Key Insights

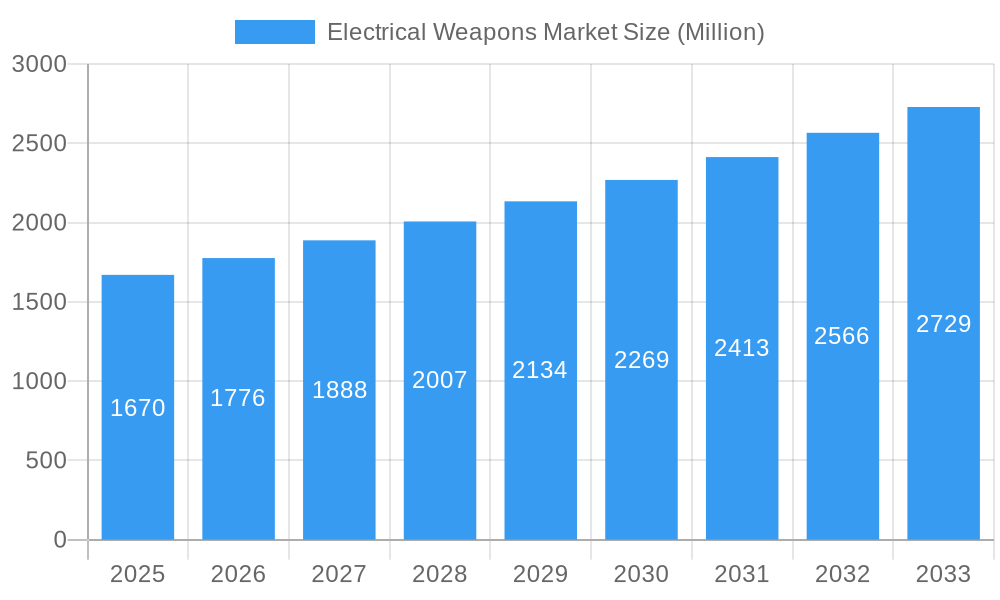

The global Electrical Weapons Market is poised for significant expansion, projected to reach approximately USD 1.67 billion with a Compound Annual Growth Rate (CAGR) of 6.34% from 2025 to 2033. This robust growth trajectory is underpinned by a confluence of factors, primarily driven by the escalating demand for non-lethal incapacitation solutions in both law enforcement and military applications. The increasing emphasis on de-escalation tactics, coupled with the need for effective crowd control and personal defense mechanisms, fuels the adoption of electrical weapons. Technological advancements are playing a pivotal role, with continuous innovation leading to more sophisticated and reliable devices. Specifically, the development of advanced Directed Energy Weapons (DEWs) and more refined Taser technologies is expanding the market's capabilities and appeal. The versatility of these weapons, offering alternatives to lethal force, is a key determinant in their growing acceptance across diverse operational scenarios.

Electrical Weapons Market Market Size (In Billion)

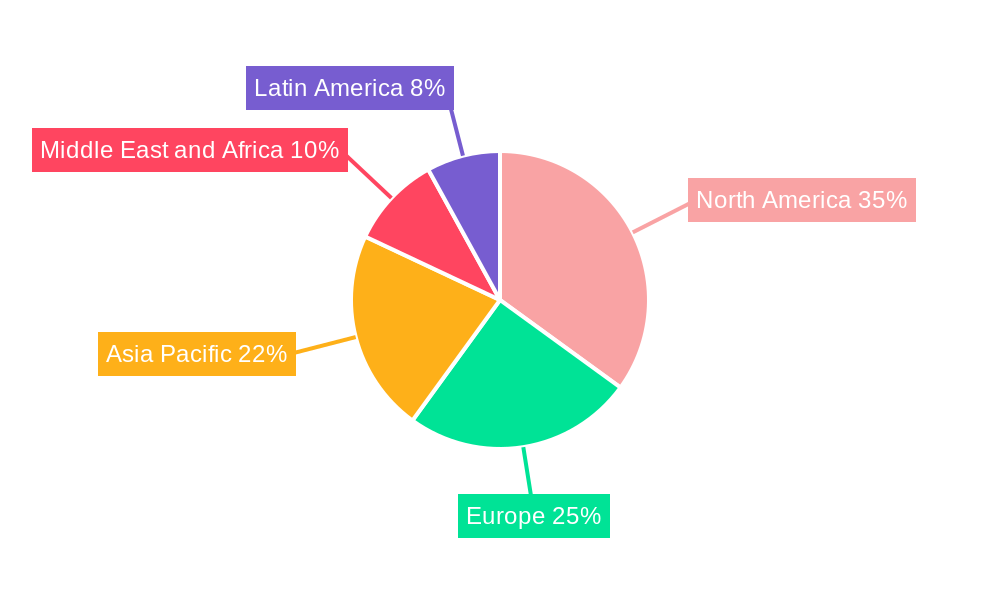

The market is segmented into key product types including Railguns, Directed Energy Weapons, Stun Guns, and Tasers, each catering to distinct use cases and operational requirements. Law enforcement agencies represent a dominant application segment, leveraging these technologies for suspect apprehension and public safety. The military sector is also a significant contributor, exploring DEWs for defensive and offensive capabilities, as well as for force protection. Geographically, North America, particularly the United States, is anticipated to remain a leading market due to substantial government spending on defense and homeland security, alongside widespread adoption by law enforcement. Asia Pacific is emerging as a high-growth region, driven by increasing defense budgets and a growing focus on internal security in countries like China, India, and Japan. Despite the strong growth prospects, the market faces certain restraints, including stringent regulatory frameworks, ethical considerations surrounding the use of force, and the high initial cost of some advanced technologies. However, the persistent need for advanced security solutions and the ongoing evolution of electrical weapon technology are expected to largely outweigh these challenges.

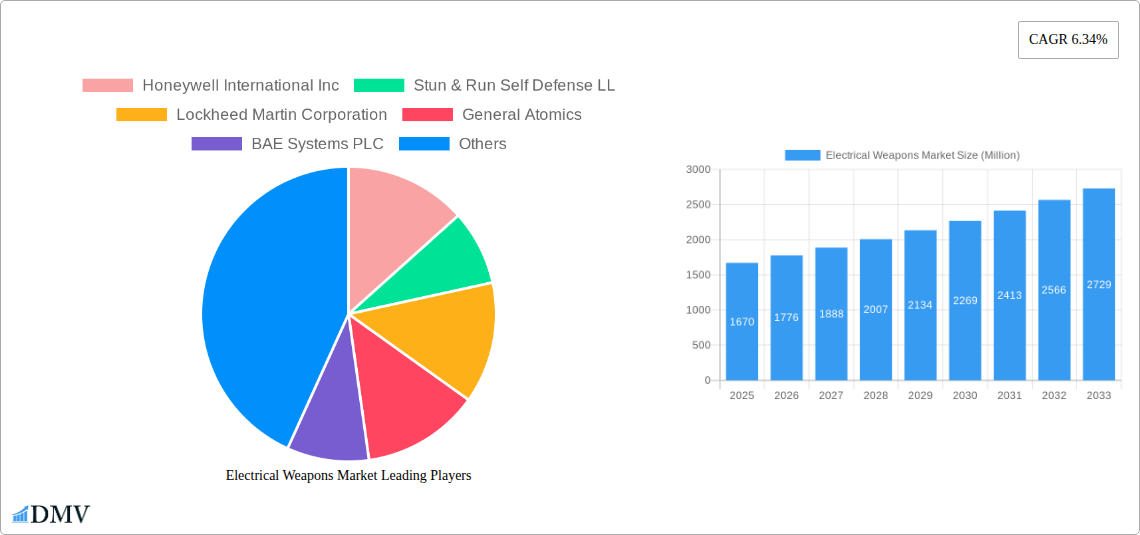

Electrical Weapons Market Company Market Share

This in-depth report provides a definitive analysis of the global Electrical Weapons Market, offering critical insights into its composition, trends, industry evolution, and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this research empowers stakeholders with actionable intelligence. Delve into the intricacies of railguns, directed energy weapons, stun guns, and tasers, understanding their impact on law enforcement, military, and industrial applications.

Electrical Weapons Market Market Composition & Trends

The Electrical Weapons Market is characterized by a moderate to high concentration of key players, driven by significant R&D investments and stringent quality control requirements. Innovation catalysts include escalating global security concerns, advancements in power management and miniaturization technologies, and the persistent need for less-lethal alternatives. The regulatory landscape is evolving, with governments worldwide establishing frameworks for the development, deployment, and ethical use of electrical weapons. Substitute products, primarily traditional firearms and less-lethal chemical agents, present a competitive challenge, though their limitations in terms of escalation and collateral damage often favor electrical solutions. End-user profiles are diverse, ranging from specialized military units and law enforcement agencies to security personnel in critical infrastructure and private security firms. Mergers and Acquisitions (M&A) activities are projected to reach a cumulative value of $5,000 Million by 2033, indicating a consolidation trend and strategic partnerships to gain market share and technological prowess.

- Market Share Distribution: The market share is fragmented but trending towards consolidation, with top players holding a significant portion.

- M&A Deal Values: Anticipated to reach $5,000 Million by 2033.

- Key Trends: Increasing demand for advanced non-lethal options, integration of smart technologies, and growing export markets for advanced defense systems.

Electrical Weapons Market Industry Evolution

The Electrical Weapons Market has witnessed remarkable evolution, driven by a confluence of technological breakthroughs and a growing global imperative for enhanced security and de-escalation capabilities. From early iterations of rudimentary stun devices to sophisticated directed energy weapons (DEWs) and advanced railgun technology, the industry's growth trajectory has been consistently upward. The historical period (2019-2024) saw significant investments in research and development, particularly in enhancing power delivery systems, projectile acceleration mechanisms for railguns, and the precision targeting capabilities of DEWs. The base year, 2025, marks a pivotal point where several promising technologies are transitioning from experimental phases to operational deployment. Market growth rates are projected to accelerate, with an estimated CAGR of 12.5% from 2025 to 2033. This growth is fueled by increasing defense budgets, the rising adoption of non-lethal alternatives in law enforcement to mitigate excessive force concerns, and the potential for industrial applications in areas such as remote demolition and material processing. Consumer demand, though primarily driven by institutional buyers, is also influenced by the perceived effectiveness and reduced risk associated with these advanced systems. Adoption metrics for tactical tasers and advanced DEW prototypes in specialized military units have shown a steady increase, indicating a growing reliance on electrical weapon systems. The proliferation of smart features, including data logging, remote activation, and integrated targeting systems, further enhances their appeal and drives market expansion. The ongoing pursuit of miniaturization and increased power efficiency continues to be a central theme in the industry's evolution, promising even more versatile and deployable solutions in the forecast period.

Leading Regions, Countries, or Segments in Electrical Weapons Market

North America currently dominates the Electrical Weapons Market, driven by substantial government investment in defense and law enforcement modernization. The United States, in particular, is a leading consumer and developer of electrical weapon technologies, supported by robust research institutions and a strong industrial base.

- Dominant Region: North America.

- Key Drivers in North America:

- High Defense Spending: Significant investments by the US military in advanced weaponry.

- Law Enforcement Modernization: Widespread adoption of tasers and stun guns by police departments.

- Technological Innovation Hubs: Presence of leading defense contractors and research facilities.

- Favorable Regulatory Environment: Relatively less restrictive regulations for development and deployment compared to some other regions.

Within the Type segment, Directed Energy Weapons (DEWs) are emerging as a high-growth area, projected to capture 30% of the market share by 2033. This surge is attributed to advancements in laser and microwave technologies offering non-lethal or effects-based engagement capabilities for a range of threats. Tasers continue to hold a significant market share due to their established use in law enforcement and widespread availability. Railguns, though still in advanced development and early deployment phases, represent a transformative technology with immense future potential, particularly for naval applications.

In terms of Application, the Military segment is the largest contributor, accounting for an estimated 65% of the market revenue in 2025. This is driven by the demand for advanced battlefield solutions, anti-drone capabilities, and non-kinetic warfare options. The Law Enforcement segment follows closely, with a projected market size of $15,000 Million by 2033, fueled by the ongoing need for crowd control, incapacitation of suspects, and officer safety. The Industry segment, though smaller, presents nascent growth opportunities in niche applications like remote inspection and material manipulation.

Electrical Weapons Market Product Innovations

Product innovation in the Electrical Weapons Market is accelerating, focusing on enhanced precision, increased range, and improved safety features. Directed Energy Weapons (DEWs) are witnessing advancements in miniaturization, leading to man-portable systems capable of precise targeting. Railgun technology continues to evolve with improved power conditioning and barrel designs, promising greater projectile velocity and range. For less-lethal options like tasers, innovations include extended range cartridges, improved electrode deployment, and integrated data recording for accountability. Unique selling propositions include reduced collateral damage, a spectrum of effects from non-lethal to incapacitating, and the potential for silent operation.

Propelling Factors for Electrical Weapons Market Growth

The Electrical Weapons Market is propelled by several interconnected factors. Technological advancements in power generation, energy storage, and materials science are enabling the development of more potent and compact electrical weapon systems. Increased global security threats and the demand for effective, less-lethal alternatives to traditional firearms are driving adoption in both military and law enforcement sectors. Furthermore, the rising defense budgets in major economies and the evolving nature of warfare, which increasingly emphasizes asymmetric and non-kinetic approaches, create significant demand. Regulatory support for the development and testing of advanced non-lethal technologies also plays a crucial role.

Obstacles in the Electrical Weapons Market Market

Despite its promising growth, the Electrical Weapons Market faces several obstacles. High research and development costs associated with cutting-edge technologies like railguns and advanced DEWs can be a significant barrier. Stringent and often evolving regulatory frameworks governing the ethical use and deployment of such weapons can create uncertainty and slow down market penetration. Supply chain disruptions for specialized components and rare earth materials can impact production timelines and costs. Moreover, public perception and ethical debates surrounding the use of directed energy and electroshock weapons can influence adoption rates and necessitate extensive public engagement.

Future Opportunities in Electrical Weapons Market

Emerging opportunities within the Electrical Weapons Market are vast. The development of portable and scalable directed energy systems for anti-drone and counter-swarm capabilities presents a significant growth area for military applications. In law enforcement, advancements in less-lethal technologies offering variable intensity and targeted effects will open new deployment scenarios. The industrial sector offers potential in areas like non-destructive testing, remote material manipulation, and advanced manufacturing processes. Furthermore, the increasing global focus on de-escalation and minimizing casualties is creating a fertile ground for the widespread adoption of advanced electrical weapon systems across various domains.

Major Players in the Electrical Weapons Market Ecosystem

- Honeywell International Inc

- Stun & Run Self Defense LL

- Lockheed Martin Corporation

- General Atomics

- BAE Systems PLC

- RTX Corporation

- Axon Enterprise Inc

- March International Ltd

- EURO SECURITY PRODUCTS s r o (Ltd)

- Northrop Grumman Corporation

Key Developments in Electrical Weapons Market Industry

- 2023/08: Axon Enterprise Inc. announces advancements in Taser technology with enhanced data recording capabilities.

- 2023/05: Lockheed Martin Corporation showcases a next-generation directed energy weapon prototype for naval platforms.

- 2022/11: BAE Systems PLC secures a contract for the development of advanced railgun components for naval applications.

- 2022/06: General Atomics demonstrates a novel high-power microwave weapon system for counter-UAS operations.

- 2021/09: RTX Corporation expands its portfolio of non-lethal directed energy solutions for law enforcement.

- 2021/03: Honeywell International Inc. invests in research for advanced power management systems crucial for electrical weaponry.

- 2020/10: Northrop Grumman Corporation highlights progress in laser weapon systems for strategic defense.

Strategic Electrical Weapons Market Market Forecast

The strategic forecast for the Electrical Weapons Market points towards robust growth, underpinned by continuous technological innovation and increasing global security demands. The expansion of directed energy weapons and railgun technology for advanced military applications, coupled with the persistent need for effective less-lethal tools in law enforcement, will be key growth catalysts. The market is poised to benefit from significant R&D investments, a growing acceptance of non-kinetic engagement capabilities, and potential diversification into industrial sectors. The anticipated market size of $70,000 Million by 2033 underscores the substantial opportunities and transformative potential of electrical weapon systems in shaping future defense and security landscapes.

Electrical Weapons Market Segmentation

-

1. Type

- 1.1. Railgun

- 1.2. Directed Energy Weapons

- 1.3. Stun Guns

- 1.4. Tasers

- 1.5. Other Types

-

2. Application

- 2.1. Law Enforcement

- 2.2. Military

Electrical Weapons Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Qatar

- 5.4. Rest of Middle East and Africa

Electrical Weapons Market Regional Market Share

Geographic Coverage of Electrical Weapons Market

Electrical Weapons Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Law Enforcement Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electrical Weapons Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Railgun

- 5.1.2. Directed Energy Weapons

- 5.1.3. Stun Guns

- 5.1.4. Tasers

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Law Enforcement

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Electrical Weapons Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Railgun

- 6.1.2. Directed Energy Weapons

- 6.1.3. Stun Guns

- 6.1.4. Tasers

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Law Enforcement

- 6.2.2. Military

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Electrical Weapons Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Railgun

- 7.1.2. Directed Energy Weapons

- 7.1.3. Stun Guns

- 7.1.4. Tasers

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Law Enforcement

- 7.2.2. Military

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Electrical Weapons Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Railgun

- 8.1.2. Directed Energy Weapons

- 8.1.3. Stun Guns

- 8.1.4. Tasers

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Law Enforcement

- 8.2.2. Military

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Electrical Weapons Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Railgun

- 9.1.2. Directed Energy Weapons

- 9.1.3. Stun Guns

- 9.1.4. Tasers

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Law Enforcement

- 9.2.2. Military

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Electrical Weapons Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Railgun

- 10.1.2. Directed Energy Weapons

- 10.1.3. Stun Guns

- 10.1.4. Tasers

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Law Enforcement

- 10.2.2. Military

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Stun & Run Self Defense LL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lockheed Martin Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Atomics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BAE Systems PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 RTX Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Axon Enterprise Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 March International Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EURO SECURITY PRODUCTS s r o (Ltd)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Northrop Grumman Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Electrical Weapons Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Electrical Weapons Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Electrical Weapons Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Electrical Weapons Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Electrical Weapons Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Electrical Weapons Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Electrical Weapons Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Electrical Weapons Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Electrical Weapons Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Electrical Weapons Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Electrical Weapons Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Electrical Weapons Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Electrical Weapons Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Electrical Weapons Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Electrical Weapons Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Electrical Weapons Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Electrical Weapons Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Electrical Weapons Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Electrical Weapons Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Electrical Weapons Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Electrical Weapons Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Electrical Weapons Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Latin America Electrical Weapons Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Electrical Weapons Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Electrical Weapons Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Electrical Weapons Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Electrical Weapons Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Electrical Weapons Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Electrical Weapons Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Electrical Weapons Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Electrical Weapons Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electrical Weapons Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Electrical Weapons Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Electrical Weapons Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Electrical Weapons Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Electrical Weapons Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Electrical Weapons Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Electrical Weapons Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Electrical Weapons Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Electrical Weapons Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Electrical Weapons Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Electrical Weapons Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Electrical Weapons Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Electrical Weapons Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Electrical Weapons Market Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global Electrical Weapons Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Brazil Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Mexico Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Electrical Weapons Market Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Electrical Weapons Market Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Electrical Weapons Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: United Arab Emirates Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Qatar Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East and Africa Electrical Weapons Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electrical Weapons Market?

The projected CAGR is approximately 6.34%.

2. Which companies are prominent players in the Electrical Weapons Market?

Key companies in the market include Honeywell International Inc, Stun & Run Self Defense LL, Lockheed Martin Corporation, General Atomics, BAE Systems PLC, RTX Corporation, Axon Enterprise Inc, March International Ltd, EURO SECURITY PRODUCTS s r o (Ltd), Northrop Grumman Corporation.

3. What are the main segments of the Electrical Weapons Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.67 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Law Enforcement Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electrical Weapons Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electrical Weapons Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electrical Weapons Market?

To stay informed about further developments, trends, and reports in the Electrical Weapons Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence