Key Insights

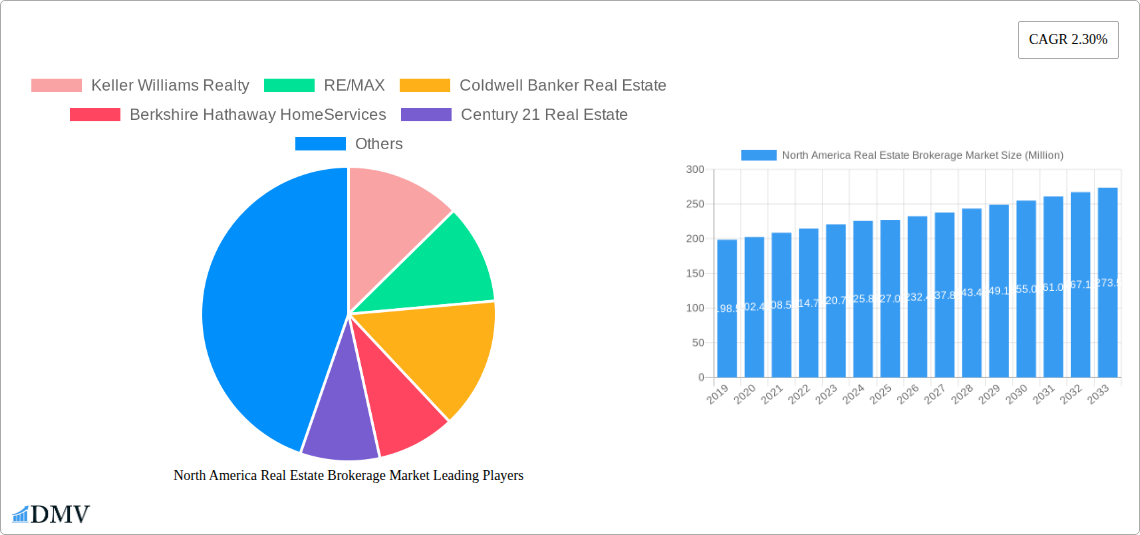

The North America Real Estate Brokerage Market is poised for steady expansion, projected to reach $227.08 million in value by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 2.30% through 2033. This growth is primarily fueled by robust economic conditions and a sustained demand for both residential and non-residential properties across the United States, Canada, and Mexico. Key drivers include increasing urbanization, which necessitates new housing and commercial spaces, alongside a growing population and evolving lifestyle preferences that continually reshape property needs. The market benefits from a dynamic environment where sales and rental services cater to diverse client requirements, from first-time homebuyers to large-scale commercial investors. Furthermore, technological advancements in real estate platforms, virtual tours, and data analytics are enhancing brokerage efficiency and customer experience, further stimulating market activity.

North America Real Estate Brokerage Market Market Size (In Million)

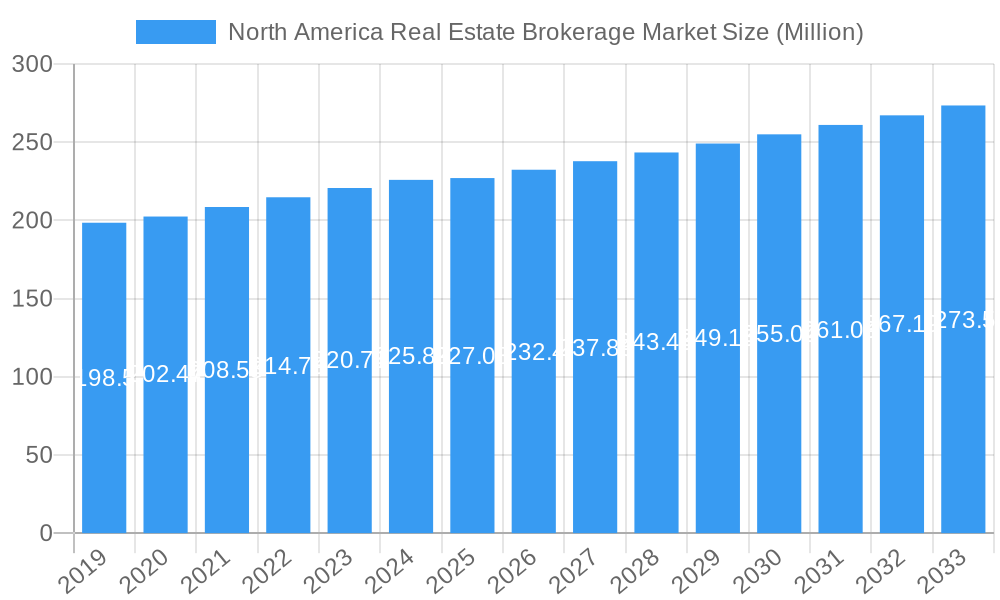

Despite the positive trajectory, the market faces certain restraints. Fluctuations in interest rates can impact affordability and, consequently, demand for property transactions. Regulatory changes within the real estate sector, while aimed at market stability, can also introduce complexities for brokerages. Nevertheless, the overall outlook remains optimistic, driven by a resilient housing market and significant investment in commercial real estate development. The brokerage sector's ability to adapt to these dynamics, leveraging innovative technologies and offering comprehensive service portfolios, will be crucial for sustained success. Leading companies such as Keller Williams Realty, RE/MAX, and Coldwell Banker Real Estate are actively shaping the competitive landscape, emphasizing strategic partnerships, agent training, and expanded service offerings to capture market share in this evolving North American real estate brokerage ecosystem.

North America Real Estate Brokerage Market Company Market Share

This in-depth report offers a definitive analysis of the North America Real Estate Brokerage Market, providing critical insights into its present state and projecting its future trajectory. Covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a comprehensive forecast period extending to 2033, this report is an essential resource for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate competitive landscapes. We meticulously examine market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future prospects, all underpinned by robust data and expert analysis.

North America Real Estate Brokerage Market Market Composition & Trends

The North America Real estate brokerage market exhibits a dynamic composition characterized by a blend of established giants and agile disruptors. Market concentration varies across geographies, with some regions dominated by a few key players, while others foster more fragmented ecosystems. Innovation is a significant catalyst, driven by technological advancements like AI-powered property matching, virtual tours, and blockchain for secure transactions, pushing the boundaries of traditional brokerage services. The regulatory landscape is diverse, with varying state and provincial laws impacting licensing, commission structures, and data privacy. Substitute products, such as direct-to-consumer online real estate platforms and iBuyers, continue to challenge traditional models, forcing brokerages to adapt and enhance their value propositions. End-user profiles are evolving, with increasing demand for personalized service, data-driven insights, and seamless digital experiences from both buyers and sellers. Mergers and acquisitions (M&A) are a constant feature, shaping market share distribution and fostering consolidation. For instance, recent M&A activities have seen prominent firms expand their geographical reach and service offerings. The market share distribution indicates a significant presence of leading companies, with their combined share projected to evolve in response to ongoing consolidation and new entrants. M&A deal values in the past year have been substantial, reflecting the strategic importance of acquiring market share and technological capabilities.

- Market Concentration: Varies significantly across regions, with notable consolidation in key metropolitan areas.

- Innovation Catalysts: AI, virtual reality tours, data analytics, and proptech solutions are reshaping service delivery.

- Regulatory Landscapes: Jurisdictional differences in licensing, disclosure requirements, and commission rules influence operations.

- Substitute Products: Online listing portals, iBuyers, and direct sales models present ongoing competition.

- End-User Profiles: Growing demand for personalized service, digital convenience, and expert guidance.

- M&A Activities: Strategic acquisitions and partnerships are prevalent, driving market consolidation and expansion.

North America Real Estate Brokerage Market Industry Evolution

The North America Real Estate Brokerage Market has undergone a profound evolution, transforming from a traditionally relationship-driven industry to a data-intensive and technology-augmented sector. Over the historical period (2019-2024), we've witnessed significant market growth trajectories fueled by a strong housing demand and an expanding agent base. Technological advancements have been the primary enablers of this transformation. The adoption of Customer Relationship Management (CRM) systems, digital marketing tools, and sophisticated property listing platforms has become standard practice for brokerages aiming to enhance efficiency and client engagement. Furthermore, the rise of proptech has introduced innovative solutions for virtual showings, property valuation, and transaction management, streamlining processes for both agents and clients. Shifting consumer demands have also played a pivotal role. Today's buyers and sellers expect instant access to information, seamless online experiences, and personalized guidance. This has pushed brokerages to invest heavily in their digital infrastructure and agent training to meet these evolving expectations. The market has seen a growth rate of approximately 7% annually in the historical period, with online engagement metrics skyrocketing as more transactions are initiated and managed digitally. Agent productivity, measured by average transaction volume per agent, has also seen an upward trend due to better tools and increased market activity. The forecast period (2025-2033) anticipates continued robust growth, with an estimated CAGR of 6.5%, driven by further technological integration and a dynamic economic environment. The shift towards hybrid models, combining in-person interactions with robust digital tools, will continue to define the industry's evolution. The increasing reliance on data analytics for market insights and personalized client strategies will also become more pronounced, differentiating leading brokerages.

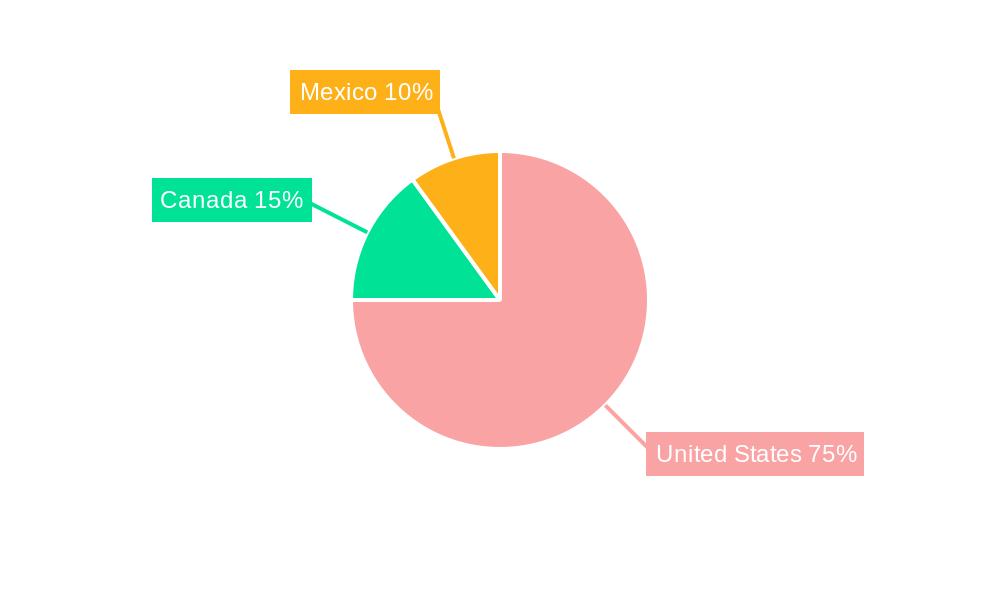

Leading Regions, Countries, or Segments in North America Real Estate Brokerage Market

The North America Real Estate Brokerage Market is profoundly influenced by regional dynamics, with the United States emerging as the dominant geography due to its sheer market size, diverse economic conditions, and robust real estate activity across residential and non-residential segments. Within the United States, major metropolitan areas consistently lead in transaction volumes and brokerage revenue. The Residential segment typically commands a larger market share than the Non-Residential segment, driven by consistent demand for housing, homeownership aspirations, and investor interest. However, the Non-Residential segment, encompassing commercial properties, industrial spaces, and land, also presents significant opportunities, particularly in booming economic hubs.

When examining the Service segment, Sales consistently outperforms Rental services in terms of overall market value and transaction volume, reflecting the primary focus of most brokerages on facilitating property transactions. However, rental services remain a crucial component, especially in densely populated urban areas and for investors seeking passive income.

Dominant Geography: United States

- Key Drivers: Large population base, significant economic output, diverse housing markets (from high-cost urban centers to suburban and rural areas), strong investment in commercial real estate, and a well-established regulatory framework for real estate transactions.

- Investment Trends: High levels of both domestic and international investment in residential and commercial properties, particularly in tech hubs and major economic centers.

- Regulatory Support: A generally favorable regulatory environment for real estate transactions, though subject to state and local variations.

Leading Segment: Residential (Type)

- Key Drivers: Strong cultural emphasis on homeownership, population growth, demographic shifts (e.g., millennials entering the housing market), and the appeal of real estate as a long-term investment.

- Market Dynamics: High transaction volumes, diverse property types (single-family homes, condos, townhouses), and a significant role for residential agents.

Dominant Service: Sales

- Key Drivers: The primary objective of most individuals and investors is property acquisition and disposition, leading to a high demand for brokerage services facilitating these transactions.

- Market Impact: Drives the majority of brokerage revenue through commissions earned on property sales.

Other Significant Geographies: Canada and Mexico also contribute substantially to the North American market. Canada's market is characterized by high property values in major cities and a stable economy. Mexico, while having a smaller market share, offers unique opportunities in tourism-driven markets and burgeoning economic centers.

North America Real Estate Brokerage Market Product Innovations

Product innovations in the North America Real Estate Brokerage Market are rapidly transforming how services are delivered and experienced. Key advancements include AI-powered property matching algorithms that personalize recommendations for buyers, saving time and increasing satisfaction. Virtual reality (VR) tours are allowing potential buyers to explore properties remotely with unprecedented realism, expanding reach and reducing the need for in-person visits. Predictive analytics tools are empowering agents with data-driven insights into market trends, pricing strategies, and potential buyer behavior. Furthermore, integrated digital platforms that streamline the entire transaction process, from initial search and offer submission to closing, are becoming standard. These innovations aim to enhance agent efficiency, improve client experience, and ultimately drive higher transaction volumes and customer loyalty. Performance metrics for these innovations show a notable increase in lead conversion rates and a reduction in time-to-close for properties marketed using advanced digital tools.

Propelling Factors for North America Real Estate Brokerage Market Growth

The North America Real Estate Brokerage Market is propelled by a confluence of powerful factors. Technological integration, including AI, VR, and advanced data analytics, is enhancing efficiency and client experience. Economic stability and favorable interest rates, where applicable, stimulate buyer demand and investor confidence. Favorable demographic trends, such as millennial entry into the housing market and a growing population, underpin consistent demand for both residential and commercial properties. Regulatory support for real estate transactions and investment, while varied, generally creates a conducive environment for market activity. Government initiatives promoting homeownership and urban development also contribute to market expansion. Furthermore, the ongoing urbanization trend in many North American cities continues to drive demand for real estate services.

Obstacles in the North America Real Estate Brokerage Market Market

Despite strong growth, the North America Real Estate Brokerage Market faces several significant obstacles. Stricter regulatory frameworks and evolving compliance requirements can increase operational costs and complexity for brokerages. Supply chain disruptions, while less direct than in manufacturing, can impact construction timelines and the availability of new properties, indirectly affecting the brokerage market. Intense competitive pressures from both traditional brokerages and emerging online platforms and iBuyers necessitate continuous innovation and investment, putting pressure on profit margins. Economic downturns and rising interest rates can dampen buyer demand and reduce transaction volumes, posing a significant challenge. Furthermore, attracting and retaining top talent in a competitive job market, alongside the need for continuous upskilling due to technological advancements, remains a persistent hurdle.

Future Opportunities in North America Real Estate Brokerage Market

The future of the North America Real Estate Brokerage Market is ripe with emerging opportunities. The increasing adoption of proptech solutions presents a significant avenue for innovation and service enhancement, creating specialized niches for tech-forward brokerages. The growing demand for sustainable and green real estate is opening new markets for eco-conscious properties and services. The expansion of emerging technologies like the metaverse could offer novel platforms for virtual property tours and transactions. Furthermore, underserved markets and demographic segments, such as the aging population and first-time homebuyers, present opportunities for tailored services and marketing strategies. The continued globalization of real estate investment also opens doors for cross-border brokerage services and expertise.

Major Players in the North America Real Estate Brokerage Market Ecosystem

- Keller Williams Realty

- RE/MAX

- Coldwell Banker Real Estate

- Berkshire Hathaway HomeServices

- Century 21 Real Estate

- Sotheby's International Realty

- ERA Real Estate

- Corcoran Group

- Compass

- Douglas Elliman Real Estate

- Real Brokerage Inc.

- Latter & Blum

(List Not Exhaustive - Includes 6 of the 3 Other Companies)

Key Developments in North America Real Estate Brokerage Market Industry

- June 2024: Real Brokerage Inc., North America's fastest-growing publicly traded real estate brokerage, reported a significant expansion, surpassing 19,000 agents after a robust month of recruitment. This development highlights the strong agent acquisition capabilities and rapid growth trajectory of agile brokerage models.

- April 2024: Compass finalized its acquisition of Latter & Blum, a prominent brokerage firm based in New Orleans. Latter & Blum, known for its strong foothold in Louisiana and other Gulf Coast metros, has now become a part of Compass. This strategic move not only solidifies Compass' presence in the region but also propels it to a significant market share, estimated at around 15% in New Orleans, demonstrating the ongoing trend of consolidation and regional expansion through M&A.

Strategic North America Real Estate Brokerage Market Market Forecast

The strategic forecast for the North America Real Estate Brokerage Market indicates sustained growth driven by continuous technological integration and evolving consumer preferences. The increasing adoption of AI, VR, and data analytics will empower brokerages to offer more personalized and efficient services, enhancing client satisfaction and transaction success rates. Favorable economic conditions, combined with demographic shifts favoring homeownership and investment, are expected to fuel demand across residential and non-residential segments. Emerging opportunities in sustainable real estate and the potential of the metaverse present new avenues for innovation and market expansion. While regulatory challenges and competitive pressures persist, strategic investments in technology and talent will be crucial for brokerages to capitalize on these opportunities, solidify market positions, and achieve robust future growth.

North America Real Estate Brokerage Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Non-Residential

-

2. Service

- 2.1. Sales

- 2.2. Rental

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Real Estate Brokerage Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Real Estate Brokerage Market Regional Market Share

Geographic Coverage of North America Real Estate Brokerage Market

North America Real Estate Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market

- 3.4. Market Trends

- 3.4.1. Industrial Rental Growth Faces Challenges Amidst Changing Dynamics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Non-Residential

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Sales

- 5.2.2. Rental

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Residential

- 6.1.2. Non-Residential

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Sales

- 6.2.2. Rental

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Residential

- 7.1.2. Non-Residential

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Sales

- 7.2.2. Rental

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Residential

- 8.1.2. Non-Residential

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Sales

- 8.2.2. Rental

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Keller Williams Realty

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 RE/MAX

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Coldwell Banker Real Estate

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Berkshire Hathaway HomeServices

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Century 21 Real Estate

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Sotheby's International Realty

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 ERA Real Estate

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Corcoran Group

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Compass

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Douglas Elliman Real Estate**List Not Exhaustive 6 3 Other Companie

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Keller Williams Realty

List of Figures

- Figure 1: Global North America Real Estate Brokerage Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global North America Real Estate Brokerage Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United States North America Real Estate Brokerage Market Revenue (Million), by Type 2025 & 2033

- Figure 4: United States North America Real Estate Brokerage Market Volume (Billion), by Type 2025 & 2033

- Figure 5: United States North America Real Estate Brokerage Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: United States North America Real Estate Brokerage Market Volume Share (%), by Type 2025 & 2033

- Figure 7: United States North America Real Estate Brokerage Market Revenue (Million), by Service 2025 & 2033

- Figure 8: United States North America Real Estate Brokerage Market Volume (Billion), by Service 2025 & 2033

- Figure 9: United States North America Real Estate Brokerage Market Revenue Share (%), by Service 2025 & 2033

- Figure 10: United States North America Real Estate Brokerage Market Volume Share (%), by Service 2025 & 2033

- Figure 11: United States North America Real Estate Brokerage Market Revenue (Million), by Geography 2025 & 2033

- Figure 12: United States North America Real Estate Brokerage Market Volume (Billion), by Geography 2025 & 2033

- Figure 13: United States North America Real Estate Brokerage Market Revenue Share (%), by Geography 2025 & 2033

- Figure 14: United States North America Real Estate Brokerage Market Volume Share (%), by Geography 2025 & 2033

- Figure 15: United States North America Real Estate Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 16: United States North America Real Estate Brokerage Market Volume (Billion), by Country 2025 & 2033

- Figure 17: United States North America Real Estate Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: United States North America Real Estate Brokerage Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Canada North America Real Estate Brokerage Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Canada North America Real Estate Brokerage Market Volume (Billion), by Type 2025 & 2033

- Figure 21: Canada North America Real Estate Brokerage Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Canada North America Real Estate Brokerage Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Canada North America Real Estate Brokerage Market Revenue (Million), by Service 2025 & 2033

- Figure 24: Canada North America Real Estate Brokerage Market Volume (Billion), by Service 2025 & 2033

- Figure 25: Canada North America Real Estate Brokerage Market Revenue Share (%), by Service 2025 & 2033

- Figure 26: Canada North America Real Estate Brokerage Market Volume Share (%), by Service 2025 & 2033

- Figure 27: Canada North America Real Estate Brokerage Market Revenue (Million), by Geography 2025 & 2033

- Figure 28: Canada North America Real Estate Brokerage Market Volume (Billion), by Geography 2025 & 2033

- Figure 29: Canada North America Real Estate Brokerage Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Canada North America Real Estate Brokerage Market Volume Share (%), by Geography 2025 & 2033

- Figure 31: Canada North America Real Estate Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Canada North America Real Estate Brokerage Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Canada North America Real Estate Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Canada North America Real Estate Brokerage Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Mexico North America Real Estate Brokerage Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Mexico North America Real Estate Brokerage Market Volume (Billion), by Type 2025 & 2033

- Figure 37: Mexico North America Real Estate Brokerage Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Mexico North America Real Estate Brokerage Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Mexico North America Real Estate Brokerage Market Revenue (Million), by Service 2025 & 2033

- Figure 40: Mexico North America Real Estate Brokerage Market Volume (Billion), by Service 2025 & 2033

- Figure 41: Mexico North America Real Estate Brokerage Market Revenue Share (%), by Service 2025 & 2033

- Figure 42: Mexico North America Real Estate Brokerage Market Volume Share (%), by Service 2025 & 2033

- Figure 43: Mexico North America Real Estate Brokerage Market Revenue (Million), by Geography 2025 & 2033

- Figure 44: Mexico North America Real Estate Brokerage Market Volume (Billion), by Geography 2025 & 2033

- Figure 45: Mexico North America Real Estate Brokerage Market Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Mexico North America Real Estate Brokerage Market Volume Share (%), by Geography 2025 & 2033

- Figure 47: Mexico North America Real Estate Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Mexico North America Real Estate Brokerage Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Mexico North America Real Estate Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Mexico North America Real Estate Brokerage Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 13: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 19: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 20: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 21: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 28: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 29: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 31: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Real Estate Brokerage Market?

The projected CAGR is approximately 2.30%.

2. Which companies are prominent players in the North America Real Estate Brokerage Market?

Key companies in the market include Keller Williams Realty, RE/MAX, Coldwell Banker Real Estate, Berkshire Hathaway HomeServices, Century 21 Real Estate, Sotheby's International Realty, ERA Real Estate, Corcoran Group, Compass, Douglas Elliman Real Estate**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the North America Real Estate Brokerage Market?

The market segments include Type, Service, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 227.08 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market.

6. What are the notable trends driving market growth?

Industrial Rental Growth Faces Challenges Amidst Changing Dynamics.

7. Are there any restraints impacting market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market.

8. Can you provide examples of recent developments in the market?

June 2024: Real Brokerage Inc., North America's fastest-growing publicly traded real estate brokerage, reported a significant expansion, surpassing 19,000 agents after a robust month of recruitment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Real Estate Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Real Estate Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Real Estate Brokerage Market?

To stay informed about further developments, trends, and reports in the North America Real Estate Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence