Key Insights

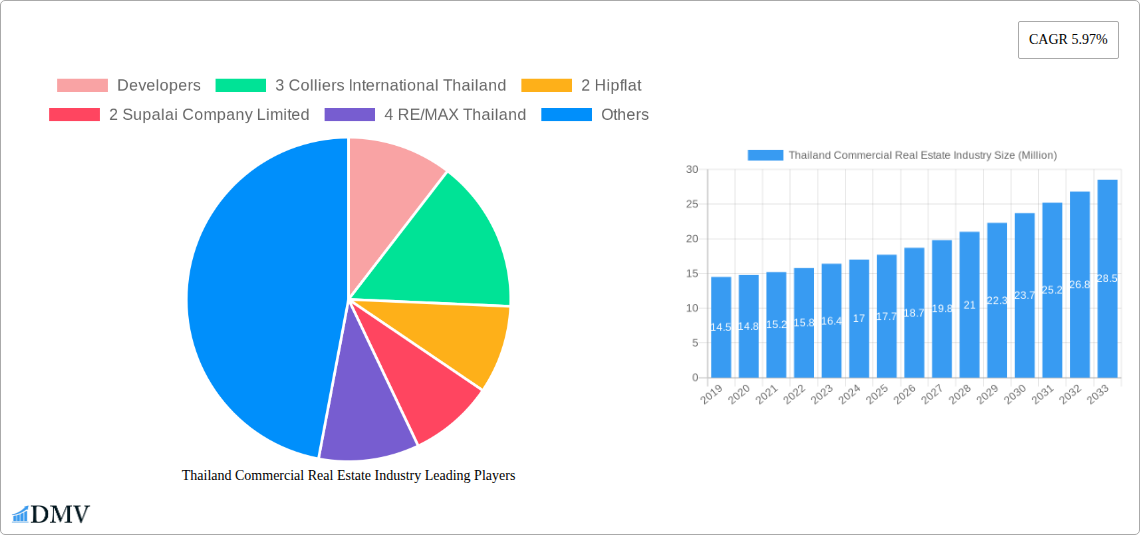

The Thailand Commercial Real Estate Industry is poised for substantial growth, with an estimated market size of $17 million in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.97% through 2033. This robust expansion is fueled by a confluence of compelling market drivers, including a burgeoning tourism sector, increasing foreign direct investment, and a growing demand for modern office spaces driven by the expansion of multinational corporations and the thriving startup ecosystem. The industrial and logistics segment, in particular, is experiencing significant traction due to Thailand's strategic location as a regional hub, coupled with advancements in e-commerce and supply chain efficiencies. Furthermore, the hospitality sector is anticipated to witness a revival and sustained growth as travel restrictions ease and tourist confidence returns, particularly in key destinations like Bangkok, Chiang Mai, Hua Hin, and Koh Samui. These positive indicators suggest a dynamic and resilient market, attracting both domestic and international investors seeking lucrative opportunities.

Thailand Commercial Real Estate Industry Market Size (In Million)

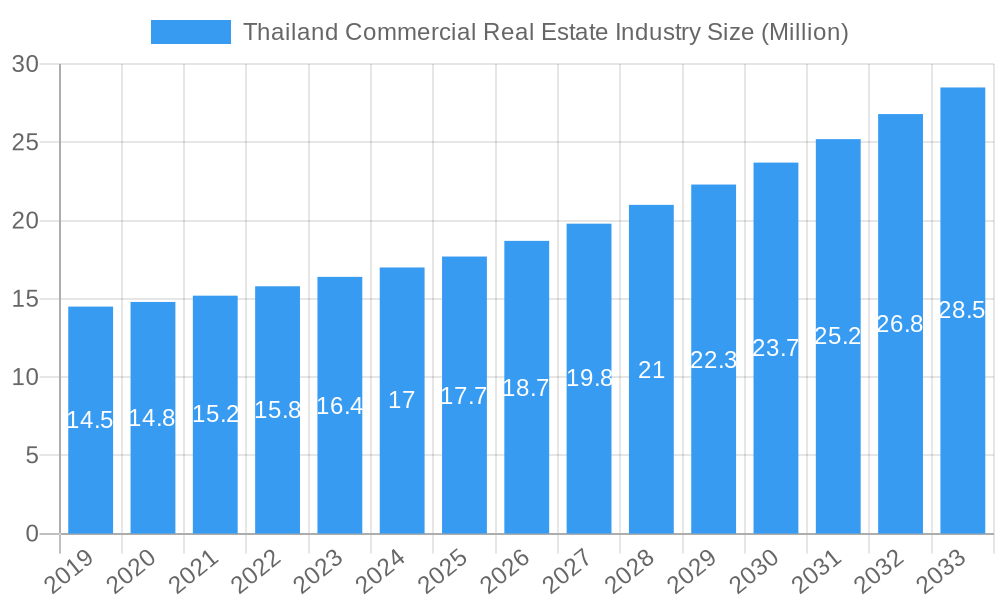

Despite the optimistic outlook, the market is not without its challenges. Potential restraints include fluctuating economic conditions, geopolitical uncertainties, and evolving regulatory frameworks that could impact investment decisions and project timelines. However, innovative real estate solutions, such as flexible office spaces, sustainable development practices, and the integration of proptech, are emerging to address these concerns and unlock new avenues for growth. The competitive landscape is characterized by a mix of established developers like Supalai Company Limited, Central Pattana PLC, and Property Perfect, alongside prominent real estate agencies such as Colliers International Thailand, Savills, CBRE Thailand, and Knight Frank Thailand. Emerging players and associations are also contributing to market dynamism, alongside specialized firms like Blink Design Group. This diverse ecosystem fosters healthy competition and drives continuous innovation, ensuring the Thailand Commercial Real Estate Industry remains vibrant and attractive to a wide spectrum of stakeholders.

Thailand Commercial Real Estate Industry Company Market Share

Thailand Commercial Real Estate Industry Market Composition & Trends

This comprehensive report offers an in-depth analysis of the Thailand Commercial Real Estate Industry, exploring its market composition and evolving trends from 2019 to 2033, with a base and estimated year of 2025. We delve into market concentration, identifying key players and their market share distribution. Innovation catalysts such as technological advancements and novel business models are examined, alongside the dynamic regulatory landscape shaping investment and development. Substitute products and their impact on traditional commercial real estate offerings are assessed, and end-user profiles are meticulously detailed to understand evolving demands. Furthermore, the report scrutinizes Merger & Acquisition (M&A) activities, providing insights into deal values and strategic consolidations within the Thai property market. This analysis is crucial for stakeholders seeking to navigate the complexities and capitalize on the burgeoning opportunities within Thailand's dynamic commercial property sector.

- Market Concentration: Characterized by a mix of established conglomerates and emerging developers, with a trend towards strategic alliances.

- Innovation Catalysts: Driven by smart building technologies, sustainable design, and flexible workspace solutions.

- Regulatory Landscapes: Influenced by government initiatives promoting foreign investment and urban development.

- Substitute Products: Growing competition from co-working spaces and e-commerce impacting traditional retail and office models.

- End-User Profiles: Shifting towards demand for integrated lifestyle spaces, efficient logistics hubs, and sustainable hospitality.

- M&A Activities: M&A deal values are projected to see a steady increase as companies seek to expand their portfolios and market reach.

Thailand Commercial Real Estate Industry Industry Evolution

The Thailand Commercial Real Estate Industry has undergone a significant transformation, marked by robust growth trajectories and accelerated technological advancements. From 2019 to 2024, the historical period showcases a resilient market, recovering from initial economic headwinds and demonstrating a consistent upward trend in investment and development. The forecast period, 2025–2033, is poised for even greater expansion, driven by Thailand's strategic position as a regional hub and its burgeoning tourism and manufacturing sectors. Key to this evolution is the adoption of cutting-edge technologies, including Building Information Modeling (BIM), Artificial Intelligence (AI) for property management, and the integration of smart city solutions, which are enhancing operational efficiency and tenant experience. Shifting consumer demands play a pivotal role, with an increasing preference for sustainable, mixed-use developments that integrate living, working, and leisure. This has spurred a diversification in property types, with a surge in demand for industrial and logistics facilities to support the e-commerce boom, alongside a revitalization of retail spaces to focus on experiential shopping. The hospitality sector continues to attract substantial investment, fueled by inbound tourism and the demand for unique, digitally-enabled guest experiences. The overall growth rate of the commercial property market in Thailand is expected to witness a compound annual growth rate (CAGR) of xx% during the forecast period, reflecting strong underlying economic fundamentals and a favorable investment climate. Adoption metrics for digital property management tools are projected to rise by xx% annually, underscoring the industry's embrace of innovation.

Leading Regions, Countries, or Segments in Thailand Commercial Real Estate Industry

The Thailand Commercial Real Estate Industry is spearheaded by Bangkok, the nation's bustling capital and economic powerhouse, exhibiting unparalleled dominance across multiple segments. Within Bangkok, the Office segment continues to be a cornerstone, attracting significant foreign direct investment and housing multinational corporations. The city's prime business districts are witnessing a sustained demand for Grade A office spaces, characterized by modern amenities, sustainable certifications, and advanced technological infrastructure. This segment is further bolstered by the growing trend of flexible workspaces and co-working solutions, catering to the evolving needs of startups and agile businesses.

The Retail segment in Bangkok is undergoing a significant metamorphosis, moving beyond traditional shopping malls to embrace experiential retail concepts. New developments are prioritizing immersive brand experiences, integrated entertainment zones, and a curated mix of local and international retailers, reflecting a conscious effort to adapt to the rise of e-commerce. Luxury retail, in particular, remains a strong performer, driven by both local affluent consumers and international tourists.

The Industrial and Logistics segment is experiencing unprecedented growth, largely propelled by Bangkok's strategic location and Thailand's role as a manufacturing and distribution hub for Southeast Asia. The burgeoning e-commerce sector has created a massive demand for modern warehousing facilities, cold storage, and last-mile delivery centers. Investments in this segment are focused on developing smart logistics parks equipped with automation and efficient supply chain management systems.

Hua Hin emerges as a significant player, particularly in the Hospitality and Residential (though the report focuses on commercial) segments, attracting a steady stream of tourists and expatriates seeking leisure and retirement opportunities. Its appeal lies in its coastal charm, world-class resorts, and a growing infrastructure that supports a vibrant tourism economy.

Koh Samui, renowned for its picturesque beaches and luxury resorts, continues to be a prime destination for the Hospitality sector. Investment here is focused on high-end resorts, boutique hotels, and wellness retreats, catering to a discerning clientele.

The Rest of Thailand encompasses a diverse range of commercial opportunities, with Chiang Mai showcasing a growing demand for office spaces driven by its burgeoning tech and creative industries, alongside a vibrant tourism and hospitality sector. Other emerging cities are also attracting investment in retail and industrial segments as economic development spreads beyond the major metropolises.

- Bangkok's Dominance:

- Office: High demand for Grade A spaces, driven by MNCs and flexible workspace adoption.

- Retail: Shift towards experiential retail, integrating entertainment and curated brand experiences.

- Industrial & Logistics: Exponential growth due to e-commerce and Thailand's manufacturing prowess.

- Hua Hin's Niche:

- Hospitality: Strong performance in resort and leisure tourism, attracting domestic and international visitors.

- Koh Samui's Appeal:

- Hospitality: Focus on luxury resorts and boutique accommodations for high-net-worth individuals.

- Chiang Mai's Rise:

- Office: Growing demand from tech and creative sectors.

- Hospitality: Sustained tourism momentum driving investment.

- Key Drivers of Dominance:

- Investment Trends: Significant inflows of foreign and domestic capital into key segments.

- Regulatory Support: Government policies encouraging development and investment in strategic areas.

- Infrastructure Development: Ongoing enhancements in transportation and connectivity.

- Economic Growth: Broad-based economic expansion fueling demand across all commercial property types.

Thailand Commercial Real Estate Industry Product Innovations

The Thailand Commercial Real Estate Industry is embracing innovation to enhance functionality, sustainability, and user experience. Smart building technologies are at the forefront, integrating IoT sensors for real-time monitoring of energy consumption, occupancy rates, and environmental conditions. These systems optimize building performance, reduce operational costs, and improve tenant comfort. Sustainable design principles are increasingly being adopted, with a focus on green building materials, energy-efficient systems, and water conservation measures, leading to a rise in LEED-certified developments. Flexible workspace solutions are also evolving, offering modular designs and adaptable layouts to cater to the dynamic needs of businesses. Furthermore, the integration of AI-powered property management platforms is streamlining operations, from tenant communication to predictive maintenance, enhancing overall efficiency and tenant satisfaction.

Propelling Factors for Thailand Commercial Real Estate Industry Growth

Several key factors are propelling the Thailand Commercial Real Estate Industry forward. Economically, Thailand's steady GDP growth, coupled with increasing foreign direct investment (FDI), fuels demand for commercial spaces across all sectors. Government initiatives promoting economic diversification and infrastructure development, such as the Eastern Economic Corridor (EEC), are creating new hubs for industrial and logistics growth. Technologically, the widespread adoption of digital solutions, including AI-driven property management and smart building technologies, is enhancing operational efficiency and tenant experience, making properties more attractive. Furthermore, Thailand's strong tourism sector continues to drive significant investment in the hospitality and retail segments, creating a vibrant ecosystem for commercial real estate development. The growing e-commerce market is also a major catalyst, spurring demand for modern industrial and logistics facilities.

Obstacles in the Thailand Commercial Real Estate Industry Market

Despite its growth, the Thailand Commercial Real Estate Industry faces several obstacles. Regulatory complexities and bureaucratic procedures can sometimes slow down project approvals and development timelines. Fluctuations in global economic conditions and geopolitical uncertainties can impact investor confidence and capital flows. Supply chain disruptions, particularly in the sourcing of construction materials, can lead to increased costs and project delays, affecting the overall profitability of developments. Competitive pressures are also significant, with an increasing number of developers vying for market share, potentially leading to oversupply in certain segments and locations. Furthermore, evolving tenant expectations for sustainability and technological integration require continuous adaptation and investment, posing a challenge for some established players.

Future Opportunities in Thailand Commercial Real Estate Industry

Emerging opportunities within the Thailand Commercial Real Estate Industry are abundant. The continued expansion of e-commerce presents a significant opportunity for the development of advanced logistics and warehousing facilities, particularly in strategic locations with excellent connectivity. The growing demand for sustainable and green buildings offers a chance for developers to innovate and attract environmentally conscious tenants and investors. The rise of the digital economy and the creative industries is creating demand for modern, flexible office spaces in secondary cities, presenting opportunities for diversification beyond Bangkok. Furthermore, Thailand's status as a regional tourism hub continues to drive investment in the hospitality sector, with opportunities in niche segments like wellness tourism and eco-lodges. The increasing interest in mixed-use developments, integrating residential, commercial, and leisure components, also represents a significant growth avenue.

Major Players in the Thailand Commercial Real Estate Industry Ecosystem

- Colliers International Thailand

- Hipflat

- Supalai Company Limited

- RE/MAX Thailand

- Central Pattana PLC

- Savills

- Dot Property

- Knight Frank Thailand

- CBRE Thailand

- JLL Thailand

- Pace Development Corporation PLC

- Property Perfect

- Blink Design Group

- Raimon Land PCL

- DDProperty

- Other Companies (Start-ups Associations)

Key Developments in Thailand Commercial Real Estate Industry Industry

- February 2024: Central Retail Corporation, Thailand's leading retailer, set aside THB 22 to 24 billion (USD 613 to USD 669 million) for expansion in 2024, signaling robust retail sector confidence and planned growth.

- December 2023: FitFlop, a UK-based ergonomic and wellness footwear brand, ramped up its global growth by securing new distributors in Canada, Eastern Europe, and Asia. The brand is further expanding its retail presence in Thailand, teaming up with local partner CMG. Notably, the Thailand store is the first to showcase FitFlop's revamped retail design, aligning it with its contemporary image and marketing campaigns, indicating a focus on modern retail experiences.

Strategic Thailand Commercial Real Estate Industry Market Forecast

The strategic outlook for the Thailand Commercial Real Estate Industry is overwhelmingly positive, driven by a confluence of robust economic growth, favorable government policies, and significant technological integration. The forecast period, 2025–2033, is expected to witness sustained expansion, particularly in the industrial and logistics sectors, propelled by the e-commerce boom and Thailand's pivotal role in regional supply chains. The retail sector is poised for a revival through experiential concepts and omnichannel strategies, while the hospitality industry will continue to benefit from Thailand's appeal as a top global tourist destination. Key growth catalysts include ongoing infrastructure development, particularly in the Eastern Economic Corridor (EEC), and the increasing adoption of sustainable building practices and smart technologies. These factors collectively position Thailand as a highly attractive destination for both domestic and international real estate investment, promising substantial market potential and opportunities for stakeholders.

Thailand Commercial Real Estate Industry Segmentation

-

1. Type

- 1.1. Office

- 1.2. Retail

- 1.3. Industrial and Logistics

- 1.4. Hospitality

- 1.5. Others

-

2. Key Cities

- 2.1. Bangkok

- 2.2. Chiang Mai

- 2.3. Hua Hin

- 2.4. Koh Samui

- 2.5. Rest of Thailand

Thailand Commercial Real Estate Industry Segmentation By Geography

- 1. Thailand

Thailand Commercial Real Estate Industry Regional Market Share

Geographic Coverage of Thailand Commercial Real Estate Industry

Thailand Commercial Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Overall economic growth driving the market; The growth of business and industries driving the market

- 3.3. Market Restrains

- 3.3.1. Fluctuating economic conditions hindering the growth of the market; Difficulty in landownership and leasing rights affecting the market

- 3.4. Market Trends

- 3.4.1. Growing Demand for Retail Spaces in Thailand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Commercial Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office

- 5.1.2. Retail

- 5.1.3. Industrial and Logistics

- 5.1.4. Hospitality

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Bangkok

- 5.2.2. Chiang Mai

- 5.2.3. Hua Hin

- 5.2.4. Koh Samui

- 5.2.5. Rest of Thailand

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Developers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3 Colliers International Thailand

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 2 Hipflat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 2 Supalai Company Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 4 RE/MAX Thailand

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 1 Central Pattana PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 2 Savills

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 4 Dot Property**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 6 Knight Frank Thailand*

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 1 CBRE Thailand

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Other Companies (Start-ups Associations)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 5 JLL Thailand

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 3 Pace Development Corporation PLC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Real Estate Agencies

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 1 Property Perfect

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 5 Blink Design Group*

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 4 Raimon Land PCL

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 3 DDProperty

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 Developers

List of Figures

- Figure 1: Thailand Commercial Real Estate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Commercial Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Commercial Real Estate Industry?

The projected CAGR is approximately 5.97%.

2. Which companies are prominent players in the Thailand Commercial Real Estate Industry?

Key companies in the market include Developers, 3 Colliers International Thailand, 2 Hipflat, 2 Supalai Company Limited, 4 RE/MAX Thailand, 1 Central Pattana PLC, 2 Savills, 4 Dot Property**List Not Exhaustive, 6 Knight Frank Thailand*, 1 CBRE Thailand, Other Companies (Start-ups Associations), 5 JLL Thailand, 3 Pace Development Corporation PLC, Real Estate Agencies, 1 Property Perfect, 5 Blink Design Group*, 4 Raimon Land PCL, 3 DDProperty.

3. What are the main segments of the Thailand Commercial Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 17 Million as of 2022.

5. What are some drivers contributing to market growth?

Overall economic growth driving the market; The growth of business and industries driving the market.

6. What are the notable trends driving market growth?

Growing Demand for Retail Spaces in Thailand.

7. Are there any restraints impacting market growth?

Fluctuating economic conditions hindering the growth of the market; Difficulty in landownership and leasing rights affecting the market.

8. Can you provide examples of recent developments in the market?

February 2024: Central Retail Corporation, Thailand's leading retailer, set aside THB 22 to 24 billion (USD 613 to USD 669 million) for expansion in 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Commercial Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Commercial Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Commercial Real Estate Industry?

To stay informed about further developments, trends, and reports in the Thailand Commercial Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence