Key Insights

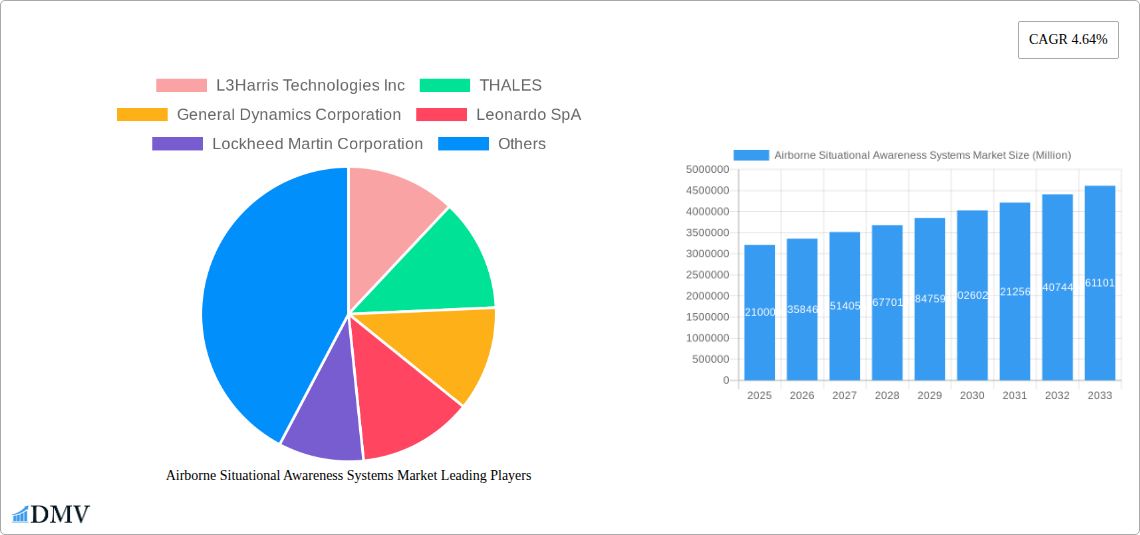

The global Airborne Situational Awareness Systems Market is projected for robust growth, currently valued at USD 3.21 million and poised to expand at a Compound Annual Growth Rate (CAGR) of 4.64% through 2033. This sustained expansion is fueled by escalating geopolitical tensions and a growing emphasis on enhancing military and civilian aviation safety and operational effectiveness. Key drivers include the increasing demand for advanced sensor technologies, sophisticated radar systems, and integrated optronics to provide comprehensive real-time battlefield and airspace intelligence. The evolution towards networked warfare and the integration of artificial intelligence and machine learning in data processing are further accelerating market adoption. Moreover, ongoing investments in modernizing aging aircraft fleets and the development of next-generation aerial platforms with enhanced surveillance capabilities are significant contributors to this upward trajectory.

Airborne Situational Awareness Systems Market Market Size (In Million)

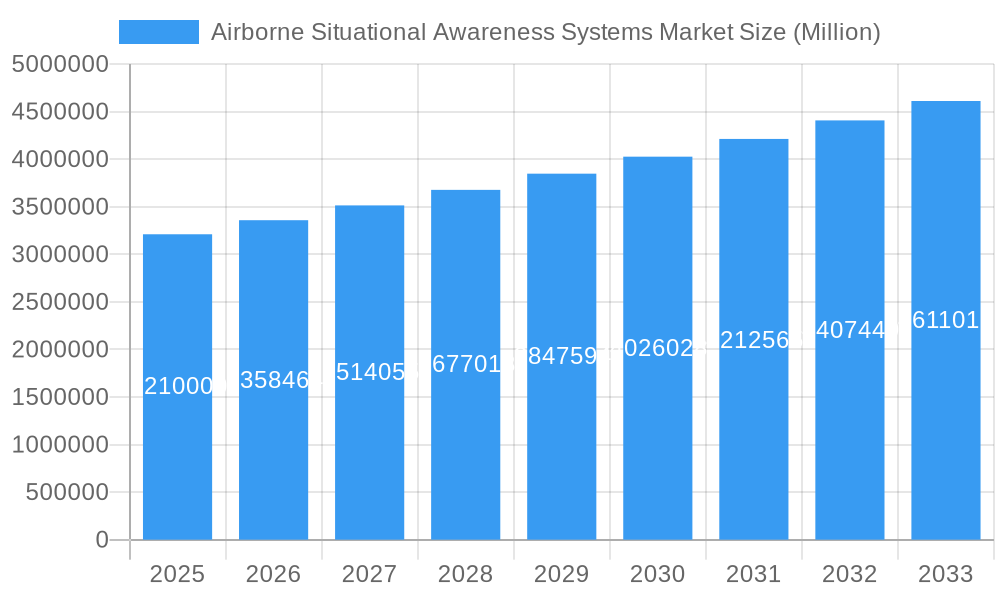

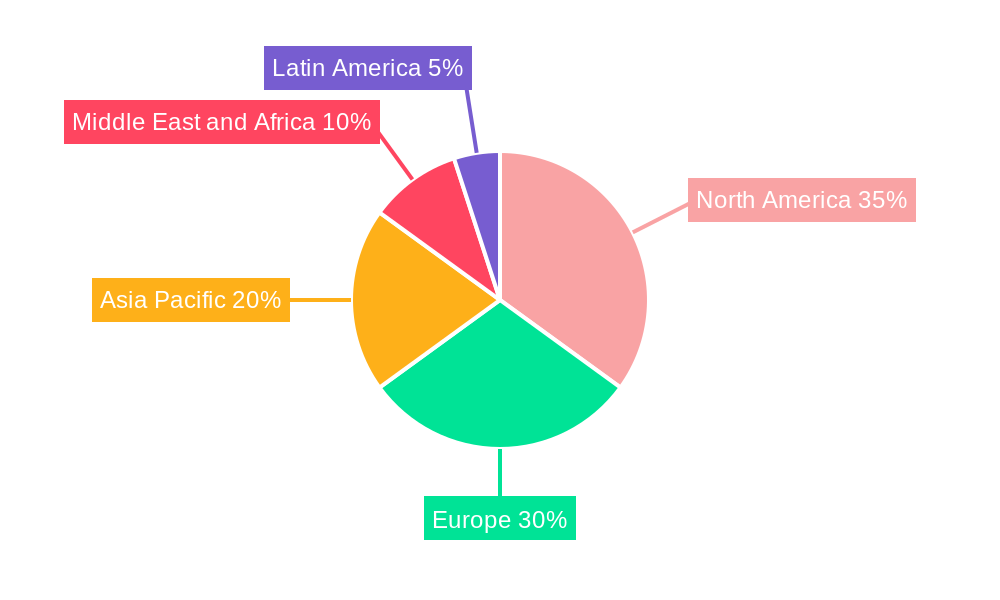

The market is segmented across components such as sensors, displays and notification systems, and other critical components. In terms of type, Command and Control, RADARs, Optronics, and Other Types represent distinct segments, each contributing to the overall intelligence gathering and dissemination capabilities. North America and Europe currently dominate the market, driven by significant defense spending and the presence of major industry players. However, the Asia Pacific region, particularly China and India, is exhibiting substantial growth potential due to rapid military modernization and increasing air traffic. Restraints, such as the high cost of sophisticated systems and stringent regulatory frameworks, are being addressed through technological advancements and strategic partnerships aimed at cost optimization and streamlined deployment. The competitive landscape features prominent global players like L3Harris Technologies Inc., THALES, General Dynamics Corporation, and Lockheed Martin Corporation, actively engaged in research and development to offer cutting-edge solutions.

Airborne Situational Awareness Systems Market Company Market Share

This report delves into the dynamic Airborne Situational Awareness Systems Market, a critical sector driven by advancements in defense, aviation safety, and surveillance technologies. The study, spanning 2019–2033, with a Base Year and Estimated Year of 2025, and a Forecast Period of 2025–2033, meticulously analyzes historical trends from 2019–2024. Gain unparalleled insights into market dynamics, technological innovations, and strategic growth opportunities within this rapidly evolving landscape. Discover the key players, their market strategies, and the future trajectory of airborne intelligence, surveillance, and reconnaissance (ISR) capabilities.

Airborne Situational Awareness Systems Market Market Composition & Trends

The Airborne Situational Awareness Systems Market exhibits a moderate to high degree of market concentration, with major defense contractors and specialized technology providers dominating the landscape. Innovation is primarily driven by the relentless pursuit of enhanced sensor fusion, artificial intelligence (AI) integration for real-time data processing, and miniaturization of advanced avionics. The regulatory landscape is characterized by stringent defense procurement policies and evolving air traffic management regulations, influencing system development and deployment. Substitute products, while limited in direct competition with comprehensive airborne solutions, exist in the form of ground-based surveillance and advanced drone capabilities, pushing for greater efficiency and cost-effectiveness in airborne platforms. End-user profiles are predominantly military organizations, followed by homeland security agencies, and increasingly, commercial aviation and critical infrastructure monitoring entities. Mergers and acquisitions (M&A) activity is a significant catalyst for market consolidation and technological integration. Key M&A deals in recent years have involved acquisitions valued in the hundreds of Millions, aimed at bolstering portfolios in areas like advanced sensor technology and AI-driven analytics.

- Market Share Distribution: Top 5 players are estimated to hold approximately 55-65% of the market share in the Airborne Situational Awareness Systems Market.

- M&A Deal Values: Significant M&A transactions have exceeded $500 Million in value, focusing on acquiring specialized sensor and AI capabilities.

- Innovation Catalysts: AI/ML integration, sensor fusion technologies, and reduced SWaP-C (Size, Weight, Power, and Cost) are primary drivers.

Airborne Situational Awareness Systems Market Industry Evolution

The Airborne Situational Awareness Systems Market has witnessed a profound evolution driven by escalating geopolitical tensions, the growing demand for enhanced ISR capabilities, and the accelerating pace of technological innovation. Over the study period, the market has transitioned from rudimentary radar and electro-optical systems to highly integrated, multi-sensor platforms capable of providing unparalleled real-time battlefield awareness and air traffic management. The historical period (2019–2024) saw significant investments in modernizing existing fleets with advanced sensor suites and communication systems, driven by a need for superior threat detection and decision-making speed. Technological advancements in areas such as AI-powered data analysis, synthetic aperture radar (SAR), and passive sensing technologies have fundamentally reshaped the capabilities of airborne platforms. For instance, the adoption of AI for automatic target recognition (ATR) has dramatically reduced operator workload and improved the accuracy of threat identification, contributing to a growth rate in AI integration estimated at 18-22% annually.

The forecast period (2025–2033) is poised for continued robust growth, fueled by the increasing deployment of unmanned aerial vehicles (UAVs) requiring sophisticated situational awareness, the modernization of legacy aircraft with next-generation avionics, and the expanding applications of airborne intelligence beyond traditional military theaters, including disaster response and environmental monitoring. The demand for multi-spectral sensors, hypersonic missile detection capabilities, and advanced electronic warfare (EW) integration is expected to be a major growth catalyst. Furthermore, the development of resilient communication networks and secure data links is paramount, ensuring the integrity and timely dissemination of critical situational awareness data. Consumer demand for enhanced safety and efficiency in air traffic management also presents a substantial growth avenue, encouraging the development of civilian-grade airborne situational awareness solutions. Overall, the industry is characterized by a compound annual growth rate (CAGR) projected to be between 7.5% and 9.0% during the forecast period, reflecting the indispensable role of airborne situational awareness in a complex and interconnected world. The base year 2025 is anticipated to see market revenues in the range of $15,000 Million, with projected growth to over $28,000 Million by 2033.

Leading Regions, Countries, or Segments in Airborne Situational Awareness Systems Market

The Airborne Situational Awareness Systems Market is significantly influenced by regional geopolitical dynamics and the technological prowess of specific countries. North America, led by the United States, currently dominates the market. This dominance is attributed to substantial defense spending, a robust aerospace and defense industry ecosystem, and continuous investment in cutting-edge technologies like advanced sensors and AI-driven platforms. The U.S. Air Force, Army, and Navy are major procurers of airborne situational awareness systems for various missions, including air superiority, intelligence gathering, and battlefield management.

- North America (Dominant Region):

- Key Drivers: High defense budgets, aggressive modernization programs, and strong R&D capabilities in AI and sensor technology.

- Market Size: Estimated to contribute over 40% of the global market revenue in 2025, projected to reach over $12,000 Million by 2033.

- Investment Trends: Significant investments in next-generation fighter jets, surveillance aircraft, and unmanned aerial systems (UAS) platforms, all requiring advanced situational awareness.

- Regulatory Support: Favorable government policies and defense procurement frameworks supporting domestic R&D and manufacturing.

Within the Component segment, Sensors represent the largest and most rapidly growing sub-segment. This is directly linked to the increasing sophistication of airborne ISR platforms that rely on a diverse array of sensors, including radar, electro-optical/infrared (EO/IR), electronic support measures (ESM), and SIGINT (Signals Intelligence) systems. The advancement in sensor fusion algorithms, allowing for the seamless integration of data from multiple sensor types, further amplifies the demand for advanced sensing technologies.

- Component: Sensors (Dominant Segment):

- Growth Drivers: Demand for multi-spectral, high-resolution, and miniaturized sensors; advancements in radar technology (e.g., AESA, SAR); and increased use of passive sensing.

- Market Share: Expected to account for approximately 55-60% of the total component market value in 2025.

In terms of Type, RADARs historically hold a significant share due to their all-weather capabilities and effectiveness in detection and tracking. However, the Command and Control segment is experiencing remarkable growth, driven by the need for integrated decision-making platforms that leverage the vast amounts of data generated by airborne sensors. The convergence of sensor data and AI-powered analytics within command and control systems is revolutionizing airborne operations.

- Type: Command and Control (High Growth Segment):

- Growth Drivers: Integration of AI for data processing and decision support; increasing complexity of modern warfare; and demand for networked battle management systems.

- Market Trajectory: Projected to exhibit a CAGR of 8-10% during the forecast period.

Airborne Situational Awareness Systems Market Product Innovations

The Airborne Situational Awareness Systems Market is characterized by continuous product innovation aimed at enhancing platform performance and operational effectiveness. Key advancements include the integration of artificial intelligence (AI) and machine learning (ML) algorithms for real-time threat detection and data fusion, significantly reducing operator workload and improving decision-making speed. Miniaturized and lightweight sensor modules, such as advanced EO/IR and SIGINT payloads, are enabling their deployment on a wider range of airborne platforms, including smaller tactical aircraft and drones. Furthermore, the development of resilient communication systems ensures secure and reliable data transmission in contested environments. These innovations are driving a paradigm shift towards proactive intelligence gathering and enhanced operational agility, with performance metrics seeing improvements in detection range by up to 25% and data processing times reduced by 40%.

Propelling Factors for Airborne Situational Awareness Systems Market Growth

The growth of the Airborne Situational Awareness Systems Market is propelled by several critical factors. Heightened global security concerns and the proliferation of advanced threats necessitate enhanced intelligence, surveillance, and reconnaissance (ISR) capabilities for military and homeland security applications. Technological advancements, particularly in artificial intelligence, sensor fusion, and miniaturization, are enabling more sophisticated and cost-effective airborne solutions. Furthermore, the increasing adoption of unmanned aerial systems (UAS) for diverse missions, from reconnaissance to combat support, is creating a significant demand for integrated situational awareness systems. Government investments in defense modernization programs worldwide, coupled with evolving air traffic management regulations promoting enhanced safety, are also key growth drivers.

Obstacles in the Airborne Situational Awareness Systems Market Market

Despite the robust growth trajectory, the Airborne Situational Awareness Systems Market faces several obstacles. Stringent regulatory approval processes and lengthy procurement cycles for defense systems can impede market penetration and product adoption. High development and integration costs associated with advanced technologies can also pose a challenge, particularly for smaller defense contractors and emerging markets. Supply chain disruptions, exacerbated by global geopolitical events and component shortages, can impact production timelines and costs. Furthermore, the cybersecurity landscape presents a constant threat, requiring robust measures to protect sensitive data and critical infrastructure from cyberattacks.

Future Opportunities in Airborne Situational Awareness Systems Market

Emerging opportunities in the Airborne Situational Awareness Systems Market are abundant. The growing demand for integrated ISR solutions for next-generation fighter jets and unmanned combat aerial vehicles (UCAVs) presents a significant growth avenue. Expansion into commercial aviation, particularly for enhanced air traffic management and airborne surveillance for critical infrastructure monitoring, offers new market segments. The increasing focus on multi-domain operations and the need for seamless integration of airborne, ground, and maritime data present opportunities for advanced command and control systems. Furthermore, advancements in AI-powered predictive analytics for threat assessment and mission planning are poised to unlock new levels of operational efficiency.

Major Players in the Airborne Situational Awareness Systems Market Ecosystem

- L3Harris Technologies Inc

- THALES

- General Dynamics Corporation

- Leonardo SpA

- Lockheed Martin Corporation

- Elbit Systems Ltd

- Rafael Advanced Defense Systems Ltd

- BAE Systems PLC

- HENSOLDT AG

- RTX Corporation

- Northrop Grumman Corporation

- Saab AB

- Teledyne FLIR LLC

Key Developments in Airborne Situational Awareness Systems Market Industry

- 2023 October: RTX Corporation announced the successful testing of its new airborne radar system, enhancing target detection capabilities by 15%.

- 2023 September: L3Harris Technologies Inc secured a significant contract for advanced sensor integration on new military aircraft, valued at approximately $300 Million.

- 2023 June: THALES unveiled its next-generation airborne surveillance suite, incorporating AI for improved real-time data analysis.

- 2022 December: Lockheed Martin Corporation announced a strategic partnership with a leading AI firm to accelerate the development of intelligent airborne situational awareness systems.

- 2022 October: Elbit Systems Ltd delivered a sophisticated airborne electronic warfare suite, enhancing threat detection and electronic countermeasures.

- 2022 July: Leonardo SpA expanded its portfolio of airborne surveillance sensors with the launch of a new compact, high-resolution EO/IR system.

Strategic Airborne Situational Awareness Systems Market Market Forecast

The strategic forecast for the Airborne Situational Awareness Systems Market indicates sustained and significant growth. The market will be driven by the escalating need for enhanced national security, coupled with continuous technological innovation in sensor fusion, AI, and data analytics. Future opportunities lie in the integration of these systems into unmanned platforms and the expansion of their application in civilian sectors like air traffic management and infrastructure monitoring. Strategic investments in R&D and partnerships will be crucial for key players to maintain their competitive edge and capitalize on the evolving demands for superior airborne intelligence, surveillance, and reconnaissance capabilities, projecting a robust CAGR over the forecast period.

Airborne Situational Awareness Systems Market Segmentation

-

1. Component

- 1.1. Sensors

- 1.2. Displays and Notification Systems

- 1.3. Other Components

-

2. Type

- 2.1. Command and Control

- 2.2. RADARs

- 2.3. Optronics

- 2.4. Other Types

Airborne Situational Awareness Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Airborne Situational Awareness Systems Market Regional Market Share

Geographic Coverage of Airborne Situational Awareness Systems Market

Airborne Situational Awareness Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Sensor Segment is Expected to Grow with Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Sensors

- 5.1.2. Displays and Notification Systems

- 5.1.3. Other Components

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Command and Control

- 5.2.2. RADARs

- 5.2.3. Optronics

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Sensors

- 6.1.2. Displays and Notification Systems

- 6.1.3. Other Components

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Command and Control

- 6.2.2. RADARs

- 6.2.3. Optronics

- 6.2.4. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Sensors

- 7.1.2. Displays and Notification Systems

- 7.1.3. Other Components

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Command and Control

- 7.2.2. RADARs

- 7.2.3. Optronics

- 7.2.4. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Sensors

- 8.1.2. Displays and Notification Systems

- 8.1.3. Other Components

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Command and Control

- 8.2.2. RADARs

- 8.2.3. Optronics

- 8.2.4. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Sensors

- 9.1.2. Displays and Notification Systems

- 9.1.3. Other Components

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Command and Control

- 9.2.2. RADARs

- 9.2.3. Optronics

- 9.2.4. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Sensors

- 10.1.2. Displays and Notification Systems

- 10.1.3. Other Components

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Command and Control

- 10.2.2. RADARs

- 10.2.3. Optronics

- 10.2.4. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 THALES

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Dynamics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Leonardo SpA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lockheed Martin Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Elbit Systems Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rafael Advanced Defense Systems Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BAE Systems PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HENSOLDT AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 RTX Corporatio

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Northrop Grumman Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Saab AB

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Teledyne FLIR LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Airborne Situational Awareness Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Airborne Situational Awareness Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Airborne Situational Awareness Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Airborne Situational Awareness Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Airborne Situational Awareness Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Airborne Situational Awareness Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Airborne Situational Awareness Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 9: Europe Airborne Situational Awareness Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Airborne Situational Awareness Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Airborne Situational Awareness Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Airborne Situational Awareness Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Airborne Situational Awareness Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 15: Asia Pacific Airborne Situational Awareness Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Airborne Situational Awareness Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 17: Asia Pacific Airborne Situational Awareness Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Pacific Airborne Situational Awareness Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Airborne Situational Awareness Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 21: Latin America Airborne Situational Awareness Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Latin America Airborne Situational Awareness Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Latin America Airborne Situational Awareness Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Latin America Airborne Situational Awareness Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Airborne Situational Awareness Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Middle East and Africa Airborne Situational Awareness Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Middle East and Africa Airborne Situational Awareness Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Middle East and Africa Airborne Situational Awareness Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East and Africa Airborne Situational Awareness Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 26: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 31: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Israel Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airborne Situational Awareness Systems Market?

The projected CAGR is approximately 4.64%.

2. Which companies are prominent players in the Airborne Situational Awareness Systems Market?

Key companies in the market include L3Harris Technologies Inc, THALES, General Dynamics Corporation, Leonardo SpA, Lockheed Martin Corporation, Elbit Systems Ltd, Rafael Advanced Defense Systems Ltd, BAE Systems PLC, HENSOLDT AG, RTX Corporatio, Northrop Grumman Corporation, Saab AB, Teledyne FLIR LLC.

3. What are the main segments of the Airborne Situational Awareness Systems Market?

The market segments include Component, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.21 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Sensor Segment is Expected to Grow with Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airborne Situational Awareness Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airborne Situational Awareness Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airborne Situational Awareness Systems Market?

To stay informed about further developments, trends, and reports in the Airborne Situational Awareness Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence