Key Insights

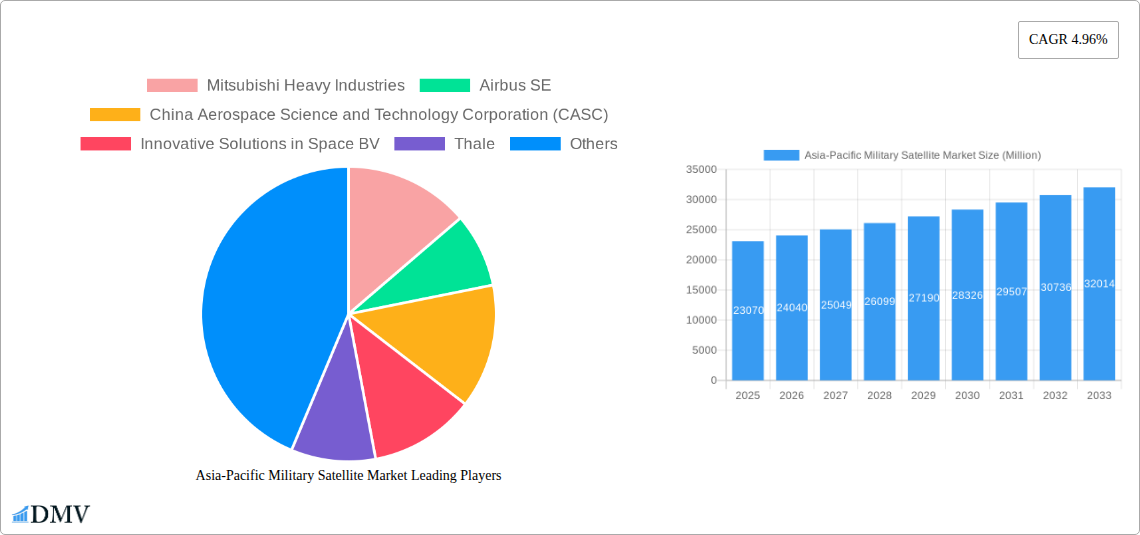

The Asia-Pacific Military Satellite Market is poised for significant expansion, projected to reach USD 23.07 billion in 2025. This growth is fueled by increasing geopolitical tensions, a rising need for advanced intelligence, surveillance, and reconnaissance (ISR) capabilities, and the continuous evolution of satellite technology for defense applications. The market is expected to witness a robust CAGR of 4.29% throughout the forecast period of 2025-2033, indicating sustained demand for sophisticated military satellite solutions. Key drivers include the growing adoption of secure communication satellites, the necessity for precise navigation systems, and the deployment of advanced earth observation satellites for strategic planning and threat assessment. The segment of satellites weighing between 10-100kg and 100-500kg is anticipated to dominate the market, reflecting the trend towards more agile and responsive satellite constellations. Furthermore, the LEO (Low Earth Orbit) class of satellites is expected to see substantial growth due to their cost-effectiveness and improved resolution for ISR missions.

Asia-Pacific Military Satellite Market Market Size (In Billion)

The market's trajectory is further shaped by the integration of cutting-edge satellite subsystems, particularly propulsion hardware and propellant, alongside advancements in solar arrays and power hardware to ensure mission longevity. While the demand for communication, earth observation, and navigation applications will remain paramount, the "Others" segment, encompassing electronic warfare and missile defense support, is also expected to gain traction. Restraints such as the high cost of development and deployment, and stringent regulatory frameworks, are being progressively mitigated by technological innovations and increasing government investments in space-based defense infrastructure. Leading players like Airbus SE, China Aerospace Science and Technology Corporation (CASC), and Mitsubishi Heavy Industries are actively investing in R&D to offer next-generation military satellite systems, further stimulating market dynamism within the Asia-Pacific region.

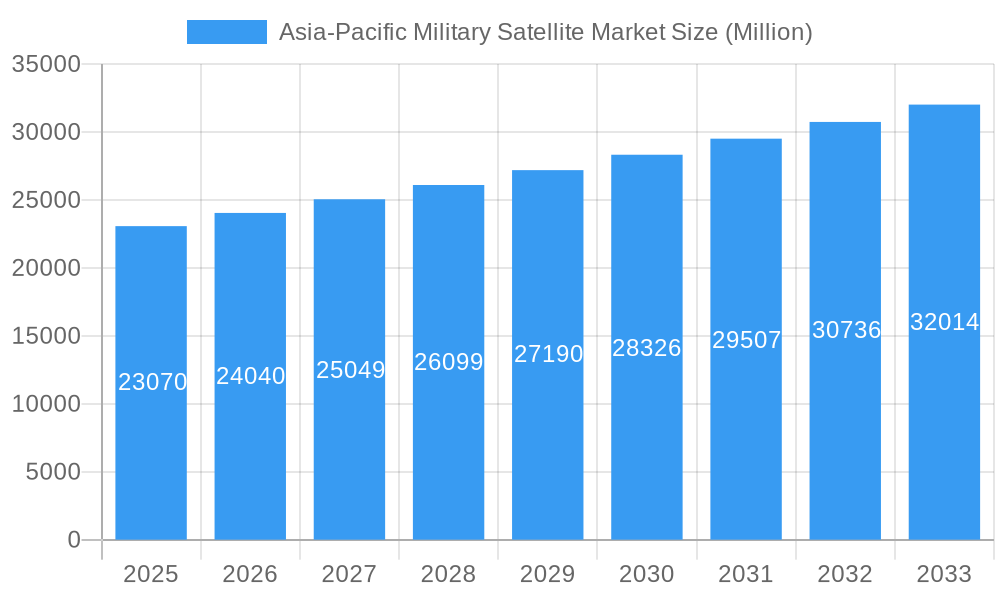

Asia-Pacific Military Satellite Market Company Market Share

Unlock critical insights into the dynamic Asia-Pacific military satellite market with this definitive report. Spanning the historical period of 2019–2024 and projecting growth through 2033, this comprehensive analysis provides stakeholders with an indispensable roadmap to navigate the evolving defense and space landscape. We delve into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities, supported by robust data and expert analysis. The report's base year is 2025, with detailed forecasts for the estimated year 2025 and the forecast period 2025–2033, offering unparalleled strategic foresight. This report is essential for understanding the competitive strategies, technological advancements, and investment trends shaping the future of military space capabilities in the Asia-Pacific region.

Asia-Pacific Military Satellite Market Market Composition & Trends

The Asia-Pacific military satellite market exhibits a dynamic composition driven by increasing defense expenditures and the strategic imperative for enhanced national security and intelligence gathering. Market concentration is influenced by a few key players with significant technological capabilities and government contracts, yet the proliferation of smaller, specialized satellite manufacturers for niche applications is also a notable trend. Innovation catalysts are primarily found in the rapid advancements in satellite subsystems, such as miniaturized propulsion systems and high-resolution imaging payloads, along with the growing adoption of AI and machine learning for data analysis. Regulatory landscapes, while evolving, often favor domestic development and procurement, creating distinct market dynamics across different nations. Substitute products, such as high-altitude pseudo-satellites (HAPS) and advanced aerial surveillance, are emerging but do not fully replicate the persistent, global coverage offered by military satellites. End-user profiles are predominantly defense ministries, intelligence agencies, and space research organizations, with a growing interest from civilian agencies for dual-use applications like disaster management. Mergers and acquisitions (M&A) activities are expected to increase as larger entities seek to consolidate market share and acquire specialized technologies, with M&A deal values projected to reach in the billions of dollars, particularly in sectors focused on satellite manufacturing and launch services.

- Market Share Distribution: Characterized by a few dominant players and a growing segment of specialized providers.

- M&A Activity: Anticipated to rise, driven by consolidation and technology acquisition, with significant investment potential.

- Innovation Focus: Advancements in propulsion, imaging, and data processing are key differentiators.

Asia-Pacific Military Satellite Market Industry Evolution

The Asia-Pacific military satellite market has witnessed a transformative evolution over the past decade, largely fueled by geopolitical shifts and the escalating need for sovereign defense capabilities. During the historical period (2019–2024), the market experienced robust growth, driven by heightened regional tensions and a concerted effort by many nations to bolster their space-based intelligence, surveillance, and reconnaissance (ISR) assets. This era saw increased investment in both the development and deployment of new satellite constellations, catering to a diverse range of applications including secure communication, advanced Earth observation, and precise navigation. Technological advancements have been a cornerstone of this evolution. The miniaturization of satellite components, coupled with the development of more efficient propulsion systems, has enabled the creation of smaller, more agile, and cost-effective satellites. Furthermore, the integration of artificial intelligence and machine learning into satellite operations and data analysis has significantly enhanced their operational capabilities and the speed at which actionable intelligence can be disseminated.

Shifting consumer demands, or rather, the evolving requirements of defense ministries and intelligence agencies, have also played a pivotal role. There's a discernible trend towards more resilient and secure communication networks, the demand for higher spatial and temporal resolution in Earth observation data, and the need for enhanced GPS-denied navigation capabilities. The rise of LEO constellations, offering lower latency and higher revisit rates compared to traditional GEO satellites, has become a significant focus. Growth rates in this sector have been consistently high, often exceeding 10% annually in key markets, driven by substantial government budgets allocated to defense modernization. Adoption metrics for advanced satellite technologies, such as multi-spectral imaging and secure quantum communication payloads, are steadily increasing. The increasing complexity of threats and the desire for assured access to space have propelled the industry towards developing more sophisticated and responsive satellite systems. This continuous cycle of innovation and adoption is shaping a market poised for sustained expansion in the forecast period (2025–2033), with significant investments anticipated in next-generation technologies, including satellite constellations designed for electronic warfare and space domain awareness. The industry is moving towards greater autonomy, network-centric operations, and a more integrated approach to space as a critical domain for national security.

Leading Regions, Countries, or Segments in Asia-Pacific Military Satellite Market

The Asia-Pacific military satellite market is characterized by significant regional disparities and segment dominance. Among the satellite mass segments, above 1000kg satellites continue to command a substantial portion of the market value due to their advanced capabilities and mission-critical roles in communication and strategic ISR. However, the 10-100kg and 100-500kg segments are experiencing rapid growth, driven by the increasing demand for more agile and cost-effective solutions, particularly for Earth observation and reconnaissance missions. The Below 10 Kg segment, encompassing CubeSats and small satellites, is witnessing exponential growth, driven by lower development costs and the ability to deploy constellations for specific, rapid-response needs.

In terms of Orbit Class, GEO (Geostationary Orbit) satellites remain crucial for persistent communication and early warning systems due to their stable, fixed position relative to the Earth. However, LEO (Low Earth Orbit) is rapidly gaining prominence for ISR and tactical communication due to its lower latency, higher revisit rates, and the potential for rapid deployment of constellations. MEO (Medium Earth Orbit) is primarily relevant for navigation systems.

Analyzing Satellite Subsystems, Satellite Bus & Subsystems represent a significant market share due to their foundational role in any satellite mission. Propulsion Hardware and Propellant are critical for maneuverability and station-keeping, especially with the trend towards more agile satellites. Solar Array & Power Hardware are indispensable for sustained operations.

The Application segment is dominated by Communication and Earth Observation, both vital for military operations, intelligence gathering, and situational awareness. Navigation is another critical application, ensuring accurate positioning for forces. Space Observation plays a role in threat detection and space domain awareness.

Geographically, China is a dominant force in the Asia-Pacific military satellite market, investing heavily in indigenous capabilities across all segments. Japan is also a significant player, with a strong focus on advanced imaging and reconnaissance satellites. India is rapidly expanding its space capabilities, with a growing emphasis on indigenous satellite development for defense and strategic purposes. Other nations like South Korea, Australia, and several Southeast Asian countries are increasing their investments to enhance their satellite-based defense systems.

- Key Drivers in Satellite Mass (Above 1000kg): Demand for strategic ISR, secure communications, and long-duration missions.

- Key Drivers in Satellite Mass (10-100kg & 100-500kg): Cost-effectiveness, agility, and specialized ISR capabilities.

- Key Drivers in Satellite Mass (Below 10 Kg): Rapid deployment, constellation capabilities, and niche applications like signals intelligence.

- Key Drivers in Orbit Class (GEO): Persistent surveillance, communication relays, and early warning systems.

- Key Drivers in Orbit Class (LEO): High revisit rates, low latency communication, and advanced ISR.

- Key Drivers in Application (Communication): Secure tactical communication, battlefield management, and command and control.

- Key Drivers in Application (Earth Observation): Strategic ISR, target identification, damage assessment, and environmental monitoring.

- Dominant Countries: China, Japan, India, and growing investments from South Korea and Australia.

Asia-Pacific Military Satellite Market Product Innovations

The Asia-Pacific military satellite market is characterized by a relentless pace of product innovation. Key advancements include the development of highly capable synthetic aperture radar (SAR) satellites offering all-weather, day-and-night imaging, crucial for reconnaissance and target acquisition. Miniaturized and more efficient electric propulsion systems are enabling greater maneuverability and longer mission lifetimes for smaller satellites. The integration of advanced optical sensors with resolutions below XXX cm are providing unprecedented detail for Earth observation. Furthermore, the emergence of secure communication payloads, including those leveraging quantum cryptography, is enhancing the resilience of military networks against jamming and interception. Innovations in satellite bus architectures are leading to more modular and scalable platforms, allowing for quicker customization and deployment of specialized satellite constellations.

Propelling Factors for Asia-Pacific Military Satellite Market Growth

The Asia-Pacific military satellite market is propelled by a confluence of critical factors. Foremost is the escalating geopolitical tension and the ensuing demand for enhanced national security and intelligence capabilities across the region. Nations are prioritizing the development of sovereign space assets to ensure assured access to information and maintain a strategic advantage. Technological advancements, particularly in miniaturization and sensor technology, are enabling the creation of more sophisticated and cost-effective satellite systems, lowering the barrier to entry for new capabilities. Government investment in defense modernization programs, with substantial allocations towards space-based assets, forms a significant economic driver. Furthermore, the increasing recognition of space as a critical domain for military operations is driving the adoption of advanced satellite applications for communication, navigation, and surveillance.

Obstacles in the Asia-Pacific Military Satellite Market Market

Despite its strong growth trajectory, the Asia-Pacific military satellite market faces several significant obstacles. The stringent regulatory environment surrounding satellite development and deployment, particularly concerning dual-use technologies and export controls, can lead to delays and increased costs. Supply chain disruptions, exacerbated by global events, can impact the availability of specialized components and raw materials, affecting production timelines and increasing expenses. Intense competition among established players and emerging market entrants creates price pressures and necessitates continuous innovation to maintain market share. Furthermore, the high cost associated with developing, launching, and maintaining complex satellite systems remains a considerable barrier for some nations and organizations. The risk of space debris and the increasing congestion of orbital pathways also pose long-term challenges to the sustainability of satellite operations.

Future Opportunities in Asia-Pacific Military Satellite Market

The Asia-Pacific military satellite market presents numerous promising opportunities for growth and innovation. The increasing demand for resilient, secure communication networks is driving the development of advanced satellite constellations capable of providing global coverage and combating electronic warfare. The expanding use of Artificial Intelligence (AI) and Machine Learning (ML) in satellite data analysis offers opportunities for developing more sophisticated intelligence-gathering and decision-support systems. The growing emphasis on space domain awareness (SDA) and the need to monitor potential threats in space create a market for advanced sensor technologies and satellite-based tracking systems. Furthermore, the potential for dual-use applications, where military satellite technology can be leveraged for civilian purposes like disaster management and climate monitoring, opens up new revenue streams and strategic partnerships.

Major Players in the Asia-Pacific Military Satellite Market Ecosystem

- Mitsubishi Heavy Industries

- Airbus SE

- China Aerospace Science and Technology Corporation (CASC)

- Innovative Solutions in Space BV

- Thales

- Indian Space Research Organisation (ISRO)

Key Developments in Asia-Pacific Military Satellite Market Industry

- October 2023: Mitsubishi Electric was awarded a contract by JAXA, the Ministry of Environment, and the National Institute of Environmental Studies, Japan, to build the Greenhouse Gases Observing Satellite-2 (GOSAT-2). The satellite was launched from the Tanegashima Space Center in southern Japan. This development underscores Japan's commitment to advanced Earth observation capabilities with potential dual-use military implications.

- September 2023: The Royal Thai Air Force awarded Innovative Solutions In Space a contract to build its next satellite mission based on an ISISpace 6U CubeSat. This signifies the growing adoption of smaller, modular satellite solutions for defense applications in Southeast Asia, enhancing tactical ISR and communication capabilities.

- February 2023: Mitsubishi Electric was awarded a contract by Cabinet Satellite Intelligence Center (CSIC) to build a reconnaissance satellite named IGS Optical 7. The satellite was launched from the Tanegashima Space Center in southern Japan. This marks a significant advancement in Japan's high-resolution reconnaissance satellite program, bolstering its strategic intelligence gathering capabilities.

Strategic Asia-Pacific Military Satellite Market Market Forecast

The strategic forecast for the Asia-Pacific military satellite market indicates continued robust growth driven by increasing defense modernization efforts and the imperative for technological sovereignty. Key growth catalysts include the escalating demand for advanced ISR capabilities, resilient communication networks, and precise navigation systems. Investments in next-generation technologies, such as AI-enabled data analysis, quantum communication, and small satellite constellations, will be pivotal. The market is expected to witness increased collaboration between nations and private sector entities to accelerate innovation and deployment, further solidifying the strategic importance of space assets in regional security paradigms. The expansion of LEO constellations for tactical applications and the continued development of high-resolution Earth observation satellites will shape the market's future landscape, presenting significant opportunities for stakeholders who can adapt to these evolving demands.

Asia-Pacific Military Satellite Market Segmentation

-

1. Satellite Mass

- 1.1. 10-100kg

- 1.2. 100-500kg

- 1.3. 500-1000kg

- 1.4. Below 10 Kg

- 1.5. above 1000kg

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. Satellite Subsystem

- 3.1. Propulsion Hardware and Propellant

- 3.2. Satellite Bus & Subsystems

- 3.3. Solar Array & Power Hardware

- 3.4. Structures, Harness & Mechanisms

-

4. Application

- 4.1. Communication

- 4.2. Earth Observation

- 4.3. Navigation

- 4.4. Space Observation

- 4.5. Others

Asia-Pacific Military Satellite Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Military Satellite Market Regional Market Share

Geographic Coverage of Asia-Pacific Military Satellite Market

Asia-Pacific Military Satellite Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Military Satellite Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.1.1. 10-100kg

- 5.1.2. 100-500kg

- 5.1.3. 500-1000kg

- 5.1.4. Below 10 Kg

- 5.1.5. above 1000kg

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 5.3.1. Propulsion Hardware and Propellant

- 5.3.2. Satellite Bus & Subsystems

- 5.3.3. Solar Array & Power Hardware

- 5.3.4. Structures, Harness & Mechanisms

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Communication

- 5.4.2. Earth Observation

- 5.4.3. Navigation

- 5.4.4. Space Observation

- 5.4.5. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitsubishi Heavy Industries

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Airbus SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Aerospace Science and Technology Corporation (CASC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Innovative Solutions in Space BV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thale

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Indian Space Research Organisation (ISRO)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi Heavy Industries

List of Figures

- Figure 1: Asia-Pacific Military Satellite Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Military Satellite Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Military Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 2: Asia-Pacific Military Satellite Market Revenue undefined Forecast, by Orbit Class 2020 & 2033

- Table 3: Asia-Pacific Military Satellite Market Revenue undefined Forecast, by Satellite Subsystem 2020 & 2033

- Table 4: Asia-Pacific Military Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Military Satellite Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Military Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 7: Asia-Pacific Military Satellite Market Revenue undefined Forecast, by Orbit Class 2020 & 2033

- Table 8: Asia-Pacific Military Satellite Market Revenue undefined Forecast, by Satellite Subsystem 2020 & 2033

- Table 9: Asia-Pacific Military Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Asia-Pacific Military Satellite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-Pacific Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-Pacific Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-Pacific Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-Pacific Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-Pacific Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-Pacific Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-Pacific Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-Pacific Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Military Satellite Market?

The projected CAGR is approximately 4.29%.

2. Which companies are prominent players in the Asia-Pacific Military Satellite Market?

Key companies in the market include Mitsubishi Heavy Industries, Airbus SE, China Aerospace Science and Technology Corporation (CASC), Innovative Solutions in Space BV, Thale, Indian Space Research Organisation (ISRO).

3. What are the main segments of the Asia-Pacific Military Satellite Market?

The market segments include Satellite Mass, Orbit Class, Satellite Subsystem, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2023: Mitsubishi Electric was given a contract by JAXA, the Ministry of Environment, and the National Institute of Environmental Studies, Japan, to build the Greenhouse Gases Observing Satellite-2 (GOSAT-2). The satellite was launched from the Tanegashima Space Center in southern Japan.September 2023: The Royal Thai Air Force awarded Innovative Solutions In Space a contract to build its next satellite mission based on an ISISpace 6U CubeSat.February 2023: Mitsubishi Electric was given a contract by Cabinet Satellite Intelligence Center (CSIC) to build a reconnaissance satellite named IGS Optical 7. The satellite was launched from the Tanegashima Space Center in southern Japan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Military Satellite Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Military Satellite Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Military Satellite Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Military Satellite Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence