Key Insights

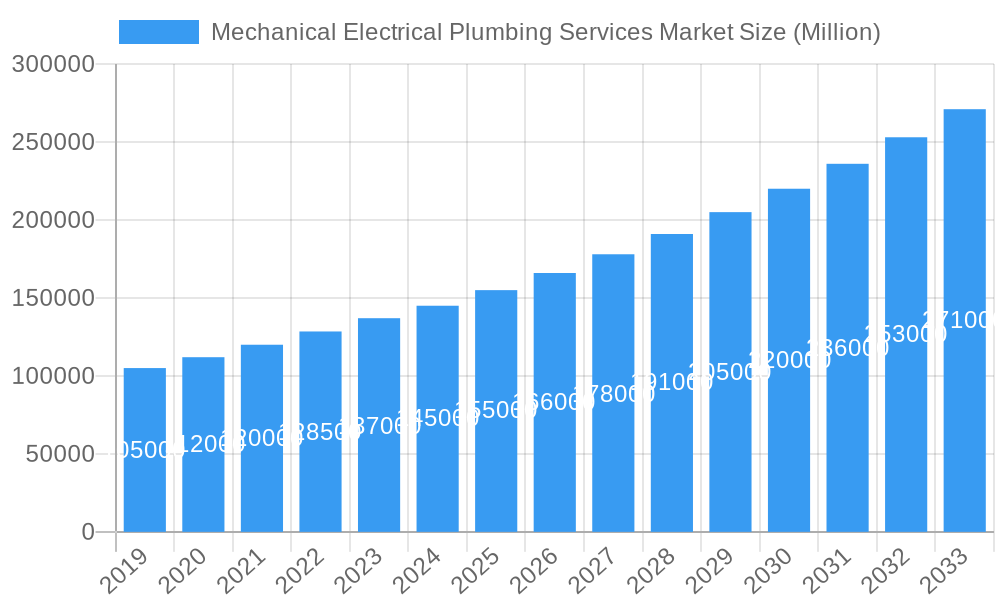

The global Mechanical Electrical Plumbing (MEP) Services market is projected to reach $10.73 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 11.88%. This expansion is driven by rapid urbanization and escalating demand for advanced infrastructure in commercial and residential sectors. Key growth catalysts include the increasing complexity of modern buildings, necessitating sophisticated HVAC, electrical, and water management systems for enhanced efficiency and sustainability. Government initiatives promoting energy-efficient construction and building retrofitting further support market growth. The market is segmented across Mechanical, Electrical, and Plumbing services, with a growing emphasis on smart building technologies and integrated MEP solutions. Leading companies are actively contributing to market development through innovation and strategic partnerships.

Mechanical Electrical Plumbing Services Market Market Size (In Billion)

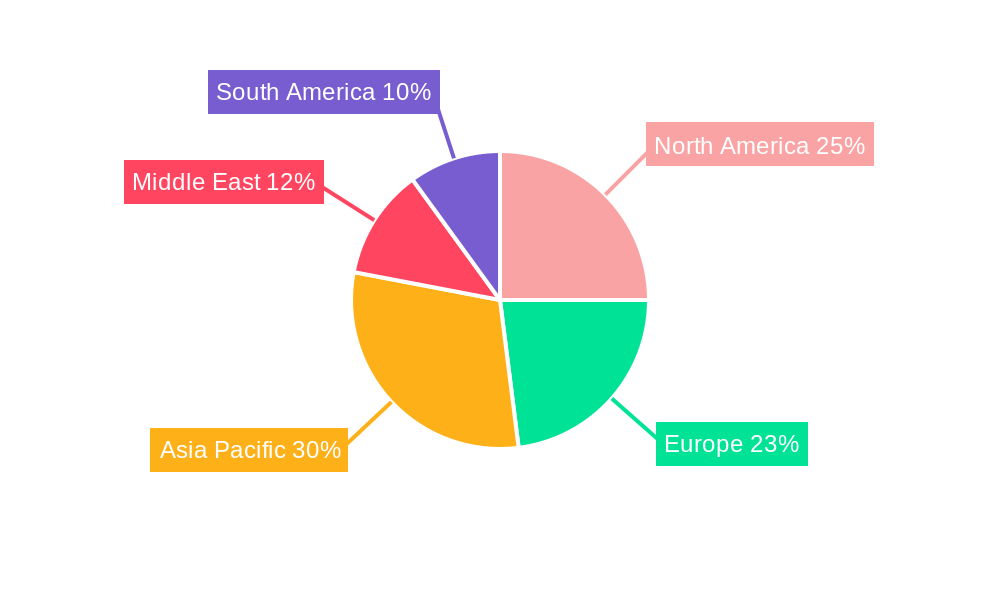

The forecast period of 2025-2033 anticipates sustained demand from recurring maintenance, upgrades, and the adoption of new technologies like IoT-enabled building management systems. Challenges such as skilled labor shortages and material cost fluctuations may present obstacles. Geographically, the Asia Pacific region, particularly China and India, is expected to lead due to rapid industrialization and substantial infrastructure projects. North America and Europe, with their focus on sustainable and technologically advanced solutions, will also be significant contributors. The Middle East, driven by large-scale construction in the UAE and Saudi Arabia, offers considerable opportunities. Both residential and commercial end-user segments are expected to experience robust growth fueled by new construction and renovation projects.

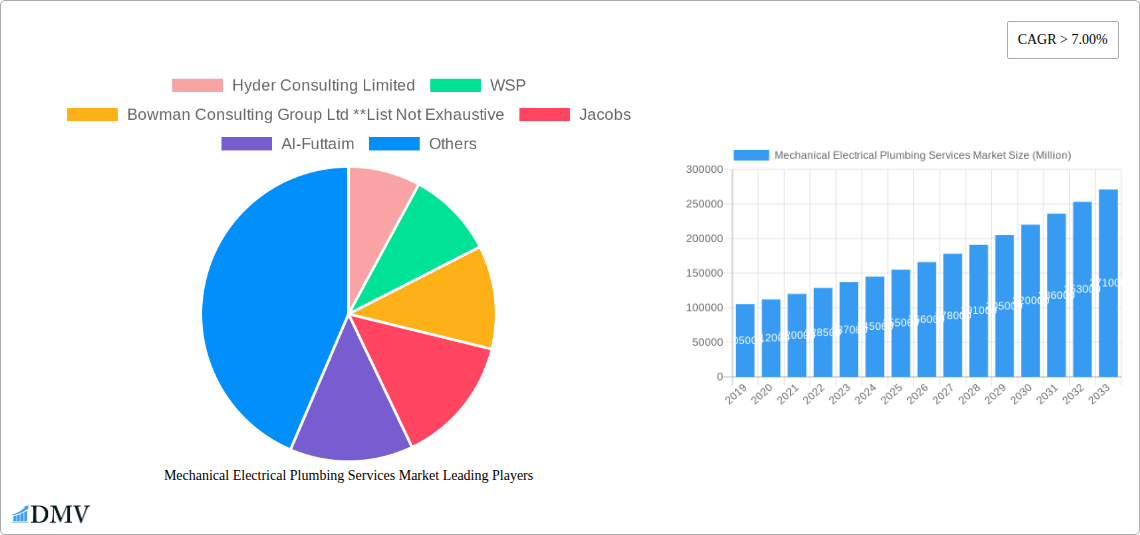

Mechanical Electrical Plumbing Services Market Company Market Share

Discover the potential of the global Mechanical Electrical Plumbing (MEP) Services Market. This report offers a comprehensive analysis of market dynamics, key trends, growth drivers, and future opportunities. With a study period from 2019 to 2033 and a base year of 2025, this report provides actionable intelligence for strategic decision-making.

MEP services are essential for the design, installation, and maintenance of mechanical, electrical, and plumbing systems in buildings and infrastructure, ensuring functionality, safety, and efficiency. The accelerating pace of urbanization and the growing imperative for sustainability are fueling a surge in demand for sophisticated and integrated MEP solutions. This report offers a data-driven roadmap for navigating this vital market.

Investments in smart building technologies, energy-efficient systems, and resilient infrastructure are driving significant market expansion. Understand the evolving landscape shaped by innovation, regulatory changes, and shifting end-user demands to capitalize on emerging opportunities.

Mechanical Electrical Plumbing Services Market Market Composition & Trends

The Mechanical Electrical Plumbing (MEP) Services Market exhibits a dynamic composition influenced by technological innovation, evolving regulatory frameworks, and shifting end-user preferences. Market concentration varies significantly across regions, with established players and emerging firms vying for market share. Key innovation catalysts include the integration of Building Information Modeling (BIM), the adoption of Internet of Things (IoT) for smart building management, and the increasing demand for sustainable and energy-efficient MEP solutions. Regulatory landscapes, particularly those pertaining to energy efficiency standards, building codes, and environmental protection, play a crucial role in shaping market trends and driving compliance-driven demand. While direct substitute products for core MEP services are limited, the efficiency and performance of traditional systems are continually challenged by advancements in alternative technologies, such as renewable energy integration and advanced water conservation techniques. End-user profiles are increasingly sophisticated, with commercial entities prioritizing operational efficiency, cost savings, and occupant comfort, while residential users seek convenience, safety, and sustainability. Industry consolidation through mergers and acquisitions (M&A) is a notable trend, with major players seeking to expand their service portfolios, geographic reach, and technological capabilities. For instance, the market saw significant M&A activity in the historical period, with deal values reaching an estimated XXX Million, reflecting a strategic drive towards market dominance and expanded service offerings.

- Market Share Distribution: The market share is fragmented with a mix of large global corporations and specialized regional providers. The estimated market share distribution for the base year 2025 indicates a XXX% share for Mechanical Services, XX% for Electrical Services, and XX% for Plumbing Services.

- M&A Deal Values (Historical Period 2019-2024): An estimated XXX Million in M&A deal values was observed.

- Innovation Catalysts:

- Smart Building Technologies (IoT integration)

- Energy-Efficient Design and Implementation

- Building Information Modeling (BIM) adoption

- Sustainable Material Sourcing

- Regulatory Influences:

- Stringent energy efficiency standards (e.g., LEED, BREEAM)

- Updated building codes and safety regulations

- Environmental protection mandates

Mechanical Electrical Plumbing Services Market Industry Evolution

The Mechanical Electrical Plumbing (MEP) Services Market has undergone a profound evolution, transforming from traditional installation and maintenance roles to sophisticated, integrated solutions providers. The historical period from 2019 to 2024 witnessed significant shifts, driven by technological advancements and a growing awareness of sustainability. Market growth trajectories have been consistently upward, fueled by a combination of new construction projects, extensive renovation and retrofitting initiatives, and the increasing complexity of building systems. In the historical period, the overall market experienced a Compound Annual Growth Rate (CAGR) of approximately XX%, with Electrical Services showing a robust XX% growth due to the proliferation of smart technologies and data infrastructure. Mechanical Services followed closely at XX%, propelled by demand for efficient HVAC systems and advanced climate control solutions, while Plumbing Services registered a steady XX% growth, driven by water conservation technologies and smart plumbing installations. Technological advancements have been a cornerstone of this evolution. The widespread adoption of Building Information Modeling (BIM) has revolutionized the design and planning phases, enabling greater accuracy, collaboration, and clash detection, thereby reducing on-site issues and costs. Furthermore, the integration of the Internet of Things (IoT) has enabled real-time monitoring, predictive maintenance, and optimized performance of MEP systems, leading to enhanced operational efficiency and significant cost savings for building owners. Cloud-based platforms for project management and facility management have also become integral, streamlining communication and data accessibility. Shifting consumer demands have played a pivotal role in shaping the industry. End-users are no longer solely focused on basic functionality but are increasingly prioritizing energy efficiency, occupant comfort, indoor air quality, and long-term operational cost reduction. This has led to a heightened demand for green building certifications and sustainable MEP practices. For example, the adoption rate of energy-efficient HVAC systems has increased by an estimated XX% in the last five years. Similarly, the demand for smart thermostats and automated lighting systems in residential and commercial spaces has surged by approximately XX%. The industry has also seen a growing emphasis on lifecycle cost analysis, encouraging investments in higher-quality, more durable, and energy-efficient MEP components and systems. The post-pandemic era has further amplified the focus on indoor air quality and occupant well-being, creating new opportunities for specialized ventilation and filtration solutions within the mechanical services segment. The increasing complexity of modern buildings, with their interconnected systems and advanced technological integration, necessitates a higher level of expertise and integrated service offerings from MEP providers, moving beyond siloed disciplines to holistic solutions. The industry's capacity to adapt to these evolving demands, while embracing new technologies and sustainable practices, will determine its continued growth and success in the forecast period.

Leading Regions, Countries, or Segments in Mechanical Electrical Plumbing Services Market

The Mechanical Electrical Plumbing (MEP) Services Market showcases distinct leadership across various regions, countries, and specific segments, driven by a confluence of economic development, regulatory support, and investment trends. In terms of regional dominance, North America and Asia-Pacific are emerging as the frontrunners, with their robust construction sectors and progressive adoption of advanced MEP technologies. Within these regions, countries like the United States and China are spearheading growth, propelled by substantial investments in infrastructure development, commercial real estate expansion, and a growing emphasis on sustainable building practices.

Dominant Segments by Type:

- Mechanical Services: This segment is experiencing substantial growth due to increasing demand for energy-efficient HVAC systems, smart ventilation solutions, and advanced climate control technologies in both commercial and residential sectors. The growing focus on indoor air quality and occupant comfort further bolsters its leadership. Investment trends in retrofitting existing buildings with modern, eco-friendly mechanical systems are a significant driver.

- Key Drivers:

- Rising demand for energy-efficient HVAC systems (XX% market share in 2025 forecast).

- Government incentives for green building certifications.

- Technological advancements in climate control and automation.

- Increased focus on indoor air quality post-pandemic.

- Key Drivers:

- Electrical Services: This segment holds a dominant position, fueled by the relentless growth of smart buildings, IoT integration, data centers, and the electrification of various industries. The increasing complexity of electrical systems in modern infrastructure, coupled with stringent safety regulations, necessitates specialized electrical MEP services.

- Key Drivers:

- Proliferation of smart building technologies and IoT devices (XX% market share in 2025 forecast).

- Expansion of data center infrastructure.

- Electrification of transportation and industrial processes.

- Demand for reliable and safe electrical systems.

- Key Drivers:

- Plumbing Services: While traditionally a foundational service, plumbing is evolving with the integration of smart water management systems, water conservation technologies, and advanced sanitation solutions. The growing global awareness of water scarcity is a major catalyst for innovation and demand in this segment.

- Key Drivers:

- Increasing adoption of water-saving fixtures and technologies (XX% market share in 2025 forecast).

- Focus on hygiene and sanitation in commercial and residential spaces.

- Government initiatives promoting water conservation.

- Retrofitting of older plumbing systems.

- Key Drivers:

Dominant Segments by End-User:

- Commercial: This sector consistently represents the largest share of the MEP services market. The continuous development of office buildings, retail spaces, hospitality venues, and healthcare facilities, all requiring sophisticated MEP systems for optimal functionality, energy efficiency, and occupant experience, drives this dominance. Investment in creating smart and sustainable commercial environments is a key factor.

- Key Drivers:

- High volume of new commercial construction and renovation projects.

- Demand for energy-efficient and cost-effective building operations.

- Emphasis on occupant comfort and productivity in workspaces.

- Adoption of smart building technologies for enhanced management.

- Key Drivers:

- Residential: The residential sector is also a significant contributor, driven by new housing construction, home renovations, and the increasing demand for smart home technologies. Homeowners are increasingly seeking energy-efficient appliances, advanced security systems, and integrated comfort solutions, contributing to the growth of residential MEP services.

- Key Drivers:

- Growth in new residential construction and urban expansion.

- Rising adoption of smart home devices and automation.

- Demand for energy-efficient and sustainable home solutions.

- Home renovation and upgrade trends.

- Key Drivers:

The dominance of these segments and regions is further amplified by factors such as supportive government policies, increased disposable income, and the growing awareness of the long-term benefits of investing in robust and efficient MEP systems. The forecast period is expected to see continued strong performance in these areas, with potential for emerging markets to gain traction as they develop their infrastructure and embrace modern building standards.

Mechanical Electrical Plumbing Services Market Product Innovations

The Mechanical Electrical Plumbing (MEP) Services Market is characterized by rapid product innovations aimed at enhancing efficiency, sustainability, and user experience. Key advancements include the development of AI-powered predictive maintenance platforms for MEP systems, enabling proactive issue resolution and minimizing downtime. Smart thermostats and occupancy sensors are revolutionizing HVAC control in commercial and residential spaces, optimizing energy consumption based on real-time usage patterns. In electrical services, innovations like smart grids, advanced surge protection, and integrated charging solutions for electric vehicles are gaining prominence. Plumbing services are witnessing the introduction of water-leak detection systems, advanced filtration technologies for improved water quality, and low-flow fixtures that significantly reduce water consumption. These innovations collectively contribute to reduced operational costs, a smaller environmental footprint, and improved building performance. The unique selling proposition lies in delivering integrated, intelligent, and sustainable MEP solutions that offer a superior return on investment.

Propelling Factors for Mechanical Electrical Plumbing Services Market Growth

Several key factors are propelling the growth of the Mechanical Electrical Plumbing (MEP) Services Market. Technologically, the pervasive adoption of Building Information Modeling (BIM) and the Internet of Things (IoT) are revolutionizing design, installation, and operational efficiency. Economically, rising global urbanization, coupled with significant investments in infrastructure development and commercial real estate, is creating sustained demand. Regulatory influences, such as increasingly stringent energy efficiency standards and building codes worldwide, are mandating the adoption of advanced and sustainable MEP solutions. For instance, government mandates for net-zero energy buildings are a significant growth catalyst. Furthermore, the growing awareness among end-users about the long-term cost savings and environmental benefits associated with efficient MEP systems is driving demand for retrofitting and upgrades in existing structures.

Obstacles in the Mechanical Electrical Plumbing Services Market Market

Despite the robust growth, the Mechanical Electrical Plumbing (MEP) Services Market faces several obstacles. Regulatory challenges, particularly in regions with inconsistent or rapidly changing building codes, can create compliance complexities and increase project timelines. Supply chain disruptions, exacerbated by global events, can lead to material shortages and price volatility, impacting project feasibility and profitability. Competitive pressures, especially from smaller, specialized firms and the increasing commoditization of certain services, can squeeze profit margins. The skilled labor shortage remains a persistent issue, hindering the timely execution of projects and potentially impacting the quality of work. Quantifiable impacts include project delays estimated at XX% and cost overruns of XX% due to supply chain issues in the historical period.

Future Opportunities in Mechanical Electrical Plumbing Services Market

The future for the Mechanical Electrical Plumbing (MEP) Services Market is replete with emerging opportunities. The burgeoning demand for sustainable and green building solutions presents a significant avenue for growth, driven by global climate change initiatives. The integration of renewable energy sources, such as solar and geothermal, into MEP systems offers substantial potential. The increasing prevalence of smart cities and the expansion of smart home technologies will continue to fuel demand for advanced electrical and control systems. Furthermore, the growing need for resilient infrastructure in the face of extreme weather events and natural disasters creates opportunities for specialized MEP design and installation focusing on durability and disaster preparedness. The retrofitting market for older buildings to meet modern energy efficiency standards also represents a vast, untapped opportunity.

Major Players in the Mechanical Electrical Plumbing Services Market Ecosystem

- Hyder Consulting Limited

- WSP

- Bowman Consulting Group Ltd

- Jacobs

- Al-Futtaim

- Atkins

- Habtoor Leighton Specon

- ETA Engineering

- AECOM

- Dar Al-Handasah

- Drake & Scull Engineering

Key Developments in Mechanical Electrical Plumbing Services Market Industry

- 2023 September: AECOM announced a strategic partnership to enhance smart building integration capabilities.

- 2023 June: WSP acquired a specialized firm to bolster its sustainable MEP design expertise.

- 2022 December: Dar Al-Handasah launched an innovative AI-driven diagnostic tool for HVAC systems.

- 2022 October: Drake & Scull Engineering secured a major contract for a large-scale commercial project in the Middle East, focusing on advanced MEP systems.

- 2022 May: Hyder Consulting Limited introduced a new suite of energy-efficient plumbing solutions for residential projects.

- 2021 November: Atkins expanded its service offering to include advanced fire and life safety MEP integration.

- 2021 July: Jacobs finalized a significant merger, strengthening its global MEP consulting footprint.

- 2020 February: ETA Engineering reported a substantial increase in demand for integrated smart home electrical systems.

Strategic Mechanical Electrical Plumbing Services Market Market Forecast

The Mechanical Electrical Plumbing (MEP) Services Market is poised for substantial growth in the forecast period (2025-2033), driven by a confluence of strategic catalysts. The relentless push towards sustainability and net-zero buildings will continue to be a primary growth engine, mandating the adoption of energy-efficient and environmentally friendly MEP solutions. The ongoing digital transformation, with the widespread integration of IoT, AI, and BIM, will enhance operational efficiency, predictive maintenance, and overall building performance. Increased investments in smart city initiatives and resilient infrastructure will create new avenues for sophisticated MEP design and implementation. The growing emphasis on occupant well-being and indoor air quality will further fuel demand for advanced mechanical systems. The market's ability to adapt to evolving regulatory landscapes and embrace innovative technologies will be key to capitalizing on its significant future potential, with an estimated market expansion of XX% by 2033.

Mechanical Electrical Plumbing Services Market Segmentation

-

1. Type

- 1.1. Mechanical Services

- 1.2. Electrical Services

- 1.3. Plumbing Services

-

2. End-Users

- 2.1. Commercial

- 2.2. Residential

Mechanical Electrical Plumbing Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Mexico

- 1.3. Canada

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. Rest of Asia Pacific

- 4. Middle East

-

5. Qatar

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Colombia

- 6.4. Rest of South America

Mechanical Electrical Plumbing Services Market Regional Market Share

Geographic Coverage of Mechanical Electrical Plumbing Services Market

Mechanical Electrical Plumbing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Population is Boosting the Residential Real Estate Market; Rapid Growth in Urbanization

- 3.3. Market Restrains

- 3.3.1. Accelerated Increase in Construction Costs

- 3.4. Market Trends

- 3.4.1. Rise in Construction Sector to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mechanical Electrical Plumbing Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mechanical Services

- 5.1.2. Electrical Services

- 5.1.3. Plumbing Services

- 5.2. Market Analysis, Insights and Forecast - by End-Users

- 5.2.1. Commercial

- 5.2.2. Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East

- 5.3.5. Qatar

- 5.3.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Mechanical Electrical Plumbing Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mechanical Services

- 6.1.2. Electrical Services

- 6.1.3. Plumbing Services

- 6.2. Market Analysis, Insights and Forecast - by End-Users

- 6.2.1. Commercial

- 6.2.2. Residential

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Mechanical Electrical Plumbing Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mechanical Services

- 7.1.2. Electrical Services

- 7.1.3. Plumbing Services

- 7.2. Market Analysis, Insights and Forecast - by End-Users

- 7.2.1. Commercial

- 7.2.2. Residential

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Mechanical Electrical Plumbing Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mechanical Services

- 8.1.2. Electrical Services

- 8.1.3. Plumbing Services

- 8.2. Market Analysis, Insights and Forecast - by End-Users

- 8.2.1. Commercial

- 8.2.2. Residential

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East Mechanical Electrical Plumbing Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mechanical Services

- 9.1.2. Electrical Services

- 9.1.3. Plumbing Services

- 9.2. Market Analysis, Insights and Forecast - by End-Users

- 9.2.1. Commercial

- 9.2.2. Residential

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Qatar Mechanical Electrical Plumbing Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Mechanical Services

- 10.1.2. Electrical Services

- 10.1.3. Plumbing Services

- 10.2. Market Analysis, Insights and Forecast - by End-Users

- 10.2.1. Commercial

- 10.2.2. Residential

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. South America Mechanical Electrical Plumbing Services Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Mechanical Services

- 11.1.2. Electrical Services

- 11.1.3. Plumbing Services

- 11.2. Market Analysis, Insights and Forecast - by End-Users

- 11.2.1. Commercial

- 11.2.2. Residential

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Hyder Consulting Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 WSP

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Bowman Consulting Group Ltd **List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Jacobs

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Al-Futtaim

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Atkins

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Habtoor Leighton Specon

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ETA Engineering

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 AECOM

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Dar Al-Handasah

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Drake & Scull Engineering

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Hyder Consulting Limited

List of Figures

- Figure 1: Global Mechanical Electrical Plumbing Services Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Mechanical Electrical Plumbing Services Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Mechanical Electrical Plumbing Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Mechanical Electrical Plumbing Services Market Revenue (billion), by End-Users 2025 & 2033

- Figure 5: North America Mechanical Electrical Plumbing Services Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 6: North America Mechanical Electrical Plumbing Services Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Mechanical Electrical Plumbing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Mechanical Electrical Plumbing Services Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Mechanical Electrical Plumbing Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Mechanical Electrical Plumbing Services Market Revenue (billion), by End-Users 2025 & 2033

- Figure 11: Europe Mechanical Electrical Plumbing Services Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 12: Europe Mechanical Electrical Plumbing Services Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Mechanical Electrical Plumbing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Mechanical Electrical Plumbing Services Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Mechanical Electrical Plumbing Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Mechanical Electrical Plumbing Services Market Revenue (billion), by End-Users 2025 & 2033

- Figure 17: Asia Pacific Mechanical Electrical Plumbing Services Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 18: Asia Pacific Mechanical Electrical Plumbing Services Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Mechanical Electrical Plumbing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East Mechanical Electrical Plumbing Services Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East Mechanical Electrical Plumbing Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East Mechanical Electrical Plumbing Services Market Revenue (billion), by End-Users 2025 & 2033

- Figure 23: Middle East Mechanical Electrical Plumbing Services Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 24: Middle East Mechanical Electrical Plumbing Services Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East Mechanical Electrical Plumbing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Qatar Mechanical Electrical Plumbing Services Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Qatar Mechanical Electrical Plumbing Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Qatar Mechanical Electrical Plumbing Services Market Revenue (billion), by End-Users 2025 & 2033

- Figure 29: Qatar Mechanical Electrical Plumbing Services Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 30: Qatar Mechanical Electrical Plumbing Services Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Qatar Mechanical Electrical Plumbing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Mechanical Electrical Plumbing Services Market Revenue (billion), by Type 2025 & 2033

- Figure 33: South America Mechanical Electrical Plumbing Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: South America Mechanical Electrical Plumbing Services Market Revenue (billion), by End-Users 2025 & 2033

- Figure 35: South America Mechanical Electrical Plumbing Services Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 36: South America Mechanical Electrical Plumbing Services Market Revenue (billion), by Country 2025 & 2033

- Figure 37: South America Mechanical Electrical Plumbing Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by End-Users 2020 & 2033

- Table 3: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by End-Users 2020 & 2033

- Table 6: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Mexico Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Canada Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by End-Users 2020 & 2033

- Table 13: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Germany Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Russia Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 21: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by End-Users 2020 & 2033

- Table 22: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: China Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Japan Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by End-Users 2020 & 2033

- Table 30: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by End-Users 2020 & 2033

- Table 33: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: Saudi Arabia Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: United Arab Emirates Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 39: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by End-Users 2020 & 2033

- Table 40: Global Mechanical Electrical Plumbing Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Brazil Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Argentina Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Colombia Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Rest of South America Mechanical Electrical Plumbing Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mechanical Electrical Plumbing Services Market?

The projected CAGR is approximately 11.88%.

2. Which companies are prominent players in the Mechanical Electrical Plumbing Services Market?

Key companies in the market include Hyder Consulting Limited, WSP, Bowman Consulting Group Ltd **List Not Exhaustive, Jacobs, Al-Futtaim, Atkins, Habtoor Leighton Specon, ETA Engineering, AECOM, Dar Al-Handasah, Drake & Scull Engineering.

3. What are the main segments of the Mechanical Electrical Plumbing Services Market?

The market segments include Type, End-Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.73 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Population is Boosting the Residential Real Estate Market; Rapid Growth in Urbanization.

6. What are the notable trends driving market growth?

Rise in Construction Sector to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Accelerated Increase in Construction Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mechanical Electrical Plumbing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mechanical Electrical Plumbing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mechanical Electrical Plumbing Services Market?

To stay informed about further developments, trends, and reports in the Mechanical Electrical Plumbing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence