Key Insights

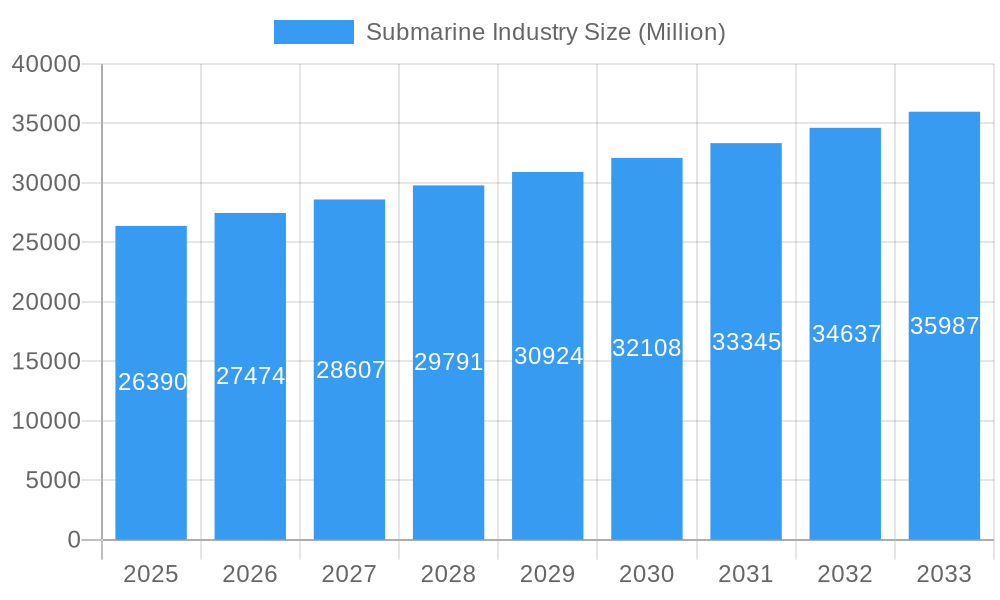

The global submarine market is poised for robust expansion, projected to reach a substantial $26.39 billion by 2025, driven by an estimated Compound Annual Growth Rate (CAGR) of 4.17% through 2033. This significant growth is propelled by escalating geopolitical tensions, a heightened focus on maritime security, and the increasing need for advanced underwater capabilities among navies worldwide. Nations are prioritizing the modernization of their fleets to counter emerging threats, enhance strategic deterrence, and maintain underwater superiority. Key growth drivers include significant investments in indigenous defense manufacturing, the development of next-generation submarine technologies such as advanced sonar systems, stealth capabilities, and unmanned underwater vehicles (UUVs), and the ongoing replacement of aging submarine fleets with more capable platforms. The demand for both conventional and nuclear-powered submarines is expected to remain strong, catering to diverse operational requirements and strategic doctrines of various countries.

Submarine Industry Market Size (In Billion)

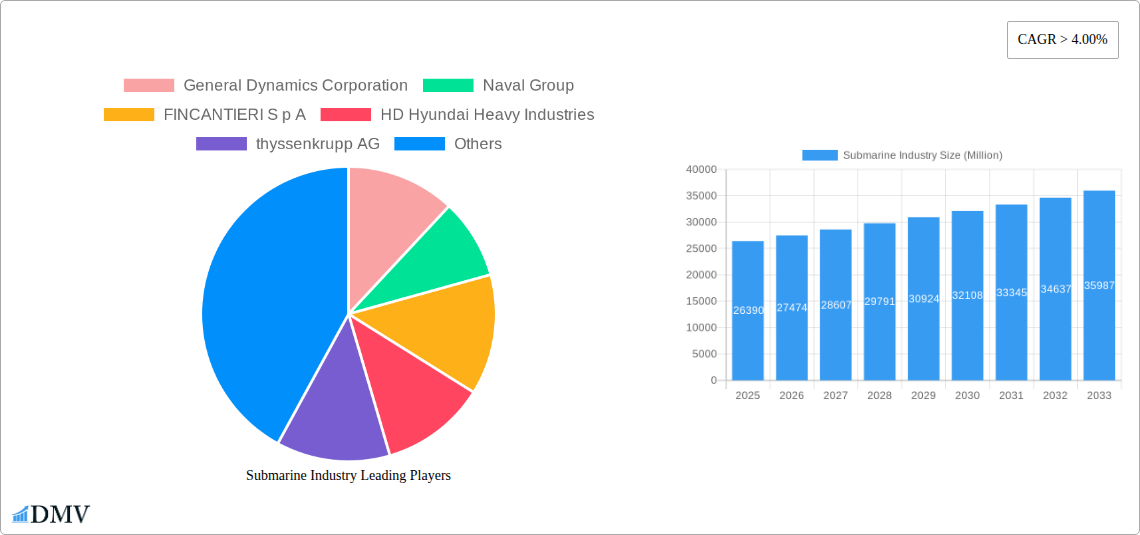

The competitive landscape of the submarine industry is characterized by a concentration of highly specialized and technologically advanced players. Major companies like General Dynamics Corporation, Naval Group, and Huntington Ingalls Industries are at the forefront, investing heavily in research and development to maintain their technological edge. Emerging market trends include a surge in demand for non-nuclear submarines equipped with Air-Independent Propulsion (AIP) systems, offering extended submerged endurance, and the growing integration of artificial intelligence and data analytics for enhanced situational awareness and operational efficiency. However, the market also faces restraints such as the substantial capital investment required for submarine acquisition and maintenance, stringent regulatory frameworks, and the long lead times inherent in complex defense procurement processes. Despite these challenges, the pervasive need for robust underwater defense infrastructure ensures a sustained upward trajectory for the global submarine market.

Submarine Industry Company Market Share

This comprehensive report delves into the global Submarine Industry, providing an in-depth analysis of its current landscape and future trajectory. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this research offers invaluable insights into submarine market share, underwater defense systems, and naval technology advancements. We meticulously examine submarine production analysis, consumption patterns, global submarine imports and exports (value & volume), and submarine price trends. This report is essential for stakeholders seeking to understand market concentration, innovation drivers, regulatory impacts, and the evolving competitive environment within the multi-billion dollar submarine sector.

Submarine Industry Market Composition & Trends

The Submarine Industry is characterized by a concentrated market, with a few dominant players controlling a significant portion of global submarine sales and naval shipbuilding contracts. Innovation is heavily driven by defense spending, geopolitical tensions, and the relentless pursuit of advanced underwater combat capabilities. Regulatory landscapes are stringent, prioritizing national security and technological sovereignty, influencing defense procurement processes and submarine technology development. Substitute products, while limited in the military sphere, can include advanced unmanned underwater vehicles (UUVs) and sophisticated sonar systems for specific surveillance roles. End-user profiles are predominantly national navies, demanding robust, technologically superior, and long-lifecycle submersible vessels. Mergers and Acquisitions (M&A) activities are significant, with deal values often reaching billions of dollars, as major corporations consolidate their market positions and expand their technological portfolios. For instance, recent M&A activities in the defense sector, which often include naval capabilities, have seen transactions exceeding $5 billion, reflecting the strategic importance and consolidation trends within the global defense industry.

- Market Share Distribution: Dominated by key players, with top 5 companies holding over 70% of the market.

- Innovation Catalysts: Geopolitical instability, technological arms race, and demand for stealth and autonomous capabilities.

- Regulatory Landscapes: Strict national security protocols, export control regulations, and compliance with international maritime law.

- Substitute Products: Advanced UUVs, ASW (Anti-Submarine Warfare) technologies, and passive acoustic monitoring systems.

- End-User Profiles: National Navies, Coast Guards, and specialized research institutions.

- M&A Activities: Strategic acquisitions to gain market access, technological expertise, and expand product offerings, with an estimated total deal value of over $10 billion historically.

Submarine Industry Industry Evolution

The Submarine Industry has witnessed a remarkable evolution, driven by continuous technological innovation and shifting geopolitical priorities. Over the historical period (2019–2024), the market has seen a consistent upward trajectory in submarine market growth, primarily fueled by increased defense budgets in key nations and rising maritime security concerns. Technological advancements have been a cornerstone of this evolution, with a strong emphasis on developing more stealthy, advanced sensor-equipped, and increasingly autonomous submersible platforms. The introduction of conventional submarines with enhanced conventional prompt strike capabilities and the development of next-generation nuclear-powered submarines are prime examples. Shifting consumer demands, which in this context refers to the evolving requirements of naval forces, have moved towards greater operational flexibility, longer endurance, and reduced acoustic signatures. The forecast period (2025–2033) is projected to see sustained growth, with an estimated compound annual growth rate (CAGR) of approximately 5-7%, reaching a market value well into the tens of billions of dollars. This growth will be further propelled by advancements in underwater warfare technologies, including sophisticated sonar, electronic warfare systems, and unmanned systems integration. The base year (2025) is expected to reflect a robust market performance, setting the stage for accelerated expansion in the subsequent years. Key metrics indicating this evolution include the increasing investment in submarine modernization programs, the rising number of new submarine construction contracts, and the adoption rates of advanced propulsion systems like Air-Independent Propulsion (AIP) in conventional submarines, which have seen an adoption rate of over 80% in new builds for certain navies. The overall defense spending trends directly correlate with the industry's growth, with nations prioritizing naval power projection and deterrence.

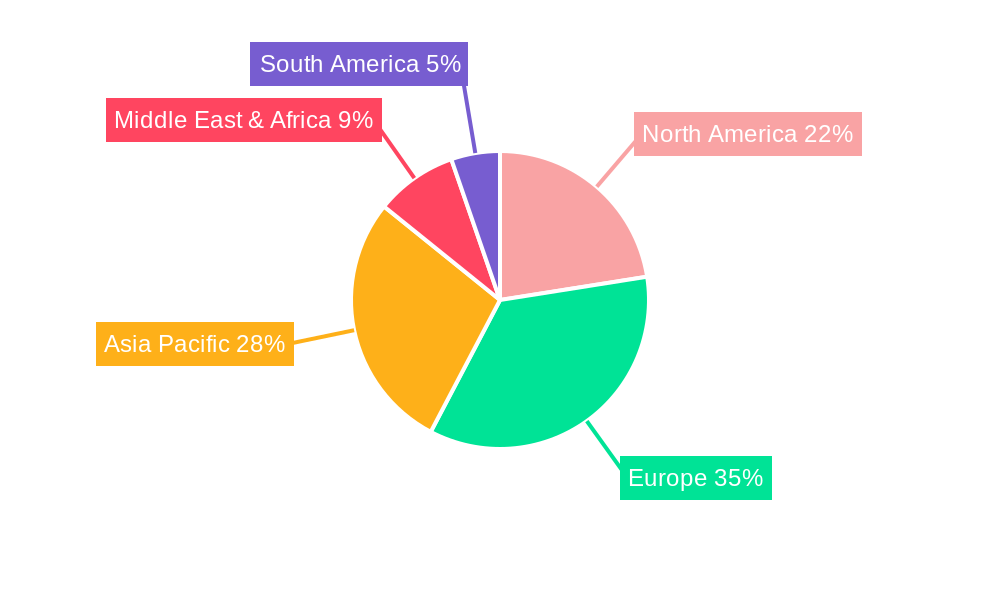

Leading Regions, Countries, or Segments in Submarine Industry

The Submarine Industry landscape is dominated by a select group of regions and countries with established naval capabilities and robust defense industrial bases. North America and Europe are consistently leading in submarine production and technological innovation.

Production Analysis: The United States and several European nations, particularly France, Germany, and the United Kingdom, are at the forefront of submarine manufacturing. These regions possess the advanced technological infrastructure, skilled workforce, and significant government investment required for complex submarine construction. The demand for both conventional and nuclear-powered submarines fuels continuous production activities.

- Key Drivers:

- Significant government investment in naval modernization programs.

- Advanced technological capabilities in shipbuilding and defense systems.

- Geopolitical imperatives driving the need for powerful underwater deterrents.

Consumption Analysis: Major naval powers worldwide are the primary consumers of submarines. This includes countries with extensive coastlines, strategic maritime interests, and a focus on power projection. Asia-Pacific, driven by countries like China, India, and South Korea, is emerging as a significant consumption region, with ongoing fleet expansion and modernization efforts.

- Key Drivers:

- Rising maritime security concerns and territorial disputes.

- Strategic naval power development and fleet expansion initiatives.

- Demand for diverse submarine capabilities, from stealth attack to ballistic missile deterrence.

Import Market Analysis (Value & Volume): While major powers are often self-sufficient in production, many nations rely on imports to acquire advanced submarine technology and replenish their fleets. European and Asian countries frequently import high-value, technologically advanced submarines. The import market is characterized by high-value transactions, often in the billions of dollars per vessel.

- Key Drivers:

- Access to cutting-edge technology not available domestically.

- Cost-effectiveness and time-to-delivery compared to indigenous production.

- Interoperability requirements with allied naval forces.

Export Market Analysis (Value & Volume): Leading submarine manufacturers in countries like Germany, France, and Russia are major exporters. The export market for submarines is highly competitive and often involves long-term defense agreements and strategic partnerships, with export deals cumulatively reaching billions of dollars annually.

- Key Drivers:

- Technological superiority and proven operational performance.

- Competitive pricing and attractive financing packages.

- Strong diplomatic and military relationships with importing nations.

Price Trend Analysis: The price of submarines varies significantly based on type (conventional vs. nuclear), technological complexity, armament, and national origin. Prices for advanced conventional submarines can range from $500 million to $1 billion, while nuclear-powered ballistic missile submarines (SSBNs) and attack submarines (SSNs) can cost several billions of dollars each. The trend is towards increasing costs due to technological advancements and complex integration requirements.

- Key Drivers:

- Escalating research and development costs.

- Integration of advanced combat systems and stealth technologies.

- Inflationary pressures and material costs.

Submarine Industry Product Innovations

Product innovations in the Submarine Industry are focused on enhancing stealth, operational endurance, and combat effectiveness. The development of Air-Independent Propulsion (AIP) systems has revolutionized conventional submarine capabilities, allowing for longer submerged operations and reducing the need for frequent surfacing. Advanced sonar arrays, integrated combat management systems, and sophisticated electronic warfare suites are becoming standard. Furthermore, there is a significant push towards integrating unmanned underwater vehicles (UUVs) and autonomous systems, enhancing situational awareness and expanding mission profiles without increasing crew complement. These innovations, such as the integration of quantum sensing technologies, promise to redefine underwater detection and navigation, offering a competitive edge and ensuring operational superiority in the multi-billion dollar naval defense market.

Propelling Factors for Submarine Industry Growth

The Submarine Industry is propelled by several critical factors. Growing geopolitical tensions and the expansion of maritime territorial claims worldwide are significantly increasing demand for advanced naval assets, including submarines, for deterrence and defense. Continuous technological advancements in areas such as stealth technology, improved sonar capabilities, and advanced propulsion systems like AIP are driving the need for fleet modernization. Furthermore, increasing defense budgets in major economies, particularly in the Asia-Pacific region, are fueling substantial investments in naval shipbuilding, including the procurement and development of new submarine platforms. The strategic importance of underwater warfare in maintaining naval superiority and securing vital sea lanes ensures sustained government commitment and R&D funding, contributing to a multi-billion dollar market expansion.

- Geopolitical Instability: Increased regional conflicts and territorial disputes drive demand for naval power.

- Technological Advancements: Innovations in stealth, sensors, and propulsion necessitate fleet upgrades.

- Rising Defense Budgets: Nations are allocating more resources to naval modernization and expansion.

- Strategic Deterrence: Submarines remain a critical component of nuclear and conventional deterrence strategies.

Obstacles in the Submarine Industry Market

Despite robust growth, the Submarine Industry faces significant obstacles. The extremely high cost of development and acquisition for modern submarines, often running into billions of dollars per platform, presents a considerable financial barrier for many nations. The complex and lengthy submarine construction timelines, often spanning over a decade, can lead to delays and cost overruns. Stringent export control regulations and the proprietary nature of advanced underwater defense technologies limit market access for many potential buyers. Furthermore, the specialized nature of the industry and the limited pool of skilled personnel required for design, manufacturing, and maintenance pose ongoing human capital challenges. Supply chain disruptions, particularly for specialized components, can also impact production schedules and costs.

- High Acquisition Costs: Submarines represent a multi-billion dollar investment.

- Long Development & Production Cycles: Extended timelines lead to planning complexities.

- Stringent Export Controls: Restrictions on technology transfer limit market reach.

- Skilled Workforce Shortages: Demand for specialized engineering and manufacturing talent.

- Supply Chain Vulnerabilities: Reliance on specialized suppliers for critical components.

Future Opportunities in Submarine Industry

Future opportunities in the Submarine Industry lie in the growing demand for unmanned underwater vehicles (UUVs) and autonomous submarine technologies, offering cost-effective alternatives and enhanced mission capabilities for surveillance, mine countermeasures, and intelligence gathering. The increasing emphasis on anti-submarine warfare (ASW) capabilities also presents opportunities for companies developing advanced detection and neutralization systems. Emerging markets in Southeast Asia and the Middle East are showing a growing interest in naval expansion, creating new avenues for both conventional and advanced submarine sales. The development of next-generation propulsion systems, such as advanced fuel cell technology and potentially even fusion power for future nuclear submarines, offers long-term growth potential. The integration of AI and machine learning into submarine operations and combat systems also represents a significant area for innovation and market expansion, with potential to impact multi-billion dollar defense contracts.

- Growth of UUVs & Autonomous Systems: Expanding market for unmanned underwater capabilities.

- Emerging Market Expansion: Increasing naval investments in Southeast Asia and the Middle East.

- Advanced Propulsion Technologies: Development of next-generation power sources.

- AI Integration: Enhancing submarine operations and decision-making.

Major Players in the Submarine Industry Ecosystem

- General Dynamics Corporation

- Naval Group

- FINCANTIERI S p A

- HD Hyundai Heavy Industries

- thyssenkrupp AG

- Daewoo Shipbuilding & Marine Engineering Co Ltd

- Huntington Ingalls Industries Inc

- Navantia S A SM E

- BAE Systems plc

- United Shipbuilding Corporation

- Saab AB

- Mitsubishi Heavy Industries Ltd

Key Developments in Submarine Industry Industry

- December 2022: Indian shipbuilder Mazagon Dock Limited (MDL) delivered "Vagir," the fifth Scorpene-type submarine (Kalvari-class), to the Indian Navy, bolstering India's underwater capabilities and highlighting indigenous shipbuilding prowess.

- December 2022: President Vladimir Putin oversaw the commissioning of several new warships and a nuclear-powered submarine, including the Generalissimus Suvorov ballistic missile submarine, underscoring Russia's commitment to strengthening its naval fleet with advanced underwater assets.

- December 2022: The UK Royal Navy ordered its first crewless submarine, "Cetus," signaling a significant shift towards autonomous underwater warfare capabilities for enhanced stealthy monitoring and defense of critical infrastructure.

Strategic Submarine Industry Market Forecast

The Submarine Industry is poised for robust growth throughout the forecast period (2025–2033), driven by a confluence of strategic imperatives and technological advancements. The increasing focus on national security, coupled with escalating geopolitical tensions and territorial disputes, is compelling nations to invest heavily in modernizing and expanding their naval fleets. The demand for advanced stealth submarines, enhanced underwater combat systems, and increasingly autonomous underwater vehicles (UUVs) will continue to be a primary growth catalyst. Investments in R&D for next-generation propulsion and sensor technologies will further shape the market. The global submarine market, already valued in the tens of billions of dollars, is expected to see continued expansion as defense budgets remain a priority for major economies, creating sustained opportunities for innovation and procurement in the underwater defense sector.

Submarine Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Submarine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Submarine Industry Regional Market Share

Geographic Coverage of Submarine Industry

Submarine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Nuclear-Powered Submarines (SSN) Segment Is Anticipated to Grow with the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Submarine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Submarine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Submarine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Submarine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Submarine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Submarine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 General Dynamics Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Naval Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FINCANTIERI S p A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HD Hyundai Heavy Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 thyssenkrupp AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Daewoo Shipbuilding & Marine Engineering Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Huntington Ingalls Industries Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Navantia S A SM E

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BAE Systems plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 United Shipbuilding Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Saab AB

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Mitsubishi Heavy Industries Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 General Dynamics Corporation

List of Figures

- Figure 1: Global Submarine Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Submarine Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 3: North America Submarine Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Submarine Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 5: North America Submarine Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Submarine Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Submarine Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Submarine Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Submarine Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Submarine Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Submarine Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Submarine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Submarine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Submarine Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 15: South America Submarine Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Submarine Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 17: South America Submarine Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Submarine Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Submarine Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Submarine Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Submarine Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Submarine Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Submarine Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Submarine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Submarine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Submarine Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 27: Europe Submarine Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Submarine Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Submarine Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Submarine Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Submarine Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Submarine Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Submarine Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Submarine Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Submarine Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Submarine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: Europe Submarine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Submarine Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Submarine Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Submarine Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Submarine Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Submarine Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Submarine Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Submarine Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Submarine Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Submarine Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Submarine Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Submarine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 49: Middle East & Africa Submarine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Submarine Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Submarine Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Submarine Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Submarine Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Submarine Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Submarine Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Submarine Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Submarine Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Submarine Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Submarine Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Submarine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 61: Asia Pacific Submarine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Submarine Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Submarine Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Submarine Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Submarine Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Submarine Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Submarine Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Global Submarine Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Submarine Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Submarine Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Submarine Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Submarine Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Submarine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Submarine Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Submarine Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Submarine Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Submarine Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Submarine Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Submarine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Brazil Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Argentina Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Submarine Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Submarine Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Submarine Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Submarine Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Submarine Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Submarine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: France Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Italy Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Spain Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Russia Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Benelux Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Nordics Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global Submarine Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Submarine Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Submarine Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Submarine Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Submarine Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Submarine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Turkey Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Israel Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: GCC Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: North Africa Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: South Africa Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Global Submarine Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Submarine Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Submarine Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Submarine Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Submarine Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Submarine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 58: China Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 59: India Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Japan Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 61: South Korea Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 63: Oceania Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Submarine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Submarine Industry?

The projected CAGR is approximately 4.17%.

2. Which companies are prominent players in the Submarine Industry?

Key companies in the market include General Dynamics Corporation, Naval Group, FINCANTIERI S p A, HD Hyundai Heavy Industries, thyssenkrupp AG, Daewoo Shipbuilding & Marine Engineering Co Ltd, Huntington Ingalls Industries Inc, Navantia S A SM E, BAE Systems plc, United Shipbuilding Corporation, Saab AB, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Submarine Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Nuclear-Powered Submarines (SSN) Segment Is Anticipated to Grow with the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

December 2022: Indian shipbuilder Mazagon Dock Limited (MDL) announced that they delivered "Vagir," the fifth Scorpene-type submarine (Kalvari-class), to the Indian Navy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Submarine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Submarine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Submarine Industry?

To stay informed about further developments, trends, and reports in the Submarine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence