Key Insights

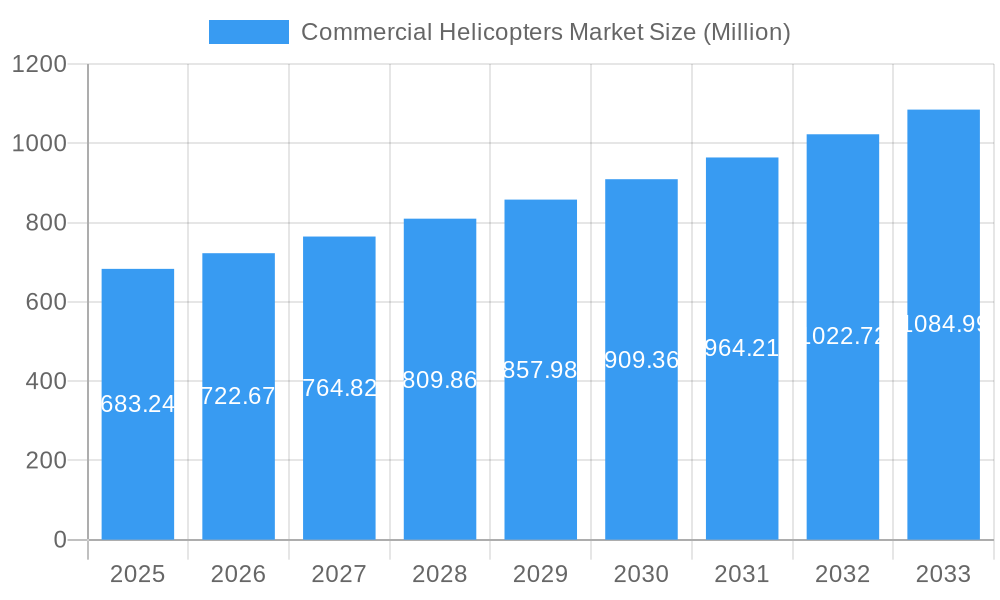

The global commercial helicopter market, valued at $683.24 million in 2025, is projected to experience robust growth, driven by increasing demand across various sectors. The market's Compound Annual Growth Rate (CAGR) of 5.54% from 2019 to 2024 indicates a steadily expanding market. Key growth drivers include the rising need for efficient emergency medical services (EMS), robust search and rescue operations, and the expanding law enforcement and border patrol applications. Furthermore, the increasing adoption of technologically advanced helicopters featuring improved safety features and enhanced operational capabilities is fueling market expansion. Government initiatives aimed at modernizing their fleets also contribute significantly to market growth. Segment-wise, medium helicopters are likely to hold a substantial market share due to their versatility and suitability for a wide range of applications, while the heavy helicopter segment is anticipated to demonstrate significant growth driven by large-scale operations and increased cargo capacity demands. Regionally, North America and Europe are likely to remain dominant markets due to established infrastructure and high adoption rates, while the Asia-Pacific region is poised for significant growth in the coming years due to infrastructure development and increasing investment in various sectors. However, challenges such as high acquisition costs and stringent regulatory frameworks may somewhat impede market growth in the coming years.

Commercial Helicopters Market Market Size (In Million)

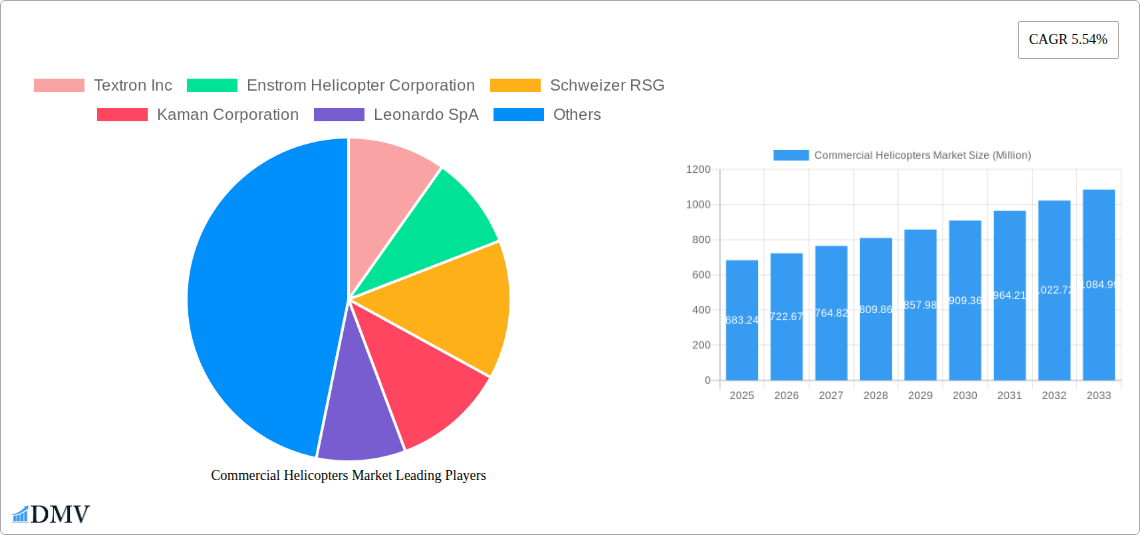

The competitive landscape is characterized by the presence of both established global players and regional manufacturers. Key players like Textron Inc, Airbus SE, Leonardo SpA, and others are continuously investing in research and development to improve helicopter technology and expand their product portfolio. Strategic partnerships, mergers, and acquisitions are expected to shape the market's competitive dynamics. While the market is predicted to witness steady expansion, the overall growth trajectory is heavily dependent on several factors, including geopolitical stability, economic conditions in key regions, and technological innovations. The forecast period from 2025-2033 suggests a promising outlook for the commercial helicopter market, projecting substantial growth opportunities for manufacturers and stakeholders.

Commercial Helicopters Market Company Market Share

Commercial Helicopters Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the global Commercial Helicopters Market, offering a detailed overview of market dynamics, key players, and future growth prospects. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report is essential for stakeholders including manufacturers, investors, and government agencies seeking to understand and capitalize on opportunities within this dynamic sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Commercial Helicopters Market Composition & Trends

This section delves into the intricate structure and evolving trends of the commercial helicopters market. We analyze the competitive landscape, evaluating market concentration through metrics like the Herfindahl-Hirschman Index (HHI) and market share distribution amongst key players such as Textron Inc, Airbus SE, Leonardo SpA, and others. The report also examines the role of innovation, exploring technological advancements driving market growth, and analyzes the regulatory landscape, including its impact on market access and operational costs. Furthermore, we investigate the influence of substitute products, the evolving end-user profiles across diverse sectors like government, oil & gas, and tourism, and the impact of mergers and acquisitions (M&A) activities, including the analysis of deal values and their implications for market consolidation. Key aspects include:

- Market Concentration: Analysis of market share held by top 5 players, revealing a xx% combined market share in 2025.

- Innovation Catalysts: Discussion of key technological advancements like autonomous flight systems and hybrid propulsion impacting the sector.

- Regulatory Landscape: Evaluation of impact of airworthiness certifications and safety regulations on market entry and operational costs.

- Substitute Products: Assessment of the competitive threat from alternative transportation modes like fixed-wing aircraft and drones.

- End-User Profiles: Detailed analysis of market segmentation across various end-use sectors, focusing on their specific needs and growth drivers.

- M&A Activities: Review of significant M&A activities during the study period (2019-2024) with an estimated total deal value of xx Million.

Commercial Helicopters Market Industry Evolution

This section provides a deep dive into the historical and projected evolution of the commercial helicopter market. We analyze growth trajectories from 2019 to 2024, highlighting key periods of expansion and contraction. The analysis incorporates technological advancements such as the introduction of new materials, engine technologies, and avionics systems, assessing their influence on operational efficiency, safety, and overall market appeal. We also explore shifting consumer demands, identifying emerging trends in helicopter design, functionality, and operational capabilities, reflecting the needs of various end-users. Data points include detailed growth rates for each segment, adoption rates of new technologies, and evolving consumer preferences influencing market demand. The analysis considers factors such as increasing demand for efficient and sustainable helicopters in various sectors including Emergency Medical Services (EMS) and law enforcement.

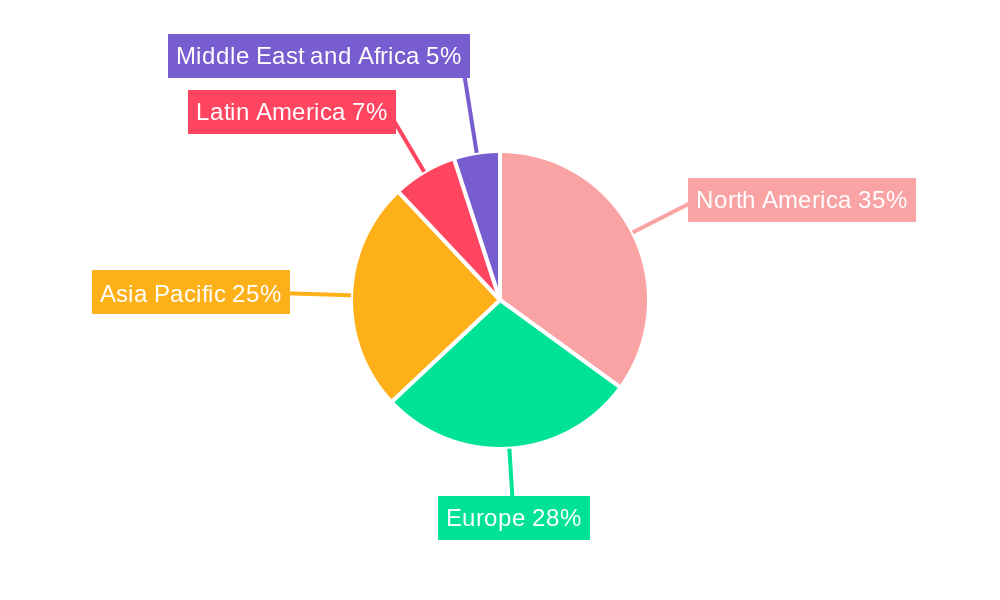

Leading Regions, Countries, or Segments in Commercial Helicopters Market

This segment identifies the dominant regions, countries, and segments within the commercial helicopter market. We analyze the market performance of light, medium, and heavy helicopters across key applications, including government, search and rescue, fire service, law enforcement, emergency medical service, coast guard, and border patrol. The analysis identifies the leading region and/or country, providing in-depth insights into the factors driving this dominance.

Key Drivers for Dominance:

- North America: High levels of government and commercial investment in helicopter services, particularly EMS and law enforcement. Strong presence of major helicopter manufacturers.

- Europe: Significant demand in EMS, tourism, and oil & gas sectors, coupled with supportive government policies.

- Asia-Pacific: Rapid infrastructure development and increasing demand from government and commercial operations, particularly in China and India.

Segmental Dominance:

- Application: The Government sector consistently accounts for the largest share of commercial helicopter operations, driven by robust defense budgets and increasing national security needs.

- Maximum Take-off Weight (MTOW): Medium Helicopters hold a significant market share due to their versatility in fulfilling diverse operational roles across multiple sectors.

Commercial Helicopters Market Product Innovations

The report highlights recent product innovations in the commercial helicopter market. This includes advancements in design, materials, and technology, leading to enhanced performance metrics like improved fuel efficiency, increased payload capacity, and enhanced safety features. The section explores the unique selling propositions of new helicopter models and discusses the integration of cutting-edge technologies like advanced avionics, fly-by-wire systems, and improved rotor designs that significantly enhance operational efficiency and safety. Focus is also placed on innovations specific to particular applications, such as specialized medical configurations for EMS helicopters or advanced surveillance capabilities for law enforcement.

Propelling Factors for Commercial Helicopters Market Growth

Several factors are driving growth in the commercial helicopters market. Increasing demand from various sectors, particularly government agencies for search and rescue, law enforcement, and border patrol operations, is a key driver. The growing need for efficient and reliable transportation in remote areas and challenging terrains also fuels market expansion. Technological advancements, such as the development of more fuel-efficient engines and advanced avionics, are reducing operating costs and improving safety. Furthermore, favorable regulatory environments in some regions are promoting the adoption of helicopters across various applications.

Obstacles in the Commercial Helicopters Market

The commercial helicopter market faces challenges such as stringent regulatory compliance requirements that increase manufacturing and operational costs. Supply chain disruptions, particularly in sourcing specialized components, can impact production and delivery schedules. Intense competition from established players and the emergence of new entrants is also placing downward pressure on pricing. The high initial investment cost associated with purchasing and maintaining helicopters can act as a barrier to entry for smaller operators.

Future Opportunities in Commercial Helicopters Market

The future presents several opportunities. Expanding into new and developing markets with increasing infrastructural needs offers significant growth potential. The integration of advanced technologies such as autonomous flight systems and electric or hybrid propulsion systems will create new avenues for market expansion and enhance efficiency and sustainability. The development of specialized helicopter configurations optimized for specific applications, like environmentally-friendly designs for eco-tourism operations, will unlock new market segments.

Major Players in the Commercial Helicopters Market Ecosystem

- Textron Inc

- Enstrom Helicopter Corporation

- Schweizer RSG

- Kaman Corporation

- Leonardo SpA

- Lockheed Martin Corporation

- Airbus SE

- Rostec (Russian Helicopters)

- Hindustan Aeronautics Limited

- Robinson Helicopter Company

- Aviation Industry Corporation of China Ltd

- MD Helicopters Inc

- Kawasaki Heavy Industries Ltd

Key Developments in Commercial Helicopters Market Industry

- 2024 Q4: Airbus Helicopters announces the launch of a new generation of light utility helicopters.

- 2023 Q2: Textron Aviation acquires a smaller helicopter manufacturer, expanding its market share.

- 2022 Q3: Leonardo SpA unveils a new hybrid-electric helicopter prototype.

- 2021 Q1: Regulatory changes in the European Union impact the certification process for new helicopter models.

- 2020 Q4: The COVID-19 pandemic temporarily disrupts the supply chain for helicopter components.

Strategic Commercial Helicopters Market Forecast

The commercial helicopters market is poised for continued growth over the next decade. Demand is anticipated to rise across various segments, fueled by expanding applications and advancements in technology. The increasing adoption of sustainable solutions, such as electric and hybrid propulsion systems, is expected to drive efficiency and reduce the environmental impact of helicopter operations. New entrants entering the market and technological innovations will shape the industry's evolution, promising both opportunities and competitive challenges in the years to come.

Commercial Helicopters Market Segmentation

-

1. Maximum Take-off Weight

- 1.1. Light Helicopters

- 1.2. Medium Helicopters

- 1.3. Heavy Helicopters

-

2. Number of Engines

- 2.1. Single-engine

- 2.2. Multi-engine

-

3. End-Users

- 3.1. Commercial

- 3.2. Private

- 3.3. Other End-Users

Commercial Helicopters Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Colombia

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Turkey

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

Commercial Helicopters Market Regional Market Share

Geographic Coverage of Commercial Helicopters Market

Commercial Helicopters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Search and Rescue Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Helicopters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 5.1.1. Light Helicopters

- 5.1.2. Medium Helicopters

- 5.1.3. Heavy Helicopters

- 5.2. Market Analysis, Insights and Forecast - by Number of Engines

- 5.2.1. Single-engine

- 5.2.2. Multi-engine

- 5.3. Market Analysis, Insights and Forecast - by End-Users

- 5.3.1. Commercial

- 5.3.2. Private

- 5.3.3. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 6. North America Commercial Helicopters Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 6.1.1. Light Helicopters

- 6.1.2. Medium Helicopters

- 6.1.3. Heavy Helicopters

- 6.2. Market Analysis, Insights and Forecast - by Number of Engines

- 6.2.1. Single-engine

- 6.2.2. Multi-engine

- 6.3. Market Analysis, Insights and Forecast - by End-Users

- 6.3.1. Commercial

- 6.3.2. Private

- 6.3.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 7. Europe Commercial Helicopters Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 7.1.1. Light Helicopters

- 7.1.2. Medium Helicopters

- 7.1.3. Heavy Helicopters

- 7.2. Market Analysis, Insights and Forecast - by Number of Engines

- 7.2.1. Single-engine

- 7.2.2. Multi-engine

- 7.3. Market Analysis, Insights and Forecast - by End-Users

- 7.3.1. Commercial

- 7.3.2. Private

- 7.3.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 8. Asia Pacific Commercial Helicopters Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 8.1.1. Light Helicopters

- 8.1.2. Medium Helicopters

- 8.1.3. Heavy Helicopters

- 8.2. Market Analysis, Insights and Forecast - by Number of Engines

- 8.2.1. Single-engine

- 8.2.2. Multi-engine

- 8.3. Market Analysis, Insights and Forecast - by End-Users

- 8.3.1. Commercial

- 8.3.2. Private

- 8.3.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 9. Latin America Commercial Helicopters Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 9.1.1. Light Helicopters

- 9.1.2. Medium Helicopters

- 9.1.3. Heavy Helicopters

- 9.2. Market Analysis, Insights and Forecast - by Number of Engines

- 9.2.1. Single-engine

- 9.2.2. Multi-engine

- 9.3. Market Analysis, Insights and Forecast - by End-Users

- 9.3.1. Commercial

- 9.3.2. Private

- 9.3.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 10. Middle East and Africa Commercial Helicopters Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 10.1.1. Light Helicopters

- 10.1.2. Medium Helicopters

- 10.1.3. Heavy Helicopters

- 10.2. Market Analysis, Insights and Forecast - by Number of Engines

- 10.2.1. Single-engine

- 10.2.2. Multi-engine

- 10.3. Market Analysis, Insights and Forecast - by End-Users

- 10.3.1. Commercial

- 10.3.2. Private

- 10.3.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Enstrom Helicopter Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Schweizer RSG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kaman Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Leonardo SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lockheed Martin Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Airbus SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rostec (Russian Helicopters)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hindustan Aeronautics Limite

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Robinson Helicopter Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aviation Industry Corporation of China Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 MD Helicopters Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Kawasaki Heavy Industries Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global Commercial Helicopters Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Commercial Helicopters Market Revenue (Million), by Maximum Take-off Weight 2025 & 2033

- Figure 3: North America Commercial Helicopters Market Revenue Share (%), by Maximum Take-off Weight 2025 & 2033

- Figure 4: North America Commercial Helicopters Market Revenue (Million), by Number of Engines 2025 & 2033

- Figure 5: North America Commercial Helicopters Market Revenue Share (%), by Number of Engines 2025 & 2033

- Figure 6: North America Commercial Helicopters Market Revenue (Million), by End-Users 2025 & 2033

- Figure 7: North America Commercial Helicopters Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 8: North America Commercial Helicopters Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Commercial Helicopters Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Commercial Helicopters Market Revenue (Million), by Maximum Take-off Weight 2025 & 2033

- Figure 11: Europe Commercial Helicopters Market Revenue Share (%), by Maximum Take-off Weight 2025 & 2033

- Figure 12: Europe Commercial Helicopters Market Revenue (Million), by Number of Engines 2025 & 2033

- Figure 13: Europe Commercial Helicopters Market Revenue Share (%), by Number of Engines 2025 & 2033

- Figure 14: Europe Commercial Helicopters Market Revenue (Million), by End-Users 2025 & 2033

- Figure 15: Europe Commercial Helicopters Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 16: Europe Commercial Helicopters Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Commercial Helicopters Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Commercial Helicopters Market Revenue (Million), by Maximum Take-off Weight 2025 & 2033

- Figure 19: Asia Pacific Commercial Helicopters Market Revenue Share (%), by Maximum Take-off Weight 2025 & 2033

- Figure 20: Asia Pacific Commercial Helicopters Market Revenue (Million), by Number of Engines 2025 & 2033

- Figure 21: Asia Pacific Commercial Helicopters Market Revenue Share (%), by Number of Engines 2025 & 2033

- Figure 22: Asia Pacific Commercial Helicopters Market Revenue (Million), by End-Users 2025 & 2033

- Figure 23: Asia Pacific Commercial Helicopters Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 24: Asia Pacific Commercial Helicopters Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Commercial Helicopters Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Commercial Helicopters Market Revenue (Million), by Maximum Take-off Weight 2025 & 2033

- Figure 27: Latin America Commercial Helicopters Market Revenue Share (%), by Maximum Take-off Weight 2025 & 2033

- Figure 28: Latin America Commercial Helicopters Market Revenue (Million), by Number of Engines 2025 & 2033

- Figure 29: Latin America Commercial Helicopters Market Revenue Share (%), by Number of Engines 2025 & 2033

- Figure 30: Latin America Commercial Helicopters Market Revenue (Million), by End-Users 2025 & 2033

- Figure 31: Latin America Commercial Helicopters Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 32: Latin America Commercial Helicopters Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Commercial Helicopters Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Commercial Helicopters Market Revenue (Million), by Maximum Take-off Weight 2025 & 2033

- Figure 35: Middle East and Africa Commercial Helicopters Market Revenue Share (%), by Maximum Take-off Weight 2025 & 2033

- Figure 36: Middle East and Africa Commercial Helicopters Market Revenue (Million), by Number of Engines 2025 & 2033

- Figure 37: Middle East and Africa Commercial Helicopters Market Revenue Share (%), by Number of Engines 2025 & 2033

- Figure 38: Middle East and Africa Commercial Helicopters Market Revenue (Million), by End-Users 2025 & 2033

- Figure 39: Middle East and Africa Commercial Helicopters Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 40: Middle East and Africa Commercial Helicopters Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Commercial Helicopters Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Helicopters Market Revenue Million Forecast, by Maximum Take-off Weight 2020 & 2033

- Table 2: Global Commercial Helicopters Market Revenue Million Forecast, by Number of Engines 2020 & 2033

- Table 3: Global Commercial Helicopters Market Revenue Million Forecast, by End-Users 2020 & 2033

- Table 4: Global Commercial Helicopters Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Commercial Helicopters Market Revenue Million Forecast, by Maximum Take-off Weight 2020 & 2033

- Table 6: Global Commercial Helicopters Market Revenue Million Forecast, by Number of Engines 2020 & 2033

- Table 7: Global Commercial Helicopters Market Revenue Million Forecast, by End-Users 2020 & 2033

- Table 8: Global Commercial Helicopters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Commercial Helicopters Market Revenue Million Forecast, by Maximum Take-off Weight 2020 & 2033

- Table 12: Global Commercial Helicopters Market Revenue Million Forecast, by Number of Engines 2020 & 2033

- Table 13: Global Commercial Helicopters Market Revenue Million Forecast, by End-Users 2020 & 2033

- Table 14: Global Commercial Helicopters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Germany Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Russia Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Commercial Helicopters Market Revenue Million Forecast, by Maximum Take-off Weight 2020 & 2033

- Table 21: Global Commercial Helicopters Market Revenue Million Forecast, by Number of Engines 2020 & 2033

- Table 22: Global Commercial Helicopters Market Revenue Million Forecast, by End-Users 2020 & 2033

- Table 23: Global Commercial Helicopters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Commercial Helicopters Market Revenue Million Forecast, by Maximum Take-off Weight 2020 & 2033

- Table 30: Global Commercial Helicopters Market Revenue Million Forecast, by Number of Engines 2020 & 2033

- Table 31: Global Commercial Helicopters Market Revenue Million Forecast, by End-Users 2020 & 2033

- Table 32: Global Commercial Helicopters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Colombia Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Latin America Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Commercial Helicopters Market Revenue Million Forecast, by Maximum Take-off Weight 2020 & 2033

- Table 37: Global Commercial Helicopters Market Revenue Million Forecast, by Number of Engines 2020 & 2033

- Table 38: Global Commercial Helicopters Market Revenue Million Forecast, by End-Users 2020 & 2033

- Table 39: Global Commercial Helicopters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Saudi Arabia Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: United Arab Emirates Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Turkey Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Africa Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East and Africa Commercial Helicopters Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Helicopters Market?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the Commercial Helicopters Market?

Key companies in the market include Textron Inc, Enstrom Helicopter Corporation, Schweizer RSG, Kaman Corporation, Leonardo SpA, Lockheed Martin Corporation, Airbus SE, Rostec (Russian Helicopters), Hindustan Aeronautics Limite, Robinson Helicopter Company, Aviation Industry Corporation of China Ltd, MD Helicopters Inc, Kawasaki Heavy Industries Ltd.

3. What are the main segments of the Commercial Helicopters Market?

The market segments include Maximum Take-off Weight, Number of Engines, End-Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 683.24 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Search and Rescue Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Helicopters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Helicopters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Helicopters Market?

To stay informed about further developments, trends, and reports in the Commercial Helicopters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence