Key Insights

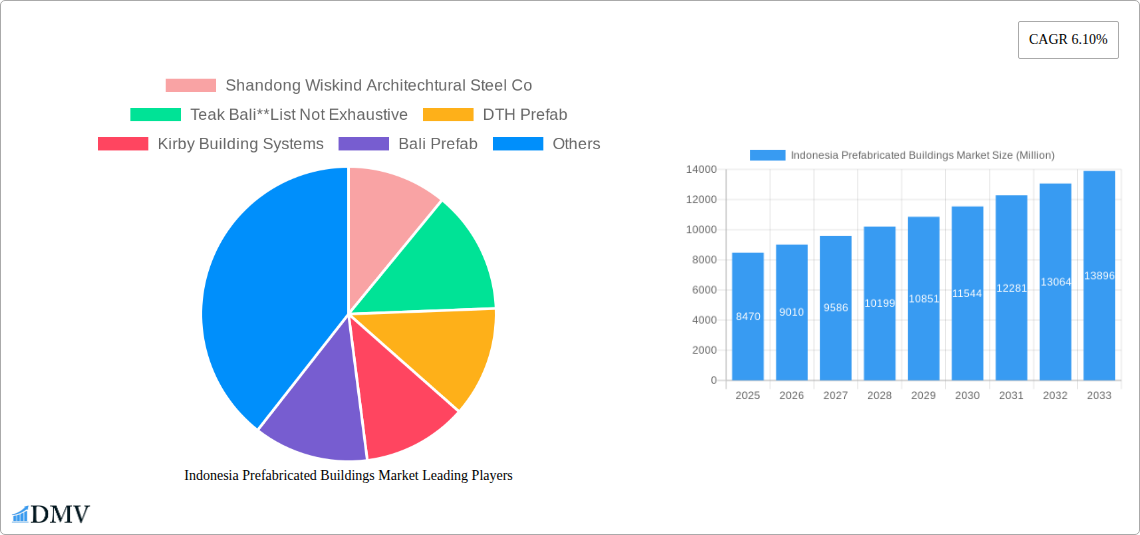

The Indonesian prefabricated buildings market, valued at $8.47 billion in 2025, is projected to experience robust growth, driven by increasing urbanization, government infrastructure initiatives, and a rising demand for cost-effective and rapidly deployable construction solutions. The market's Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033 indicates significant expansion potential. Key market drivers include the government's focus on affordable housing projects and infrastructure development, particularly in rapidly developing urban centers. Furthermore, the rising popularity of sustainable building practices and the efficiency gains offered by prefabricated construction are fueling market growth. The market is segmented by material type (concrete, glass, metal, timber, and others) and application (residential, commercial, and others, encompassing industrial, institutional, and infrastructure projects). While concrete remains a dominant material, the adoption of sustainable alternatives like timber and metal is growing, reflecting a broader trend toward environmentally conscious construction. The competitive landscape is characterized by a mix of both local and international players, with companies like Shandong Wiskind, Kirby Building Systems, and several Indonesian firms vying for market share. Challenges include overcoming potential regulatory hurdles and ensuring skilled labor availability to facilitate the efficient implementation of prefabricated building technologies. However, the overall outlook for the Indonesian prefabricated building market remains positive, with substantial growth opportunities expected in the coming years.

Indonesia Prefabricated Buildings Market Market Size (In Billion)

The ongoing expansion of Indonesia's infrastructure projects, coupled with a burgeoning construction sector focused on residential development, is expected to further propel market growth. Factors influencing future market dynamics include advancements in prefabrication technologies, improvements in building materials, and increasing awareness of the environmental and economic benefits of prefabricated structures. The market's segmentation into diverse material types and applications presents opportunities for specialized businesses targeting specific niches. For instance, companies focusing on sustainable, eco-friendly prefabricated solutions are likely to gain significant traction amidst rising environmental awareness. Competition is expected to intensify as more players enter the market, leading to increased innovation and potentially more competitive pricing, ultimately benefiting the end-users. Further market analysis is required to assess specific regional variations and the impact of external factors such as economic fluctuations and global supply chain dynamics.

Indonesia Prefabricated Buildings Market Company Market Share

This insightful report provides a detailed analysis of the Indonesia Prefabricated Buildings Market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The market is projected to reach xx Million by 2033.

Indonesia Prefabricated Buildings Market Composition & Trends

This section delves into the intricate structure of the Indonesian prefabricated buildings market, examining its concentration, innovative drivers, regulatory environment, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The market exhibits a moderately concentrated landscape, with a few dominant players alongside numerous smaller companies. Market share distribution is dynamic, influenced by technological advancements and fluctuating material costs. The estimated market size for 2025 is xx Million.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2025).

- Innovation Catalysts: Government initiatives promoting sustainable construction and advancements in modular building techniques are key drivers.

- Regulatory Landscape: Building codes and regulations influence material choices and construction methods. Ongoing changes in regulations necessitate continuous adaptation.

- Substitute Products: Conventional construction methods remain a significant competitor. The increasing adoption of prefabricated structures is driven by their cost-effectiveness, speed of construction, and improved quality.

- End-User Profiles: The market caters to diverse end-users, including residential, commercial, and industrial sectors, with residential construction currently dominating.

- M&A Activity: The past five years have seen xx M&A deals in the Indonesian prefabricated buildings market, with a total value of approximately xx Million. These activities reflect consolidation within the industry and the expansion of key players.

Indonesia Prefabricated Buildings Market Industry Evolution

The Indonesian prefabricated buildings market has witnessed significant growth over the past five years (2019-2024), exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily fueled by rising urbanization, increasing infrastructure investments, and a growing preference for faster and more efficient construction methods. Technological advancements, such as the adoption of Building Information Modeling (BIM) and 3D printing, are further accelerating market expansion. Shifting consumer demands towards sustainable and cost-effective housing solutions are also contributing to market growth. The market is expected to maintain a robust CAGR of xx% during the forecast period (2025-2033), driven by factors such as government initiatives, advancements in design technology, and continued urban expansion.

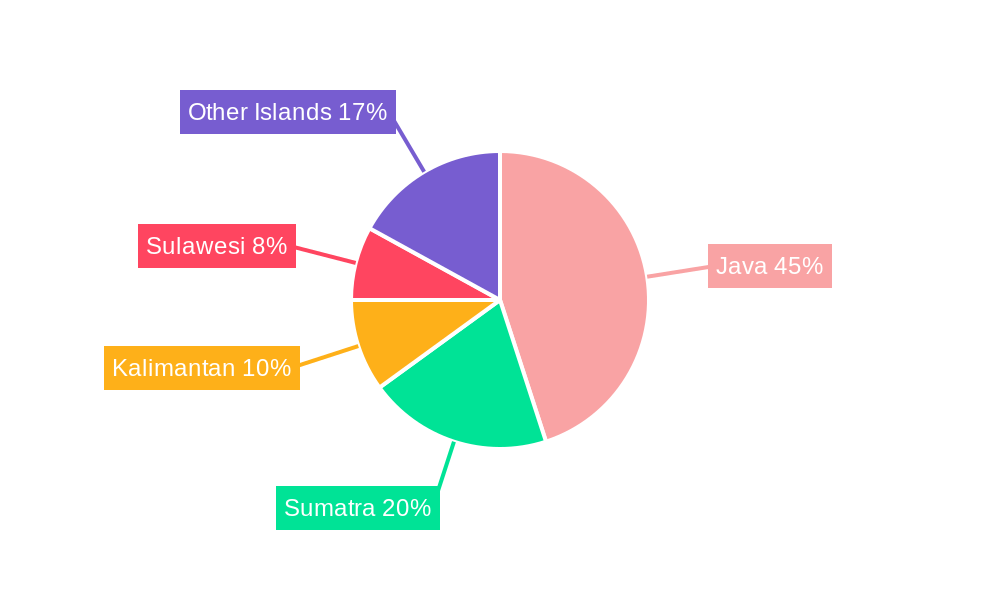

Leading Regions, Countries, or Segments in Indonesia Prefabricated Buildings Market

While data on specific regional breakdowns is limited, the Java region, due to its high population density and economic activity, is likely the leading market for prefabricated buildings in Indonesia.

Material Type:

- Metal: Metal is expected to be a dominant material type due to its durability, cost-effectiveness, and suitability for diverse applications.

- Concrete: Concrete remains significant, particularly in residential construction, but faces competition from faster and potentially more sustainable alternatives.

- Timber: Timber's use is largely confined to certain niches, currently holding a smaller market share due to supply limitations and environmental concerns.

Application:

- Residential: The residential segment holds the largest share, driven by increasing housing demands and the benefits of rapid construction using prefabricated techniques.

- Commercial: Commercial construction is a significant segment, though it may exhibit slower growth due to larger project scales and more complex designs compared to residential projects.

- Other Applications: The industrial, institutional and infrastructure segments show growth potential, driven by government spending on infrastructure projects and the cost-efficiency of prefabrication for larger-scale applications.

Key Drivers:

- Increasing government investment in infrastructure development.

- Growing urbanization and the demand for affordable housing.

- Adoption of advanced construction technologies.

- Favorable regulatory policies supporting sustainable building practices.

Indonesia Prefabricated Buildings Market Product Innovations

Recent innovations have focused on improving the efficiency, durability, and sustainability of prefabricated buildings. This includes the integration of smart home technologies, the use of advanced materials with improved insulation properties, and the development of more efficient modular designs enabling rapid assembly. These innovations are enhancing the attractiveness of prefabricated structures across various applications, contributing to the increasing adoption rates.

Propelling Factors for Indonesia Prefabricated Buildings Market Growth

The Indonesian prefabricated buildings market is experiencing significant growth propelled by several factors. Firstly, government initiatives promoting affordable housing and infrastructure development are fueling demand. Secondly, rapid urbanization is driving the need for cost-effective and fast construction solutions. Finally, technological advancements, such as improved modular designs and the use of sustainable materials, are increasing the appeal and efficiency of prefabricated construction.

Obstacles in the Indonesia Prefabricated Buildings Market

Despite the positive outlook, the market faces challenges. Supply chain disruptions and fluctuations in raw material prices can impact profitability. Furthermore, the relatively new nature of prefabricated construction in Indonesia means some regulatory hurdles and a lack of skilled labor remain to be addressed, potentially slowing market penetration.

Future Opportunities in Indonesia Prefabricated Buildings Market

Future opportunities lie in expanding into less developed regions and tapping into the growing demand for sustainable and resilient buildings. The integration of advanced technologies, such as 3D printing and BIM, along with exploring innovative materials, presents further potential for expansion. The market will also benefit from continued infrastructure investment and government support.

Major Players in the Indonesia Prefabricated Buildings Market Ecosystem

- Shandong Wiskind Architechtural Steel Co

- Teak Bali

- DTH Prefab

- Kirby Building Systems

- Bali Prefab

- PT Touchwood

- Laras Bali

- Sanwa Prefab Technology

- Karmod Prefabricated Technologies

- Prefab World Bali International

Key Developments in Indonesia Prefabricated Buildings Market Industry

- April 2022: PT. Modern Panel Indonesia's new housing project utilizing earthquake-safe precast elements showcases the growing adoption of advanced prefabrication techniques and automated production processes. This signifies a shift towards higher quality and more efficient construction methods.

- April 2022: NTT's Jakarta 3 Data Center exemplifies the use of prefabricated modular designs in large-scale commercial projects. This indicates the increasing acceptance of prefabrication for complex and demanding applications.

Strategic Indonesia Prefabricated Buildings Market Forecast

The Indonesian prefabricated buildings market is poised for sustained growth, driven by increasing urbanization, government initiatives, and technological innovation. The market is expected to experience substantial expansion in the coming years, offering significant opportunities for companies operating within the sector. The focus on sustainability and the adoption of advanced technologies will further shape market evolution.

Indonesia Prefabricated Buildings Market Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

Indonesia Prefabricated Buildings Market Segmentation By Geography

- 1. Indonesia

Indonesia Prefabricated Buildings Market Regional Market Share

Geographic Coverage of Indonesia Prefabricated Buildings Market

Indonesia Prefabricated Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Transport Infrstructure Investment

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Rising Property Prices to Increase the Adoption of Prefab Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Prefabricated Buildings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shandong Wiskind Architechtural Steel Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Teak Bali**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DTH Prefab

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kirby Building Systems

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bali Prefab

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Touchwood

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Laras Bali

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sanwa Prefab Technology

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Karmod Prefabricated Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Prefab World Bali International

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shandong Wiskind Architechtural Steel Co

List of Figures

- Figure 1: Indonesia Prefabricated Buildings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Prefabricated Buildings Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Indonesia Prefabricated Buildings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Indonesia Prefabricated Buildings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Indonesia Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Indonesia Prefabricated Buildings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Indonesia Prefabricated Buildings Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Prefabricated Buildings Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Indonesia Prefabricated Buildings Market?

Key companies in the market include Shandong Wiskind Architechtural Steel Co, Teak Bali**List Not Exhaustive, DTH Prefab, Kirby Building Systems, Bali Prefab, PT Touchwood, Laras Bali, Sanwa Prefab Technology, Karmod Prefabricated Technologies, Prefab World Bali International.

3. What are the main segments of the Indonesia Prefabricated Buildings Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Transport Infrstructure Investment.

6. What are the notable trends driving market growth?

Rising Property Prices to Increase the Adoption of Prefab Construction.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor.

8. Can you provide examples of recent developments in the market?

April 2022: PT. Modern Panel Indonesia, a subsidiary of Modernland, one of Indonesia's leading developers, announced a new housing project using tested, earthquake-safe precast elements. The prefabricated elements are produced at the company's own automated precast plant equipped by the PROGRESS GROUP. The reinforcement for the precast elements is processed more effectively and automated with the new mesh welding plant M-System BlueMesh from the leading automation machinery provider.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Prefabricated Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Prefabricated Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Prefabricated Buildings Market?

To stay informed about further developments, trends, and reports in the Indonesia Prefabricated Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence