Key Insights

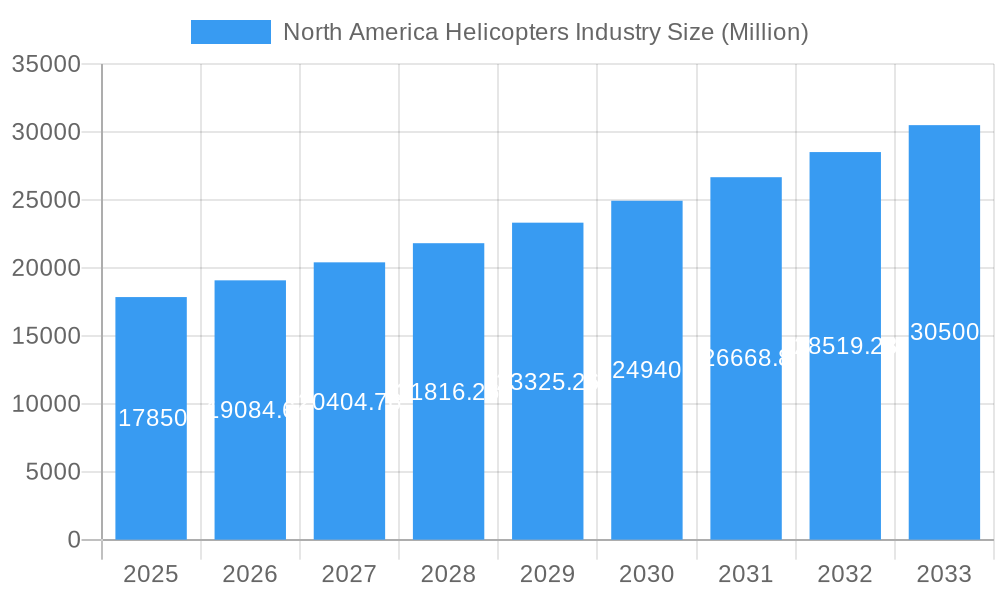

The North American helicopter market, valued at $17.85 billion in 2025, is projected to experience robust growth, driven by increasing demand from both commercial and military sectors. The commercial segment is fueled by expanding air ambulance services, offshore oil and gas operations, and rising tourism, particularly in regions with challenging terrain. The military segment benefits from ongoing investments in defense modernization and national security initiatives, requiring advanced helicopter platforms for various missions including search and rescue, troop transport, and surveillance. Technological advancements, such as the integration of advanced avionics, improved safety features, and the development of more fuel-efficient engines, are further stimulating market expansion. However, factors such as high acquisition and maintenance costs, stringent regulatory compliance requirements, and potential supply chain disruptions pose challenges to the market's growth trajectory. The market is segmented by end-user (commercial and military) and engine type (piston and turbine), with the turbine engine segment dominating due to its superior power and performance characteristics. Key players like Textron, Lockheed Martin, Airbus, and Boeing are driving innovation and competition within the market, shaping future growth and technological advancements. The forecast period of 2025-2033 is expected to witness considerable expansion, propelled by the factors previously mentioned.

North America Helicopters Industry Market Size (In Billion)

The North American market, representing a significant portion of the global helicopter industry, benefits from a robust aerospace ecosystem, skilled workforce, and substantial government investment. The United States, in particular, plays a dominant role due to its large defense budget and significant commercial aviation activities. Canada and Mexico also contribute to the market, although on a smaller scale. Future growth will depend on sustained economic growth, continued government spending on defense, and the successful adoption of new technologies. Careful management of operational costs and adaptation to evolving regulatory landscapes will be critical for market participants to maintain competitiveness and maximize opportunities in this dynamic sector. The competitive landscape is characterized by established industry giants and emerging players, all vying for market share through technological innovation, strategic partnerships, and aggressive expansion strategies. Long-term growth is anticipated to remain positive, driven by the enduring demand for versatile and reliable aerial platforms across various applications.

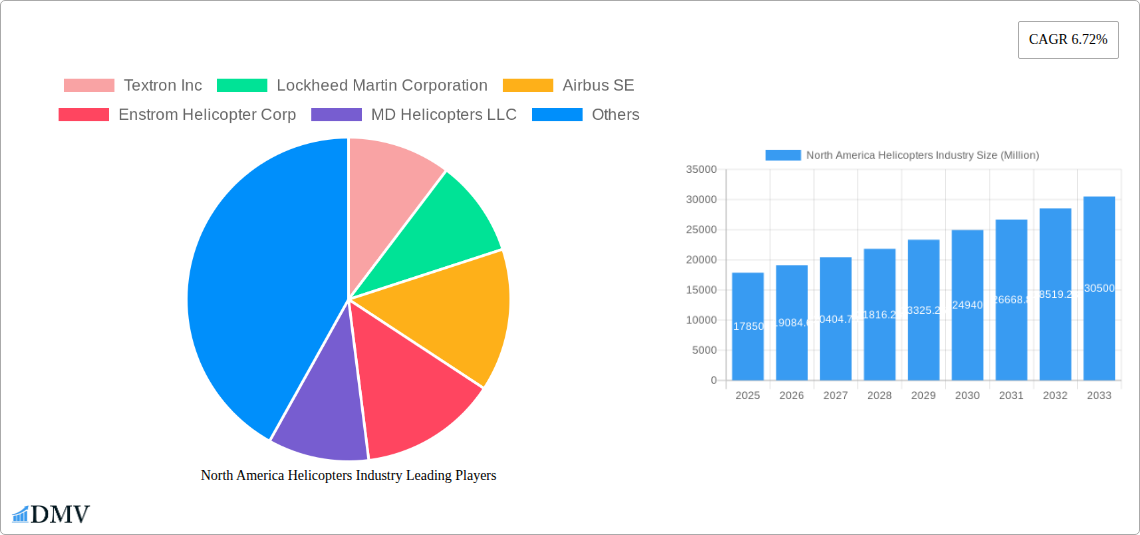

North America Helicopters Industry Company Market Share

North America Helicopters Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America helicopters industry, offering crucial insights for stakeholders seeking to navigate this dynamic market. Spanning the period from 2019 to 2033 (Study Period), with a focus on 2025 (Base Year and Estimated Year) and a forecast extending to 2033 (Forecast Period), this report covers the historical period of 2019-2024. Key players such as Textron Inc, Lockheed Martin Corporation, Airbus SE, and Boeing are analyzed, along with market segments encompassing Commercial and Military end-users and Piston and Turbine engines.

North America Helicopters Industry Market Composition & Trends

The North American helicopters market exhibits a moderately concentrated landscape, with a few major players commanding significant market share. Textron Inc., Airbus SE, and Boeing collectively hold an estimated 60% market share in 2025, while smaller players like Robinson Helicopter Company and MD Helicopters LLC compete for the remaining share. Market concentration is expected to remain relatively stable throughout the forecast period, although potential M&A activity could alter the competitive dynamics. Innovation is driven by advancements in engine technology, particularly the integration of more fuel-efficient turbine engines, and the development of advanced flight control systems enhancing safety and efficiency. Regulatory compliance, especially concerning airworthiness and safety standards imposed by the FAA, significantly shapes the industry. Substitute products, such as fixed-wing aircraft for certain commercial applications, present a limited challenge. The end-user landscape is dominated by the commercial sector (approximately 65% in 2025), driven by applications in emergency medical services (EMS), law enforcement, and offshore operations. The military segment remains a significant customer, particularly for specialized military helicopters. M&A activity in the last five years has seen deal values averaging $xx Million, with a focus on consolidating smaller players into larger entities.

- Market Share Distribution (2025): Textron Inc. (25%), Airbus SE (20%), Boeing (15%), Others (40%)

- Average M&A Deal Value (2019-2024): $xx Million

North America Helicopters Industry Evolution

The North American helicopters industry has experienced fluctuating growth in recent years, impacted by economic cycles and technological advancements. The historical period (2019-2024) saw an average annual growth rate (AAGR) of approximately 3%, with periods of stronger growth counterbalanced by downturns. The market is projected to exhibit a more robust CAGR of 4% during the forecast period (2025-2033), driven by increasing demand from the commercial sector and continued investment in military capabilities. Technological advancements, such as the adoption of fly-by-wire systems and improved rotor designs, are enhancing helicopter performance, safety, and efficiency. This is further amplified by the integration of advanced avionics and communication systems, improving situational awareness and operational effectiveness. Consumer demand is shifting towards more versatile, fuel-efficient, and technologically sophisticated helicopters for diverse applications, from EMS to tourism. Adoption of new technologies is driven by the need to increase payload capacity, range, and operational safety. Market growth is influenced by factors such as government spending on defense, infrastructure development, and growth in the energy and tourism sectors.

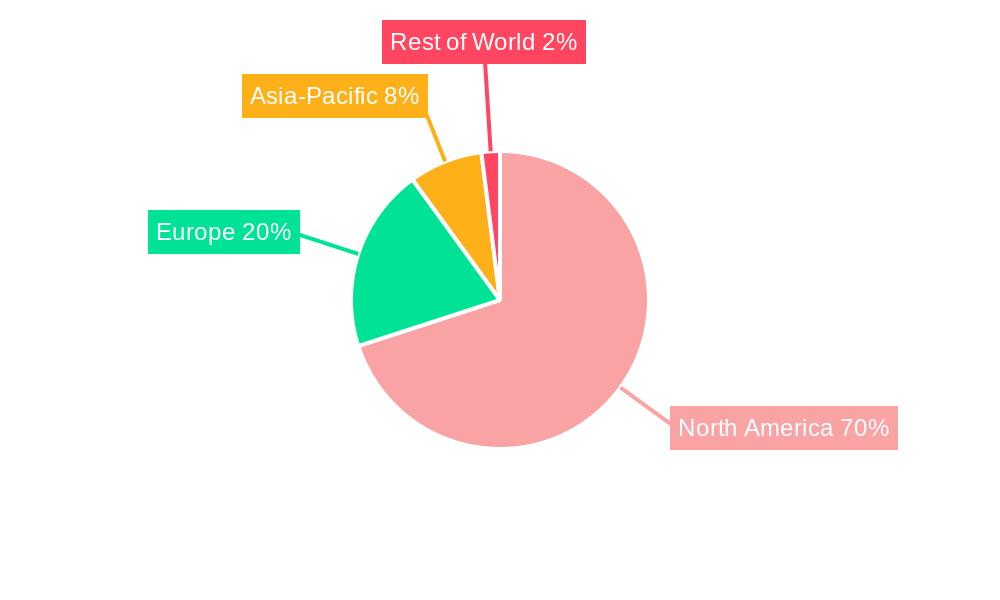

Leading Regions, Countries, or Segments in North America Helicopters Industry

The southwestern United States and regions with significant oil and gas activity emerge as dominant regions, driven by high demand for commercial helicopters in support of offshore operations, search and rescue operations, and EMS. The military sector displays significant presence in areas with large military bases, impacting helicopter demand.

Key Drivers (Commercial Segment):

- High demand for EMS and law enforcement applications.

- Growth in offshore oil and gas operations.

- Expanding tourism and private aviation sectors.

Key Drivers (Military Segment):

- Government spending on defense and national security.

- Modernization of military fleets.

- Development of specialized military helicopters.

Key Drivers (Turbine Engine Segment):

- Superior performance and efficiency compared to piston engines.

- Increased adoption in high-performance helicopters.

- Technological advancements resulting in reduced fuel consumption and emissions.

The turbine engine segment dominates, reflecting the demand for higher performance and efficiency in various applications. The commercial segment shows the highest growth potential due to factors like population growth, economic development, and the ongoing need for efficient transportation and service delivery.

North America Helicopters Industry Product Innovations

Recent innovations encompass the development of lighter, yet more robust composite materials that reduce weight and enhance performance. Advanced avionics integration improves situational awareness and safety, while enhanced engine designs contribute to better fuel efficiency. These innovations directly translate into increased payload capacity, longer flight ranges, and reduced operating costs, boosting the market's appeal across sectors. Unique selling propositions often revolve around improved safety features, cost-effectiveness, and operational flexibility.

Propelling Factors for North America Helicopters Industry Growth

Technological advancements, particularly in engine technology and materials science, significantly propel industry growth. Economic growth in various sectors, such as tourism and energy, drives demand for commercial helicopters. Favorable government policies and increased military spending contribute to market expansion. Specific examples include investment in advanced air mobility (AAM) initiatives and the continued modernization of military helicopter fleets.

Obstacles in the North America Helicopters Industry Market

High manufacturing and operational costs present a significant challenge. Supply chain disruptions, particularly regarding critical components, can impact production and increase costs. Intense competition among established players and the emergence of new technologies can create considerable pressure on profit margins. Stringent regulatory requirements regarding safety and maintenance also impose added costs. These challenges contribute to a complex operational environment.

Future Opportunities in North America Helicopters Industry

The burgeoning AAM market and increased demand for urban air mobility solutions offer promising prospects. Technological advancements in autonomous flight and electric propulsion open new avenues for innovation and growth. Expansion into emerging markets and applications, such as cargo delivery and aerial surveillance, presents significant opportunities.

Major Players in the North America Helicopters Industry Ecosystem

- Textron Inc

- Lockheed Martin Corporation

- Airbus SE

- Enstrom Helicopter Corp

- MD Helicopters LLC

- Kopter Group

- Robinson Helicopter Company

- Leonardo S p A

- The Boeing Company

Key Developments in North America Helicopters Industry Industry

- 2023-Q3: Airbus SE announced a new variant of its H145 helicopter with enhanced capabilities.

- 2022-Q4: Textron Inc. secured a significant contract for supplying helicopters to a government agency.

- 2021-Q2: MD Helicopters LLC unveiled a new prototype featuring advanced avionics technology.

Strategic North America Helicopters Industry Market Forecast

The North American helicopter industry is poised for continued growth, driven by technological innovation and increased demand across various sectors. Emerging opportunities in the AAM market and the expanding use of helicopters in diverse applications will shape the future. Technological advancements and increased efficiency will make helicopters more accessible and cost-effective, thus boosting market expansion in the coming years.

North America Helicopters Industry Segmentation

-

1. Engine

- 1.1. Piston

- 1.2. Turbine

-

2. End-user

- 2.1. Commercial

- 2.2. Military

-

3. Geography

- 3.1. United States

- 3.2. Canada

North America Helicopters Industry Segmentation By Geography

- 1. United States

- 2. Canada

North America Helicopters Industry Regional Market Share

Geographic Coverage of North America Helicopters Industry

North America Helicopters Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Military End-user Segment to Dominate the Market in Terms of Revenue

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Helicopters Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Engine

- 5.1.1. Piston

- 5.1.2. Turbine

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Commercial

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Engine

- 6. United States North America Helicopters Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Engine

- 6.1.1. Piston

- 6.1.2. Turbine

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Commercial

- 6.2.2. Military

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Engine

- 7. Canada North America Helicopters Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Engine

- 7.1.1. Piston

- 7.1.2. Turbine

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Commercial

- 7.2.2. Military

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Engine

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Textron Inc

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Lockheed Martin Corporation

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Airbus SE

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Enstrom Helicopter Corp

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 MD Helicopters LLC

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Kopter Group

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Robinson Helicopter Compan

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Leonardo S p A

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 The Boeing Company

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.1 Textron Inc

List of Figures

- Figure 1: North America Helicopters Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Helicopters Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Helicopters Industry Revenue Million Forecast, by Engine 2020 & 2033

- Table 2: North America Helicopters Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 3: North America Helicopters Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Helicopters Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Helicopters Industry Revenue Million Forecast, by Engine 2020 & 2033

- Table 6: North America Helicopters Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 7: North America Helicopters Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Helicopters Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Helicopters Industry Revenue Million Forecast, by Engine 2020 & 2033

- Table 10: North America Helicopters Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 11: North America Helicopters Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Helicopters Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Helicopters Industry?

The projected CAGR is approximately 6.72%.

2. Which companies are prominent players in the North America Helicopters Industry?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, Enstrom Helicopter Corp, MD Helicopters LLC, Kopter Group, Robinson Helicopter Compan, Leonardo S p A, The Boeing Company.

3. What are the main segments of the North America Helicopters Industry?

The market segments include Engine, End-user, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.85 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Military End-user Segment to Dominate the Market in Terms of Revenue.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Helicopters Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Helicopters Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Helicopters Industry?

To stay informed about further developments, trends, and reports in the North America Helicopters Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence