Key Insights

The Asia Pacific manufactured homes market is projected for substantial growth, anticipated to reach a market size of USD 40.56 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.32% during the forecast period of 2025-2033. Key growth drivers include increasing urbanization, a rising demand for affordable housing, and government initiatives promoting modular construction to address housing shortages. Technological advancements in manufacturing and design are enhancing the quality, aesthetics, and energy efficiency of manufactured homes, expanding their appeal. The market is segmented into single-family and multi-family homes, with the multi-family segment expected to see accelerated adoption due to its suitability for urban areas and cost-effectiveness in large-scale developments.

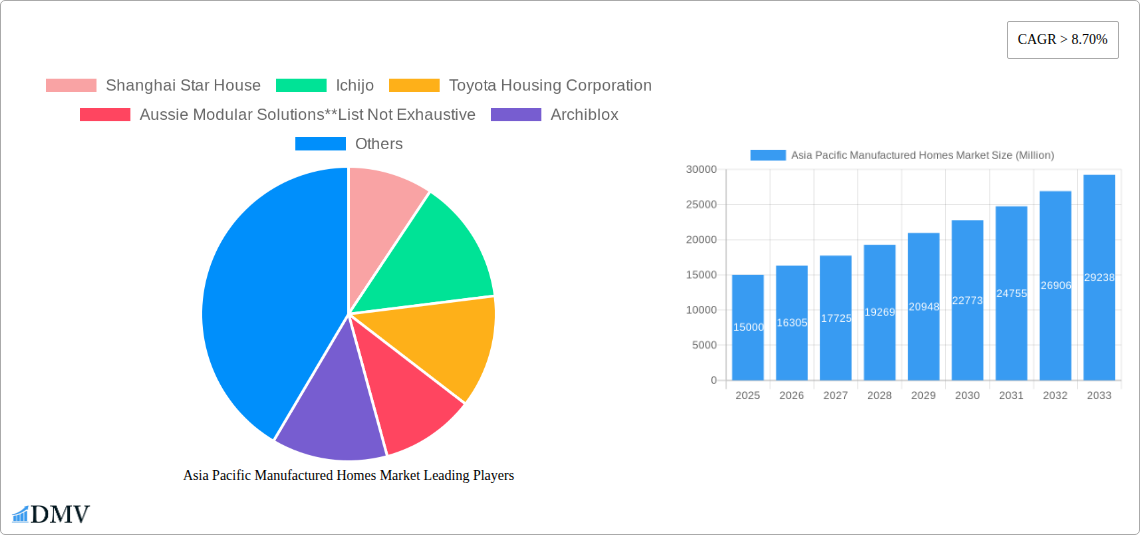

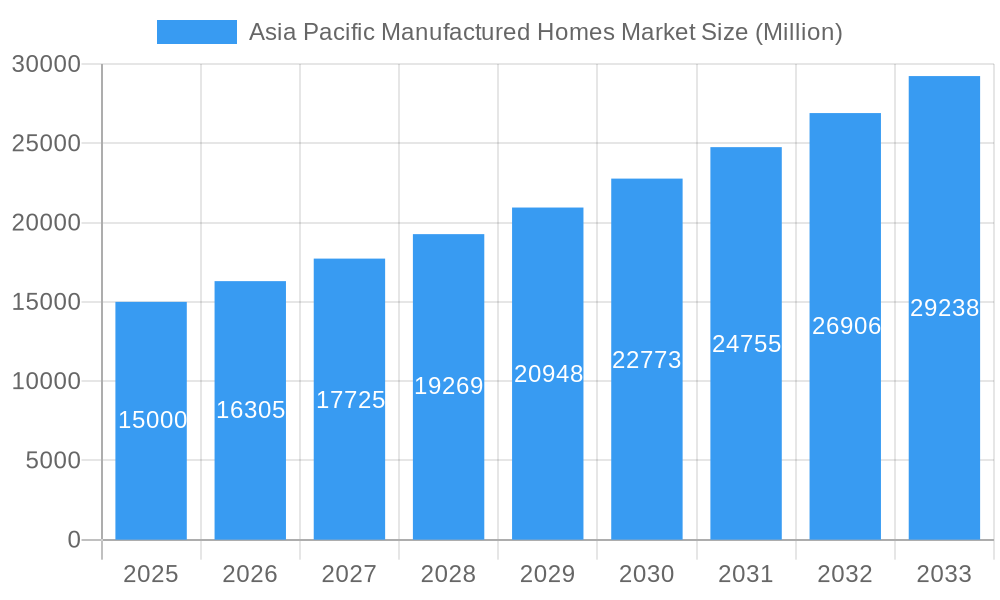

Asia Pacific Manufactured Homes Market Market Size (In Billion)

Significant trends shaping the market include a focus on green building practices and smart home technology integration, aligning with sustainability and convenience demands. Companies are investing in R&D for customizable and rapidly deployable modular designs to meet urgent housing needs. Leading players include Sekisui House, Daiwa House Industry, and Panasonic Homes, alongside emerging innovators. Challenges may include stringent building codes and perceptions of manufactured homes, but economic development and increasing acceptance of modular construction indicate a period of dynamic growth and innovation.

Asia Pacific Manufactured Homes Market Company Market Share

This comprehensive report provides a holistic overview of the Asia Pacific manufactured homes market. Covering the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033), this analysis offers critical insights. Our research delves into market dynamics, industry evolution, regional trends, product innovations, growth drivers, obstacles, future opportunities, key players, and major developments. Sophisticated analytical methodologies are employed to provide a clear roadmap for capitalizing on the demand for high-quality, sustainable, and cost-effective housing solutions across Asia Pacific. Understand the market share distribution, M&A deal values, and growth rates defining this transformative market.

Asia Pacific Manufactured Homes Market Market Composition & Trends

The Asia Pacific manufactured homes market is characterized by a growing emphasis on scalability, affordability, and sustainability. Market concentration varies across sub-regions, with some exhibiting a more fragmented landscape and others dominated by a few key players. Innovation catalysts are primarily driven by technological advancements in construction methods, material science, and smart home integration, aiming to enhance durability, energy efficiency, and aesthetic appeal. The regulatory landscape, while presenting some challenges, is gradually evolving to support offsite construction through streamlined permitting processes and the adoption of international building standards. Substitute products, such as traditional site-built homes and other prefabricated solutions, continue to compete, but the unique value proposition of manufactured homes—speed of construction, cost-effectiveness, and reduced environmental impact—is gaining traction. End-user profiles are diversifying, encompassing first-time homebuyers, individuals seeking vacation homes, and even institutions requiring rapid deployment of housing for specific needs. Mergers & acquisitions (M&A) activities are on the rise as established players seek to expand their market reach, acquire innovative technologies, and consolidate market share. For instance, recent M&A deal values are estimated to be in the hundreds of millions of USD, reflecting strategic investments in market expansion and capability enhancement.

- Market Concentration: Fragmented in some emerging economies, consolidating in mature markets.

- Innovation Catalysts: Advanced manufacturing techniques, sustainable materials, smart home integration, modular design.

- Regulatory Landscapes: Evolving; increasing adoption of standardized building codes and streamlined permitting for offsite construction.

- Substitute Products: Traditional site-built homes, container homes, other modular construction systems.

- End-User Profiles: Young families, retirees, vacation property buyers, disaster relief housing providers, developers.

- M&A Activities: Increasing, driven by market consolidation, technology acquisition, and geographic expansion.

Asia Pacific Manufactured Homes Market Industry Evolution

The Asia Pacific manufactured homes market has witnessed a profound evolution, transitioning from a niche segment to a mainstream housing solution. Historically, manufactured homes were often perceived as low-cost alternatives, but advancements in design, technology, and construction methodologies have dramatically reshaped this perception. Over the study period (2019-2033), the industry has experienced a consistent upward trajectory, driven by a confluence of factors including rapid urbanization, increasing housing demand, and a growing awareness of sustainable building practices. The historical period (2019-2024) saw initial growth fueled by economic development and a need for faster housing delivery. The base year (2025) marks a significant point where the market has matured, with established players and a growing consumer acceptance.

Technological advancements have been pivotal in this evolution. The adoption of Building Information Modeling (BIM) and advanced manufacturing processes has led to increased precision, reduced waste, and faster assembly times. Smart home integration is becoming a standard feature, enhancing the appeal and functionality of manufactured homes. Furthermore, the development of innovative materials, such as high-performance insulation and eco-friendly composites, has improved the energy efficiency and durability of these homes, addressing environmental concerns and lowering long-term operational costs.

Shifting consumer demands are also playing a crucial role. Buyers are increasingly seeking customizable options, modern aesthetics, and homes that align with their environmental values. The affordability factor remains a key driver, especially in densely populated urban areas where land costs are prohibitive. Manufactured homes offer a compelling solution for first-time homebuyers and those looking for cost-effective second homes. The forecast period (2025-2033) is expected to see accelerated growth, with projected annual growth rates in the range of 5-8%. This growth will be further propelled by government initiatives aimed at addressing housing shortages and promoting green building. For instance, adoption metrics for energy-efficient components in manufactured homes are projected to exceed 70% by 2030. The industry's ability to adapt to diverse climatic conditions and cultural preferences across the vast Asia Pacific region will be critical for sustained success. The transition towards higher quality, customizable, and sustainable manufactured housing solutions will continue to redefine the market landscape.

Leading Regions, Countries, or Segments in Asia Pacific Manufactured Homes Market

The Asia Pacific manufactured homes market exhibits distinct regional dynamics, with certain countries and segments demonstrating exceptional leadership. Among the Type segments, Single Family manufactured homes currently hold a dominant position across most of the Asia Pacific region. This dominance is attributed to a combination of factors, including a persistent demand for private dwelling spaces, evolving family structures, and greater individual purchasing power. The allure of owning a detached home, even a prefabricated one, remains strong across various income brackets.

- Dominant Segment: Single Family Manufactured Homes

- Key Drivers:

- Strong Demand for Private Dwellings: Cultural preferences and the desire for personal space contribute significantly.

- Increasing Urbanization & Suburbanization: As cities expand, there's a growing need for housing solutions on the outskirts, where land is more accessible for manufactured homes.

- Affordability Advantage: Single-family manufactured homes offer a more attainable entry point into homeownership compared to traditional site-built single-family homes.

- Customization Potential: Manufacturers are increasingly offering a wide range of customization options, allowing buyers to personalize their single-family homes to a greater extent.

- Government Housing Initiatives: Many governments in the region are promoting affordable housing solutions, which often include single-family manufactured homes.

- Key Drivers:

In terms of leading regions, Japan stands out as a pioneering market for manufactured and modular housing in Asia Pacific. The country’s advanced technological infrastructure, stringent earthquake-resistant building codes, and a long-standing appreciation for prefabrication have fostered a highly sophisticated manufactured homes industry. Companies like Sekisui House and Daiwa House Industry are global leaders, continuously innovating in design, sustainability, and construction efficiency. The Japanese market consistently sees significant investment in research and development, leading to the adoption of cutting-edge technologies that enhance the quality, durability, and aesthetic appeal of manufactured homes.

Australia also presents a robust and growing market, particularly for modular and prefabricated solutions catering to both urban and remote areas. The high cost of land and labor in Australia makes manufactured homes an attractive alternative for single-family dwellings. Companies such as Aussie Modular Solutions, Anchor Homes, and Archiblox are prominent, offering a diverse range of designs and solutions. The increasing focus on sustainable building practices and the demand for faster construction timelines further bolster the Australian market.

The Multi Family segment, while currently smaller in overall market share compared to single-family homes, is experiencing significant growth potential, especially in densely populated urban centers across countries like China and South Korea. The escalating housing crises in these metropolises are driving demand for multi-unit residential buildings that can be constructed rapidly and affordably. Innovative modular multi-family projects are emerging, showcasing the efficiency and scalability of offsite construction for apartment complexes and co-living spaces. The future growth of the multi-family segment is intricately linked to urbanization trends and the development of innovative construction techniques to address the unique challenges of multi-story modular construction.

Asia Pacific Manufactured Homes Market Product Innovations

Product innovations in the Asia Pacific manufactured homes market are centered on enhancing sustainability, improving energy efficiency, and integrating advanced technologies. Manufacturers are increasingly utilizing eco-friendly materials such as recycled steel, bamboo composites, and low-VOC (Volatile Organic Compound) finishes. Smart home features, including integrated climate control, energy monitoring systems, and automated lighting, are becoming standard offerings, appealing to a tech-savvy consumer base. Furthermore, advancements in modular design and construction techniques allow for greater customization, faster assembly times, and superior structural integrity, particularly in regions prone to seismic activity. Performance metrics are consistently improving, with new designs demonstrating enhanced thermal insulation, reduced water consumption, and increased resistance to extreme weather conditions.

Propelling Factors for Asia Pacific Manufactured Homes Market Growth

Several key factors are propelling the growth of the Asia Pacific manufactured homes market. Technological advancements in offsite construction, including 3D printing and robotics, are enhancing precision, speed, and cost-effectiveness. Economic factors such as rising disposable incomes and increasing urbanization are fueling demand for affordable and quickly deployable housing solutions. Government initiatives promoting affordable housing, sustainable building, and land development are creating a supportive regulatory environment. For example, the push for green building certifications and incentives for energy-efficient construction directly benefits the manufactured homes sector.

Obstacles in the Asia Pacific Manufactured Homes Market Market

Despite its promising growth, the Asia Pacific manufactured homes market faces several obstacles. Regulatory challenges related to zoning laws, building permits, and industry standards can vary significantly across different countries and municipalities, leading to delays and increased costs. Supply chain disruptions, particularly for specialized materials and components, can impact production timelines and costs. Perception challenges persist, with some consumers still associating manufactured homes with lower quality or temporary structures, although this is rapidly changing. High initial investment required for setting up large-scale manufacturing facilities can also be a barrier for new entrants.

Future Opportunities in Asia Pacific Manufactured Homes Market

Emerging opportunities in the Asia Pacific manufactured homes market are abundant. The growing demand for sustainable and eco-friendly housing presents a significant avenue for growth, with opportunities in developing homes with advanced energy-saving features and utilizing recycled materials. The expansion into emerging economies with developing infrastructure and a pressing need for affordable housing offers substantial untapped potential. Furthermore, the integration of smart home technologies and the development of disaster-resilient housing solutions are opening up new market niches. The increasing acceptance of multi-family modular construction for urban development also signifies a major future opportunity.

Major Players in the Asia Pacific Manufactured Homes Market Ecosystem

- Shanghai Star House

- Ichijo

- Toyota Housing Corporation

- Aussie Modular Solutions

- Archiblox

- Anchor Homes

- Panasonic Homes

- Sekisui House

- Ausco Modular Construction

- Daiwa House Industry

Key Developments in Asia Pacific Manufactured Homes Market Industry

- June 2022: Daiwa Lifenext Co. Ltd. (Headquarters: Minato-ku, Tokyo, President: Junko Ishizaki) of the Daiwa House Group is working to realize evacuation at home in an apartment that is effective in avoiding damages in case of a natural disaster caused by the corona disaster.

- January 2022: Japanese-backed modular firm gets £12m (USD 14.6 million) investment. Sekisui House UK, a subsidiary of the Japan-based Sekisui, received the capital injection from its owner. Sekisui formally entered the UK market in 2019 when it invested £22m (USD 26.9 million) for a 35 percent stake in a joint venture with Homes England and developer Urban Splash.

Strategic Asia Pacific Manufactured Homes Market Market Forecast

The strategic forecast for the Asia Pacific manufactured homes market is exceptionally strong, driven by a synergistic interplay of technological innovation, evolving consumer preferences, and supportive governmental policies. The increasing adoption of modular construction techniques promises to revolutionize the housing sector by offering faster build times, reduced costs, and enhanced sustainability. The continuous push for energy-efficient and smart homes aligns perfectly with the capabilities of manufactured housing. As urban populations continue to swell and the demand for affordable yet high-quality housing intensifies, manufactured homes are strategically positioned to meet these needs. The market is anticipated to witness sustained double-digit growth over the forecast period, making it an attractive investment and development opportunity.

Asia Pacific Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

Asia Pacific Manufactured Homes Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Manufactured Homes Market Regional Market Share

Geographic Coverage of Asia Pacific Manufactured Homes Market

Asia Pacific Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Investment to Support the Growth and Innovation in the Housing Sector in Australia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Manufactured Homes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shanghai Star House

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ichijo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Toyota Housing Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aussie Modular Solutions**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Archiblox

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Anchor Homes

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Panasonic Homes

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sekisui House

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ausco Modular Construction

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Daiwa House Industry

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shanghai Star House

List of Figures

- Figure 1: Asia Pacific Manufactured Homes Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Manufactured Homes Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Manufactured Homes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Manufactured Homes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Asia Pacific Manufactured Homes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Asia Pacific Manufactured Homes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: China Asia Pacific Manufactured Homes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Japan Asia Pacific Manufactured Homes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asia Pacific Manufactured Homes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Asia Pacific Manufactured Homes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Australia Asia Pacific Manufactured Homes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: New Zealand Asia Pacific Manufactured Homes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Asia Pacific Manufactured Homes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Asia Pacific Manufactured Homes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Singapore Asia Pacific Manufactured Homes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia Pacific Manufactured Homes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Vietnam Asia Pacific Manufactured Homes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Philippines Asia Pacific Manufactured Homes Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Manufactured Homes Market?

The projected CAGR is approximately 7.32%.

2. Which companies are prominent players in the Asia Pacific Manufactured Homes Market?

Key companies in the market include Shanghai Star House, Ichijo, Toyota Housing Corporation, Aussie Modular Solutions**List Not Exhaustive, Archiblox, Anchor Homes, Panasonic Homes, Sekisui House, Ausco Modular Construction, Daiwa House Industry.

3. What are the main segments of the Asia Pacific Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Investment to Support the Growth and Innovation in the Housing Sector in Australia.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

June 2022: Daiwa Lifenext Co. Ltd. (Headquarters: Minato-ku, Tokyo, President: Junko Ishizaki) of the Daiwa House Group is working to realize evacuation at home in an apartment that is effective in avoiding damages in case of a natural disaster caused by the corona disaster.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence