Key Insights

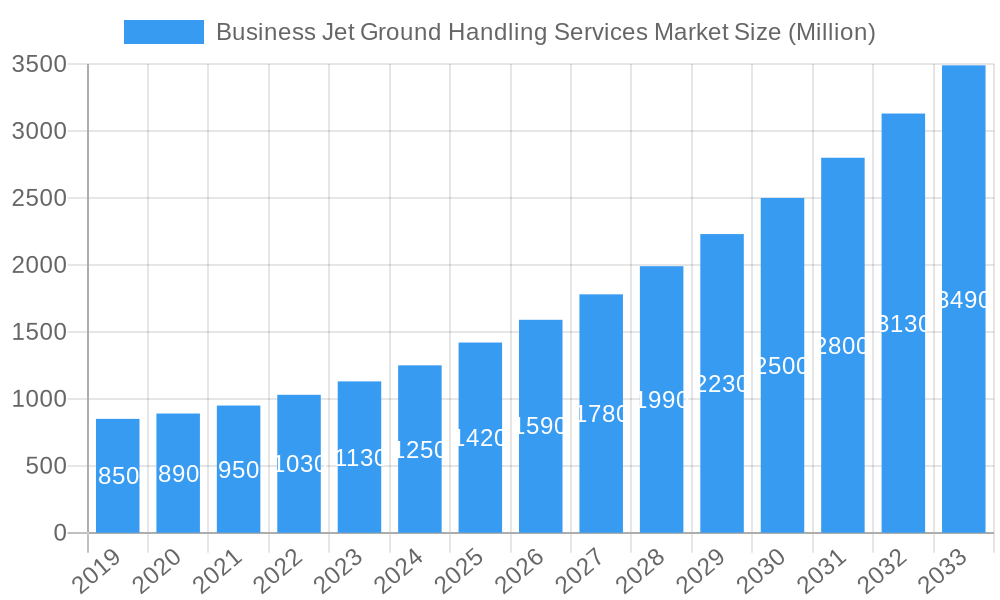

The global business jet ground handling services market is poised for significant expansion, projected to reach approximately $1.42 billion by 2025. This robust growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 11.87%, indicating a dynamic and thriving sector. The market's buoyancy can be attributed to several key drivers, including the escalating demand for private aviation, a surge in fractional ownership and jet card programs, and the increasing complexity of air traffic management and regulatory requirements. These factors collectively necessitate specialized and efficient ground handling operations, from aircraft parking and refueling to passenger and baggage services. The market is segmented into Aircraft Handling, Passenger Handling, and Cargo and Baggage Handling, each contributing to the overall value chain and experiencing its own growth trajectory. The increasing adoption of advanced technologies for operational efficiency and enhanced passenger experience is also a prominent trend shaping the market landscape.

Business Jet Ground Handling Services Market Market Size (In Million)

Despite the optimistic outlook, certain restraints could influence the market's pace. These may include the high capital investment required for state-of-the-art ground support equipment, potential labor shortages in skilled ground handling personnel, and the impact of fluctuating fuel prices on operational costs. However, the inherent advantages of business jet travel, such as flexibility, time savings, and enhanced privacy, continue to drive demand, outweighing these challenges. Major players like Dnata, ExecuJet Aviation Group, and Signature Aviation are actively investing in expanding their service portfolios and geographical reach to cater to the evolving needs of the business aviation sector. North America and Europe are expected to remain dominant regions, driven by established private aviation infrastructure and a high concentration of business jet activity, while the Asia Pacific region is anticipated to witness substantial growth due to increasing wealth and a developing business aviation ecosystem.

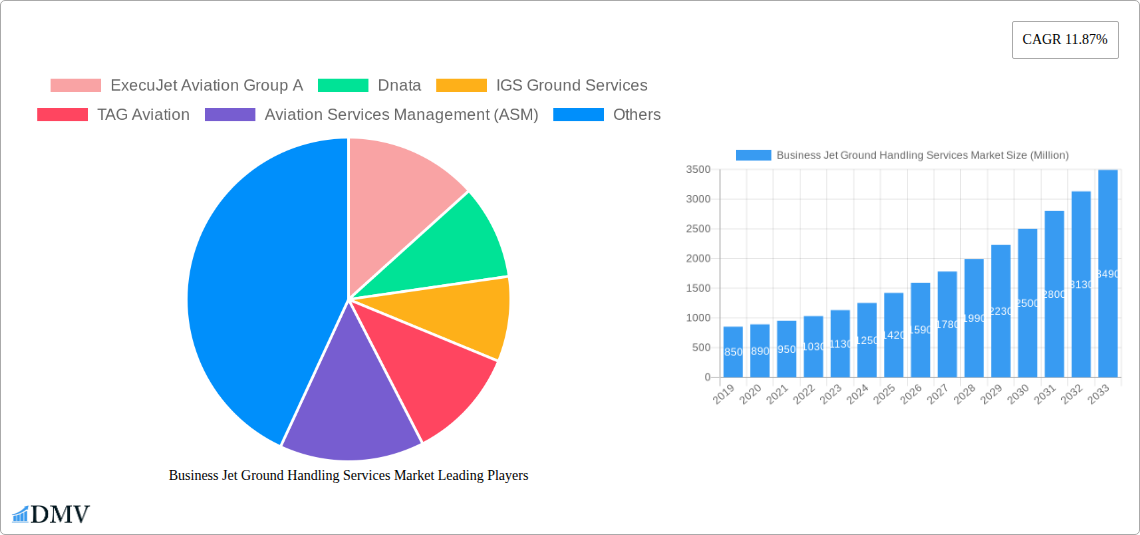

Business Jet Ground Handling Services Market Company Market Share

This in-depth market research report provides a panoramic view of the global Business Jet Ground Handling Services Market, meticulously analyzing its current landscape, historical trends, and future projections. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report is an indispensable resource for stakeholders seeking to understand market dynamics, identify growth opportunities, and strategize for success in the lucrative private aviation ground services sector. Our analysis delves into critical aspects including market concentration, technological advancements, regulatory influences, and the competitive ecosystem, offering actionable insights for business aviation FBOs and related service providers.

Business Jet Ground Handling Services Market Market Composition & Trends

The Business Jet Ground Handling Services Market exhibits a moderately concentrated structure, characterized by a blend of global players and regional specialists. Innovation is predominantly driven by the demand for enhanced efficiency, passenger experience, and environmental sustainability. Regulatory landscapes vary significantly by region, impacting operational standards and investment decisions. Substitute products are limited within core ground handling, though the rise of integrated digital solutions is a notable trend. End-user profiles range from individual aircraft owners to large corporate flight departments and charter operators, each with distinct service requirements. Mergers and acquisitions (M&A) play a crucial role in market consolidation and expansion. Significant M&A deals, such as those involving major FBO networks, underscore the strategic importance of this market. The market share distribution indicates a steady increase in the adoption of advanced technologies.

- Market Concentration: Moderately concentrated, with key players holding substantial market share.

- Innovation Catalysts: Demand for efficiency, passenger comfort, digitalization, and sustainability.

- Regulatory Landscapes: Varied, with evolving safety, security, and environmental standards.

- Substitute Products: Primarily digital workflow integration, rather than direct service replacement.

- End-User Profiles: High-net-worth individuals, corporate flight departments, charter operators.

- M&A Activities: Ongoing consolidation to expand service networks and market reach.

Business Jet Ground Handling Services Market Industry Evolution

The Business Jet Ground Handling Services Market has witnessed robust growth and significant evolution throughout the historical period of 2019-2024 and is poised for accelerated expansion from 2025 to 2033. This growth trajectory is intrinsically linked to the burgeoning global business aviation sector, which in turn fuels the demand for comprehensive and specialized ground support. Technological advancements have been a cornerstone of this evolution, transforming traditional ground handling operations into more streamlined, efficient, and customer-centric services. Early in the historical period, the focus was on basic aircraft servicing and passenger facilitation. However, the industry has rapidly embraced digital transformation, integrating sophisticated software for flight scheduling, resource management, and real-time communication. This shift has led to a significant increase in operational efficiency, reducing turnaround times and enhancing the overall passenger experience. For instance, the adoption of digital declarations at major airports, as seen with Amsterdam Airport Schiphol’s Automated Nomination initiative in April 2022, exemplifies this trend by streamlining the cargo chain and improving logistical accuracy.

Furthermore, a growing emphasis on sustainability is reshaping the industry. The investment in electric de-icing equipment, like the EUR 4 million procurement of Elephant e-BETA de-icers by Airpro in April 2022, highlights a proactive approach to reducing the environmental footprint of ground operations. This move positions Airpro as a leader in electric ground handling services in Finland. The demand for specialized services, such as expedited baggage handling and premium passenger lounges, continues to rise, driven by the discerning clientele of business aviation. The average annual growth rate in this sector is projected to remain strong, reflecting consistent demand from emerging economies and the recovery of established markets. The adoption rate of advanced GSE (Ground Support Equipment) has also seen a steady increase, with operators investing in newer, more efficient fleets to meet stringent operational requirements and enhance service quality. The continuous evolution in aircraft types and sizes necessitates ongoing adaptation of handling procedures and equipment, further stimulating innovation and investment within the market.

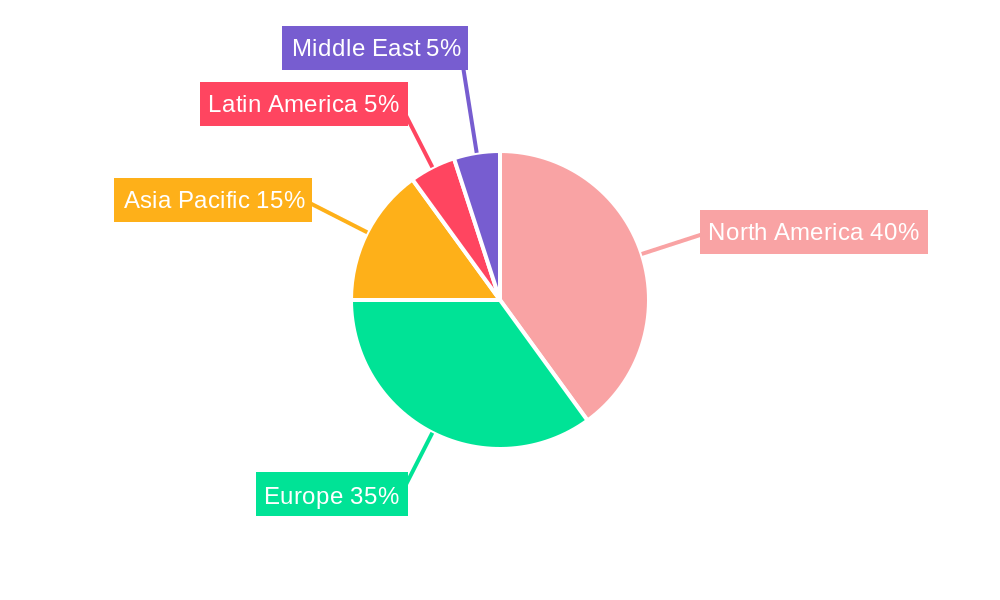

Leading Regions, Countries, or Segments in Business Jet Ground Handling Services Market

The Business Jet Ground Handling Services Market is currently dominated by North America, primarily driven by the United States' extensive business aviation infrastructure, high concentration of private jet operators, and robust economic activity. The region benefits from a mature market with established Fixed-Base Operators (FBOs) and a strong demand for comprehensive ground support services. Europe follows closely, with countries like the UK, Germany, and France exhibiting significant market activity due to their strong financial sectors and extensive business travel networks. Asia-Pacific is emerging as a critical growth frontier, propelled by rapid economic development and increasing adoption of business jets in countries such as China and India.

Within the Type segment, Aircraft Handling currently holds the largest market share. This segment encompasses a wide range of essential services including ramp handling, aircraft towing, marshalling, and technical support. The sheer volume of aircraft movements and the complexity of handling various business jet models contribute to its dominance. However, Passenger Handling is experiencing rapid growth, fueled by the increasing emphasis on premium passenger experiences. This includes VIP services, seamless transfers, lounge access, and personalized assistance. The demand for expedited and discreet passenger processing is a key differentiator for service providers. Cargo and Baggage Handling is also a significant segment, particularly for charter operations and transient aircraft carrying specialized equipment or cargo. The efficiency and security of these operations are paramount.

Dominant Region: North America

- Key Drivers: High volume of business jet movements, established FBO network, significant corporate presence, strong economic indicators.

- In-depth Analysis: The mature business aviation ecosystem in the US, coupled with favorable regulatory environments and a high density of ultra-high-net-worth individuals, underpins North America's leadership. Significant investments in airport infrastructure and FBO expansions further solidify its position.

Emerging Growth Frontier: Asia-Pacific

- Key Drivers: Rapid economic expansion, increasing disposable income, growing corporate flight departments, government initiatives to boost aviation.

- In-depth Analysis: While currently a smaller market share holder, Asia-Pacific presents the highest growth potential. Factors such as the expansion of new airports, increasing aircraft orders, and the development of dedicated business aviation hubs are expected to drive substantial market growth.

Key Segment: Aircraft Handling

- Drivers: Essential nature of services for all business jet operations, complexity of diverse aircraft types, demand for safety and efficiency.

- In-depth Analysis: This segment forms the bedrock of ground handling. The continuous need for skilled personnel and specialized equipment ensures its sustained dominance. Innovations in GSE and automation are further enhancing efficiency.

High-Growth Segment: Passenger Handling

- Drivers: Increasing demand for premium and personalized experiences, focus on VIP services, and discreet passenger facilitation.

- In-depth Analysis: As business jet travel becomes more accessible and the expectations of discerning travelers rise, passenger handling services are evolving to offer unparalleled convenience and luxury, driving significant market expansion.

Business Jet Ground Handling Services Market Product Innovations

Product innovations in the Business Jet Ground Handling Services Market are primarily focused on enhancing operational efficiency, improving safety, and elevating the passenger experience. Advancements in Ground Support Equipment (GSE) are notable, with a trend towards electric and autonomous vehicles to reduce emissions and operational costs. For instance, the procurement of electric de-icers signifies a move towards eco-friendly solutions. Digital platforms are revolutionizing how ground handling services are managed, offering real-time tracking, automated communication, and integrated booking systems. These innovations lead to reduced turnaround times, minimized errors, and a more seamless experience for aircraft operators and passengers. The unique selling proposition of innovative services lies in their ability to offer faster, safer, and more personalized support, setting market leaders apart.

Propelling Factors for Business Jet Ground Handling Services Market Growth

The Business Jet Ground Handling Services Market is propelled by several key factors. Firstly, the sustained growth in the global business aviation sector, driven by economic expansion and the increasing use of private jets for business and leisure, directly translates to higher demand for ground handling. Secondly, technological advancements, including digitalization of operations, automation in GSE, and enhanced communication systems, are improving efficiency and service quality, making ground handling more attractive. Thirdly, a growing emphasis on enhancing passenger experience and convenience, with clients expecting seamless and personalized services, is driving innovation and investment in premium ground support. Finally, evolving regulatory frameworks, which often mandate higher safety and environmental standards, encourage operators to invest in modern, compliant ground handling solutions.

- Sustained Business Aviation Growth: Increasing fleet sizes and flight hours globally.

- Technological Advancements: Digitalization, automation, and AI in operations.

- Enhanced Passenger Experience Demand: Focus on VIP services, efficiency, and convenience.

- Evolving Regulatory Standards: Mandates for safety, security, and environmental compliance.

Obstacles in the Business Jet Ground Handling Services Market Market

Despite robust growth, the Business Jet Ground Handling Services Market faces several obstacles. Regulatory complexities and varying compliance standards across different jurisdictions can impede seamless international operations and increase administrative burdens. Supply chain disruptions, particularly for specialized equipment and parts, can lead to operational delays and increased costs. Intense competition among service providers, especially in highly saturated markets, can put pressure on pricing and profit margins. Furthermore, the shortage of skilled labor in aviation ground handling poses a significant challenge, impacting service delivery and operational efficiency. High initial investment costs for advanced GSE and infrastructure also act as a barrier for smaller players.

- Regulatory Hurdles: Divergent international standards and complex compliance.

- Supply Chain Vulnerabilities: Delays and cost fluctuations for critical equipment.

- Intense Competition: Price pressures and market saturation.

- Skilled Labor Shortage: Difficulty in recruiting and retaining qualified personnel.

- High Capital Investment: Significant upfront costs for advanced infrastructure and equipment.

Future Opportunities in Business Jet Ground Handling Services Market

The Business Jet Ground Handling Services Market is brimming with future opportunities. The expansion of business aviation into emerging markets in Asia, Africa, and Latin America presents significant untapped potential for ground service providers. The increasing adoption of sustainable aviation fuels (SAFs) and electric aircraft will necessitate the development of new ground handling infrastructure and services, such as SAF refueling and electric charging facilities. The integration of advanced artificial intelligence (AI) and machine learning (ML) in operations offers opportunities for predictive maintenance, optimized resource allocation, and personalized passenger services. Furthermore, the growing trend of outsourcing ground handling by smaller operators and flight departments creates opportunities for specialized and comprehensive service providers.

- Emerging Market Expansion: Tapping into high-growth regions in Asia, Africa, and Latin America.

- Sustainable Aviation Services: Development of infrastructure and services for SAF and electric aircraft.

- AI & ML Integration: Opportunities for operational optimization and enhanced customer service.

- Outsourcing Trends: Catering to the growing need for specialized third-party ground handling.

Major Players in the Business Jet Ground Handling Services Market Ecosystem

- ExecuJet Aviation Group

- Dnata

- IGS Ground Services

- TAG Aviation

- Aviation Services Management (ASM)

- Jet Aviation AG

- Signature Aviation Limited

- Atlantic Aviation

- RoyalJet LLC

- World Fuel Services Corporation

- Dassault Falcon Service

- Universal Weather and Aviation LLC

Key Developments in Business Jet Ground Handling Services Market Industry

- August 2023: Menzies, a ground handling operator at the Entebbe International Airport in Uganda, acquired new ground handling equipment worth USD 1 million, enhancing its operational capabilities and service efficiency.

- April 2022: Airpro announced an investment of EUR 4 million to procure four Elephant e-BETA de-icers from Vestergaard Company. The equipment, expected for delivery by winter 2022 and to be operated at Helsinki Airport, positions Airpro as a pioneer in electric de-icing services in Finland, signaling a move towards sustainable ground operations.

- April 2022: Amsterdam Airport Schiphol approved digital declarations to streamline the cargo chain. The introduction of Automated Nomination ensures import cargo is automatically assigned to the correct forwarder before physical arrival at the airport, significantly improving logistical efficiency and reducing processing times.

Strategic Business Jet Ground Handling Services Market Market Forecast

The Business Jet Ground Handling Services Market is projected for robust and sustained growth driven by a confluence of factors. The increasing global demand for business aviation, coupled with the continuous pursuit of operational efficiency and superior passenger experiences, will act as primary growth catalysts. Innovations in technology, particularly in digitalization and sustainable ground support equipment, will not only enhance service delivery but also attract environmentally conscious operators. Furthermore, the expansion of business aviation infrastructure in emerging economies presents significant untapped potential. Strategic investments in advanced GSE, skilled workforce development, and comprehensive service portfolios will be crucial for market leaders to capitalize on future opportunities, ensuring a dynamic and expanding market landscape.

Business Jet Ground Handling Services Market Segmentation

-

1. Type

- 1.1. Aircraft Handling

- 1.2. Passenger Handling

- 1.3. Cargo and Baggage Handling

Business Jet Ground Handling Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Business Jet Ground Handling Services Market Regional Market Share

Geographic Coverage of Business Jet Ground Handling Services Market

Business Jet Ground Handling Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Aircraft Handling Services to Dominate the Market During the Forecasted Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Aircraft Handling

- 5.1.2. Passenger Handling

- 5.1.3. Cargo and Baggage Handling

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Aircraft Handling

- 6.1.2. Passenger Handling

- 6.1.3. Cargo and Baggage Handling

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Aircraft Handling

- 7.1.2. Passenger Handling

- 7.1.3. Cargo and Baggage Handling

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Aircraft Handling

- 8.1.2. Passenger Handling

- 8.1.3. Cargo and Baggage Handling

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Aircraft Handling

- 9.1.2. Passenger Handling

- 9.1.3. Cargo and Baggage Handling

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Aircraft Handling

- 10.1.2. Passenger Handling

- 10.1.3. Cargo and Baggage Handling

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ExecuJet Aviation Group A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dnata

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IGS Ground Services

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TAG Aviation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aviation Services Management (ASM)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jet Aviation AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Signature Aviation Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Atlantic Aviation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 RoyalJet LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 World Fuel Services Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dassault Falcon Service

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Universal Weather and Aviation LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 ExecuJet Aviation Group A

List of Figures

- Figure 1: Global Business Jet Ground Handling Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Business Jet Ground Handling Services Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Business Jet Ground Handling Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Business Jet Ground Handling Services Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Business Jet Ground Handling Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Business Jet Ground Handling Services Market Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Business Jet Ground Handling Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Business Jet Ground Handling Services Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Business Jet Ground Handling Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Business Jet Ground Handling Services Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Business Jet Ground Handling Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Business Jet Ground Handling Services Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Business Jet Ground Handling Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Business Jet Ground Handling Services Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Latin America Business Jet Ground Handling Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Business Jet Ground Handling Services Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Business Jet Ground Handling Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Business Jet Ground Handling Services Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Middle East Business Jet Ground Handling Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East Business Jet Ground Handling Services Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East Business Jet Ground Handling Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Jet Ground Handling Services Market?

The projected CAGR is approximately 11.87%.

2. Which companies are prominent players in the Business Jet Ground Handling Services Market?

Key companies in the market include ExecuJet Aviation Group A, Dnata, IGS Ground Services, TAG Aviation, Aviation Services Management (ASM), Jet Aviation AG, Signature Aviation Limited, Atlantic Aviation, RoyalJet LLC, World Fuel Services Corporation, Dassault Falcon Service, Universal Weather and Aviation LLC.

3. What are the main segments of the Business Jet Ground Handling Services Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.42 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Aircraft Handling Services to Dominate the Market During the Forecasted Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2023: Menzies, a ground handling operator at the Entebbe International Airport in Uganda acquired new ground handling equipment worth USD 1 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Business Jet Ground Handling Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Business Jet Ground Handling Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Business Jet Ground Handling Services Market?

To stay informed about further developments, trends, and reports in the Business Jet Ground Handling Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence