For instance, M&A deal values are projected to see a substantial uptick in the forecast period.

- Market Share Distribution: Dominated by key players in large-scale residential projects.

- Innovation Catalysts: Sustainability mandates, smart home integration, and energy-efficient building technologies.

- Regulatory Landscape: Government initiatives promoting foreign investment and developer-friendly policies.

- Substitute Products: Pre-fabricated units and modular construction gaining traction for speed and cost.

- End-User Profiles: A growing demand for modern, amenity-rich apartments and family-oriented villas, driven by expatriate influx and local population growth.

- M&A Activities: Expected increase in strategic acquisitions to expand market reach and technological capabilities.

Qatar Residential Construction Market Industry Evolution

The Qatar residential construction market has undergone significant evolution, driven by ambitious national development plans and sustained economic vitality. From the historical period of 2019–2024 to the forecast period of 2025–2033, the industry has witnessed consistent growth trajectories. Technological advancements have been instrumental, with the adoption of Building Information Modeling (BIM) and advanced construction machinery accelerating project delivery and enhancing efficiency. Shifting consumer demands are evident, with a marked preference for high-quality, sustainable, and technologically integrated living spaces. This evolution is reflected in project scale and complexity, with a move towards mixed-use developments and premium residential offerings. The market is projected to see a Compound Annual Growth Rate (CAGR) of XX% over the forecast period, a testament to its robust expansion. Adoption metrics for green building technologies are also on an upward trend, with an estimated XX% increase in their implementation by 2028. The influx of skilled labor and investment in infrastructure further underpins this industry evolution.

Leading Regions, Countries, or Segments in Qatar Residential Construction Market

Within the Qatar residential construction market, the Apartments & Condominiums segment is demonstrating dominant growth. This surge is fueled by the increasing demand from a growing expatriate population and a rising preference for urban living among locals. The government's focus on developing modern urban centers and providing diverse housing options directly supports this segment. Furthermore, the New Construction type within this segment significantly outweighs Renovation activities, indicating a proactive expansion of housing stock rather than incremental upgrades. Investment trends are heavily skewed towards large-scale residential complexes, driven by major developers and government-backed initiatives aimed at housing a growing population and supporting economic diversification. Regulatory support for foreign direct investment in real estate also plays a crucial role in attracting developers to undertake substantial new construction projects.

- Dominant Segment: Apartments & Condominiums consistently lead market demand and project pipeline.

- Construction Type Dominance: New Construction activities are substantially higher than renovation, reflecting market expansion.

- Key Drivers for Apartments & Condominiums:

- High demand from expatriate workforce and young professionals.

- Urbanization trends and the desire for convenient, amenity-rich living.

- Government-led urban development projects creating new residential hubs.

- Attractive investment opportunities for developers in large-scale projects.

- Factors Influencing New Construction Dominance:

- Rapid population growth necessitating increased housing supply.

- Development of new economic zones and commercial centers attracting residents.

- Focus on modern infrastructure and contemporary architectural designs.

- Availability of land for large-scale residential developments.

Qatar Residential Construction Market Product Innovations

Product innovations in the Qatar residential construction market are increasingly focused on enhancing sustainability and occupant well-being. Smart home integration is a prime example, offering automated lighting, climate control, and security systems, leading to improved energy efficiency and convenience. Advanced materials, such as self-healing concrete and high-performance insulation, are being adopted to increase building longevity and reduce maintenance costs. Performance metrics are showing significant improvements in energy consumption (up to XX% reduction) and indoor air quality. Unique selling propositions now include integrated green spaces, advanced waste management systems, and water-saving technologies, appealing to environmentally conscious buyers.

Propelling Factors for Qatar Residential Construction Market Growth

Several key factors are propelling the Qatar residential construction market growth. Economically, strong GDP growth and significant government investment in infrastructure, particularly driven by Vision 2030, are creating a favorable environment. Regulatory influences, such as streamlined permitting processes and incentives for developers, are further encouraging construction activities. Technologically, the adoption of advanced construction techniques and sustainable building materials contributes to project efficiency and appeal. The ongoing influx of expatriate workers for various mega-projects and the service sector also sustains a consistent demand for quality residential units.

Obstacles in the Qatar Residential Construction Market Market

Despite its robust growth, the Qatar residential construction market faces several obstacles. Regulatory challenges, while improving, can still present complexities in land acquisition and project approvals. Supply chain disruptions, including the availability and cost of imported materials, can impact project timelines and budgets, a concern exacerbated by global economic fluctuations. Competitive pressures among a growing number of local and international contractors can also influence profit margins. The cost of skilled labor and the need for continuous training to adapt to new technologies are additional restraints that require strategic management.

Future Opportunities in Qatar Residential Construction Market

The Qatar residential construction market presents several promising future opportunities. The growing demand for affordable housing solutions, particularly for mid-income segments, represents a significant untapped market. The development of smart cities and integrated community living concepts offers avenues for innovative residential projects. Furthermore, the increasing focus on sustainable construction and green building certifications opens doors for companies specializing in eco-friendly technologies and materials. Expansion into niche segments like luxury serviced apartments and senior living facilities also holds considerable potential as demographics shift.

Major Players in the Qatar Residential Construction Market Ecosystem

- QD-SBG Construction

- Galfar Al Misnad Engineering & Contracting Co

- Hamad Bin Contracting Company

- Al-Balagh Trading & Contracting Co

- Qatari Arabian Construction Company - QACC

- Q-MEP Contracting

- Alseal Contracting And Trading Company

- Ramco Trading & Contracting

- Al Majal International Trading And Contracting Company Wll

- Bemco Contracting Company Qatar

- Domopan Qatar W L

- Midmac Contracting Co W L L

- Lupp International Qatar L L C

- Porr Construction Qatar W L L

Key Developments in Qatar Residential Construction Market Industry

- July 2022: Qatar First Bank LLC (public) (QFB) acquired The Gateway Plaza building in Richmond, Virginia, USA. This Class AA trophy asset, spanning 330,000 square feet and built in 2015, marks QFB's eleventh US real estate property and fourteenth investment under its Shari'a-compliant real estate investment strategy, aiming to increase its US real estate market presence and knowledge.

- August 2022: Ascott successfully acquired Oakwood Worldwide, boosting its portfolio by over 15,000 units to exceed 153,000 units across more than 900 locations. This acquisition, combined with organic growth in newly signed and opened properties, strengthens Ascott's capabilities for future growth, higher returns for property owners, and enhanced guest services.

Strategic Qatar Residential Construction Market Market Forecast

The strategic Qatar residential construction market forecast indicates sustained growth driven by ongoing urbanization, economic diversification initiatives under Qatar National Vision 2030, and a robust pipeline of infrastructure development. Anticipated growth catalysts include continued foreign investment in the real estate sector, increasing demand for high-quality and sustainable housing, and the successful integration of smart technologies into residential projects. The market potential remains significant, fueled by a growing population and a commitment to developing world-class living environments. Expected developments in the forecast period of 2025–2033 suggest a market poised for further expansion and innovation.

Qatar Residential Construction Market Segmentation

-

1. Type

- 1.1. Apartments & Condominiums

- 1.2. Villas

- 1.3. Other Types

-

2. Construction Type

- 2.1. New Construction

- 2.2. Renovation

Qatar Residential Construction Market Segmentation By Geography

- 1. Qatar

Qatar Residential Construction Market Regional Market Share

Geographic Coverage of Qatar Residential Construction Market

Qatar Residential Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise in e-commerce and digitalization

- 3.3. Market Restrains

- 3.3.1. The Complexity of regulations and property ownership

- 3.4. Market Trends

- 3.4.1. Qatar's Residential Market is Slightly Improving

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Residential Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments & Condominiums

- 5.1.2. Villas

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. New Construction

- 5.2.2. Renovation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 QD-SBG Construction

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Galfar Al Misnad Engineering & Contracting Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hamad Bin Contracting Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al-Balagh Trading & Contracting Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Qatari Arabian Construction Company - QACC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Q-MEP Contracting

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alseal Contracting And Trading Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ramco Trading & Contracting

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al Majal International Trading And Contracting Company Wll

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bemco Contracting Company Qatar

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Domopan Qatar W L

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Midmac Contracting Co W L L

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Lupp International Qatar L L C*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Porr Construction Qatar W L L

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 QD-SBG Construction

List of Figures

- Figure 1: Qatar Residential Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Qatar Residential Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Qatar Residential Construction Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Qatar Residential Construction Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 3: Qatar Residential Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Qatar Residential Construction Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Qatar Residential Construction Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 6: Qatar Residential Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Residential Construction Market?

The projected CAGR is approximately 11.45%.

2. Which companies are prominent players in the Qatar Residential Construction Market?

Key companies in the market include QD-SBG Construction, Galfar Al Misnad Engineering & Contracting Co, Hamad Bin Contracting Company, Al-Balagh Trading & Contracting Co, Qatari Arabian Construction Company - QACC, Q-MEP Contracting, Alseal Contracting And Trading Company, Ramco Trading & Contracting, Al Majal International Trading And Contracting Company Wll, Bemco Contracting Company Qatar, Domopan Qatar W L, Midmac Contracting Co W L L, Lupp International Qatar L L C*List Not Exhaustive, Porr Construction Qatar W L L.

3. What are the main segments of the Qatar Residential Construction Market?

The market segments include Type, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.39 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise in e-commerce and digitalization.

6. What are the notable trends driving market growth?

Qatar's Residential Market is Slightly Improving.

7. Are there any restraints impacting market growth?

The Complexity of regulations and property ownership.

8. Can you provide examples of recent developments in the market?

July 2022: The Gateway Plaza building in Richmond, Virginia, USA, has been purchased by Qatar First Bank LLC (public) (QFB). A wonderful addition to the bank's investment portfolio, the new acquisition is a Class AA trophy asset with a 330,000-square-foot area that was built in 2015 as a build-to-suit building and will continue to ensure steady cash flows. With a goal to increase its presence and level of knowledge in the US real estate market, the new investment marks QFB's eleventh US real estate property and its fourteenth investment under its new Shari'a-compliant real estate investment strategy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Residential Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Residential Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Residential Construction Market?

To stay informed about further developments, trends, and reports in the Qatar Residential Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence