Key Insights

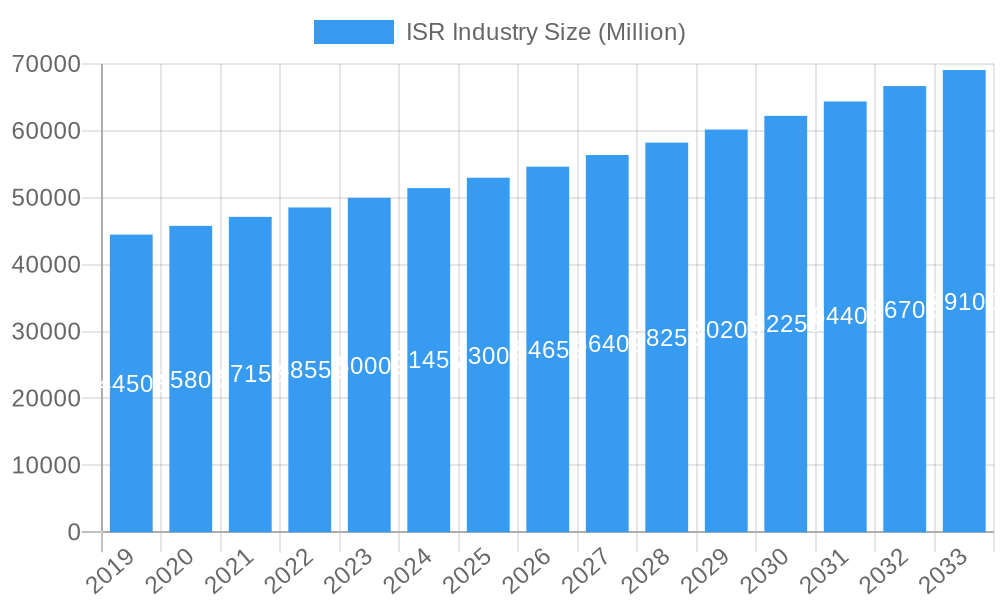

The Intelligence, Surveillance, and Reconnaissance (ISR) market is poised for significant expansion, projected to reach an estimated $55,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 4.50% throughout the study period. This dynamic growth is propelled by escalating geopolitical tensions, the increasing adoption of advanced technologies like AI and machine learning for data analysis, and the persistent demand for enhanced situational awareness across defense and civilian sectors. Governments worldwide are heavily investing in modernizing their ISR capabilities to counter emerging threats, including cyber warfare, terrorism, and conventional military actions. The continuous evolution of sensor technologies, coupled with the integration of unmanned systems and satellite-based platforms, further fuels market expansion. Furthermore, the growing emphasis on real-time data processing and dissemination for informed decision-making across diverse applications, from border security to disaster response, underscores the critical role of ISR in contemporary operations.

ISR Industry Market Size (In Billion)

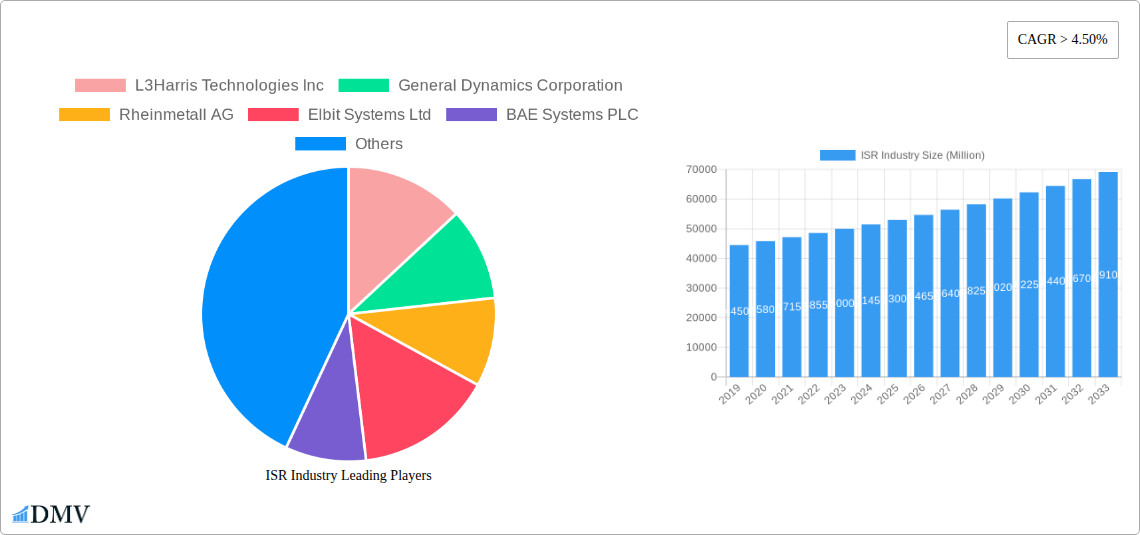

The ISR market is characterized by a diverse range of platforms, with Land-based ISR systems leading in current adoption due to their deployability and versatility in various operational environments. However, Air and Sea-based ISR platforms are witnessing substantial investments driven by the need for broader surveillance coverage and persistent monitoring capabilities. Emerging trends indicate a strong trajectory towards integrated ISR solutions, where data from multiple sources is fused for a comprehensive operational picture. Key restraints include the substantial upfront investment required for advanced ISR technologies and the complex regulatory frameworks governing data acquisition and dissemination. Despite these challenges, the market is expected to witness sustained growth driven by ongoing innovation and the imperative for enhanced security and intelligence gathering globally. Major players such as L3Harris Technologies Inc, General Dynamics Corporation, and BAE Systems PLC are at the forefront of this market, consistently innovating and expanding their offerings.

ISR Industry Company Market Share

ISR Industry Market Composition & Trends

The ISR industry market is characterized by a dynamic composition, driven by continuous innovation and evolving global security needs. Market concentration is high, with a few dominant players like Northrop Grumman Corporation, L3Harris Technologies Inc, and The Boeing Company holding significant market share. These giants are at the forefront of developing cutting-edge intelligence, surveillance, and reconnaissance solutions. Innovation is primarily fueled by advancements in AI, machine learning, and sensor technology, enabling more sophisticated data collection and analysis. The regulatory landscape is complex, influenced by national security interests and international agreements, often creating both opportunities and challenges for market entry and expansion. Substitute products, while present in niche applications, struggle to match the integrated capabilities offered by dedicated ISR platforms. End-user profiles range from national defense agencies and intelligence communities to increasingly, civilian sectors such as law enforcement and environmental monitoring. Mergers and acquisitions (M&A) are a significant trend, with deal values often in the hundreds of millions, consolidating expertise and market reach. For instance, recent M&A activities have seen companies like CACI International Inc and Kratos Defense & Security Solutions Inc strategically acquire specialized capabilities. Market share distribution for major players typically sits within a range of 5% to 15% each, with smaller, specialized firms capturing the remaining share.

ISR Industry Industry Evolution

The evolution of the ISR industry has been nothing short of transformative, charting a consistent growth trajectory fueled by technological advancements and shifting global demands. Over the study period of 2019–2033, the industry has witnessed an average annual growth rate of approximately 9.5%, demonstrating robust expansion. The base year of 2025 serves as a pivotal point, with estimated growth mirroring this strong trend. The forecast period of 2025–2033 is expected to see a sustained CAGR of 10.2%, driven by increased investment in advanced defense and security technologies. This growth is intrinsically linked to significant technological leaps. Artificial intelligence and machine learning are no longer niche applications but are deeply embedded in ISR systems, enhancing data processing and decision-making capabilities. Furthermore, the proliferation of drones and unmanned aerial vehicles (UAVs) has democratized ISR capabilities, opening new avenues for both military and civilian applications. Shifting consumer demands, particularly from defense ministries globally, are prioritizing integrated solutions that offer multi-domain awareness across Land, Air, Sea, and Space platforms. The historical period of 2019–2024 laid the groundwork for this accelerated evolution, marked by substantial R&D investments and the initial integration of these advanced technologies into operational frameworks. Adoption metrics for AI-driven analytics, for example, have surged by over 60% in the last five years, underscoring the industry's rapid adaptation to new paradigms. The increasing complexity of geopolitical landscapes and the rise of asymmetric warfare further compel nations to bolster their ISR capabilities, ensuring sustained demand and innovation within the sector.

Leading Regions, Countries, or Segments in ISR Industry

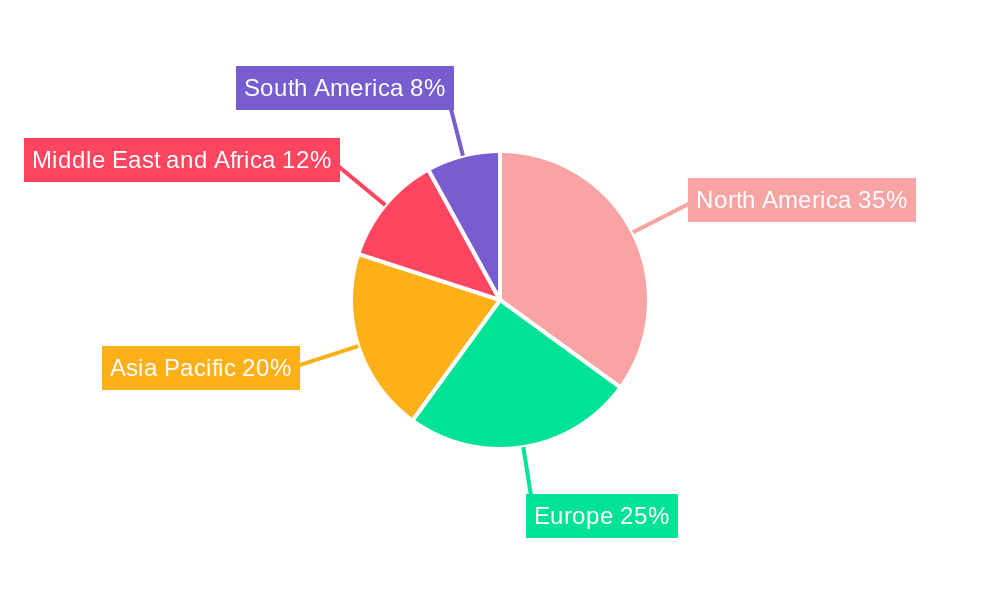

The dominance within the ISR industry is multifaceted, with several regions and segments vying for leadership, driven by distinct investment trends and regulatory support. However, the Air segment consistently emerges as a leading force, propelled by substantial government investments and the inherent advantages of aerial reconnaissance for wide-area surveillance and rapid deployment. North America, particularly the United States, remains the undisputed leader in terms of market size and technological prowess, with entities like Northrop Grumman Corporation, General Dynamics Corporation, and L3Harris Technologies Inc spearheading innovation and procurement.

- North America's Dominance: The United States accounts for over 40% of the global ISR market share. This is attributed to sustained high defense budgets, a robust aerospace and defense industrial base, and a strong emphasis on technological superiority in intelligence gathering.

- European Growth: European nations, including the UK and Germany, represented by companies like BAE Systems PLC and Rheinmetall AG, are also significant players. Their market share, estimated at 25%, is growing due to modernization programs and collaborative defense initiatives within NATO.

- Asia-Pacific Expansion: The Asia-Pacific region, with countries like Israel (Elbit Systems Ltd) and its growing defense sector, is experiencing rapid growth, projected to capture 20% of the market by 2033. This surge is driven by regional security concerns and increasing defense spending.

In terms of platforms, the Air segment holds a commanding position, valued at over $70 Billion in 2025. This is due to the unparalleled reach, speed, and persistent surveillance capabilities offered by aircraft, drones, and satellites. The development of advanced ISR platforms like stealth reconnaissance aircraft and sophisticated satellite constellations, coupled with advancements in sensor technology, has cemented the Air segment's leadership. While Land and Sea platforms are crucial for tactical and strategic operations, their scope is often more localized compared to the global reach of aerial ISR. The Space segment, though still developing, is rapidly gaining importance with the proliferation of small satellites and advanced sensor payloads, promising enhanced global coverage and persistent monitoring capabilities, projected to grow at a CAGR of 11.5% over the forecast period. Regulatory support in North America, through substantial defense appropriations and research grants, alongside international collaborations, has fostered an environment conducive to the rapid development and deployment of advanced aerial ISR systems.

ISR Industry Product Innovations

Product innovations in the ISR industry are rapidly transforming operational capabilities. Key advancements include the development of AI-powered sensor fusion platforms that integrate data from multiple sources, such as electro-optical, infrared, and radar systems, providing unparalleled situational awareness. The miniaturization of high-resolution sensors and the increasing autonomy of unmanned systems are enabling persistent surveillance in contested environments. Furthermore, advancements in cybersecurity for ISR data ensure the integrity and security of sensitive intelligence. These innovations offer unique selling propositions like extended loiter times, reduced operational costs, and enhanced precision targeting, significantly improving mission effectiveness across Land, Air, and Sea domains.

Propelling Factors for ISR Industry Growth

Several factors are propelling the ISR industry forward. Geopolitical instability and the rise of asymmetric threats necessitate continuous advancements in surveillance and intelligence gathering. Technological innovation, particularly in AI, machine learning, and sensor technology, is creating more sophisticated and effective ISR solutions. Governments worldwide are increasing defense budgets, recognizing the critical role of ISR in national security and modern warfare. The growing demand for real-time data and actionable intelligence across various sectors, including defense, homeland security, and civilian applications, further fuels market expansion. For instance, the increasing use of ISR data for border security and disaster management demonstrates its expanding utility beyond traditional defense applications.

Obstacles in the ISR Industry Market

Despite robust growth, the ISR industry faces several obstacles. Stringent regulatory frameworks and export controls, particularly for advanced technologies, can impede market access and international collaboration. High research and development costs, coupled with the lengthy procurement cycles of defense ministries, present financial challenges. Supply chain disruptions, exacerbated by geopolitical events, can impact the availability of critical components for advanced ISR systems. Furthermore, the constant evolution of adversary tactics requires continuous adaptation and investment, placing significant pressure on existing budgets and capabilities. The cybersecurity threat landscape also poses a continuous challenge, requiring robust defenses for sensitive ISR data.

Future Opportunities in ISR Industry

The ISR industry is ripe with future opportunities. The increasing adoption of Space-based ISR offers vast potential for global, persistent monitoring. Advancements in AI and data analytics are creating opportunities for predictive intelligence and automated threat detection. The expansion of ISR applications into civilian sectors, such as precision agriculture, environmental monitoring, and urban planning, presents a significant growth avenue. Furthermore, the ongoing demand for advanced ISR capabilities in emerging defense technologies like hypersonic weapons and directed energy systems will drive further innovation and market expansion. The integration of quantum computing for data processing could also revolutionize ISR capabilities.

Major Players in the ISR Industry Ecosystem

- L3Harris Technologies Inc

- General Dynamics Corporation

- Rheinmetall AG

- Elbit Systems Ltd

- BAE Systems PLC

- ThalesRaytheonSystems

- Kratos Defense & Security Solutions Inc

- CACI International Inc

- Northrop Grumman Corporation

- The Boeing Company

Key Developments in ISR Industry Industry

- January 2024: Northrop Grumman unveils its next-generation reconnaissance aircraft, enhancing stealth and sensor capabilities.

- November 2023: L3Harris Technologies Inc announces a significant contract award for advanced multi-intelligence airborne sensors.

- September 2023: BAE Systems PLC acquires a specialized AI analytics firm to bolster its ISR data processing capabilities.

- July 2023: Elbit Systems Ltd secures a major deal for advanced drone-based ISR systems for an undisclosed international customer.

- April 2023: ThalesRaytheonSystems demonstrates a new integrated air and missile defense radar with enhanced ISR functionalities.

- February 2023: Kratos Defense & Security Solutions Inc expands its drone production capacity to meet growing demand for unmanned ISR platforms.

- December 2022: The Boeing Company successfully tests a new autonomous ISR capability for naval applications.

- October 2022: General Dynamics Corporation announces the integration of AI into its ground-based ISR systems.

- August 2022: CACI International Inc acquires a cybersecurity firm to strengthen the security of its ISR data solutions.

- June 2022: Rheinmetall AG showcases its latest multi-mission reconnaissance vehicle with advanced sensor suites.

Strategic ISR Industry Market Forecast

The ISR industry market is poised for significant strategic growth, driven by an unyielding demand for advanced intelligence, surveillance, and reconnaissance capabilities. The forecast period of 2025–2033 anticipates robust expansion, fueled by continuous technological innovation, particularly in AI, machine learning, and sensor fusion across Land, Air, Sea, and Space platforms. Increased global defense spending, coupled with the growing adoption of ISR solutions in civilian sectors, presents substantial market potential. Strategic investments in R&D and the ongoing consolidation through M&A will further shape the competitive landscape, positioning leading players like Northrop Grumman Corporation and L3Harris Technologies Inc for continued dominance. Emerging opportunities in space-based ISR and data analytics will be key growth catalysts.

ISR Industry Segmentation

-

1. Platform

- 1.1. Land

- 1.2. Air

- 1.3. Sea

- 1.4. Space

ISR Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

ISR Industry Regional Market Share

Geographic Coverage of ISR Industry

ISR Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Growth Led by the Air Segment of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ISR Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Land

- 5.1.2. Air

- 5.1.3. Sea

- 5.1.4. Space

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America ISR Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Land

- 6.1.2. Air

- 6.1.3. Sea

- 6.1.4. Space

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. Europe ISR Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Land

- 7.1.2. Air

- 7.1.3. Sea

- 7.1.4. Space

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Asia Pacific ISR Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Land

- 8.1.2. Air

- 8.1.3. Sea

- 8.1.4. Space

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. South America ISR Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Land

- 9.1.2. Air

- 9.1.3. Sea

- 9.1.4. Space

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Middle East and Africa ISR Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. Land

- 10.1.2. Air

- 10.1.3. Sea

- 10.1.4. Space

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Dynamics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rheinmetall AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Elbit Systems Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BAE Systems PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ThalesRaytheonSystems

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kratos Defense & Security Solutions Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CACI International Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Northrop Grumman Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Boeing Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global ISR Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America ISR Industry Revenue (undefined), by Platform 2025 & 2033

- Figure 3: North America ISR Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 4: North America ISR Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America ISR Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe ISR Industry Revenue (undefined), by Platform 2025 & 2033

- Figure 7: Europe ISR Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 8: Europe ISR Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe ISR Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific ISR Industry Revenue (undefined), by Platform 2025 & 2033

- Figure 11: Asia Pacific ISR Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Asia Pacific ISR Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific ISR Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America ISR Industry Revenue (undefined), by Platform 2025 & 2033

- Figure 15: South America ISR Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 16: South America ISR Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America ISR Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa ISR Industry Revenue (undefined), by Platform 2025 & 2033

- Figure 19: Middle East and Africa ISR Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 20: Middle East and Africa ISR Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East and Africa ISR Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ISR Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 2: Global ISR Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global ISR Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 4: Global ISR Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global ISR Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 9: Global ISR Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Germany ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: France ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Russia ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global ISR Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 16: Global ISR Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: China ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Japan ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: India ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: South Korea ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global ISR Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 23: Global ISR Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Brazil ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Argentina ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global ISR Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 28: Global ISR Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Israel ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Rest of Middle East and Africa ISR Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ISR Industry?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the ISR Industry?

Key companies in the market include L3Harris Technologies Inc, General Dynamics Corporation, Rheinmetall AG, Elbit Systems Ltd, BAE Systems PLC, ThalesRaytheonSystems, Kratos Defense & Security Solutions Inc, CACI International Inc, Northrop Grumman Corporation, The Boeing Company.

3. What are the main segments of the ISR Industry?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Growth Led by the Air Segment of the Market.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ISR Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ISR Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ISR Industry?

To stay informed about further developments, trends, and reports in the ISR Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence