Key Insights

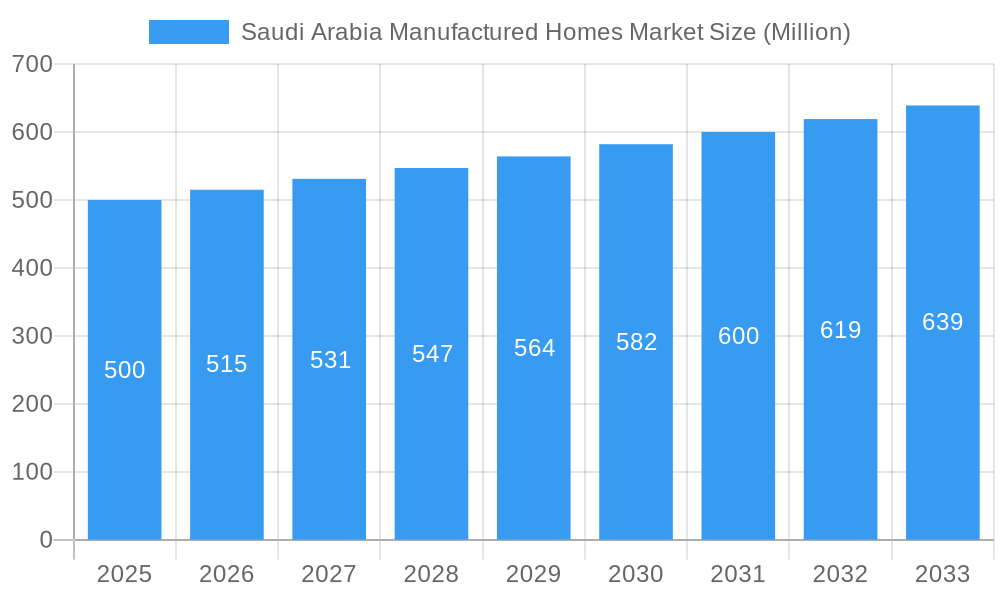

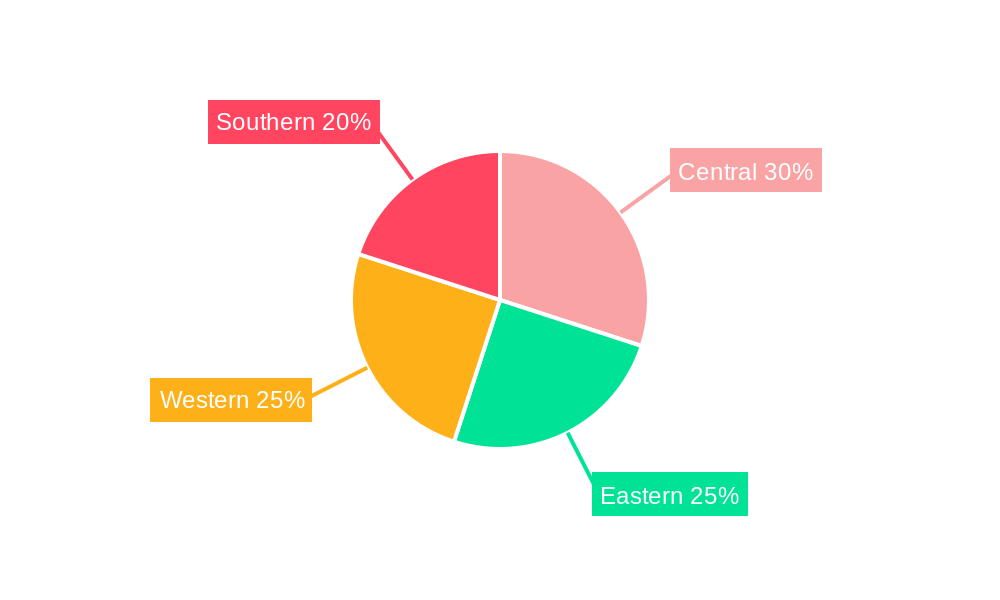

The Saudi Arabian manufactured homes market is exhibiting robust expansion, propelled by increasing urbanization, accelerated infrastructure development, and government-led initiatives promoting accessible housing solutions. The market, projected to reach $1869.4 million by 2025, is forecast to grow at a compound annual growth rate (CAGR) of 6.6% from 2025 to 2033. This growth is attributed to a burgeoning young population seeking affordable housing and the demand for temporary accommodations supporting extensive construction projects across the nation's Central, Eastern, Western, and Southern regions. Single-family units are expected to lead the market due to high demand for individual residences, while multi-family units are gaining traction amidst rising urban population density. Leading companies such as Speed House Group of Companies, Red Sea International, and BK Gulf are influencing the market through technological innovation, advanced designs, and strategic alliances. Potential market restraints include fluctuating raw material costs and the prevailing economic climate. However, the long-term outlook remains favorable, with significant growth potential bolstered by sustained government investment in infrastructure and housing.

Saudi Arabia Manufactured Homes Market Market Size (In Billion)

The competitive landscape is dynamic, featuring both local and international entities. Key players like ISG Prefab, Aldamegh Portable House Factory, and Karmod Prefabricated Technologies are capitalizing on their expertise in prefabricated construction to meet escalating demand. Geographically, strong demand is evident across all Saudi Arabian regions, with urban areas anticipated to experience higher growth rates. Future market expansion will be significantly shaped by advancements in prefabrication technology, the integration of sustainability within the construction sector, and the effective implementation of government policies aimed at delivering affordable and sustainable housing for the nation's growing populace. In-depth analysis of specific project pipelines and government expenditure data is recommended for more precise forecasting.

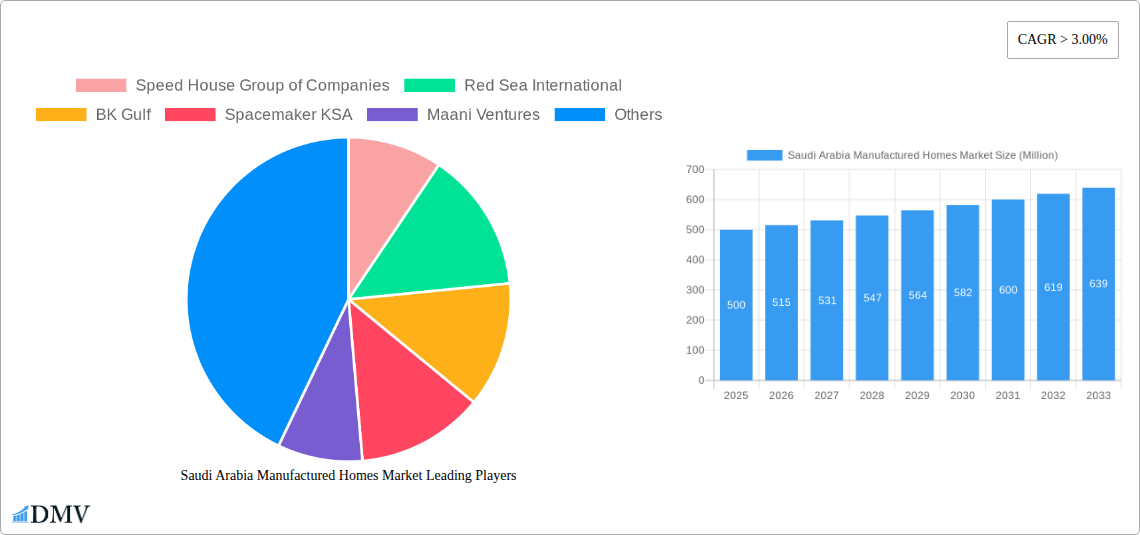

Saudi Arabia Manufactured Homes Market Company Market Share

Saudi Arabia Manufactured Homes Market Report: Trends, Growth, and Forecast (2019-2033)

This comprehensive report offers a detailed analysis of the Saudi Arabian manufactured homes market, providing an overview of market dynamics, key stakeholders, and future growth trajectories. Covering the period from 2019 to 2033, with a specific focus on 2025, this study is an indispensable resource for stakeholders aiming to understand and leverage opportunities within this evolving sector. The report encompasses significant projects, market segmentation, and competitive analysis for a holistic perspective. The Saudi Arabian manufactured homes market is poised for substantial growth, driven by government policies, infrastructure development, and increasing urbanization.

Saudi Arabia Manufactured Homes Market Composition & Trends

The Saudi Arabia manufactured homes market exhibits a moderately concentrated structure, with several key players holding significant market share. The market is characterized by ongoing innovation, particularly in modular design and sustainable building materials. Government regulations, while evolving, generally support the growth of the sector, focusing on efficient and affordable housing solutions. Competition comes from traditional construction methods, but the advantages of manufactured homes in terms of speed, cost, and sustainability are steadily gaining traction. Mergers and acquisitions (M&A) activity remains relatively low, with deal values averaging xx Million USD annually in the historical period (2019-2024), though we expect this to increase in the forecast period due to market consolidation.

- Market Share Distribution (2024): Red Sea International: xx%; Speed House Group of Companies: xx%; BK Gulf: xx%; Others: xx%

- M&A Activity (2019-2024): Total deal value: xx Million USD

- Key Innovation Catalysts: Sustainable building materials, smart home integration, prefabricated designs.

- End-User Profiles: Government agencies, private developers, and individual homebuyers.

Saudi Arabia Manufactured Homes Market Industry Evolution

The Saudi Arabia manufactured homes market has witnessed significant growth over the past five years (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to several factors, including increasing urbanization, government initiatives promoting affordable housing, and technological advancements in manufacturing and design. Consumer demand is shifting towards more energy-efficient and technologically advanced homes. The adoption of prefabricated construction techniques is accelerating, with a xx% increase in market share between 2019 and 2024. Future growth is expected to be fueled by large-scale infrastructure projects, such as Neom, and the continued focus on providing affordable housing options across the kingdom. We project a CAGR of xx% for the forecast period (2025-2033).

Leading Regions, Countries, or Segments in Saudi Arabia Manufactured Homes Market

The single-family segment currently dominates the Saudi Arabia manufactured homes market. This is driven primarily by increasing demand for affordable and efficient housing solutions among individuals and young families. However, the multi-family segment is projected to experience substantial growth over the forecast period due to government initiatives focusing on the construction of affordable housing complexes.

Key Drivers for Single-Family Dominance:

- High demand for individual housing units

- Government support for affordable housing initiatives

- Ease of construction and customization.

Key Drivers for Multi-Family Growth Potential:

- Government investment in large-scale housing projects

- Increased urban density and population growth.

The Western region, due to large-scale projects such as the Red Sea Project, showcases the highest growth and strongest demand.

Saudi Arabia Manufactured Homes Market Product Innovations

Recent innovations include the incorporation of smart home technology, enhanced insulation for improved energy efficiency, and the use of sustainable and locally sourced materials. These innovations are improving the quality, functionality, and environmental footprint of manufactured homes. Companies are increasingly focusing on offering customizable designs to cater to diverse customer preferences. This leads to unique selling propositions focused on speed of construction, cost-effectiveness, and environmentally friendly options.

Propelling Factors for Saudi Arabia Manufactured Homes Market Growth

Several factors contribute to the market's growth trajectory. Government initiatives promoting affordable housing are a primary driver, complemented by the kingdom's ongoing infrastructure development projects and the increasing urbanization rate. Technological advancements, leading to faster construction times and improved designs, are also key factors. The construction of Neom and the Red Sea Project significantly boosts demand.

Obstacles in the Saudi Arabia Manufactured Homes Market

Challenges include the need for further infrastructure development to support the expansion of the manufactured housing sector, ensuring a skilled workforce, and addressing potential supply chain bottlenecks. Competition from traditional construction methods also presents a challenge. Regulatory uncertainties could also impact growth in the near term.

Future Opportunities in Saudi Arabia Manufactured Homes Market

Significant opportunities lie in expanding into rural and underserved areas, leveraging advancements in sustainable materials, and catering to niche segments, such as luxury manufactured homes. Technological integrations, such as smart home technology and off-grid solutions, represent a further area of growth. Government initiatives focused on Vision 2030 further enhance the market's future opportunities.

Major Players in the Saudi Arabia Manufactured Homes Market Ecosystem

- Speed House Group of Companies

- Red Sea International

- BK Gulf

- Spacemaker KSA

- Maani Ventures

- ISG Prefab

- Aldamegh Portable House Factory

- TSSC Group

- Karmod Prefabricated Technologies

- Amana

Key Developments in Saudi Arabia Manufactured Homes Market Industry

January 2022: Red Sea International Co. secured a SAR 60.5 Million (USD 16.12 Million) contract with The Red Sea Development Co. for the design, manufacturing, supply, and installation of three complexes. This project significantly boosted market activity in the Western region.

December 2022: Red Sea International secured another substantial contract worth SAR 192.01 Million (USD 51.11 Million) with the Royal Commission for AlUla (RCU) for the construction of an integrated housing complex in AlUla. This further cemented Red Sea International's position in the market and demonstrated the growing demand for modular housing in large-scale projects.

Strategic Saudi Arabia Manufactured Homes Market Forecast

The Saudi Arabia manufactured homes market is poised for continued expansion, driven by ongoing infrastructure development, government support, and technological advancements. The market's growth potential is substantial, with increased demand expected across both the single-family and multi-family segments. The forecast period (2025-2033) anticipates significant growth, primarily fueled by large-scale projects and the kingdom's Vision 2030 goals.

Saudi Arabia Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

Saudi Arabia Manufactured Homes Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Manufactured Homes Market Regional Market Share

Geographic Coverage of Saudi Arabia Manufactured Homes Market

Saudi Arabia Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Commercial Property Development; Rapid Digitalization of Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Emerging Safety and Labour Issues; Rise in Cost of Construction

- 3.4. Market Trends

- 3.4.1. Rising Construction Costs May Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Manufactured Homes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Speed House Group of Companies

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Red Sea International

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BK Gulf

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Spacemaker KSA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Maani Ventures

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ISG Prefab

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aldamegh Portable House Factory

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TSSC Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Karmod Prefabricated Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amana**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Speed House Group of Companies

List of Figures

- Figure 1: Saudi Arabia Manufactured Homes Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Manufactured Homes Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Manufactured Homes Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Manufactured Homes Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Saudi Arabia Manufactured Homes Market Revenue million Forecast, by Type 2020 & 2033

- Table 4: Saudi Arabia Manufactured Homes Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Manufactured Homes Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Saudi Arabia Manufactured Homes Market?

Key companies in the market include Speed House Group of Companies, Red Sea International, BK Gulf, Spacemaker KSA, Maani Ventures, ISG Prefab, Aldamegh Portable House Factory, TSSC Group, Karmod Prefabricated Technologies, Amana**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1869.4 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Commercial Property Development; Rapid Digitalization of Commercial Construction.

6. What are the notable trends driving market growth?

Rising Construction Costs May Drive the Market Growth.

7. Are there any restraints impacting market growth?

Emerging Safety and Labour Issues; Rise in Cost of Construction.

8. Can you provide examples of recent developments in the market?

January 2022: Red Sea International Co. signed a SAR 60.5 million (USD 16.12 million) contract with The Red Sea Development Co., known as TRSDC, to design, manufacture, supply, and install three complexes in the Saudi western region. This comes in line to support the construction activities of luxury hotels on three islands in the Red Sea, Sheybarah and Ummahat Al Shaikh islands. The contract duration is 194 days. The contract consists of various types of modular units, which can be used as accommodations or offices. These units will be fully furnished to provide all the requirements for the crew working on the construction site.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence