Key Insights

The Europe Condominiums and Apartments Market is projected for significant growth, fueled by demographic shifts and evolving housing preferences. With a current market size of €1,279.93 billion and a projected Compound Annual Growth Rate (CAGR) of 4.9%, the sector anticipates sustained value appreciation from 2025 to 2033. Key drivers include increasing urbanization, demand for modern living spaces, and supportive government housing initiatives. Investment in new construction and property redevelopment further supports market expansion, attracting both first-time buyers and investors. The rental segment is particularly dynamic, driven by rising living costs and a preference for mobility.

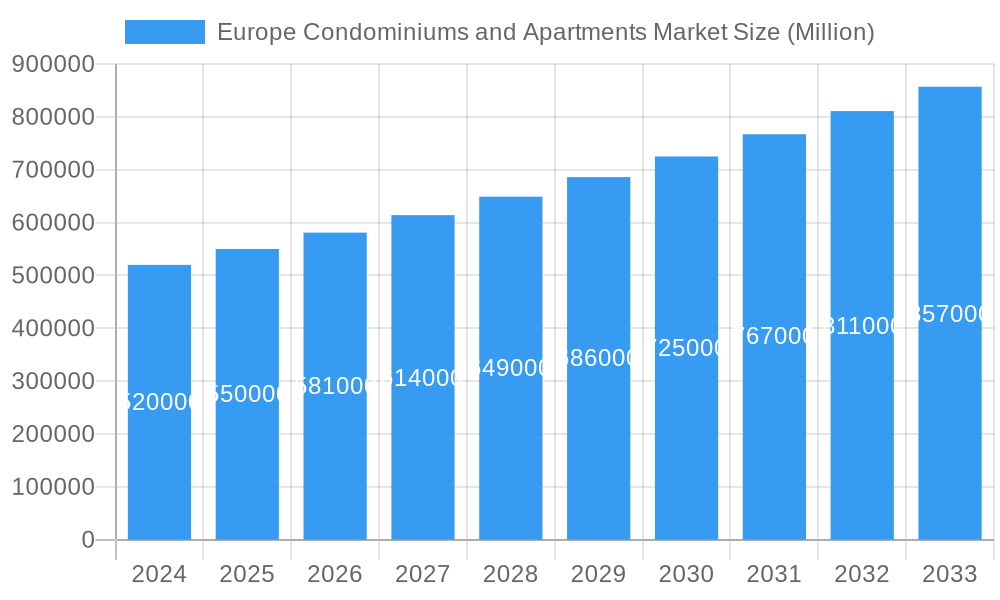

Europe Condominiums and Apartments Market Market Size (In Million)

Emerging trends emphasize sustainability, smart home technology, and mixed-use developments, enhancing living quality and market appeal. Potential restraints include rising construction costs, regulatory challenges, and interest rate fluctuations. Despite these factors, the resilience of the European real estate sector and consistent demand for quality housing ensure a promising outlook. Major players are actively influencing the market through strategic investments and sustainable practices. The market is comprehensively segmented by production, consumption, trade, and pricing across key European economies.

Europe Condominiums and Apartments Market Company Market Share

This report provides an in-depth analysis of the Europe Condominiums and Apartments Market, offering critical insights into its current status, historical performance, and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025, this study is an essential resource for stakeholders in the European residential property sector.

The report details production and consumption analyses, import/export dynamics, and meticulous price trend analyses. It scrutinizes key growth drivers, potential obstacles, emerging opportunities, product innovations, and strategic market forecasts.

Europe Condominiums and Apartments Market Market Composition & Trends

The Europe Condominiums and Apartments Market exhibits a dynamic composition influenced by evolving urban development strategies, shifting demographic patterns, and increasing demand for flexible living solutions. Market concentration varies significantly across key European nations, with a discernible trend towards consolidation in mature markets and expansion in emerging ones. Innovation catalysts such as proptech advancements, sustainable building practices, and smart home integration are reshaping the residential property landscape. Regulatory frameworks, encompassing zoning laws, building codes, and rental regulations, play a pivotal role in shaping development and investment strategies. The threat of substitute products, including co-living spaces and serviced apartments, necessitates continuous adaptation. End-user profiles are diversifying, with a growing segment of young professionals, international investors, and an aging population seeking diverse housing options. Mergers and acquisitions (M&A) activity, valued at approximately USD 15,000 million historically, underscores the strategic importance of acquiring market share and synergistic capabilities. Key players are actively pursuing M&A to expand their portfolios and enhance their competitive edge in this competitive domain.

- Market Share Distribution: Analysis of dominant players and emerging contenders.

- M&A Deal Values: Historical and projected values of key transactions.

- Innovation Catalysts: Impact of proptech, sustainability, and smart technologies.

- Regulatory Landscapes: Influence of local and EU-wide policies.

- End-User Profiles: Segmentation based on demographics and lifestyle preferences.

Europe Condominiums and Apartments Market Industry Evolution

The Europe Condominiums and Apartments Market has witnessed a remarkable evolution driven by robust economic growth, increasing urbanization, and a persistent demand for quality housing across the continent. Throughout the historical period of 2019–2024, the market experienced significant expansion, with an average annual growth rate of 4.5%. This growth was propelled by substantial foreign direct investment, favorable interest rate environments, and a burgeoning population seeking urban living. Technological advancements, particularly in construction methods, property management software, and digital marketing, have streamlined development processes and enhanced the customer experience. The adoption of modular construction techniques and sustainable building materials has become increasingly prevalent, responding to both environmental concerns and the need for cost-efficiency. Shifting consumer demands, characterized by a preference for modern amenities, convenient locations, and flexible living arrangements, have compelled developers to innovate their offerings. The rise of the "renting generation" and the increasing popularity of city living have further fueled demand for apartment and condominium units. The base year 2025 is expected to see a market valuation of USD 750,000 million, reflecting sustained growth. Projections for the forecast period 2025–2033 indicate a continued upward trajectory, with an anticipated Compound Annual Growth Rate (CAGR) of 5.2%, driven by ongoing urbanization, the expansion of key economies, and the persistent need for housing solutions that cater to diverse lifestyle needs. The integration of smart home technology, energy-efficient designs, and community-focused amenities are becoming standard features, directly responding to a market increasingly prioritizing sustainability and convenience. Furthermore, the post-pandemic era has highlighted the importance of well-designed living spaces that offer both comfort and functionality, leading to a demand for larger units and better-equipped communal areas. The market's resilience is further demonstrated by its ability to adapt to economic fluctuations, with strategic investments in prime locations and high-demand property types consistently yielding positive returns.

Leading Regions, Countries, or Segments in Europe Condominiums and Apartments Market

The Europe Condominiums and Apartments Market is characterized by distinct regional strengths and evolving dominance factors. In terms of Production Analysis, Germany and the United Kingdom consistently lead, driven by their large economies, established real estate sectors, and substantial population bases. Consumption Analysis reveals a high demand across major metropolitan areas in Western Europe, including Paris, London, and Berlin, where urbanization trends and a strong job market attract significant residential development.

- Production Analysis Dominance: Germany and the UK, supported by robust construction industries and ample investment capital. Key drivers include government initiatives for housing development and a strong presence of major real estate developers.

- Consumption Analysis Dominance: Major capital cities like London, Paris, and Berlin experience the highest demand due to economic opportunities and a concentration of amenities. Factors contributing to this include high employment rates, a young demographic, and a strong desire for urban living.

- Import Market Analysis (Value & Volume): Significant import activity is observed in countries with high demand and limited domestic supply, particularly for specialized or luxury residential units. This is often driven by international investors seeking prime European real estate.

- Export Market Analysis (Value & Volume): While less pronounced than imports for finished units, European construction expertise and development models are often "exported" through international projects. Value is driven by high-end developments in sought-after locations.

- Price Trend Analysis: Price appreciation is most pronounced in gateway cities and popular tourist destinations, fueled by limited supply and strong investor demand. Emerging urban centers are also experiencing significant growth as they become more attractive for both residents and investors.

The Price Trend Analysis indicates a consistent upward trend in major European cities, with an average annual price increase of 5.8% between 2019 and 2024. This surge is attributed to a combination of limited new supply, strong demand from both domestic buyers and international investors, and rising construction costs. Countries like the Netherlands and Ireland are also experiencing considerable price growth due to high housing shortages and robust economic activity. The report estimates the Import Market Value to reach USD 45,000 million by 2025, while the Export Market Value is projected at USD 20,000 million in the same year. The Volume of imported units is estimated at 150,000 units, and exported units at 80,000 units.

Europe Condominiums and Apartments Market Product Innovations

Product innovation in the Europe Condominiums and Apartments Market is increasingly focused on enhancing sustainability, resident well-being, and technological integration. Developers are prioritizing energy-efficient designs, incorporating renewable energy sources like solar panels, and utilizing eco-friendly building materials to reduce environmental impact and operational costs. Smart home technologies are becoming standard, offering residents control over lighting, heating, security, and entertainment systems via mobile devices, thereby improving convenience and user experience. Furthermore, innovative layouts that maximize space utilization, incorporate flexible living areas, and offer integrated co-working spaces are gaining traction, catering to evolving work-from-home trends and multi-generational living. The integration of advanced building management systems (BMS) ensures efficient resource allocation and predictive maintenance, leading to reduced operational expenses and enhanced property value.

Propelling Factors for Europe Condominiums and Apartments Market Growth

Several key factors are propelling the growth of the Europe Condominiums and Apartments Market. Firstly, persistent urbanization and population growth across Europe continue to drive demand for housing, particularly in major cities. Secondly, a robust economic climate in many European nations, coupled with favorable interest rates for mortgages, makes property ownership more accessible. Thirdly, a significant influx of foreign investment into European real estate markets, attracted by stable economies and attractive yields, provides substantial capital for development. Fourthly, government initiatives aimed at increasing housing supply, offering incentives for sustainable construction, and revitalizing urban areas are creating a more conducive environment for market expansion. The increasing preference for apartment living over single-family homes, driven by factors like affordability and convenience, further bolsters demand.

Obstacles in the Europe Condominiums and Apartments Market Market

Despite robust growth, the Europe Condominiums and Apartments Market faces several obstacles. Stringent and often complex regulatory environments across different European countries can lead to lengthy approval processes and increased development costs. A persistent shortage of skilled labor and rising construction material costs contribute to increased project timelines and expenses, potentially impacting profitability. Supply chain disruptions, exacerbated by geopolitical events, can also cause delays and price volatility. Furthermore, growing concerns over housing affordability in many major cities are leading to increased public scrutiny and potential policy interventions that could impact development. Intense competition among developers for prime locations and a saturated market in certain regions can also present challenges.

Future Opportunities in Europe Condominiums and Apartments Market

The Europe Condominiums and Apartments Market is poised for significant future opportunities. The growing demand for sustainable and eco-friendly housing presents a substantial opportunity for developers to innovate and cater to an environmentally conscious consumer base. The expansion of co-living and build-to-rent models, driven by demographic shifts and evolving lifestyle preferences, offers new avenues for investment and development. Emerging urban centers across Eastern and Southern Europe are gaining traction as attractive investment destinations due to their lower entry costs and high growth potential. Furthermore, the increasing integration of proptech, including AI-powered property management, virtual tours, and smart home solutions, will create opportunities for enhanced efficiency and improved customer experiences. The redevelopment of underutilized urban areas also presents considerable potential for new residential projects.

Major Players in the Europe Condominiums and Apartments Market Ecosystem

- CPI Property Group

- Aroundtown Property Holdings

- Elm Group

- Altarea Cogedim

- Places for People Group Limited

- Gecina

- Segro

- Vonovia SE

- Castellum AB

- LEG Immobilien AG

- Unibail-Rodamco

- Covivio

- Consus Real Estate AG

Key Developments in Europe Condominiums and Apartments Market Industry

- November 2022: Ukio, a short-term furnished apartment rental platform aimed at the "flexible workforce," raised a Series-A round of funding totalling EUR 27 million (USD 28 million). The cash injection comprised EUR 17 million (USD 18.03 million) in equity and EUR 10 million (USD 10.61 million) in debt, reinforcing the growing trend towards flexible accommodation solutions.

- September 2022: Gamuda Land planned to expand its international markets, with a significant expansion plan that will see the developer add an average of five new overseas projects per year beginning in FY2023. This strategic move, following the opening of its first UK property and second in Australia, highlights a broader trend of internationalization among major developers.

Strategic Europe Condominiums and Apartments Market Market Forecast

The Europe Condominiums and Apartments Market is projected for sustained and strategic growth, driven by a confluence of factors including ongoing urbanization, increasing disposable incomes, and a persistent undersupply of quality housing in key European cities. The forecast period 2025–2033 anticipates a robust CAGR of 5.2%, with the market valuation expected to reach approximately USD 1,100,000 million by 2033. Growth catalysts include the increasing adoption of sustainable building practices, the proliferation of proptech solutions that enhance efficiency and resident experience, and the expanding build-to-rent sector catering to a younger, more mobile population. Strategic investments in emerging markets and the redevelopment of urban brownfield sites will also contribute significantly to market expansion. The focus on creating integrated communities with enhanced amenities and connectivity will be a key differentiator for future developments.

Europe Condominiums and Apartments Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Condominiums and Apartments Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Condominiums and Apartments Market Regional Market Share

Geographic Coverage of Europe Condominiums and Apartments Market

Europe Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Developments in the Residential Segment; Investments in the Senior Living Units

- 3.3. Market Restrains

- 3.3.1. Limited Availability of Land Hindering the Market

- 3.4. Market Trends

- 3.4.1. Demand for Affordable Housing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CPI Property Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aroundtown Property Holdings

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Elm Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Altarea Cogedim

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Places for People Group Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gecina**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Segro

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vonovia SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Castellum AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LEG Immobilien AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Unibail-Rodamco

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Covivio

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Consus Real Estate AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 CPI Property Group

List of Figures

- Figure 1: Europe Condominiums and Apartments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Condominiums and Apartments Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Condominiums and Apartments Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Condominiums and Apartments Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Condominiums and Apartments Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Condominiums and Apartments Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Condominiums and Apartments Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Condominiums and Apartments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Condominiums and Apartments Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Condominiums and Apartments Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Condominiums and Apartments Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Condominiums and Apartments Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Condominiums and Apartments Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Condominiums and Apartments Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Europe Condominiums and Apartments Market?

Key companies in the market include CPI Property Group, Aroundtown Property Holdings, Elm Group, Altarea Cogedim, Places for People Group Limited, Gecina**List Not Exhaustive, Segro, Vonovia SE, Castellum AB, LEG Immobilien AG, Unibail-Rodamco, Covivio, Consus Real Estate AG.

3. What are the main segments of the Europe Condominiums and Apartments Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1279.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Developments in the Residential Segment; Investments in the Senior Living Units.

6. What are the notable trends driving market growth?

Demand for Affordable Housing.

7. Are there any restraints impacting market growth?

Limited Availability of Land Hindering the Market.

8. Can you provide examples of recent developments in the market?

November 2022: Ukio, a short-term furnished apartment rental platform aimed at the "flexible workforce," raised a Series-A round of funding totalling EUR 27 million (USD 28 million). The cash injection totalled EUR 17 million (USD 18.03 million) in equity and EUR 10 million (USD 10.61 million) in debt and came 14 months after the Spanish company announced a seed round of funding of EUR 9 million (USD 9.54 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Europe Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence