Key Insights

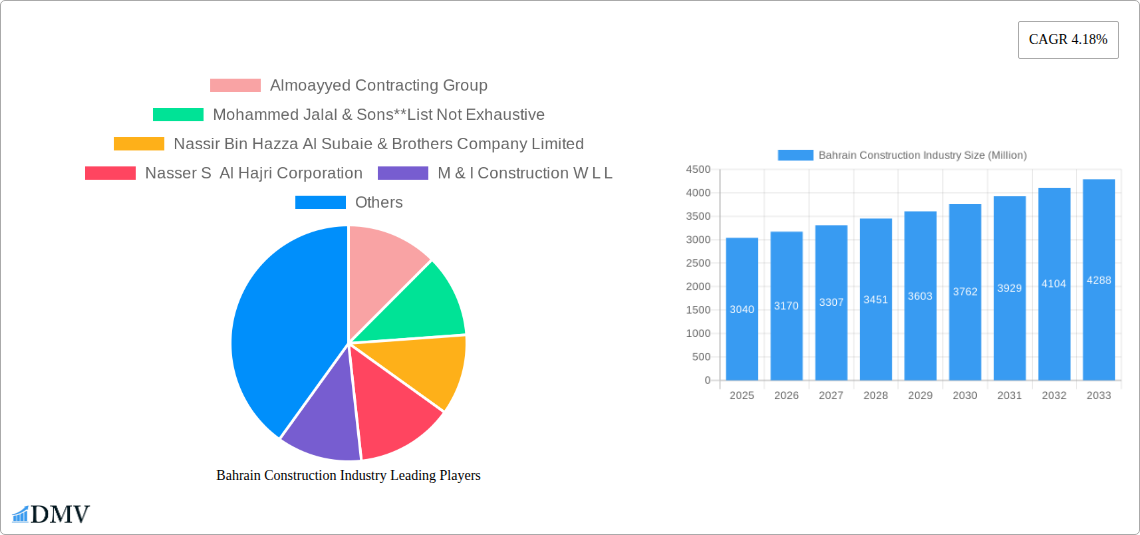

The Bahrain construction industry, valued at $3.04 billion in 2025, is projected to experience steady growth, driven by robust government investments in infrastructure development and a burgeoning real estate sector. The Compound Annual Growth Rate (CAGR) of 4.18% from 2025 to 2033 indicates a promising outlook. Key drivers include ongoing large-scale infrastructure projects, a growing population necessitating increased residential construction, and the expansion of commercial and industrial sectors. The sector is segmented into Commercial, Residential, Industrial, Infrastructure (Transportation), and Energy & Utilities Construction. Commercial and Infrastructure construction are likely to be the strongest performing segments, fueled by significant government spending on transportation networks and the development of new commercial centers. While the industry faces potential restraints such as material price fluctuations and global economic uncertainty, the long-term outlook remains positive due to the government's commitment to economic diversification and sustainable development initiatives. Leading players like Almoayyed Contracting Group, Mohammed Jalal & Sons, and Nass Corporation are well-positioned to benefit from this growth, contributing to the overall competitiveness and expertise within the sector. The consistent investment in infrastructure, combined with a stable political environment, is expected to maintain the industry's upward trajectory.

Bahrain Construction Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates a significant expansion of the construction market. Given the 4.18% CAGR, we can expect continued growth across all segments. Residential construction will likely see increased activity due to population growth and demand for housing. Industrial construction will benefit from ongoing diversification efforts within the Bahraini economy. The transportation sector, a crucial part of Bahrain’s infrastructure, will continue to receive considerable investment, further bolstering the overall construction market. Careful management of potential challenges, including supply chain disruptions and skilled labor shortages, will be crucial for maintaining sustainable growth and ensuring the successful completion of ongoing and future projects. Overall, the Bahrain construction industry presents a favorable investment environment with significant opportunities for both domestic and international players.

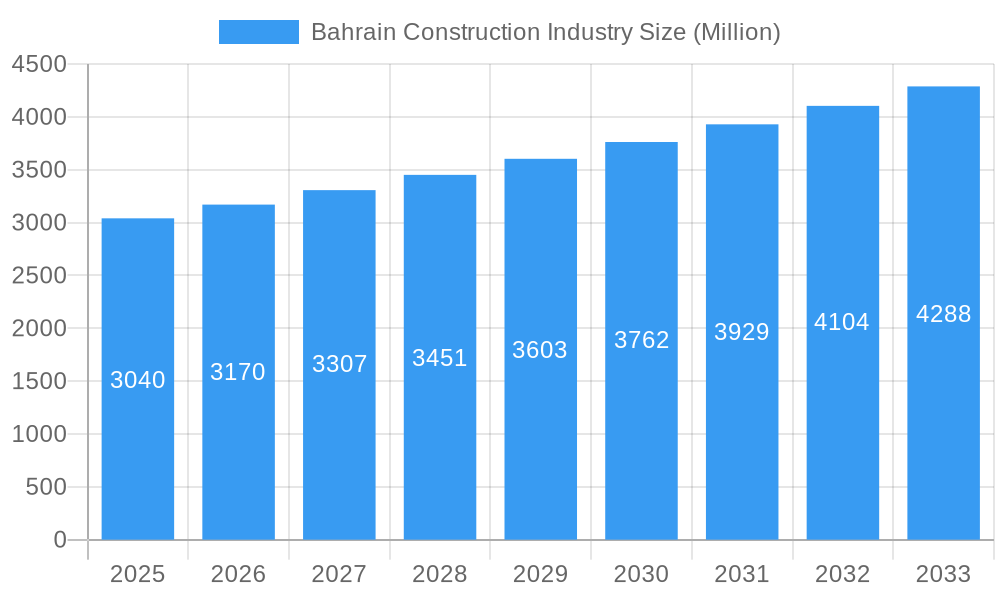

Bahrain Construction Industry Company Market Share

Bahrain Construction Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Bahrain construction industry, offering a comprehensive overview of its market dynamics, key players, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The report leverages extensive data analysis to project a xx Million market value by 2033, highlighting significant growth potential.

Bahrain Construction Industry Market Composition & Trends

This section delves into the intricate composition of the Bahrain construction market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activities. The market is characterized by a moderately concentrated landscape, with several large players holding significant market share. However, a number of smaller firms contribute to the overall dynamism.

Market Share Distribution: Almoayyed Contracting Group and Nass Corporation are estimated to hold approximately xx% and xx% of the market share respectively in 2025. The remaining share is distributed amongst numerous smaller players. The exact distribution requires further detailed investigation (beyond the scope of this overview).

M&A Activity: Over the period 2019-2024, the total value of M&A transactions in the Bahrain construction sector is estimated at xx Million. Most transactions involved smaller companies being acquired by larger ones, aiming for enhanced market presence and capabilities.

Innovation Catalysts: Government initiatives promoting sustainable construction practices and technological advancements such as Building Information Modeling (BIM) are key drivers of innovation.

Regulatory Landscape: The regulatory environment in Bahrain plays a crucial role in shaping the industry. Regulations on building codes, safety standards, and environmental concerns influence project development and execution.

Substitute Products: The substitute products are limited but could include prefabricated construction modules and 3D printing technology.

End-User Profiles: The end-user base encompasses the government, private developers, and industrial corporations, with demand varying across residential, commercial, industrial, and infrastructure projects.

Bahrain Construction Industry Industry Evolution

This section examines the transformative trajectory of the Bahrain construction industry, focusing on market growth trajectories, technological integration, and evolving consumer preferences. The historical period (2019-2024) showed a compound annual growth rate (CAGR) of approximately xx%, driven largely by government investments in infrastructure and real estate developments. The forecast period (2025-2033) is projected to witness a CAGR of approximately xx%, fueled by ongoing infrastructure projects and increased private sector activity. The adoption of advanced technologies such as BIM and prefabrication is accelerating, improving efficiency and project timelines. This evolution is further influenced by changing consumer expectations, including the growing demand for eco-friendly and sustainable buildings. The shift towards smart buildings and IoT integration is also becoming increasingly significant, alongside the rise of proptech companies disrupting traditional industry practices. The government's push for sustainable development, using materials such as recycled concrete and sustainable building practices is also a key factor in influencing the sector's trajectory.

Leading Regions, Countries, or Segments in Bahrain Construction Industry

While Bahrain is a single country, different sectors show varying growth rates and importance within the construction market. Currently, Infrastructure (Transportation) Construction exhibits the strongest growth potential, driven by substantial government investment in projects like the Bahrain Metro and the new greenfield airport.

- Infrastructure (Transportation) Construction: This segment's dominance is fueled by substantial government investment in mega-projects such as the Bahrain Metro, enhancing connectivity and transportation infrastructure. The ongoing development of the new airport project further emphasizes its importance.

- Key Drivers: Government funding, Public-Private Partnerships (PPPs), and the need for improved infrastructure to support economic growth.

- Commercial Construction: This sector experiences steady growth, with ongoing developments across commercial real estate projects. The demand is tied to the growth of the financial and tourism sectors.

- Key Drivers: Growth of the private sector, ongoing investment in commercial real estate, and sustained tourism growth.

- Residential Construction: Steady growth expected, with increasing population and growing demand for housing.

- Key Drivers: Population growth, government incentives, and rising disposable incomes.

- Industrial Construction: Moderate growth, directly linked to growth in the manufacturing and industrial sectors.

- Key Drivers: Industrial diversification and ongoing industrial expansion.

- Energy and Utilities Construction: Growth tied to investment in renewable energy sources and modernization of the country's energy infrastructure.

- Key Drivers: Commitment to sustainable energy initiatives, renewable energy projects, and modernization of existing energy infrastructure.

Bahrain Construction Industry Product Innovations

Recent innovations include the adoption of Building Information Modeling (BIM) for improved project management and efficiency, the increased use of prefabricated components for faster construction, and the incorporation of sustainable building materials and technologies to promote environmentally friendly construction practices. These innovations focus on enhancing project speed, cost-effectiveness, and sustainability. The unique selling propositions of these innovations include reduced construction time, improved project accuracy, minimized waste, and enhanced environmental performance.

Propelling Factors for Bahrain Construction Industry Growth

Several factors are driving the growth of the Bahrain construction industry. Significant government investments in infrastructure projects, such as the Bahrain Metro and the new airport, are a major catalyst. Economic diversification strategies are attracting foreign investment and stimulating construction activity across multiple sectors. Furthermore, the government’s emphasis on sustainable development is leading to the adoption of green building practices and technologies, fueling demand for eco-friendly construction solutions.

Obstacles in the Bahrain Construction Industry Market

The industry faces challenges like reliance on imported materials, potentially leading to supply chain disruptions and price volatility. The competitive landscape can lead to price pressures and reduced margins. Furthermore, fluctuating global oil prices and the overall regional economic climate can influence the project pipeline. These challenges require strategic management to mitigate risks and maintain profitability.

Future Opportunities in Bahrain Construction Industry

The industry presents significant opportunities. The focus on sustainable development creates demand for green building technologies and materials. The growth of the tourism sector necessitates further development in hospitality and related infrastructure. Moreover, the increasing adoption of technology in construction, such as BIM and prefabrication, opens avenues for innovation and efficiency improvements.

Major Players in the Bahrain Construction Industry Ecosystem

- Almoayyed Contracting Group

- Mohammed Jalal & Sons

- Nassir Bin Hazza Al Subaie & Brothers Company Limited

- Nasser S Al Hajri Corporation

- M & I Construction W L L

- Nass Corporation

- Projects Holding Company W L L

- Mannai Holding

- Delta Construction Co W L L

- The Al Namal Group

- The VKL

Key Developments in Bahrain Construction Industry Industry

November 2022: Bahrain announced plans to commence procurement for a significant metro network in Q1 2023. Eleven major global infrastructure companies are competing for the 29-kilometer Phase 1 of the Bahrain Metro, a Public-Private Partnership (PPP) project. This 109 km, four-line network is set to be developed in four stages. This signifies a huge boost to the infrastructure construction sector.

May 2023: The Ministry of Transportation & Telecommunications awarded a $1.437 Million contract to Netherlands Airport Consultants for an initial study of Bahrain’s new greenfield airport project, estimated at $10 Billion. This project is set to become a landmark for the country and propel growth in the aviation sector related construction.

Strategic Bahrain Construction Industry Market Forecast

The Bahrain construction industry is poised for robust growth over the forecast period (2025-2033). Government investments in large-scale infrastructure projects, coupled with a growing private sector and increasing focus on sustainability, will be key drivers. The projected growth is further bolstered by the potential influx of foreign investment spurred by the nation's economic diversification efforts. This creates a positive outlook for the industry and its stakeholders.

Bahrain Construction Industry Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

Bahrain Construction Industry Segmentation By Geography

- 1. Bahrain

Bahrain Construction Industry Regional Market Share

Geographic Coverage of Bahrain Construction Industry

Bahrain Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Focus on green buildings4.; Increased investment in infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; High value of construction material

- 3.4. Market Trends

- 3.4.1. Increase in the number of Construction Projects driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bahrain Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Almoayyed Contracting Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mohammed Jalal & Sons**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nassir Bin Hazza Al Subaie & Brothers Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nasser S Al Hajri Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 M & I Construction W L L

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nass Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Projects Holding Company W L L

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mannai Holding

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Delta Construction Co W L L

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Al Namal Group and the VKL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Almoayyed Contracting Group

List of Figures

- Figure 1: Bahrain Construction Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Bahrain Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: Bahrain Construction Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Bahrain Construction Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Bahrain Construction Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Bahrain Construction Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bahrain Construction Industry?

The projected CAGR is approximately 4.18%.

2. Which companies are prominent players in the Bahrain Construction Industry?

Key companies in the market include Almoayyed Contracting Group, Mohammed Jalal & Sons**List Not Exhaustive, Nassir Bin Hazza Al Subaie & Brothers Company Limited, Nasser S Al Hajri Corporation, M & I Construction W L L, Nass Corporation, Projects Holding Company W L L, Mannai Holding, Delta Construction Co W L L, The Al Namal Group and the VKL.

3. What are the main segments of the Bahrain Construction Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.04 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Focus on green buildings4.; Increased investment in infrastructure.

6. What are the notable trends driving market growth?

Increase in the number of Construction Projects driving the market.

7. Are there any restraints impacting market growth?

4.; High value of construction material.

8. Can you provide examples of recent developments in the market?

November 2022: According to the local publication Gulf Daily News, Bahrain will start a significant procurement for building a metro network in the first quarter of 2023. According to prior reports by Zawya Projects and others, 11 major global infrastructure companies are competing for a 29-kilometer Phase 1 of Bahrain Metro, which is being developed in a Public-Private Partnership (PPP) model. The 109 km, four transit line, the fully automated urban railway network will be built out in four stages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bahrain Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bahrain Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bahrain Construction Industry?

To stay informed about further developments, trends, and reports in the Bahrain Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence