Key Insights

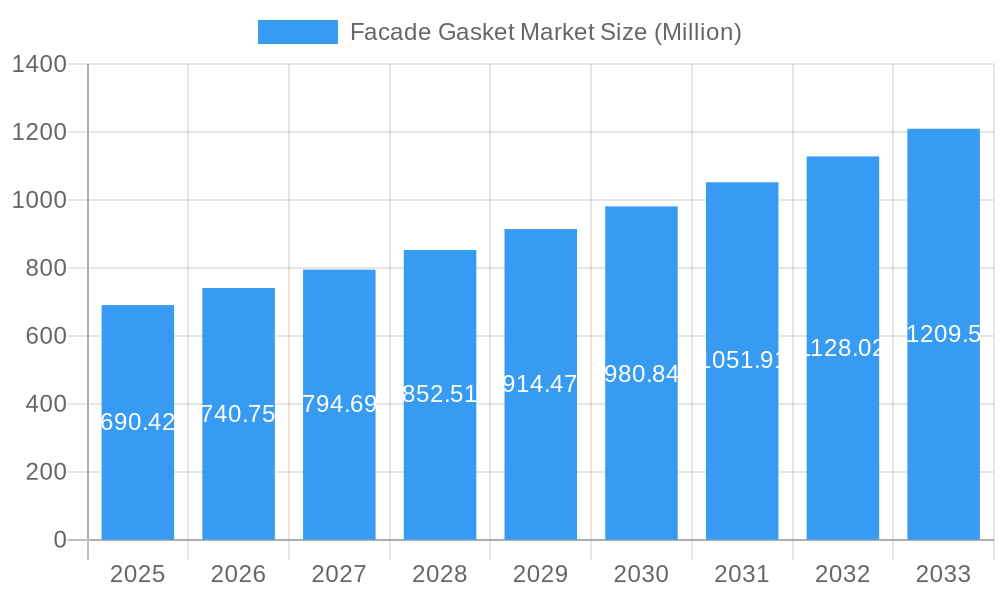

The global Facade Gasket Market is poised for significant expansion, projected to reach approximately USD 690.42 million in 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 7.17% expected between 2019 and 2033. A primary driver for this upward trajectory is the increasing demand for energy-efficient buildings and the growing adoption of advanced facade systems that prioritize weatherproofing and structural integrity. The rising construction of commercial spaces, coupled with a sustained interest in residential upgrades and new builds, creates a substantial and consistent market. Furthermore, the continuous evolution of building materials and design aesthetics necessitates specialized gasket solutions that offer durability, flexibility, and aesthetic appeal, further propelling market demand. Technological advancements in material science are also contributing, leading to the development of innovative gasket types and improved performance characteristics.

Facade Gasket Market Market Size (In Million)

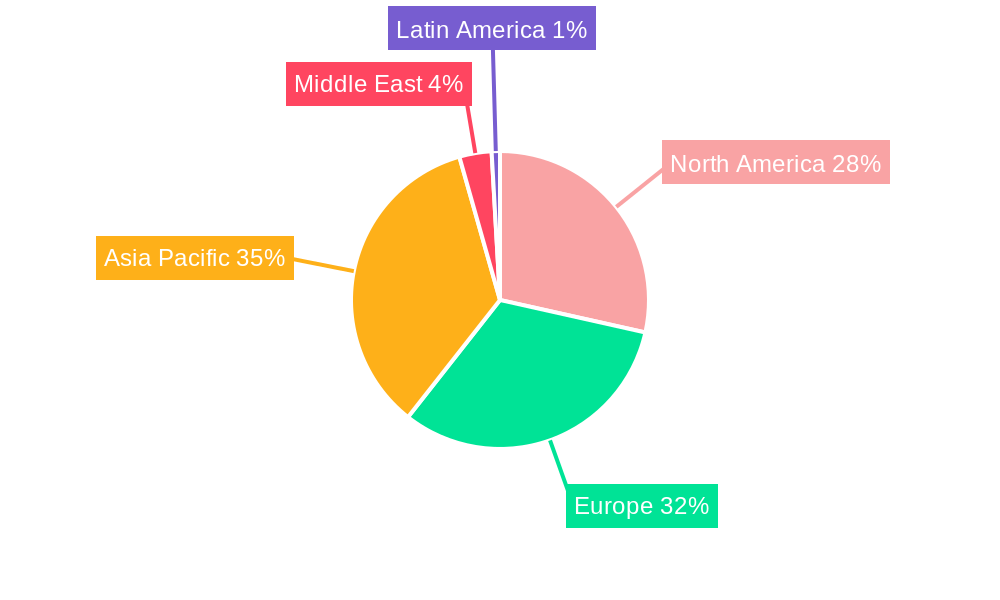

The market is segmented across various applications, types, and materials, reflecting the diverse needs of the construction industry. Residential and commercial applications represent the dominant segments, driven by new construction and renovation projects. Within types, E gaskets and Wedge gaskets are anticipated to hold significant market share due to their widespread use in sealing building envelopes. Silicone and Rubber are expected to be the leading material segments, favored for their inherent properties of resilience, weather resistance, and longevity. Geographically, the Asia Pacific region is emerging as a key growth engine, fueled by rapid urbanization and substantial infrastructure development in countries like China and India. North America and Europe, with their mature construction markets and stringent building regulations, continue to be significant contributors, focusing on high-performance and sustainable solutions. Emerging economies in the Middle East and Latin America are also showing promising growth potential, driven by increasing investment in construction projects.

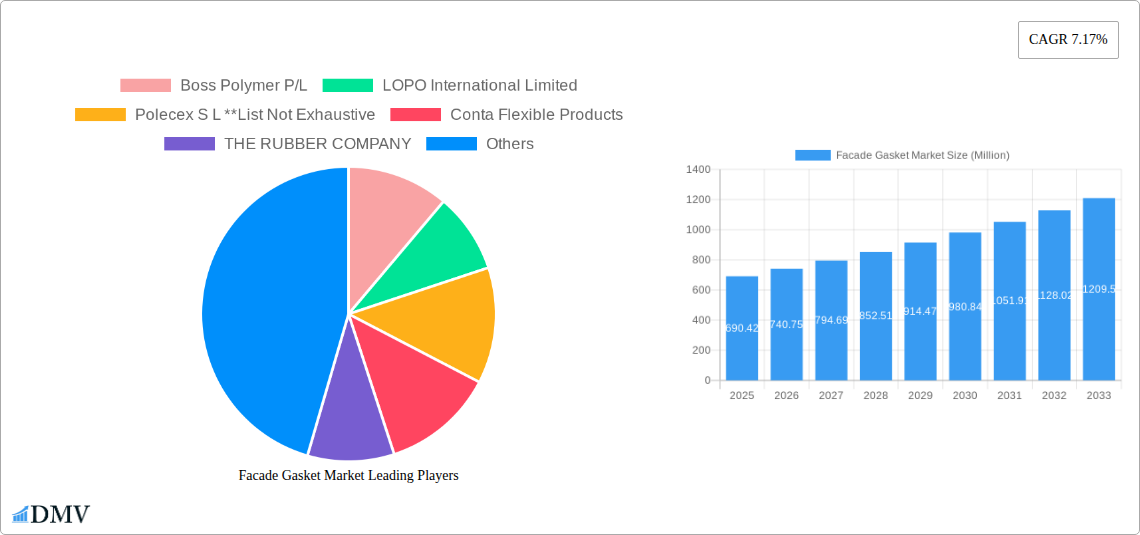

Facade Gasket Market Company Market Share

This in-depth report provides a strategic analysis of the global Facade Gasket Market, offering critical insights into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. With a comprehensive study period spanning from 2019 to 2033, based on 2025 data, this report is an indispensable resource for stakeholders seeking to understand current trends and forecast future trajectories in the facade sealing solutions sector. We meticulously examine key segments including Application (Residential, Commercial, Other Applications), Type (E Gaskets, Wedge Gaskets, Bubble Gaskets, Other Types), and Material (Silicone, Rubber, Other Materials).

Facade Gasket Market Market Composition & Trends

The Facade Gasket Market exhibits a moderately concentrated landscape, with key players investing heavily in R&D to drive innovation. Market concentration is influenced by the increasing demand for high-performance, durable, and energy-efficient building envelopes. Regulatory landscapes are evolving, with a growing emphasis on fire safety and sustainability, directly impacting product development and material choices. Substitute products, while present, often fall short of the specific performance and longevity offered by specialized facade gaskets, particularly in demanding architectural applications. End-user profiles range from large-scale commercial developers to individual residential builders, each with distinct requirements concerning cost-effectiveness, aesthetic integration, and performance specifications. Mergers and Acquisitions (M&A) activity is a significant trend, with strategic consolidations aimed at expanding market reach and product portfolios. For instance, a recent M&A deal in the sector was valued at approximately $50 Million, demonstrating the strategic importance of acquiring complementary technologies and market access. Market share distribution is dynamic, with leading companies continuously striving to capture a larger portion through product differentiation and strategic partnerships. The overall market is characterized by a steady upward trend, fueled by global construction activity and increasing awareness of the critical role facade gaskets play in building integrity and performance.

- Market Concentration: Moderately concentrated with a few key global players.

- Innovation Catalysts: Demand for energy efficiency, durability, and advanced weatherproofing.

- Regulatory Landscapes: Growing emphasis on fire safety, sustainability, and building codes.

- Substitute Products: Limited substitutes offer comparable performance and longevity.

- End-User Profiles: Diverse, including commercial developers, architects, builders, and residential owners.

- M&A Activities: Active, with companies acquiring competitors or complementary businesses for growth.

- M&A Deal Value: Estimated at approximately $50 Million for recent significant transactions.

Facade Gasket Market Industry Evolution

The Facade Gasket Market has undergone a significant evolution, driven by technological advancements, increasing construction activities globally, and a heightened awareness of building performance. Over the historical period (2019–2024), the market witnessed a compound annual growth rate (CAGR) of approximately 5.8%, a testament to the growing demand for robust and reliable building envelope solutions. The base year (2025) marks a pivotal point, with the market projected to reach an estimated value of $12 Billion. The forecast period (2025–2033) anticipates continued robust growth, with an expected CAGR of 6.5%, driven by several interconnected factors. Technological advancements have been central to this evolution. Early facade gaskets were primarily focused on basic weatherproofing. However, contemporary solutions incorporate advanced materials and manufacturing techniques to offer enhanced thermal insulation, acoustic dampening, and UV resistance. The adoption of silicone and advanced rubber compounds has become mainstream, offering superior flexibility, longevity, and resistance to extreme temperatures and environmental degradation compared to older materials. The increasing complexity of architectural designs, featuring curved facades, extensive glazing, and innovative structural elements, necessitates custom-engineered gasket solutions, further pushing technological boundaries. Consumer demands have also shifted dramatically. Building owners and specifiers are no longer solely focused on initial cost but are prioritizing long-term lifecycle costs, energy efficiency, and occupant comfort. This has led to a greater appreciation for the role of high-quality facade gaskets in reducing energy consumption for heating and cooling, minimizing air and water infiltration, and enhancing the overall durability and aesthetic appeal of a building. The global push towards sustainable construction and green building certifications has further amplified the importance of effective sealing solutions. Facade gaskets contribute significantly to achieving these goals by preventing energy loss and improving indoor air quality. Furthermore, the increasing frequency of extreme weather events globally is prompting a stronger focus on building resilience, making durable and high-performance facade gaskets a critical component in ensuring structural integrity and preventing costly damage. The industry's trajectory is clearly defined by a move towards higher performance, greater sustainability, and more specialized solutions tailored to the evolving needs of the construction sector.

Leading Regions, Countries, or Segments in Facade Gasket Market

The Facade Gasket Market demonstrates distinct leadership across various regions and segments, driven by a confluence of economic factors, construction trends, and regulatory support. Geographically, North America and Europe currently lead the market, accounting for a significant share of global demand. This dominance is attributed to their mature construction industries, stringent building codes mandating high-performance envelopes, and substantial investments in retrofitting existing structures for energy efficiency.

Within the Application segment, Commercial applications represent the largest share. This is propelled by the continuous construction of office buildings, retail spaces, and industrial facilities that require sophisticated facade systems for performance and aesthetics. The "Other Applications" segment, encompassing infrastructure projects and specialized industrial buildings, also contributes substantially to market growth due to the demand for highly durable and customized sealing solutions.

In terms of Type, E Gaskets emerge as the most dominant. Their versatility, ease of installation, and effectiveness in providing a reliable seal for various glazing and panel systems make them a preferred choice across a wide spectrum of commercial and residential projects. Wedge gaskets also hold a significant market share, particularly in applications requiring a robust mechanical seal.

The Material segment is heavily influenced by the prevalence of Silicone and Rubber gaskets. Silicone, with its superior UV resistance, temperature tolerance, and longevity, is increasingly favored for high-end architectural projects and applications exposed to harsh environmental conditions. Rubber gaskets, while often more cost-effective, continue to be widely adopted for their excellent sealing properties and durability in a broad range of applications.

- Dominant Regions: North America and Europe lead due to mature construction markets and stringent building regulations.

- Application Drivers:

- Commercial: High demand from new construction of office towers, retail centers, and industrial complexes.

- Residential: Steady growth driven by new home construction and renovations.

- Other Applications: Increasing use in infrastructure, specialized industrial buildings, and custom architectural projects.

- Type Drivers:

- E Gaskets: Preferred for their versatility, ease of installation, and broad applicability.

- Wedge Gaskets: Valued for robust mechanical sealing in demanding applications.

- Bubble Gaskets: Gaining traction for their compression and sealing capabilities in specific systems.

- Material Drivers:

- Silicone: Preferred for its superior UV resistance, temperature tolerance, and longevity in premium applications.

- Rubber: Widely adopted for its cost-effectiveness, good sealing properties, and durability.

- Other Materials: Growing interest in advanced polymers for specific performance requirements.

Facade Gasket Market Product Innovations

Product innovations in the Facade Gasket Market are increasingly focused on enhancing performance and addressing emerging construction challenges. Manufacturers are developing advanced silicone and EPDM rubber compounds that offer superior UV, ozone, and chemical resistance, extending product lifespan in harsh environments. Innovations also include the development of specialized gasket profiles designed for complex facade geometries and energy-efficient building designs, such as those incorporating thermal breaks to minimize heat transfer. Furthermore, there's a growing trend towards incorporating fire-retardant properties into gaskets, a significant advancement highlighted by recent product launches. These advancements are crucial for meeting evolving building codes and ensuring occupant safety. Performance metrics like air and water infiltration resistance are continuously being improved, alongside enhanced acoustic dampening capabilities for quieter interior spaces.

Propelling Factors for Facade Gasket Market Growth

The growth of the Facade Gasket Market is propelled by several key factors. Firstly, the sustained global growth in the construction industry, particularly in emerging economies, is a primary driver. Secondly, an increasing emphasis on energy efficiency in buildings, driven by government regulations and rising energy costs, necessitates advanced sealing solutions that minimize air leakage. Thirdly, evolving architectural trends favoring complex and large-scale glazing systems require specialized and high-performance gaskets for watertight and airtight installations. Finally, the growing awareness of the importance of building durability and resilience against extreme weather conditions further fuels demand for robust facade gasket solutions.

Obstacles in the Facade Gasket Market Market

Despite the robust growth, the Facade Gasket Market faces several obstacles. Price volatility of raw materials, particularly rubber and silicone, can impact manufacturing costs and profitability. Stringent regulatory compliance for new materials and performance standards requires significant R&D investment and can lead to longer product development cycles. Supply chain disruptions, as witnessed in recent years, can affect the availability and timely delivery of essential materials and finished products. Furthermore, intense competition from established players and emerging low-cost manufacturers can put pressure on profit margins, especially in less specialized market segments. The availability of skilled labor for installation and specialized applications also presents a challenge in some regions.

Future Opportunities in Facade Gasket Market

Future opportunities in the Facade Gasket Market lie in several key areas. The burgeoning demand for sustainable and green building solutions presents a significant avenue for growth, with opportunities in developing biodegradable or recyclable gasket materials. The increasing adoption of modular and prefabricated construction methods opens doors for standardized, easy-to-install gasket systems. Furthermore, the growing focus on retrofitting older buildings for energy efficiency and structural upgrades offers a substantial market for replacement gaskets. Technological advancements in smart building materials also present an opportunity for integrating sensors or responsive elements into facade gaskets. Expansion into developing markets with rapidly growing construction sectors, coupled with customization for unique climatic conditions, will also be crucial for future success.

Major Players in the Facade Gasket Market Ecosystem

- Boss Polymer P/L

- LOPO International Limited

- Polecex S L

- Conta Flexible Products

- THE RUBBER COMPANY

- Cooper Standard

- Vip Rubber and Plastic Company

- Semperit AG Holding

- Silicone Engineering Ltd

- SADEV

Key Developments in Facade Gasket Market Industry

- January 2023: SADEV, an engineering company specializing in stapled glass fixing and building envelopes, acquired its subsidiary SADEV USA. This strategic move aims to accelerate business development and expand its footprint across the North American market, enhancing its service offerings and market penetration.

- April 2022: Semperit AG, a prominent facade gasket manufacturer, launched its new line of fireproof gaskets. These innovative products are designed to prevent the spread of fire and smoke through facades, windows, and door elements, significantly enhancing building safety. The fireproof gaskets have undergone rigorous testing and have been classified as flame retardant by reputable external testing institutes like ift Rosenheim.

Strategic Facade Gasket Market Market Forecast

The Facade Gasket Market is poised for sustained growth, driven by global urbanization, increasing construction activities, and a rising emphasis on energy-efficient and sustainable buildings. The forecast period (2025–2033) is expected to witness continued innovation in material science and product design, leading to gaskets with enhanced thermal insulation, acoustic performance, and fire resistance. The commercial and residential construction sectors will remain key demand drivers, with a growing segment of the market focused on retrofitting existing structures. Emerging economies present significant untapped potential for market expansion. Strategic initiatives by key players, including product diversification, technological advancements, and expansion into new geographical regions, will shape the market's trajectory, ensuring a robust and dynamic future for facade sealing solutions.

Facade Gasket Market Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Other Applications

-

2. Type

- 2.1. E Gaskets

- 2.2. Wedge Gaskets

- 2.3. Bubble Gaskets

- 2.4. Other Types

-

3. Material

- 3.1. Silicone

- 3.2. Rubber

- 3.3. Other Materials

Facade Gasket Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. United Arab Emirates

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East

-

6. Latin America

- 6.1. Mexico

- 6.2. Brazil

- 6.3. Argentina

- 6.4. Rest of Latin America

Facade Gasket Market Regional Market Share

Geographic Coverage of Facade Gasket Market

Facade Gasket Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Residential Real Estate Demand by Young People4.; Increase in Average Housing Price in Mexico

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Affordable Housing Inhibiting the Growth of the Market4.; Economic Instability Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Asia Pacific is Witnessing Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Facade Gasket Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. E Gaskets

- 5.2.2. Wedge Gaskets

- 5.2.3. Bubble Gaskets

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Material

- 5.3.1. Silicone

- 5.3.2. Rubber

- 5.3.3. Other Materials

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East

- 5.4.5. United Arab Emirates

- 5.4.6. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Facade Gasket Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. E Gaskets

- 6.2.2. Wedge Gaskets

- 6.2.3. Bubble Gaskets

- 6.2.4. Other Types

- 6.3. Market Analysis, Insights and Forecast - by Material

- 6.3.1. Silicone

- 6.3.2. Rubber

- 6.3.3. Other Materials

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Facade Gasket Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. E Gaskets

- 7.2.2. Wedge Gaskets

- 7.2.3. Bubble Gaskets

- 7.2.4. Other Types

- 7.3. Market Analysis, Insights and Forecast - by Material

- 7.3.1. Silicone

- 7.3.2. Rubber

- 7.3.3. Other Materials

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Facade Gasket Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. E Gaskets

- 8.2.2. Wedge Gaskets

- 8.2.3. Bubble Gaskets

- 8.2.4. Other Types

- 8.3. Market Analysis, Insights and Forecast - by Material

- 8.3.1. Silicone

- 8.3.2. Rubber

- 8.3.3. Other Materials

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East Facade Gasket Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. E Gaskets

- 9.2.2. Wedge Gaskets

- 9.2.3. Bubble Gaskets

- 9.2.4. Other Types

- 9.3. Market Analysis, Insights and Forecast - by Material

- 9.3.1. Silicone

- 9.3.2. Rubber

- 9.3.3. Other Materials

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. United Arab Emirates Facade Gasket Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. E Gaskets

- 10.2.2. Wedge Gaskets

- 10.2.3. Bubble Gaskets

- 10.2.4. Other Types

- 10.3. Market Analysis, Insights and Forecast - by Material

- 10.3.1. Silicone

- 10.3.2. Rubber

- 10.3.3. Other Materials

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Latin America Facade Gasket Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Residential

- 11.1.2. Commercial

- 11.1.3. Other Applications

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. E Gaskets

- 11.2.2. Wedge Gaskets

- 11.2.3. Bubble Gaskets

- 11.2.4. Other Types

- 11.3. Market Analysis, Insights and Forecast - by Material

- 11.3.1. Silicone

- 11.3.2. Rubber

- 11.3.3. Other Materials

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Boss Polymer P/L

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 LOPO International Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Polecex S L **List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Conta Flexible Products

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 THE RUBBER COMPANY

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Cooper Standard

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Vip Rubber and Plastic Company

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Semperit AG Holding

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Silicone Engineering Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SADEV

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Boss Polymer P/L

List of Figures

- Figure 1: Global Facade Gasket Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Facade Gasket Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Facade Gasket Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Facade Gasket Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Facade Gasket Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Facade Gasket Market Revenue (Million), by Material 2025 & 2033

- Figure 7: North America Facade Gasket Market Revenue Share (%), by Material 2025 & 2033

- Figure 8: North America Facade Gasket Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Facade Gasket Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Facade Gasket Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Facade Gasket Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Facade Gasket Market Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Facade Gasket Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Facade Gasket Market Revenue (Million), by Material 2025 & 2033

- Figure 15: Europe Facade Gasket Market Revenue Share (%), by Material 2025 & 2033

- Figure 16: Europe Facade Gasket Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Facade Gasket Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Facade Gasket Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Asia Pacific Facade Gasket Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Asia Pacific Facade Gasket Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Facade Gasket Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Facade Gasket Market Revenue (Million), by Material 2025 & 2033

- Figure 23: Asia Pacific Facade Gasket Market Revenue Share (%), by Material 2025 & 2033

- Figure 24: Asia Pacific Facade Gasket Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Facade Gasket Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Facade Gasket Market Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East Facade Gasket Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East Facade Gasket Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Middle East Facade Gasket Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East Facade Gasket Market Revenue (Million), by Material 2025 & 2033

- Figure 31: Middle East Facade Gasket Market Revenue Share (%), by Material 2025 & 2033

- Figure 32: Middle East Facade Gasket Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East Facade Gasket Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: United Arab Emirates Facade Gasket Market Revenue (Million), by Application 2025 & 2033

- Figure 35: United Arab Emirates Facade Gasket Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: United Arab Emirates Facade Gasket Market Revenue (Million), by Type 2025 & 2033

- Figure 37: United Arab Emirates Facade Gasket Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: United Arab Emirates Facade Gasket Market Revenue (Million), by Material 2025 & 2033

- Figure 39: United Arab Emirates Facade Gasket Market Revenue Share (%), by Material 2025 & 2033

- Figure 40: United Arab Emirates Facade Gasket Market Revenue (Million), by Country 2025 & 2033

- Figure 41: United Arab Emirates Facade Gasket Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Latin America Facade Gasket Market Revenue (Million), by Application 2025 & 2033

- Figure 43: Latin America Facade Gasket Market Revenue Share (%), by Application 2025 & 2033

- Figure 44: Latin America Facade Gasket Market Revenue (Million), by Type 2025 & 2033

- Figure 45: Latin America Facade Gasket Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Latin America Facade Gasket Market Revenue (Million), by Material 2025 & 2033

- Figure 47: Latin America Facade Gasket Market Revenue Share (%), by Material 2025 & 2033

- Figure 48: Latin America Facade Gasket Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Latin America Facade Gasket Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Facade Gasket Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Facade Gasket Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Facade Gasket Market Revenue Million Forecast, by Material 2020 & 2033

- Table 4: Global Facade Gasket Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Facade Gasket Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Facade Gasket Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Facade Gasket Market Revenue Million Forecast, by Material 2020 & 2033

- Table 8: Global Facade Gasket Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Facade Gasket Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Facade Gasket Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Facade Gasket Market Revenue Million Forecast, by Material 2020 & 2033

- Table 14: Global Facade Gasket Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Germany Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Facade Gasket Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Facade Gasket Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Facade Gasket Market Revenue Million Forecast, by Material 2020 & 2033

- Table 22: Global Facade Gasket Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Facade Gasket Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Facade Gasket Market Revenue Million Forecast, by Type 2020 & 2033

- Table 31: Global Facade Gasket Market Revenue Million Forecast, by Material 2020 & 2033

- Table 32: Global Facade Gasket Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Global Facade Gasket Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Facade Gasket Market Revenue Million Forecast, by Type 2020 & 2033

- Table 35: Global Facade Gasket Market Revenue Million Forecast, by Material 2020 & 2033

- Table 36: Global Facade Gasket Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Saudi Arabia Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: South Africa Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Facade Gasket Market Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Facade Gasket Market Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Global Facade Gasket Market Revenue Million Forecast, by Material 2020 & 2033

- Table 43: Global Facade Gasket Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Mexico Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Brazil Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Argentina Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Rest of Latin America Facade Gasket Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Facade Gasket Market?

The projected CAGR is approximately 7.17%.

2. Which companies are prominent players in the Facade Gasket Market?

Key companies in the market include Boss Polymer P/L, LOPO International Limited, Polecex S L **List Not Exhaustive, Conta Flexible Products, THE RUBBER COMPANY, Cooper Standard, Vip Rubber and Plastic Company, Semperit AG Holding, Silicone Engineering Ltd, SADEV.

3. What are the main segments of the Facade Gasket Market?

The market segments include Application, Type, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 690.42 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Residential Real Estate Demand by Young People4.; Increase in Average Housing Price in Mexico.

6. What are the notable trends driving market growth?

Asia Pacific is Witnessing Significant Growth.

7. Are there any restraints impacting market growth?

4.; Lack of Affordable Housing Inhibiting the Growth of the Market4.; Economic Instability Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

January 2023: SADEV (an engineering company in the field of stapled glass fixing and building envelopes) acquired its subsidiary SADEV USA. The acquisition was aimed at effectively developing the company's business across North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Facade Gasket Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Facade Gasket Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Facade Gasket Market?

To stay informed about further developments, trends, and reports in the Facade Gasket Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence