Key Insights

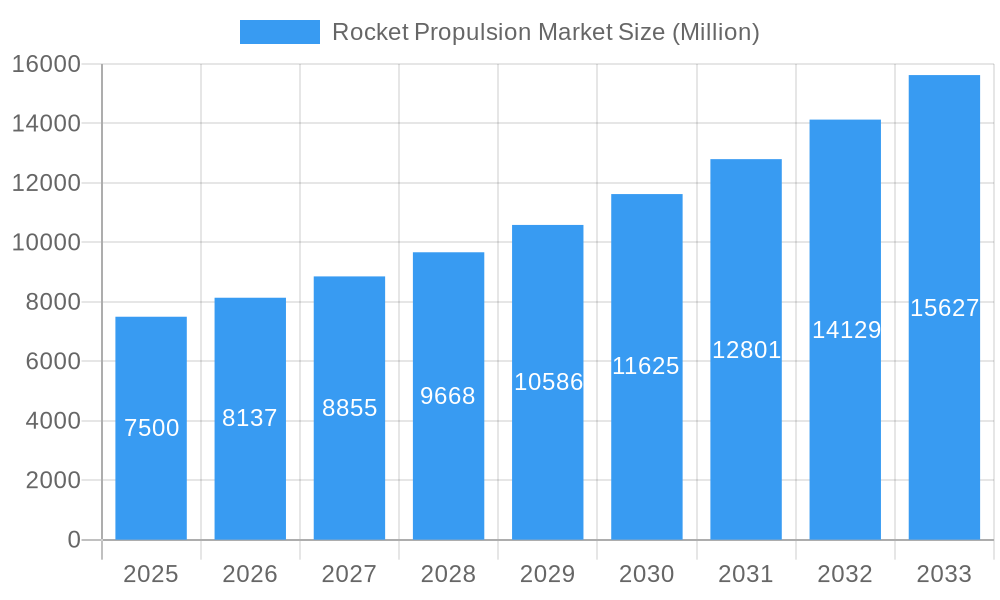

The global Rocket Propulsion Market is poised for substantial expansion, projected to reach a market size of XX million by 2033, driven by an impressive Compound Annual Growth Rate (CAGR) exceeding 8.50%. This robust growth trajectory is fueled by a confluence of accelerating space exploration initiatives, both governmental and private, and the burgeoning demand for satellite deployment across civil and commercial sectors. The increasing frequency of space missions, advancements in rocket engine technology, and the growing need for responsive launch capabilities for scientific research and national security are significant drivers. Furthermore, the commercialization of space, with constellations of satellites for communication, earth observation, and internet services, is creating sustained demand for reliable and efficient rocket propulsion systems. The market is witnessing innovation in liquid and solid propellants, with a growing interest in hybrid systems offering a balance of performance and safety.

Rocket Propulsion Market Market Size (In Billion)

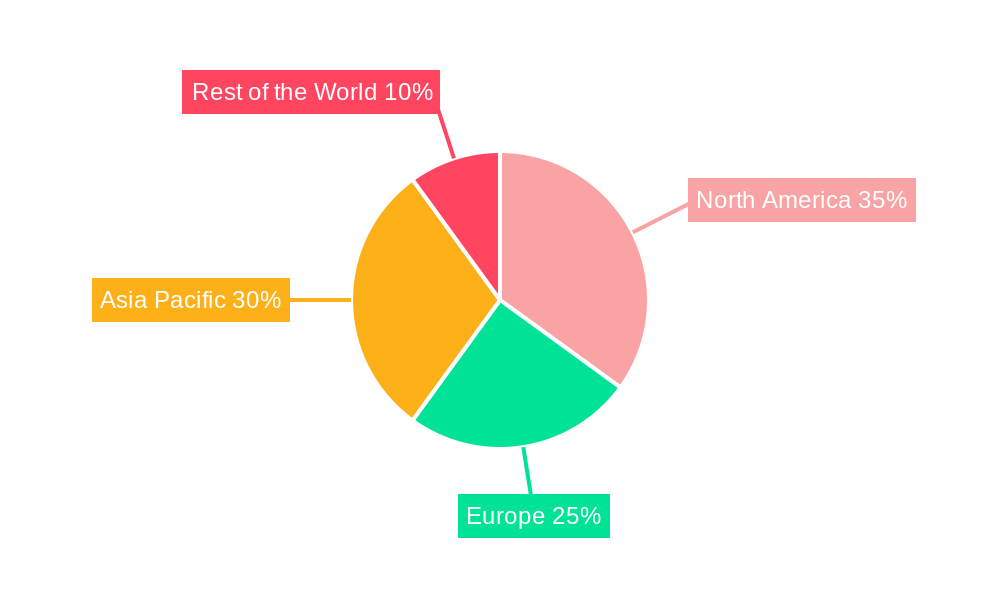

The market's momentum is further propelled by key trends such as the rise of small satellite launch services, the development of reusable rocket technology to reduce launch costs, and an increasing investment in in-space propulsion for orbital maneuvers and deep space exploration. Prominent companies like Space Exploration Technologies Corp, Blue Origin Federation LLC, and Rocket Lab USA Inc. are at the forefront of these advancements, pushing the boundaries of what's possible. However, challenges such as stringent regulatory hurdles, the high cost of research and development, and the need for robust safety protocols can act as restraints. Geographically, North America and Asia Pacific are expected to lead the market, owing to significant government investment in space programs and a thriving private space industry. Europe also presents a strong market, supported by established aerospace players and collaborative space initiatives.

Rocket Propulsion Market Company Market Share

Here's the SEO-optimized and insightful report description for the Rocket Propulsion Market, crafted for maximum visibility and stakeholder engagement:

Rocket Propulsion Market Market Composition & Trends

The global rocket propulsion market is experiencing dynamic shifts, driven by increased investment in space exploration and burgeoning satellite deployment. Market concentration is moderately fragmented, with key players like Space Exploration Technologies Corp, Northrop Grumman Corporation, and Aerojet Rocketdyne holding significant influence. Innovation catalysts are primarily focused on developing more efficient, reusable, and cost-effective propulsion systems. The solid rocket motor market and liquid rocket engine market continue to dominate, though hybrid rocket propulsion is gaining traction. Regulatory landscapes, particularly concerning launch safety and environmental impact, are evolving, shaping product development and market entry strategies. Substitute products are minimal in the core launch vehicle segment, but advancements in electric propulsion for in-orbit maneuvering present a different competitive dimension. End-user profiles are diversifying, with strong growth from civil and commercial sectors, including satellite constellation deployment and space tourism, alongside sustained demand from the military segment for national security applications. Mergers and acquisitions (M&A) activity is a notable trend, with substantial deal values, such as potential acquisitions in the small satellite launch vehicle segment, reflecting a consolidation drive. The market share distribution is increasingly influenced by companies offering innovative, turn-key launch solutions.

- Market Concentration: Moderately fragmented with leading players.

- Innovation Catalysts: Efficiency, reusability, cost reduction, advanced materials.

- Regulatory Landscape: Evolving safety and environmental standards.

- Substitute Products: Limited in core launch, growing in in-orbit propulsion.

- End-User Profiles: Diversified across Civil/Commercial and Military.

- M&A Activities: Significant deal values, driving consolidation.

Rocket Propulsion Market Industry Evolution

The rocket propulsion industry has witnessed a transformative evolution, marked by sustained growth and profound technological leaps throughout the study period (2019–2033), with a base year of 2025. This evolution is intrinsically linked to the burgeoning space economy, fueled by an unprecedented surge in satellite launches, interplanetary missions, and the ambitious expansion of commercial space ventures. The forecast period (2025–2033) anticipates a compounded annual growth rate (CAGR) of approximately 6.8%, reaching an estimated market size of USD 18,500 Million by 2033, up from an estimated USD 11,200 Million in 2025. This growth trajectory is primarily propelled by the increasing demand for reliable and high-performance liquid rocket engines, which offer greater control and efficiency for complex missions, and robust solid rocket motors for their reliability and thrust capabilities, especially in boosters.

Technological advancements have been pivotal, with a strong focus on developing reusable rocket engines and advanced propulsion systems. Companies like Space Exploration Technologies Corp (SpaceX) have revolutionized the industry with their successful implementation of reusable booster technology, significantly driving down launch costs and increasing launch cadence. The development of cryogenic rocket engines, electric propulsion systems for in-orbit applications, and increasingly sophisticated 3D-printed rocket components are further enhancing performance metrics, reducing manufacturing times, and enabling more complex mission architectures. The hybrid rocket propulsion market, while smaller, is also seeing innovation in its potential for safer and more scalable solutions.

Shifting consumer demands, particularly from the civil and commercial sectors, are reshaping the industry's landscape. The proliferation of small satellite constellations for telecommunications, Earth observation, and internet services has created a substantial market for dedicated small launch vehicles, fostering innovation in smaller, more agile rocket propulsion systems. Furthermore, the growing interest in space tourism and private space ventures by entities like Blue Origin Federation LLC is opening new avenues for commercial propulsion development. The military segment continues to be a significant end-user, demanding high-thrust, reliable propulsion for national security and defense applications, including missile defense systems and reconnaissance satellites. Antrix Corporation Limited, IHI Corporation, and Mitsubishi Heavy Industries Ltd are key players contributing to these diverse demands.

The historical period (2019–2024) laid the groundwork for this accelerated growth, characterized by increased government funding for space programs, private sector investment, and significant technological breakthroughs. Adoption metrics for advanced propulsion technologies have shown a steady increase, with higher performance characteristics and improved fuel efficiency becoming key differentiators. The market's evolution is a testament to human ingenuity and the ever-expanding aspirations in space, setting the stage for continued expansion and groundbreaking innovations in the coming decade.

Leading Regions, Countries, or Segments in Rocket Propulsion Market

The North American region stands as the dominant force in the global rocket propulsion market, driven by a confluence of factors that underscore its leadership across various segments, particularly within the civil and commercial sectors. The United States, the primary contributor to North America's market dominance, benefits from a robust ecosystem of private aerospace companies, significant government investment in space programs, and a strong research and development infrastructure. Key drivers for this dominance include substantial funding from agencies like NASA and the Department of Defense, fostering innovation and demand for cutting-edge liquid rocket engines and solid rocket boosters.

The civil and commercial segment in North America is experiencing unprecedented growth, primarily due to the exponential rise in satellite constellation deployments for broadband internet, Earth observation, and telecommunications. Companies such as Space Exploration Technologies Corp, Rocket Lab USA Inc, and Blue Origin Federation LLC are at the forefront, developing and deploying innovative and cost-effective liquid propulsion systems and solid rocket motors tailored for the burgeoning small and medium satellite market. The increasing frequency of launches and the development of reusable launch vehicles are significant demand catalysts.

Within the military segment, North America's dominance is sustained by its strategic importance in global defense. The demand for advanced rocket propulsion for intercontinental ballistic missiles (ICBMs), satellite deployment for reconnaissance and communication, and missile defense systems remains consistently high. Northrop Grumman Corporation and Aerojet Rocketdyne are critical suppliers to the U.S. military, providing reliable and high-performance solid rocket motors and liquid rocket engines. The ongoing modernization of military assets and the development of new space-based defense capabilities further bolster this segment's contribution.

The liquid rocket engine segment is a primary driver of North America's market leadership, owing to its versatility, controllability, and reusability, making it ideal for complex orbital maneuvers and crewed missions. The continuous advancements in cryogenic liquid propulsion and methane-fueled engines by leading companies are pushing the boundaries of performance and efficiency, catering to both commercial and government demands. While solid rocket motors remain crucial for their high thrust and reliability in booster applications, the innovation and investment in liquid propulsion are creating a distinct advantage for North America. The regulatory support, including favorable launch licensing and export control policies for space technologies, further solidifies the region's leading position, attracting significant international investment and talent, and positioning it for continued expansion throughout the forecast period.

Rocket Propulsion Market Product Innovations

The rocket propulsion market is characterized by relentless innovation, pushing the boundaries of performance and application. Key advancements include the development of highly efficient methane-liquid oxygen (methalox) rocket engines, offering improved performance and reduced environmental impact. Innovations in reusable rocket engine technology, exemplified by SpaceX's Merlin and Raptor engines, significantly reduce launch costs and increase launch frequency. Furthermore, additive manufacturing (3D printing) is revolutionizing the production of rocket engine components, enabling faster iteration cycles, complex geometries, and reduced part counts. The focus is also on developing more robust and reliable solid rocket motors for booster applications and exploring novel hybrid propulsion designs for enhanced safety and scalability.

Propelling Factors for Rocket Propulsion Market Growth

The rocket propulsion market is propelled by several key factors that ensure robust growth. The escalating demand for satellite deployment, driven by the proliferation of small satellite constellations for global internet access, Earth observation, and IoT applications, is a primary catalyst. Increased government funding for space exploration missions, including lunar and Martian endeavors, by space agencies worldwide fuels the need for advanced propulsion systems. The growing commercialization of space, encompassing space tourism and private space stations, creates new market opportunities. Furthermore, technological advancements such as the development of reusable rocket engines, advanced materials, and additive manufacturing are reducing costs and enhancing performance, making space access more viable.

Obstacles in the Rocket Propulsion Market Market

Despite its robust growth, the rocket propulsion market faces several obstacles. High research and development costs associated with advanced propulsion technologies represent a significant barrier. Stringent regulatory requirements for safety and environmental compliance, particularly for launches and hazardous materials, can lead to extended development cycles and increased costs. Supply chain disruptions, especially for specialized components and raw materials, can impact production timelines and cost-effectiveness. Intense competition among established players and emerging startups also exerts downward pressure on pricing. Moreover, the inherent complexity and inherent risks associated with rocket launches require substantial insurance and contingency planning, adding to overall mission expenses.

Future Opportunities in Rocket Propulsion Market

The rocket propulsion market presents numerous future opportunities. The burgeoning in-space propulsion market, driven by the need for orbital maneuvering, station-keeping, and deep-space exploration, offers significant growth potential for electric and advanced chemical propulsion systems. The development of sustainable propulsion technologies, utilizing greener propellants and reduced emissions, is a growing area of interest. The expansion of commercial lunar and Martian exploration, including resource utilization and settlement efforts, will demand specialized and robust propulsion solutions. Furthermore, the increasing demand for high-throughput launch services for large constellations and the potential for hypersonic vehicle development also present lucrative avenues for innovation and market expansion.

Major Players in the Rocket Propulsion Market Ecosystem

- Space Exploration Technologies Corp

- Land Space Technology Co Ltd

- Antrix Corporation Limited

- Aerojet Rocketdyne

- Safran SA

- NPO Energomash

- IHI Corporation

- Rocket Lab USA Inc

- Blue Origin Federation LLC

- Northrop Grumman Corporation

- Mitsubishi Heavy Industries Ltd

Key Developments in Rocket Propulsion Market Industry

- 2023/09: Rocket Lab successfully launches its 40th mission, demonstrating continued reliability in the small satellite launch market with its Electron rocket's liquid propulsion system.

- 2023/07: Blue Origin Federation LLC conducts a test flight of its New Shepard rocket, showcasing advancements in its suborbital rocket propulsion capabilities for space tourism.

- 2023/05: Northrop Grumman Corporation successfully completes a static fire test of its OmegA rocket's first stage, highlighting advancements in its solid rocket booster technology.

- 2023/02: Space Exploration Technologies Corp (SpaceX) achieves a record number of orbital launches for the year, driven by the high performance and reusability of its liquid rocket engines.

- 2022/11: Safran SA announces plans for a new generation of high-performance liquid rocket engines to support future European space missions.

- 2022/08: Aerojet Rocketdyne receives a significant contract for advanced rocket propulsion systems for future defense applications.

- 2021/12: Land Space Technology Co Ltd successfully launches its ZQ-2 rocket, demonstrating progress in China's liquid rocket engine development.

- 2021/10: IHI Corporation announces a breakthrough in cryogenic rocket engine technology, enhancing efficiency for future launches.

- 2020/06: Mitsubishi Heavy Industries Ltd. launches a mission utilizing its H-IIA rocket, featuring reliable liquid and solid propulsion systems.

- 2019/04: Antrix Corporation Limited, the commercial arm of ISRO, continues to support Indian space missions with robust rocket propulsion solutions.

Strategic Rocket Propulsion Market Market Forecast

The rocket propulsion market is poised for substantial growth, driven by the insatiable demand for space access and the continuous evolution of propulsion technologies. Strategic investments in reusable liquid rocket engines, particularly methalox and cryogenic variants, will be crucial for cost reduction and increased launch cadence. The expansion of satellite constellations, coupled with ambitious government-led space exploration programs, will necessitate reliable and high-thrust solid rocket motors and advanced liquid propulsion systems. Opportunities in the in-space propulsion sector, catering to orbital maneuvering and deep-space missions, will also significantly contribute to market expansion. The ongoing commitment to innovation and efficiency will ensure that the rocket propulsion market remains a dynamic and expanding sector for the foreseeable future, reaching an estimated USD 18,500 Million by 2033.

Rocket Propulsion Market Segmentation

-

1. Type

- 1.1. Solid

- 1.2. Liquid

- 1.3. Hybrid

-

2. End User

- 2.1. Civil and Commercial

- 2.2. Military

Rocket Propulsion Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Rocket Propulsion Market Regional Market Share

Geographic Coverage of Rocket Propulsion Market

Rocket Propulsion Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Enhanced Expenditure on Space Exploration Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solid

- 5.1.2. Liquid

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Civil and Commercial

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solid

- 6.1.2. Liquid

- 6.1.3. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Civil and Commercial

- 6.2.2. Military

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solid

- 7.1.2. Liquid

- 7.1.3. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Civil and Commercial

- 7.2.2. Military

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solid

- 8.1.2. Liquid

- 8.1.3. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Civil and Commercial

- 8.2.2. Military

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solid

- 9.1.2. Liquid

- 9.1.3. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Civil and Commercial

- 9.2.2. Military

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Space Exploration Technologies Corp

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Land Space Technology Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Antrix Corporation Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aerojet Rocketdyne

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Safran SA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NPO Energomash

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 IHI Corporatio

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Rocket Lab USA Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Blue Origin Federation LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Northrop Grumman Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Mitsubishi Heavy Industries Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: Global Rocket Propulsion Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Rocket Propulsion Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Rocket Propulsion Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Rocket Propulsion Market Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Rocket Propulsion Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Rocket Propulsion Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Rocket Propulsion Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Rocket Propulsion Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Rocket Propulsion Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Rocket Propulsion Market Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Rocket Propulsion Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Rocket Propulsion Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Rocket Propulsion Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Rocket Propulsion Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Rocket Propulsion Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Rocket Propulsion Market Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Rocket Propulsion Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Rocket Propulsion Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Rocket Propulsion Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Rocket Propulsion Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Rest of the World Rocket Propulsion Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Rocket Propulsion Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Rest of the World Rocket Propulsion Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World Rocket Propulsion Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Rocket Propulsion Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Rocket Propulsion Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Rocket Propulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 9: Global Rocket Propulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global Rocket Propulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Rocket Propulsion Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rocket Propulsion Market?

The projected CAGR is approximately 7.06%.

2. Which companies are prominent players in the Rocket Propulsion Market?

Key companies in the market include Space Exploration Technologies Corp, Land Space Technology Co Ltd, Antrix Corporation Limited, Aerojet Rocketdyne, Safran SA, NPO Energomash, IHI Corporatio, Rocket Lab USA Inc, Blue Origin Federation LLC, Northrop Grumman Corporation, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Rocket Propulsion Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Enhanced Expenditure on Space Exploration Activities.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rocket Propulsion Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rocket Propulsion Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rocket Propulsion Market?

To stay informed about further developments, trends, and reports in the Rocket Propulsion Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence