Key Insights

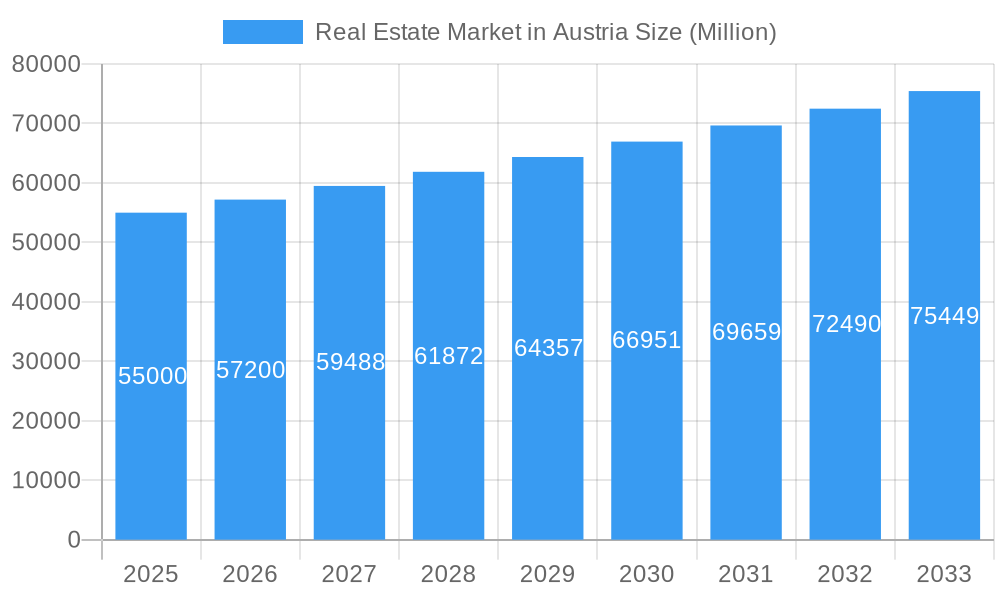

The Austrian Real Estate Market is poised for sustained growth, projected to reach a significant Market Size of Approximately 55,000 Million EUR by 2025, with a compelling CAGR of 4.00% over the forecast period of 2025-2033. This expansion is primarily fueled by robust economic indicators within Austria, a stable political climate fostering investor confidence, and an increasing demand for housing driven by a growing population and urbanization trends. The market is experiencing a strong influx of both domestic and international investment, attracted by the country's high quality of life, strategic location in the heart of Europe, and a well-developed infrastructure. Key growth drivers include government initiatives supporting construction and sustainable development, alongside evolving lifestyle preferences that favor modern, energy-efficient, and well-connected living spaces. The market is also witnessing a surge in demand for smart homes and properties incorporating innovative architectural designs, reflecting a broader shift towards technologically advanced and environmentally conscious real estate solutions.

Real Estate Market in Austria Market Size (In Billion)

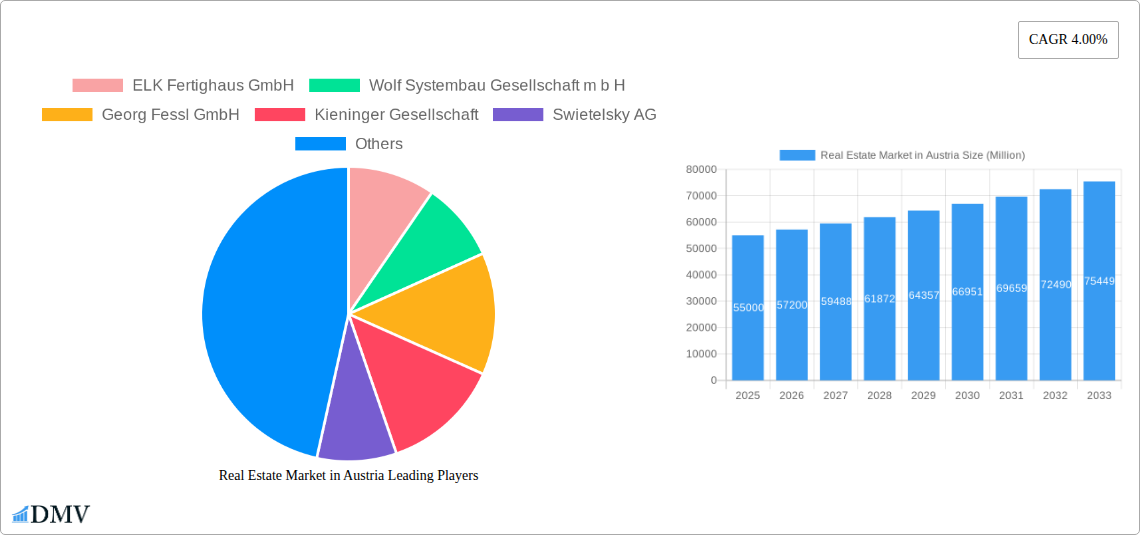

The Austrian Real Estate Market is characterized by distinct segment growth, with both single-family and multi-family housing contributing to overall expansion. While single-family homes continue to be a popular choice for individuals and families seeking space and privacy, multi-family developments are gaining traction, especially in urban centers, to address housing shortages and capitalize on economies of scale. Key players like ELK Fertighaus GmbH, Wolf Systembau Gesellschaft m b H, and Swietelsky AG are actively shaping the market through their innovative construction methods and diverse project portfolios. Emerging trends such as the integration of renewable energy sources in new constructions, the revitalization of existing properties, and the increasing focus on sustainable building materials are becoming paramount. However, the market is not without its challenges. Rising construction costs, stringent environmental regulations, and fluctuations in interest rates present potential restraints that require strategic navigation by developers and investors. Nonetheless, the underlying demand and the positive economic outlook suggest a resilient and dynamic Austrian Real Estate Market for the foreseeable future.

Real Estate Market in Austria Company Market Share

Real Estate Market in Austria Market Composition & Trends

The Austrian real estate market, encompassing both Single Family and Multi Family segments, is characterized by a dynamic interplay of established players and emerging trends. Market concentration is moderate, with key companies like Swietelsky AG, Wimberger Holding GmbH, and Wolf Systembau Gesellschaft m b H holding significant shares. Innovation is driven by increasing demand for sustainable building practices, smart home technologies, and energy-efficient solutions. Regulatory landscapes, while generally stable, can influence development through zoning laws and subsidies for affordable housing initiatives. Substitute products, such as rental properties and alternative investment vehicles, also play a role in shaping demand. End-user profiles are diverse, ranging from first-time homebuyers and families seeking larger dwellings to investors and retirees. Merger and acquisition (M&A) activities, with estimated deal values in the hundreds of millions of Euros, reflect a consolidation drive and strategic expansion within the sector. Future M&A activity is predicted to focus on companies with strong sustainability portfolios and technological integration capabilities.

- Market Share Distribution: Leading companies hold an estimated combined market share of 30-40% in their respective specialties.

- M&A Deal Values: Significant transactions in the past two years have ranged from €50 Million to €200 Million.

- Innovation Catalysts: Growing environmental consciousness and government incentives for green construction.

- Regulatory Impact: Building codes and energy performance certifications are key drivers of innovation.

- End-User Segmentation: Young professionals, families, and the aging population represent distinct demand segments.

Real Estate Market in Austria Industry Evolution

The Austrian real estate industry has witnessed remarkable evolution from 2019 to 2024, with a projected continued upward trajectory through 2033. The historical period (2019-2024) has been marked by a steady growth rate averaging 4.5% annually, fueled by a combination of low interest rates and robust economic conditions. Technological advancements have been pivotal, with the adoption of Building Information Modeling (BIM) becoming increasingly mainstream, enhancing design efficiency and project management. Prefabricated and modular construction methods, championed by companies like ELK Fertighaus GmbH and Karmod, have gained traction, promising faster construction times and cost savings. Shifting consumer demands are a significant driver, with a pronounced preference for energy-efficient homes, smart home integration, and proximity to green spaces and amenities. The demand for flexible living spaces that can adapt to changing family needs or remote work arrangements is also on the rise. The base year of 2025 is anticipated to see continued momentum, with an estimated growth rate of 5.0%. The forecast period (2025-2033) projects sustained growth, albeit potentially moderating to 3.5-4.0% annually, as market saturation in certain prime locations becomes a factor. However, innovation in sustainable materials, circular economy principles in construction, and the integration of renewable energy sources will continue to propel the industry forward. The rise of co-living and multi-generational housing solutions also reflects evolving societal needs and a desire for community. The industry's evolution is a testament to its adaptability in responding to economic shifts, technological breakthroughs, and the ever-changing aspirations of homebuyers and investors.

Leading Regions, Countries, or Segments in Real Estate Market in Austria

The Austrian real estate market, when analyzed by segment, exhibits distinct dominance patterns. While the nation as a whole is a strong performer, the Multi Family segment has been a consistent frontrunner in terms of investment volume and development activity from 2019 to 2025. This dominance is underpinned by several key drivers, including increasing urbanization, a growing demand for rental properties, and the attractiveness of multi-unit developments for institutional investors. The regulatory landscape often favors multi-family projects through zoning allowances and incentives for affordable housing, making them a more streamlined development option compared to individual single-family homes.

- Investment Trends: Multi-family developments consistently attract a higher volume of institutional investment due to predictable rental income and economies of scale in management.

- Regulatory Support: Favorable zoning regulations and government subsidies for affordable multi-family housing projects significantly boost development.

- Urbanization: A continuous influx of population into major cities drives demand for apartments and condominiums.

- Cost-Effectiveness: For developers, building multiple units simultaneously often leads to greater cost efficiencies.

- Consumer Demand: A growing preference for convenient, low-maintenance urban living among a younger demographic.

While the Single Family segment remains vital and appealing to a substantial portion of the population, its growth rate has been more tempered by land availability, rising construction costs, and a greater regulatory burden on individual plot developments. However, innovative approaches in prefabricated and modular single-family homes, exemplified by companies like Palmatin and Georg Fessl GmbH, are making homeownership more accessible and sustainable. The demand for larger plots and detached properties in suburban and rural areas persists, particularly among families seeking space and privacy. The perceived stability and long-term value appreciation associated with owning a single-family home continue to drive demand from a demographic seeking asset building and legacy creation.

Real Estate Market in Austria Product Innovations

Product innovation in the Austrian real estate market is increasingly focused on sustainability and smart technology. The integration of advanced insulation materials, solar panel systems, and intelligent heating/cooling solutions are becoming standard features, significantly improving energy efficiency. Prefabricated and modular construction techniques are offering faster build times and reduced waste, appealing to both developers and environmentally conscious buyers. Companies are exploring the use of recycled and bio-based building materials to minimize their carbon footprint. Smart home systems, enabling remote control of lighting, temperature, security, and appliances, are also gaining widespread adoption, enhancing convenience and living comfort. These innovations are crucial for meeting evolving consumer expectations and stringent environmental regulations.

Propelling Factors for Real Estate Market in Austria Growth

The growth of the Austrian real estate market is propelled by a confluence of robust economic indicators, supportive government policies, and technological advancements. Low interest rates have historically made mortgages more accessible, stimulating demand for both residential and commercial properties. Government initiatives promoting energy efficiency, sustainable construction, and affordable housing development provide significant incentives for developers and buyers alike. The increasing attractiveness of Austria as an investment destination, coupled with a stable political and economic environment, draws both domestic and international capital. Technological advancements in construction, such as modular building and BIM, are streamlining processes and reducing costs, further boosting market activity.

- Economic Stability: Austria's consistently strong economy and low unemployment rates underpin consumer confidence and purchasing power.

- Favorable Interest Rates: Historically low mortgage rates have made property ownership more attainable.

- Government Incentives: Subsidies for energy-efficient buildings and affordable housing projects encourage development.

- Technological Integration: Advancements in construction technology are increasing efficiency and reducing costs.

- Foreign Investment: A safe-haven appeal attracts international investors seeking stable returns.

Obstacles in the Real Estate Market in Austria Market

Despite its positive trajectory, the Austrian real estate market faces several significant obstacles. Rising construction costs, driven by inflation and supply chain disruptions for materials like timber and steel, are a primary concern. The availability of suitable land in prime urban locations is becoming increasingly scarce, leading to higher land prices and intensified competition among developers. Stringent building regulations and lengthy approval processes can also create delays and increase development costs. Furthermore, a shortage of skilled labor within the construction industry poses a continuous challenge to project timelines and quality. While demand remains strong, affordability remains a critical issue for a segment of the population, particularly in major urban centers.

- Rising Construction Costs: Inflation and supply chain issues have increased material and labor expenses.

- Land Scarcity: Limited availability of developable land, especially in sought-after areas.

- Regulatory Hurdles: Complex permitting processes and strict building codes can slow down development.

- Labor Shortages: A deficit of skilled tradespeople impacts project completion rates.

- Affordability Concerns: Increasing property prices are making homeownership unattainable for some.

Future Opportunities in Real Estate Market in Austria

The Austrian real estate market is poised for future growth driven by emerging opportunities in sustainable development and urban regeneration. The increasing focus on green building technologies and energy-efficient solutions presents a significant avenue for innovation and market differentiation. The demand for co-living spaces and adaptable residential units catering to changing lifestyle trends is expected to rise. Furthermore, opportunities exist in the revitalization of underutilized urban areas and the development of smart city infrastructure. The continued growth of tourism and the demand for high-quality hospitality real estate also offer potential for expansion. Embracing digitalization and new construction methods will be key to unlocking these future opportunities.

- Green Building: Growing demand for eco-friendly and energy-efficient properties.

- Urban Regeneration: Redevelopment of brownfield sites and underutilized urban spaces.

- Flexible Living: Expansion of co-living, micro-apartments, and adaptable housing solutions.

- Smart City Integration: Development of properties that leverage smart technology and sustainable urban planning.

- Tourism Real Estate: Investment in hotels, serviced apartments, and other hospitality-related properties.

Major Players in the Real Estate Market in Austria Ecosystem

- ELK Fertighaus GmbH

- Wolf Systembau Gesellschaft m b H

- Georg Fessl GmbH

- Kieninger Gesellschaft

- Swietelsky AG

- Palmatin

- Wimberger Holding GmbH

- Austrohaus

- Schmid Hochbau GmbH

- Karmod

Key Developments in Real Estate Market in Austria Industry

- January 2023: The residential project for the Neunkirchen non-profit housing and settlement cooperative is being completed by the SWIETELSKY branch office for building construction in Lower Austria and Burgenland as general contractor. This project, situated on approximately 4,000-square-meter plot, involves the development of 38 low-rise residential apartments with subsidies and 75 underground parking spaces, addressing the need for affordable housing.

- January 2023: Non-profit cooperatives GEDESAG and SCHNERE ZUKUNFT are constructing a total of 40 residential units in the Waldviertel neighborhood, facilitated by a SWIETELSKY subsidiary. Concurrently, for the non-profit Donau-Ennstalersiedlungs AG, 16 apartments and six semi-detached homes are being constructed in Gföhl. The semi-detached homes offer approximately 105 square meters of living space spread across three levels, with an additional 60 square meter basement. Nearby, a two-story residential building adds to the housing stock, with units ranging from 55 to 84 square meters. These developments highlight a focus on expanding the supply of subsidized and energy-efficient housing.

Strategic Real Estate Market in Austria Market Forecast

The strategic forecast for the Austrian real estate market predicts sustained growth driven by an increasing demand for sustainable and technologically advanced properties. The emphasis on energy efficiency and green building practices will continue to shape new developments, attracting environmentally conscious buyers and investors. The market's resilience is further bolstered by government support for affordable housing and urban regeneration projects, creating opportunities for both large-scale developers and specialized niche players. The integration of smart home technologies and innovative construction methods like modular building will enhance property value and market competitiveness. While challenges related to construction costs and land availability persist, strategic investments in urban infill development and the adoption of new building materials are expected to mitigate these constraints, ensuring a positive and evolving real estate landscape through 2033.

Real Estate Market in Austria Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

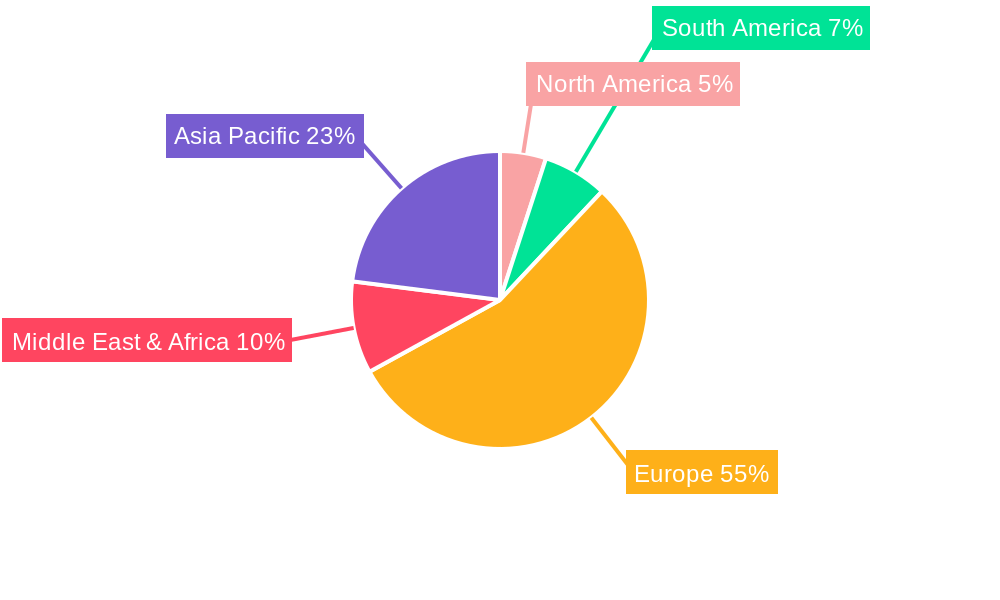

Real Estate Market in Austria Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Real Estate Market in Austria Regional Market Share

Geographic Coverage of Real Estate Market in Austria

Real Estate Market in Austria REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of prefabricated Housing in GCC; Government Initiatives Driving the Construction

- 3.3. Market Restrains

- 3.3.1 Low construction tolerance

- 3.3.2 supplier dependance and expensive development

- 3.4. Market Trends

- 3.4.1. The decrease in Labor Force in Austria is driving the demand of prefabricated houses

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Real Estate Market in Austria Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Real Estate Market in Austria Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Single Family

- 6.1.2. Multi Family

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Real Estate Market in Austria Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Single Family

- 7.1.2. Multi Family

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Real Estate Market in Austria Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Single Family

- 8.1.2. Multi Family

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Real Estate Market in Austria Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Single Family

- 9.1.2. Multi Family

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Real Estate Market in Austria Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Single Family

- 10.1.2. Multi Family

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ELK Fertighaus GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wolf Systembau Gesellschaft m b H

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Georg Fessl GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kieninger Gesellschaft

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Swietelsky AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Palmatin

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wimberger Holding GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Austrohaus**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schmid Hochbau GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Karmod

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ELK Fertighaus GmbH

List of Figures

- Figure 1: Global Real Estate Market in Austria Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Real Estate Market in Austria Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Real Estate Market in Austria Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Real Estate Market in Austria Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Real Estate Market in Austria Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Real Estate Market in Austria Revenue (Million), by Type 2025 & 2033

- Figure 7: South America Real Estate Market in Austria Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America Real Estate Market in Austria Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Real Estate Market in Austria Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Real Estate Market in Austria Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Real Estate Market in Austria Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Real Estate Market in Austria Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Real Estate Market in Austria Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Real Estate Market in Austria Revenue (Million), by Type 2025 & 2033

- Figure 15: Middle East & Africa Real Estate Market in Austria Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa Real Estate Market in Austria Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Real Estate Market in Austria Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Real Estate Market in Austria Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Real Estate Market in Austria Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Real Estate Market in Austria Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Real Estate Market in Austria Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Real Estate Market in Austria Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Real Estate Market in Austria Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Real Estate Market in Austria Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Real Estate Market in Austria Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Real Estate Market in Austria Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Global Real Estate Market in Austria Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Real Estate Market in Austria Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Real Estate Market in Austria Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Real Estate Market in Austria Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global Real Estate Market in Austria Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Real Estate Market in Austria Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Real Estate Market in Austria Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Real Estate Market in Austria Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Real Estate Market in Austria?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Real Estate Market in Austria?

Key companies in the market include ELK Fertighaus GmbH, Wolf Systembau Gesellschaft m b H, Georg Fessl GmbH, Kieninger Gesellschaft, Swietelsky AG, Palmatin, Wimberger Holding GmbH, Austrohaus**List Not Exhaustive, Schmid Hochbau GmbH, Karmod.

3. What are the main segments of the Real Estate Market in Austria?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of prefabricated Housing in GCC; Government Initiatives Driving the Construction.

6. What are the notable trends driving market growth?

The decrease in Labor Force in Austria is driving the demand of prefabricated houses.

7. Are there any restraints impacting market growth?

Low construction tolerance. supplier dependance and expensive development.

8. Can you provide examples of recent developments in the market?

January 2023: The residential project is being completed for the Neunkirchen non-profit housing and settlement cooperative by the SWIETELSKY branch office for building construction in Lower Austria and Burgenland as part of the general contractor. On a roughly 4,000-square-meter plot, 38 low-rise residential apartments with subsidies are being developed, along with 75 underground parking spaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Real Estate Market in Austria," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Real Estate Market in Austria report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Real Estate Market in Austria?

To stay informed about further developments, trends, and reports in the Real Estate Market in Austria, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence