Key Insights

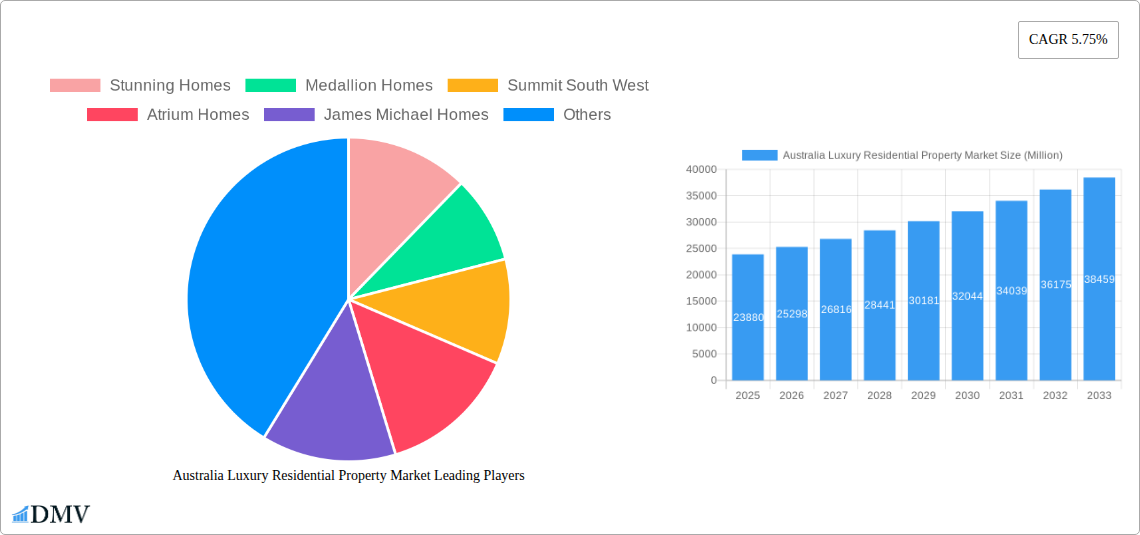

The Australian luxury residential property market, valued at $23.88 billion in 2025, is poised for robust growth, projected to expand at a compound annual growth rate (CAGR) of 5.75% from 2025 to 2033. This growth is fueled by several key drivers. Firstly, a strong economy and increasing high-net-worth individuals contribute significantly to the demand for premium properties. Secondly, a limited supply of luxury homes in prime locations, particularly in major cities like Sydney, Melbourne, and Brisbane, further inflates prices and fuels competition. Furthermore, a preference for larger, more luxurious homes with high-end amenities, coupled with a trend towards sustainable and smart home features, is shaping the market. While rising interest rates and potential economic uncertainty pose some restraints, the underlying demand for luxury properties remains strong, particularly within established and sought-after suburbs. The market is segmented by property type (apartments/condominiums, villas/landed houses) and city, with Sydney, Melbourne, and Brisbane representing the largest segments. Key players include Stunning Homes, Medallion Homes, Summit South West, and others, competing in a market characterized by both established developers and niche builders catering to specific luxury preferences.

Australia Luxury Residential Property Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued expansion, although the rate of growth might fluctuate year-to-year depending on broader economic conditions. The segment of villas and landed houses is expected to retain a higher market share due to the enduring appeal of spacious properties in exclusive locations. However, the apartment and condominium segment will likely see growth driven by increasing demand for luxurious city-center living. Strategic partnerships between developers and high-end interior designers/architects are expected to become increasingly prevalent, further enhancing the luxury offerings and attracting discerning buyers. This competitive landscape necessitates innovative marketing strategies and a strong focus on providing a superior customer experience to succeed in this lucrative sector.

Australia Luxury Residential Property Market Company Market Share

Australia Luxury Residential Property Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Australian luxury residential property market, covering the period 2019-2033. It examines market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, future opportunities, and key players. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the dynamics of this lucrative market. The report details significant developments, including recent luxury apartment projects in Sydney and Brisbane, providing crucial insights into current market trends and future projections. Expect detailed breakdowns by property type (apartments & condominiums, villas & landed houses), city (Sydney, Melbourne, Brisbane, Perth, and other cities), and analysis of key players like Stunning Homes, Medallion Homes, and Metricon Homes. The total market value is projected to reach xx Million by 2033.

Australia Luxury Residential Property Market Composition & Trends

This section evaluates the concentration of the Australian luxury residential property market, examining innovation, regulations, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity from 2019 to 2024.

Market Concentration: The market exhibits a moderately concentrated structure, with a few large players holding significant market share, while numerous smaller boutique developers cater to niche segments. The top five developers are estimated to control approximately xx% of the market in 2024. The remaining market share is distributed amongst numerous smaller players.

Innovation Catalysts: Technological advancements such as smart home integration, sustainable building materials, and virtual reality property tours are driving innovation.

Regulatory Landscape: Government policies impacting foreign investment, zoning regulations, and environmental standards significantly influence market dynamics.

Substitute Products: While limited, alternative investment options like luxury commercial real estate and high-end art compete for high-net-worth investors’ capital.

End-User Profiles: The primary end-users are high-net-worth individuals (HNWIs), both domestic and international, seeking prestigious properties for primary residences or investment purposes.

M&A Activity: The period 2019-2024 witnessed xx M&A deals in the luxury residential sector, with a total deal value of approximately xx Million. These deals primarily involved smaller developers being acquired by larger firms aiming for expansion or market consolidation. The average deal value was xx Million.

Australia Luxury Residential Property Market Industry Evolution

This section analyzes the evolution of the Australian luxury residential property market, focusing on growth trajectories, technological advancements, and shifting consumer preferences from 2019 to 2024. The market experienced an average annual growth rate (AAGR) of xx% during this period. Technological advancements have led to increased use of sustainable building materials (xx% adoption in 2024), smart home technology integration (xx% adoption in 2024), and sophisticated marketing strategies incorporating virtual tours and online platforms. Consumer demand shifted towards properties with sustainable features, smart home technology and increased focus on location and lifestyle elements. The growth is projected to continue, driven by increasing HNWIs population, government initiatives, and rising foreign investment.

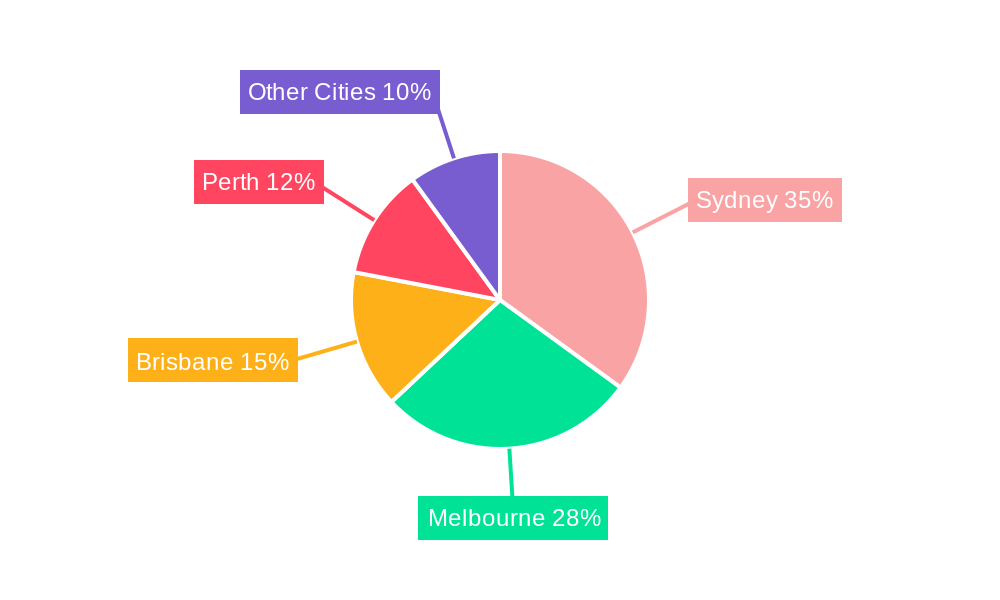

Leading Regions, Countries, or Segments in Australia Luxury Residential Property Market

Sydney, Melbourne, and Brisbane dominate the Australian luxury residential property market.

By City:

- Sydney: Sydney's strong economy, iconic harbor views, and established luxury infrastructure fuel high demand and premium pricing. Investment trends focused on waterfront properties and inner-city apartments are particularly strong, driving property value appreciation.

- Melbourne: Melbourne's cultural vibrancy, excellent lifestyle, and strong rental market contribute to its popularity among luxury buyers.

- Brisbane: Brisbane shows strong growth, driven by infrastructure development, affordability compared to Sydney and Melbourne, and rising population.

- Perth: Perth's luxury market is more cyclical, tied to the resources sector. However, strong mining activity has positive effect on luxury property prices.

- Other Cities: Smaller markets, such as those in the Gold Coast, offer opportunities for niche developers.

By Type:

- Apartments and Condominiums: High demand for low-maintenance, secure, and centrally located residences drives this segment's growth.

- Villas and Landed Houses: This segment caters to buyers seeking larger spaces, privacy, and premium outdoor areas.

Australia Luxury Residential Property Market Product Innovations

Recent innovations include the incorporation of smart home technologies (e.g., automated lighting and security systems), sustainable building materials (e.g., cross-laminated timber and solar panels), and design features that emphasize wellness and indoor-outdoor living. These innovations enhance the luxury experience, improve energy efficiency and sustainability, and offer unique selling propositions to attract discerning buyers.

Propelling Factors for Australia Luxury Residential Property Market Growth

Key growth drivers include strong economic conditions leading to increased HNWIs, government initiatives supporting infrastructure development and foreign investment, and evolving consumer preferences towards sustainable and technologically advanced properties. Increased foreign investment, particularly from Asian countries, further fuels this growth.

Obstacles in the Australia Luxury Residential Property Market

Obstacles include regulatory hurdles relating to planning approvals and foreign investment restrictions, supply chain disruptions impacting construction timelines and costs, and intense competition among developers. These factors can lead to project delays and increased costs impacting profitability.

Future Opportunities in Australia Luxury Residential Property Market

Future opportunities include catering to the growing demand for sustainable and smart homes, leveraging technology for enhanced marketing and sales, expanding into new markets and developing unique luxury experiences, and focusing on niche segments such as wellness retreats and bespoke design. Foreign investments and strong economic growth will also increase opportunities.

Major Players in the Australia Luxury Residential Property Market Ecosystem

- Stunning Homes

- Medallion Homes

- Summit South West

- Atrium Homes

- James Michael Homes

- Metricon Homes

- High End Nicheliving

- Broadway Homes

- Lomma Homes

- Rossadale Homes

Key Developments in Australia Luxury Residential Property Market Industry

- August 2023: Made Property launches Corsa Mortlake, a 20-apartment luxury development in Sydney's inner west, featuring three-bedroom apartments with marina access. Completion expected late 2025.

- September 2023: DD Living launches Burly Residences, a luxury beachfront apartment development in North Burleigh, Queensland.

Strategic Australia Luxury Residential Property Market Forecast

The Australian luxury residential property market is poised for sustained growth over the forecast period (2025-2033), driven by continued strong economic conditions, increasing HNWIs, and ongoing demand for premium properties. Opportunities exist within the sustainable and smart home segments and niche markets. The market is expected to reach xx Million by 2033.

Australia Luxury Residential Property Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. City

- 2.1. Sydney

- 2.2. Perth

- 2.3. Melbourne

- 2.4. Brisbane

- 2.5. Other Cities

Australia Luxury Residential Property Market Segmentation By Geography

- 1. Australia

Australia Luxury Residential Property Market Regional Market Share

Geographic Coverage of Australia Luxury Residential Property Market

Australia Luxury Residential Property Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of High Net-Worth Individuals (HNWIs)

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Interest Rates

- 3.4. Market Trends

- 3.4.1. Ultra High Net Worth Population Driving the Demand for Prime Properties

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Luxury Residential Property Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Sydney

- 5.2.2. Perth

- 5.2.3. Melbourne

- 5.2.4. Brisbane

- 5.2.5. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Stunning Homes

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medallion Homes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Summit South West

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Atrium Homes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 James Michael Homes

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Metricon Homes

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 High End Nicheliving

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Broadway Homes**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lomma Homes

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rossadale Homes

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Stunning Homes

List of Figures

- Figure 1: Australia Luxury Residential Property Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Luxury Residential Property Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Luxury Residential Property Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Australia Luxury Residential Property Market Revenue Million Forecast, by City 2020 & 2033

- Table 3: Australia Luxury Residential Property Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Luxury Residential Property Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Australia Luxury Residential Property Market Revenue Million Forecast, by City 2020 & 2033

- Table 6: Australia Luxury Residential Property Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Luxury Residential Property Market?

The projected CAGR is approximately 5.75%.

2. Which companies are prominent players in the Australia Luxury Residential Property Market?

Key companies in the market include Stunning Homes, Medallion Homes, Summit South West, Atrium Homes, James Michael Homes, Metricon Homes, High End Nicheliving, Broadway Homes**List Not Exhaustive, Lomma Homes, Rossadale Homes.

3. What are the main segments of the Australia Luxury Residential Property Market?

The market segments include Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.88 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of High Net-Worth Individuals (HNWIs).

6. What are the notable trends driving market growth?

Ultra High Net Worth Population Driving the Demand for Prime Properties.

7. Are there any restraints impacting market growth?

4.; Rising Interest Rates.

8. Can you provide examples of recent developments in the market?

August 2023: Sydney-based boutique developer Made Property laid plans for a new apartment project along Sydney Harbour amid sustained demand for luxury waterfront properties. The Corsa Mortlake development, positioned on Majors Bay in the harbor city’s inner west, will deliver 20 three-bedroom apartments offering house-sized living spaces and ready access to a 23-berth marina accommodating yachts up to 20 meters. With development approval secured for the project, the company is moving quickly to construction. Made Property expects construction to be completed in late 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Luxury Residential Property Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Luxury Residential Property Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Luxury Residential Property Market?

To stay informed about further developments, trends, and reports in the Australia Luxury Residential Property Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence