Key Insights

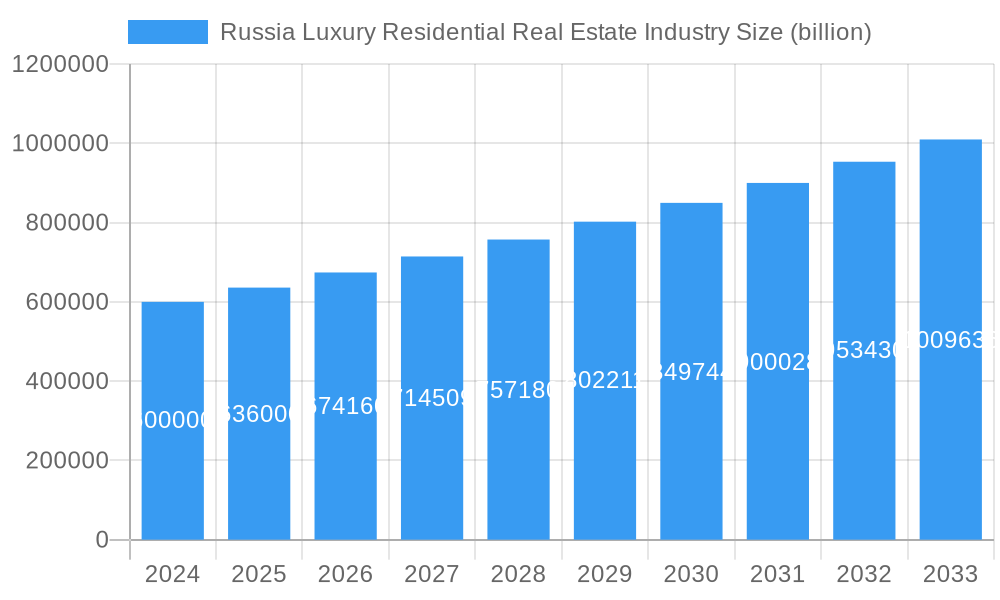

The Russian luxury residential real estate market is poised for substantial growth, currently estimated at $600 billion in 2024, with a projected Compound Annual Growth Rate (CAGR) of 6% over the forecast period of 2025-2033. This robust expansion is driven by a confluence of factors including increasing disposable incomes among high-net-worth individuals, a sustained demand for premium living spaces, and ongoing urbanization trends. The market is characterized by a growing preference for modern, high-specification apartments and condominiums offering enhanced amenities and services, alongside continued demand for exclusive villas and landed houses that provide privacy and spaciousness. Major metropolitan areas like Moscow and St. Petersburg continue to lead the market, attracting significant investment due to their established infrastructure and vibrant economies. However, secondary cities are also witnessing a rise in luxury developments as developers diversify their portfolios and cater to emerging affluent populations in these regions.

Russia Luxury Residential Real Estate Industry Market Size (In Billion)

Key trends shaping the Russian luxury real estate landscape include a strong emphasis on smart home technology, sustainable building practices, and a desire for integrated lifestyle communities that offer a blend of residential, retail, and recreational facilities. While the market benefits from strong domestic demand and a growing class of affluent buyers, potential restraints could emerge from evolving economic conditions, geopolitical influences, and regulatory changes that might impact foreign investment. Nonetheless, the inherent appeal of luxury properties as both aspirational living spaces and secure investments is expected to sustain market momentum. Leading developers such as PIK Group, SU-, Samolet Group, Glavstroy, and LSR Group are actively engaged in shaping this evolving market through innovative designs and strategic project developments, catering to the discerning needs of the affluent Russian buyer.

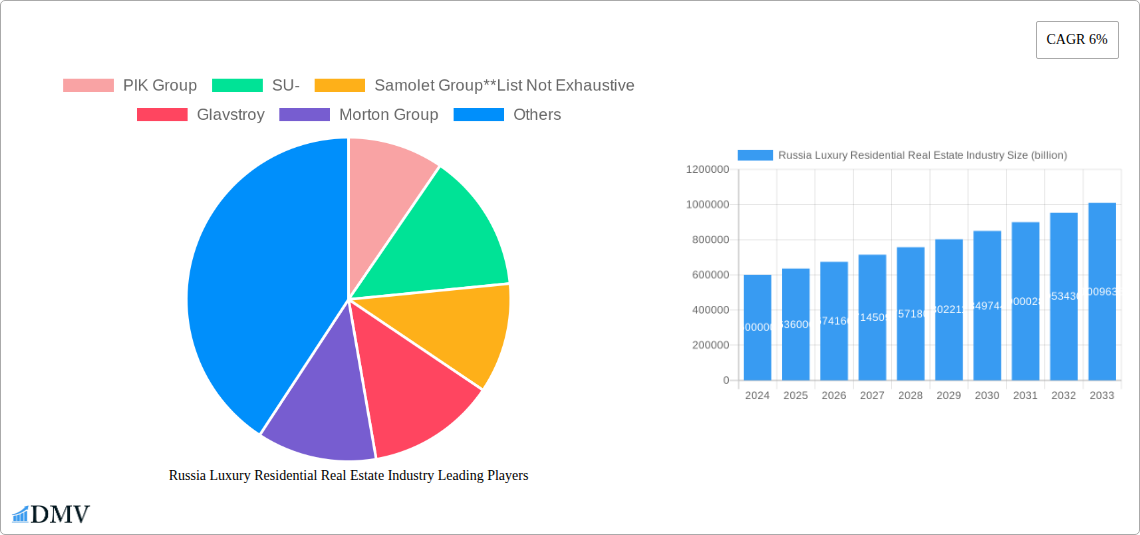

Russia Luxury Residential Real Estate Industry Company Market Share

This comprehensive report offers an in-depth analysis of the Russia Luxury Residential Real Estate Industry. Delving into the market dynamics from 2019–2033, with a base year of 2025, this study provides unparalleled insights into market composition, evolving trends, and future projections for stakeholders. We meticulously examine the luxury housing market, focusing on apartments and condominiums, villas and landed houses, with a keen eye on key urban centers like Moscow, St. Petersburg, and Novosibirsk, alongside emerging other cities. Unlock the secrets to navigating this lucrative Russian real estate market with data-driven strategies and expert commentary.

Russia Luxury Residential Real Estate Industry Market Composition & Trends

The Russia Luxury Residential Real Estate Industry is characterized by a notable market concentration, with a handful of prominent developers dominating the landscape. Innovation within this segment is primarily driven by evolving consumer preferences for high-end amenities, smart home technology integration, and sustainable building practices. The regulatory environment, while presenting certain compliance challenges, also fosters growth through urban planning initiatives and foreign investment policies. Substitute products, such as premium serviced apartments and short-term luxury rentals, pose a competitive challenge, necessitating continuous value enhancement for traditional residential offerings. End-user profiles are increasingly sophisticated, comprising ultra-high-net-worth individuals (UHNWIs), expatriates, and domestic investors seeking capital appreciation and exclusive living experiences. Mergers and acquisitions (M&A) activities are pivotal for consolidating market share and expanding geographical reach. Notable M&A deal values in the historical period (2019-2024) are estimated to be in the range of billions. The market share distribution, while dynamic, sees key players holding substantial portions of the luxury segment. Understanding these interconnected elements is crucial for strategic planning and investment decisions in the Russian premium property market.

- Market Concentration: Dominated by a few key developers, leading to significant market share for top players.

- Innovation Catalysts: Demand for smart homes, sustainable designs, and exclusive amenities.

- Regulatory Landscape: Evolving urban planning and foreign investment policies shaping development.

- Substitute Products: Serviced apartments and luxury rentals offer alternative premium living.

- End-User Profiles: UHNWIs, expatriates, and discerning domestic investors.

- M&A Activities: Strategic acquisitions to bolster market presence and portfolio diversification.

- Estimated M&A deal values in the historical period (2019-2024): XX billion.

Russia Luxury Residential Real Estate Industry Industry Evolution

The Russia Luxury Residential Real Estate Industry has witnessed a significant evolution over the historical period (2019–2024), with its trajectory set to continue its upward climb through the forecast period (2025–2033). Market growth has been propelled by a confluence of factors, including robust economic indicators, a growing class of affluent individuals, and increased demand for premium living spaces. Technological advancements have been transformative, with the integration of smart home systems, advanced security features, and eco-friendly construction materials becoming standard expectations in luxury residences. Developers are increasingly adopting digital tools for marketing, sales, and property management, enhancing customer engagement and operational efficiency. Consumer demands are shifting towards bespoke experiences, emphasizing personalized design, extensive on-site amenities such as spas, gyms, and concierge services, and prime locations offering both exclusivity and convenience. The Russian property market, particularly its luxury segment, is responding to a global trend of wellness-oriented living, with properties now incorporating features that promote health and well-being. The estimated year of 2025 marks a critical point where these trends solidify, with projected market growth rates in the high single digits annually. Adoption metrics for sustainable building practices are showing a marked increase, reflecting both regulatory pressures and consumer awareness. Furthermore, the market is becoming more sophisticated in its offering, moving beyond mere square footage to emphasize lifestyle, community, and investment potential. The luxury apartments and condominiums segment continues to lead, but villas and landed houses in exclusive enclaves are also experiencing renewed interest. This dynamic evolution underscores the resilience and adaptability of the Russian luxury real estate sector.

Leading Regions, Countries, or Segments in Russia Luxury Residential Real Estate Industry

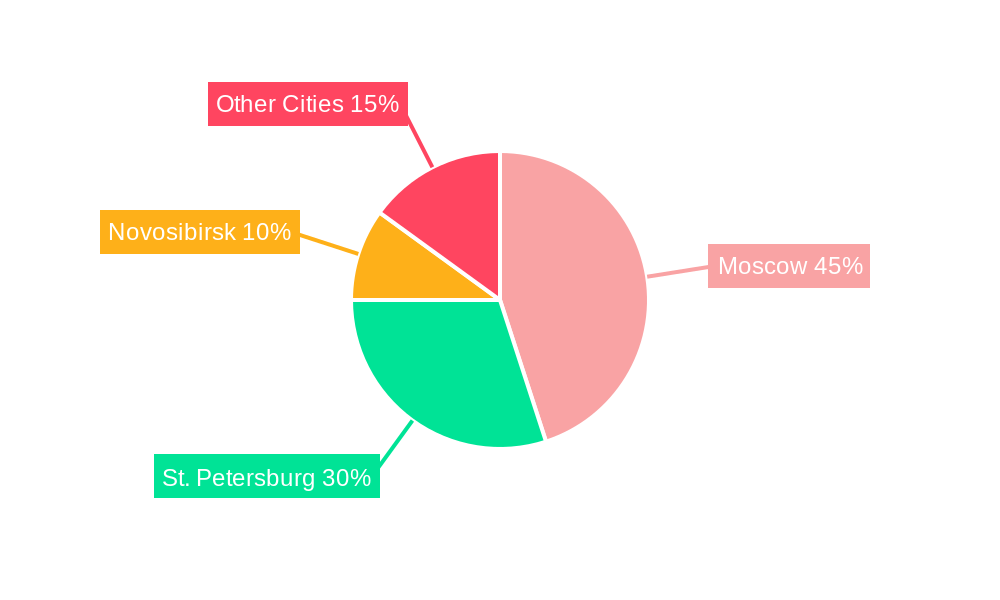

The Russia Luxury Residential Real Estate Industry is unequivocally dominated by Moscow and St. Petersburg, with these two metropolitan giants accounting for the lion's share of high-net-worth individuals and the primary demand for premium properties. Moscow, as the nation's economic and political heart, boasts the highest concentration of wealth, driving a sustained demand for luxury apartments and condominiums and, to a lesser extent, exclusive villas and landed houses in its affluent suburbs. The city's infrastructure, global connectivity, and vibrant lifestyle offerings make it a magnet for both domestic and international buyers.

St. Petersburg, with its rich cultural heritage and picturesque setting, appeals to a slightly different demographic, often attracting those who value aesthetics and a more serene, yet sophisticated, urban experience. Here, historic buildings are meticulously transformed into luxury residences, alongside the development of modern, high-end apartment complexes. The demand for premium properties in St. Petersburg remains robust, fueled by its status as a major tourist destination and a growing hub for creative industries.

While Novosibirsk and other cities are emerging as secondary luxury real estate markets, they have not yet reached the scale or sophistication of the leading two. Investment trends in these regions are often driven by a more localized economic growth and a burgeoning middle class aspiring to higher living standards. Regulatory support, though present nationwide, is often more dynamically implemented in the primary markets, fostering faster development and innovation. The dominance of apartments and condominiums in Moscow and St. Petersburg is a direct reflection of urbanization trends and the desire for convenient, amenity-rich living in prime locations.

- Dominant Regions: Moscow and St. Petersburg.

- Moscow's Dominance:

- Key Drivers: Concentration of wealth, economic powerhouse, global connectivity, diverse lifestyle offerings.

- Property Types: High demand for luxury apartments, condominiums, and exclusive villas.

- Market Focus: Prime locations and integrated lifestyle developments.

- St. Petersburg's Appeal:

- Key Drivers: Cultural significance, aesthetic appeal, burgeoning creative industries.

- Property Types: Renovation of historic buildings into luxury residences, modern high-end apartments.

- Market Focus: Sophisticated urban living and unique architectural integration.

- Emerging Markets (Novosibirsk & Other Cities):

- Key Drivers: Local economic growth, aspiring middle class.

- Market Dynamics: Developing luxury segment with potential for future expansion.

- Investment Trends: Capitalizing on the established luxury markets and exploring growth in secondary cities.

- Regulatory Support: Favorable policies in major cities often accelerate market development.

Russia Luxury Residential Real Estate Industry Product Innovations

Product innovations in the Russia Luxury Residential Real Estate Industry are increasingly focused on enhancing lifestyle and convenience. This includes the integration of cutting-edge smart home technology for seamless control of lighting, climate, security, and entertainment systems. Furthermore, a growing emphasis is placed on sustainable building materials and energy-efficient designs, appealing to environmentally conscious buyers. Exclusive on-site amenities, such as private cinemas, rooftop gardens, co-working spaces, and advanced fitness centers, are becoming standard differentiators. Performance metrics are measured not just by resale value but also by resident satisfaction and the ability of properties to offer a holistic, curated living experience. Unique selling propositions often lie in bespoke interior design services, personalized concierge offerings, and access to exclusive communities. Technological advancements are also seen in innovative construction methods and advanced security solutions, ensuring both safety and comfort.

Propelling Factors for Russia Luxury Residential Real Estate Industry Growth

Several factors are propelling the Russia Luxury Residential Real Estate Industry forward. Economically, a stable or growing economy with increasing disposable income among affluent segments fuels demand for premium housing. Technological advancements, such as smart home integration and sustainable building solutions, enhance the attractiveness and value proposition of luxury properties. Regulatory support, including favorable urban development policies and investment incentives, further stimulates growth. The increasing urbanization trend, particularly in major cities like Moscow and St. Petersburg, concentrates wealth and drives demand for high-density, high-quality residential options. Evolving consumer preferences towards wellness, exclusivity, and amenity-rich living also play a crucial role.

Obstacles in the Russia Luxury Residential Real Estate Industry Market

Despite its growth potential, the Russia Luxury Residential Real Estate Industry faces several obstacles. Regulatory challenges, including complex permitting processes and potential changes in property laws, can create uncertainty. Supply chain disruptions, exacerbated by global economic conditions, can lead to increased construction costs and project delays. Competitive pressures from a saturated market in certain prime locations and from alternative luxury offerings, such as high-end serviced apartments, necessitate continuous innovation and aggressive marketing. Economic volatility, geopolitical events, and fluctuating interest rates can also impact buyer sentiment and the overall affordability of luxury properties.

Future Opportunities in Russia Luxury Residential Real Estate Industry

Emerging opportunities within the Russia Luxury Residential Real Estate Industry are abundant. The expansion into other cities beyond the primary hubs presents significant growth potential as regional economies develop. Technological integration continues to be a key avenue for innovation, with advancements in AI-powered property management and personalized living experiences. New consumer trends, such as the demand for multi-functional living spaces that accommodate remote work and the growing interest in eco-luxury developments, offer niche markets. Furthermore, strategic partnerships and fractional ownership models could unlock new investment avenues for a broader range of affluent buyers.

Major Players in the Russia Luxury Residential Real Estate Industry Ecosystem

- PIK Group

- SU-

- Samolet Group

- Glavstroy

- Morton Group

- Ingrad

- Donstroy

- SETL Group

- LSR Group

- Etalon Group

Key Developments in Russia Luxury Residential Real Estate Industry Industry

- 2019: Increased adoption of smart home technology in new luxury developments.

- 2020: Focus on enhanced security features and contactless services due to global health concerns.

- 2021: Growing demand for properties with dedicated home office spaces.

- 2022: Rise in sustainable building practices and green certifications for luxury residences.

- 2023: Significant M&A activities as developers consolidate market share.

- 2024: Introduction of premium co-living and co-working spaces within luxury residential complexes.

Strategic Russia Luxury Residential Real Estate Industry Market Forecast

The strategic Russia Luxury Residential Real Estate Industry Market Forecast indicates continued robust growth, driven by a confluence of economic recovery, increasing wealth accumulation, and evolving lifestyle demands. Opportunities lie in leveraging technological advancements for smarter, more sustainable living experiences and in tapping into the potential of emerging urban centers. The market's ability to adapt to discerning consumer preferences for exclusivity, wellness, and integrated amenities will be crucial. With a projected compound annual growth rate of XX%, the industry is poised for substantial expansion, offering attractive prospects for investors and developers alike in the premium Russian property market.

Russia Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. Cities

- 2.1. Moscow

- 2.2. St. Petersburg

- 2.3. Novosibirsk

- 2.4. Other Cities

Russia Luxury Residential Real Estate Industry Segmentation By Geography

- 1. Russia

Russia Luxury Residential Real Estate Industry Regional Market Share

Geographic Coverage of Russia Luxury Residential Real Estate Industry

Russia Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing construction spending by governments; Growing popularity of interior design and architecture is likely to increase the demand for polymer sheets

- 3.3. Market Restrains

- 3.3.1. Shortage of Raw Materials

- 3.4. Market Trends

- 3.4.1. Growth in the Apartment Buildings Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Moscow

- 5.2.2. St. Petersburg

- 5.2.3. Novosibirsk

- 5.2.4. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PIK Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SU-

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samolet Group**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Glavstroy

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Morton Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ingrad

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Donstroy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SETL Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LSR Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Etalon Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PIK Group

List of Figures

- Figure 1: Russia Luxury Residential Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Luxury Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Russia Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Russia Luxury Residential Real Estate Industry Revenue billion Forecast, by Cities 2020 & 2033

- Table 3: Russia Luxury Residential Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Russia Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Russia Luxury Residential Real Estate Industry Revenue billion Forecast, by Cities 2020 & 2033

- Table 6: Russia Luxury Residential Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Luxury Residential Real Estate Industry?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Russia Luxury Residential Real Estate Industry?

Key companies in the market include PIK Group, SU-, Samolet Group**List Not Exhaustive, Glavstroy, Morton Group, Ingrad, Donstroy, SETL Group, LSR Group, Etalon Group.

3. What are the main segments of the Russia Luxury Residential Real Estate Industry?

The market segments include Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 600 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing construction spending by governments; Growing popularity of interior design and architecture is likely to increase the demand for polymer sheets.

6. What are the notable trends driving market growth?

Growth in the Apartment Buildings Driving the Market.

7. Are there any restraints impacting market growth?

Shortage of Raw Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Russia Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence