Key Insights

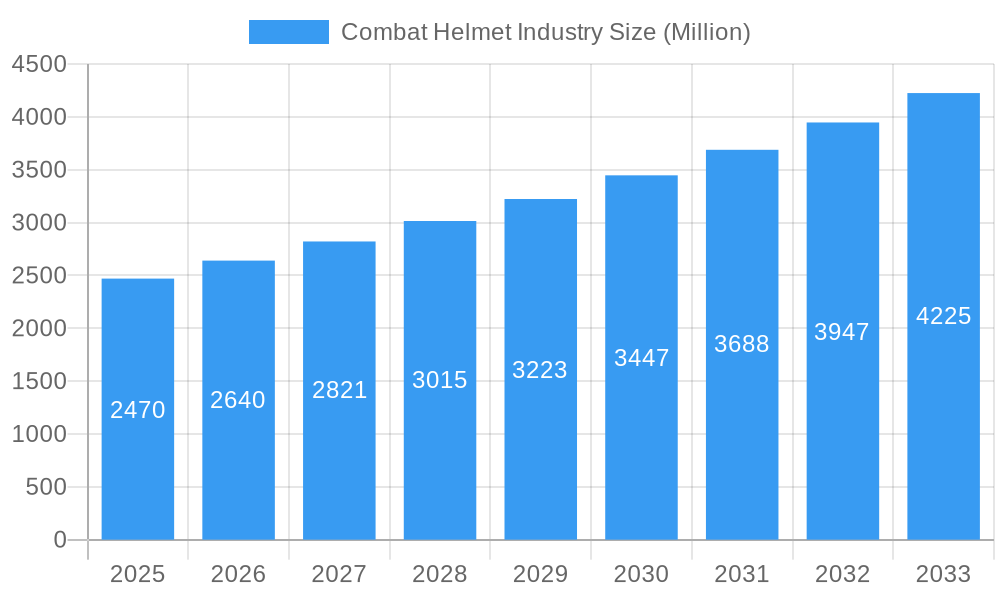

The global combat helmet market is projected for robust expansion, reaching an estimated $2.47 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 6.87% through 2033. This significant growth is primarily fueled by the escalating geopolitical tensions and the persistent need for advanced soldier protection in law enforcement agencies and military operations worldwide. The demand for superior ballistic fibers and lightweight, high-strength thermoplastic materials for helmet construction is a key driver, enhancing soldier survivability and operational effectiveness. Furthermore, the integration of advanced technologies for communication and visual assistance within combat helmets is creating new market opportunities. Emerging trends include the development of modular helmet systems allowing for customization based on specific mission requirements, and the incorporation of smart technologies for enhanced situational awareness. The increasing adoption of lightweight composite materials and advanced manufacturing techniques like 3D printing is also shaping the market landscape, promising more comfortable and effective protective gear for armed forces and law enforcement personnel globally.

Combat Helmet Industry Market Size (In Billion)

Despite the positive growth trajectory, the combat helmet market faces certain restraints. The high cost associated with research and development of advanced protective materials and technologies can be a significant barrier for smaller manufacturers. Stringent testing and certification processes also add to the development time and cost. However, the continuous threat of evolving warfare tactics and the imperative to equip soldiers with cutting-edge protective gear are expected to outweigh these challenges. Key market segments include ballistic fiber and thermoplastic materials, with law enforcement agencies and military being the primary end-users. Protection remains the core application, but the integration of communication and visual assistance features is rapidly gaining prominence, reflecting a shift towards multi-functional protective equipment. Major players like Galvio, Honeywell International Inc., and DuPont de Nemours Inc. are actively investing in innovation to capture a larger market share by offering advanced solutions.

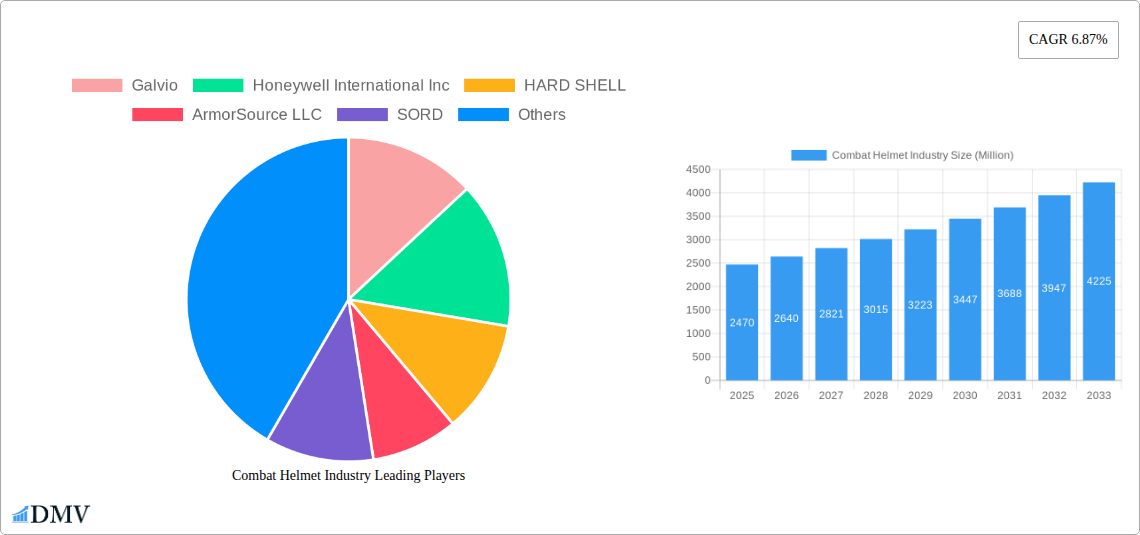

Combat Helmet Industry Company Market Share

Combat Helmet Industry Market Composition & Trends

The global combat helmet market is a dynamic sector characterized by a moderate level of concentration among key players, with companies like Galvio, Honeywell International Inc, HARD SHELL, ArmorSource LLC, SORD, DuPont de Nemours Inc, Gentex Corporation, 3M Company, Revision Military Inc, Indian Armour Systems Pvt Ltd, MKU Limited, and Point Blank Enterprises holding significant market share. Innovation is a primary catalyst, driven by the relentless pursuit of enhanced ballistic protection, reduced weight, and improved user comfort. Regulatory landscapes, particularly stringent military and law enforcement procurement standards, shape product development and market entry. Substitute products, while limited in offering comparable ballistic protection, can include older helmet designs or non-ballistic head protection for specific, lower-threat scenarios. End-user profiles are predominantly military personnel and law enforcement agencies, with evolving requirements for modularity and integrated systems. Mergers and acquisitions (M&A) activity, with an estimated deal value of over XXX Million in the historical period, plays a crucial role in market consolidation and strategic expansion.

- Market Share Distribution: Leading companies command substantial portions of the market, with the top 5 players estimated to hold over 60% of the global market value.

- M&A Deal Values: Historical M&A activity has seen significant investment, with multiple deals exceeding XXX Million, indicating strategic consolidation and market expansion efforts.

Combat Helmet Industry Industry Evolution

The combat helmet industry has undergone a significant evolution over the historical period of 2019–2024, driven by a confluence of technological advancements, escalating geopolitical tensions, and the increasing sophistication of battlefield threats. The market growth trajectory has been consistently upward, with a projected Compound Annual Growth Rate (CAGR) of approximately X.XX% during the forecast period of 2025–2033. This growth is fundamentally linked to the continuous demand for superior protective gear that can withstand an ever-widening array of ballistic threats, including high-velocity rifle rounds and blast fragments. Technological advancements have been pivotal, with a shift towards lightweight yet highly durable materials like advanced ballistic fibers and composite thermoplastics replacing traditional metal components in many applications.

Consumer demands have also evolved considerably. Modern military and law enforcement end-users are no longer satisfied with basic protection. There is a growing emphasis on helmets that offer modularity, allowing for the attachment of various accessories such as communication systems, night vision goggle mounts, and advanced sensor suites. The integration of these functionalities aims to enhance situational awareness, operational efficiency, and overall soldier survivability. Adoption metrics for next-generation helmets showcasing these integrated capabilities have seen a notable increase, with an estimated adoption rate of XX% among advanced military units by the end of the historical period.

Furthermore, the industry has witnessed a strong emphasis on anthropometric research and ergonomic design. This focus ensures that helmets provide not only paramount protection but also optimal comfort for extended wear, reducing fatigue and improving combat effectiveness. The adoption of advanced manufacturing techniques, including 3D printing and precision molding, has enabled greater customization and the production of helmets tailored to specific user needs and head shapes. This evolution signifies a move from a product-centric approach to a user-centric one, where performance, comfort, and integrated technology are paramount. The market is projected to continue this upward trajectory, fueled by ongoing research and development and the persistent need for cutting-edge personal protective equipment.

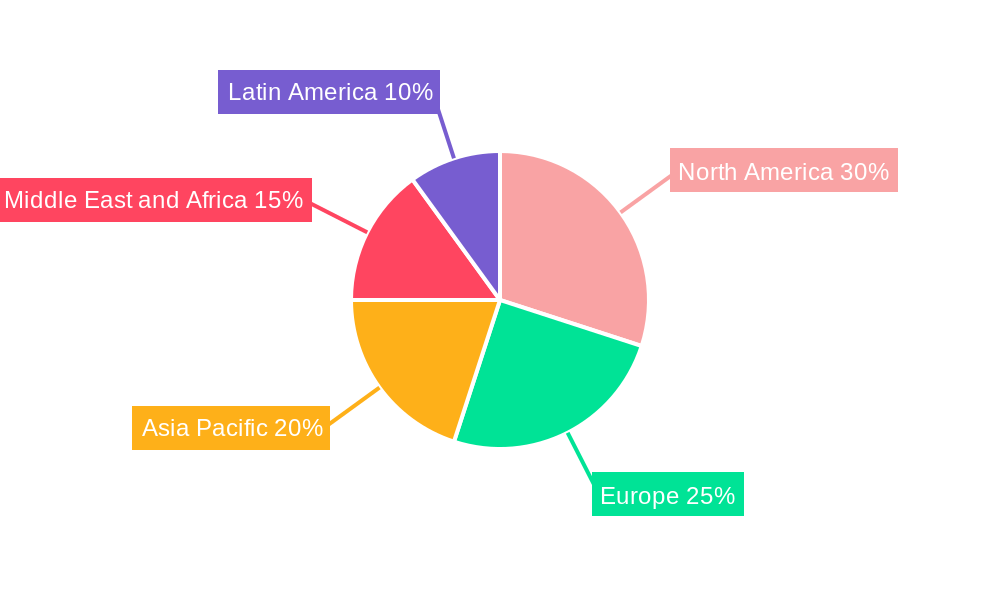

Leading Regions, Countries, or Segments in Combat Helmet Industry

The combat helmet industry's dominance is multifaceted, with key regions, countries, and segments exhibiting strong growth and influence. North America, particularly the United States, stands out as a leading region, driven by substantial government procurement budgets for military and law enforcement agencies, coupled with a robust ecosystem of advanced material manufacturers and helmet developers. This dominance is further amplified by significant investment in research and development, pushing the boundaries of ballistic protection and helmet technology.

Within the Material segment, Ballistic Fiber is currently the most dominant, accounting for an estimated XX% of the market value. This is due to its superior strength-to-weight ratio and proven effectiveness against high-velocity threats. However, Thermoplastics are experiencing rapid growth, driven by advancements in their protective capabilities and cost-effectiveness.

In terms of End User, the Military segment represents the largest share, estimated at over XX% of the market. This is a direct consequence of global defense spending and ongoing military modernization programs. Law Enforcement Agencies constitute a significant secondary market, with increasing demand for advanced protective gear to counter rising levels of sophisticated criminal activity and urban warfare scenarios.

The Application segment clearly highlights Protection as the primary driver, representing approximately XX% of market value. However, the demand for integrated Communication and Visual Assistance capabilities is surging, with these applications showing the highest growth rates. This reflects a shift towards 'smart' helmets that enhance soldier-to-soldier communication, improve target acquisition, and provide real-time tactical information.

Key Drivers in North America:

- Investment Trends: Significant government R&D funding and procurement contracts for advanced soldier systems, exceeding XXX Million annually.

- Regulatory Support: Strict defense procurement standards and certifications drive the adoption of high-performance protective equipment.

- Technological Hubs: Presence of leading defense contractors and material science innovators fosters continuous product development.

Dominance Factors in Ballistic Fiber Segment:

- Proven Performance: Decades of battlefield validation against a wide range of ballistic threats.

- Material Science Advancements: Ongoing improvements in fiber strength, weave patterns, and resin systems enhance protective capabilities.

- Extensive Supply Chain: Well-established global supply chains for critical raw materials like Aramid and UHMWPE fibers.

Dominance Factors in Military End User Segment:

- Large-Scale Procurement: Sustained demand from national defense forces for troop modernization and replacement cycles.

- High-Threat Environments: Ongoing global conflicts and counter-terrorism operations necessitate advanced protective gear.

- Technological Integration: Military forces are early adopters of integrated communication and sensor systems within helmets.

Combat Helmet Industry Product Innovations

Product innovations in the combat helmet industry are revolutionizing soldier protection and operational effectiveness. Companies are increasingly focusing on ultra-lightweight designs, such as ArmorSource LLC's Aire System, which utilizes new lightweight materials and offers modular shells, significantly reducing user burden without compromising protection. The integration of advanced materials like advanced ballistic fibers and reinforced thermoplastics is leading to helmets that offer superior ballistic resistance at reduced weights. Furthermore, the development of modular helmet systems allows for the seamless attachment of communication devices, night vision goggle mounts, and advanced sensor arrays, enhancing situational awareness and interoperability. Performance metrics are being redefined, with new helmets exceeding established standards for ballistic impact resistance, fragmentation protection, and blunt force trauma reduction, often achieving up to XX% improvement in these areas.

Propelling Factors for Combat Helmet Industry Growth

The combat helmet industry's growth is propelled by several key factors. Geopolitical instability and ongoing conflicts globally necessitate enhanced soldier protection, driving demand for advanced ballistic helmets. Technological advancements in material science, particularly in lightweight ballistic fibers and advanced composites, enable the creation of more effective and comfortable protective gear. Government defense modernization programs and procurement initiatives, backed by substantial budgets in the tens of billions of USD annually, are critical drivers. The increasing adoption of integrated communication and visual assistance systems within helmets by military and law enforcement agencies further fuels innovation and market expansion.

Obstacles in the Combat Helmet Industry Market

Despite robust growth, the combat helmet industry faces several obstacles. High research and development costs associated with cutting-edge materials and integrated technologies can be a barrier to entry for smaller players. Stringent and evolving military procurement standards and lengthy certification processes can delay product commercialization and increase development timelines, potentially impacting market agility. Supply chain disruptions, particularly for specialized raw materials like advanced ballistic fibers, can lead to production delays and increased costs, with potential impacts of up to XX% on production schedules. Intense competition among established players and the emergence of new entrants also exert pressure on pricing and market share.

Future Opportunities in Combat Helmet Industry

Significant future opportunities lie in the development of "smart helmets" with advanced integrated functionalities, such as real-time threat detection, augmented reality displays, and enhanced communication capabilities, potentially creating a new market segment valued at over XXX Million. The growing demand for customized solutions for specialized units within military and law enforcement agencies presents another avenue for growth. Furthermore, the expansion into emerging markets with increasing defense spending and modernization efforts offers substantial untapped potential. Innovations in biomimetic materials and energy-harvesting technologies for helmet-integrated devices could also redefine future product offerings.

Major Players in the Combat Helmet Industry Ecosystem

- Galvio

- Honeywell International Inc

- HARD SHELL

- ArmorSource LLC

- SORD

- DuPont de Nemours Inc

- Gentex Corporation

- 3M Company

- Revision Military Inc

- Indian Armour Systems Pvt Ltd

- MKU Limited

- Point Blank Enterprises

Key Developments in Combat Helmet Industry Industry

- April 2023: ArmorSource LLC, a US-based ballistic helmet manufacturer, introduced its next-generation Aire System, a helmet that offers six different shells that use new lightweight materials. In addition to the shells, the system includes an ultra-lightweight helmet mount and multiple helmet accessories designed to provide maximum protection and comfort. This launch significantly enhances modularity and user-centric design in the market.

- March 2022: Australia announced a landmark AUD 35 million (USD 24 million) contract with the local company Aquaterro. It is for the refurbishment of the ADF Tiered Combat Helmet used by the Australian Armed Forces. This signifies significant investment in extending the lifespan and improving existing protective gear.

- February 2022: The Indian Army announced plans to acquire 80,000 new ballistic helmets, providing greater protection against high-velocity bullets. According to the service, the helmet must be capable of protecting troops from 7.6239 mm mild steel core bullets at a range of 10 m (32.8 ft). It must also lessen the impact of high-speed blast fragments from explosives. This development highlights the growing demand for high-level ballistic protection in major defense forces.

Strategic Combat Helmet Industry Market Forecast

The combat helmet industry is poised for significant strategic growth, driven by an intensifying global security landscape and continuous demand for advanced soldier protection. Future opportunities are deeply rooted in the integration of smart technologies, enhancing situational awareness and communication for military and law enforcement personnel. The market will witness a sustained emphasis on lightweight yet superior ballistic materials, alongside ergonomic designs for improved user comfort and performance. Emerging economies with increasing defense budgets represent substantial growth markets. Strategic partnerships and continuous innovation in material science and protective technologies will be crucial for players aiming to capture market share and capitalize on the evolving needs of end-users, projecting a market value to reach well over XXX Million by 2033.

Combat Helmet Industry Segmentation

-

1. Material

- 1.1. Ballistic Fiber

- 1.2. Thermoplastic

- 1.3. Metal

-

2. End User

- 2.1. Law Enforcement Agencies

- 2.2. Military

-

3. Application

- 3.1. Protection

- 3.2. Communication

- 3.3. Visual Assistance

Combat Helmet Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Turkey

- 5.4. Rest of Middle East and Africa

Combat Helmet Industry Regional Market Share

Geographic Coverage of Combat Helmet Industry

Combat Helmet Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Ballistic Fiber Helmets Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Combat Helmet Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Ballistic Fiber

- 5.1.2. Thermoplastic

- 5.1.3. Metal

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Law Enforcement Agencies

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Protection

- 5.3.2. Communication

- 5.3.3. Visual Assistance

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Combat Helmet Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Ballistic Fiber

- 6.1.2. Thermoplastic

- 6.1.3. Metal

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Law Enforcement Agencies

- 6.2.2. Military

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Protection

- 6.3.2. Communication

- 6.3.3. Visual Assistance

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Combat Helmet Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Ballistic Fiber

- 7.1.2. Thermoplastic

- 7.1.3. Metal

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Law Enforcement Agencies

- 7.2.2. Military

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Protection

- 7.3.2. Communication

- 7.3.3. Visual Assistance

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Combat Helmet Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Ballistic Fiber

- 8.1.2. Thermoplastic

- 8.1.3. Metal

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Law Enforcement Agencies

- 8.2.2. Military

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Protection

- 8.3.2. Communication

- 8.3.3. Visual Assistance

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America Combat Helmet Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Ballistic Fiber

- 9.1.2. Thermoplastic

- 9.1.3. Metal

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Law Enforcement Agencies

- 9.2.2. Military

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Protection

- 9.3.2. Communication

- 9.3.3. Visual Assistance

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Combat Helmet Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Ballistic Fiber

- 10.1.2. Thermoplastic

- 10.1.3. Metal

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Law Enforcement Agencies

- 10.2.2. Military

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Protection

- 10.3.2. Communication

- 10.3.3. Visual Assistance

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Galvio

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HARD SHELL

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ArmorSource LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SORD

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DuPont de Nemours Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gentex Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 3M Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Revision Military Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Indian Armour Systems Pvt Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MKU Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Point Blank Enterprises

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Galvio

List of Figures

- Figure 1: Global Combat Helmet Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Combat Helmet Industry Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Combat Helmet Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Combat Helmet Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Combat Helmet Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Combat Helmet Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Combat Helmet Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Combat Helmet Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Combat Helmet Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Combat Helmet Industry Revenue (Million), by Material 2025 & 2033

- Figure 11: Europe Combat Helmet Industry Revenue Share (%), by Material 2025 & 2033

- Figure 12: Europe Combat Helmet Industry Revenue (Million), by End User 2025 & 2033

- Figure 13: Europe Combat Helmet Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Combat Helmet Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Combat Helmet Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Combat Helmet Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Combat Helmet Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Combat Helmet Industry Revenue (Million), by Material 2025 & 2033

- Figure 19: Asia Pacific Combat Helmet Industry Revenue Share (%), by Material 2025 & 2033

- Figure 20: Asia Pacific Combat Helmet Industry Revenue (Million), by End User 2025 & 2033

- Figure 21: Asia Pacific Combat Helmet Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific Combat Helmet Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Combat Helmet Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Combat Helmet Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Combat Helmet Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Combat Helmet Industry Revenue (Million), by Material 2025 & 2033

- Figure 27: Latin America Combat Helmet Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: Latin America Combat Helmet Industry Revenue (Million), by End User 2025 & 2033

- Figure 29: Latin America Combat Helmet Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Latin America Combat Helmet Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: Latin America Combat Helmet Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America Combat Helmet Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Combat Helmet Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Combat Helmet Industry Revenue (Million), by Material 2025 & 2033

- Figure 35: Middle East and Africa Combat Helmet Industry Revenue Share (%), by Material 2025 & 2033

- Figure 36: Middle East and Africa Combat Helmet Industry Revenue (Million), by End User 2025 & 2033

- Figure 37: Middle East and Africa Combat Helmet Industry Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East and Africa Combat Helmet Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Combat Helmet Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Combat Helmet Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Combat Helmet Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Combat Helmet Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Combat Helmet Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Combat Helmet Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Combat Helmet Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Combat Helmet Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Combat Helmet Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Global Combat Helmet Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Combat Helmet Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Combat Helmet Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 12: Global Combat Helmet Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 13: Global Combat Helmet Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Combat Helmet Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Germany Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Combat Helmet Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 20: Global Combat Helmet Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 21: Global Combat Helmet Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Combat Helmet Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Combat Helmet Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 29: Global Combat Helmet Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global Combat Helmet Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Combat Helmet Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Mexico Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Brazil Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Latin America Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Combat Helmet Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 36: Global Combat Helmet Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 37: Global Combat Helmet Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Combat Helmet Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 39: Saudi Arabia Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: United Arab Emirates Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Turkey Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Combat Helmet Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Combat Helmet Industry?

The projected CAGR is approximately 6.87%.

2. Which companies are prominent players in the Combat Helmet Industry?

Key companies in the market include Galvio, Honeywell International Inc, HARD SHELL, ArmorSource LLC, SORD, DuPont de Nemours Inc, Gentex Corporation, 3M Company, Revision Military Inc, Indian Armour Systems Pvt Ltd, MKU Limited, Point Blank Enterprises.

3. What are the main segments of the Combat Helmet Industry?

The market segments include Material, End User, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.47 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Ballistic Fiber Helmets Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2023: ArmorSource LLC, a US-based ballistic helmet manufacturer, introduced its next-generation Aire System, a helmet that offers six different shells that use new lightweight materials. In addition to the shells, the system includes an ultra-lightweight helmet mount and multiple helmet accessories designed to provide maximum protection and comfort.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Combat Helmet Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Combat Helmet Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Combat Helmet Industry?

To stay informed about further developments, trends, and reports in the Combat Helmet Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence