Key Insights

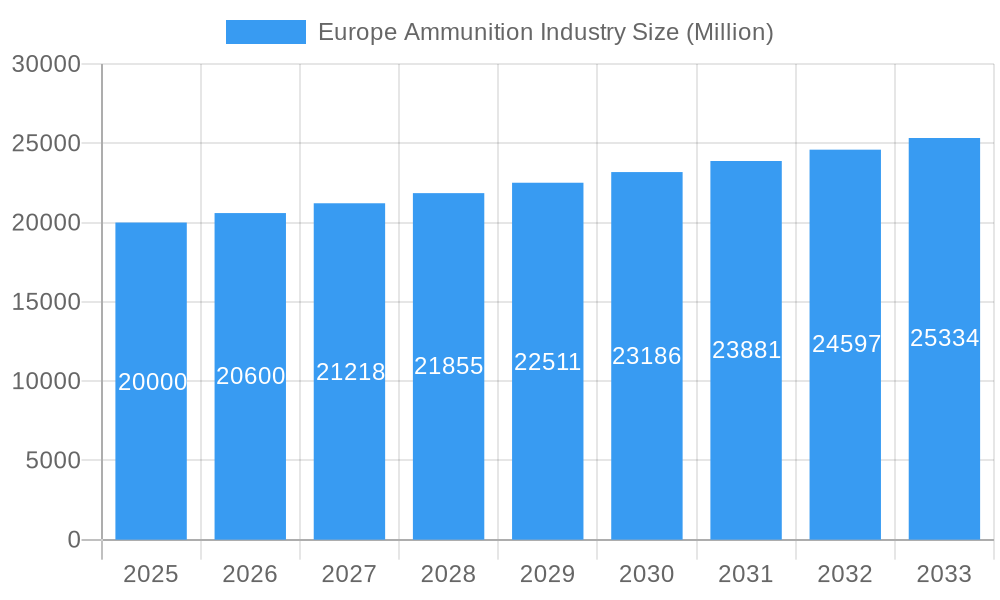

The European ammunition market is poised for significant expansion, projected to reach a substantial market size of approximately $20,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 3.00% through 2033. This growth is primarily fueled by escalating geopolitical tensions, increased defense spending across European nations, and ongoing modernization efforts within military forces. The demand for advanced and specialized ammunition is particularly pronounced, driven by the need for enhanced combat effectiveness and precision targeting. Key market drivers include heightened security concerns stemming from regional conflicts, the imperative to replenish stockpiles due to increased military exercises and deployments, and government initiatives aimed at fostering domestic defense industries and ensuring supply chain resilience. The market's trajectory is further bolstered by technological advancements in ammunition design, such as smart munitions and guided projectiles, which offer superior performance and reduced collateral damage.

Europe Ammunition Industry Market Size (In Billion)

The European ammunition landscape is characterized by a dynamic interplay of production, consumption, import, and export activities, each contributing to its overall market health. Production analysis reveals a strong emphasis on meeting domestic defense requirements while also catering to international markets. Consumption patterns are largely dictated by the operational needs of national armed forces, training exercises, and defense procurement programs. Import and export analyses highlight the intricate global trade network of ammunition, with European countries acting as both significant suppliers and consumers. Price trends are influenced by raw material costs, manufacturing complexities, and fluctuating demand-supply dynamics. Key restraints, however, include stringent regulatory frameworks governing the production and trade of ordnance, the high cost of research and development for new ammunition technologies, and the ethical considerations surrounding the use of certain types of munitions. Despite these challenges, the inherent demand for secure and effective defense capabilities ensures a sustained and positive outlook for the European ammunition market.

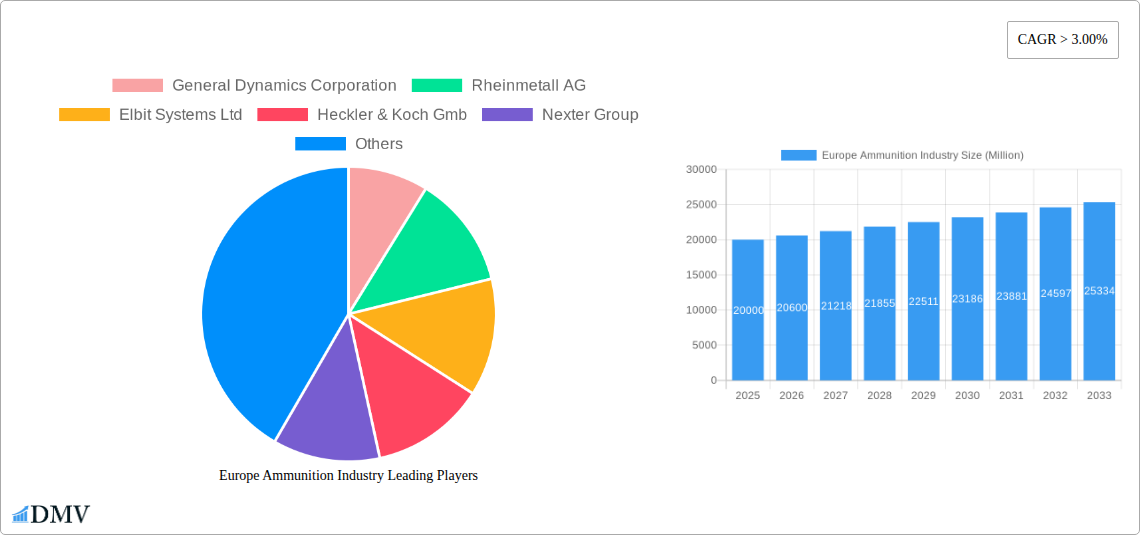

Europe Ammunition Industry Company Market Share

Europe Ammunition Industry Market Composition & Trends

The Europe Ammunition Industry is characterized by a moderately concentrated market, driven by significant geopolitical shifts and escalating defense spending. Innovation remains a crucial catalyst, with companies investing heavily in advanced projectile technologies, smart munitions, and increased lethality. The regulatory landscape is complex, influenced by national defense policies, international arms control treaties, and evolving NATO standardization efforts. Substitute products are limited in direct military applications, though advancements in electronic warfare and non-kinetic countermeasures present indirect competition. End-user profiles are predominantly governmental defense agencies and law enforcement organizations, with a growing emphasis on domestic production capabilities and supply chain resilience. Mergers and acquisitions (M&A) activity is on the rise as major players consolidate their market positions and acquire specialized technologies. For instance, recent M&A deal values within the European defense sector, including ammunition manufacturers, are estimated to be in the hundreds of millions USD, reflecting strategic consolidation. Market share distribution remains dominated by key players, though smaller, specialized firms are gaining traction in niche segments.

Europe Ammunition Industry Industry Evolution

The Europe Ammunition Industry has witnessed a transformative evolution over the Historical Period (2019–2024), driven by a confluence of geopolitical instability and technological advancements. The Study Period (2019–2033) encapsulates a significant shift, with the Base Year (2025) and Estimated Year (2025) marking a critical juncture where increased demand directly impacts production capacities. Market growth trajectories have accelerated, particularly following heightened geopolitical tensions, leading to a surge in defense budgets across European nations. This surge is projected to continue through the Forecast Period (2025–2033). Technological advancements have been pivotal, with a strong emphasis on developing intelligent munitions, enhanced range, precision-guided systems, and improved warhead effectiveness. The adoption of these advanced technologies is directly linked to an increase in the value of ammunition procured, even if unit volumes see more moderate growth. Consumer demand, primarily from national defense ministries, is increasingly focused on interoperability, sustainability, and reduced collateral damage, influencing the types of ammunition being developed and produced. For example, the shift towards more sophisticated, yet potentially lower-volume, smart munitions represents a significant change in demand patterns compared to traditional bulk procurement. This evolution underscores a continuous drive for qualitative improvement and strategic advantage in the European defense landscape.

Leading Regions, Countries, or Segments in Europe Ammunition Industry

The dominance within the Europe Ammunition Industry is clearly discernible across several key areas, with Production Analysis and Export Market Analysis (Value & Volume) showing pronounced strengths.

Production Analysis:

- Key Drivers: Significant defense spending by major European powers, established industrial infrastructure, and a robust R&D ecosystem are primary drivers of production dominance.

- Dominant Factors: Countries like Germany, France, and the United Kingdom possess a long-standing history in defense manufacturing, with leading companies investing heavily in modernized production facilities. The ongoing global demand for advanced weaponry, fueled by geopolitical concerns, ensures continuous operational tempo for these manufacturers. Production volumes are estimated to reach billions of units annually within the forecast period.

Consumption Analysis:

- Key Drivers: Geopolitical necessity, modernization programs, and NATO defense commitments are the main drivers of consumption.

- Dominant Factors: The majority of consumption originates from national defense forces of larger European countries. The increasing need to replenish stocks and modernize legacy systems are major consumption factors, with estimated annual consumption valued at tens of billions USD.

Import Market Analysis (Value & Volume):

- Key Drivers: Specialized ammunition types not readily produced domestically, urgent operational requirements, and collaborative defense initiatives.

- Dominant Factors: While Europe is a major producer, certain specialized calibers or advanced technologies might be sourced internationally. The import market is projected to be in the hundreds of millions USD annually, with volume varying based on specific product needs.

Export Market Analysis (Value & Volume):

- Key Drivers: Advanced technological capabilities, competitive pricing, and established international relationships.

- Dominant Factors: European manufacturers are major global exporters of ammunition. Their reputation for quality and innovation allows them to secure significant international contracts. The export market is expected to be a substantial contributor, valued at billions of USD annually, with high-volume sales of standard calibers and specialized munitions.

Price Trend Analysis:

- Key Drivers: Raw material costs, inflation, technological complexity, and demand-supply dynamics.

- Dominant Factors: Price trends are generally upward, driven by increasing raw material costs and the rising complexity of advanced ammunition. Inflationary pressures and the sustained high demand, particularly for certain calibers, contribute to price appreciation, with annual price increases estimated in the low-to-mid single-digit percentages.

Europe Ammunition Industry Product Innovations

The Europe Ammunition Industry is witnessing a surge in product innovations focused on enhancing lethality, precision, and operational effectiveness. Key advancements include the development of smart munitions capable of real-time target acquisition and guidance, significantly improving accuracy and reducing collateral damage. Innovations also extend to novel propellants and explosives offering increased range and reduced smoke signature. Performance metrics are seeing considerable improvements, with accuracy rates exceeding 99% for guided munitions and extended effective ranges for various calibers. Unique selling propositions revolve around enhanced situational awareness for the operator, greater interoperability across different platforms, and the development of environmentally friendlier or less toxic ammunition variants. These technological leaps are crucial for maintaining a competitive edge in the global defense market.

Propelling Factors for Europe Ammunition Industry Growth

Several key factors are propelling the growth of the Europe Ammunition Industry. Geopolitical tensions and the subsequent increase in defense spending across European nations, particularly in light of recent global conflicts, are paramount. This has led to significant investment in military modernization programs and a renewed focus on national security, directly boosting demand for ammunition. Technological advancements are another major driver, with continuous innovation in smart munitions, precision-guided systems, and advanced materials enabling the development of higher-value and more effective products. Furthermore, a strong emphasis on domestic defense industrial bases and supply chain resilience is encouraging governments to support local manufacturers, leading to increased production and R&D investment. For instance, government contracts for modernizing artillery and small arms ammunition are in the hundreds of millions USD range.

Obstacles in the Europe Ammunition Industry Market

Despite robust growth, the Europe Ammunition Industry faces significant obstacles. Stringent regulatory frameworks surrounding the production, sale, and export of defense materials can create complex compliance challenges. Supply chain disruptions, exacerbated by global events and reliance on critical raw materials, pose a constant threat to timely production and delivery, potentially impacting order fulfillment. Competitive pressures, both from established global players and emerging specialized manufacturers, necessitate continuous innovation and cost-efficiency. Furthermore, the fluctuating geopolitical landscape can lead to unpredictable demand shifts. The high cost of research and development for advanced ammunition can also be a barrier, especially for smaller companies, with R&D expenditures often reaching tens of millions USD for new product lines.

Future Opportunities in Europe Ammunition Industry

The Europe Ammunition Industry is poised for significant future opportunities. The ongoing military modernization efforts across NATO and allied nations present a substantial and sustained demand for advanced ammunition. The increasing adoption of modular and multi-role ammunition systems opens new market segments, offering greater versatility. Emerging technologies such as directed energy weapons and counter-drone capabilities, while not direct ammunition replacements, are driving innovation in defensive ammunition and counter-ammunition systems. Furthermore, the global demand for reliable and high-quality ammunition, particularly from regions undergoing defense upgrades, presents a considerable export market potential, estimated to grow by 5-10% annually. The focus on sustainable and environmentally conscious ammunition production also offers a niche for forward-thinking manufacturers.

Major Players in the Europe Ammunition Industry Ecosystem

- General Dynamics Corporation

- Rheinmetall AG

- Elbit Systems Ltd

- Heckler & Koch Gmb

- Nexter Group

- Nammo AS

- Denel PMP

- BAE Systems plc

- ROSTEC

- Saab AB

Key Developments in Europe Ammunition Industry Industry

- December 2022: A European NATO customer entered into a contract with Rheinmetall to supply a maximum of 300,000 rounds of 40mm ammunition, consisting of LV (low velocity) and HV (high velocity) variants. The contract includes a first call-off of approximately 75,000 cartridges, significantly boosting Rheinmetall's 40mm ammunition order book.

- January 2022: The German Bundeswehr signed a contract with Rheinmetall AG to modernize its mortar systems and provide 120mm mortar ammunition. The contract is worth approximately EUR 27 million (USD 30 million) and will be completed by 2023, showcasing a focus on modernizing indirect fire capabilities and securing essential mortar ammunition supplies.

Strategic Europe Ammunition Industry Market Forecast

The strategic outlook for the Europe Ammunition Industry is exceptionally positive, driven by sustained geopolitical imperatives and continuous technological innovation. The Forecast Period (2025–2033) is expected to witness robust growth, fueled by ongoing defense spending and the critical need for nations to bolster their strategic reserves and modernize their arsenals. The increasing demand for advanced, precision-guided munitions, coupled with a growing emphasis on interoperability and modularity, will shape market dynamics. Opportunities lie in catering to these evolving military requirements, with a particular focus on smart ammunition and advanced materials. The market is projected to expand considerably, with annual growth rates expected to remain strong, driven by both domestic European needs and significant export potential, leading to market expansion in the tens of billions USD range.

Europe Ammunition Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

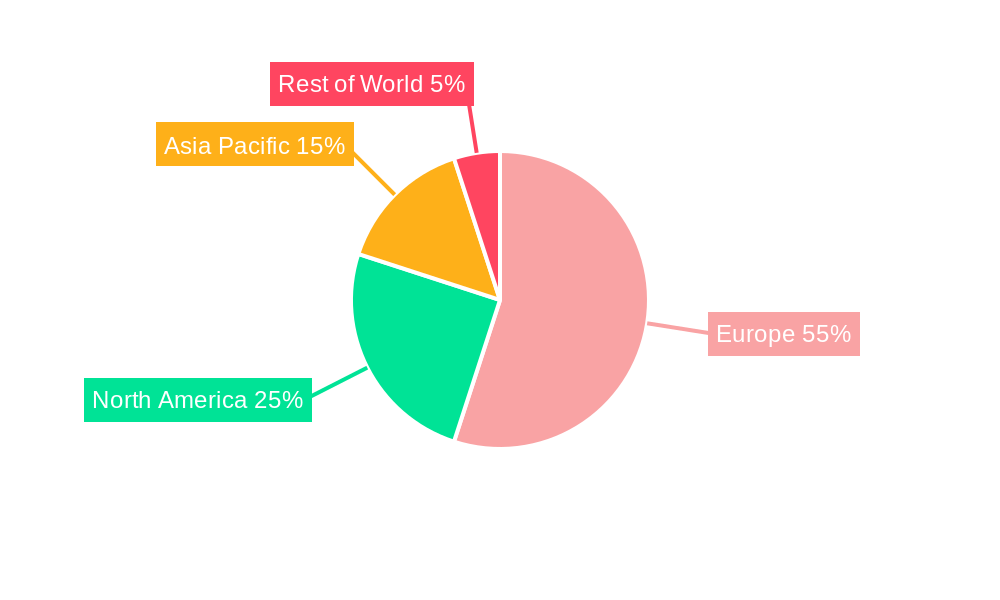

Europe Ammunition Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Ammunition Industry Regional Market Share

Geographic Coverage of Europe Ammunition Industry

Europe Ammunition Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Military to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 General Dynamics Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rheinmetall AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Elbit Systems Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Heckler & Koch Gmb

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nexter Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nammo AS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Denel PMP

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BAE Systems plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ROSTEC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Saab AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 General Dynamics Corporation

List of Figures

- Figure 1: Europe Ammunition Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Ammunition Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Ammunition Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Ammunition Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Ammunition Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Ammunition Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Ammunition Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Ammunition Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Europe Ammunition Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Ammunition Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Ammunition Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Ammunition Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Ammunition Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Ammunition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Ammunition Industry?

The projected CAGR is approximately 8.64%.

2. Which companies are prominent players in the Europe Ammunition Industry?

Key companies in the market include General Dynamics Corporation, Rheinmetall AG, Elbit Systems Ltd, Heckler & Koch Gmb, Nexter Group, Nammo AS, Denel PMP, BAE Systems plc, ROSTEC, Saab AB.

3. What are the main segments of the Europe Ammunition Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Military to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

December 2022: A European NATO customer entered into a contract with Rheinmetall to supply a maximum of 300,000 rounds of 40mm ammunition, consisting of LV (low velocity) and HV (high velocity) variants. The contract includes a first call-off of approximately 75,000 cartridges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Ammunition Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Ammunition Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Ammunition Industry?

To stay informed about further developments, trends, and reports in the Europe Ammunition Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence