Key Insights

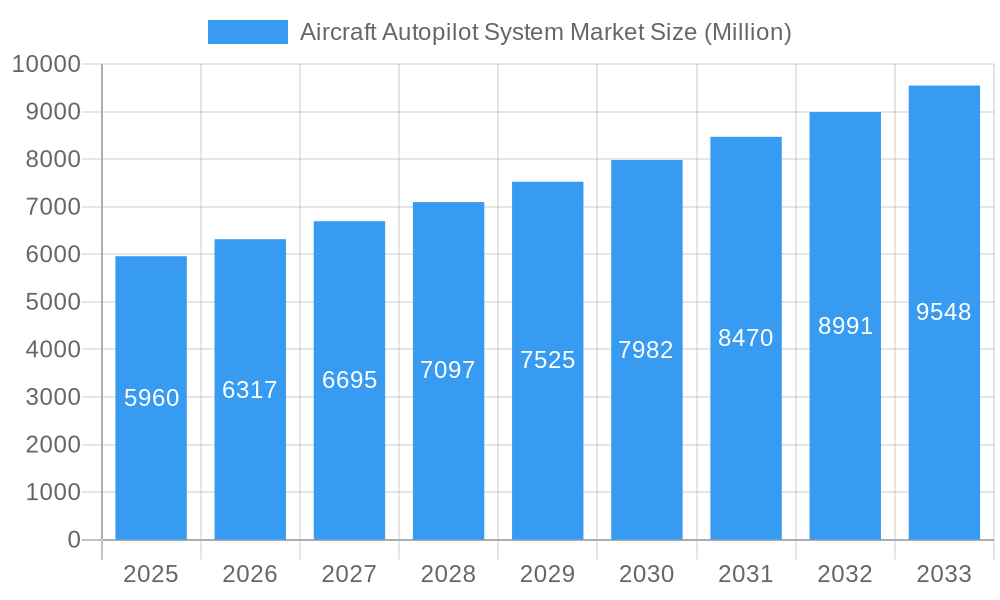

The global Aircraft Autopilot System Market is projected for robust expansion, driven by increasing demand for enhanced flight safety, improved operational efficiency, and the growing adoption of advanced avionics across both civil and military aviation sectors. The market is estimated to be valued at approximately $5.96 billion, with a projected Compound Annual Growth Rate (CAGR) of around 5.97% during the forecast period of 2025-2033. This sustained growth is fueled by the continuous integration of sophisticated technologies such as Attitude and Heading Reference Systems (AHRS), Flight Director Systems (FDS), and advanced Flight Control Systems (FCS). The rising complexity of air traffic management, coupled with the need to reduce pilot workload and minimize human error, further underpins the market's upward trajectory. Furthermore, advancements in digitalization and the increasing demand for smart cockpits are expected to propel the adoption of next-generation autopilot systems.

Aircraft Autopilot System Market Market Size (In Billion)

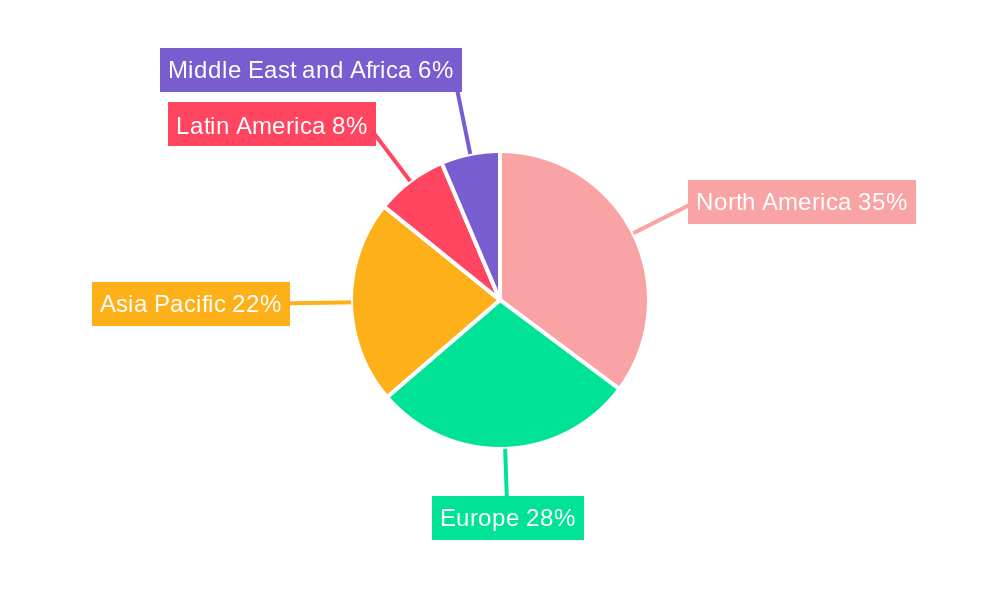

The market's potential is also being shaped by ongoing technological innovations and strategic collaborations among leading players. Companies are investing heavily in research and development to introduce more intuitive, reliable, and cost-effective autopilot solutions, including those with enhanced automation capabilities for complex maneuvers and emergency situations. While the market benefits from a strong demand for new aircraft and retrofitting existing fleets, potential restraints could include stringent regulatory approvals, high initial investment costs for advanced systems, and the skilled labor requirement for installation and maintenance. Geographically, North America is anticipated to lead the market due to its advanced aerospace industry and high rate of technology adoption, followed by Europe and the Asia Pacific, which is experiencing rapid growth in air travel and defense spending. Key market segments include the critical Flight Control System and the broader Avionics System, with Civil and Commercial applications representing a significant portion of the market share.

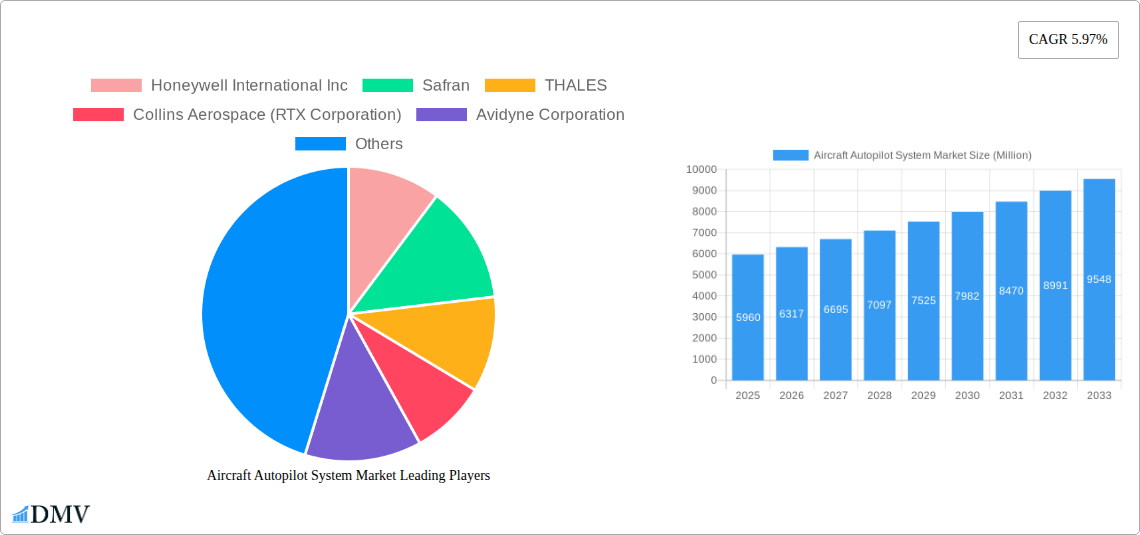

Aircraft Autopilot System Market Company Market Share

Global Aircraft Autopilot System Market Analysis 2019-2033: Trends, Innovations & Future Outlook

This comprehensive report delves into the dynamic Aircraft Autopilot System Market, offering an in-depth analysis of its composition, trends, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. Leveraging extensive data from 2019-2033, with a base year of 2025, this report provides critical insights for stakeholders navigating this rapidly advancing sector. Discover market-leading companies, key developments, and strategic forecasts to inform your business decisions in the evolving aerospace landscape.

Aircraft Autopilot System Market Market Composition & Trends

The global Aircraft Autopilot System Market exhibits a moderate to high concentration, driven by the significant R&D investments and stringent certification requirements that favor established players. Innovation catalysts include the continuous pursuit of enhanced safety, fuel efficiency, and automation in both civil and military aviation. The regulatory landscape, governed by bodies like the FAA and EASA, plays a pivotal role in shaping product development and market entry. Substitute products, while limited for core autopilot functions, are evolving in the form of advanced co-pilot assistance systems and semi-autonomous flight technologies. End-user profiles span a wide spectrum, from commercial airlines seeking operational efficiency and pilot workload reduction to military forces demanding precision and mission reliability, and general aviation enthusiasts prioritizing ease of operation and safety. Merger and acquisition (M&A) activities are a notable trend, with strategic consolidation aimed at expanding product portfolios, technological capabilities, and market reach. For instance, recent M&A deals in the broader aerospace sector, with estimated values in the hundreds of millions, indicate a robust appetite for acquiring cutting-edge avionics and control system technologies relevant to autopilots. Market share distribution is dynamic, with leading companies continually vying for dominance through technological superiority and strategic partnerships.

Aircraft Autopilot System Market Industry Evolution

The Aircraft Autopilot System Market has witnessed a remarkable evolution characterized by consistent growth trajectories, driven by an increasing demand for enhanced flight safety, reduced pilot workload, and improved operational efficiency across all aviation segments. Throughout the historical period (2019-2024) and projected through the forecast period (2025-2033), the market has been on an upward climb, fueled by relentless technological advancements. Early autopilot systems, primarily focused on basic directional stability, have metamorphosed into sophisticated Flight Control Systems (FCS) capable of managing complex flight envelopes, performing precise maneuvers, and integrating seamlessly with advanced navigation and communication suites. The adoption of digital technologies, including advanced processing power, enhanced sensor fusion, and artificial intelligence (AI) algorithms, has been a game-changer. These advancements have enabled the development of autopilots that offer predictive capabilities, adaptive flight path management, and sophisticated autoland functionalities, significantly reducing the risk of human error and improving fuel economy. The shift from analog to digital systems has not only improved performance but also reduced maintenance costs and increased reliability, making advanced autopilot systems more accessible.

Consumer demand has also evolved considerably. For civil and commercial aviation, the impetus is on cost savings through optimized flight paths and reduced fuel consumption, alongside enhanced passenger safety and comfort. Airlines are increasingly investing in autopilot systems that can reduce pilot fatigue on long-haul flights and improve the efficiency of flight operations, especially in congested airspaces. In the military sector, the demand is for highly precise, resilient, and autonomous capabilities that can support a wide range of mission profiles, from reconnaissance and surveillance to combat operations. The integration of autopilots with unmanned aerial vehicles (UAVs) and advanced combat aircraft signifies a paradigm shift towards greater autonomy. Market growth rates have consistently remained in the mid-single digits, with projections indicating continued expansion due to ongoing fleet modernization programs, the development of new aircraft models, and the retrofitting of older aircraft with advanced autopilot technologies. For example, the global market size for autopilot systems is estimated to reach approximately $15 Billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of around 5.8% from 2025 to 2033, reaching an estimated $23 Billion by 2033. This growth is further underpinned by increasing air traffic volume and the continuous push for greater automation in aerospace.

Leading Regions, Countries, or Segments in Aircraft Autopilot System Market

North America, particularly the United States, stands as the dominant region in the global Aircraft Autopilot System Market. This leadership is propelled by a confluence of factors including a robust aerospace manufacturing base, significant defense spending, a large commercial aviation fleet, and a proactive regulatory environment that encourages technological innovation and adoption. The region benefits from the presence of major aerospace manufacturers and system integrators, fostering a highly competitive and technologically advanced ecosystem.

Key Drivers of Dominance in North America:

- Military Application Dominance: The substantial defense budgets and ongoing modernization programs by the U.S. military are a primary driver. The demand for advanced, highly reliable, and autonomous autopilot systems for fighter jets, bombers, reconnaissance aircraft, and unmanned aerial vehicles (UAVs) is immense. This includes systems designed for complex mission profiles, electronic warfare environments, and enhanced situational awareness.

- Civil and Commercial Aviation Strength: North America boasts one of the largest commercial aviation fleets globally. Continuous fleet renewal, coupled with the drive for operational efficiency, fuel savings, and enhanced passenger safety, fuels the demand for advanced autopilots. The integration of sophisticated Flight Director Systems and Flight Control Systems into new aircraft, as well as retrofitting programs for existing fleets, contributes significantly to market growth.

- Technological Innovation Hub: The concentration of leading aerospace companies like Honeywell International Inc., Collins Aerospace (RTX Corporation), Lockheed Martin Corporation, and Garmin Ltd. in North America fosters a vibrant innovation ecosystem. These companies are at the forefront of developing next-generation autopilot technologies, including AI-powered systems and advanced sensor integration.

- Regulatory Support and Certification: The Federal Aviation Administration (FAA) provides a well-established framework for the certification of aviation technologies, facilitating the introduction of new and advanced autopilot systems into the market. This regulatory certainty encourages investment and development.

Dominant Segments:

Within the broader market, specific segments are experiencing significant growth and contributing to North America's leading position:

- Flight Control System (FCS): This is arguably the most critical and high-value segment. Modern FCS are complex integrated systems that manage all aspects of flight control, from basic stabilization to advanced maneuver automation. The demand for fly-by-wire technology and highly integrated FCS is a major growth catalyst.

- Attitude and Heading Reference System (AHRS): AHRS are fundamental to autopilot functionality, providing crucial data on the aircraft's orientation and direction. Advancements in solid-state gyroscopes and MEMS technology have made AHRS more accurate, reliable, and compact, driving their widespread adoption across all aircraft types.

- Avionics System Integration: The trend towards highly integrated avionics suites means that autopilot systems are increasingly embedded within a broader digital cockpit architecture. This integration enhances functionality, reduces pilot workload, and improves overall flight management. The demand for networked and software-defined avionics directly impacts the evolution of autopilot systems.

While other regions like Europe and Asia-Pacific are significant and growing markets, North America's comprehensive ecosystem of R&D, manufacturing, military demand, and commercial aviation activity solidifies its leading position in the global Aircraft Autopilot System Market.

Aircraft Autopilot System Market Product Innovations

Product innovations in the Aircraft Autopilot System Market are revolutionizing flight capabilities. Key advancements include the development of AI-powered autopilot systems that can predict and adapt to changing flight conditions, and advanced autoland capabilities for all-weather operations. Companies are integrating next-generation Attitude and Heading Reference Systems (AHRS) with enhanced accuracy and robustness, alongside sophisticated Flight Director Systems that offer superior guidance and pilot assistance. Performance metrics are seeing improvements in reduced flight path deviations, minimized fuel consumption through optimized routing, and significantly enhanced safety through predictive error detection and automated anomaly correction. Unique selling propositions revolve around increased automation, improved pilot workload reduction, and seamless integration with broader avionics suites.

Propelling Factors for Aircraft Autopilot System Market Growth

Several key factors are propelling the growth of the Aircraft Autopilot System Market. Firstly, the escalating demand for enhanced aviation safety, driven by stringent regulations and a desire to minimize pilot-induced errors, is paramount. Secondly, the continuous push for operational efficiency in commercial aviation, focusing on fuel savings through optimized flight paths and reduced pilot workload, directly stimulates autopilot adoption. Technological advancements, particularly in AI, sensor fusion, and digital avionics, are enabling more sophisticated and capable autopilot systems, making them increasingly attractive. Furthermore, the robust growth in air traffic, both commercial and cargo, necessitates more automated and efficient air traffic management, which is intrinsically linked to advanced autopilot capabilities. The military sector's ongoing modernization programs and the increasing deployment of unmanned aerial vehicles also contribute significantly to market expansion.

Obstacles in the Aircraft Autopilot System Market Market

Despite robust growth, the Aircraft Autopilot System Market faces certain obstacles. The stringent and evolving regulatory certification processes for new autopilot technologies can lead to extended development cycles and significant costs. The initial high cost of advanced autopilot systems can be a barrier to adoption for smaller operators and general aviation segments. Supply chain disruptions for critical electronic components, exacerbated by global events, can impact production timelines and costs. Additionally, the cybersecurity of highly connected autopilot systems is a growing concern, requiring significant investment in robust security measures. The inertia of established practices and the need for extensive pilot training on new systems can also slow down widespread adoption.

Future Opportunities in Aircraft Autopilot System Market

Emerging opportunities in the Aircraft Autopilot System Market are plentiful. The rapid development and integration of Artificial Intelligence (AI) and Machine Learning (ML) into autopilot systems present a significant avenue for creating highly adaptive and predictive flight control. The expansion of urban air mobility (UAM) and electric vertical take-off and landing (eVTOL) aircraft necessitates the development of specialized, highly automated autopilot solutions. Retrofitting existing fleets with advanced autopilot technologies offers a substantial market segment. Furthermore, the increasing demand for autonomous flight capabilities in military applications, including drone swarms and optionally manned aircraft, provides fertile ground for innovation. The growing emphasis on sustainable aviation fuels and optimized flight profiles also opens doors for autopilots designed for enhanced fuel efficiency.

Major Players in the Aircraft Autopilot System Market Ecosystem

- Honeywell International Inc.

- Safran

- THALES

- Collins Aerospace (RTX Corporation)

- Avidyne Corporation

- Lockheed Martin Corporation

- Garmin Ltd

- Moog Inc

- Meggitt (Parker Hannifin Corporation)

- Dynon Avionics

- BAE Systems plc

- Genesys Aerosystems

Key Developments in Aircraft Autopilot System Market Industry

- 2024: Collins Aerospace (RTX Corporation) announces advancements in its Pro Line Fusion integrated flight deck, enhancing autopilot capabilities for business jets with improved situational awareness and automation.

- 2023: Honeywell International Inc. launches a new generation of flight control systems incorporating AI for enhanced predictive maintenance and flight path optimization.

- 2023: Garmin Ltd. introduces a new integrated flight deck for light business aircraft featuring advanced autoland capabilities and improved pilot interface.

- 2022: THALES secures a major contract for the supply of advanced autopilot systems for next-generation fighter aircraft, emphasizing enhanced maneuverability and tactical autonomy.

- 2021: Safran demonstrates a new fully autonomous flight system for commercial aircraft prototypes, showcasing significant strides in AI-driven decision-making during flight.

- 2020: BAE Systems plc expands its portfolio of electronic warfare and flight control solutions, further integrating autopilot functionalities for enhanced military platform performance.

- 2019: Avidyne Corporation receives certification for its new autopilot system designed for the general aviation market, focusing on ease of use and advanced safety features.

Strategic Aircraft Autopilot System Market Market Forecast

The strategic outlook for the Aircraft Autopilot System Market is exceptionally positive, driven by a persistent demand for enhanced flight safety, operational efficiency, and advanced automation. Future growth will be significantly influenced by continued technological innovation, particularly in AI, autonomous flight, and integrated avionics. The increasing global air traffic and the ongoing modernization of both commercial and military aircraft fleets will serve as consistent growth catalysts. Emerging markets and the development of new aircraft categories like eVTOLs present substantial untapped potential. Stakeholders can expect to see a market increasingly characterized by highly intelligent, connected, and resilient autopilot systems that redefine the future of flight.

Aircraft Autopilot System Market Segmentation

-

1. System

- 1.1. Attitude and Heading Reference System

- 1.2. Flight Director System

- 1.3. Flight Control System

- 1.4. Avionics System

-

2. Application

- 2.1. Civil and Commercial

- 2.2. Military

Aircraft Autopilot System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Aircraft Autopilot System Market Regional Market Share

Geographic Coverage of Aircraft Autopilot System Market

Aircraft Autopilot System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Segment to Dominate Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Autopilot System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by System

- 5.1.1. Attitude and Heading Reference System

- 5.1.2. Flight Director System

- 5.1.3. Flight Control System

- 5.1.4. Avionics System

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Civil and Commercial

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by System

- 6. North America Aircraft Autopilot System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by System

- 6.1.1. Attitude and Heading Reference System

- 6.1.2. Flight Director System

- 6.1.3. Flight Control System

- 6.1.4. Avionics System

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Civil and Commercial

- 6.2.2. Military

- 6.1. Market Analysis, Insights and Forecast - by System

- 7. Europe Aircraft Autopilot System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by System

- 7.1.1. Attitude and Heading Reference System

- 7.1.2. Flight Director System

- 7.1.3. Flight Control System

- 7.1.4. Avionics System

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Civil and Commercial

- 7.2.2. Military

- 7.1. Market Analysis, Insights and Forecast - by System

- 8. Asia Pacific Aircraft Autopilot System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by System

- 8.1.1. Attitude and Heading Reference System

- 8.1.2. Flight Director System

- 8.1.3. Flight Control System

- 8.1.4. Avionics System

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Civil and Commercial

- 8.2.2. Military

- 8.1. Market Analysis, Insights and Forecast - by System

- 9. Latin America Aircraft Autopilot System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by System

- 9.1.1. Attitude and Heading Reference System

- 9.1.2. Flight Director System

- 9.1.3. Flight Control System

- 9.1.4. Avionics System

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Civil and Commercial

- 9.2.2. Military

- 9.1. Market Analysis, Insights and Forecast - by System

- 10. Middle East and Africa Aircraft Autopilot System Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by System

- 10.1.1. Attitude and Heading Reference System

- 10.1.2. Flight Director System

- 10.1.3. Flight Control System

- 10.1.4. Avionics System

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Civil and Commercial

- 10.2.2. Military

- 10.1. Market Analysis, Insights and Forecast - by System

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Safran

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 THALES

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Collins Aerospace (RTX Corporation)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Avidyne Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lockheed Martin Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Garmin Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Moog Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Meggitt (Parker Hannifin Corporation)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dynon Avionics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BAE Systems plc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Genesys Aerosystems

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Aircraft Autopilot System Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aircraft Autopilot System Market Revenue (Million), by System 2025 & 2033

- Figure 3: North America Aircraft Autopilot System Market Revenue Share (%), by System 2025 & 2033

- Figure 4: North America Aircraft Autopilot System Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Aircraft Autopilot System Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Aircraft Autopilot System Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Aircraft Autopilot System Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aircraft Autopilot System Market Revenue (Million), by System 2025 & 2033

- Figure 9: Europe Aircraft Autopilot System Market Revenue Share (%), by System 2025 & 2033

- Figure 10: Europe Aircraft Autopilot System Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Aircraft Autopilot System Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Aircraft Autopilot System Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Aircraft Autopilot System Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Aircraft Autopilot System Market Revenue (Million), by System 2025 & 2033

- Figure 15: Asia Pacific Aircraft Autopilot System Market Revenue Share (%), by System 2025 & 2033

- Figure 16: Asia Pacific Aircraft Autopilot System Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Aircraft Autopilot System Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Aircraft Autopilot System Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Aircraft Autopilot System Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Aircraft Autopilot System Market Revenue (Million), by System 2025 & 2033

- Figure 21: Latin America Aircraft Autopilot System Market Revenue Share (%), by System 2025 & 2033

- Figure 22: Latin America Aircraft Autopilot System Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Latin America Aircraft Autopilot System Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Aircraft Autopilot System Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Aircraft Autopilot System Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Aircraft Autopilot System Market Revenue (Million), by System 2025 & 2033

- Figure 27: Middle East and Africa Aircraft Autopilot System Market Revenue Share (%), by System 2025 & 2033

- Figure 28: Middle East and Africa Aircraft Autopilot System Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Aircraft Autopilot System Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Aircraft Autopilot System Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Aircraft Autopilot System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aircraft Autopilot System Market Revenue Million Forecast, by System 2020 & 2033

- Table 2: Global Aircraft Autopilot System Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Aircraft Autopilot System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Aircraft Autopilot System Market Revenue Million Forecast, by System 2020 & 2033

- Table 5: Global Aircraft Autopilot System Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Aircraft Autopilot System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Aircraft Autopilot System Market Revenue Million Forecast, by System 2020 & 2033

- Table 10: Global Aircraft Autopilot System Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Aircraft Autopilot System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Russia Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Aircraft Autopilot System Market Revenue Million Forecast, by System 2020 & 2033

- Table 19: Global Aircraft Autopilot System Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Aircraft Autopilot System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: China Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Aircraft Autopilot System Market Revenue Million Forecast, by System 2020 & 2033

- Table 28: Global Aircraft Autopilot System Market Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Global Aircraft Autopilot System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Mexico Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Latin America Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Aircraft Autopilot System Market Revenue Million Forecast, by System 2020 & 2033

- Table 34: Global Aircraft Autopilot System Market Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global Aircraft Autopilot System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: United Arab Emirates Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Saudi Arabia Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: South Africa Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Aircraft Autopilot System Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Autopilot System Market?

The projected CAGR is approximately 5.97%.

2. Which companies are prominent players in the Aircraft Autopilot System Market?

Key companies in the market include Honeywell International Inc, Safran, THALES, Collins Aerospace (RTX Corporation), Avidyne Corporation, Lockheed Martin Corporation, Garmin Ltd, Moog Inc, Meggitt (Parker Hannifin Corporation), Dynon Avionics, BAE Systems plc, Genesys Aerosystems.

3. What are the main segments of the Aircraft Autopilot System Market?

The market segments include System, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.96 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Segment to Dominate Market Share.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Autopilot System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Autopilot System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Autopilot System Market?

To stay informed about further developments, trends, and reports in the Aircraft Autopilot System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence