Key Insights

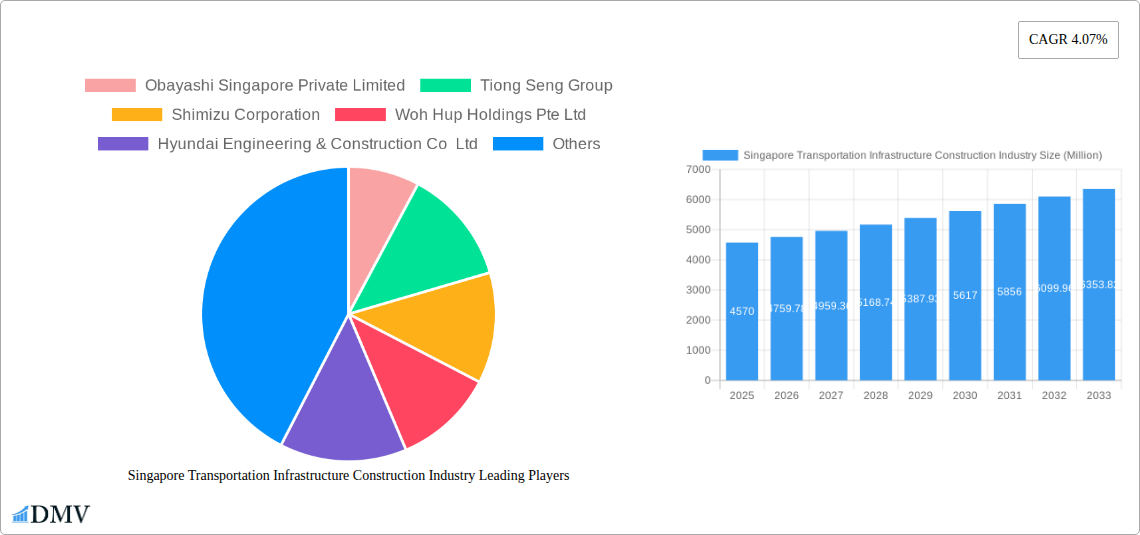

The Singapore transportation infrastructure construction industry is experiencing robust growth, projected to reach a market size of $4.57 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.07% from 2019 to 2033. This expansion is driven by several key factors. Firstly, Singapore's ongoing commitment to enhancing its public transportation network, including investments in MRT expansions, new roads, and port modernization, fuels significant demand for construction services. Secondly, the government's focus on sustainable infrastructure development and technological advancements, such as the integration of smart city solutions into transportation systems, further stimulates market growth. The industry is segmented by mode of transport—roadways, railways, airways, ports, and inland waterways—with roadways and railways likely comprising the largest shares due to ongoing urban expansion and the need to improve connectivity. Key players, including Obayashi Singapore, Tiong Seng Group, and Shimizu Corporation, compete in this dynamic market, leveraging their expertise in large-scale projects. However, challenges remain, such as land scarcity, rising construction costs, and potential labor shortages which might moderate growth in certain years.

Singapore Transportation Infrastructure Construction Industry Market Size (In Billion)

Looking ahead to 2033, the industry's trajectory is likely to remain positive, albeit with potential fluctuations depending on government spending priorities and global economic conditions. The focus on resilience and sustainability will continue to shape the industry's landscape, driving demand for innovative construction materials and techniques. The increasing complexity of projects will necessitate strategic collaborations and partnerships among construction firms, technology providers, and government agencies. Maintaining a skilled workforce and efficient project management will be crucial for companies to succeed in this competitive environment. The continuing growth in e-commerce and logistics further reinforces the need for robust transportation networks, contributing to the long-term positive outlook for the Singapore transportation infrastructure construction industry.

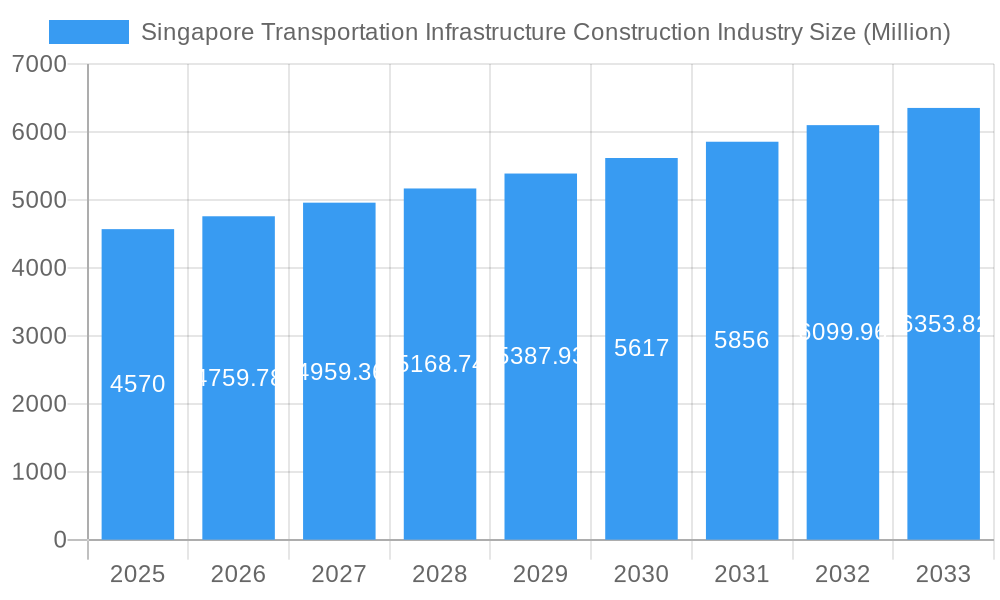

Singapore Transportation Infrastructure Construction Industry Company Market Share

Singapore Transportation Infrastructure Construction Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Singapore transportation infrastructure construction industry, offering a comprehensive overview of market trends, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The report leverages historical data from 2019-2024 and presents a robust market projection for the years to come. The total market value in 2025 is estimated at xx Million USD.

Singapore Transportation Infrastructure Construction Industry Market Composition & Trends

This section delves into the competitive landscape of Singapore's transportation infrastructure construction industry. Market concentration is analyzed, revealing the market share distribution among key players like Obayashi Singapore Private Limited, Tiong Seng Group, Shimizu Corporation, Woh Hup Holdings Pte Ltd, Hyundai Engineering & Construction Co Ltd, Koh Brothers Building & Civil Engineering Contractor Pte Ltd, and CSC Holdings Limited. The report also examines less prominent but significant players such as Daelim Industrial Co Ltd, Lum Chang Holdings Limited, and Jurong Engineering Limited, providing an overview of their key activities and contributions. The influence of innovation, regulatory frameworks (e.g., building codes, environmental regulations), substitute product availability, end-user demands (government agencies, private developers), and M&A activities (including deal values and their impact on market dynamics) are thoroughly assessed. Analysis includes an evaluation of approximately xx Million USD worth of M&A deals during the period 2019-2024. The report identifies key innovation catalysts, such as the adoption of Building Information Modeling (BIM) and advanced construction techniques.

- Market Share Distribution: Detailed breakdown of market share among leading players.

- M&A Activity: Analysis of recent mergers and acquisitions, including deal values and their impact.

- Regulatory Landscape: Comprehensive overview of relevant regulations and their effect on the market.

- Innovation Catalysts: Discussion of technological advancements driving industry innovation.

Singapore Transportation Infrastructure Construction Industry Industry Evolution

This section analyzes the evolutionary trajectory of Singapore's transportation infrastructure construction industry from 2019 to 2033. It explores market growth trajectories, presenting historical growth rates (2019-2024) and projecting future growth (2025-2033). This analysis incorporates the impact of technological advancements, such as the adoption of prefabricated modular construction and the use of drones for site surveying. Furthermore, it examines shifts in consumer demands, focusing on the increasing emphasis on sustainability and resilience in infrastructure projects. The report highlights the increasing adoption of digital technologies, with a projected xx% increase in BIM usage by 2033. The analysis includes a projection of the market size reaching xx Million USD by 2033, driven by major infrastructure development initiatives.

Leading Regions, Countries, or Segments in Singapore Transportation Infrastructure Construction Industry

This section identifies the dominant segments within Singapore’s transportation infrastructure construction industry (Roadways, Railways, Airways, Ports and Inland Waterways). The analysis focuses on the Railways sector's dominance, driven by significant government investments in expanding the Mass Rapid Transit (MRT) network and projects like the Cross Island Line (CRL) and the RTS Link.

- Key Drivers for Railway Sector Dominance:

- High Government Investment: Significant public spending on expanding rail networks.

- Technological Advancements: Implementation of advanced signaling systems and automation technologies.

- Population Growth and Urbanization: Increased demand for efficient mass transit solutions.

- Regional Connectivity: Projects like the RTS Link enhance cross-border transportation.

The report provides an in-depth analysis of the factors contributing to this dominance, including investment trends, regulatory support, and technological advancements. Further examination of other modes of transport (Roadways, Airways, Ports, and Inland Waterways) will reveal their respective market sizes and growth potentials within the overall infrastructure development landscape.

Singapore Transportation Infrastructure Construction Industry Product Innovations

The industry is witnessing significant innovation in materials, construction techniques, and project management. The adoption of prefabricated modular construction reduces construction time and costs. Advanced materials like high-performance concrete and sustainable building materials are gaining traction. The use of digital twins for project planning and monitoring enables improved efficiency and cost control. These innovations offer enhanced durability, sustainability, and operational efficiency, leading to superior project outcomes.

Propelling Factors for Singapore Transportation Infrastructure Construction Industry Growth

Several factors are driving growth in the Singapore transportation infrastructure construction industry. Significant government investments in infrastructure projects play a vital role, including substantial funding for the expansion of the MRT network and the development of new airports and ports. Furthermore, economic growth and increasing urbanization fuel demand for better transportation infrastructure. Stringent government regulations promoting sustainable and green construction practices also influence market growth. The ongoing digitalization within the construction sector, with the adoption of technologies like BIM and IoT, contributes to increased efficiency and productivity.

Obstacles in the Singapore Transportation Infrastructure Construction Industry Market

The industry faces challenges, including labor shortages, especially skilled labor, resulting in potential project delays and cost overruns. Fluctuations in global commodity prices, especially steel and cement, impact project costs. Stringent regulatory compliance requirements and obtaining necessary permits can also cause delays. Intense competition among construction firms adds another layer of complexity. These factors contribute to an estimated xx% increase in project costs compared to initial estimates during the period 2019-2024.

Future Opportunities in Singapore Transportation Infrastructure Construction Industry

Future opportunities exist in adopting innovative technologies like 3D printing, automation, and robotics to enhance efficiency and reduce costs. The development of sustainable and resilient infrastructure is another key area, aligning with the nation's environmental goals. Expansion into new market segments, like smart city infrastructure, offers further potential for growth. The increasing demand for efficient public transportation systems driven by population growth and the need for better connectivity present significant opportunities.

Major Players in the Singapore Transportation Infrastructure Construction Industry Ecosystem

- Obayashi Singapore Private Limited

- Tiong Seng Group

- Shimizu Corporation

- Woh Hup Holdings Pte Ltd

- Hyundai Engineering & Construction Co Ltd

- Koh Brothers Building & Civil Engineering Contractor Pte Ltd

- CSC Holdings Limited

- Daelim Industrial Co Ltd

- Lum Chang Holdings Limited

- Jurong Engineering Limited

Key Developments in Singapore Transportation Infrastructure Construction Industry Industry

- April 2023: Siemens Mobility secures a USD 333.65 Million contract for the Cross Island Line (CRL) signaling system and platform screen doors, signifying a move towards advanced automation (GoA 4).

- July 2023: The RTS Link between Johor Baru and Singapore reaches 41% completion, highlighting progress in regional connectivity initiatives. This project, with an estimated completion cost of xx Million USD, is expected to significantly impact cross-border commute times.

Strategic Singapore Transportation Infrastructure Construction Industry Market Forecast

The Singapore transportation infrastructure construction industry is poised for continued growth, driven by ongoing government investments in major infrastructure projects, technological advancements, and the need to address the challenges of urbanization and population growth. Future opportunities lie in embracing innovative construction methods, sustainable practices, and digital technologies to optimize project delivery, enhance efficiency, and meet evolving infrastructural demands. The projected market size for 2033 signifies substantial growth potential for industry players.

Singapore Transportation Infrastructure Construction Industry Segmentation

-

1. Mode

- 1.1. Roadways

- 1.2. Railways

- 1.3. Airways

- 1.4. Ports and Inland Waterways

Singapore Transportation Infrastructure Construction Industry Segmentation By Geography

- 1. Singapore

Singapore Transportation Infrastructure Construction Industry Regional Market Share

Geographic Coverage of Singapore Transportation Infrastructure Construction Industry

Singapore Transportation Infrastructure Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase In Tourism Industry4.; Sustainability and Environmental Concerns

- 3.3. Market Restrains

- 3.3.1. 4.; Financial Constraints4.; High Maintenance and Keep Up

- 3.4. Market Trends

- 3.4.1. Metro Expansion in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roadways

- 5.1.2. Railways

- 5.1.3. Airways

- 5.1.4. Ports and Inland Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Obayashi Singapore Private Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tiong Seng Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shimizu Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Woh Hup Holdings Pte Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hyundai Engineering & Construction Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Koh Brothers Building & Civil Engineering Contractor Pte Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CSC Holdings Limited**List Not Exhaustive 6 3 Other Companies (Overview/Key Information

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Daelim Industrial Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lum Chang Holdings Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jurong Engineering Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Obayashi Singapore Private Limited

List of Figures

- Figure 1: Singapore Transportation Infrastructure Construction Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Transportation Infrastructure Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: Singapore Transportation Infrastructure Construction Industry Revenue Million Forecast, by Mode 2020 & 2033

- Table 2: Singapore Transportation Infrastructure Construction Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Singapore Transportation Infrastructure Construction Industry Revenue Million Forecast, by Mode 2020 & 2033

- Table 4: Singapore Transportation Infrastructure Construction Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Transportation Infrastructure Construction Industry?

The projected CAGR is approximately 4.07%.

2. Which companies are prominent players in the Singapore Transportation Infrastructure Construction Industry?

Key companies in the market include Obayashi Singapore Private Limited, Tiong Seng Group, Shimizu Corporation, Woh Hup Holdings Pte Ltd, Hyundai Engineering & Construction Co Ltd, Koh Brothers Building & Civil Engineering Contractor Pte Ltd, CSC Holdings Limited**List Not Exhaustive 6 3 Other Companies (Overview/Key Information, Daelim Industrial Co Ltd, Lum Chang Holdings Limited, Jurong Engineering Limited.

3. What are the main segments of the Singapore Transportation Infrastructure Construction Industry?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.57 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase In Tourism Industry4.; Sustainability and Environmental Concerns.

6. What are the notable trends driving market growth?

Metro Expansion in the Country.

7. Are there any restraints impacting market growth?

4.; Financial Constraints4.; High Maintenance and Keep Up.

8. Can you provide examples of recent developments in the market?

April 2023: Siemens Mobility has been awarded a contract by the Singapore Land Transport Authority (LTA) to provide a signaling system (CBTC) and full-height platform screen doors (PSD) for the Cross Island Line (CRL). The order is worth approximately USD 333.65 million. The signaling system will feature Siemens Mobility’s Trainguard CBTC solution, modern interlocking Westrace MKII, and Automatic Train Supervision (ATS) Rail9k to support the maximum grade of automation, GoA 4, and allow fully unattended train operation along around 50 kilometers of track and 21 stations of CRL1, CRL2 and Punggol Extension.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Transportation Infrastructure Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Transportation Infrastructure Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Transportation Infrastructure Construction Industry?

To stay informed about further developments, trends, and reports in the Singapore Transportation Infrastructure Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence