Key Insights

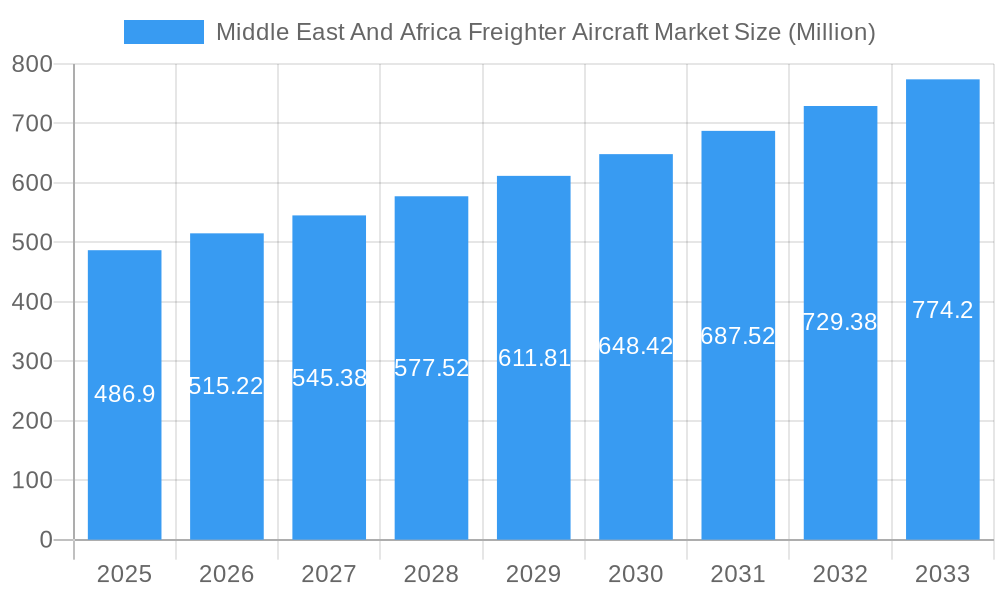

The Middle East and Africa freighter aircraft market is projected to reach \$486.90 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.59% from 2025 to 2033. This growth is fueled by several key factors. The burgeoning e-commerce sector across the region is driving demand for faster and more reliable air freight solutions, particularly in rapidly developing economies like those in East Africa and the Gulf Cooperation Council (GCC). Expansion of air cargo hubs in major cities such as Dubai, Addis Ababa, and Nairobi is further bolstering market expansion. The increasing reliance on air freight for time-sensitive goods, including pharmaceuticals and perishables, is another significant driver. Furthermore, government initiatives to improve infrastructure and streamline logistics within the region are creating a more favorable environment for freighter aircraft operations. While economic fluctuations and geopolitical uncertainties pose potential challenges, the long-term outlook remains positive due to sustained economic growth and increasing trade volumes within and beyond the region.

Middle East And Africa Freighter Aircraft Market Market Size (In Million)

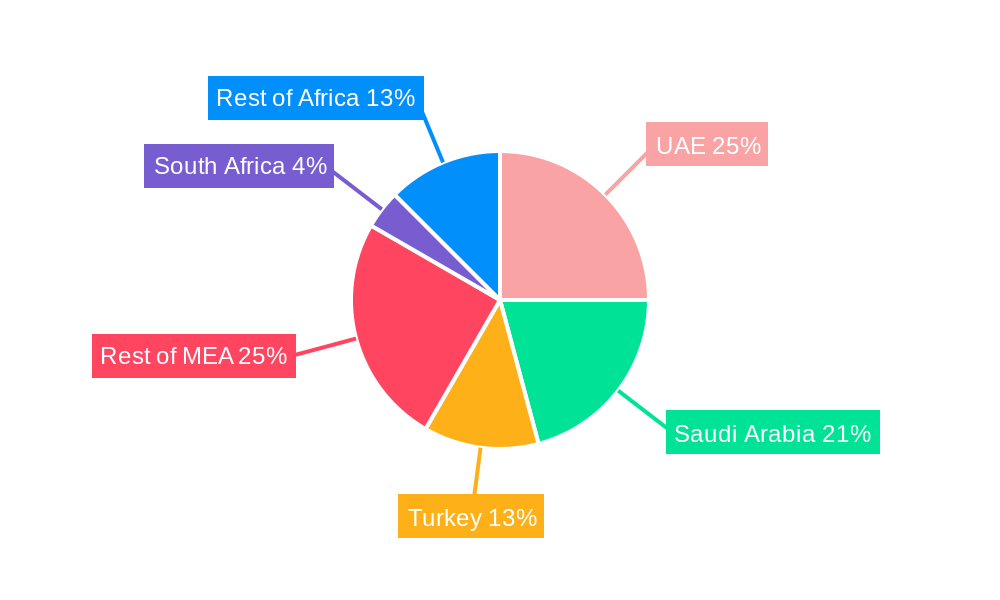

The market segmentation reveals significant opportunities within specific aircraft types and regions. Dedicated cargo aircraft are expected to maintain a dominant market share, reflecting the growing preference for purpose-built solutions offering optimized cargo capacity and efficiency. Within engine types, turbofan aircraft are projected to witness faster growth compared to turboprop aircraft due to their ability to handle longer routes and heavier payloads. Geographically, the United Arab Emirates and Saudi Arabia are expected to remain key markets, driven by their well-established logistics infrastructure and strategic geographic location. However, significant growth potential exists in other countries such as Turkey and rapidly developing nations in Sub-Saharan Africa, such as Kenya and South Africa. The presence of established players like Boeing, Airbus, and Textron, along with regional maintenance, repair, and overhaul (MRO) providers, indicates a healthy competitive landscape fostering innovation and service quality.

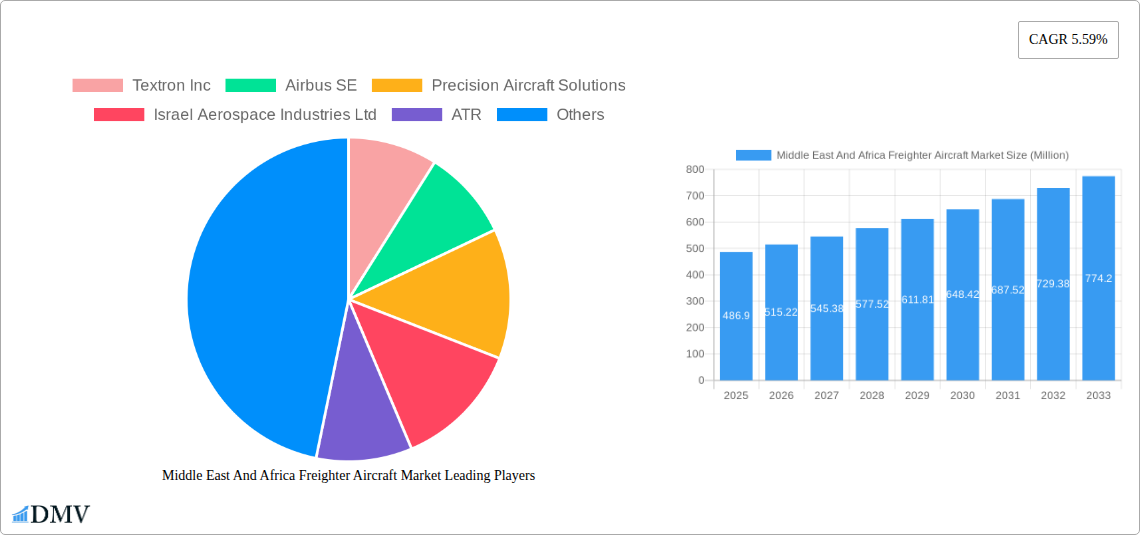

Middle East And Africa Freighter Aircraft Market Company Market Share

Middle East & Africa Freighter Aircraft Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Middle East & Africa freighter aircraft market, offering a comprehensive overview of market trends, leading players, and future growth prospects. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report is crucial for stakeholders seeking to understand the dynamics of this rapidly evolving sector, offering actionable insights for strategic decision-making. The market is projected to reach xx Million by 2033.

Middle East And Africa Freighter Aircraft Market Market Composition & Trends

This section delves into the competitive landscape of the Middle East & Africa freighter aircraft market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. We examine market share distribution among key players such as Textron Inc, Airbus SE, The Boeing Company, and others, revealing the level of market concentration. Innovation catalysts, including advancements in engine technology and aircraft design, are explored alongside their impact on market growth. The report also assesses the influence of regulatory landscapes, including safety standards and environmental regulations, on market dynamics. The analysis considers substitute products and their competitive threat, alongside a deep dive into the diverse end-user profiles driving demand. Finally, we examine past and potential future M&A activities, including deal values, and their consequences for market consolidation and competition. For example, the xx Million deal between X and Y in 2022 significantly altered market share. The analysis also incorporates data on the prevalence of leasing versus purchasing within the sector.

Middle East And Africa Freighter Aircraft Market Industry Evolution

This section provides a comprehensive analysis of the Middle East & Africa freighter aircraft market's evolutionary trajectory from 2019 to 2033. We examine the market's growth rate, technological advancements, and evolving consumer demands. Key aspects covered include the impact of e-commerce on airfreight demand, the shift towards larger and more fuel-efficient aircraft, and the adoption of advanced technologies like digitalization and automation. Specific data points such as year-on-year growth rates and adoption metrics for new technologies will be presented to illustrate the market's dynamic evolution. The influence of geopolitical factors on air freight capacity and the increasing focus on sustainability within the aviation industry will also be explored. The impact of the COVID-19 pandemic and its subsequent recovery on market growth will be analyzed in detail. Specific data on growth rate (e.g., a CAGR of xx% between 2025 and 2033) and adoption metrics of new technologies will illustrate the market's evolution.

Leading Regions, Countries, or Segments in Middle East And Africa Freighter Aircraft Market

This section identifies the leading regions, countries, and segments within the Middle East & Africa freighter aircraft market. We analyze market dominance factors for each category:

Aircraft Type: Dedicated Cargo Aircraft vs. Derivative of Non-Cargo Aircraft. The report will analyze market share and growth potential for each type, highlighting factors such as initial investment costs, operating costs, and payload capacity.

Engine Type: Turboprop Aircraft vs. Turbofan Aircraft. We will compare the advantages and disadvantages of each engine type regarding fuel efficiency, range, and maintenance costs, examining their impact on market share and future trends.

Country: United Arab Emirates, Saudi Arabia, Turkey, Rest of the Middle East and Africa. The dominance of specific countries is assessed considering factors like economic growth, airfreight infrastructure development, and government policies. The report will explore the key drivers of market growth within each country, including investment trends and regulatory support.

The report provides a detailed explanation of why certain regions, countries, or segments are leading, incorporating detailed data on market size and growth forecasts.

Middle East And Africa Freighter Aircraft Market Product Innovations

This section explores recent product innovations in the Middle East & Africa freighter aircraft market, focusing on new aircraft designs, engine technologies, and operational improvements. We highlight unique selling propositions (USPs) such as enhanced fuel efficiency, increased payload capacity, and advanced safety features. Technological advancements like improved cargo handling systems and the integration of digital technologies for fleet management will be discussed, along with their impact on market competitiveness. Key performance metrics, like fuel consumption per ton-kilometer and operating costs, will also be evaluated.

Propelling Factors for Middle East And Africa Freighter Aircraft Market Growth

Several factors are driving growth in the Middle East & Africa freighter aircraft market. Technological advancements, such as the development of more fuel-efficient engines and advanced aircraft designs, are significantly impacting market growth. Economic factors, including the expansion of e-commerce and the growth of manufacturing and trade in the region, are also key drivers. Furthermore, supportive government policies and infrastructure developments are playing a significant role. For instance, investments in new airports and cargo handling facilities are increasing the capacity for airfreight operations.

Obstacles in the Middle East And Africa Freighter Aircraft Market Market

Despite the growth potential, the Middle East & Africa freighter aircraft market faces several challenges. Regulatory hurdles, such as complex airworthiness certifications and stringent environmental regulations, can significantly impede market growth. Supply chain disruptions, resulting in delays in aircraft deliveries and increased maintenance costs, pose another significant challenge. Furthermore, intense competition among established and new market entrants adds pressure on profitability and market share. These obstacles, along with their quantitative impact on market growth, are carefully analyzed in the report.

Future Opportunities in Middle East And Africa Freighter Aircraft Market

The Middle East & Africa freighter aircraft market presents numerous future opportunities. The expansion of e-commerce and the growth of regional trade will continue to fuel demand for airfreight services. The adoption of new technologies, such as autonomous flight systems and advanced cargo handling solutions, offers significant potential for improving efficiency and reducing costs. Furthermore, untapped markets in certain African countries represent significant growth prospects for the industry. The development of sustainable aviation fuels will also be a major driver of market growth in the coming years.

Major Players in the Middle East And Africa Freighter Aircraft Market Ecosystem

- Textron Inc

- Airbus SE (Airbus SE)

- Precision Aircraft Solutions

- Israel Aerospace Industries Ltd (Israel Aerospace Industries Ltd)

- ATR (ATR)

- Singapore Technologies Engineering Ltd (Singapore Technologies Engineering Ltd)

- KF Aerospace

- Aeronautical Engineers Inc

- The Boeing Company (The Boeing Company)

Key Developments in Middle East And Africa Freighter Aircraft Market Industry

June 2023: Israel Aerospace Industries (IAI) announced plans to open a new passenger-to-freighter conversion (P2F) facility in Abu Dhabi, capable of converting up to 100 Boeing B777-300ERSFs. This development significantly expands P2F capacity in the region.

May 2022: Saudia Airlines ordered seven passenger-to-freighter conversions of the Boeing B777-300 from Mammoth Freighters, doubling its freighter fleet. This signals a major investment in airfreight capacity and reinforces the growth of the P2F conversion market.

Strategic Middle East And Africa Freighter Aircraft Market Market Forecast

The Middle East & Africa freighter aircraft market is poised for significant growth, driven by expanding e-commerce, rising trade volumes, and investments in airfreight infrastructure. The increasing adoption of fuel-efficient aircraft and advanced technologies will further enhance market dynamics. Opportunities exist in both established and emerging markets, presenting considerable potential for industry players. The forecast anticipates sustained growth, making the region an attractive investment destination for stakeholders in the aviation sector.

Middle East And Africa Freighter Aircraft Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Middle East And Africa Freighter Aircraft Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East And Africa Freighter Aircraft Market Regional Market Share

Geographic Coverage of Middle East And Africa Freighter Aircraft Market

Middle East And Africa Freighter Aircraft Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Turbofan Segment Dominates the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa Freighter Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Airbus SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Precision Aircraft Solutions

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Israel Aerospace Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ATR

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Singapore Technologies Engineering Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KF Aerospace

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aeronautical Engineers Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Boeing Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: Middle East And Africa Freighter Aircraft Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East And Africa Freighter Aircraft Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Arab Emirates Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Israel Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Qatar Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Kuwait Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Oman Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Bahrain Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Jordan Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Lebanon Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Freighter Aircraft Market?

The projected CAGR is approximately 5.59%.

2. Which companies are prominent players in the Middle East And Africa Freighter Aircraft Market?

Key companies in the market include Textron Inc, Airbus SE, Precision Aircraft Solutions, Israel Aerospace Industries Ltd, ATR, Singapore Technologies Engineering Ltd, KF Aerospace, Aeronautical Engineers Inc, The Boeing Company.

3. What are the main segments of the Middle East And Africa Freighter Aircraft Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 486.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Turbofan Segment Dominates the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

June 2023: Israel Aerospace Industries (IAI) announced that it is planning to open its new Abu Dhabi passenger-to-freighter conversion (P2F) facility in the second half of this year. The facility could convert up to 100 Boeing B777-300ERSFs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Freighter Aircraft Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Freighter Aircraft Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Freighter Aircraft Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Freighter Aircraft Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence