Key Insights

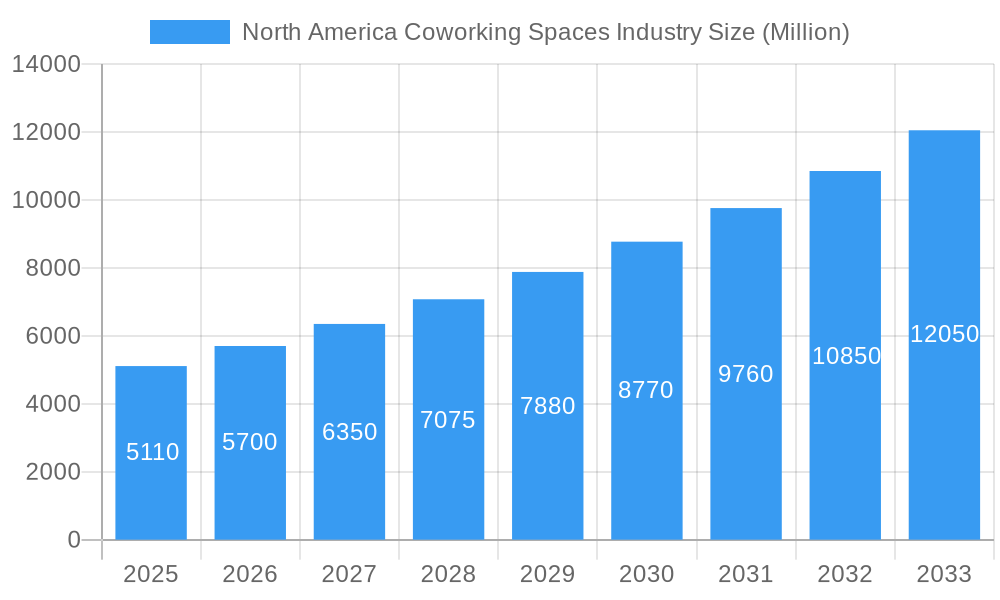

The North American coworking space industry is experiencing robust growth, projected to reach a market size of $5.11 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 11% through 2033. This expansion is driven by several key factors. The increasing popularity of remote work and the gig economy fuels demand for flexible, collaborative workspaces among independent professionals, startups, and SMEs. Large corporations are also increasingly adopting coworking spaces to expand their footprint, offer employees alternative work arrangements, and access diverse talent pools. Furthermore, the diverse business models—including sub-lease, revenue-sharing, and owner-operator models—cater to varied needs and investment capabilities, fostering market dynamism. The industry's segmentation across business types (new spaces, expansions, chains), end-users, and geographic regions within North America (United States, Canada, Mexico) further contributes to its growth trajectory. Competition amongst established players like WeWork, Regus, and Industrious, alongside the emergence of smaller, niche providers, ensures continuous innovation and service enhancement. The ongoing trend of incorporating amenities like high-speed internet, meeting rooms, and community events also enhances the appeal of coworking spaces, strengthening the market's overall growth prospects.

North America Coworking Spaces Industry Market Size (In Billion)

The North American market is geographically diverse, with the United States forming the largest segment, followed by Canada and Mexico. Future growth will likely be influenced by economic conditions, technological advancements (e.g., improved virtual collaboration tools), and evolving workplace preferences. Potential restraints could include fluctuations in commercial real estate prices, competition from alternative work arrangements (e.g., home offices), and the potential impact of economic downturns on business expansion plans. However, the overall outlook remains positive, indicating significant opportunities for growth and investment in the coworking space sector throughout the forecast period (2025-2033). The industry's adaptability to changing market dynamics and its capacity to offer flexible solutions position it for continued success in the long term.

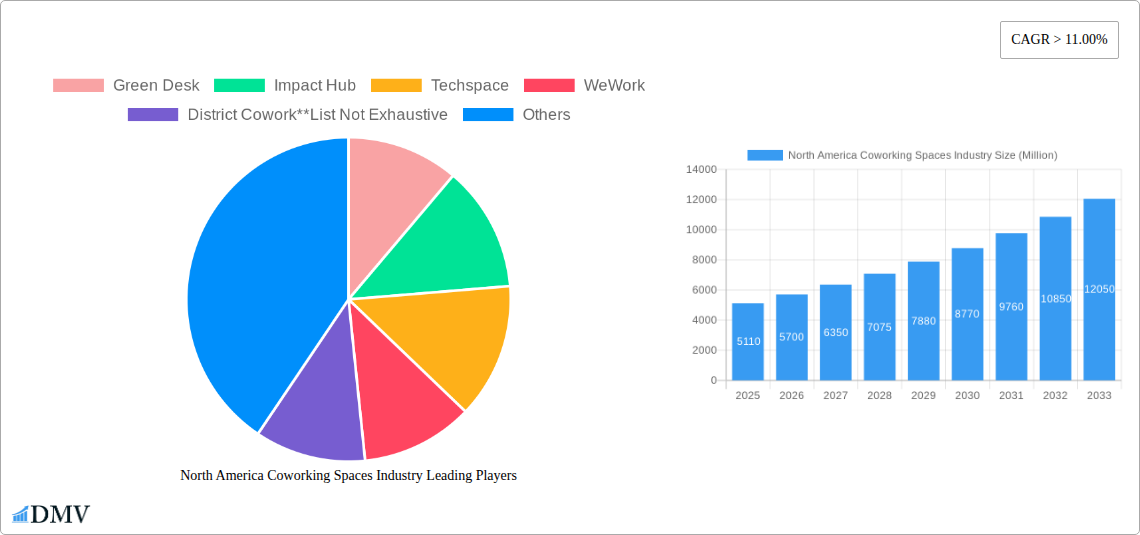

North America Coworking Spaces Industry Company Market Share

North America Coworking Spaces Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North American coworking spaces industry, encompassing market size, trends, key players, and future growth projections from 2019 to 2033. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). This report is crucial for stakeholders seeking to understand the dynamics of this rapidly evolving market and make informed strategic decisions. The total market value in 2025 is estimated at $XX Million.

North America Coworking Spaces Industry Market Composition & Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics of the North American coworking spaces industry. We delve into market concentration, examining the market share distribution among major players like WeWork, Regus Coworking, Industrious Office, and others. The report also explores the impact of mergers and acquisitions (M&A) activities, including deal values and their implications on market structure. Innovation catalysts, such as technological advancements in workspace management and flexible lease agreements, are thoroughly examined. Furthermore, the report assesses the regulatory landscape's influence on market growth and explores substitute products and services affecting the industry. End-user profiles, including independent professionals, startups, SMEs, and large corporations, are analyzed to identify their specific needs and preferences.

- Market Concentration: WeWork holds an estimated XX% market share in 2025, followed by Regus Coworking with XX% and Industrious Office with XX%. The remaining market share is fragmented among numerous smaller operators.

- M&A Activity: The report details XX major M&A deals within the period, with a total estimated value of $XX Million. These deals significantly impacted market consolidation and competitive dynamics.

- Innovation Catalysts: The increasing adoption of smart building technologies and flexible workspace solutions are key drivers of innovation.

- Regulatory Landscape: Varying regulations across different states and provinces influence the industry's growth trajectory.

- Substitute Products: Traditional office spaces and virtual offices remain key substitute products.

North America Coworking Spaces Industry Industry Evolution

This section examines the evolution of the North American coworking spaces industry, tracing its growth trajectory from 2019 to 2033. We analyze factors influencing market expansion, including technological advancements in workspace design and management systems, and evolving consumer preferences for flexible work arrangements. The report provides detailed data on growth rates, market size, and adoption metrics for various segments. The industry experienced a XX% CAGR between 2019 and 2024, with projections indicating a XX% CAGR between 2025 and 2033, reaching a projected market size of $XX Million by 2033. The shift in work culture towards remote and hybrid models significantly boosted the industry's growth. Increased demand for flexible and collaborative workspaces from startups, SMEs, and large corporations fuelled the expansion. Technological advancements like smart office solutions and booking platforms have enhanced efficiency and user experience.

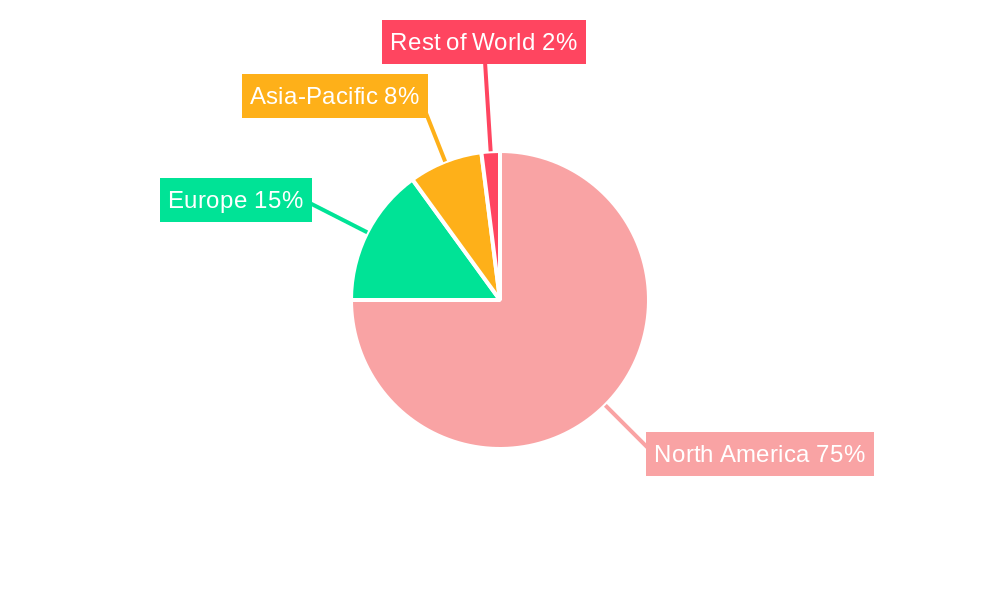

Leading Regions, Countries, or Segments in North America Coworking Spaces Industry

This section identifies the leading regions, countries, and segments within the North American coworking spaces industry. We analyze factors contributing to the dominance of specific segments by business type (new spaces, expansions, chains), business model (sub-lease, revenue sharing, owner-operator), end-user (independent professionals, startups, SMEs, large corporations), and country (United States, Canada, Mexico).

- By Country: The United States is the dominant market, accounting for approximately XX% of the total market value in 2025, followed by Canada (XX%) and Mexico (XX%).

- By Business Type: Chains dominate the market, with XX% market share in 2025, followed by expansions (XX%) and new spaces (XX%).

- By Business Model: The revenue-sharing model is prevalent, holding approximately XX% market share. This model offers balanced risk and reward for operators and landlords.

- By End-User: SMEs form the largest segment of end-users, followed by independent professionals and startup teams. Large scale corporations' adoption is also increasing.

Key Drivers: High levels of venture capital investment in the US and Canada, supportive government policies promoting entrepreneurship and flexible work arrangements, and a growing preference for collaborative work environments are key drivers of growth in these markets.

North America Coworking Spaces Industry Product Innovations

The coworking spaces industry constantly evolves, introducing new products and services to cater to evolving needs. Innovations include smart building technologies that optimize energy usage and enhance security, advanced booking systems improving space utilization, and personalized workspace solutions tailored to diverse user requirements. The integration of collaborative tools and virtual office features is further enhancing the user experience. These innovations offer unique selling propositions such as increased efficiency, improved productivity, and flexible workspace configurations.

Propelling Factors for North America Coworking Spaces Industry Growth

Several factors contribute to the growth of the North American coworking spaces industry. Technological advancements, such as improved workspace management software and virtual office integration, enhance efficiency and attract users. Economic factors, including the rise of the gig economy and the increasing popularity of remote work, fuel demand for flexible workspace solutions. Supportive regulatory environments in some regions encourage the development of coworking spaces by providing tax incentives or simplifying licensing procedures. For instance, certain cities offer tax breaks to businesses that lease space in designated areas, stimulating development.

Obstacles in the North America Coworking Spaces Industry Market

Despite significant growth, the industry faces challenges. Stringent regulations in some regions increase operational costs and limit expansion. Supply chain disruptions can affect the timely delivery of furniture and equipment, delaying project completion. Intense competition among established players and new entrants puts pressure on pricing and profitability. The overall economic climate and fluctuating real estate costs significantly impact operational expenses and profitability. For instance, a sudden increase in rental rates could severely impact the cost-effectiveness of running a coworking space.

Future Opportunities in North America Coworking Spaces Industry

The future holds substantial opportunities for the North American coworking spaces industry. Expansion into underserved markets, particularly in smaller cities and suburban areas, offers significant potential for growth. Integrating advanced technologies, such as AI-powered workspace management and virtual reality tours, will enhance user experience and attract new customers. Catering to niche markets, like specific industries or remote work teams, allows operators to differentiate their offerings and capture a targeted customer segment.

Major Players in the North America Coworking Spaces Industry Ecosystem

- Green Desk

- Impact Hub

- Techspace

- WeWork

- District Cowork

- Serendipity Labs

- Regus Coworking

- Mix Pace

- Industrious Office

- Knotel

Key Developments in North America Coworking Spaces Industry Industry

- June 2022: IWG plans to add 500-700 new flexible office spaces in the US within 12 months, expanding its reach and strengthening its market position. This demonstrates significant investment and confidence in the US market.

- November 2022: Knotel's lease of 23,700 square feet in Coral Gables, Florida, indicates continued expansion and investment in high-demand locations. This signifies confidence in the long-term viability of the coworking model and its appeal to businesses.

Strategic North America Coworking Spaces Industry Market Forecast

The North American coworking spaces industry is poised for continued growth, driven by technological advancements, evolving work styles, and increasing demand for flexible workspaces. The market's expansion into underserved regions, coupled with the adoption of innovative technologies, will unlock new growth avenues. The strategic focus on providing tailored workspace solutions to diverse customer segments, along with enhancing the overall user experience, will solidify the industry's position in the evolving workspace landscape. The industry is projected to reach $XX Million by 2033, showcasing remarkable potential for both existing players and new entrants.

North America Coworking Spaces Industry Segmentation

-

1. Business Type

- 1.1. New Spaces

- 1.2. Expansions

- 1.3. Chains

-

2. Business Model

- 2.1. Sub-lease Model

- 2.2. Revenue Sharing Model

- 2.3. Owner-Operator Model

-

3. End User

- 3.1. Independent Professionals (Freelancers)

- 3.2. Startup Teams

- 3.3. Small to Medium Sized Enterprises (SMEs)

- 3.4. Large Scale Corporations

North America Coworking Spaces Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Coworking Spaces Industry Regional Market Share

Geographic Coverage of North America Coworking Spaces Industry

North America Coworking Spaces Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 11.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing demand for flexible office spaces; Surge in investments in niche co-working spaces such as women-only spaces

- 3.2.2 LGBTQ+ spaces

- 3.2.3 and other social groups

- 3.3. Market Restrains

- 3.3.1. Low Awareness and Privacy Issues

- 3.4. Market Trends

- 3.4.1. Increasing number of Startups Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Coworking Spaces Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Business Type

- 5.1.1. New Spaces

- 5.1.2. Expansions

- 5.1.3. Chains

- 5.2. Market Analysis, Insights and Forecast - by Business Model

- 5.2.1. Sub-lease Model

- 5.2.2. Revenue Sharing Model

- 5.2.3. Owner-Operator Model

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Independent Professionals (Freelancers)

- 5.3.2. Startup Teams

- 5.3.3. Small to Medium Sized Enterprises (SMEs)

- 5.3.4. Large Scale Corporations

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Business Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Green Desk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Impact Hub

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Techspace

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WeWork

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 District Cowork**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Serendipity Labs

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Regus Coworking

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mix Pace

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Industrious Office

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Knotel

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Green Desk

List of Figures

- Figure 1: North America Coworking Spaces Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Coworking Spaces Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Coworking Spaces Industry Revenue Million Forecast, by Business Type 2020 & 2033

- Table 2: North America Coworking Spaces Industry Revenue Million Forecast, by Business Model 2020 & 2033

- Table 3: North America Coworking Spaces Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: North America Coworking Spaces Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Coworking Spaces Industry Revenue Million Forecast, by Business Type 2020 & 2033

- Table 6: North America Coworking Spaces Industry Revenue Million Forecast, by Business Model 2020 & 2033

- Table 7: North America Coworking Spaces Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: North America Coworking Spaces Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Coworking Spaces Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Coworking Spaces Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Coworking Spaces Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Coworking Spaces Industry?

The projected CAGR is approximately > 11.00%.

2. Which companies are prominent players in the North America Coworking Spaces Industry?

Key companies in the market include Green Desk, Impact Hub, Techspace, WeWork, District Cowork**List Not Exhaustive, Serendipity Labs, Regus Coworking, Mix Pace, Industrious Office, Knotel.

3. What are the main segments of the North America Coworking Spaces Industry?

The market segments include Business Type, Business Model, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for flexible office spaces; Surge in investments in niche co-working spaces such as women-only spaces. LGBTQ+ spaces. and other social groups.

6. What are the notable trends driving market growth?

Increasing number of Startups Boosting the Market.

7. Are there any restraints impacting market growth?

Low Awareness and Privacy Issues.

8. Can you provide examples of recent developments in the market?

November 2022: The Newmark-owned firm Knotel secured a long-term lease for 23,700 square feet at Ofizzina, a Coral Gables, Florida, office condo project. Knotel intends to finish three complete stories of the 16-story skyscraper at 1200 Ponce De Leon Boulevard. TSG Group and BF Group created Offizina, which comprises 60 office condominiums.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Coworking Spaces Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Coworking Spaces Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Coworking Spaces Industry?

To stay informed about further developments, trends, and reports in the North America Coworking Spaces Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence