Key Insights

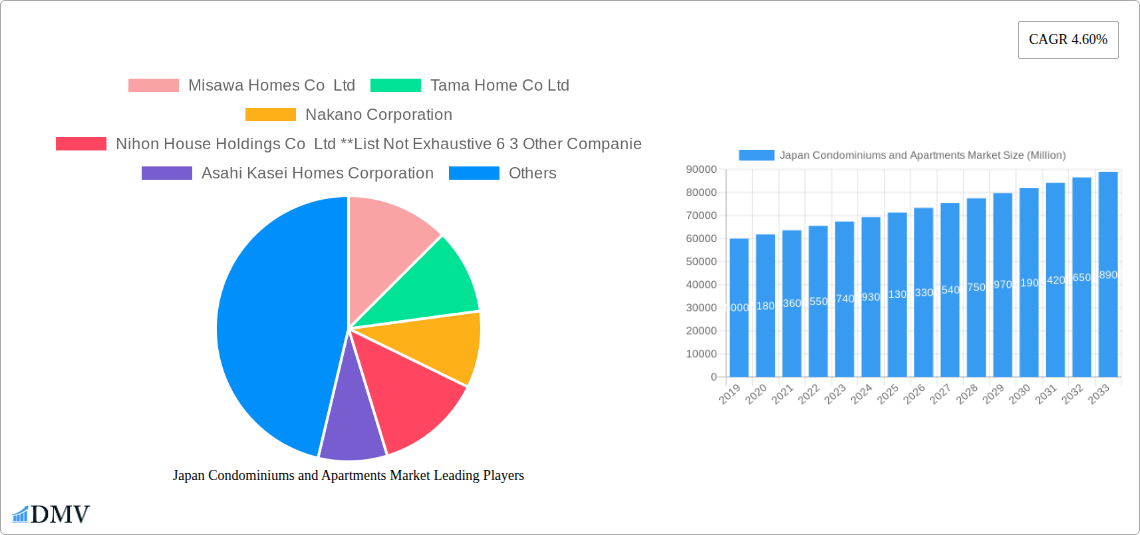

The Japan condominiums and apartments market is projected for substantial growth, with an estimated market size of ¥16.48 billion by 2025 and a Compound Annual Growth Rate (CAGR) of 6% from 2025 to 2033. Key growth drivers include persistent urbanization, an aging demographic, and a rise in single-person households, all fueling demand for modern urban residences. Government housing development initiatives further support market expansion. The market is characterized by increasing adoption of smart home technology and energy-efficient designs, aligning with sustainability and convenience trends.

Japan Condominiums and Apartments Market Market Size (In Billion)

Challenges such as rising construction costs and land scarcity in prime urban areas may temper growth. However, the market is expected to thrive, driven by demand for both condominiums and apartments. Leading companies like Sekisui House Limited, Asahi Kasei Homes Corporation, and Panasonic Homes Corporation are innovating to meet evolving consumer preferences for amenities, community living, and sustainable practices.

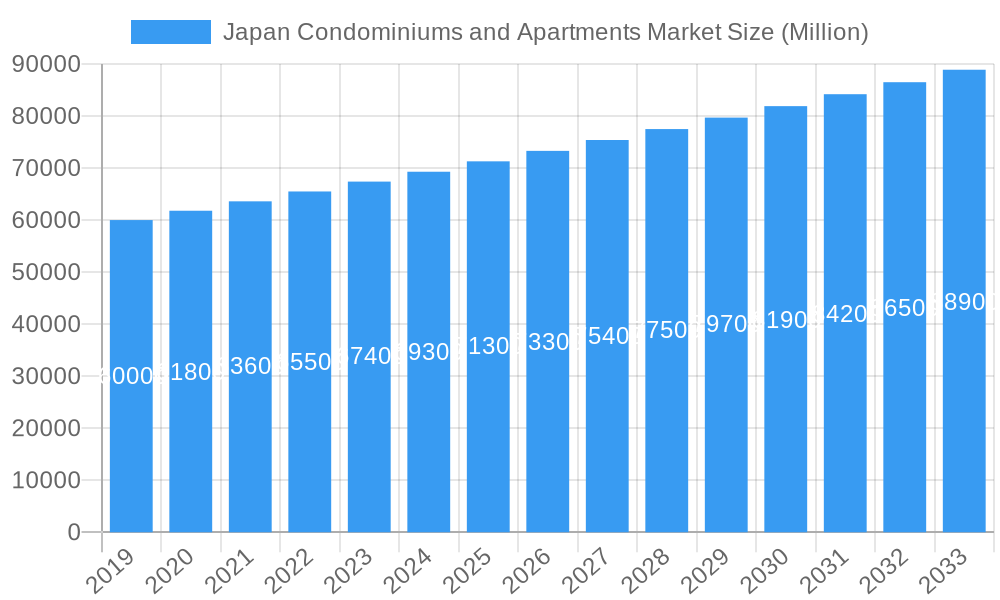

Japan Condominiums and Apartments Market Company Market Share

This report offers an in-depth analysis of the Japan condominiums and apartments market. Covering the period 2019-2024, with a base year of 2025 and a forecast to 2033, it provides critical insights for investors, developers, and industry stakeholders. Analysis includes market composition, industry evolution, regional dynamics, product innovation, growth drivers, restraints, and future opportunities within the Japanese housing sector.

Japan Condominiums and Apartments Market Market Composition & Trends

The Japan condominiums and apartments market is characterized by a moderately concentrated landscape, with key players driving innovation and shaping the industry. Regulatory frameworks, including land use policies and building codes, significantly influence market dynamics and investment. The prevalence of substitute products, such as single-family homes, is carefully considered, alongside evolving end-user profiles, driven by demographic shifts and changing lifestyle preferences. Mergers and Acquisitions (M&A) activities are a crucial indicator of market consolidation and strategic growth.

- Market Concentration: Dominated by a few large developers, with increasing fragmentation in niche segments.

- Innovation Catalysts: Driven by demand for smart homes, sustainable building practices, and flexible living spaces.

- Regulatory Landscapes: Stringent earthquake-resistant building standards and urban planning regulations impact development costs and timelines.

- Substitute Products: Single-family homes, serviced apartments, and rental housing offer alternatives to traditional condominium and apartment ownership.

- End-User Profiles: Growing demand from young professionals, dual-income households, and an aging population seeking convenient urban living.

- M&A Activities: Strategic acquisitions are aimed at expanding market reach, acquiring land banks, and integrating technological capabilities. M&A deal values are projected to reach XX Million by 2033.

Japan Condominiums and Apartments Market Industry Evolution

The Japan condominiums and apartments market has witnessed a robust evolution driven by consistent economic development, technological advancements, and persistent shifts in consumer demands. Over the historical period of 2019-2024, the market experienced a steady growth rate of approximately 3.5% annually, a testament to Japan's resilient real estate sector. The base year of 2025 sets the stage for continued expansion, with projections indicating a compound annual growth rate (CAGR) of 3.8% during the forecast period of 2025-2033. This sustained growth is underpinned by significant investments in urban regeneration projects and a rising demand for high-quality residential spaces, particularly in metropolitan areas. Technological advancements have played a pivotal role, with the integration of smart home technologies becoming a standard feature, enhancing convenience and energy efficiency. Adoption rates for IoT-enabled building management systems have surged by an estimated 15% year-over-year. Shifting consumer demands are evident in the preference for smaller, more efficient units in prime locations, as well as a growing interest in sustainable and eco-friendly housing solutions. The increasing prevalence of remote work has also influenced demand, with buyers seeking flexible layouts that can accommodate home offices. Furthermore, the Japanese government's initiatives to boost domestic tourism and encourage foreign investment in real estate have indirectly fueled demand for both short-term rental apartments and long-term residential properties, contributing to the market's overall dynamism and resilience. The market's evolution is a complex interplay of economic stability, technological innovation, and deeply ingrained cultural preferences, all converging to shape the future of Japanese urban living.

Leading Regions, Countries, or Segments in Japan Condominiums and Apartments Market

The Japan condominiums and apartments market is most dynamically shaped by its urban centers, with Tokyo metropolitan area consistently emerging as the dominant region. This dominance is attributed to its status as the economic and cultural hub of Japan, attracting a significant influx of young professionals and international residents, thereby fueling sustained demand for both condominiums and apartments. The segment of Condominiums within this market holds a substantial share, accounting for approximately 60% of total market value in 2025, driven by factors such as perceived investment value, security, and access to amenities.

Dominant Region: Tokyo Metropolitan Area

- Investment Trends: Robust foreign and domestic investment attracted by high rental yields and capital appreciation potential.

- Regulatory Support: Favorable urban planning policies and infrastructure development projects supporting high-density living.

- Demographic Concentration: High population density of working professionals and a strong job market creating consistent demand.

- Infrastructure Excellence: Superior public transportation networks and access to services enhance the desirability of urban living.

Dominant Segment: Condominiums

- Lifestyle Appeal: Offering a blend of modern amenities, security, and convenient urban access, particularly appealing to singles and young families.

- Investment Vehicles: Perceived as stable assets with potential for rental income and long-term capital gains.

- Developer Innovation: Continuous introduction of high-rise condominiums with advanced features like smart home technology, communal spaces, and earthquake-resistant designs.

- Market Size: Estimated market share of 60% in 2025, projected to grow at a CAGR of 4.0% through 2033.

Growing Segment: Apartments

- Affordability and Accessibility: Offering more budget-friendly options compared to premium condominiums, attracting a broader demographic.

- Rental Market Strength: A robust rental market supports apartment demand, especially in areas with high student populations and transient workforces.

- Adaptability: Increasingly incorporating modern design and amenities to cater to evolving tenant expectations.

The influence of the Tokyo Metropolitan Area is further amplified by its status as a testing ground for innovative housing solutions, from compact, technologically advanced units to eco-friendly developments. The concentration of financial institutions and real estate agencies within this region facilitates smoother transactions and greater liquidity, solidifying its position as the most influential market for condominiums and apartments in Japan.

Japan Condominiums and Apartments Market Product Innovations

Product innovations in the Japan condominiums and apartments market are increasingly focused on enhancing living experiences and sustainability. Key advancements include the integration of sophisticated smart home technology, offering residents centralized control over lighting, temperature, security, and entertainment systems. Modular construction techniques are also gaining traction, enabling faster build times and greater cost efficiency. Furthermore, a growing emphasis on eco-friendly materials and energy-efficient designs is evident, with many new developments incorporating solar panels, advanced insulation, and water-saving fixtures. Performance metrics for these innovations include reduced energy consumption by up to 20% and improved occupant comfort.

Propelling Factors for Japan Condominiums and Apartments Market Growth

Several key factors are propelling the Japan condominiums and apartments market forward. Technologically, the widespread adoption of smart home technology enhances desirability and functionality, while advancements in construction materials lead to more durable and sustainable buildings. Economically, low interest rates and government incentives for first-time homebuyers are stimulating demand. Regulatory support, particularly through urban redevelopment initiatives and favorable zoning laws in major cities, is encouraging new construction and modernizing existing stock. The growing demand for convenience and compact living spaces in urban centers, driven by demographic shifts and a preference for city living, is a significant underlying trend.

Obstacles in the Japan Condominiums and Apartments Market Market

Despite the growth, the Japan condominiums and apartments market faces notable obstacles. Stringent building codes and land scarcity in desirable urban locations can increase development costs and limit supply, impacting affordability. Supply chain disruptions, exacerbated by global economic factors, can lead to project delays and rising material costs, with potential cost increases of 5-10% impacting project viability. Intense competition among developers, particularly for prime land, drives up acquisition costs. Furthermore, demographic shifts, such as a declining birthrate and an aging population, present long-term challenges to sustained demand in certain regions. The regulatory environment, while supportive in some aspects, can also be complex and time-consuming, potentially hindering rapid development.

Future Opportunities in Japan Condominiums and Apartments Market

Emerging opportunities within the Japan condominiums and apartments market are abundant. The growing demand for co-living spaces and flexible housing solutions presents a significant niche. Technological integration, particularly in energy-efficient buildings and smart communities, offers avenues for premium developments. Expansion into secondary cities with improving infrastructure and lower property prices can unlock new markets. Furthermore, the increasing interest in sustainable tourism and the rise of the digital nomad demographic are creating demand for short-term and serviced apartment rentals, a segment ripe for growth. The integration of AI in property management and maintenance also presents opportunities for enhanced operational efficiency.

Major Players in the Japan Condominiums and Apartments Market Ecosystem

- Misawa Homes Co Ltd

- Tama Home Co Ltd

- Nakano Corporation

- Nihon House Holdings Co Ltd

- Asahi Kasei Homes Corporation

- Kajima Corporation

- Yamada Homes Co Ltd

- Sumitomo Forestry's Co Ltd

- Sekisui House Limited

- Panasonic Homes Co Ltd

- 6 Other Companies

Key Developments in Japan Condominiums and Apartments Market Industry

- 2023 December: Launch of innovative, earthquake-resistant condominium designs with integrated smart home features.

- 2024 January: Major developers announce increased investment in sustainable building materials and renewable energy integration.

- 2024 March: Government initiatives to streamline approval processes for urban redevelopment projects.

- 2024 April: Increased M&A activity as larger firms acquire smaller developers to expand market share and land banks.

- 2024 May: Introduction of new rental apartment models catering to the growing demand for flexible living arrangements.

Strategic Japan Condominiums and Apartments Market Market Forecast

The strategic forecast for the Japan condominiums and apartments market indicates sustained growth, driven by ongoing urbanization, technological integration, and evolving lifestyle preferences. The market is poised to benefit from continued investments in smart home technologies and sustainable building practices, enhancing the appeal and value of residential properties. Opportunities in the burgeoning co-living sector and the expansion into emerging urban centers will further diversify the market landscape. With a focus on innovation and adaptability, the Japanese housing market is expected to offer attractive returns for stakeholders, solidifying its position as a resilient and promising sector within the global real estate arena. The market is projected to reach a value of approximately XX Billion Yen by 2033.

Japan Condominiums and Apartments Market Segmentation

-

1. Type

- 1.1. Condominiums

- 1.2. Apartments

Japan Condominiums and Apartments Market Segmentation By Geography

- 1. Japan

Japan Condominiums and Apartments Market Regional Market Share

Geographic Coverage of Japan Condominiums and Apartments Market

Japan Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Governments' Investments and Plans in Residential Housing to Boost the Prefab Industry; Rise in the overall construction industry and increasing prices

- 3.3. Market Restrains

- 3.3.1. Uneven Topography; Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Japan’s Shrinking Population is Producing a Surplus of Housing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums

- 5.1.2. Apartments

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Misawa Homes Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tama Home Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nakano Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nihon House Holdings Co Ltd **List Not Exhaustive 6 3 Other Companie

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Asahi Kasei Homes Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kajima Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yamada Homes Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sumitomo Forestry's Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sekisui House Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Homes Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Misawa Homes Co Ltd

List of Figures

- Figure 1: Japan Condominiums and Apartments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Condominiums and Apartments Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Condominiums and Apartments Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Japan Condominiums and Apartments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Japan Condominiums and Apartments Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Japan Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Condominiums and Apartments Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Japan Condominiums and Apartments Market?

Key companies in the market include Misawa Homes Co Ltd, Tama Home Co Ltd, Nakano Corporation, Nihon House Holdings Co Ltd **List Not Exhaustive 6 3 Other Companie, Asahi Kasei Homes Corporation, Kajima Corporation, Yamada Homes Co Ltd, Sumitomo Forestry's Co Ltd, Sekisui House Limited, Panasonic Homes Co Ltd.

3. What are the main segments of the Japan Condominiums and Apartments Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.48 billion as of 2022.

5. What are some drivers contributing to market growth?

Governments' Investments and Plans in Residential Housing to Boost the Prefab Industry; Rise in the overall construction industry and increasing prices.

6. What are the notable trends driving market growth?

Japan’s Shrinking Population is Producing a Surplus of Housing.

7. Are there any restraints impacting market growth?

Uneven Topography; Lack of Awareness.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Japan Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence