Key Insights

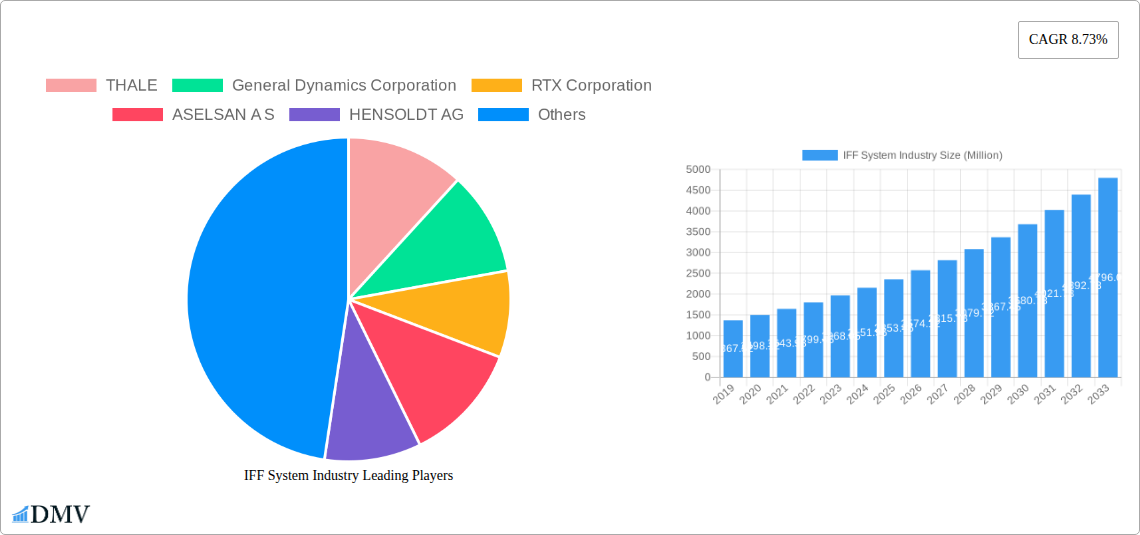

The Identification Friend or Foe (IFF) System Industry is poised for significant expansion, with a current market size estimated at a robust $1.96 billion. This growth trajectory is driven by an impressive Compound Annual Growth Rate (CAGR) of 8.73%, projecting substantial value increases through 2033. The escalating geopolitical tensions and the increasing adoption of advanced defense technologies are primary catalysts propelling the demand for sophisticated IFF systems. These systems are crucial for modern warfare, enabling rapid and accurate identification of friendly, hostile, or neutral forces, thereby minimizing fratricidal incidents and enhancing operational effectiveness. Investments in upgrading existing military platforms with next-generation IFF capabilities, coupled with the development of new defense assets, are further fueling market expansion. The industry's resilience is also bolstered by continuous innovation, with manufacturers focusing on developing IFF solutions with enhanced cybersecurity features, reduced signature detection, and improved interoperability across diverse military branches and allied nations.

IFF System Industry Market Size (In Billion)

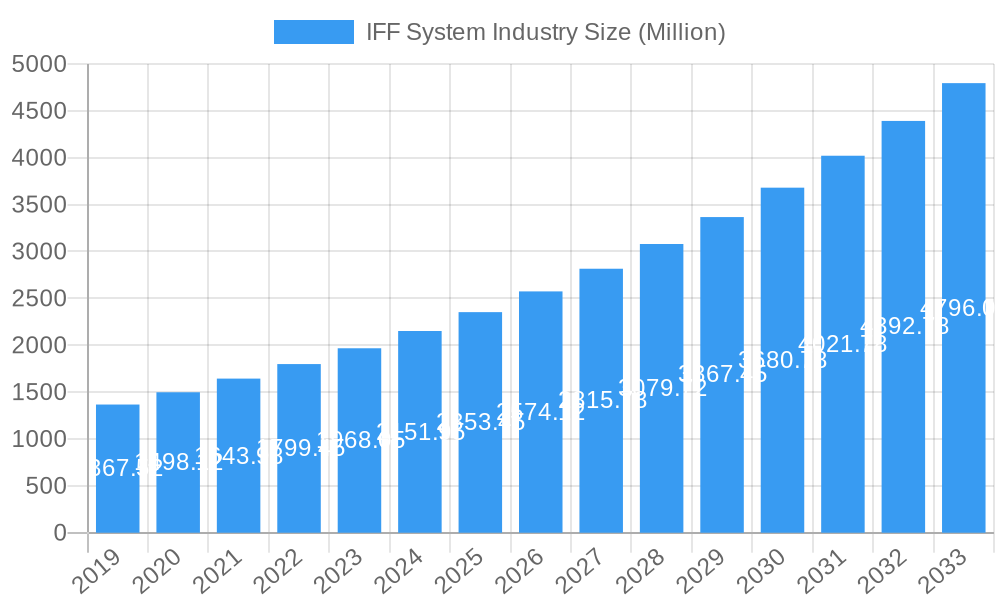

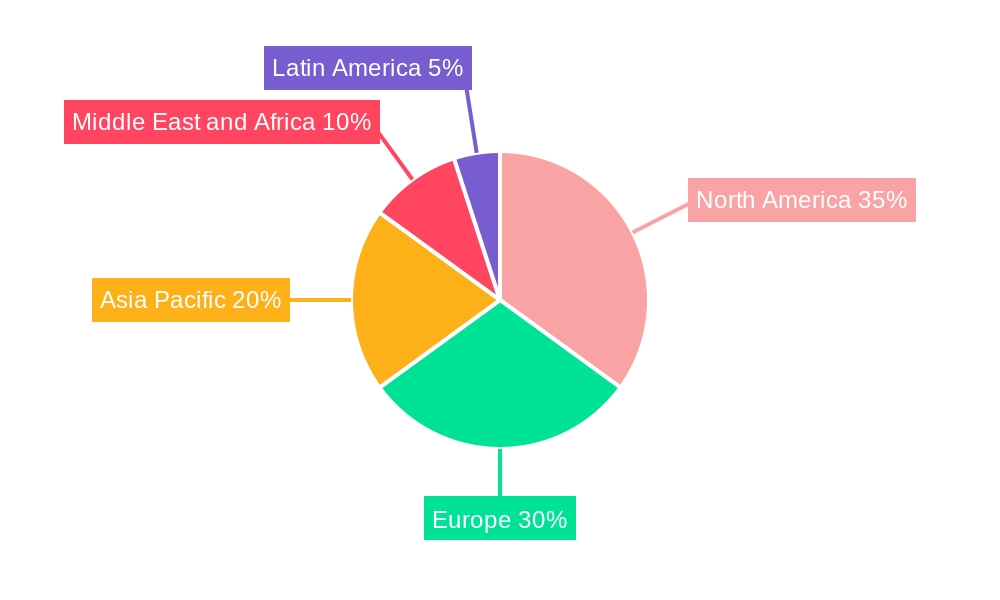

The market is segmented across key platforms, including Terrestrial, Airborne, and Naval IFF systems, each catering to distinct operational environments and defense requirements. Major players like THALE, General Dynamics Corporation, RTX Corporation, and Northrop Grumman Corporation are actively engaged in research and development, strategic partnerships, and acquisitions to solidify their market positions. North America and Europe currently represent significant markets due to substantial defense spending and the presence of leading IFF system manufacturers. However, the Asia Pacific region is emerging as a critical growth area, driven by increasing defense modernization efforts in countries like China and India. While opportunities abound, the industry faces potential restraints such as the high cost of implementing advanced IFF technologies and the complexity of integrating these systems with legacy military infrastructure. Nevertheless, the unwavering need for battlefield clarity and force protection ensures a sustained demand for advanced IFF solutions, underscoring the industry's vital role in global security.

IFF System Industry Company Market Share

This comprehensive report, "IFF System Industry: Market Analysis, Trends, and Forecast 2025-2033," offers an in-depth examination of the Identification Friend or Foe (IFF) system industry. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this analysis provides critical insights for stakeholders. The report covers the terrestrial, airborne, and naval platforms, detailing market composition, evolutionary trends, leading regions, product innovations, growth drivers, obstacles, and future opportunities. With meticulous research and detailed forecasts, this report is an indispensable resource for understanding the global IFF system market dynamics and strategic outlook.

IFF System Industry Market Composition & Trends

The global IFF system industry is characterized by a moderate to high concentration, driven by significant research and development investments and stringent national security mandates. Innovation catalysts include the continuous need for enhanced battlefield awareness, reduced fratricide, and integration with advanced command and control (C2) systems. The regulatory landscape is robust, with international standards and national defense procurement policies shaping market entry and product development. Substitute products, while limited in direct functional equivalence, include passive identification systems and advanced surveillance technologies that can augment IFF capabilities. End-user profiles primarily comprise government defense agencies and military organizations worldwide, with significant procurement activities expected from major defense powers. Mergers and acquisitions (M&A) activities are strategic, aimed at consolidating market share, acquiring advanced technologies, and expanding geographical reach. Recent M&A deals have seen valuations ranging from XXX Million to XXX Million, reflecting the strategic importance of IFF capabilities in national defense portfolios. The market share distribution indicates a dominance by a few key players, with smaller, specialized firms focusing on niche technologies and emerging markets.

IFF System Industry Industry Evolution

The IFF system industry has witnessed a dynamic evolution, driven by the imperative of modern warfare to accurately distinguish between friendly and hostile forces, thereby minimizing fratricide and maximizing operational efficiency. The historical period from 2019 to 2024 saw a steady growth trajectory, fueled by ongoing geopolitical tensions and increased defense spending in key regions. This period was marked by significant advancements in digital signal processing, secure cryptographic techniques, and the development of Mode 5 IFF systems, which have become the international standard for NATO and allied forces. The estimated year of 2025 represents a pivotal point where the adoption of advanced IFF capabilities is accelerating, driven by the need to integrate with next-generation combat platforms and networked warfare environments.

Looking into the forecast period from 2025 to 2033, the market is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 6.5%. This growth is underpinned by several key factors. Firstly, the continuous modernization of military inventories across the globe necessitates the upgrade and replacement of legacy IFF systems. Nations are actively investing in newer generations of IFF transponders, interrogators, and cryptographic modules to ensure interoperability and enhanced security. Secondly, the proliferation of drone technology and unmanned systems has created a new set of challenges for identification, spurring demand for IFF solutions capable of identifying and tracking these smaller, faster, and more numerous targets. Thirdly, the increasing emphasis on multi-domain operations – across land, sea, air, and cyber – requires IFF systems that can seamlessly operate and share data across diverse platforms and domains, thereby enhancing situational awareness and coordinated responses. Technological advancements, such as the integration of AI and machine learning for improved threat detection and target classification, along with the development of resilient and jam-resistant IFF capabilities, are expected to further propel market expansion. Shifting consumer demands, or rather, end-user requirements, are increasingly focused on modular, software-defined IFF systems that can be easily updated and adapted to evolving threats and operational needs, demonstrating a move towards more flexible and future-proof solutions. The overall market trajectory points towards a significant expansion in the coming decade, driven by technological innovation and an unwavering commitment to enhancing military operational effectiveness and safety.

Leading Regions, Countries, or Segments in IFF System Industry

The dominance within the IFF System Industry is predominantly observed across Airborne platforms, reflecting the critical need for rapid and accurate identification in complex aerial combat scenarios and air traffic management. This segment's leadership is driven by a confluence of substantial defense budgets, ongoing technological advancements, and the inherent operational tempo of air forces worldwide.

- Investment Trends: Major defense spending by global powers, particularly in fighter jet modernization, surveillance aircraft, and unmanned aerial vehicles (UAVs), directly translates into significant investments in airborne IFF systems. The integration of IFF with advanced radar and electronic warfare systems is a priority, enhancing the survivability and effectiveness of aerial assets.

- Regulatory Support: International standards, such as those mandated by NATO for Mode 5 IFF, provide a strong regulatory framework that encourages widespread adoption and interoperability for airborne applications. This standardization streamlines procurement and ensures that allied forces can operate together seamlessly.

- Technological Advancement: The airborne environment demands the most sophisticated IFF solutions. Innovations in miniaturization, reduced power consumption, and enhanced resistance to jamming and spoofing are critical for airborne platforms. The development of Mode 5 IFF, which offers encrypted replies and advanced cryptographic keys, has significantly boosted its adoption in air operations.

In-depth analysis reveals that North America, particularly the United States, and Europe, with countries like the UK and Germany, are leading markets for airborne IFF systems. The continuous upgrade cycles for aging fighter fleets (e.g., F-16, F-15, Eurofighter Typhoon) and the ongoing development and deployment of new platforms (e.g., F-35, Tempest, FCAS) necessitate the integration of state-of-the-art IFF interrogators and transponders. Furthermore, the growing threat of sophisticated adversaries and the increasing use of stealth technology by potential adversaries amplify the importance of robust and secure identification systems for airborne platforms. The integration of IFF with AI-driven decision support systems is also a key development in the airborne segment, aiming to provide pilots with real-time, accurate situational awareness to avoid friendly fire incidents. The naval segment also presents a substantial and growing market, driven by the need for accurate identification in congested maritime environments and the modernization of naval fleets, including surface combatants and submarines. Terrestrial platforms, while important, often involve less technologically advanced or more specialized IFF requirements compared to the dynamic and high-threat aerial domain.

IFF System Industry Product Innovations

The IFF System Industry is experiencing a surge in product innovations focused on enhancing security, interoperability, and operational efficiency. Key advancements include the widespread adoption and refinement of Mode 5 IFF, offering encrypted communication and advanced cryptographic keys to prevent spoofing and ensure positive identification. Innovations in miniaturization and power efficiency are enabling the integration of IFF capabilities into a wider range of platforms, including smaller unmanned aerial vehicles (UAVs) and ground vehicles. Furthermore, the development of software-defined IFF systems allows for greater flexibility in updating cryptographic algorithms and adapting to new threat environments. Applications are expanding beyond traditional military contexts to include critical infrastructure protection and air traffic control, demanding more robust and secure identification solutions. Performance metrics are improving with reduced latency, increased range, and enhanced resistance to jamming and interference, ensuring reliable operation in complex electromagnetic environments.

Propelling Factors for IFF System Industry Growth

The IFF System Industry's growth is propelled by a confluence of strategic factors. Firstly, increasing geopolitical tensions and a heightened focus on national security worldwide are driving substantial defense procurement, with IFF systems being a fundamental component of modern military readiness. Secondly, the imperative to reduce fratricide and enhance battlefield awareness remains paramount, leading to the demand for advanced, encrypted IFF solutions like Mode 5. Thirdly, rapid technological advancements, particularly in digital signal processing, cryptography, and miniaturization, enable the development of more sophisticated, interoperable, and cost-effective IFF systems. The proliferation of unmanned systems also necessitates new IFF capabilities. Finally, stringent regulatory mandates and international interoperability standards, such as those set by NATO, are fostering widespread adoption and driving upgrades to compliant systems.

Obstacles in the IFF System Industry Market

Despite robust growth, the IFF System Industry faces several obstacles. High development and procurement costs for advanced IFF systems, particularly encrypted Mode 5 variants, can pose a significant barrier for smaller nations or those with constrained defense budgets. Cybersecurity threats and the potential for electronic warfare interference necessitate continuous investment in advanced countermeasures and system resilience, adding complexity and cost. Interoperability challenges between legacy systems and newer technologies, especially across different allied forces, can hinder seamless integration and require costly upgrades or middleware solutions. Complex regulatory approval processes and lengthy procurement cycles within government defense sectors can also slow down market adoption and innovation. Furthermore, supply chain disruptions for specialized electronic components can impact manufacturing timelines and availability.

Future Opportunities in IFF System Industry

The IFF System Industry is poised for significant future opportunities. The growing demand for IFF solutions for unmanned systems, including drones and autonomous vehicles, presents a major growth avenue as these platforms become increasingly integrated into military operations. Expansion into emerging markets in regions with developing defense capabilities offers substantial untapped potential. The advancement of AI and machine learning integration within IFF systems, enabling predictive identification and enhanced threat assessment, represents a significant technological frontier. Furthermore, the development of multi-function IFF systems that integrate identification capabilities with other sensor or communication functions can offer cost efficiencies and enhanced operational effectiveness. The ongoing modernization of global air defense networks and the need for enhanced maritime situational awareness will continue to drive demand for advanced IFF technologies.

Major Players in the IFF System Industry Ecosystem

- THALE

- General Dynamics Corporation

- RTX Corporation

- ASELSAN A S

- HENSOLDT AG

- Leonardo S p A

- BAE Systems plc

- Indra Sistemas S A

- Northrop Grumman Corporation

Key Developments in IFF System Industry Industry

- 2023/01: RTX Corporation announced a new contract for Mode 5 IFF systems for the U.S. Air Force, enhancing interoperability and security for its fleet.

- 2023/05: BAE Systems plc unveiled its latest generation IFF interrogator, offering advanced capabilities for next-generation fighter aircraft, improving threat detection and reducing false alarms.

- 2023/08: Leonardo S p A secured a significant order for its IFF systems for naval platforms, reinforcing its position in the maritime defense sector.

- 2023/11: General Dynamics Corporation demonstrated enhanced cybersecurity features for its IFF transponders, addressing growing concerns over electronic warfare threats.

- 2024/02: ASELSAN A S announced advancements in its IFF solutions for land-based military vehicles, focusing on robust identification in complex terrestrial environments.

- 2024/04: HENSOLDT AG launched a new compact IFF interrogator designed for integration into smaller unmanned aerial systems.

- 2024/06: Indra Sistemas S A secured a contract to upgrade existing IFF systems across multiple European air forces to the latest Mode 5 standards.

- 2024/09: THALE announced successful interoperability testing of its IFF system with a major allied air defense network, highlighting its commitment to NATO standards.

- 2024/12: Northrop Grumman Corporation showcased a new IFF technology incorporating artificial intelligence for improved target classification and reduced crew workload.

Strategic IFF System Industry Market Forecast

The strategic forecast for the IFF System Industry indicates continued robust growth, driven by escalating global defense spending and the paramount need for accurate battlefield identification. Future opportunities lie in the expanding integration of IFF with unmanned systems and advanced AI technologies, promising enhanced operational effectiveness and reduced fratricide. The ongoing modernization of military fleets across terrestrial, airborne, and naval platforms, coupled with strict adherence to international interoperability standards, will sustain demand for sophisticated IFF solutions. Companies that can offer innovative, secure, and adaptable IFF systems are well-positioned to capitalize on this expanding market, with projected market values to reach XXX Million by 2033.

IFF System Industry Segmentation

-

1. Platform

- 1.1. Terrestrial

- 1.2. Airborne

- 1.3. Naval

IFF System Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Egypt

- 5.4. Rest of Middle East and Africa

IFF System Industry Regional Market Share

Geographic Coverage of IFF System Industry

IFF System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Terrestrial Segment Accounted for a Major Market Share in 2023

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IFF System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Terrestrial

- 5.1.2. Airborne

- 5.1.3. Naval

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America IFF System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Terrestrial

- 6.1.2. Airborne

- 6.1.3. Naval

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. Europe IFF System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Terrestrial

- 7.1.2. Airborne

- 7.1.3. Naval

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Asia Pacific IFF System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Terrestrial

- 8.1.2. Airborne

- 8.1.3. Naval

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Latin America IFF System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Terrestrial

- 9.1.2. Airborne

- 9.1.3. Naval

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Middle East and Africa IFF System Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. Terrestrial

- 10.1.2. Airborne

- 10.1.3. Naval

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 THALE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Dynamics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 RTX Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ASELSAN A S

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HENSOLDT AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Leonardo S p A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BAE Systems plc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Indra Sistemas S A

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Northrop Grumman Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 THALE

List of Figures

- Figure 1: Global IFF System Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America IFF System Industry Revenue (Million), by Platform 2025 & 2033

- Figure 3: North America IFF System Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 4: North America IFF System Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America IFF System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe IFF System Industry Revenue (Million), by Platform 2025 & 2033

- Figure 7: Europe IFF System Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 8: Europe IFF System Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe IFF System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific IFF System Industry Revenue (Million), by Platform 2025 & 2033

- Figure 11: Asia Pacific IFF System Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Asia Pacific IFF System Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific IFF System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America IFF System Industry Revenue (Million), by Platform 2025 & 2033

- Figure 15: Latin America IFF System Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Latin America IFF System Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America IFF System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa IFF System Industry Revenue (Million), by Platform 2025 & 2033

- Figure 19: Middle East and Africa IFF System Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 20: Middle East and Africa IFF System Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa IFF System Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global IFF System Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: Global IFF System Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global IFF System Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Global IFF System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global IFF System Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Global IFF System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Russia IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global IFF System Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 15: Global IFF System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: India IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global IFF System Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 22: Global IFF System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Brazil IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Latin America IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global IFF System Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 26: Global IFF System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Arab Emirates IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Saudi Arabia IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Egypt IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Middle East and Africa IFF System Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IFF System Industry?

The projected CAGR is approximately 8.73%.

2. Which companies are prominent players in the IFF System Industry?

Key companies in the market include THALE, General Dynamics Corporation, RTX Corporation, ASELSAN A S, HENSOLDT AG, Leonardo S p A, BAE Systems plc, Indra Sistemas S A, Northrop Grumman Corporation.

3. What are the main segments of the IFF System Industry?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.96 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Terrestrial Segment Accounted for a Major Market Share in 2023.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IFF System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IFF System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IFF System Industry?

To stay informed about further developments, trends, and reports in the IFF System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence