Key Insights

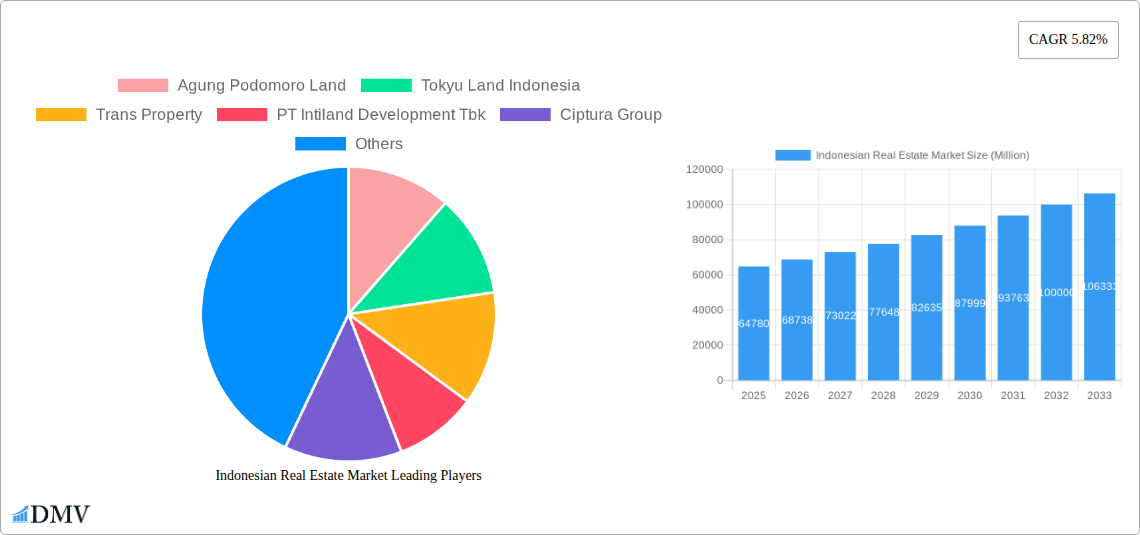

The Indonesian real estate market, valued at $64.78 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.82% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning middle class with increasing disposable income fuels demand for residential properties, particularly in rapidly urbanizing areas like Jakarta and Bali. Government initiatives aimed at infrastructure development and improved housing affordability further stimulate market activity. The tourism sector's contribution is significant, driving demand for hospitality and retail real estate, especially in popular tourist destinations like Bali. However, challenges remain. Interest rate fluctuations and potential economic uncertainties could impact investor sentiment and purchasing power. Furthermore, land scarcity and regulatory complexities can hinder project development and increase construction costs. The market is segmented by property type (residential, office, retail, hospitality, industrial) and by city (Jakarta, Bali, Rest of Indonesia), offering diversified investment opportunities. Major players like Agung Podomoro Land, Tokyu Land Indonesia, and Lippo Group dominate the landscape, alongside several other significant regional and national developers. The forecast period suggests sustained growth, though strategic management of risk factors will be crucial for sustained market health.

Indonesian Real Estate Market Market Size (In Billion)

The future of the Indonesian real estate market hinges on successfully navigating these opportunities and challenges. Continued infrastructure investment, coupled with sustainable urban planning and transparent regulatory frameworks, will be vital in unlocking the market's full potential. The evolving preferences of Indonesian consumers, particularly concerning eco-friendly and technologically advanced properties, also present significant opportunities for developers. Furthermore, strategic partnerships between local and international players can contribute to knowledge transfer and access to capital, driving innovation and expansion within the sector. Careful monitoring of macroeconomic indicators and adept risk mitigation strategies will be essential for investors and developers to capitalize on this dynamic and expanding market.

Indonesian Real Estate Market Company Market Share

Indonesian Real Estate Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic Indonesian real estate market, offering a comprehensive analysis from 2019 to 2033. With a focus on key players like Agung Podomoro Land, Tokyu Land Indonesia, Trans Property, PT Intiland Development Tbk, Ciptura Group, Lippo Group, Sinar Mas Land, and PT Pakuwon Jati Tbk (alongside 73 other companies including Agung Sedayu Group and PP Properti), this report unveils market trends, growth drivers, and future opportunities. The report utilizes a base year of 2025, with estimations for 2025 and forecasts spanning 2025-2033, building upon historical data from 2019-2024. This meticulously researched report is an invaluable resource for stakeholders seeking to understand and capitalize on the immense potential of the Indonesian real estate sector. Expect detailed analysis across residential, office, retail, hospitality, and industrial segments, spanning key cities like Jakarta and Bali, and encompassing M&A activity valued in Millions.

Indonesian Real Estate Market Composition & Trends

This section analyzes the Indonesian real estate market's competitive landscape, innovation drivers, regulatory environment, substitute products, end-user profiles, and M&A activity. We dissect market share distribution among key players, revealing the concentration levels and highlighting emerging trends. The analysis includes:

- Market Concentration: A detailed breakdown of market share held by leading players like Agung Podomoro Land and Sinar Mas Land, quantifying the degree of market concentration and identifying potential future shifts.

- Innovation Catalysts: Examination of technological advancements (e.g., proptech adoption, sustainable building practices) driving innovation within the sector and their impact on market dynamics.

- Regulatory Landscape: Analysis of government policies and regulations impacting the real estate market, including their effect on investment and development.

- Substitute Products: Identification and assessment of alternative investment options and their influence on the real estate market's growth.

- End-User Profiles: Segmentation of the end-user base (residential, commercial, etc.), analyzing their preferences and driving forces behind their purchasing decisions.

- M&A Activities: A review of significant mergers and acquisitions within the period, including deal values (in Millions) and their consequences for market consolidation. For example, we will analyze the impact of a hypothetical xx Million deal in 2023 on market dynamics.

Indonesian Real Estate Market Industry Evolution

This section delves into the evolutionary trajectory of the Indonesian real estate market, examining growth trajectories (with specific growth rates provided), technological progress, and evolving consumer preferences. We trace the market's transformation, analyzing shifts in demand, supply, and technological adoption rates (quantified where possible). The section will cover:

- Market Growth Trajectories: Detailed analysis of past, present, and future growth, including projections based on current trends and future expectations. We'll analyze factors contributing to an estimated xx% compound annual growth rate (CAGR) between 2025 and 2033.

- Technological Advancements: In-depth discussion of technological integrations like proptech solutions impacting market efficiency, transparency, and customer experience. We will analyze the adoption rate of digital platforms by real estate companies, estimating the market penetration to be xx% by 2033.

- Shifting Consumer Demands: Exploration of changes in consumer needs and preferences across different property types and geographical locations. We will analyze increasing demand for sustainable housing and its influence on market growth.

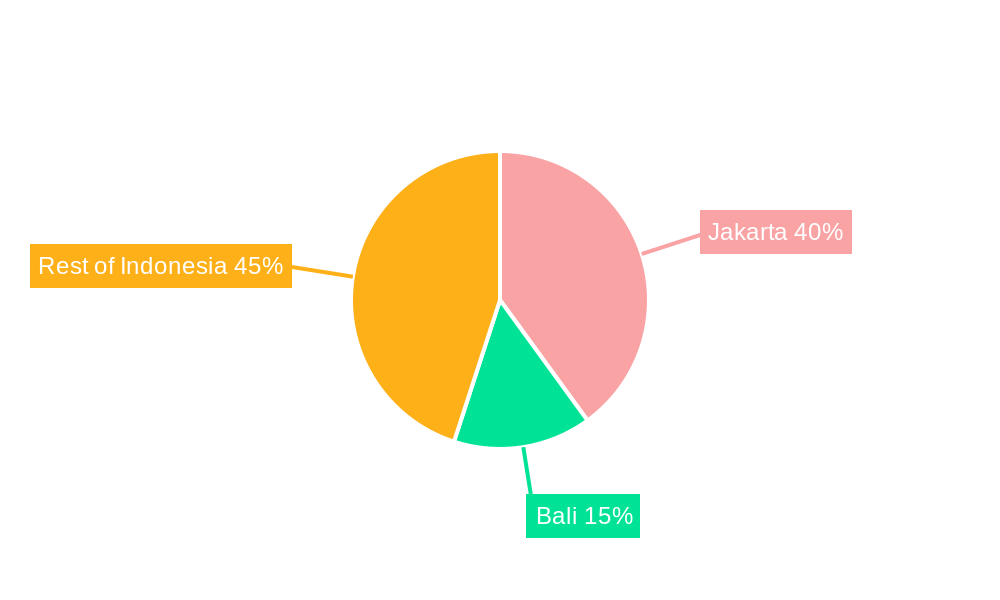

Leading Regions, Countries, or Segments in Indonesian Real Estate Market

This section identifies the dominant regions, countries, or segments within the Indonesian real estate market. We analyze leading segments (residential, office, retail, hospitality, industrial) and cities (Jakarta, Bali, Rest of Indonesia) to uncover the key success factors driving their dominance.

- Dominant Segment Analysis: A detailed evaluation of the leading segment(s), providing in-depth reasons for their dominance. We anticipate the residential segment to remain dominant, representing xx Million of the total market value in 2025.

- Key Drivers (Bullet Points):

- Jakarta's dominance: Strong economic activity, high population density, and robust infrastructure investment.

- Bali's tourism-driven growth: High demand for hospitality and residential properties fueled by the tourism sector.

- Residential segment leadership: Growing population, increasing urbanization, and rising disposable incomes.

- Office segment growth: Expansion of businesses and increasing demand for modern office spaces.

- In-depth Analysis of Dominance Factors: A detailed examination of the factors driving the success of the leading segments and regions, analyzing macroeconomic conditions, regulatory support, and investment trends.

Indonesian Real Estate Market Product Innovations

This section explores recent product innovations in the Indonesian real estate market, highlighting unique selling propositions and technological advancements. The analysis will showcase new building materials, smart home technologies, and sustainable design features implemented by leading companies, leading to improvements in energy efficiency by an estimated xx% compared to traditional construction methods.

Propelling Factors for Indonesian Real Estate Market Growth

This section identifies and analyzes the key drivers contributing to the growth of the Indonesian real estate market. Key factors include robust economic growth, supportive government policies, and increasing urbanization. Technological advancements and rising disposable incomes among the middle class also play a significant role, fueling demand for quality housing and commercial spaces.

Obstacles in the Indonesian Real Estate Market

This section highlights the challenges faced by the Indonesian real estate market. These include regulatory hurdles, land acquisition complexities, infrastructure limitations in some areas, and potential economic slowdowns impacting investment. Supply chain disruptions and increasing competition also present obstacles that need to be addressed for sustainable growth. We estimate that regulatory delays can cause a xx Million reduction in projected annual investment.

Future Opportunities in Indonesian Real Estate Market

The Indonesian real estate market presents numerous future opportunities. These include the expansion into underserved areas, growing demand for affordable housing, and the potential of green building technologies. The development of sustainable infrastructure and the integration of technology are also crucial for future growth. The emergence of new urban centers and growing demand for logistics and industrial spaces also present significant prospects.

Major Players in the Indonesian Real Estate Market Ecosystem

- Agung Podomoro Land

- Tokyu Land Indonesia

- Trans Property

- PT Intiland Development Tbk

- Ciptura Group

- Lippo Group

- Sinar Mas Land

- PT Pakuwon Jati Tbk

- Agung Sedayu Group

- PP Properti

- 73 Other Companies

Key Developments in Indonesian Real Estate Market Industry

- 2022 Q4: Launch of a new luxury residential project by Agung Podomoro Land in Jakarta.

- 2023 Q1: Merger between two mid-sized developers in Bali, resulting in increased market share.

- 2023 Q3: Introduction of a new sustainable building code by the Indonesian government.

- 2024 Q2: Significant investment in infrastructure projects by the government to improve connectivity within major cities. (Further developments to be added based on available data)

Strategic Indonesian Real Estate Market Forecast

The Indonesian real estate market is poised for continued growth, driven by strong economic fundamentals, urbanization, and government initiatives. Opportunities lie in sustainable development, affordable housing, and technological integration. We forecast a continued expansion, with potential for significant returns for investors who capitalize on these opportunities. The market is projected to reach a value of xx Million by 2033, representing a substantial increase from the 2025 estimated value.

Indonesian Real Estate Market Segmentation

-

1. Property Type

- 1.1. Residential

- 1.2. Office

- 1.3. Retail

- 1.4. Hospitality

- 1.5. Industrial

-

2. City

- 2.1. Jakarta

- 2.2. Bali

- 2.3. Rest of Indonesia

Indonesian Real Estate Market Segmentation By Geography

- 1. Indonesia

Indonesian Real Estate Market Regional Market Share

Geographic Coverage of Indonesian Real Estate Market

Indonesian Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Population; Increase in Demand for Residential Real Estate

- 3.3. Market Restrains

- 3.3.1. Increase in Costs

- 3.4. Market Trends

- 3.4.1. Jakarta Emerging as a Prime Rental Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesian Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Residential

- 5.1.2. Office

- 5.1.3. Retail

- 5.1.4. Hospitality

- 5.1.5. Industrial

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Jakarta

- 5.2.2. Bali

- 5.2.3. Rest of Indonesia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Agung Podomoro Land

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tokyu Land Indonesia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trans Property

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Intiland Development Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ciptura Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lippo Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sinar Mas Land

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Pakuwon Jati Tbk**List Not Exhaustive 7 3 Other Companie

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Agung Sedayu Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PP Properti

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Agung Podomoro Land

List of Figures

- Figure 1: Indonesian Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesian Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesian Real Estate Market Revenue Million Forecast, by Property Type 2020 & 2033

- Table 2: Indonesian Real Estate Market Revenue Million Forecast, by City 2020 & 2033

- Table 3: Indonesian Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Indonesian Real Estate Market Revenue Million Forecast, by Property Type 2020 & 2033

- Table 5: Indonesian Real Estate Market Revenue Million Forecast, by City 2020 & 2033

- Table 6: Indonesian Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesian Real Estate Market?

The projected CAGR is approximately 5.82%.

2. Which companies are prominent players in the Indonesian Real Estate Market?

Key companies in the market include Agung Podomoro Land, Tokyu Land Indonesia, Trans Property, PT Intiland Development Tbk, Ciptura Group, Lippo Group, Sinar Mas Land, PT Pakuwon Jati Tbk**List Not Exhaustive 7 3 Other Companie, Agung Sedayu Group, PP Properti.

3. What are the main segments of the Indonesian Real Estate Market?

The market segments include Property Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Population; Increase in Demand for Residential Real Estate.

6. What are the notable trends driving market growth?

Jakarta Emerging as a Prime Rental Market.

7. Are there any restraints impacting market growth?

Increase in Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesian Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesian Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesian Real Estate Market?

To stay informed about further developments, trends, and reports in the Indonesian Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence