Key Insights

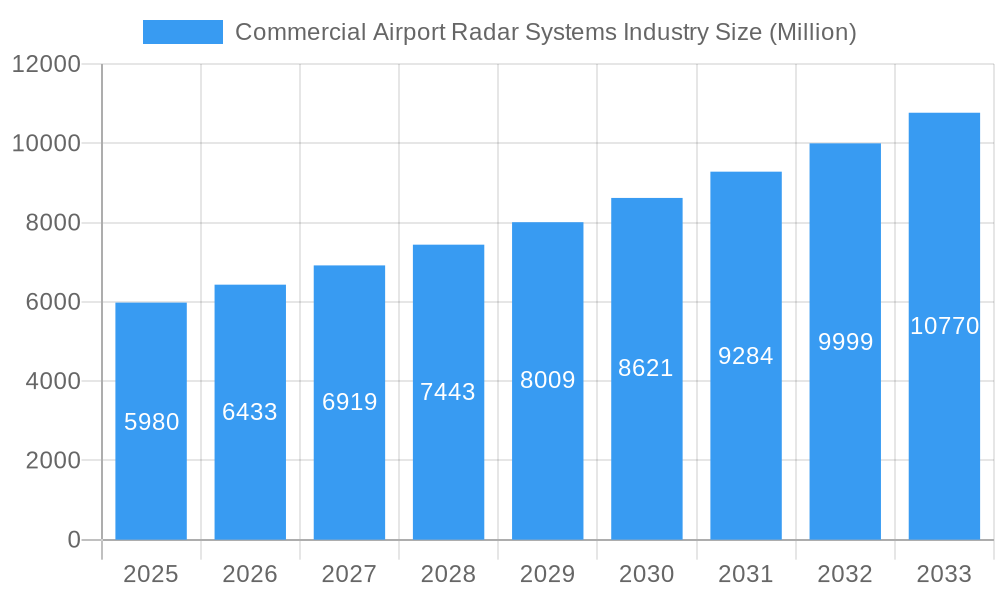

The global Commercial Airport Radar Systems market is poised for significant expansion, projected to reach an estimated USD 5.98 billion by 2025, and is anticipated to grow at a robust Compound Annual Growth Rate (CAGR) of 7.48% during the forecast period of 2025-2033. This growth is primarily fueled by the escalating demand for enhanced air traffic management and safety, driven by the continuous rise in air passenger traffic and the subsequent increase in flight operations worldwide. Modernization initiatives at airports to upgrade aging radar infrastructure and the integration of advanced technologies like AI and machine learning for improved surveillance and detection capabilities are key market drivers. Furthermore, stringent regulatory mandates for aviation safety and the development of smart airport ecosystems are compelling airport authorities to invest in sophisticated radar solutions. The market is segmented across production, consumption, import/export, and price trends, with each segment offering distinct opportunities and challenges to stakeholders.

Commercial Airport Radar Systems Industry Market Size (In Billion)

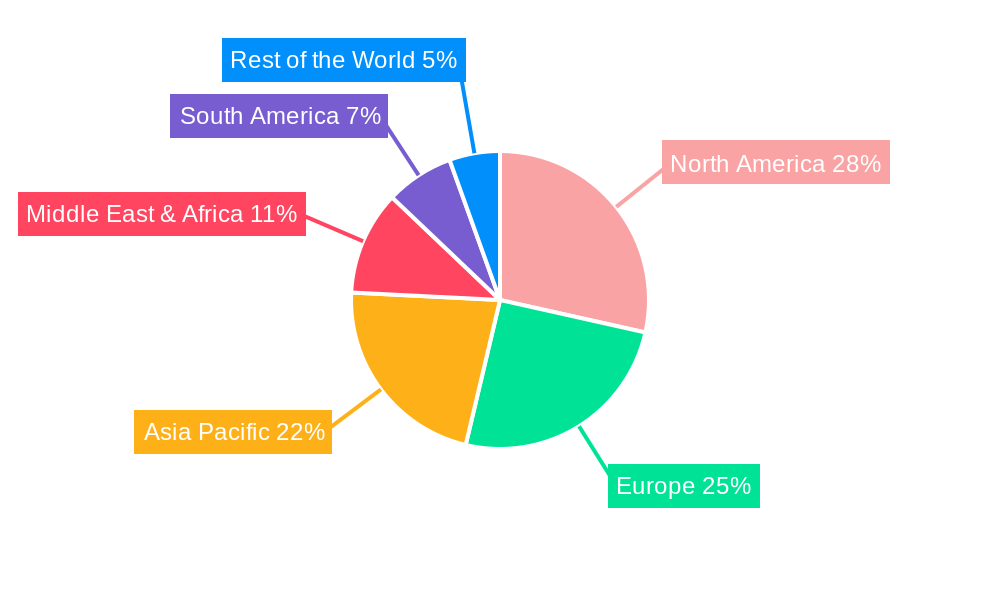

The market's upward trajectory is further supported by the proactive adoption of next-generation radar technologies that offer superior performance in adverse weather conditions and increased detection range, thereby minimizing the risk of air traffic incidents. Emerging economies in the Asia Pacific and Middle East & Africa regions are demonstrating particularly strong growth potential, driven by substantial investments in airport infrastructure development and the burgeoning aviation sectors. While the market is characterized by intense competition among established players such as Honeywell International Inc., THALES, and RTX Corporation, there's also room for innovation and specialization. Potential restraints might include the high initial investment costs for advanced radar systems and the complex integration processes with existing air traffic control infrastructure. However, the overarching need for enhanced aviation safety and efficiency is expected to outweigh these challenges, ensuring a dynamic and expanding market for commercial airport radar systems.

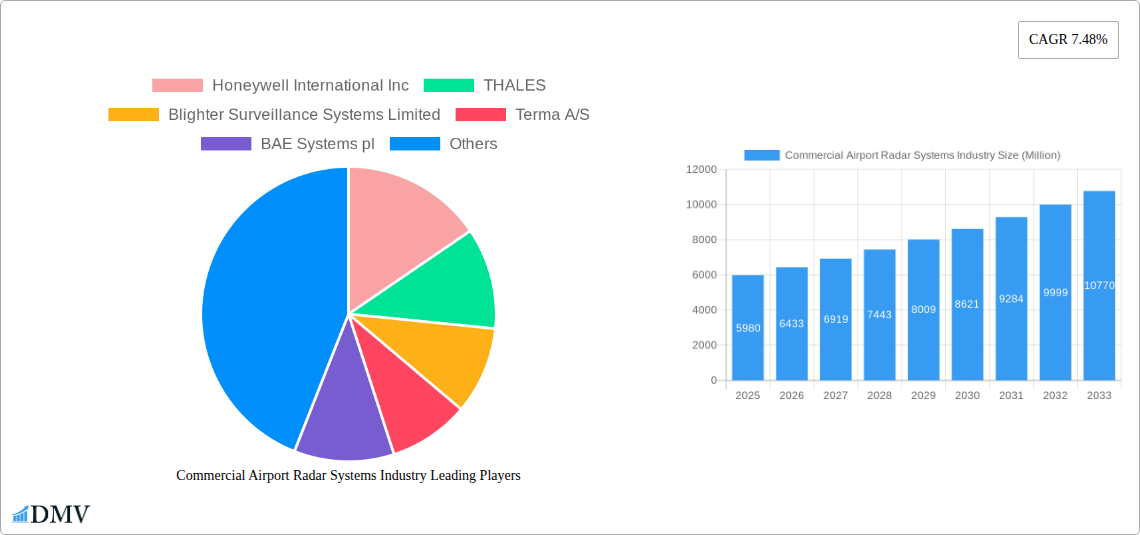

Commercial Airport Radar Systems Industry Company Market Share

Commercial Airport Radar Systems Industry Market Composition & Trends

The global Commercial Airport Radar Systems market is characterized by a moderate concentration, driven by significant R&D investments and stringent safety regulations. Innovation is a key catalyst, with companies continuously developing advanced weather radar, air traffic control (ATC) radar, and surveillance radar systems to meet evolving aviation demands. The regulatory landscape, particularly through bodies like the International Civil Aviation Organization (ICAO), dictates performance standards and deployment protocols, influencing market entry and product development. Substitute products, while present in niche applications (e.g., ground-based radar for specific operational needs), are generally not direct competitors for core airport surveillance and air traffic management functions. End-user profiles primarily consist of civil aviation authorities, airport operators, and defense ministries overseeing air traffic control infrastructure. Mergers and Acquisitions (M&A) activities are strategic plays to consolidate market share, acquire new technologies, and expand geographical reach, with significant deal values typically ranging in the hundreds of millions to billions of dollars. The distribution of market share reflects the dominance of a few key players, with the top five companies often holding over 60% of the global market.

- Market Concentration: Moderate to High, with a few key players dominating.

- Innovation Drivers: Technological advancements in radar signal processing, AI integration, and miniaturization.

- Regulatory Influence: ICAO, FAA, EASA standards significantly shape product development and market access.

- Substitute Products: Limited direct substitutes for primary airport surveillance and ATC functions.

- End-Users: Civil aviation authorities, airport operators, defense organizations.

- M&A Activity: Strategic acquisitions to gain market share and technological expertise, with deal values in the hundreds of millions to billions of dollars.

- Market Share Distribution: Top 5 players estimated to hold >60% of the global market.

Commercial Airport Radar Systems Industry Industry Evolution

The Commercial Airport Radar Systems industry has witnessed a dynamic evolution, propelled by the ever-increasing demand for air travel and the paramount need for aviation safety. Over the historical period from 2019 to 2024, the market experienced steady growth, driven by the modernization of air traffic control infrastructure globally. The base year of 2025 stands as a pivotal point, with projected significant expansion driven by renewed investments in airport upgrades and the integration of more sophisticated surveillance technologies. The forecast period from 2025 to 2033 is anticipated to be a period of accelerated growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 6.5% to 7.5%. This robust expansion is fueled by several interconnected factors. Firstly, the continuous rise in global air passenger traffic necessitates enhanced air traffic management capabilities, directly translating into demand for advanced radar systems capable of handling higher volumes of air traffic with greater precision and safety. Secondly, technological advancements have been instrumental in shaping the industry's trajectory. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into radar systems for enhanced data processing, predictive maintenance, and improved anomaly detection is becoming increasingly prevalent. Furthermore, the development of more advanced surveillance technologies, such as Passive Coherent Location (PCL) radar and multi-static radar, offers improved detection capabilities, particularly for stealth aircraft and in challenging weather conditions, catering to both civilian and military applications within airport environments. The shift towards digital radar solutions and the increasing adoption of cloud-based data management and analysis are also significant trends. From a consumer demand perspective, there is a growing emphasis on integrated solutions that offer not just radar detection but also data fusion, enhanced situational awareness, and seamless interoperability with other air traffic management systems. The demand for solutions that can mitigate the impact of adverse weather conditions on air traffic flow, such as advanced weather radar systems, is also a key driver. The industry's evolution is also marked by a move towards more energy-efficient and environmentally friendly radar technologies.

Leading Regions, Countries, or Segments in Commercial Airport Radar Systems Industry

The North America region stands out as a dominant force in the Commercial Airport Radar Systems market. This leadership is underpinned by several critical factors that influence its substantial share in Production Analysis, Consumption Analysis, Import Market Analysis, Export Market Analysis, and Price Trend Analysis.

In terms of Production Analysis, North America benefits from a well-established aerospace and defense manufacturing base, with major players like Honeywell International Inc. and RTX Corporation headquartered in the region. These companies possess advanced research and development capabilities and a robust supply chain for critical components, enabling them to produce high-end radar systems. The significant presence of leading technology providers allows for substantial domestic production and innovation.

The Consumption Analysis in North America is driven by the sheer volume of air traffic and the extensive network of airports. The United States, in particular, has a mature aviation infrastructure with continuous investment in upgrades and modernization. Regulatory mandates from the Federal Aviation Administration (FAA) consistently push for the adoption of the latest surveillance and air traffic control technologies to ensure the highest levels of safety and efficiency. This translates into a consistent and substantial demand for advanced radar systems.

Regarding Import Market Analysis (Value & Volume), while North America is a major producer, it also imports specialized components and technologies to complement its domestic manufacturing. However, its export volume often surpasses its import volume due to the strong domestic manufacturing capabilities and global demand for its advanced products. For instance, the value of imports might be in the range of USD 500 Million to USD 700 Million annually, with a focus on niche technologies.

The Export Market Analysis (Value & Volume) for North America is exceptionally strong. The region is a primary exporter of advanced airport radar systems to countries worldwide, driven by the technological superiority and reliability of its products. The demand from emerging economies and countries undergoing aviation infrastructure development significantly contributes to North America's export revenues, which can range from USD 1.5 Billion to USD 2.0 Billion annually.

The Price Trend Analysis in North America is influenced by the high cost of research and development, advanced manufacturing processes, and the premium placed on safety and reliability. While initial capital expenditure for radar systems can be substantial, the long operational lifespans and the cost savings associated with improved air traffic efficiency and accident prevention justify these investments. Prices for advanced ATC radar systems can range from USD 10 Million to USD 50 Million per system, depending on features and integration complexity.

- Dominant Region: North America.

- Key Drivers in North America:

- Investment Trends: Continuous, substantial investment in airport modernization and air traffic control infrastructure.

- Regulatory Support: Strict safety mandates and proactive upgrades driven by agencies like the FAA.

- Technological Prowess: Presence of leading R&D centers and advanced manufacturing capabilities.

- High Air Traffic Volume: Extensive commercial air routes and passenger traffic demand advanced surveillance.

- Production Dominance: Home to major manufacturers like Honeywell and RTX, with integrated supply chains.

- Consumption Dominance: Extensive airport network and relentless pursuit of safety and efficiency.

- Export Strength: Global demand for technologically advanced and reliable radar systems.

- Price Influences: High R&D costs, advanced manufacturing, and premium on safety.

Commercial Airport Radar Systems Industry Product Innovations

Innovations in commercial airport radar systems are revolutionizing air traffic management and safety. Companies are increasingly developing advanced dual-polarization Doppler weather radar systems capable of providing highly accurate real-time precipitation data, wind shear detection, and storm tracking, thus mitigating weather-related flight delays and hazards. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) into surveillance radar is enhancing target detection, reducing false alarms, and improving the ability to differentiate between various types of air traffic, including drones. The development of solid-state transmitters and advanced signal processing techniques are leading to more compact, energy-efficient, and reliable radar solutions. Unique selling propositions often lie in enhanced detection range, improved resolution, weather penetration capabilities, and seamless data integration with existing air traffic control platforms.

Propelling Factors for Commercial Airport Radar Systems Industry Growth

The growth of the Commercial Airport Radar Systems market is propelled by several critical factors. The escalating global demand for air travel, leading to increased air traffic density, necessitates more sophisticated and efficient air traffic management systems. Stringent aviation safety regulations worldwide, mandated by bodies like ICAO, continuously drive the adoption of advanced radar technologies for enhanced surveillance and detection capabilities. Significant investments in airport infrastructure upgrades and modernization projects, particularly in emerging economies, are creating substantial demand for new radar installations and upgrades. Moreover, ongoing technological advancements, including the integration of AI, machine learning, and improved signal processing, are leading to the development of more accurate, reliable, and cost-effective radar solutions.

- Rising Air Traffic: Increasing passenger numbers and flight movements demand enhanced surveillance.

- Safety Regulations: Strict international and national aviation safety standards mandate advanced radar.

- Infrastructure Development: Global investment in new and upgraded airports fuels demand.

- Technological Advancements: AI, ML, and improved signal processing enhance radar performance and introduce new capabilities.

Obstacles in the Commercial Airport Radar Systems Industry Market

Despite its robust growth trajectory, the Commercial Airport Radar Systems market faces several obstacles. The high initial capital expenditure required for advanced radar systems can be a significant barrier, especially for smaller airports or those in developing regions with limited budgets. Complex regulatory approval processes and the need for extensive testing and certification for new radar technologies can lead to prolonged deployment timelines. Supply chain disruptions, particularly for specialized electronic components, can impact production schedules and lead to cost escalations. Furthermore, the integration of new radar systems with existing legacy air traffic control infrastructure can be technically challenging and costly. Competitive pressures among established players and the threat of alternative surveillance technologies in niche applications also pose challenges.

- High Capital Investment: Significant upfront costs for sophisticated radar systems.

- Regulatory Hurdles: Lengthy approval processes and stringent certification requirements.

- Supply Chain Vulnerabilities: Reliance on specialized components and potential for disruptions.

- Integration Complexities: Challenges in integrating new systems with existing infrastructure.

- Competitive Landscape: Intense competition and evolving technological alternatives.

Future Opportunities in Commercial Airport Radar Systems Industry

The Commercial Airport Radar Systems industry is poised for significant future opportunities. The increasing integration of drones and Unmanned Aerial Vehicles (UAVs) into airspace necessitates the development of specialized radar systems capable of detecting and tracking these smaller, lower-flying objects, presenting a new market segment. The growing emphasis on smart airports and the concept of the "digital air traffic control tower" opens avenues for radar systems that offer advanced data fusion, predictive analytics, and seamless integration with other airport operational systems. Emerging markets in Asia, Africa, and Latin America, with their rapidly expanding aviation sectors, represent substantial growth potential for radar deployments. Furthermore, the continuous evolution of radar technology, such as the development of more advanced weather detection capabilities and passive sensing techniques, will create opportunities for next-generation radar solutions.

- UAV Detection and Tracking: Development of radar for drones and autonomous vehicles.

- Smart Airport Integration: Opportunities in data fusion and digital air traffic control towers.

- Emerging Market Expansion: Significant growth potential in developing aviation sectors.

- Next-Generation Radar Technologies: Innovations in weather radar and passive sensing.

Major Players in the Commercial Airport Radar Systems Industry Ecosystem

- Honeywell International Inc.

- THALES

- Blighter Surveillance Systems Limited

- Terma A/S

- BAE Systems plc

- ELDIS Pardubice s.r.o.

- RTX Corporation

- HENSOLDT AG

- NEC Corporation

- Leonardo S.p.A.

- DeTect Inc.

- Indra Sistemas S.A.

- Easat Radar Systems Ltd.

Key Developments in Commercial Airport Radar Systems Industry Industry

- June 2023: The Directorate General of Civil Aviation (DGCA) signed a USD 21.4 Million contract with Italy's Leonardo Aerospace, Defense, and Security to develop the air navigation system at Kuwait International Airport, including the installation of two modern radar systems.

- January 2023: THALES partnered with the Brazilian Airspace Control Department (DECEA) to supply and install ADS-B sensors across more than 20 Brazilian states, enhancing commercial flight safety and air traffic control capabilities.

Strategic Commercial Airport Radar Systems Industry Market Forecast

The Commercial Airport Radar Systems market is set for substantial growth over the forecast period, driven by an unyielding demand for enhanced air traffic safety and efficiency. Key growth catalysts include the continuous expansion of global air travel, necessitating upgraded surveillance and control systems to manage increasing traffic volumes. Proactive regulatory frameworks worldwide are mandating the adoption of cutting-edge radar technologies. Significant investments in modernizing airport infrastructure, especially in emerging economies, will fuel demand for new installations and upgrades. Technological advancements, including the integration of AI for predictive analytics and improved target identification, along with the development of more robust weather radar capabilities, will further propel market expansion. The market's trajectory is strongly aligned with the future of aviation, promising a dynamic and expanding landscape for radar system providers.

Commercial Airport Radar Systems Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Commercial Airport Radar Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Commercial Airport Radar Systems Industry Regional Market Share

Geographic Coverage of Commercial Airport Radar Systems Industry

Commercial Airport Radar Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Weather Radars Segment is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Airport Radar Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Commercial Airport Radar Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Commercial Airport Radar Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Commercial Airport Radar Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Commercial Airport Radar Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Commercial Airport Radar Systems Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 THALES

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Blighter Surveillance Systems Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Terma A/S

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BAE Systems pl

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ELDIS Pardubice s r o

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RTX Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HENSOLDT AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NEC Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Leonardo S p A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 DeTect Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Indra Sistemas S A

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Easat Radar Systems Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Commercial Airport Radar Systems Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Commercial Airport Radar Systems Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Commercial Airport Radar Systems Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Commercial Airport Radar Systems Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Commercial Airport Radar Systems Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Commercial Airport Radar Systems Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Commercial Airport Radar Systems Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Commercial Airport Radar Systems Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Commercial Airport Radar Systems Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Commercial Airport Radar Systems Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Commercial Airport Radar Systems Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Commercial Airport Radar Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Commercial Airport Radar Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Commercial Airport Radar Systems Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Commercial Airport Radar Systems Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Commercial Airport Radar Systems Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Commercial Airport Radar Systems Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Commercial Airport Radar Systems Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Commercial Airport Radar Systems Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Commercial Airport Radar Systems Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Commercial Airport Radar Systems Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Commercial Airport Radar Systems Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Commercial Airport Radar Systems Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Commercial Airport Radar Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Commercial Airport Radar Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Commercial Airport Radar Systems Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Commercial Airport Radar Systems Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Commercial Airport Radar Systems Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Commercial Airport Radar Systems Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Commercial Airport Radar Systems Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Commercial Airport Radar Systems Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Commercial Airport Radar Systems Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Commercial Airport Radar Systems Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Commercial Airport Radar Systems Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Commercial Airport Radar Systems Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Commercial Airport Radar Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Commercial Airport Radar Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Commercial Airport Radar Systems Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Commercial Airport Radar Systems Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Commercial Airport Radar Systems Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Commercial Airport Radar Systems Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Commercial Airport Radar Systems Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Commercial Airport Radar Systems Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Commercial Airport Radar Systems Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Commercial Airport Radar Systems Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Commercial Airport Radar Systems Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Commercial Airport Radar Systems Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Commercial Airport Radar Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Commercial Airport Radar Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Commercial Airport Radar Systems Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Commercial Airport Radar Systems Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Commercial Airport Radar Systems Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Commercial Airport Radar Systems Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Commercial Airport Radar Systems Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Commercial Airport Radar Systems Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Commercial Airport Radar Systems Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Commercial Airport Radar Systems Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Commercial Airport Radar Systems Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Commercial Airport Radar Systems Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Commercial Airport Radar Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Commercial Airport Radar Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Commercial Airport Radar Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Commercial Airport Radar Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Airport Radar Systems Industry?

The projected CAGR is approximately 7.48%.

2. Which companies are prominent players in the Commercial Airport Radar Systems Industry?

Key companies in the market include Honeywell International Inc, THALES, Blighter Surveillance Systems Limited, Terma A/S, BAE Systems pl, ELDIS Pardubice s r o, RTX Corporation, HENSOLDT AG, NEC Corporation, Leonardo S p A, DeTect Inc, Indra Sistemas S A, Easat Radar Systems Ltd.

3. What are the main segments of the Commercial Airport Radar Systems Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.98 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Weather Radars Segment is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: The Directorate General of Civil Aviation (DGCA) signed a USD 21.4 million contract with Italy's Leonardo Aerospace, Defense, and Security to develop the air navigation system at Kuwait International Airport. According to KUNA, the agreement calls for the installation of two modern radar systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Airport Radar Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Airport Radar Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Airport Radar Systems Industry?

To stay informed about further developments, trends, and reports in the Commercial Airport Radar Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence