Key Insights

The South African optical biometry devices market, a key segment within the global ophthalmic diagnostics sector, is poised for significant expansion. Driven by the escalating incidence of age-related eye conditions such as cataracts and glaucoma, the demand for precise pre-operative measurement for surgical interventions is paramount. Enhanced investment in ophthalmic infrastructure and a growing recognition of accurate biometric measurement's benefits by healthcare professionals and patients are strong market accelerators. The estimated market size in 2024 is $262.85 million, with a projected Compound Annual Growth Rate (CAGR) of 4.5% from 2024 to 2033. Despite notable opportunities, market penetration is tempered by challenges including limited healthcare access in remote areas, the considerable cost of advanced equipment, and the requirement for specialized personnel. Surgical optical biometry devices represent the dominant market share, largely attributed to the high volume of annual cataract surgeries. International leaders like Johnson & Johnson and Alcon are expected to maintain strong positions, complemented by the growing influence of domestic distributors and service providers, fostering market dynamism. Future growth will be further propelled by public-private collaborations aimed at improving the accessibility and affordability of comprehensive eye care solutions.

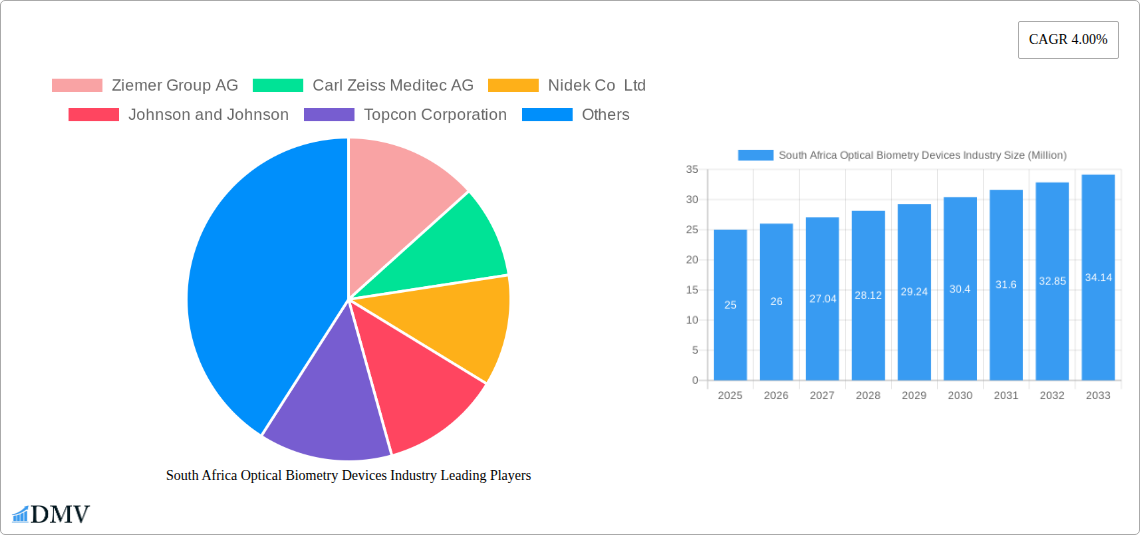

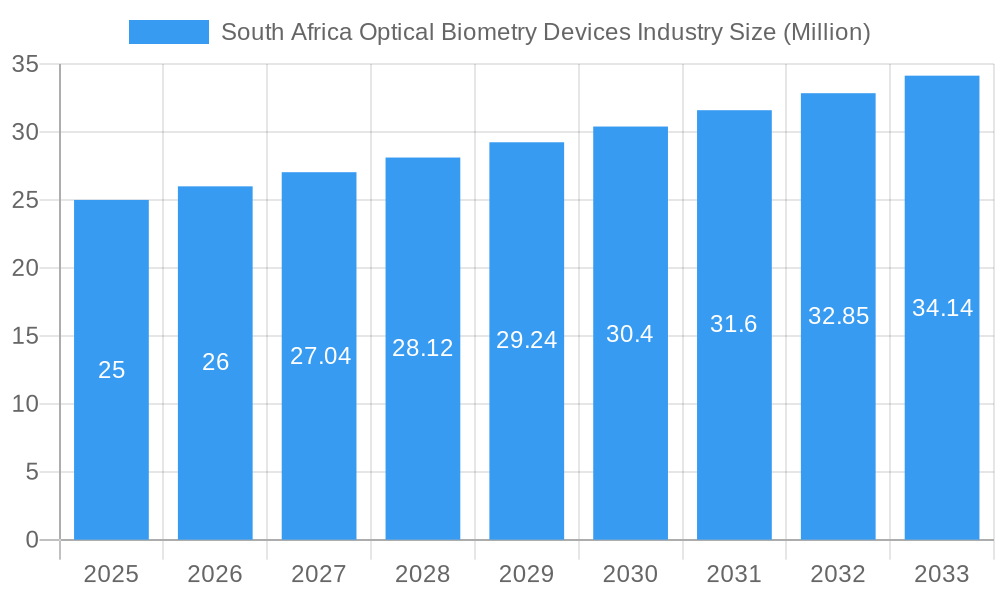

South Africa Optical Biometry Devices Industry Market Size (In Million)

Growth in the South African optical biometry devices market will be underpinned by the rising prevalence of age-related eye diseases and the increasing adoption of advanced surgical procedures. While currently a nascent market compared to global benchmarks, its growth potential is substantial. Government-led initiatives to bolster healthcare infrastructure and broaden access will be critical in shaping the market's trajectory. The strategic focus of key global players, alongside the initiatives of local enterprises, is expected to cultivate a more robust market ecosystem. Detailed regional distribution analysis within South Africa, coupled with an in-depth understanding of pricing and reimbursement models, will refine future market forecasts. Furthermore, a thorough examination of the regulatory landscape is essential for ensuring compliance and facilitating market access for these vital medical devices.

South Africa Optical Biometry Devices Industry Company Market Share

South Africa Optical Biometry Devices Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the South Africa optical biometry devices market, offering valuable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by devices (Surgical Devices and Other Surgical Devices: Diagnostic and Monitoring Devices), offering a granular view of market trends and performance. The total market value in 2025 is estimated at xx Million, and significant growth is projected throughout the forecast period.

South Africa Optical Biometry Devices Industry Market Composition & Trends

This section analyzes the South Africa optical biometry devices market, evaluating market concentration, innovation, regulatory aspects, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The market is characterized by a moderate level of concentration, with key players holding significant market shares. The estimated market share distribution in 2025 is as follows:

- Ziemer Group AG: xx%

- Carl Zeiss Meditec AG: xx%

- Nidek Co Ltd: xx%

- Johnson and Johnson: xx%

- Topcon Corporation: xx%

- Alcon Inc: xx%

- Bausch Health Companies Inc: xx%

- Hoya Corporation: xx%

- Others: xx%

Innovation is a key driver, with companies continually developing advanced technologies to improve accuracy, speed, and functionality. The regulatory landscape is relatively stable, but evolving guidelines on medical device approvals may impact market entry and growth. Substitute products are limited, although advancements in other diagnostic technologies may pose a long-term threat. End-users primarily include ophthalmologists and eye care centers. M&A activity has been relatively moderate in recent years, with deal values totaling approximately xx Million over the historical period (2019-2024).

South Africa Optical Biometry Devices Industry Industry Evolution

The South Africa optical biometry devices market has experienced steady growth over the historical period (2019-2024), driven by factors such as increasing prevalence of eye diseases, rising disposable incomes, and government initiatives to improve healthcare infrastructure. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during this period. Technological advancements, particularly in areas such as AI-powered diagnostic tools and minimally invasive surgical techniques, have significantly impacted market dynamics. Consumer demand is shifting towards more accurate, efficient, and technologically advanced devices, pushing manufacturers to innovate and offer advanced features. The forecast period (2025-2033) is projected to witness a CAGR of xx%, driven by continued technological advancements, increasing adoption of minimally invasive surgical techniques, and rising awareness among healthcare professionals and patients. This growth will be further accelerated by the expanding elderly population.

Leading Regions, Countries, or Segments in South Africa Optical Biometry Devices Industry

Within South Africa, the Gauteng province holds the largest market share due to the concentration of specialized eye care centers and ophthalmologists in major cities like Johannesburg and Pretoria. The segment of Surgical Devices holds the largest market share compared to Other Surgical Devices: Diagnostic and Monitoring Devices, accounting for approximately xx% of the market in 2025.

Key Drivers for the dominance of Surgical Devices and the Gauteng Province:

- High Prevalence of Eye Diseases: South Africa faces a significant burden of age-related macular degeneration and cataracts, driving demand for surgical procedures.

- Investment in Healthcare Infrastructure: Government and private investments in healthcare infrastructure are improving access to advanced surgical facilities and technologies, especially in Gauteng.

- Regulatory Support: The regulatory environment facilitates the adoption and implementation of cutting-edge surgical techniques and devices.

- Presence of Specialized Medical Professionals: The concentration of experienced ophthalmologists and skilled surgical staff in Gauteng enables a higher volume of procedures.

South Africa Optical Biometry Devices Industry Product Innovations

Recent innovations include advancements in intraocular lens (IOL) technology, featuring enhanced biocompatibility and precision. Improved image processing algorithms have led to more accurate and faster measurements during biometry procedures. The integration of AI-powered diagnostic tools is enabling earlier detection of eye diseases, facilitating timely intervention and improved patient outcomes. These innovations offer unique selling propositions such as improved accuracy, reduced invasiveness, and enhanced patient comfort.

Propelling Factors for South Africa Optical Biometry Devices Industry Growth

Technological advancements, such as the development of more precise and minimally invasive surgical techniques and AI-powered diagnostic tools, are a primary driver. Increasing prevalence of age-related eye diseases, coupled with the growing elderly population, further stimulates demand. Government initiatives aimed at improving healthcare infrastructure and access to quality eye care, alongside growing private healthcare investment, also contribute significantly to market growth.

Obstacles in the South Africa Optical Biometry Devices Industry Market

High costs associated with advanced devices and procedures can limit access, especially in underserved populations. Supply chain disruptions, particularly experienced during the recent global pandemic, can impact product availability and pricing. Intense competition among established and emerging players poses challenges for market penetration and pricing strategies. These factors collectively reduce overall market penetration and profitability.

Future Opportunities in South Africa Optical Biometry Devices Industry

The market presents significant opportunities for innovative companies offering technologically advanced, cost-effective, and user-friendly devices and procedures. Expansion into underserved regions through public-private partnerships can significantly boost market reach and create positive societal impact. Developing AI-based screening and diagnostic tools for early disease detection holds immense potential to enhance patient outcomes and increase market demand.

Major Players in the South Africa Optical Biometry Devices Industry Ecosystem

- Ziemer Group AG

- Carl Zeiss Meditec AG

- Nidek Co Ltd

- Johnson and Johnson

- Topcon Corporation

- Alcon Inc

- Bausch Health Companies Inc

- Hoya Corporation

Key Developments in South Africa Optical Biometry Devices Industry Industry

- April 2022: Liqid Medical launched the OptiShunt, a novel ocular implant for glaucoma treatment, potentially revolutionizing glaucoma management.

- December 2021: Eyenuk launched a nationwide Diabetic Retinopathy Screening Benefit using the EyeArt AI system, improving early detection capabilities. This significantly impacts early diagnosis and subsequent treatment strategies.

Strategic South Africa Optical Biometry Devices Industry Market Forecast

The South Africa optical biometry devices market is poised for significant growth over the forecast period (2025-2033), driven by technological innovation, rising prevalence of eye diseases, and increasing healthcare investment. Strategic partnerships, expansion into underserved markets, and focus on developing cost-effective solutions are key to capitalizing on this market potential. Continued technological advancements, such as AI integration and improved surgical techniques, promise to further enhance the accuracy, efficiency, and affordability of optical biometry devices. This will drive wider adoption, ultimately benefitting both healthcare professionals and patients.

South Africa Optical Biometry Devices Industry Segmentation

-

1. Devices

-

1.1. Surgical Devices

- 1.1.1. Glaucoma Devices

- 1.1.2. Intraocular Lenses

- 1.1.3. Lasers

- 1.1.4. Other Surgical Devices

-

1.2. Diagnostic and Monitoring Devices

- 1.2.1. Autorefractors and Keratometers

- 1.2.2. Ophthalmic Ultrasound Imaging Systems

- 1.2.3. Ophthalmoscopes

- 1.2.4. Optical Coherence Tomography Scanners

- 1.2.5. Other Diagnostic and Monitoring Devices

-

1.1. Surgical Devices

South Africa Optical Biometry Devices Industry Segmentation By Geography

- 1. South Africa

South Africa Optical Biometry Devices Industry Regional Market Share

Geographic Coverage of South Africa Optical Biometry Devices Industry

South Africa Optical Biometry Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Eye Disorders; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Risk Associated with Ophthalmic Procedures

- 3.4. Market Trends

- 3.4.1. Intraocular Lenses Segment Expects to Register a High CAGR in the South Africa Ophthalmic Devices Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Optical Biometry Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 5.1.1. Surgical Devices

- 5.1.1.1. Glaucoma Devices

- 5.1.1.2. Intraocular Lenses

- 5.1.1.3. Lasers

- 5.1.1.4. Other Surgical Devices

- 5.1.2. Diagnostic and Monitoring Devices

- 5.1.2.1. Autorefractors and Keratometers

- 5.1.2.2. Ophthalmic Ultrasound Imaging Systems

- 5.1.2.3. Ophthalmoscopes

- 5.1.2.4. Optical Coherence Tomography Scanners

- 5.1.2.5. Other Diagnostic and Monitoring Devices

- 5.1.1. Surgical Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ziemer Group AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carl Zeiss Meditec AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nidek Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Johnson and Johnson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Topcon Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alcon Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bausch Health Companies Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hoya Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Ziemer Group AG

List of Figures

- Figure 1: South Africa Optical Biometry Devices Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South Africa Optical Biometry Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Optical Biometry Devices Industry Revenue million Forecast, by Devices 2020 & 2033

- Table 2: South Africa Optical Biometry Devices Industry Volume K Unit Forecast, by Devices 2020 & 2033

- Table 3: South Africa Optical Biometry Devices Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: South Africa Optical Biometry Devices Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: South Africa Optical Biometry Devices Industry Revenue million Forecast, by Devices 2020 & 2033

- Table 6: South Africa Optical Biometry Devices Industry Volume K Unit Forecast, by Devices 2020 & 2033

- Table 7: South Africa Optical Biometry Devices Industry Revenue million Forecast, by Country 2020 & 2033

- Table 8: South Africa Optical Biometry Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Optical Biometry Devices Industry?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the South Africa Optical Biometry Devices Industry?

Key companies in the market include Ziemer Group AG, Carl Zeiss Meditec AG, Nidek Co Ltd, Johnson and Johnson, Topcon Corporation, Alcon Inc, Bausch Health Companies Inc, Hoya Corporation.

3. What are the main segments of the South Africa Optical Biometry Devices Industry?

The market segments include Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 262.85 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Eye Disorders; Technological Advancements.

6. What are the notable trends driving market growth?

Intraocular Lenses Segment Expects to Register a High CAGR in the South Africa Ophthalmic Devices Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Risk Associated with Ophthalmic Procedures.

8. Can you provide examples of recent developments in the market?

In April 2022, Liqid Medical designed a novel ocular implant, the OptiShunt, that uses a simple concept to revolutionize the treatment of glaucoma.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Optical Biometry Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Optical Biometry Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Optical Biometry Devices Industry?

To stay informed about further developments, trends, and reports in the South Africa Optical Biometry Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence