Key Insights

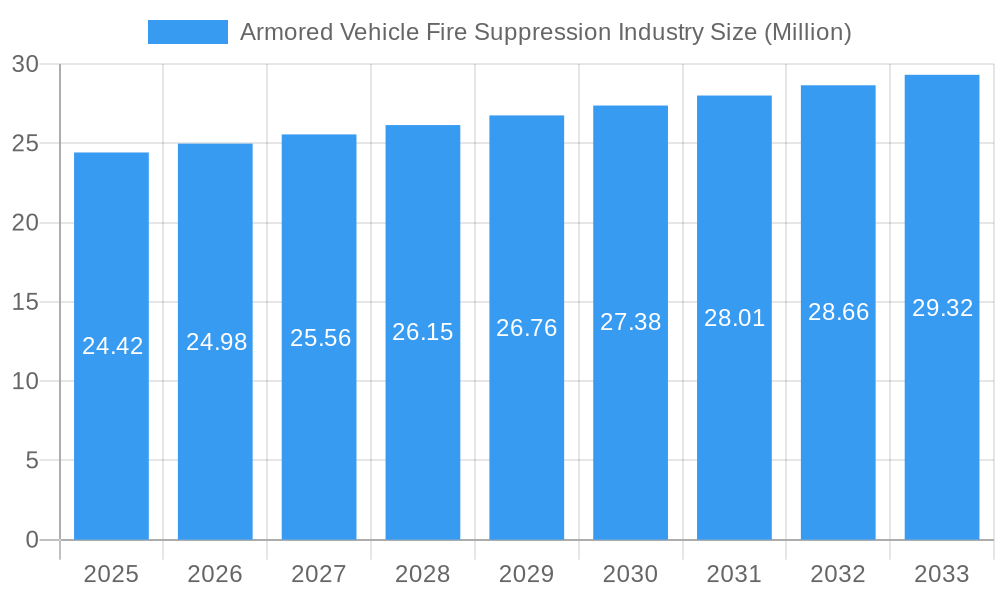

The global Armored Vehicle Fire Suppression Systems market is projected for robust expansion, currently valued at an estimated $24.42 million. This growth is fueled by a steadily increasing CAGR of 2.31% through the forecast period of 2025-2033. The primary drivers behind this upward trajectory include the escalating global defense spending, heightened geopolitical tensions, and the continuous need to upgrade aging military fleets with advanced safety and survivability features. As modern combat vehicles become more sophisticated and carry a greater array of electronics and fuel, the risk of fire incidents, whether from combat damage or internal malfunctions, also rises. Consequently, the demand for effective and reliable fire suppression solutions designed specifically for the harsh and demanding environments of armored vehicles is paramount. This necessitates innovative technologies capable of rapid detection and extinguishing of fires, thereby protecting both personnel and expensive military assets.

Armored Vehicle Fire Suppression Industry Market Size (In Million)

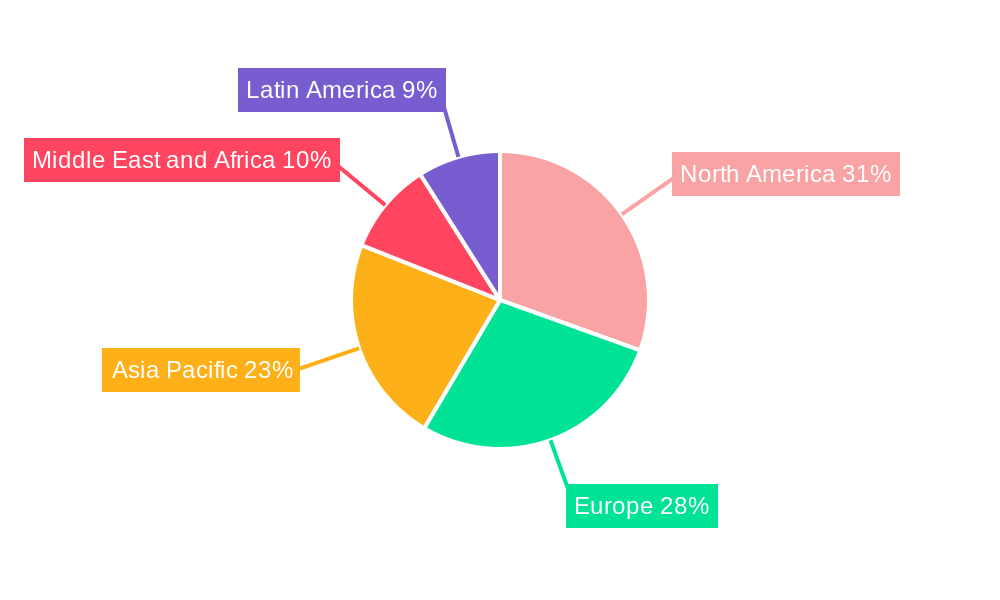

The market's expansion is further supported by several key trends, including the integration of intelligent fire detection and suppression technologies, the development of lighter and more compact systems, and an increased focus on environmentally friendly suppression agents. While the market is poised for growth, certain restraints, such as the high cost of advanced fire suppression systems and complex procurement processes within defense organizations, may temper the pace of adoption in some regions. However, the overarching imperative of enhancing crew safety and vehicle survivability is expected to outweigh these challenges. The market is segmented across various vehicle types, with Combat Vehicles and Troop Transport Vehicles representing significant segments due to their critical roles in defense operations. Geographically, North America and Europe are anticipated to lead market demand, driven by established defense industries and significant investment in military modernization. The Asia Pacific region is also expected to witness substantial growth, propelled by increasing defense budgets and ongoing military expansion.

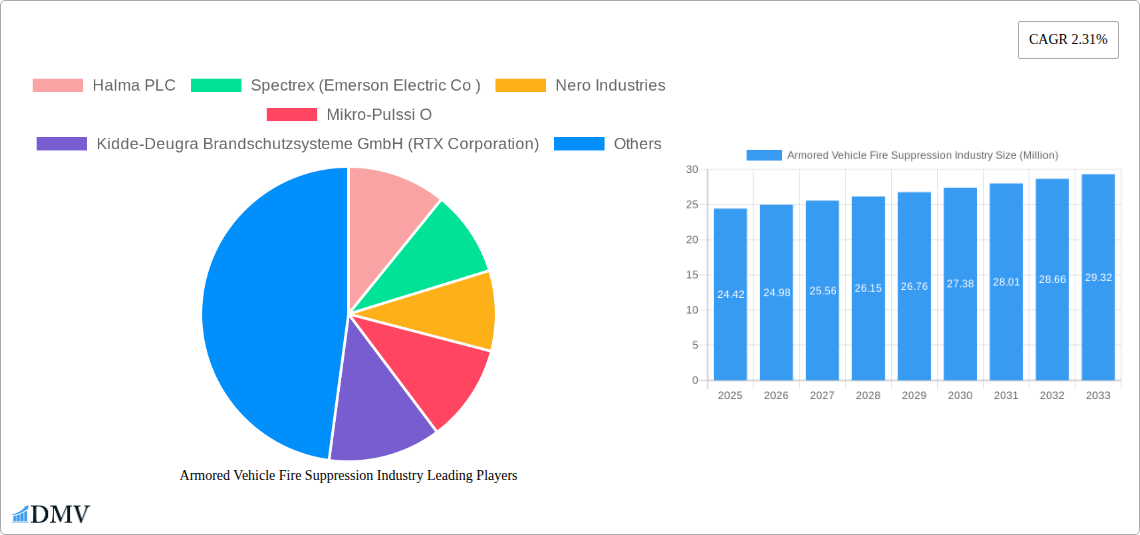

Armored Vehicle Fire Suppression Industry Company Market Share

Armored Vehicle Fire Suppression Industry: Market Analysis and Forecast 2019-2033

Report Description:

This comprehensive market research report delves into the dynamic Armored Vehicle Fire Suppression Industry, providing an in-depth analysis of market composition, trends, evolution, and future projections. Examining the period from 2019 to 2033, with a base year of 2025, this report offers critical insights for stakeholders seeking to understand market concentration, innovation catalysts, regulatory landscapes, and leading players. Our analysis covers key segments including Combat Vehicles and Troop Transport Vehicles, and identifies pivotal Industry Developments. The report is meticulously crafted for SEO optimization, incorporating high-ranking keywords such as "armored vehicle fire suppression," "military vehicle safety," "defense industry fire protection," and "vehicle fire protection systems" to ensure maximum search visibility and captivate defense procurement professionals, technology providers, and investment firms. With a forecast period extending to 2033, this report is an indispensable resource for strategic decision-making in this vital sector.

Armored Vehicle Fire Suppression Industry Market Composition & Trends

The Armored Vehicle Fire Suppression Industry exhibits a moderate to high market concentration, with key players investing heavily in research and development to introduce advanced solutions. Innovation catalysts include the escalating demand for enhanced crew survivability in high-threat environments and continuous advancements in fire detection and suppression technologies. The regulatory landscape is characterized by stringent military specifications and evolving safety standards, driving the adoption of sophisticated systems. Substitute products, while existing, often lack the specialized performance required for armored vehicles. End-user profiles predominantly consist of national defense forces, homeland security agencies, and international military organizations. Mergers and acquisition (M&A) activities are driven by the desire to consolidate market share, acquire proprietary technologies, and expand product portfolios. For instance, significant M&A deals have been observed, with an estimated aggregate deal value of XX Million across the historical period, reflecting strategic consolidation. Market share distribution is influenced by the technological prowess and long-term supply contracts secured by leading companies.

Armored Vehicle Fire Suppression Industry Industry Evolution

The Armored Vehicle Fire Suppression Industry has undergone significant evolution driven by technological innovation and the ever-increasing threat landscape faced by military and security forces. Over the historical period (2019-2024), market growth trajectories have been largely shaped by increased defense spending in response to geopolitical tensions and the proliferation of asymmetric warfare tactics. Technological advancements have been central to this evolution, with a pronounced shift towards faster, more reliable, and more intelligent fire detection and suppression systems. Early systems relied on simpler chemical-agent suppression, but advancements have introduced sophisticated sensor technologies, including infrared and ultraviolet detection, coupled with advanced extinguishing agents like HFCs and newer, environmentally friendlier alternatives. The adoption of these advanced systems has seen a steady increase, with an estimated adoption rate of XX% for next-generation fire suppression in new vehicle acquisitions during the forecast period.

Shifting consumer demands, primarily from military end-users, have consistently pushed for lighter, more compact, and energy-efficient systems that minimize the impact on vehicle performance and operational range. The increasing complexity of armored vehicles, with their integrated electronic systems and larger engine compartments, has necessitated the development of multi-zone suppression capabilities and tailored solutions for specific vehicle types. Furthermore, the focus on crew survivability has led to the development of rapid suppression systems that can activate within milliseconds of detection, significantly reducing the risk of fire-related casualties. The industry has also witnessed a growing emphasis on modularity and ease of maintenance, allowing for quicker repairs and upgrades in operational theaters. The projected market growth rate for the Armored Vehicle Fire Suppression Industry is estimated to be XX% CAGR between 2025 and 2033, indicating a robust expansion fueled by ongoing defense modernization programs and the persistent need for enhanced vehicle safety. This evolution underscores a commitment to innovation and a proactive approach to addressing the critical safety requirements of modern armored platforms.

Leading Regions, Countries, or Segments in Armored Vehicle Fire Suppression Industry

The dominance within the Armored Vehicle Fire Suppression Industry is primarily dictated by regions with substantial defense budgets, active military operations, and robust indigenous defense manufacturing capabilities. North America, particularly the United States, stands out as the leading region, driven by significant investments in military modernization and the extensive use of armored vehicles across its various branches of service. The United States military's continuous requirement for advanced protection systems for its vast fleet of Combat Vehicles, including main battle tanks and infantry fighting vehicles, fuels a substantial portion of the market demand. Furthermore, the U.S. also utilizes a significant number of Troop Transport Vehicles, where enhanced fire safety is paramount for the protection of personnel. The regulatory framework in the U.S., emphasizing stringent performance and reliability standards, further solidifies its leadership position.

- Key Drivers of Dominance in North America:

- High Defense Spending: Consistent and substantial government investment in defense procurement programs.

- Technological Advancement: Strong R&D capabilities and a proactive approach to adopting cutting-edge fire suppression technologies.

- Fleet Modernization: Ongoing programs to upgrade existing armored vehicle fleets and procure new ones with advanced safety features.

- Geopolitical Imperatives: Active involvement in global security operations necessitates robust vehicle protection.

Beyond North America, Europe, with its significant defense spending and active participation in international security initiatives, also represents a key market. Countries like Germany, the UK, and France are major consumers and producers of armored vehicles, thereby driving demand for sophisticated fire suppression systems. The segment of Combat Vehicles generally commands the largest market share due to the higher criticality of fire suppression in direct combat scenarios. However, the Troop Transport Vehicles segment is experiencing significant growth as defense forces worldwide prioritize the safety of their personnel in convoy operations and deployment scenarios. The increasing use of armored buses and personnel carriers in non-combat roles for security purposes also contributes to the expansion of this segment. The proactive development of domestic defense industries in several European nations fosters localized innovation and competition, further contributing to regional market dynamics.

Armored Vehicle Fire Suppression Industry Product Innovations

Recent product innovations in the Armored Vehicle Fire Suppression Industry focus on enhancing detection speed, system reliability, and extinguishing agent effectiveness while minimizing environmental impact and operational burden. Advanced thermal imaging and multi-spectrum fire detection sensors offer near-instantaneous identification of fire sources, even in challenging conditions. Novel extinguishing agents are being developed to offer superior fire suppression with reduced toxicity and global warming potential. Innovations also include intelligent control units capable of diagnosing system health, self-testing, and providing real-time status updates to vehicle command systems, ensuring maximum readiness. These advancements are critical for protecting the crew and sensitive onboard electronics within demanding operational environments.

Propelling Factors for Armored Vehicle Fire Suppression Industry Growth

The Armored Vehicle Fire Suppression Industry is experiencing robust growth driven by several key factors. Foremost is the global surge in defense spending and the ongoing modernization of military fleets worldwide, necessitating advanced safety solutions for all vehicle types. Increased awareness and stringent regulatory mandates regarding crew survivability in combat and high-risk operational environments are significant drivers. Technological advancements, such as faster detection systems and more effective extinguishing agents, are continuously improving the efficacy of fire suppression, making them indispensable. Furthermore, the rising threat of improvised explosive devices (IEDs) and direct fire incidents, which can lead to vehicle fires, underscores the critical need for reliable fire protection systems.

Obstacles in the Armored Vehicle Fire Suppression Industry Market

Despite its growth, the Armored Vehicle Fire Suppression Industry faces several obstacles. High development and integration costs for cutting-edge fire suppression systems can be prohibitive, particularly for smaller defense contractors or nations with limited budgets. Stringent and evolving military specifications, while ensuring quality, can also lead to lengthy qualification processes and extended product development cycles. Supply chain disruptions, particularly for specialized electronic components and chemical agents, can impact production timelines and increase costs. Intense competition among established players and emerging entrants can also put pressure on pricing and profit margins, requiring companies to constantly innovate and optimize their offerings to maintain market share. The significant upfront investment required can also be a barrier to widespread adoption in certain segments.

Future Opportunities in Armored Vehicle Fire Suppression Industry

The Armored Vehicle Fire Suppression Industry presents numerous future opportunities. The increasing adoption of unmanned ground vehicles (UGVs) in military operations opens new avenues for specialized fire suppression solutions. Growing demand for retrofitting older armored vehicle fleets with modern fire safety systems offers a substantial aftermarket opportunity. The development of smart, connected fire suppression systems that integrate with broader vehicle network architectures represents another area of growth. Furthermore, the expanding use of armored vehicles in homeland security, disaster response, and law enforcement applications outside traditional military contexts presents new market segments. The continuous pursuit of lighter, more compact, and highly efficient systems will also drive innovation and market expansion.

Major Players in the Armored Vehicle Fire Suppression Industry Ecosystem

- Halma PLC

- Spectrex (Emerson Electric Co )

- Nero Industries

- Mikro-Pulssi O

- Kidde-Deugra Brandschutzsysteme GmbH (RTX Corporation)

- N2 Towers Inc

- Bulldog Direct Protective Systems Inc

- ExploSpot Systems (Pty) Ltd

- Fire Protection Technologies Pty Ltd

- Marotta Controls Inc

Key Developments in Armored Vehicle Fire Suppression Industry Industry

- 2023/01: Spectrex (Emerson Electric Co.) launched an advanced flame detection system tailored for enhanced performance in harsh military environments.

- 2022/11: Halma PLC announced a strategic acquisition to bolster its fire suppression technology portfolio for defense applications.

- 2022/07: Kidde-Deugra Brandschutzsysteme GmbH (RTX Corporation) introduced a new generation of vehicle fire suppression systems with improved extinguishing agent efficiency.

- 2021/05: Mikro-Pulssi O secured a significant contract for the supply of fire suppression systems for a new series of armored personnel carriers.

- 2020/09: Nero Industries unveiled a modular fire suppression solution designed for rapid deployment and adaptability across various vehicle types.

Strategic Armored Vehicle Fire Suppression Industry Market Forecast

The strategic forecast for the Armored Vehicle Fire Suppression Industry indicates continued strong growth, fueled by persistent geopolitical uncertainties and the imperative for enhanced crew and asset protection. The increasing integration of artificial intelligence and IoT capabilities into fire suppression systems will enable predictive maintenance and autonomous operation, further solidifying their value. Emerging markets and the growing emphasis on internal security operations will also contribute to market expansion. Investments in research and development for next-generation extinguishing agents and advanced detection technologies will be critical for market leaders to maintain their competitive edge. The overall market potential remains substantial, driven by the unyielding need for robust fire safety in all armored vehicle applications.

Armored Vehicle Fire Suppression Industry Segmentation

-

1. Vehicle Type

- 1.1. Combat Vehicles

- 1.2. Troop Transport Vehicles

- 1.3. Other Vehicle Types

Armored Vehicle Fire Suppression Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Turkey

- 5.4. Egypt

- 5.5. Rest of Middle East and Africa

Armored Vehicle Fire Suppression Industry Regional Market Share

Geographic Coverage of Armored Vehicle Fire Suppression Industry

Armored Vehicle Fire Suppression Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Combat Vehicles to Witness Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Armored Vehicle Fire Suppression Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Combat Vehicles

- 5.1.2. Troop Transport Vehicles

- 5.1.3. Other Vehicle Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Armored Vehicle Fire Suppression Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Combat Vehicles

- 6.1.2. Troop Transport Vehicles

- 6.1.3. Other Vehicle Types

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Armored Vehicle Fire Suppression Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Combat Vehicles

- 7.1.2. Troop Transport Vehicles

- 7.1.3. Other Vehicle Types

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Armored Vehicle Fire Suppression Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Combat Vehicles

- 8.1.2. Troop Transport Vehicles

- 8.1.3. Other Vehicle Types

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Latin America Armored Vehicle Fire Suppression Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Combat Vehicles

- 9.1.2. Troop Transport Vehicles

- 9.1.3. Other Vehicle Types

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Middle East and Africa Armored Vehicle Fire Suppression Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Combat Vehicles

- 10.1.2. Troop Transport Vehicles

- 10.1.3. Other Vehicle Types

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Halma PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Spectrex (Emerson Electric Co )

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nero Industries

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mikro-Pulssi O

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kidde-Deugra Brandschutzsysteme GmbH (RTX Corporation)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 N2 Towers Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bulldog Direct Protective Systems Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ExploSpot Systems (Pty) Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fire Protection Technologies Pty Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Marotta Controls Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Halma PLC

List of Figures

- Figure 1: Global Armored Vehicle Fire Suppression Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Armored Vehicle Fire Suppression Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Armored Vehicle Fire Suppression Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Armored Vehicle Fire Suppression Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Armored Vehicle Fire Suppression Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Armored Vehicle Fire Suppression Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 7: Europe Armored Vehicle Fire Suppression Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: Europe Armored Vehicle Fire Suppression Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Armored Vehicle Fire Suppression Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Armored Vehicle Fire Suppression Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Asia Pacific Armored Vehicle Fire Suppression Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Asia Pacific Armored Vehicle Fire Suppression Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Armored Vehicle Fire Suppression Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Armored Vehicle Fire Suppression Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Latin America Armored Vehicle Fire Suppression Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Latin America Armored Vehicle Fire Suppression Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Armored Vehicle Fire Suppression Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Armored Vehicle Fire Suppression Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Middle East and Africa Armored Vehicle Fire Suppression Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Middle East and Africa Armored Vehicle Fire Suppression Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Armored Vehicle Fire Suppression Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Armored Vehicle Fire Suppression Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Armored Vehicle Fire Suppression Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Armored Vehicle Fire Suppression Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Armored Vehicle Fire Suppression Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Armored Vehicle Fire Suppression Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Armored Vehicle Fire Suppression Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Russia Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Armored Vehicle Fire Suppression Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Armored Vehicle Fire Suppression Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: India Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Armored Vehicle Fire Suppression Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 22: Global Armored Vehicle Fire Suppression Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Brazil Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Latin America Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Armored Vehicle Fire Suppression Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Armored Vehicle Fire Suppression Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Arab Emirates Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Saudi Arabia Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Turkey Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Egypt Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Armored Vehicle Fire Suppression Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Armored Vehicle Fire Suppression Industry?

The projected CAGR is approximately 2.31%.

2. Which companies are prominent players in the Armored Vehicle Fire Suppression Industry?

Key companies in the market include Halma PLC, Spectrex (Emerson Electric Co ), Nero Industries, Mikro-Pulssi O, Kidde-Deugra Brandschutzsysteme GmbH (RTX Corporation), N2 Towers Inc, Bulldog Direct Protective Systems Inc, ExploSpot Systems (Pty) Ltd, Fire Protection Technologies Pty Ltd, Marotta Controls Inc.

3. What are the main segments of the Armored Vehicle Fire Suppression Industry?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.42 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Combat Vehicles to Witness Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Armored Vehicle Fire Suppression Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Armored Vehicle Fire Suppression Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Armored Vehicle Fire Suppression Industry?

To stay informed about further developments, trends, and reports in the Armored Vehicle Fire Suppression Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence