Key Insights

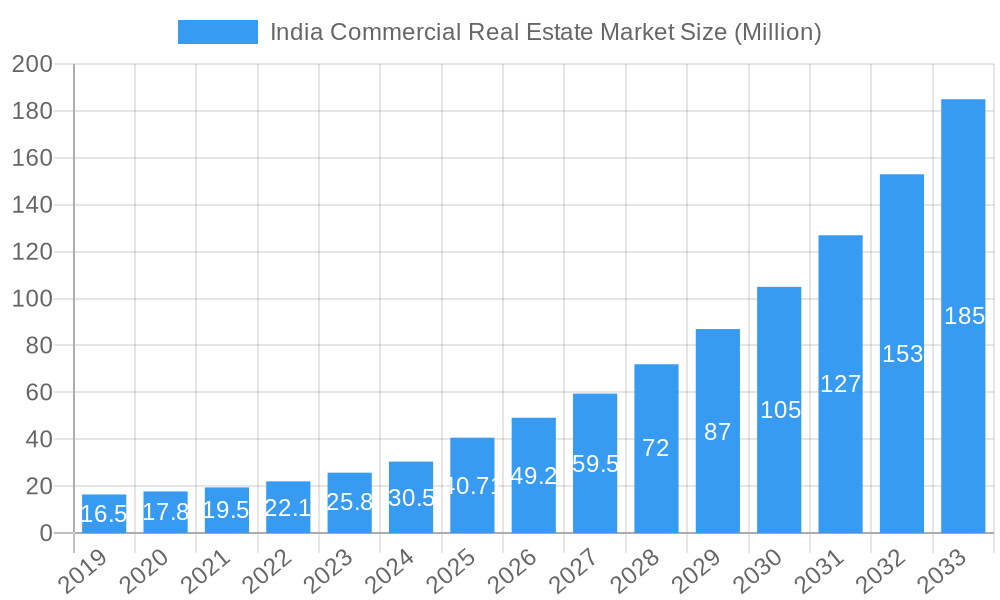

The India Commercial Real Estate Market is poised for significant expansion, with an estimated market size of USD 40.71 billion in the base year of 2025. This robust growth trajectory is further underscored by a compelling Compound Annual Growth Rate (CAGR) of 21.10%, projected to extend through the forecast period of 2025-2033. This remarkable expansion is propelled by a confluence of potent market drivers, including escalating urbanization, a burgeoning corporate sector demanding modern workspaces, and increasing foreign direct investment inflows into the country. The demand for office spaces, driven by IT/ITeS, BFSI, and startup ecosystems, remains a primary engine. Simultaneously, the retail sector is experiencing a resurgence, fueled by changing consumer preferences and the rise of organized retail. The industrial and logistics segment is witnessing unprecedented growth, directly attributable to the e-commerce boom and the government's 'Make in India' initiative, necessitating advanced warehousing and supply chain infrastructure. The hospitality sector is also recovering and expanding, supported by increased domestic and international tourism.

India Commercial Real Estate Market Market Size (In Million)

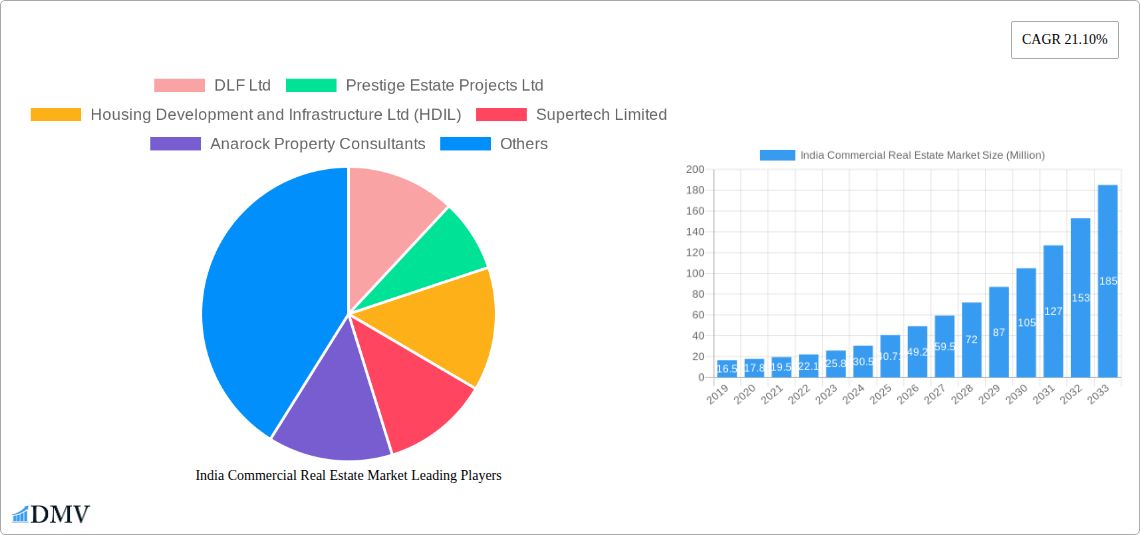

Key cities such as Mumbai, Bangalore, and Delhi are at the forefront of this commercial real estate boom, attracting substantial investment and development. However, emerging Tier-II and Tier-III cities are also presenting lucrative opportunities, as businesses decentralize and seek cost-effective operational bases. While the market is characterized by strong growth, certain restraints, such as fluctuating interest rates, regulatory complexities, and the ongoing evolution of hybrid work models, could influence the pace of expansion. Nonetheless, the overarching trend points towards sustained demand for high-quality, well-located commercial properties across diverse segments. Leading developers like DLF Ltd, Prestige Estate Projects Ltd, and Godrej Properties Ltd, alongside major real estate consultants and agencies such as JLL India, Anarock Property Consultants, and 99acres.com, are actively shaping and capitalizing on this dynamic market landscape. The market's resilience and adaptive capacity are expected to navigate these challenges, ensuring a bright future for India's commercial real estate sector.

India Commercial Real Estate Market Company Market Share

India Commercial Real Estate Market: Comprehensive Market Analysis and Future Outlook (2019–2033)

This in-depth report offers a detailed examination of the India Commercial Real Estate Market, a dynamic and rapidly evolving sector critical to the nation's economic growth. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this analysis dissects market composition, industry evolution, leading regions, product innovations, growth drivers, obstacles, and future opportunities. We provide actionable insights for investors, developers, and stakeholders seeking to navigate the complexities and capitalize on the burgeoning potential of India's commercial real estate landscape.

India Commercial Real Estate Market Market Composition & Trends

The India Commercial Real Estate Market is characterized by a moderate level of concentration, with key players like DLF Ltd, Prestige Estate Projects Ltd, and Oberoi Realty holding significant market shares. Innovation catalysts such as the adoption of smart building technologies, sustainable construction practices, and flexible office solutions are rapidly reshaping the market. The regulatory landscape, though evolving, continues to present both opportunities and challenges, with government initiatives like RERA (Real Estate (Regulation and Development) Act) aimed at enhancing transparency and investor confidence. Substitute products, including co-working spaces and the increasing trend of remote work, are influencing demand across various segments. End-user profiles are diversifying, with IT/ITeS, BFSI, and manufacturing sectors driving demand for office spaces, while e-commerce fuels growth in industrial and logistics. Mergers and Acquisitions (M&A) activities, valued at an estimated XXX Million, are expected to continue as larger entities consolidate their market positions. The market share distribution sees Offices segment leading, followed by Industrial and Logistics, Retail, and Hospitality. M&A deal values are projected to rise, driven by consolidation and strategic partnerships.

India Commercial Real Estate Market Industry Evolution

The India Commercial Real Estate Market has witnessed a remarkable growth trajectory, significantly propelled by robust economic expansion and increasing urbanization. Over the historical period (2019–2024), the market has demonstrated resilience, adapting to global economic shifts and domestic policy changes. Technological advancements have played a pivotal role in this evolution, with the integration of AI for property management, IoT for smart buildings, and advanced data analytics for market forecasting becoming commonplace. Shifting consumer demands, particularly post-pandemic, have emphasized the need for flexible, sustainable, and technologically integrated spaces. For instance, the demand for Grade A office spaces with enhanced amenities and robust digital infrastructure has surged. The Industrial and Logistics segment has experienced exponential growth, fueled by the e-commerce boom and the government's 'Make in India' initiative, with an estimated growth rate of xx% annually. The adoption of proptech solutions has been a key trend, enhancing efficiency in property development, management, and transactions, with an estimated adoption metric of xx%.

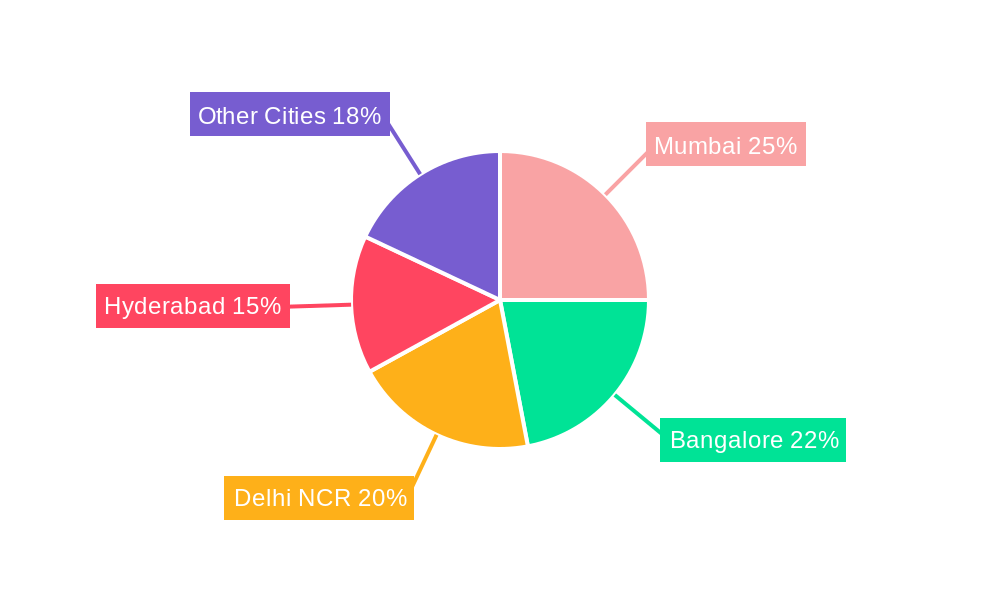

Leading Regions, Countries, or Segments in India Commercial Real Estate Market

The Offices segment stands out as the dominant force within the India Commercial Real Estate Market, driven by the nation's thriving IT/ITeS and BFSI sectors. Mumbai and Bangalore consistently emerge as the leading cities, attracting substantial investments due to their established business ecosystems, skilled talent pools, and robust infrastructure. Delhi NCR also plays a crucial role, benefiting from its status as the national capital and a major commercial hub.

- Key Drivers for Dominance in Offices:

- Investment Trends: Significant foreign direct investment (FDI) inflows into commercial office spaces, particularly in Tier-1 cities.

- Regulatory Support: Favorable government policies promoting foreign investment and ease of doing business.

- Demand from Key Industries: Sustained demand from IT/ITeS, BFSI, and burgeoning startup ecosystem requiring large office footprints.

- Infrastructure Development: Continuous improvements in transportation networks and urban amenities in leading cities.

In-depth analysis reveals that Mumbai's dominance is fueled by its financial capital status and a high concentration of corporate headquarters. Bangalore, on the other hand, leads in office space absorption due to its position as India's Silicon Valley, attracting numerous multinational corporations and startups. Hyderabad is rapidly gaining traction, offering a competitive cost structure and a growing tech industry. While Retail and Industrial/Logistics segments are experiencing robust growth, the sheer scale of demand and investment in office spaces solidifies its leading position. The Hospitality segment, though impacted by global events, is showing signs of recovery and future growth, particularly in business travel hubs.

India Commercial Real Estate Market Product Innovations

Product innovations in the India Commercial Real Estate Market are focused on enhancing sustainability, occupant well-being, and operational efficiency. The emergence of smart buildings equipped with IoT sensors for energy management and predictive maintenance is a significant trend, offering improved performance metrics. Flexible workspace solutions, including co-working and hybrid office models, are gaining traction, providing adaptability for businesses of all sizes. Green building certifications and the use of sustainable materials are becoming key differentiators, appealing to environmentally conscious corporations. Applications range from optimizing energy consumption in large office complexes to designing adaptive retail spaces that cater to evolving consumer behaviors. Unique selling propositions include reduced operational costs, enhanced employee productivity, and a reduced environmental footprint. Technological advancements are leading to the development of modular construction and prefabricated components, speeding up project delivery.

Propelling Factors for India Commercial Real Estate Market Growth

The India Commercial Real Estate Market's growth is propelled by a confluence of powerful factors. Economic Growth remains a primary driver, with a rising GDP creating a favorable environment for business expansion and consequently, office and industrial space demand. Government Initiatives such as the Smart Cities Mission and infrastructure development projects like new expressways and airports are boosting connectivity and creating new commercial hubs. Technological Advancements, particularly in proptech and construction technology, are enhancing efficiency and sustainability, attracting investment. The Growing Young Population and increasing disposable incomes contribute to demand across all commercial segments, from retail to hospitality. The "Make in India" campaign is a significant catalyst for the Industrial and Logistics sector.

Obstacles in the India Commercial Real Estate Market Market

Despite its promising outlook, the India Commercial Real Estate Market faces several obstacles. Regulatory Hurdles and bureaucratic delays in land acquisition and approvals can impede project timelines and increase costs. Supply Chain Disruptions, particularly for construction materials, can lead to price volatility and project delays. Intensified Competition among developers and a saturated market in certain micro-markets can pressure rental yields. Economic Slowdowns or global uncertainties can impact investment sentiment and tenant demand. Infrastructure Deficiencies in certain developing areas can limit their attractiveness. Labor shortages in skilled construction trades also pose a challenge.

Future Opportunities in India Commercial Real Estate Market

The India Commercial Real Estate Market is ripe with future opportunities. The Industrial and Logistics sector is poised for significant expansion, driven by the growth of e-commerce, warehousing, and manufacturing. The increasing demand for Green and Sustainable Buildings presents a substantial opportunity for developers focusing on ESG (Environmental, Social, and Governance) compliant projects. The co-working and flexible office space market is expected to continue its upward trajectory, catering to the evolving needs of businesses. Tier-2 and Tier-3 cities are emerging as new growth corridors, offering attractive investment prospects with lower entry costs and high potential returns. The "Work from Anywhere" trend might also spur demand for decentralized office hubs and smaller, well-equipped satellite offices.

Major Players in the India Commercial Real Estate Market Ecosystem

- DLF Ltd

- Prestige Estate Projects Ltd

- Housing Development and Infrastructure Ltd (HDIL)

- Supertech Limited

- Anarock Property Consultants

- 99 Acres

- Oberoi Realty

- Sulekha Properties

- Godrej Properties Ltd

- Unitech Real Estate Pvt Ltd

- Brigade Group

- JLL India

- IndiaBulls Real Estate

- RE/MAX India

- MagicBricks

- Awfis

- 3 Other Companies (Real Estate Agencies Startups Associations Etc )

Key Developments in India Commercial Real Estate Market Industry

- 2023 Q4: Launch of several Grade A office buildings in Bangalore and Hyderabad, catering to IT/ITeS demand.

- 2024 Q1: Increased investment in logistics and warehousing facilities across major consumption hubs, driven by e-commerce growth.

- 2024 Q2: Growing adoption of flexible office solutions and co-working spaces by startups and MNCs seeking agility.

- 2024 Q3: Major developers announcing plans for sustainable and green building projects to meet ESG standards.

- 2024 Q4: Increased M&A activities focused on consolidation and portfolio expansion in prime commercial markets.

- 2025 onwards: Expected surge in demand for industrial parks and manufacturing facilities due to government incentives and global supply chain diversification.

- 2025 onwards: Focus on smart city integration and development of integrated commercial and residential complexes.

Strategic India Commercial Real Estate Market Market Forecast

The strategic forecast for the India Commercial Real Estate Market anticipates sustained growth, driven by a robust economic outlook, favorable government policies, and evolving tenant demands. The Offices segment will continue to dominate, supported by the expansion of IT/ITeS and BFSI sectors, with a growing preference for flexible and ESG-compliant spaces. The Industrial and Logistics segment is projected for exceptional growth, fueled by e-commerce penetration and manufacturing initiatives. Emerging opportunities in Tier-2 and Tier-3 cities will offer diversified investment avenues. Innovations in proptech and sustainable construction will further enhance market attractiveness, promising attractive returns for astute investors and developers who can navigate the dynamic landscape.

India Commercial Real Estate Market Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial and Logistics

- 1.4. Hospitality

-

2. Key Cities

- 2.1. Mumbai

- 2.2. Bangalore

- 2.3. Delhi

- 2.4. Hyderabad

- 2.5. Other Cities

India Commercial Real Estate Market Segmentation By Geography

- 1. India

India Commercial Real Estate Market Regional Market Share

Geographic Coverage of India Commercial Real Estate Market

India Commercial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors

- 3.3. Market Restrains

- 3.3.1. Availability of Financing

- 3.4. Market Trends

- 3.4.1. Office space demand to propel the market in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial and Logistics

- 5.1.4. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Mumbai

- 5.2.2. Bangalore

- 5.2.3. Delhi

- 5.2.4. Hyderabad

- 5.2.5. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DLF Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Prestige Estate Projects Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Housing Development and Infrastructure Ltd (HDIL)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Supertech Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Anarock Property Consultants

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 99 Acres

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oberoi Realty

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sulekha Properties

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Godrej Properties Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Unitech Real Estate Pvt Ltd*6 3 Other Companies (Real Estate Agencies Startups Associations Etc )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Brigade Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 JLL India

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 IndiaBulls Real Estate

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 RE/MAX India

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 MagicBricks

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 HDIL Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Awfis

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 DLF Ltd

List of Figures

- Figure 1: India Commercial Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Commercial Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: India Commercial Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: India Commercial Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Commercial Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: India Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: India Commercial Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Commercial Real Estate Market?

The projected CAGR is approximately 21.10%.

2. Which companies are prominent players in the India Commercial Real Estate Market?

Key companies in the market include DLF Ltd, Prestige Estate Projects Ltd, Housing Development and Infrastructure Ltd (HDIL), Supertech Limited, Anarock Property Consultants, 99 Acres, Oberoi Realty, Sulekha Properties, Godrej Properties Ltd, Unitech Real Estate Pvt Ltd*6 3 Other Companies (Real Estate Agencies Startups Associations Etc ), Brigade Group, JLL India, IndiaBulls Real Estate, RE/MAX India, MagicBricks, HDIL Ltd, Awfis.

3. What are the main segments of the India Commercial Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors.

6. What are the notable trends driving market growth?

Office space demand to propel the market in India.

7. Are there any restraints impacting market growth?

Availability of Financing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Commercial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Commercial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Commercial Real Estate Market?

To stay informed about further developments, trends, and reports in the India Commercial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence