Key Insights

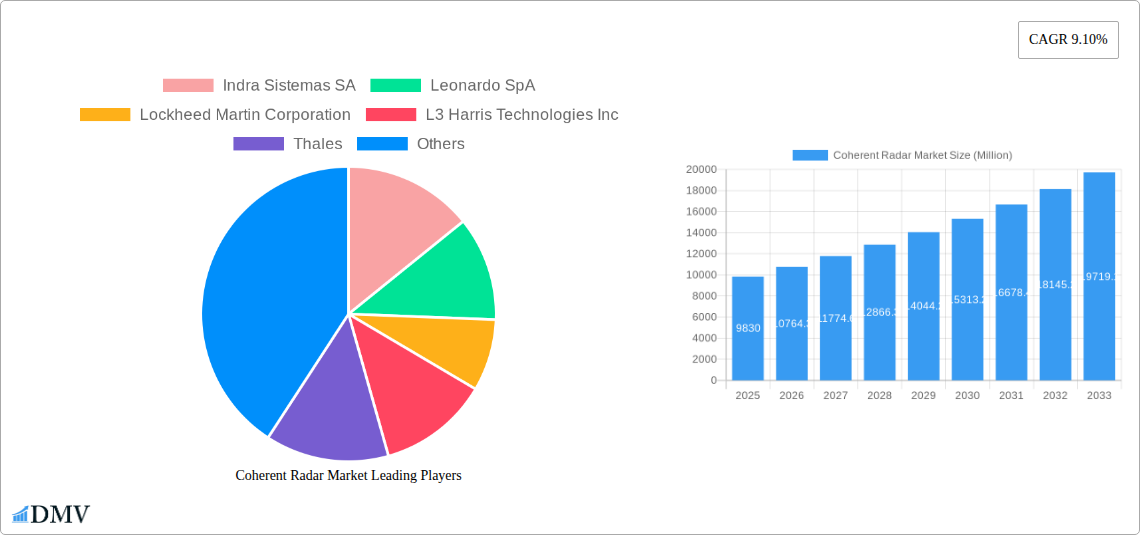

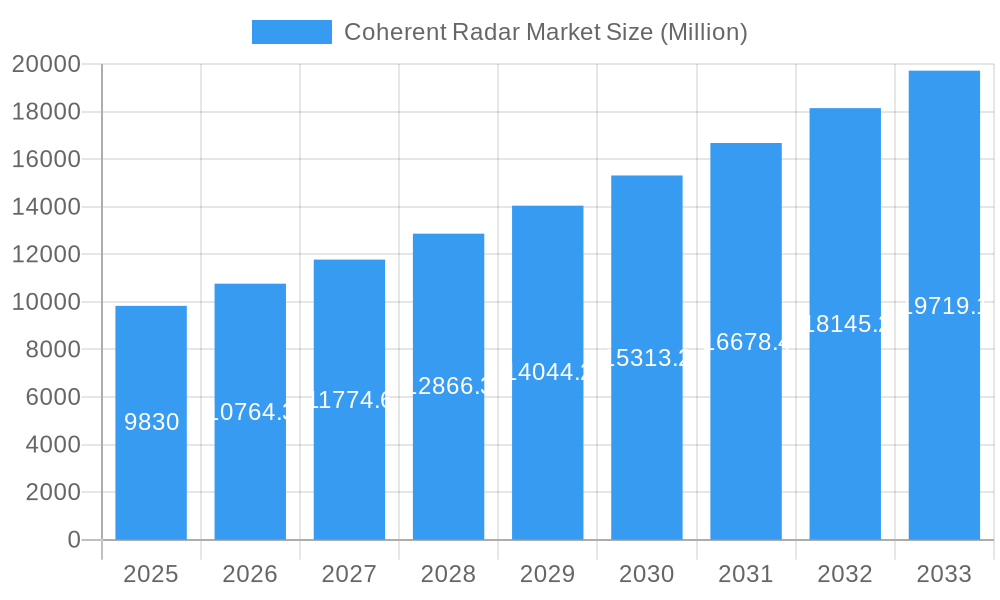

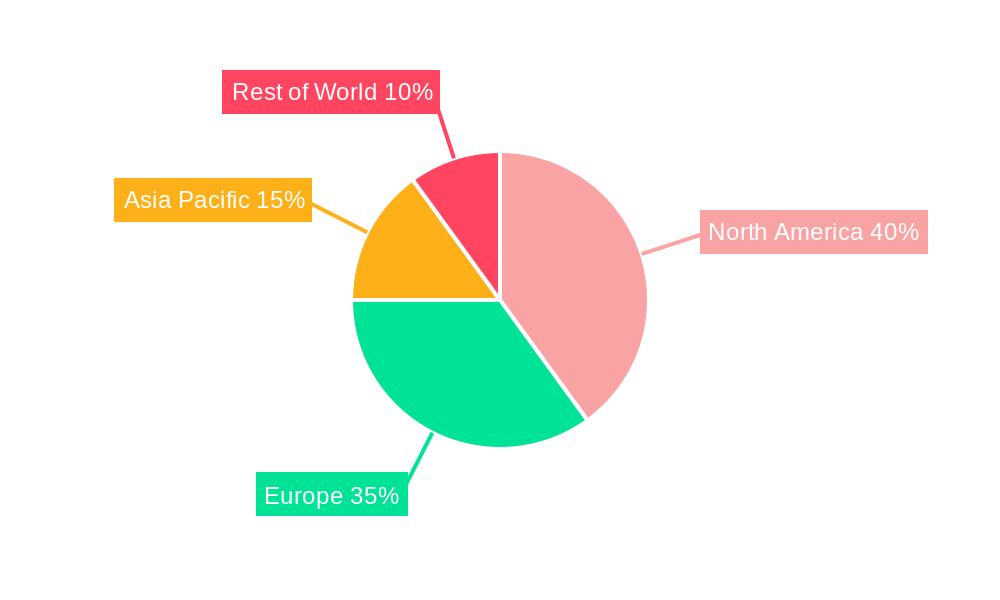

The Coherent Radar Market is experiencing robust growth, projected to reach a market size of $9.83 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 9.10% from 2019 to 2033. This expansion is driven by increasing demand for advanced surveillance systems across defense, aerospace, and commercial sectors. The rising need for enhanced situational awareness, improved target detection and tracking capabilities, and the integration of coherent radar technology into autonomous systems are significant market drivers. Technological advancements leading to smaller, lighter, and more energy-efficient radar systems are further fueling market growth. The market is segmented by platform (Airborne, Terrestrial, Naval), with the airborne segment currently dominating due to its crucial role in aerial surveillance and defense applications. However, growing investment in ground-based surveillance and naval defense systems is expected to drive growth in these segments. Geographic distribution shows strong market presence in North America and Europe, driven by substantial defense budgets and technological advancements in these regions. The Asia-Pacific region is anticipated to witness rapid growth in the coming years, fueled by increasing defense expenditure and infrastructural development. While the market faces restraints like high initial investment costs and technological complexities, the ongoing technological innovations and increasing defense spending globally are expected to mitigate these challenges and maintain the market's upward trajectory through 2033. Key players like Indra Sistemas SA, Leonardo SpA, Lockheed Martin Corporation, and Thales are driving innovation and competition within the market, constantly striving to deliver improved performance, reliability, and cost-effectiveness.

Coherent Radar Market Market Size (In Billion)

The forecast period of 2025-2033 promises continued expansion for the coherent radar market, propelled by factors such as the increasing adoption of advanced radar systems in various applications, and further miniaturization and improvement of radar technology. Government investments in defense modernization programs, particularly within emerging economies, will contribute significantly to market growth. The development of high-resolution imaging radar and advanced signal processing techniques will unlock new applications and increase the market's scope. Competitive landscape analysis indicates that strategic partnerships, mergers, and acquisitions will continue shaping the industry, driving innovation and expanding market reach. The integration of artificial intelligence and machine learning in radar systems is expected to revolutionize target identification and tracking capabilities, further fueling market growth throughout the forecast period. Although challenges remain concerning cybersecurity threats and the need for robust data management systems, the overarching market outlook remains positive, indicating significant opportunities for growth and investment in the coming years.

Coherent Radar Market Company Market Share

Coherent Radar Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Coherent Radar Market, offering a comprehensive overview of market dynamics, technological advancements, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is crucial for stakeholders seeking to understand the competitive landscape, identify growth opportunities, and make informed strategic decisions within this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Coherent Radar Market Composition & Trends

This section delves into the intricate structure of the Coherent Radar Market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute technologies, end-user profiles, and mergers & acquisitions (M&A) activities. The market is characterized by a moderately concentrated landscape, with key players like Indra Sistemas SA, Leonardo SpA, Lockheed Martin Corporation, L3 Harris Technologies Inc, and Thales holding significant market share. The combined market share of these top five players is estimated at xx%.

- Market Concentration: High (xx%), driven by the dominance of established players.

- Innovation Catalysts: Advancements in signal processing, miniaturization, and AI-driven algorithms.

- Regulatory Landscape: Stringent regulations regarding spectrum allocation and cybersecurity pose challenges.

- Substitute Products: Traditional radar systems and other surveillance technologies offer partial alternatives.

- End-User Profiles: Military and defense, aerospace, and maritime sectors constitute primary end-users.

- M&A Activities: Significant M&A activity has been observed in the last five years, with total deal values exceeding xx Million. Notable transactions include [Insert details of significant M&A deals if available, otherwise state "Data unavailable"].

Coherent Radar Market Industry Evolution

This section provides a detailed analysis of the Coherent Radar Market's evolutionary trajectory. Market growth is primarily fueled by increasing defense budgets globally, rising demand for advanced surveillance systems, and the integration of coherent radar technology in autonomous vehicles. Technological advancements such as the development of high-resolution imaging radar and the use of advanced signal processing techniques have significantly improved the accuracy and performance of these systems. The market witnessed a robust growth rate of xx% between 2019 and 2024 and is expected to maintain a strong growth trajectory during the forecast period, driven by factors like the increasing adoption of these systems in various applications, technological advancements, and increasing government investments. The adoption rate of coherent radar technology has increased significantly in recent years, particularly within the defense and aerospace sectors, showcasing a strong market uptake. Furthermore, the growing demand for improved situational awareness and enhanced security measures is fueling the market’s expansion.

Leading Regions, Countries, or Segments in Coherent Radar Market

The Airborne segment currently dominates the Coherent Radar Market, accounting for approximately xx% of the global revenue.

- Key Drivers for Airborne Segment Dominance:

- High Investment in Military Aviation: Significant investment in military aircraft modernization and development globally.

- Technological Advancements: Development of compact, high-performance radar systems tailored to airborne platforms.

- Stringent Security Needs: The need for enhanced surveillance and threat detection capabilities in air defense systems.

The dominance of the Airborne segment stems from the critical role of coherent radar in modern military aircraft. The high demand for advanced surveillance and threat detection systems, along with continuous technological advancements in radar technology, further solidifies this segment’s leadership position. Government investments in upgrading and modernizing their air forces and increasing focus on aerial situational awareness are major factors propelling this market segment. While the Terrestrial and Naval segments are also exhibiting growth, their market share remains relatively smaller compared to Airborne due to different technological maturity levels and adoption rates.

Coherent Radar Market Product Innovations

Recent years have witnessed significant product innovations within the Coherent Radar Market. New designs emphasize improved resolution, reduced size and weight, enhanced signal processing capabilities, and integration with AI-powered systems for autonomous operation. These advancements are enhancing the accuracy, reliability, and versatility of these systems across various applications, including weather forecasting, air traffic control, and autonomous driving. Key innovations focus on improving target identification, range, and resistance to countermeasures.

Propelling Factors for Coherent Radar Market Growth

The Coherent Radar Market’s growth is primarily driven by technological advancements, economic factors, and supportive government regulations. Technological improvements, such as miniaturization, improved signal processing, and greater integration with other sensor technologies, have resulted in more efficient and effective radar systems. Increasing defense budgets globally, particularly in key regions like North America and Asia-Pacific, are directly boosting market demand. Furthermore, stringent regulatory frameworks emphasizing improved safety and security in various sectors (aviation, maritime) are creating a favorable environment for market expansion.

Obstacles in the Coherent Radar Market

The Coherent Radar Market faces several obstacles. Stringent regulations concerning radio frequency spectrum allocation and stringent cybersecurity requirements are key regulatory challenges. Supply chain disruptions, particularly concerning critical components such as semiconductors, can impact production and delivery timelines. Finally, intense competition from established players and emerging entrants leads to price pressures and limits profit margins. These factors collectively represent significant challenges impacting the market growth trajectory.

Future Opportunities in Coherent Radar Market

The Coherent Radar Market holds immense potential for future growth, especially in emerging applications. The integration of coherent radar with other sensor technologies (e.g., LiDAR, cameras) to create comprehensive sensor fusion systems for autonomous vehicles offers a significant opportunity. Expansion into new markets, such as advanced driver-assistance systems (ADAS) in automobiles, presents another key avenue for growth. Further advancements in AI-driven signal processing and the development of smaller, more energy-efficient radar systems will also drive market expansion.

Major Players in the Coherent Radar Market Ecosystem

- Indra Sistemas SA

- Leonardo SpA

- Lockheed Martin Corporation

- L3 Harris Technologies Inc

- Thales

- IAI

- RTX Corporation

- BAE Systems PLC

- HENSOLDT AG

- Saab AB

Key Developments in Coherent Radar Market Industry

- [Month, Year]: [Company Name] launched a new coherent radar system with improved resolution and range.

- [Month, Year]: [Company Name] acquired [Company Name], expanding its market presence.

- [Month, Year]: A significant government contract was awarded to [Company Name] for the development of a next-generation coherent radar system.

- [Add more bullet points with specific details as available]

Strategic Coherent Radar Market Forecast

The Coherent Radar Market is poised for continued growth, driven by sustained technological advancements and increasing demand across diverse sectors. The integration of artificial intelligence and machine learning into coherent radar systems will enhance their capabilities and expand their application range. The adoption of these systems in autonomous driving, smart infrastructure, and advanced surveillance technologies will be crucial factors shaping the market’s future trajectory, leading to a significant expansion of market size and revenue generation in the coming years.

Coherent Radar Market Segmentation

-

1. Platform

- 1.1. Airborne

- 1.2. Terrestrial

- 1.3. Naval

Coherent Radar Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East and Africa

Coherent Radar Market Regional Market Share

Geographic Coverage of Coherent Radar Market

Coherent Radar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Airborne Coherent Radar Segment to Exhibit the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coherent Radar Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Airborne

- 5.1.2. Terrestrial

- 5.1.3. Naval

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America Coherent Radar Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Airborne

- 6.1.2. Terrestrial

- 6.1.3. Naval

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. Europe Coherent Radar Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Airborne

- 7.1.2. Terrestrial

- 7.1.3. Naval

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Asia Pacific Coherent Radar Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Airborne

- 8.1.2. Terrestrial

- 8.1.3. Naval

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Rest of the World Coherent Radar Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Airborne

- 9.1.2. Terrestrial

- 9.1.3. Naval

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Indra Sistemas SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Leonardo SpA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Lockheed Martin Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 L3 Harris Technologies Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Thales

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 IAI

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 RTX Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BAE Systems PLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 HENSOLDT AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Saab AB

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Indra Sistemas SA

List of Figures

- Figure 1: Global Coherent Radar Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Coherent Radar Market Revenue (Million), by Platform 2025 & 2033

- Figure 3: North America Coherent Radar Market Revenue Share (%), by Platform 2025 & 2033

- Figure 4: North America Coherent Radar Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Coherent Radar Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Coherent Radar Market Revenue (Million), by Platform 2025 & 2033

- Figure 7: Europe Coherent Radar Market Revenue Share (%), by Platform 2025 & 2033

- Figure 8: Europe Coherent Radar Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Coherent Radar Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Coherent Radar Market Revenue (Million), by Platform 2025 & 2033

- Figure 11: Asia Pacific Coherent Radar Market Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Asia Pacific Coherent Radar Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Coherent Radar Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Coherent Radar Market Revenue (Million), by Platform 2025 & 2033

- Figure 15: Rest of the World Coherent Radar Market Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Rest of the World Coherent Radar Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Coherent Radar Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Coherent Radar Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: Global Coherent Radar Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Coherent Radar Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Global Coherent Radar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Coherent Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Coherent Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Coherent Radar Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Global Coherent Radar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Coherent Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Coherent Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Coherent Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Russia Coherent Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Coherent Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Coherent Radar Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 15: Global Coherent Radar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Coherent Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: China Coherent Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Coherent Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Coherent Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Coherent Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Coherent Radar Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 22: Global Coherent Radar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Latin America Coherent Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Middle East and Africa Coherent Radar Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coherent Radar Market?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the Coherent Radar Market?

Key companies in the market include Indra Sistemas SA, Leonardo SpA, Lockheed Martin Corporation, L3 Harris Technologies Inc, Thales, IAI, RTX Corporation, BAE Systems PLC, HENSOLDT AG, Saab AB.

3. What are the main segments of the Coherent Radar Market?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.83 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Airborne Coherent Radar Segment to Exhibit the Highest Growth Rate.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Coherent Radar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Coherent Radar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Coherent Radar Market?

To stay informed about further developments, trends, and reports in the Coherent Radar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence