Key Insights

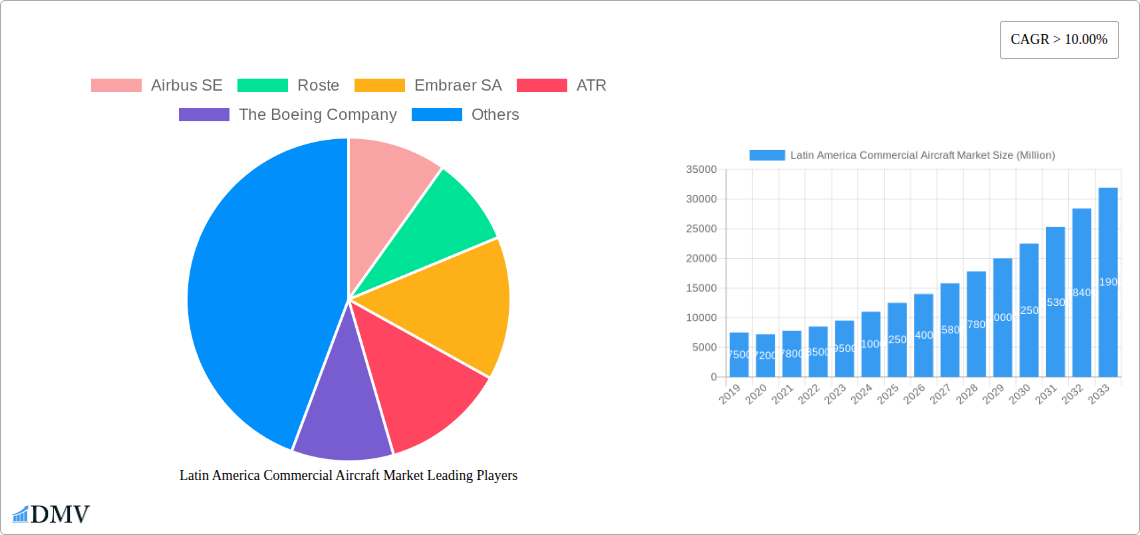

The Latin America Commercial Aircraft Market is set for substantial growth, projected to reach $38.55 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.4% through 2033. This expansion is driven by increasing air travel demand, fueled by a growing middle class and thriving tourism sectors. Fleet modernization efforts by airlines, aimed at improving fuel efficiency and passenger experience, are also significant contributors. The rise of low-cost carriers further democratizes air travel, opening new routes and passenger segments. Technological advancements in aircraft design, emphasizing fuel efficiency and environmental sustainability, are stimulating investment and fleet upgrades. Rising disposable incomes and favorable demographics in key Latin American economies are directly increasing air passenger volumes, ensuring sustained demand for advanced commercial aircraft.

Latin America Commercial Aircraft Market Market Size (In Billion)

Market challenges include economic volatility and currency fluctuations, which can affect airline profitability and capital expenditure on new aircraft. Infrastructure limitations, such as the need for airport upgrades and enhanced air traffic control, may also constrain rapid fleet expansion. Nevertheless, continued growth is anticipated, with Brazil, Mexico, and Colombia expected to lead due to their established aviation infrastructure and high passenger traffic. The "Rest of Latin America" segment is also poised for development as emerging economies improve connectivity. Key industry players including Airbus SE, Rostec, Embraer SA, ATR, and The Boeing Company are strategically positioned to leverage these opportunities, offering a diverse range of aircraft to meet regional carrier demands.

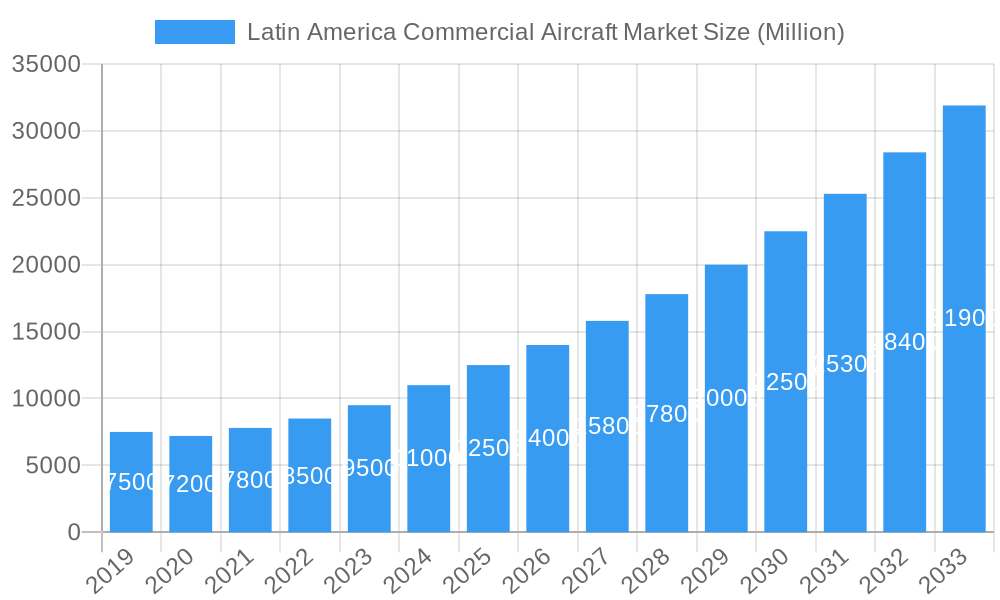

Latin America Commercial Aircraft Market Company Market Share

Latin America Commercial Aircraft Market: Comprehensive Market Insights & Future Outlook 2019-2033

This in-depth report provides a panoramic view of the Latin America Commercial Aircraft Market, offering critical insights for stakeholders seeking to capitalize on this dynamic sector. We meticulously analyze market trends, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. Leveraging extensive data and expert analysis, this report equips you with the strategic intelligence needed to navigate the complexities of the Latin American aviation landscape. Our study period spans from 2019 to 2033, with a base year of 2025 and an estimated year also of 2025, followed by a comprehensive forecast period from 2025 to 2033, with historical data from 2019 to 2024.

Latin America Commercial Aircraft Market Market Composition & Trends

The Latin America Commercial Aircraft Market is characterized by a moderate level of concentration, with Airbus SE, Embraer SA, and The Boeing Company holding significant market share, estimated at over 70% combined. ATR and Roste also play crucial roles, particularly in regional aviation and specific segments. Innovation is driven by the demand for fuel-efficient, technologically advanced aircraft, spurred by evolving environmental regulations and the need for optimized operational costs. The regulatory landscape is a critical factor, with varying national policies impacting aircraft acquisition, operations, and maintenance. While direct substitute products for commercial aircraft are limited, advancements in high-speed rail and emerging urban air mobility solutions could present future competitive pressures. End-user profiles vary from major flag carriers to low-cost airlines and cargo operators, each with distinct fleet requirements. Mergers and acquisitions (M&A) activities are anticipated to play a role in market consolidation, with potential deal values projected to reach hundreds of millions for strategic acquisitions in fleet expansion or technology integration.

Latin America Commercial Aircraft Market Industry Evolution

The Latin America Commercial Aircraft Market has witnessed a robust evolutionary trajectory, driven by a confluence of factors. Historically, from 2019 to 2024, the market experienced fluctuations influenced by global economic conditions and the unprecedented impact of the COVID-19 pandemic. However, a significant recovery and growth phase is projected from 2025 onwards. This growth is fueled by increasing air passenger traffic, especially in emerging economies within the region, and the continuous need to modernize aging fleets with more fuel-efficient and environmentally compliant aircraft. Technological advancements are at the forefront, with a growing emphasis on next-generation narrow-body and regional jets, incorporating lighter materials, advanced aerodynamics, and more efficient engine technologies. These innovations are not only aimed at reducing operational costs for airlines but also at meeting stringent emissions standards.

Shifting consumer demands, particularly for more affordable and direct flight options, are prompting airlines to invest in smaller, more agile aircraft suitable for regional routes. The expansion of low-cost carriers (LCCs) across the region continues to be a major trend, driving demand for efficient single-aisle aircraft. Furthermore, the growth in e-commerce and logistics is creating a burgeoning demand for freighter aircraft, presenting a significant growth avenue. Projections indicate a compound annual growth rate (CAGR) for the Latin America Commercial Aircraft Market in the range of 5-7% during the forecast period 2025-2033, with specific segments like regional aircraft and narrow-body jets expected to outperform. Adoption metrics for new aircraft technologies are expected to accelerate as airlines prioritize sustainability and cost-effectiveness.

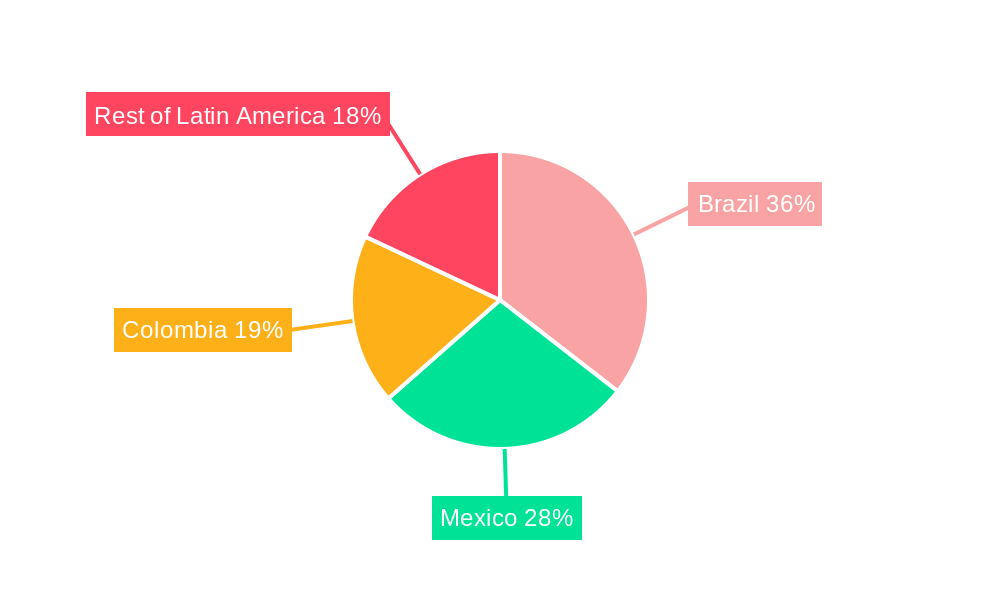

Leading Regions, Countries, or Segments in Latin America Commercial Aircraft Market

Within the Latin America Commercial Aircraft Market, Brazil consistently emerges as the dominant region, often accounting for a substantial portion of fleet orders and operational activity. This leadership is underpinned by several key drivers:

- Investment Trends: Brazil boasts the largest domestic aviation market in Latin America, attracting significant investment from both domestic and international airlines. Major carriers like LATAM Airlines Group and GOL Linhas Aéreas Inteligentes operate extensive networks, necessitating continuous fleet expansion and modernization. The sheer volume of passenger traffic and the geographical vastness of the country demand a robust commercial aviation infrastructure. Estimated investment in new aircraft by Brazilian carriers is projected to be in the billions of dollars annually.

- Regulatory Support: While regulatory frameworks can vary, Brazil has generally fostered an environment conducive to aviation growth. Government initiatives aimed at improving airport infrastructure and facilitating air travel have indirectly boosted the commercial aircraft market. Furthermore, favorable financing options and incentives for fleet acquisition can play a crucial role.

- Economic Growth and Tourism: A growing middle class and an expanding tourism sector in Brazil directly translate into higher demand for air travel. This sustained demand ensures a steady need for new and updated commercial aircraft to cater to a larger passenger base.

Following Brazil, Mexico stands out as another critical market. Its strategic location, strong economic ties with North America, and a vibrant tourism industry make it a key player. Airlines like Aeromexico and Volaris are significant operators, driving demand for both narrow-body and regional aircraft. Mexico's consistent economic performance and its appeal as a tourist destination contribute to its strong aviation sector.

Colombia represents a rapidly growing segment, driven by increasing domestic connectivity and the expansion of low-cost carriers. Airlines such as Avianca and Viva Air have been instrumental in boosting air travel penetration. Colombia's efforts to develop its tourism and business travel infrastructure further solidify its position in the market.

The Rest of Latin America, encompassing countries like Argentina, Chile, Peru, and Ecuador, collectively forms a significant and evolving segment. While individual country markets may be smaller, their combined potential is substantial. Emerging economies within this group are witnessing increasing disposable incomes and a growing aspiration for air travel, presenting considerable growth opportunities for commercial aircraft manufacturers and lessors. The expansion of regional connectivity within these nations is a key factor driving demand for smaller, more efficient aircraft.

Latin America Commercial Aircraft Market Product Innovations

The Latin America Commercial Aircraft Market is witnessing a surge in product innovations focused on enhancing fuel efficiency, reducing emissions, and improving passenger comfort. Manufacturers are emphasizing advanced composite materials in aircraft construction, leading to lighter airframes and subsequently, reduced fuel consumption. The integration of new-generation turbofan engines with higher bypass ratios significantly lowers operating costs and environmental impact, a critical factor for airlines in the region. Furthermore, cabin innovations, including redesigned interiors for optimized seating capacity and enhanced in-flight entertainment systems, are becoming key selling propositions. The development of longer-range narrow-body aircraft also offers airlines the flexibility to open new direct routes within and beyond Latin America, expanding connectivity.

Propelling Factors for Latin America Commercial Aircraft Market Growth

Several key factors are propelling the Latin America Commercial Aircraft Market forward. Technologically, the demand for more fuel-efficient and environmentally friendly aircraft is a primary driver, pushing manufacturers to innovate. Economically, the steady growth of emerging economies within the region, coupled with an expanding middle class, is leading to increased disposable income and a higher propensity for air travel. Airlines are also benefiting from lower operational costs associated with newer aircraft. Regulatory influences, while varied, generally encourage fleet modernization to meet international emissions standards. Furthermore, significant investments in tourism infrastructure across several Latin American countries are creating a sustained demand for air connectivity, directly impacting commercial aircraft acquisition.

Obstacles in the Latin America Commercial Aircraft Market Market

Despite its growth potential, the Latin America Commercial Aircraft Market faces several obstacles. Regulatory challenges, including varying import duties, certification processes, and air traffic control infrastructure, can create complexities for manufacturers and operators. Economic volatility and currency fluctuations in some countries can impact airlines' ability to secure financing for aircraft purchases. Supply chain disruptions, both global and regional, can lead to extended delivery times for new aircraft and spare parts, affecting operational continuity. Intense competitive pressures among airlines, especially in the low-cost carrier segment, can squeeze profit margins, potentially delaying fleet upgrade decisions.

Future Opportunities in Latin America Commercial Aircraft Market

The Latin America Commercial Aircraft Market presents exciting future opportunities. The growing demand for regional air travel, connecting smaller cities and underserved routes, opens avenues for turboprop and regional jet manufacturers. The e-commerce boom is fueling a significant increase in air cargo demand, creating opportunities for freighter aircraft sales and conversions. Furthermore, the ongoing focus on sustainability offers prospects for manufacturers developing electric or hybrid-electric aircraft technologies in the longer term. Digitalization of aviation services, including predictive maintenance and advanced route planning, also presents opportunities for service providers and technology integrators.

Major Players in the Latin America Commercial Aircraft Market Ecosystem

- Airbus SE

- Roste

- Embraer SA

- ATR

- The Boeing Company

Key Developments in Latin America Commercial Aircraft Market Industry

- 2024: Several Latin American airlines announce ambitious fleet modernization plans, focusing on next-generation narrow-body aircraft to improve fuel efficiency and reduce emissions.

- 2023/2024: Increased investment in airport infrastructure across key countries like Brazil and Colombia, aimed at handling larger aircraft and increasing flight capacity.

- 2023: Expansion of low-cost carrier routes within the region, driving demand for smaller, more efficient aircraft.

- 2022/2023: Growing interest in freighter aircraft conversions and dedicated cargo planes due to the surge in e-commerce and logistics demands.

- 2021-2023: Post-pandemic recovery in air passenger traffic, leading to a gradual increase in aircraft leasing and acquisition activities.

Strategic Latin America Commercial Aircraft Market Market Forecast

The Latin America Commercial Aircraft Market is poised for sustained growth, driven by a combination of economic recovery, increasing air passenger demand, and technological advancements. The strategic focus on fuel efficiency and reduced emissions will continue to shape fleet acquisition decisions, favoring modern narrow-body and regional jets. Emerging opportunities in cargo aviation and the potential for sustainable aviation fuels will further bolster market expansion. With a projected CAGR of 5-7%, the market offers significant potential for aircraft manufacturers, lessors, and related service providers who can adapt to evolving industry trends and cater to the unique demands of the Latin American aviation landscape.

Latin America Commercial Aircraft Market Segmentation

-

1. Geography

- 1.1. Brazil

- 1.2. Mexico

- 1.3. Colombia

- 1.4. Rest of Latin America

Latin America Commercial Aircraft Market Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Colombia

- 4. Rest of Latin America

Latin America Commercial Aircraft Market Regional Market Share

Geographic Coverage of Latin America Commercial Aircraft Market

Latin America Commercial Aircraft Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Passenger Aircraft Segment held the Largest Share in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Brazil

- 5.1.2. Mexico

- 5.1.3. Colombia

- 5.1.4. Rest of Latin America

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Colombia

- 5.2.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Brazil Latin America Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Brazil

- 6.1.2. Mexico

- 6.1.3. Colombia

- 6.1.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Mexico Latin America Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Brazil

- 7.1.2. Mexico

- 7.1.3. Colombia

- 7.1.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Colombia Latin America Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Brazil

- 8.1.2. Mexico

- 8.1.3. Colombia

- 8.1.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Rest of Latin America Latin America Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Brazil

- 9.1.2. Mexico

- 9.1.3. Colombia

- 9.1.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Airbus SE

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Roste

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Embraer SA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ATR

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Boeing Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 Airbus SE

List of Figures

- Figure 1: Latin America Commercial Aircraft Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Commercial Aircraft Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Commercial Aircraft Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 2: Latin America Commercial Aircraft Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Latin America Commercial Aircraft Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Latin America Commercial Aircraft Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Latin America Commercial Aircraft Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Latin America Commercial Aircraft Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Latin America Commercial Aircraft Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Latin America Commercial Aircraft Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Latin America Commercial Aircraft Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Latin America Commercial Aircraft Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Commercial Aircraft Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Latin America Commercial Aircraft Market?

Key companies in the market include Airbus SE, Roste, Embraer SA, ATR, The Boeing Company.

3. What are the main segments of the Latin America Commercial Aircraft Market?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.55 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Passenger Aircraft Segment held the Largest Share in 2021.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Commercial Aircraft Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Commercial Aircraft Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Commercial Aircraft Market?

To stay informed about further developments, trends, and reports in the Latin America Commercial Aircraft Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence