Key Insights

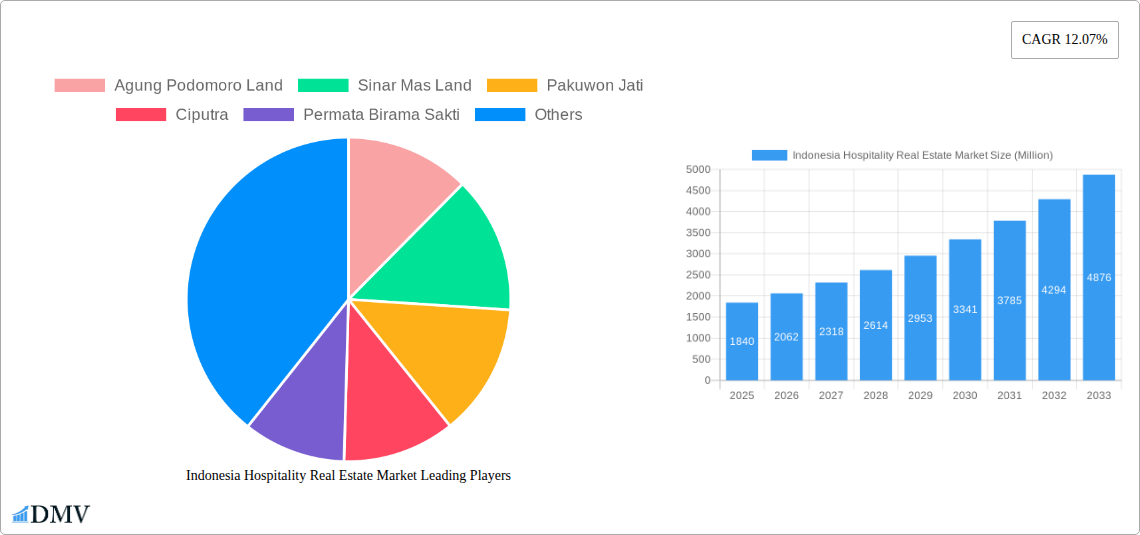

The Indonesia hospitality real estate market is experiencing robust growth, projected to reach a market size of $1.84 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.07% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, a burgeoning tourism sector in Indonesia, driven by increasing domestic and international tourist arrivals, creates significant demand for hotels, resorts, and other hospitality properties. Secondly, rising disposable incomes and a growing middle class are stimulating increased spending on leisure and travel, further bolstering the market. Government initiatives aimed at infrastructure development and tourism promotion also contribute positively. The market is segmented by property type, with hotels and accommodations dominating, followed by spas and resorts, and other property types contributing a smaller share. Key players in the market include Agung Podomoro Land, Sinar Mas Land, Pakuwon Jati, Ciputra, and several others, showcasing a mix of established developers and emerging players. Competitive dynamics involve strategic acquisitions, expansions, and innovative property developments to cater to diverse market segments. While challenges like economic fluctuations and potential regulatory changes exist, the long-term outlook remains optimistic due to Indonesia's strong economic fundamentals and its appeal as a tourism destination.

Indonesia Hospitality Real Estate Market Market Size (In Billion)

The market's growth trajectory suggests a substantial increase in market value over the forecast period. Extrapolating from the 2025 market size and CAGR, we can expect significant expansion throughout the forecast period (2025-2033). This growth will likely be concentrated in key tourism hubs and emerging destinations within Indonesia. The competitive landscape is expected to remain dynamic, with ongoing consolidation and innovation driving market evolution. Continued investment in infrastructure, targeted marketing campaigns, and effective regulatory frameworks will be crucial to sustaining this growth trajectory and realizing the full potential of the Indonesian hospitality real estate sector. The segmentation by property type indicates opportunities for specialized development and investment strategies, catering to specific market segments and traveler preferences.

Indonesia Hospitality Real Estate Market Company Market Share

Indonesia Hospitality Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Indonesian hospitality real estate market, offering invaluable insights for investors, developers, and industry stakeholders. Covering the period 2019-2033, with a base year of 2025, this report meticulously examines market trends, growth drivers, challenges, and future opportunities within this dynamic sector. The report utilizes data and projections to provide a robust understanding of this significant market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

Indonesia Hospitality Real Estate Market Composition & Trends

This section delves into the intricacies of the Indonesian hospitality real estate market, assessing its competitive landscape, innovative forces, regulatory environment, and market dynamics. We analyze market concentration, identifying key players and their respective market share. For example, Agung Podomoro Land, Sinar Mas Land, and Pakuwon Jati are anticipated to hold significant shares, though precise figures require confidential data analysis. The report also examines the impact of mergers and acquisitions (M&A) activity, with estimated deal values totaling xx Million in the historical period (2019-2024) and projected at xx Million during the forecast period (2025-2033). Innovation catalysts are explored, focusing on sustainable practices and technological advancements. Finally, the regulatory landscape is evaluated, considering its influence on market access, investment, and overall growth.

- Market Concentration: High concentration among top players, with significant regional variations.

- M&A Activity: xx Million in deal value (2019-2024), projected xx Million (2025-2033).

- Innovation Catalysts: Sustainable development initiatives, technological integrations in hotel management systems.

- Regulatory Landscape: Government policies influencing investment, construction, and operational standards.

- Substitute Products: Growth of alternative accommodations (e.g., Airbnb) impacting traditional hotels.

- End-User Profiles: A mix of domestic and international tourists, business travelers, and local residents.

Indonesia Hospitality Real Estate Market Industry Evolution

This section analyzes the evolutionary trajectory of Indonesia's hospitality real estate market, considering growth patterns, technological disruptions, and evolving consumer preferences. The market experienced a xx% Compound Annual Growth Rate (CAGR) during the historical period (2019-2024), fueled by increasing tourism and economic growth. We project a CAGR of xx% for the forecast period (2025-2033), driven by factors such as rising disposable incomes, infrastructure development, and government initiatives to boost tourism. The integration of technology, such as smart hotel systems and online booking platforms, is transforming the industry, improving operational efficiency and enhancing guest experience. Changing consumer demands, reflecting a preference for sustainable and personalized travel experiences, are also shaping market developments.

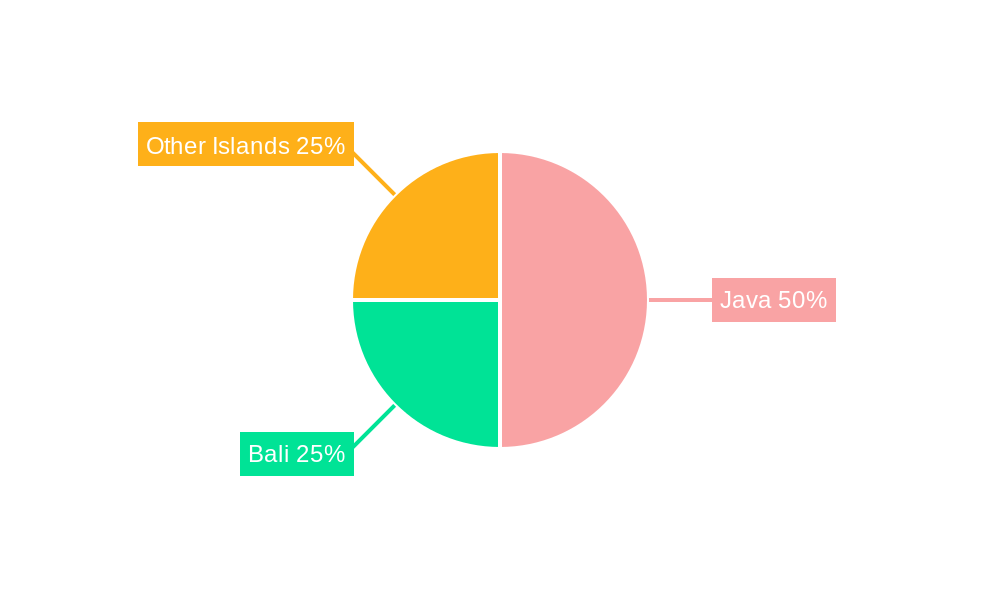

Leading Regions, Countries, or Segments in Indonesia Hospitality Real Estate Market

This section identifies the leading segments within the Indonesian hospitality real estate market, focusing on Hotels and Accommodation, Spas and Resorts, and Other Property Types. The Hotels and Accommodation segment is currently dominant, driven by robust tourism and business travel.

- Hotels and Accommodation: Key drivers include strong tourism growth, increasing business travel, and government infrastructure investments. Bali and Jakarta are key contributors to the sector.

- Spas and Resorts: This segment is experiencing growth, fueled by the rising demand for wellness tourism and luxury travel experiences. Investment in luxury resorts is contributing to the segment's expansion.

- Other Property Types: This includes serviced apartments, villas, and other hospitality-related real estate, showing steady growth due to diversification of traveller preferences.

Indonesia Hospitality Real Estate Market Product Innovations

Recent innovations focus on sustainable practices (e.g., energy-efficient designs, water conservation measures), technological integrations (smart room controls, mobile check-in/out), and personalized guest experiences (customized services, tailored amenities). These innovations are enhancing operational efficiency, improving guest satisfaction, and creating unique selling propositions for hotels and resorts.

Propelling Factors for Indonesia Hospitality Real Estate Market Growth

The Indonesian hospitality real estate market is propelled by several key factors: robust economic growth increasing disposable incomes and tourism, government initiatives promoting tourism and infrastructure development, and increasing foreign direct investment in the hospitality sector. Technological advancements, such as online booking platforms and smart hotel technologies, are also contributing to growth.

Obstacles in the Indonesia Hospitality Real Estate Market

Challenges include land acquisition complexities, infrastructure limitations in certain regions, fluctuating exchange rates impacting investment decisions, and intense competition within the market. Supply chain disruptions, especially during periods of global instability, can also hinder growth. These factors necessitate strategic planning and risk mitigation for successful ventures.

Future Opportunities in Indonesia Hospitality Real Estate Market

Future opportunities lie in expanding into emerging markets beyond major cities, focusing on sustainable and eco-friendly tourism initiatives, developing niche hospitality offerings catering to specific consumer segments, and integrating advanced technologies to enhance operational efficiency and guest experiences.

Major Players in the Indonesia Hospitality Real Estate Market Ecosystem

- Agung Podomoro Land

- Sinar Mas Land

- Pakuwon Jati

- Ciputra

- Permata Birama Sakti

- Plaza Indonesia Realty

- PP Properti

- Tokyu Land Corporation

- PT Surya Semesta Internusa (Persero) Tbk

- Duta Anggada Realty

Key Developments in Indonesia Hospitality Real Estate Market Industry

- March 2024: Sinar Mas Land and IABHI's sustainable development initiative, focusing on renewable energy and eco-friendly materials, sets a benchmark for environmentally conscious hospitality development in Indonesia. This significantly impacts the market by promoting sustainable practices and attracting environmentally conscious investors.

- November 2023: The inauguration of Mercure Pangkalan Bun marks Accor's expansion into Central Kalimantan, indicating growing interest in developing hospitality infrastructure in previously underserved regions. This development opens new markets and strengthens tourism potential in the region.

Strategic Indonesia Hospitality Real Estate Market Forecast

The Indonesian hospitality real estate market is poised for continued growth, driven by strong tourism prospects, rising domestic consumption, and strategic government investments. Opportunities abound in expanding into new regions, integrating sustainable practices, and leveraging technological innovations to enhance guest experiences. The market is expected to demonstrate significant expansion during the forecast period (2025-2033), creating considerable opportunities for investors and developers.

Indonesia Hospitality Real Estate Market Segmentation

-

1. Property Type

- 1.1. Hotels and Accommodation

- 1.2. Spas and Resorts

- 1.3. Other Property Types

Indonesia Hospitality Real Estate Market Segmentation By Geography

- 1. Indonesia

Indonesia Hospitality Real Estate Market Regional Market Share

Geographic Coverage of Indonesia Hospitality Real Estate Market

Indonesia Hospitality Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Indonesia's Hospitality Market Shifting Preference for Local and Authentic Experiences

- 3.3. Market Restrains

- 3.3.1. Difficulties in Implementing Tourism Policies

- 3.4. Market Trends

- 3.4.1. Increase in Tourism in Indonesia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Hospitality Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Hotels and Accommodation

- 5.1.2. Spas and Resorts

- 5.1.3. Other Property Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Agung Podomoro Land

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sinar Mas Land

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pakuwon Jati

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ciputra

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Permata Birama Sakti

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Plaza Indonesia Realty

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PP Properti

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tokyu Land Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Surya Semesta Internusa (Persero) Tbk**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Duta Anggada Realty

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Agung Podomoro Land

List of Figures

- Figure 1: Indonesia Hospitality Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Hospitality Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Hospitality Real Estate Market Revenue Million Forecast, by Property Type 2020 & 2033

- Table 2: Indonesia Hospitality Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Indonesia Hospitality Real Estate Market Revenue Million Forecast, by Property Type 2020 & 2033

- Table 4: Indonesia Hospitality Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Hospitality Real Estate Market?

The projected CAGR is approximately 12.07%.

2. Which companies are prominent players in the Indonesia Hospitality Real Estate Market?

Key companies in the market include Agung Podomoro Land, Sinar Mas Land, Pakuwon Jati, Ciputra, Permata Birama Sakti, Plaza Indonesia Realty, PP Properti, Tokyu Land Corporation, PT Surya Semesta Internusa (Persero) Tbk**List Not Exhaustive, Duta Anggada Realty.

3. What are the main segments of the Indonesia Hospitality Real Estate Market?

The market segments include Property Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Indonesia's Hospitality Market Shifting Preference for Local and Authentic Experiences.

6. What are the notable trends driving market growth?

Increase in Tourism in Indonesia.

7. Are there any restraints impacting market growth?

Difficulties in Implementing Tourism Policies.

8. Can you provide examples of recent developments in the market?

March 2024: Sinar Mas Land and IABHI led the charge in sustainable development by prioritizing eco-friendly materials and harnessing New Renewable Energy (EBT). Their efforts include installing solar panels in commercial buildings (hotels, resorts. and spas), implementing renewable energy certificates (RECs) from PT PLN (Persero), and even revamping energy management across their operational buildings. By championing these initiatives, Sinar Mas Land is not only aligning with government goals but also actively curbing CO2 emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Hospitality Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Hospitality Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Hospitality Real Estate Market?

To stay informed about further developments, trends, and reports in the Indonesia Hospitality Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence