Key Insights

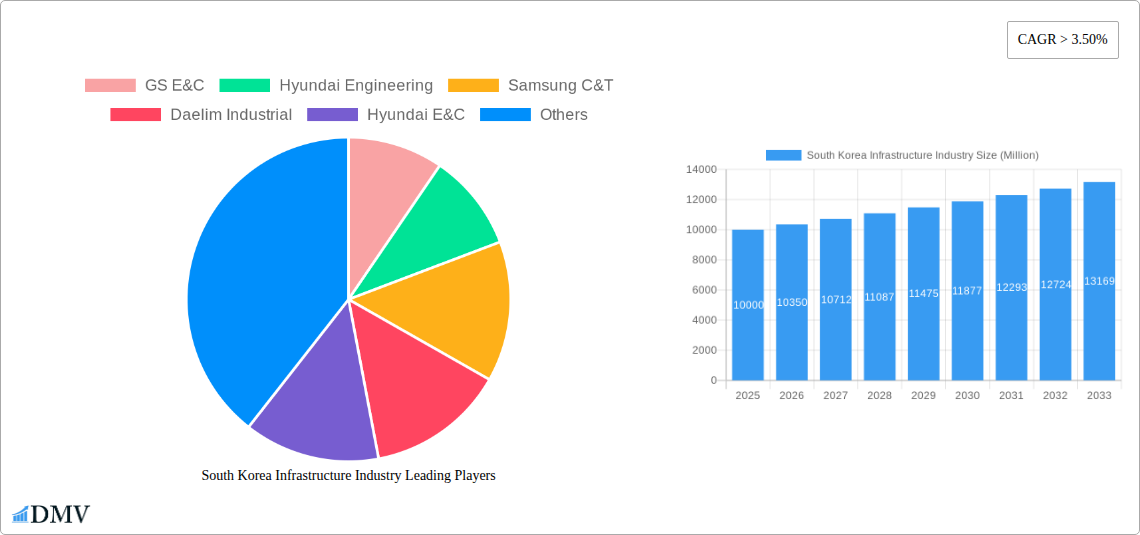

The South Korean infrastructure market, valued at approximately 19.29 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033. This expansion is propelled by significant government investments in transportation network modernization, including waterways and road infrastructure. The burgeoning telecommunications sector's demand for advanced manufacturing facilities and increasing urbanization driving the need for social infrastructure projects like housing and public utilities further bolster market growth. Despite challenges such as land scarcity and fluctuating material costs, sustained economic growth and strong government commitment to infrastructure development create a positive market outlook. Key segments include waterways extraction, telecommunications manufacturing, and social infrastructure, offering diverse investment opportunities. Prominent players like GS E&C, Hyundai Engineering, and Samsung C&T are actively engaged in major projects.

South Korea Infrastructure Industry Market Size (In Billion)

The competitive environment features established industry leaders competing for substantial projects. The market anticipates a continued focus on large-scale developments, attracting further investment and technological innovation, especially in sustainable construction and digitalization. While global economic fluctuations present potential risks, consistent government support ensures a resilient infrastructure development landscape in South Korea. The projected CAGR indicates sustained market expansion, offering significant opportunities for industry participants.

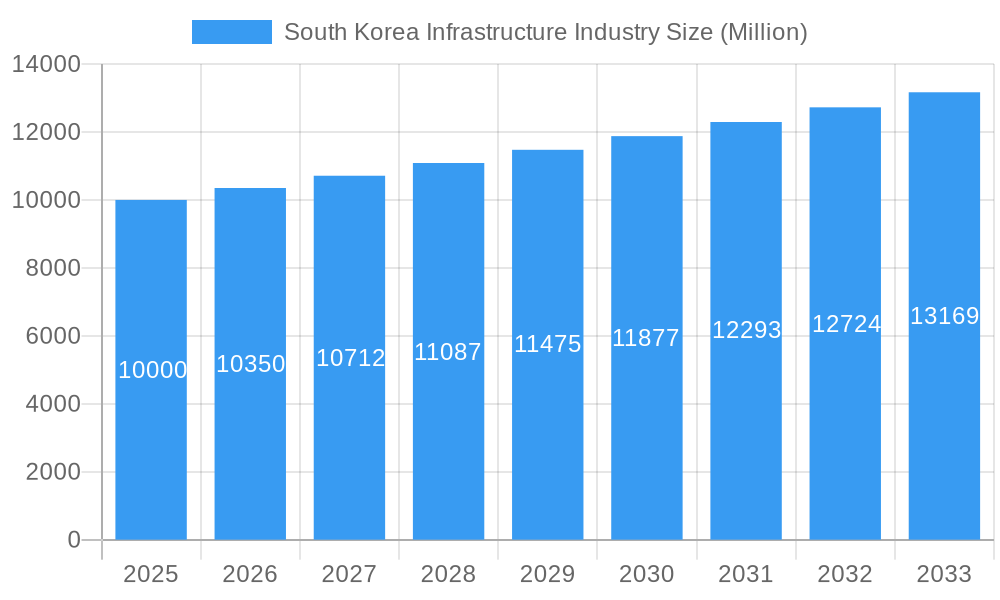

South Korea Infrastructure Industry Company Market Share

South Korea Infrastructure Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the South Korea infrastructure industry, encompassing market trends, leading players, technological advancements, and future growth projections from 2019 to 2033. With a base year of 2025 and an estimated year of 2025, this report offers invaluable insights for stakeholders seeking to understand this dynamic market. The forecast period covers 2025-2033, with historical data spanning 2019-2024. The report leverages extensive data analysis to unveil lucrative investment opportunities and potential challenges within the South Korean infrastructure landscape.

South Korea Infrastructure Industry Market Composition & Trends

This section evaluates the South Korea infrastructure market's competitive landscape, innovative drivers, regulatory environment, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The market is characterized by a moderately concentrated structure, with key players like GS E&C, Hyundai Engineering, Samsung C&T, and Daewoo E&C holding significant market share. However, the presence of numerous smaller players ensures a dynamic competitive environment.

Market Concentration & M&A Activity:

- The top 5 players collectively hold an estimated xx% market share (2024).

- Recent M&A activity highlights the industry's consolidation trend, exemplified by Keppel Infrastructure's USD 600 Million acquisition of EMK Co. in October 2022. This deal, valued at approximately 20 times EBITDA, reflects both growth potential and heightened market risk.

- Total M&A deal value in the sector from 2019 to 2024 is estimated at approximately xx Million USD.

Innovation Catalysts & Regulatory Landscape:

- Government initiatives promoting sustainable infrastructure development and smart city projects are key innovation drivers.

- Stringent environmental regulations and safety standards shape technological advancements and industry practices.

- The regulatory framework influences investment decisions and project timelines.

End-User Profiles & Substitute Products:

- Major end-users include government agencies, private companies, and public-private partnerships (PPPs).

- Substitute products and technologies (e.g., alternative transportation systems) pose some level of competitive pressure.

South Korea Infrastructure Industry Evolution

This section delves into the market's growth trajectories, technological advancements, and shifting consumer demands. The South Korean infrastructure industry has witnessed substantial growth driven by increasing urbanization, rising disposable incomes, and government investments in large-scale infrastructure projects. The market's compound annual growth rate (CAGR) from 2019 to 2024 is estimated to be xx%, reaching a market value of approximately xx Million USD in 2024. This growth is projected to continue, with a forecast CAGR of xx% during 2025-2033, driven by ongoing investments in transportation, telecommunications, and social infrastructure. Technological advancements such as the integration of 5G and 6G technologies in telecommunications infrastructure and autonomous driving technology in transportation are further accelerating growth. Shifting consumer preferences towards sustainable and resilient infrastructure are also shaping industry developments.

Leading Regions, Countries, or Segments in South Korea Infrastructure Industry

This section highlights the dominant segments within the South Korean infrastructure market.

Transportation Infrastructure: This segment dominates the market, driven by significant government investment in expanding and modernizing transportation networks, including high-speed rail, roads, and ports. The high population density and rapid economic growth create a significant demand for efficient transportation solutions.

Telecoms: Manufacturing Infrastructure: The rapid adoption of advanced technologies like 5G and the anticipated rollout of 6G drive significant investment in manufacturing infrastructure related to telecom equipment and network expansion. Hyundai Motor Group's strategic partnership with KT Corporation further emphasizes this trend.

Social Infrastructure: This segment exhibits significant growth potential due to increased focus on healthcare, education, and other social amenities. Government investments and initiatives in improving the quality of life significantly contribute to this sector's expansion.

Waterways: Extraction Infrastructure: This segment’s growth is closely tied to resource management and environmental policies. Though smaller in size than the others, ongoing modernization and expansion efforts contribute to steady market development.

Key Drivers:

- High government spending on infrastructure projects.

- Supportive regulatory policies encouraging private sector participation.

- Increasing urbanization and population growth.

- Technological advancements in construction and infrastructure management.

South Korea Infrastructure Industry Product Innovations

The South Korean infrastructure industry is witnessing rapid technological advancements. Innovations include the integration of smart technologies in transportation systems (e.g., intelligent traffic management), the use of advanced materials in construction, and the application of big data analytics for infrastructure management. These innovations improve efficiency, reduce costs, and enhance the overall quality of infrastructure assets. The focus on sustainability is also driving the adoption of eco-friendly construction materials and techniques. Companies are increasingly adopting Building Information Modeling (BIM) and other digital technologies to streamline design, construction, and maintenance processes.

Propelling Factors for South Korea Infrastructure Industry Growth

Several factors fuel the growth of South Korea's infrastructure industry. Firstly, substantial government investment in large-scale infrastructure projects like expanding high-speed rail networks and modernizing transportation systems acts as a primary driver. Secondly, the country's robust economic growth and rising urbanization increase demand for robust infrastructure. Thirdly, supportive regulatory policies encouraging private sector participation stimulate investments and innovation within the industry.

Obstacles in the South Korea Infrastructure Industry Market

Despite significant growth, the South Korean infrastructure industry faces challenges. Land scarcity and high land prices pose significant obstacles to large-scale project development. Furthermore, environmental regulations and stringent safety standards can increase project costs and timelines. Intense competition among various companies also puts pressure on profit margins. Supply chain disruptions can impact project delivery and overall market stability.

Future Opportunities in South Korea Infrastructure Industry

The South Korean infrastructure industry presents numerous future opportunities. The development of smart cities and the expansion of 5G and 6G networks provide significant potential for growth. Investment in renewable energy infrastructure and sustainable construction practices align with global environmental concerns. Additionally, the increasing focus on improving social infrastructure, particularly healthcare and education, will drive future market expansion.

Major Players in the South Korea Infrastructure Industry Ecosystem

- GS E&C

- Hyundai Engineering

- Samsung C&T

- Daelim Industrial

- Hyundai E&C

- HDC (Hyundai Development Company)

- Hoban Construction

- POSCO E&C

- Lotte E&C

- Daewoo E&C

Key Developments in South Korea Infrastructure Industry Industry

- October 2022: Keppel Infrastructure's USD 600 Million acquisition of EMK Co., reflecting both growth potential and increased market risk due to global economic conditions.

- September 2022: Hyundai Motor Group's expanded partnership with KT Corporation to collaborate on next-generation communication infrastructure and 6G technology, highlighting advancements in telecom infrastructure.

Strategic South Korea Infrastructure Industry Market Forecast

The South Korean infrastructure industry is poised for continued growth driven by government initiatives, technological advancements, and increasing private sector investment. The focus on sustainable infrastructure and smart city development presents significant opportunities for market expansion. The forecast period (2025-2033) anticipates a robust growth trajectory, with potential for significant returns on investment in key segments, particularly transportation and telecommunications. However, careful consideration of regulatory challenges and potential supply chain disruptions is crucial for successful market participation.

South Korea Infrastructure Industry Segmentation

-

1. Type

-

1.1. Social Infrastructure

- 1.1.1. Schools

- 1.1.2. Hospitals

- 1.1.3. Defense

- 1.1.4. Other Types

-

1.2. Transportation Infrastructure

- 1.2.1. Railways

- 1.2.2. Roadways

- 1.2.3. Airports

- 1.2.4. Waterways

-

1.3. Extraction Infrastructure

- 1.3.1. Power Generation

- 1.3.2. Electricity Transmission and Disribution

- 1.3.3. Gas

- 1.3.4. Telecom

-

1.4. Manufacturing Infrastructure

- 1.4.1. Metal and Ore Production

- 1.4.2. Petroleum Refining

- 1.4.3. Chemical Manufacturing

- 1.4.4. Industrial Parks and Clusters

- 1.4.5. Other Infrastructure

-

1.1. Social Infrastructure

South Korea Infrastructure Industry Segmentation By Geography

- 1. South Korea

South Korea Infrastructure Industry Regional Market Share

Geographic Coverage of South Korea Infrastructure Industry

South Korea Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; South Korea's status as a global business hub can attract expatriates and foreign executives seeking high-end accommodation options4.; Incorporating advanced technology and smart home features making luxury properties more appealing to tech-savvy buyers

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of foreign investment4.; Stricter government regulation inhibiting the growth

- 3.4. Market Trends

- 3.4.1. Investment on transportation infrastructure driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Social Infrastructure

- 5.1.1.1. Schools

- 5.1.1.2. Hospitals

- 5.1.1.3. Defense

- 5.1.1.4. Other Types

- 5.1.2. Transportation Infrastructure

- 5.1.2.1. Railways

- 5.1.2.2. Roadways

- 5.1.2.3. Airports

- 5.1.2.4. Waterways

- 5.1.3. Extraction Infrastructure

- 5.1.3.1. Power Generation

- 5.1.3.2. Electricity Transmission and Disribution

- 5.1.3.3. Gas

- 5.1.3.4. Telecom

- 5.1.4. Manufacturing Infrastructure

- 5.1.4.1. Metal and Ore Production

- 5.1.4.2. Petroleum Refining

- 5.1.4.3. Chemical Manufacturing

- 5.1.4.4. Industrial Parks and Clusters

- 5.1.4.5. Other Infrastructure

- 5.1.1. Social Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GS E&C

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hyundai Engineering

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung C&T

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Daelim Industrial

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hyundai E&C

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HDC (Hyundai Development Company)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hoban Construction**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 POSCO E&C

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lotte E&C

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Daewoo E&C

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GS E&C

List of Figures

- Figure 1: South Korea Infrastructure Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Korea Infrastructure Industry Share (%) by Company 2025

List of Tables

- Table 1: South Korea Infrastructure Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South Korea Infrastructure Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: South Korea Infrastructure Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: South Korea Infrastructure Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Infrastructure Industry?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the South Korea Infrastructure Industry?

Key companies in the market include GS E&C, Hyundai Engineering, Samsung C&T, Daelim Industrial, Hyundai E&C, HDC (Hyundai Development Company), Hoban Construction**List Not Exhaustive, POSCO E&C, Lotte E&C, Daewoo E&C.

3. What are the main segments of the South Korea Infrastructure Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.29 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; South Korea's status as a global business hub can attract expatriates and foreign executives seeking high-end accommodation options4.; Incorporating advanced technology and smart home features making luxury properties more appealing to tech-savvy buyers.

6. What are the notable trends driving market growth?

Investment on transportation infrastructure driving the market.

7. Are there any restraints impacting market growth?

4.; Lack of foreign investment4.; Stricter government regulation inhibiting the growth.

8. Can you provide examples of recent developments in the market?

October 2022: Keppel Infrastructure, based in Singapore, completed the USD 0.60 billion acquisition of EMK Co., South Korea's leading waste management company. The sale price of approximately 20 times earnings before interest, taxes, depreciation, and amortization (EBITDA) was viewed as excessive by industry sources, despite the waste management company's growth potential, given the recent deterioration in market sentiment due to rising interest rates and other bearish factors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Infrastructure Industry?

To stay informed about further developments, trends, and reports in the South Korea Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence