Key Insights

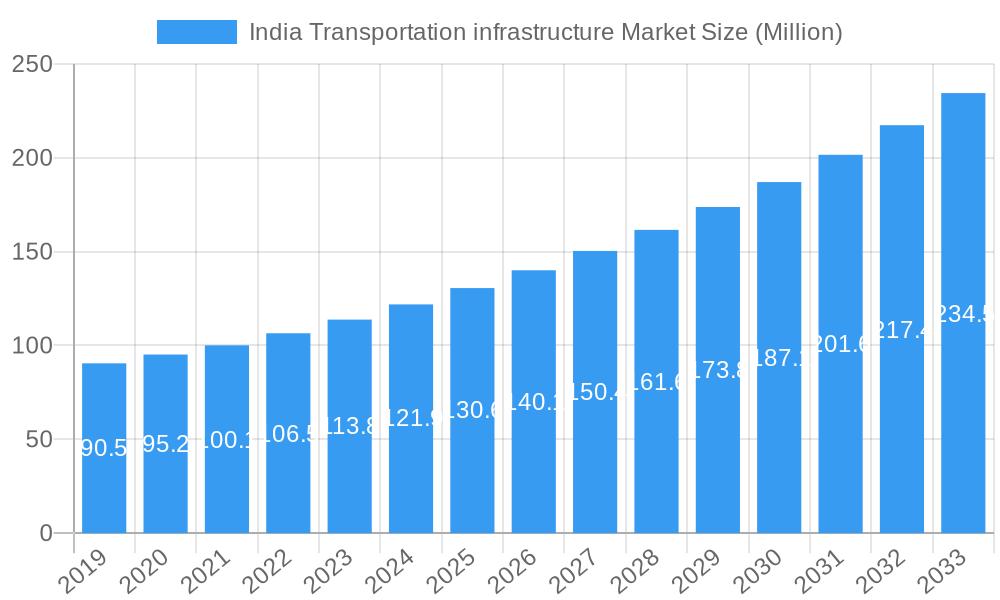

The Indian transportation infrastructure market is poised for substantial growth, projected to reach a valuation of $143.60 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.76% anticipated throughout the forecast period (2025-2033). This expansion is primarily fueled by the Indian government's ambitious infrastructure development agenda, which prioritizes enhancing connectivity and facilitating seamless movement of goods and people across the nation. Key drivers include significant investments in road network expansion, including the development of expressways and national highways, as well as the modernization and expansion of railway networks to improve freight capacity and passenger convenience. Furthermore, ongoing projects in port development and inland waterways are set to bolster logistics efficiency and reduce transportation costs, contributing significantly to the market's upward trajectory. The 'Urban' application segment, driven by rapid urbanization and the need for efficient public transport systems, is expected to see accelerated demand, alongside substantial development in 'Rural' areas to improve last-mile connectivity.

India Transportation infrastructure Market Market Size (In Million)

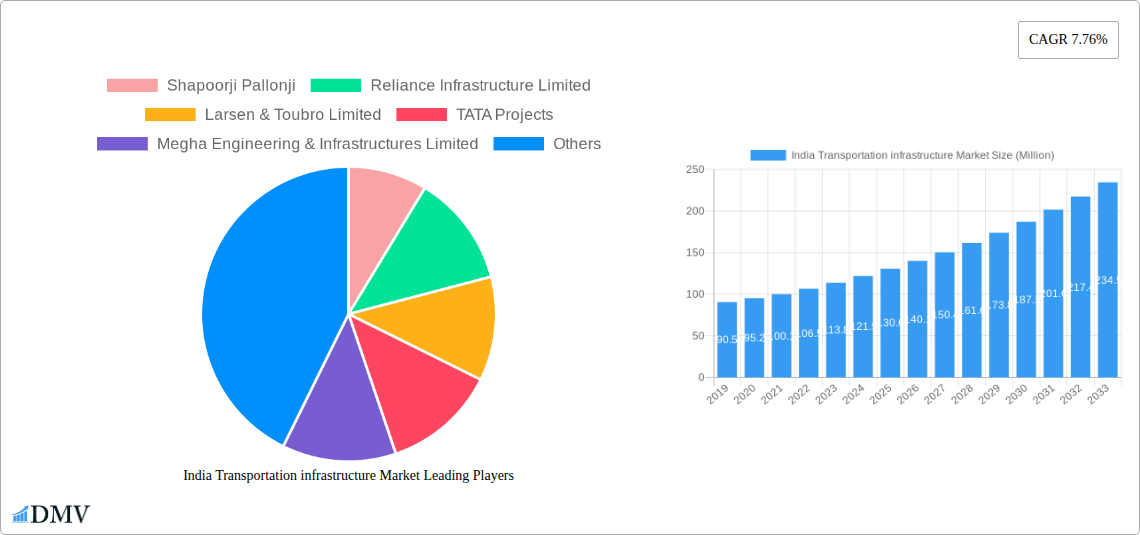

The market is characterized by a dynamic landscape influenced by evolving trends such as the integration of smart technologies for traffic management and safety, and a growing emphasis on sustainable infrastructure development, including the adoption of green building materials and energy-efficient solutions. While the overall outlook remains exceptionally positive, certain challenges persist. The need for streamlined land acquisition processes and the efficient resolution of regulatory hurdles can sometimes impede project timelines. However, the sheer scale of planned investments and the strategic importance of a well-developed transportation network for India's economic progress suggest these challenges are being actively addressed. Major players like Larsen & Toubro Limited, Reliance Infrastructure Limited, and TATA Projects are at the forefront, driving innovation and execution across various segments including Roadways, Railways, Airways, and Ports and Inland Waterways, all of which are critical components of India's vision for comprehensive infrastructure enhancement.

India Transportation infrastructure Market Company Market Share

India Transportation Infrastructure Market: Comprehensive Report Analysis

Unlock the strategic insights into India's rapidly evolving transportation infrastructure market. This comprehensive report provides an in-depth analysis of market composition, industry evolution, regional dominance, product innovations, growth drivers, challenges, and future opportunities. Delve into market trends, technological advancements, and regulatory landscapes that are shaping the Indian infrastructure sector, with a focus on roadways, railways, airways, ports, and inland waterways. This report is essential for stakeholders seeking to understand and capitalize on the growth of Indian transportation networks, driven by significant investments and government initiatives.

India Transportation infrastructure Market Market Composition & Trends

The India transportation infrastructure market is characterized by a dynamic and evolving landscape, reflecting significant government impetus and private sector participation. Market concentration, while present among key players, is increasingly influenced by the burgeoning demand for enhanced connectivity across both urban transportation and rural infrastructure development. Innovation is a crucial catalyst, with a continuous push towards adopting advanced construction techniques and sustainable materials to address the nation's vast logistical needs. The regulatory framework, though complex, is progressively streamlined to facilitate project execution and attract foreign investment. While direct substitute products are limited within core infrastructure, the efficiency and cost-effectiveness of different transportation modes act as competitive factors. End-user profiles span government bodies, public and private transportation operators, logistics companies, and the general public, all of whom benefit from improved connectivity. Merger and acquisition (M&A) activities are on the rise, signaling consolidation and strategic expansion by leading firms. The M&A deal values are projected to reach hundreds of Millions of INR as companies vie for market share and project pipelines. Market share distribution is undergoing shifts, with specialized players gaining prominence in niche segments like Indian port development and high-speed rail networks.

India Transportation infrastructure Market Industry Evolution

The Indian transportation infrastructure sector has witnessed a transformative evolution over the historical period of 2019–2024, projecting robust growth through to 2033. This evolution is a testament to India's commitment to building world-class transport infrastructure to support its burgeoning economy and large population. Driven by ambitious government schemes such as the National Infrastructure Pipeline (NIP) and the Gati Shakti Master Plan, the market has experienced sustained growth trajectories. Technological advancements have played a pivotal role, with the adoption of Building Information Modeling (BIM), advanced material science, and smart technologies revolutionizing project planning, execution, and operational efficiency. The focus has shifted from mere construction to developing integrated, multi-modal transportation systems that enhance efficiency and reduce logistics costs. Shifting consumer demands, influenced by urbanization and a growing middle class, have amplified the need for improved passenger and freight movement, thereby fueling investment in Indian road networks, railway modernization, and airport expansion. The adoption metrics for sustainable construction practices and green transportation solutions are steadily increasing, reflecting a growing awareness and regulatory push towards environmental sustainability. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 10-12% during the forecast period of 2025–2033, indicating significant investment inflows and project completions. Key segments like Indian railways modernization and highway development in India are expected to lead this growth, supported by substantial budgetary allocations and private sector participation, with the overall market size estimated to reach well over XXXX Million by 2033.

Leading Regions, Countries, or Segments in India Transportation infrastructure Market

Within the expansive India transportation infrastructure market, roadways emerge as the dominant segment, driven by unparalleled reach and government focus on enhancing the Indian highway network. This dominance is underpinned by a confluence of strategic investments, supportive regulatory policies, and the sheer necessity of improving last-mile connectivity across the nation. The urban transportation segment, particularly within metropolitan areas, also exhibits significant growth, fueled by the need for efficient public transport systems, metro rail expansion, and smart city initiatives aimed at alleviating congestion and improving commuter experiences. Conversely, rural infrastructure development, while crucial for inclusive growth, often faces challenges related to land acquisition and funding, though considerable progress is being made.

Key drivers for the dominance of roadways include:

- Massive Investment Allocation: The Indian government consistently allocates substantial budgets towards highway construction and maintenance, exemplified by initiatives like the Bharatmala Pariyojana.

- Economic Impact: Enhanced road connectivity directly stimulates economic activity by facilitating the movement of goods and people, reducing transit times, and boosting trade.

- Last-Mile Connectivity: Roads provide the most versatile solution for connecting remote areas, integrating them into the national economic mainstream.

- Public-Private Partnerships (PPPs): The widespread adoption of PPP models has accelerated project execution and brought in private capital, further bolstering road development.

The urban transportation segment's ascendance is propelled by:

- Rapid Urbanization: The continuous migration to cities necessitates advanced public transport solutions to manage growing populations.

- Smart City Missions: These missions prioritize integrated mobility solutions, including metro rail, BRTS, and intelligent traffic management systems.

- Environmental Concerns: A growing awareness of pollution and congestion drives investment in cleaner and more efficient urban transit options.

While railways continue to be a vital artery for freight and long-distance passenger travel, and airways cater to a growing segment of travelers, and ports and inland waterways are gaining traction for cargo movement, the sheer scale and foundational nature of roadways solidify its leading position in the current Indian infrastructure development landscape. The projected market size for Indian roadways is expected to contribute a significant portion, potentially exceeding XXXX Million by 2033, reflecting its pivotal role in the nation's growth story.

India Transportation infrastructure Market Product Innovations

Innovation in the India transportation infrastructure market is actively focused on enhancing efficiency, sustainability, and safety. Advanced materials like high-strength concrete, recycled aggregates, and geosynthetics are being deployed to increase the lifespan and reduce the environmental footprint of road and railway projects. Smart sensors embedded in infrastructure enable real-time monitoring of structural health and traffic flow, paving the way for predictive maintenance and optimized traffic management. Innovations in tunneling technology, modular construction, and advanced signaling systems are revolutionizing railway modernization and the development of high-speed corridors. The integration of AI and IoT is transforming airport operations and port logistics, improving turnaround times and cargo handling. Unique selling propositions for emerging infrastructure solutions revolve around cost-effectiveness, reduced construction timelines, and minimized ecological impact, aligning with the nation's push for sustainable development.

Propelling Factors for India Transportation infrastructure Market Growth

The India transportation infrastructure market is propelled by a confluence of robust factors. Government initiatives such as the National Infrastructure Pipeline and the Gati Shakti Master Plan are channeling significant investment, fostering rapid development across roadways, railways, airways, ports, and inland waterways. Economic growth and increasing disposable incomes are driving demand for enhanced passenger and freight mobility. Technological advancements, including the adoption of BIM and sustainable construction materials, are improving project efficiency and quality. Furthermore, a supportive regulatory framework aimed at encouraging private sector participation and streamlining project approvals is a key enabler. The burgeoning e-commerce sector also necessitates improved logistics and warehousing infrastructure, further fueling demand.

Obstacles in the India Transportation infrastructure Market Market

Despite its promising growth, the India transportation infrastructure market faces several obstacles. Land acquisition challenges remain a persistent bottleneck, often leading to project delays and increased costs. Regulatory hurdles and complex approval processes can slow down project execution. Supply chain disruptions, particularly for specialized materials and equipment, can impact project timelines and budgets. Intense competitive pressures among construction firms can lead to thin margins, and the need for significant upfront capital investment poses a financial challenge for many smaller players. Environmental clearances and social impact assessments, while necessary, can also add to the development timelines.

Future Opportunities in India Transportation infrastructure Market

The India transportation infrastructure market is ripe with future opportunities. The increasing focus on green infrastructure presents opportunities for sustainable transportation solutions, including electric vehicle charging networks, solar-powered railways, and development of inland waterways for eco-friendly cargo movement. The government's push for regional connectivity and development of smart cities will drive demand for integrated multi-modal transportation systems. Expansion of airports and port infrastructure to handle increasing cargo and passenger volumes, along with the development of dedicated freight corridors and high-speed rail, represent significant growth avenues. Digitalization and the adoption of IoT in logistics and traffic management offer further avenues for innovation and efficiency improvements.

Major Players in the India Transportation infrastructure Market Ecosystem

- Shapoorji Pallonji

- Reliance Infrastructure Limited

- Larsen & Toubro Limited

- TATA Projects

- Megha Engineering & Infrastructures Limited

- Dilip Buildcon Limited

- KEC International Limited

- Eagle Infra India Ltd

- Hindustan Construction Company Limited

- IRB Infrastructure Developers Ltd

- 6 Other Companies

Key Developments in India Transportation infrastructure Market Industry

- February 2024: The Power Transmission & Distribution division of Larsen and Toubro secured multiple contracts in India and the Middle East. Notably, they acquired a contract to construct a 75 MW floating solar power plant at Panchet Dam, as part of the Ultra Mega Renewable Power Park initiative across Jharkhand and West Bengal's Damodar Valley Corporation reservoirs.

- February 2024: L&T Construction, the transportation infrastructure arm, was awarded a significant contract for the construction of a 12-21 km bridge connecting Palashbari to Sualkuchi on the Brahmaputra river in Assam, under the Public Works Roads Department (PwRD), Assam. This cable-stayed bridge, with approaches, will enhance connectivity and directly link Sualkuchi, renowned for its Muga silk weaving, to Assam's nearest international airport, GAU.

Strategic India Transportation infrastructure Market Market Forecast

The strategic India transportation infrastructure market forecast indicates sustained and robust growth, driven by a clear national agenda for modernizing and expanding connectivity. Key growth catalysts include continued government investment, a projected increase in private sector participation through attractive PPP models, and the ever-growing demand for efficient logistics and passenger mobility. Emerging opportunities in sustainable infrastructure and the integration of smart technologies will further propel the market. The focus on enhancing roadways, modernizing railways, expanding airports, and developing ports and inland waterways will ensure a dynamic market landscape. The market is poised to witness significant value creation, with the overall market size expected to reach well over XXXX Million by 2033, reflecting its critical role in India's economic future.

India Transportation infrastructure Market Segmentation

-

1. Application

- 1.1. Urban

- 1.2. Rural

-

2. Type

- 2.1. Roadways

- 2.2. Railways

- 2.3. Airways

- 2.4. Ports and Inland Waterways

India Transportation infrastructure Market Segmentation By Geography

- 1. India

India Transportation infrastructure Market Regional Market Share

Geographic Coverage of India Transportation infrastructure Market

India Transportation infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Government Initiatives and Policies

- 3.2.2 such as "Make in India" and "BharatMala"4.; Indian Cities Planning and Implementing Metro Rail Systems to Address Urban Congestion and Improve Public Transportation

- 3.3. Market Restrains

- 3.3.1. 4.; Bureaucratic Delays in Project Approvals4.; Shortage of Skilled Labors Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1 Construction of Roads

- 3.4.2 Bridges

- 3.4.3 and Highways Under Government Initiatives to Promote Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Transportation infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Urban

- 5.1.2. Rural

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Roadways

- 5.2.2. Railways

- 5.2.3. Airways

- 5.2.4. Ports and Inland Waterways

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shapoorji Pallonji

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Reliance Infrastructure Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Larsen & Toubro Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TATA Projects

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Megha Engineering & Infrastructures Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dilip Buildcon Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KEC International Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eagle Infra India Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hindustan Construction Company Limited**List Not Exhaustive 6 3 Other Companie

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 IRB Infrastructure Developers Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shapoorji Pallonji

List of Figures

- Figure 1: India Transportation infrastructure Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Transportation infrastructure Market Share (%) by Company 2025

List of Tables

- Table 1: India Transportation infrastructure Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: India Transportation infrastructure Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: India Transportation infrastructure Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Transportation infrastructure Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: India Transportation infrastructure Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: India Transportation infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Transportation infrastructure Market?

The projected CAGR is approximately 7.76%.

2. Which companies are prominent players in the India Transportation infrastructure Market?

Key companies in the market include Shapoorji Pallonji, Reliance Infrastructure Limited, Larsen & Toubro Limited, TATA Projects, Megha Engineering & Infrastructures Limited, Dilip Buildcon Limited, KEC International Limited, Eagle Infra India Ltd, Hindustan Construction Company Limited**List Not Exhaustive 6 3 Other Companie, IRB Infrastructure Developers Ltd.

3. What are the main segments of the India Transportation infrastructure Market?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 143.60 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Initiatives and Policies. such as "Make in India" and "BharatMala"4.; Indian Cities Planning and Implementing Metro Rail Systems to Address Urban Congestion and Improve Public Transportation.

6. What are the notable trends driving market growth?

Construction of Roads. Bridges. and Highways Under Government Initiatives to Promote Market Growth.

7. Are there any restraints impacting market growth?

4.; Bureaucratic Delays in Project Approvals4.; Shortage of Skilled Labors Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

February 2024: The Power Transmission & Distribution division of Larsen and Toubro won several contracts in India and the Middle East. The company acquired a contract to construct a 75 MW floating solar power plant at the Panchet Dam. This plant is part of the Ultra Mega Renewable Power Park, which is being built on the Damodar Valley Corporation reservoirs in the states of Jharkhand and West Bengal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Transportation infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Transportation infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Transportation infrastructure Market?

To stay informed about further developments, trends, and reports in the India Transportation infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence