Key Insights

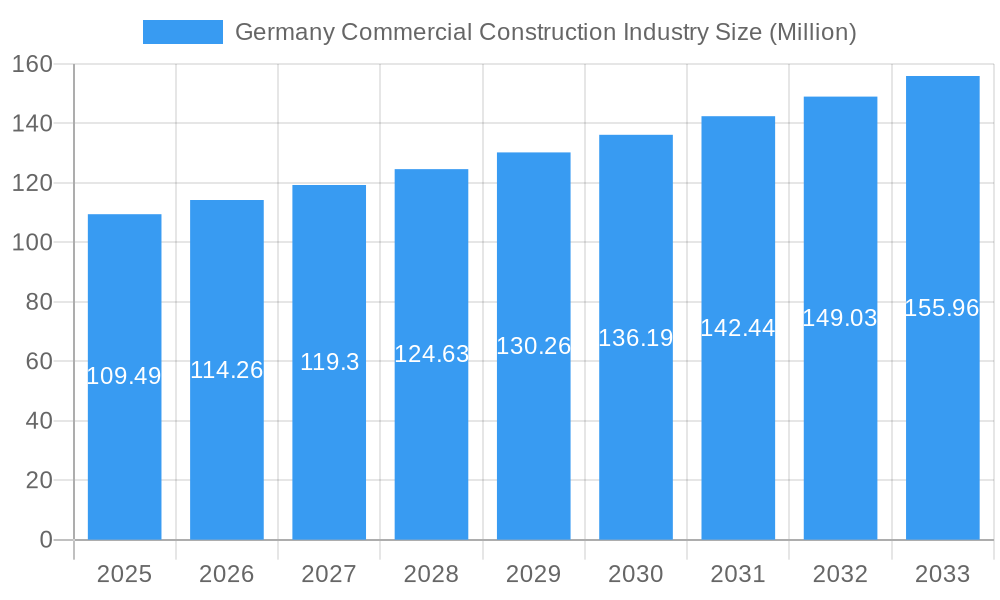

The German commercial construction industry, valued at €109.49 million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.28% from 2025 to 2033. This growth is fueled by several key factors. Increasing urbanization and a robust German economy are driving demand for new office spaces, retail outlets, and hospitality infrastructure. Government initiatives focused on infrastructure development and sustainable construction further contribute to market expansion. The industry is segmented by building type, with office building construction likely representing the largest share, followed by retail and hospitality. Strong regional performance is expected across key states like North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse, reflecting these regions' economic dynamism and population density. However, potential challenges include fluctuations in material costs, skilled labor shortages, and evolving environmental regulations, which could influence the overall growth trajectory. Competition among established players like BAM Deutschland, Strabag AG, and others is intense, requiring continuous innovation and strategic partnerships to maintain market share.

Germany Commercial Construction Industry Market Size (In Million)

The forecast period of 2025-2033 anticipates continued growth, with the market size likely surpassing €150 million by 2033, considering the projected CAGR. While the historical period (2019-2024) likely exhibited variations influenced by global economic shifts and specific national policies, the future outlook remains positive, albeit subject to external economic factors and geopolitical uncertainties. The industry's focus on sustainable and energy-efficient building practices will become increasingly important, impacting both construction methods and material selection. This trend is anticipated to further shape the competitive landscape and drive innovation within the German commercial construction sector.

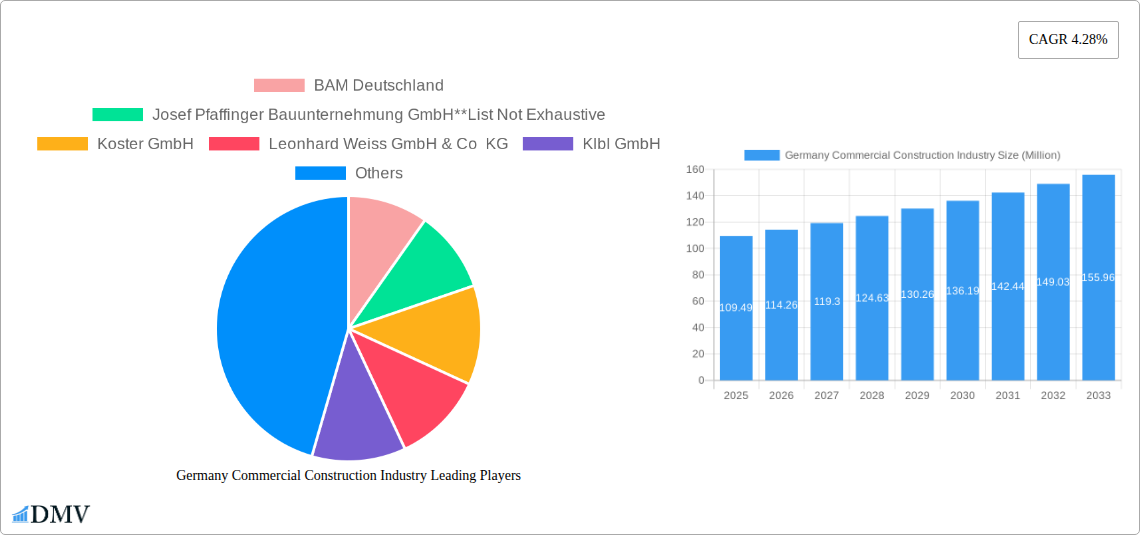

Germany Commercial Construction Industry Company Market Share

Germany Commercial Construction Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the German commercial construction industry, offering valuable insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a base year of 2025, this report examines market composition, trends, leading players, and future opportunities, providing crucial data for strategic decision-making.

Germany Commercial Construction Industry Market Composition & Trends

The German commercial construction market, valued at xx Million in 2025, exhibits a moderately concentrated landscape, with key players like Strabag AG and BAM Deutschland holding significant market share. Innovation is driven by digitalization, sustainable building practices, and prefabrication techniques. Stringent building codes and environmental regulations shape the industry's regulatory landscape, while substitute products like modular construction pose competitive pressures. End-users span diverse sectors including office, retail, hospitality, and institutional spaces. Mergers and acquisitions (M&A) activities, such as Premier Inn’s recent expansion, are reshaping the competitive dynamics.

- Market Share Distribution (2025, Estimated): Strabag AG (xx%), BAM Deutschland (xx%), Other Major Players (xx%), Smaller Firms (xx%).

- M&A Deal Value (2019-2024): xx Million (This figure is an estimation based on available data of Premier Inn's activity and other public information for the period).

- Key Players' Strategies: Focus on technological integration, sustainability, and project diversification.

Germany Commercial Construction Industry Industry Evolution

The German commercial construction market experienced a [insert growth rate, e.g., 3%] CAGR from 2019 to 2024, driven by robust economic conditions and increased investments in infrastructure. Technological advancements, such as Building Information Modeling (BIM) and the rise of digital platforms like Schuttflix, are transforming project management and supply chain efficiency. Shifting consumer demands, including preferences for sustainable and smart buildings, are influencing design and construction practices. The forecast period (2025-2033) projects continued growth, albeit at a potentially moderated pace due to factors such as global economic uncertainty and material price fluctuations. Adoption of BIM is expected to reach xx% by 2033. Further, the increase in demand for sustainable buildings is anticipated to fuel the growth of green building technologies by yy% over the forecast period.

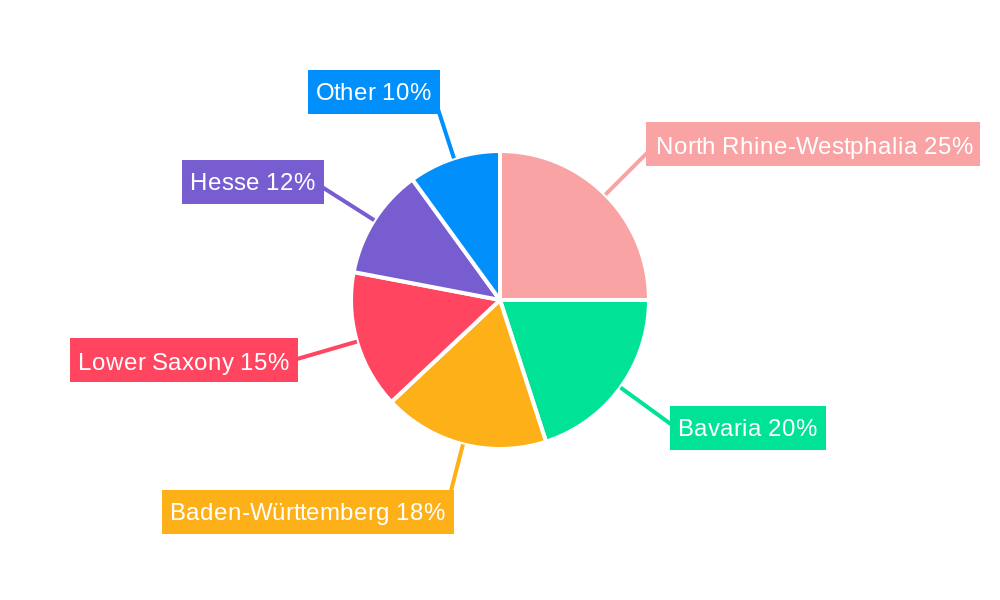

Leading Regions, Countries, or Segments in Germany Commercial Construction Industry

While data on regional breakdowns requires further investigation (xx), the Office Building Construction segment currently dominates the German commercial construction market. This is driven by sustained demand from the corporate sector, particularly in major urban centers like Berlin, Frankfurt, and Munich. The Hospitality segment shows significant potential for growth fuelled by hotel chains' expansion plans, like that of Premier Inn.

- Office Building Construction:

- Key Drivers: Strong corporate demand, investment in new office spaces, urban development projects.

- Hospitality Construction:

- Key Drivers: Expansion of hotel chains, growing tourism sector, increasing demand for budget-friendly accommodations.

- Retail Construction:

- Key Drivers: E-commerce expansion leads to a need for omnichannel strategies, including modernized physical stores in key locations.

- Institutional Construction:

- Key Drivers: Public sector investments in infrastructure, healthcare, and education.

Germany Commercial Construction Industry Product Innovations

Recent innovations focus on prefabricated modular construction, sustainable building materials (e.g., timber, recycled materials), and smart building technologies that enhance energy efficiency and operational performance. These innovations offer reduced construction times, lower costs, and improved building performance, appealing to both developers and end-users. Unique selling propositions include reduced environmental impact, improved occupant comfort, and enhanced building lifecycle management.

Propelling Factors for Germany Commercial Construction Industry Growth

Strong economic growth, sustained investment in infrastructure projects, and government support for green building initiatives are key drivers of market expansion. Technological advancements, such as BIM and digital platforms for supply chain management, further enhance efficiency and productivity. A growing population and urbanization trends contribute to the increased demand for commercial spaces.

Obstacles in the Germany Commercial Construction Industry Market

Supply chain disruptions, fluctuating material costs, and skilled labor shortages pose significant challenges. Strict regulations and bureaucratic processes can also delay project timelines and increase costs. Intense competition among established players and the entry of new players further intensify the market pressure.

Future Opportunities in Germany Commercial Construction Industry

The increasing demand for sustainable and energy-efficient buildings presents significant opportunities. The integration of smart technologies and the development of innovative construction methods offer further avenues for growth. Expansion into new regional markets and tapping into emerging sectors like data centers present additional potential.

Major Players in the Germany Commercial Construction Industry Ecosystem

- BAM Deutschland

- Josef Pfaffinger Bauunternehmung GmbH

- Koster GmbH

- Leonhard Weiss GmbH & Co KG

- Klbl GmbH

- Strabag AG

- AUG PRIEN Bauunternehmung (GmbH & Co KG)

- Goldbeck Ost GmbH Niederlassung Sachsen-Plauen

- Gottlob Brodbeck GmbH & Co KG

- Dechant hoch- und ingenieurbau gmbh

Key Developments in Germany Commercial Construction Industry Industry

- August 2023: Schuttflix secured EUR 45 Million (USD 47.37 Million) in funding to boost its digital platform for construction supplies, indicating a growing trend towards digitalization in the sector. This will likely increase efficiency and competition within the supply chain.

- April 2023: Premier Inn’s acquisition of six hotels and planned expansion of 1,000-1,500 rooms signal significant growth in the hospitality construction segment. This highlights the strong investment and potential for growth in the German hospitality sector.

Strategic Germany Commercial Construction Industry Market Forecast

The German commercial construction market is poised for continued growth, driven by factors such as economic stability, infrastructure development, and the increasing adoption of sustainable building practices. Opportunities lie in embracing digitalization, focusing on sustainable construction, and catering to evolving end-user demands. The market’s future trajectory hinges on navigating challenges like supply chain volatility and labor shortages effectively. This report provides the necessary insights to leverage these opportunities and mitigate risks effectively.

Germany Commercial Construction Industry Segmentation

-

1. Type

- 1.1. Office Building Construction

- 1.2. Retail Construction

- 1.3. Hospitality Construction

- 1.4. Institutional Construction

- 1.5. Other Types

Germany Commercial Construction Industry Segmentation By Geography

- 1. Germany

Germany Commercial Construction Industry Regional Market Share

Geographic Coverage of Germany Commercial Construction Industry

Germany Commercial Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Commercial Property Development; Rapid Digitalization of Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Emerging Safety and Labour Issues; Rise in Cost of Construction

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Green buildings is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Commercial Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office Building Construction

- 5.1.2. Retail Construction

- 5.1.3. Hospitality Construction

- 5.1.4. Institutional Construction

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BAM Deutschland

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Josef Pfaffinger Bauunternehmung GmbH**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Koster GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Leonhard Weiss GmbH & Co KG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Klbl GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Strabag AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AUG PRIEN Bauunternehmung (GmbH & Co KG)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Goldbeck Ost GmbH Niederlassung Sachsen-Plauen

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gottlob Brodbeck GmbH & Co KG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dechant hoch- und ingenieurbau gmbh

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BAM Deutschland

List of Figures

- Figure 1: Germany Commercial Construction Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Commercial Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Commercial Construction Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Germany Commercial Construction Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Germany Commercial Construction Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Germany Commercial Construction Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Commercial Construction Industry?

The projected CAGR is approximately 4.28%.

2. Which companies are prominent players in the Germany Commercial Construction Industry?

Key companies in the market include BAM Deutschland, Josef Pfaffinger Bauunternehmung GmbH**List Not Exhaustive, Koster GmbH, Leonhard Weiss GmbH & Co KG, Klbl GmbH, Strabag AG, AUG PRIEN Bauunternehmung (GmbH & Co KG), Goldbeck Ost GmbH Niederlassung Sachsen-Plauen, Gottlob Brodbeck GmbH & Co KG, Dechant hoch- und ingenieurbau gmbh.

3. What are the main segments of the Germany Commercial Construction Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 109.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Commercial Property Development; Rapid Digitalization of Commercial Construction.

6. What are the notable trends driving market growth?

Increasing Investments in Green buildings is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Emerging Safety and Labour Issues; Rise in Cost of Construction.

8. Can you provide examples of recent developments in the market?

August 2023: Gutersloh-based Schuttflix, a German digital marketplace and delivery platform for bulk construction supplies, announced that it had secured EUR 45 million (USD 47.37 million) in a fresh round of funding. Schuttflix says it will use the funds to enhance its technology, expand into new markets, diversify services, form partnerships, attract top talent, invest in marketing, prioritize customer support, and contribute to sustainability efforts in the construction sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Commercial Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Commercial Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Commercial Construction Industry?

To stay informed about further developments, trends, and reports in the Germany Commercial Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence