Key Insights

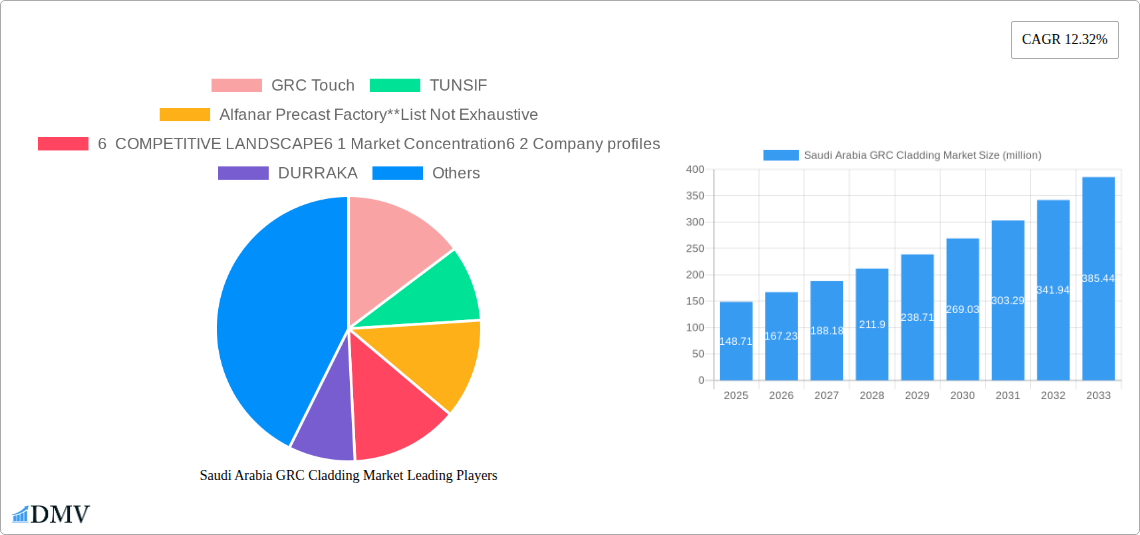

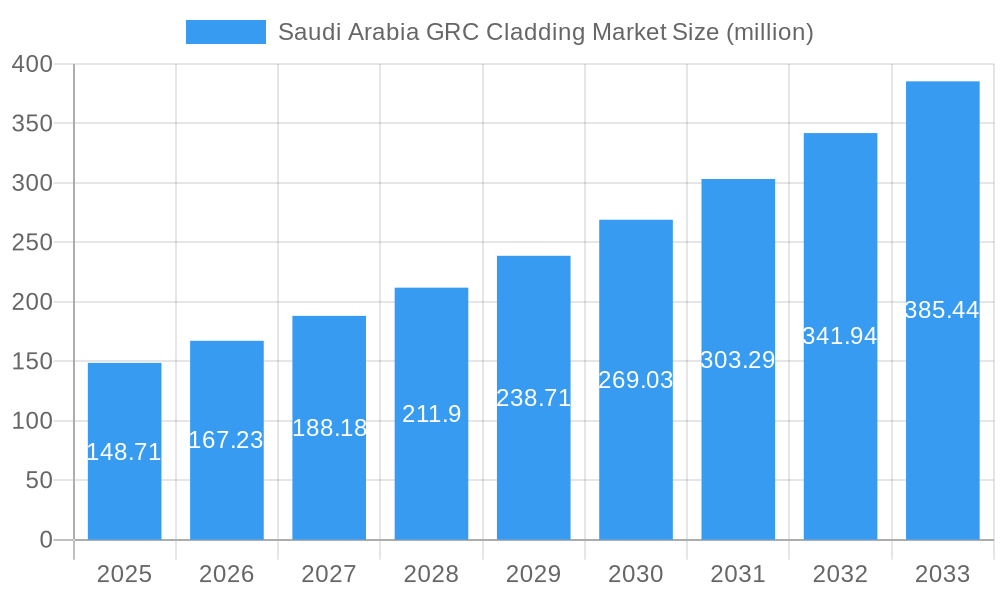

The Saudi Arabian Glassfiber Reinforced Concrete (GRC) Cladding market is poised for significant expansion, driven by increasing demand in both commercial and residential construction sectors, alongside vital infrastructure projects. With a projected market size of 148.71 million in 2025, the market is anticipated to experience robust growth, underpinned by a Compound Annual Growth Rate (CAGR) of 12.32% through 2033. This impressive trajectory is fueled by several key drivers, including the growing adoption of sustainable building materials, the aesthetic versatility of GRC, and its inherent durability and weather resistance. The Saudi government's ambitious Vision 2030 initiative, which emphasizes large-scale urban development and the construction of new cities and infrastructure, acts as a primary catalyst for this surge in GRC cladding demand. Furthermore, the increasing preference for lightweight and high-performance building materials over traditional options further bolsters the market's prospects.

Saudi Arabia GRC Cladding Market Market Size (In Million)

The market is segmented into distinct processes, with Spray, Premix, and Hybrid techniques catering to varied application needs. Applications span Commercial Construction, Residential Construction, and Civil and Other Infrastructure Construction, highlighting the broad utility of GRC cladding. Emerging trends such as advancements in GRC formulations for enhanced performance and customizability, coupled with a growing emphasis on prefabrication and modular construction, are shaping the market landscape. While the market demonstrates strong growth potential, certain restraints, such as initial cost perceptions compared to conventional materials and the need for specialized installation expertise, could pose challenges. However, the long-term benefits of GRC, including reduced maintenance and enhanced structural integrity, are increasingly recognized, positioning the Saudi Arabian GRC Cladding market for sustained and dynamic evolution.

Saudi Arabia GRC Cladding Market Company Market Share

This in-depth report offers a strategic analysis of the Saudi Arabia GRC cladding market, a rapidly evolving sector driven by ambitious infrastructure development and architectural innovation. With a study period spanning from 2019 to 2033, including a base year of 2025, estimated year of 2025, and a robust forecast period from 2025 to 2033, this report provides critical insights for stakeholders seeking to capitalize on market opportunities. We meticulously examine Glass Fibre Reinforced Concrete (GRC) cladding trends, market dynamics, and future projections within the Kingdom.

Saudi Arabia GRC Cladding Market Market Composition & Trends

The Saudi Arabia GRC cladding market is characterized by a moderate level of market concentration, with key players vying for dominance. Innovations in GRC manufacturing processes, particularly advancements in spray, premix, and hybrid techniques, are pivotal in driving market growth. The regulatory landscape, while evolving, increasingly supports sustainable building materials like GRC, aligning with the Kingdom's Vision 2030 objectives. Substitute products, such as traditional concrete and stone cladding, face stiff competition from the superior performance and aesthetic versatility of GRC. End-user profiles are diverse, encompassing major stakeholders in commercial construction, residential construction, and civil and other infrastructure construction. Mergers and acquisitions (M&A) are anticipated to shape the competitive landscape further, with estimated deal values in the tens to hundreds of millions. The market is poised for significant expansion, driven by a growing demand for durable, aesthetically pleasing, and sustainable building solutions.

- Market Share Distribution: Detailed analysis of leading GRC manufacturers' market share will be provided.

- M&A Activity: Insights into recent and potential future M&A transactions and their strategic implications.

- Regulatory Impact: Evaluation of building codes and environmental regulations influencing GRC adoption.

Saudi Arabia GRC Cladding Market Industry Evolution

The Saudi Arabia GRC cladding market has witnessed a remarkable evolution, driven by a confluence of economic diversification initiatives, technological advancements, and a burgeoning demand for modern architectural solutions. Over the historical period from 2019-2024, the market has transitioned from a niche segment to a significant contributor to the Kingdom's construction output. This growth trajectory is fueled by increased investments in large-scale infrastructure projects, including mega-cities, transportation networks, and hospitality developments, all of which necessitate high-performance and aesthetically appealing building materials. Technological advancements in GRC manufacturing processes have played a crucial role. The refinement of spray, premix, and hybrid production methods has led to enhanced material properties, including increased strength-to-weight ratios, improved durability, and greater design flexibility. This allows architects and developers to achieve complex forms and intricate details previously unachievable with conventional materials.

Shifting consumer demands, particularly a growing preference for sustainable and eco-friendly construction practices, have further propelled the adoption of GRC. Its low embodied energy and long lifespan contribute to a reduced environmental footprint, aligning with Saudi Arabia's commitment to sustainability under Vision 2030. The base year of 2025 marks a pivotal point, with projected market growth rates expected to accelerate in the coming years. Adoption metrics indicate a steady increase in GRC's market penetration across various construction segments. For instance, the demand for lightweight, precast GRC elements is on the rise, facilitating faster construction timelines and reducing labor costs. The integration of advanced additives and reinforcement fibers further enhances GRC's performance, offering superior resistance to harsh climatic conditions prevalent in Saudi Arabia. The overall industry evolution points towards a robust and expanding market, increasingly recognized for its versatility, performance, and sustainability credentials.

Leading Regions, Countries, or Segments in Saudi Arabia GRC Cladding Market

The Saudi Arabia GRC cladding market is currently experiencing its most significant growth and adoption within the Commercial Construction application segment. This dominance is driven by a confluence of factors, including substantial government investment in large-scale commercial projects, the development of new business hubs, and the expansion of the hospitality sector. The Kingdom's ambitious Vision 2030 plan actively promotes the development of commercial infrastructure, creating a fertile ground for GRC cladding solutions that offer both aesthetic appeal and functional performance.

- Commercial Construction Dominance:

- Key Drivers: Massive government spending on economic diversification projects, including entertainment venues, retail complexes, and corporate headquarters. The development of smart cities and new urban centers further fuels demand for innovative façade solutions.

- GRC Advantages: GRC's ability to create complex, custom architectural designs is highly sought after in commercial projects aiming for iconic structures and distinct brand identities. Its lightweight nature facilitates faster installation on high-rise buildings, reducing construction time and associated costs.

- Investment Trends: Significant foreign and domestic investments are flowing into the commercial real estate sector, directly impacting the demand for premium cladding materials like GRC.

- Regulatory Support: Favorable building regulations that encourage the use of modern, durable, and aesthetically versatile materials support the widespread adoption of GRC in commercial developments.

Beyond commercial construction, the Residential Construction segment is also demonstrating robust growth, albeit with a slightly lower market share. The increasing urbanization and a growing middle-class population are driving demand for new housing units. GRC's suitability for creating attractive and durable residential facades, including decorative elements and precast panels, makes it an increasingly popular choice. Furthermore, the Civil and Other Infrastructure Construction segment, while a smaller but growing contributor, is witnessing the application of GRC in areas such as bridges, tunnels, and utility structures, leveraging its durability and resistance to environmental factors. The spray process, in particular, remains a dominant manufacturing method due to its cost-effectiveness and versatility in producing a wide range of GRC components for these diverse applications.

Saudi Arabia GRC Cladding Market Product Innovations

Saudi Arabia's GRC cladding market is witnessing a surge in product innovations centered around enhanced durability, aesthetic customization, and sustainable performance. Manufacturers are developing GRC formulations with advanced fiber reinforcement and innovative admixtures to achieve superior strength, impact resistance, and thermal insulation properties, crucial for the Kingdom's climate. The development of intricate mold technologies allows for the creation of highly detailed and bespoke façade elements, ranging from sophisticated architectural panels to decorative features, enabling architects to realize visionary designs. Innovations also extend to improved manufacturing processes, leading to lighter yet stronger GRC products and more efficient production cycles. The focus on eco-friendly materials and manufacturing practices is also a key differentiator, with an increasing emphasis on recycled content and reduced energy consumption during production.

Propelling Factors for Saudi Arabia GRC Cladding Market Growth

The Saudi Arabia GRC cladding market is propelled by a confluence of powerful growth catalysts, predominantly driven by the Kingdom's ambitious Vision 2030 economic diversification strategy. This national agenda is spearheading massive investments in infrastructure development, urban regeneration, and the creation of new mega-projects, all of which require substantial quantities of advanced building materials. GRC cladding, with its inherent durability, aesthetic versatility, and fire-resistant properties, is perfectly positioned to meet the demands of these large-scale undertakings. Furthermore, a growing awareness and emphasis on sustainable construction practices are increasingly favoring GRC due to its eco-friendly attributes and long lifespan. Technological advancements in GRC manufacturing, leading to improved product performance and design flexibility, are also significantly contributing to its adoption.

Obstacles in the Saudi Arabia GRC Cladding Market Market

Despite its strong growth trajectory, the Saudi Arabia GRC cladding market faces certain obstacles. High initial capital investment for advanced GRC manufacturing facilities can be a barrier to entry for smaller players. Furthermore, the availability of skilled labor for specialized GRC production and installation requires continuous development. Supply chain disruptions, though not unique to GRC, can impact project timelines and costs. Competitive pricing from alternative cladding materials also poses a challenge, requiring GRC manufacturers to consistently emphasize the long-term value proposition of their products. Regulatory adherence and the need for consistent quality control across various projects also demand rigorous attention.

Future Opportunities in Saudi Arabia GRC Cladding Market

The Saudi Arabia GRC cladding market is ripe with future opportunities. The continued expansion of tourism infrastructure, including hotels and entertainment resorts, presents a significant avenue for GRC adoption due to its aesthetic appeal and customizability. The increasing focus on retrofitting and renovating existing structures offers another substantial market segment. Furthermore, the development of prefabricated GRC components for rapid construction is a growing trend that promises to unlock further market potential. Innovations in smart GRC, incorporating energy-harvesting or sensor capabilities, could also emerge as a disruptive force.

Major Players in the Saudi Arabia GRC Cladding Market Ecosystem

- GRC Touch

- TUNSIF

- Alfanar Precast Factory (List Not Exhaustive)

- DURRAKA

- PETRACO

- Station Contracting Co Ltd

- Arabian Tile Company

- ARTIC

- Albitar Factory Co

- Acementiat Factory

Key Developments in Saudi Arabia GRC Cladding Market Industry

- December 2022: The Makkah Mayoralty commenced short-term repairs on the Makkah Gate (also known as the Qur'an Gate), a significant landmark on the Makkah-Jeddah Expressway. This development highlights the ongoing maintenance and upgrading of vital infrastructure, where GRC's durability and aesthetic qualities are often considered.

- February 2022: Fibrex Construction Group, a full member of the GRCA, secured a contract for villa development at Aldar's Noya. Aldar Properties announced awarding contracts exceeding AED8.5 billion (USD2.3 billion) across Abu Dhabi. This signifies major construction activity in the region, underscoring the demand for advanced construction materials like GRC in large-scale residential projects.

Strategic Saudi Arabia GRC Cladding Market Market Forecast

The Saudi Arabia GRC cladding market is projected for significant and sustained growth, driven by the Kingdom's aggressive infrastructure development agenda and its commitment to economic diversification under Vision 2030. The increasing demand for visually appealing, durable, and sustainable building materials will continue to favor GRC. Advancements in manufacturing technologies, coupled with growing market awareness of GRC's superior performance characteristics, will further bolster its adoption across commercial, residential, and civil construction sectors. Strategic investments in research and development, along with potential collaborations and expansions by key market players, will be crucial in capitalizing on the burgeoning opportunities and solidifying GRC's position as a leading cladding solution in Saudi Arabia.

Saudi Arabia GRC Cladding Market Segmentation

-

1. Process

- 1.1. Spray

- 1.2. Premix

- 1.3. Hybrid

-

2. Application

- 2.1. Commercial Construction

- 2.2. Residential Construction

- 2.3. Civil and Other Infrastructure Construction

Saudi Arabia GRC Cladding Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia GRC Cladding Market Regional Market Share

Geographic Coverage of Saudi Arabia GRC Cladding Market

Saudi Arabia GRC Cladding Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio

- 3.3. Market Restrains

- 3.3.1. Lack of awareness of senior living options; Relatively small size of senior living population

- 3.4. Market Trends

- 3.4.1. Increasing Construction Spending in Saudi

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia GRC Cladding Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Spray

- 5.1.2. Premix

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Construction

- 5.2.2. Residential Construction

- 5.2.3. Civil and Other Infrastructure Construction

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GRC Touch

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TUNSIF

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alfanar Precast Factory**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DURRAKA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PETRACO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Station Contracting Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arabian Tile Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ARTIC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Albitar Factory Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Acementiat Factory

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 GRC Touch

List of Figures

- Figure 1: Saudi Arabia GRC Cladding Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia GRC Cladding Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia GRC Cladding Market Revenue million Forecast, by Process 2020 & 2033

- Table 2: Saudi Arabia GRC Cladding Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Saudi Arabia GRC Cladding Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia GRC Cladding Market Revenue million Forecast, by Process 2020 & 2033

- Table 5: Saudi Arabia GRC Cladding Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Saudi Arabia GRC Cladding Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia GRC Cladding Market?

The projected CAGR is approximately 12.32%.

2. Which companies are prominent players in the Saudi Arabia GRC Cladding Market?

Key companies in the market include GRC Touch, TUNSIF, Alfanar Precast Factory**List Not Exhaustive, 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles, DURRAKA, PETRACO, Station Contracting Co Ltd, Arabian Tile Company, ARTIC, Albitar Factory Co, Acementiat Factory.

3. What are the main segments of the Saudi Arabia GRC Cladding Market?

The market segments include Process, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 148.71 million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio.

6. What are the notable trends driving market growth?

Increasing Construction Spending in Saudi.

7. Are there any restraints impacting market growth?

Lack of awareness of senior living options; Relatively small size of senior living population.

8. Can you provide examples of recent developments in the market?

December 2022: On the imposing-looking Makkah Gate, which is situated on the Makkah-Jeddah Expressway, the Makkah Mayoralty has started performing short-term repairs. The Makkah Gate also referred to as the Qur'an Gate, is a monumental archway at the entry to Makkah from the Jeddah side and is located 27 kilometers from the Grand Mosque within the Haram border.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia GRC Cladding Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia GRC Cladding Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia GRC Cladding Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia GRC Cladding Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence