Key Insights

The Japan general surgical devices market is set for substantial growth, propelled by an aging demographic and the rising incidence of surgical intervention-requiring chronic diseases. The market is projected to reach $0.93 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 8.93% through 2033. Key growth drivers include advancements in minimally invasive surgical (MIS) techniques, fueling demand for sophisticated instruments like laparoscopic and electro-surgical devices. The increasing preference for less invasive procedures and the growing prevalence of gynecological, urological, and orthopedic conditions necessitating surgical treatment further contribute to market expansion.

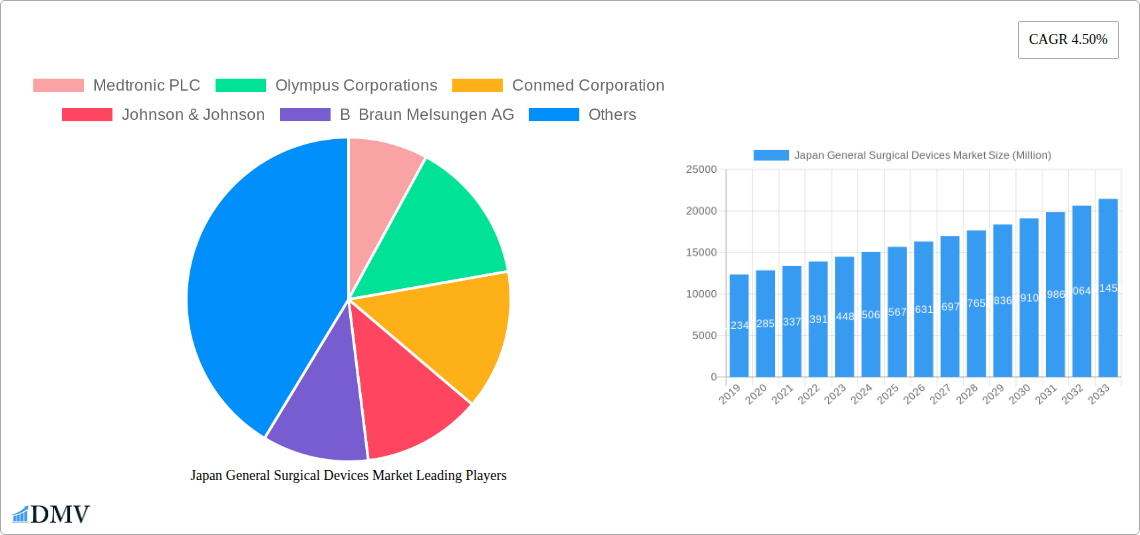

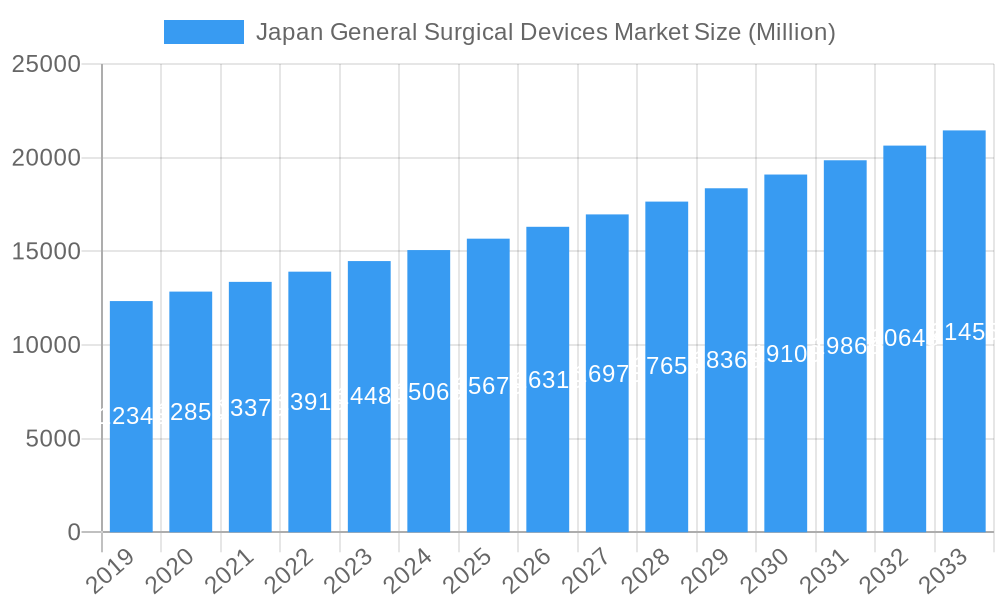

Japan General Surgical Devices Market Market Size (In Million)

Within the Japan general surgical devices market, the Laparoscopic Devices segment anticipates strong demand due to benefits such as reduced recovery times and patient discomfort, aligning with the trend towards outpatient surgeries. Electro-surgical devices also command a significant market share, owing to their versatility across various surgical applications. Potential market restraints include the high cost of advanced surgical equipment and stringent regulatory frameworks. However, continuous innovation in product development, emphasizing enhanced precision and patient safety, alongside strategic collaborations among industry leaders, is expected to ensure sustained market expansion. A focus on improving patient outcomes and reducing healthcare costs will continue to influence the adoption of new technologies.

Japan General Surgical Devices Market Company Market Share

This comprehensive report provides an in-depth analysis of the Japan general surgical devices market, offering critical insights for stakeholders. Covering the period from 2019 to 2033, with a base year of 2025, the study meticulously examines market composition, industry evolution, key segments, and future trends. Utilizing high-impact keywords such as "surgical devices Japan," "medical devices market," "minimally invasive surgery," and "healthcare technology Japan," this report serves as an authoritative resource for understanding market dynamics, competitive landscapes, and growth catalysts.

Japan General Surgical Devices Market Market Composition & Trends

The Japan general surgical devices market exhibits a moderate level of concentration, with key players like Medtronic PLC, Olympus Corporation, and Johnson & Johnson holding significant market share. The market is driven by continuous innovation, particularly in minimally invasive surgical techniques and advanced visualization platforms. Regulatory landscapes, while stringent, foster a climate of quality and safety, encouraging the adoption of cutting-edge surgical instruments and medical equipment Japan. The presence of substitute products, such as traditional open surgery tools, is gradually diminishing with the increasing preference for less invasive alternatives. End-user profiles are diverse, encompassing leading hospitals, specialized surgical centers, and ambulatory surgery centers, all seeking high-performance surgical technology Japan. Mergers and acquisitions (M&A) activities are strategic, aimed at consolidating market presence and expanding product portfolios. For instance, M&A deals in recent years have focused on acquiring innovative startups and complementary technologies, with estimated deal values in the tens of millions of USD. Market share distribution is dynamic, with top players commanding an aggregate of over 70% of the market.

Japan General Surgical Devices Market Industry Evolution

The Japan general surgical devices market has undergone significant evolution, characterized by robust growth trajectories and a rapid integration of technological advancements. Over the historical period (2019-2024), the market witnessed a consistent upward trend in adoption rates for laparoscopic devices and electrosurgical devices, driven by an aging population and a growing incidence of chronic diseases requiring surgical intervention. The shift towards minimally invasive surgical procedures has been a primary catalyst, reducing patient recovery times and hospital stays, thereby lowering healthcare costs. This trend is supported by substantial investments in research and development by leading companies, fostering continuous innovation in surgical tools and medical devices Japan. For example, advancements in robotics-assisted surgery have begun to influence the market, although their widespread adoption is still in its nascent stages. Consumer demand is increasingly prioritizing patient outcomes and procedural efficiency, pushing manufacturers to develop safer, more precise, and user-friendly surgical instruments Japan. Growth rates have averaged approximately 6-8% annually during the historical period. The estimated market size for 2025 is projected to be in the billions of USD, with a strong forecast for continued expansion through 2033. The adoption of digital health technologies, such as AI-powered diagnostic tools and connected surgical platforms, is also emerging as a key influencer, promising enhanced surgical planning and execution.

Leading Regions, Countries, or Segments in Japan General Surgical Devices Market

Within the Japan general surgical devices market, the Laproscopic Devices segment emerges as a dominant force, largely due to the widespread adoption of minimally invasive techniques across various surgical applications. This segment is further propelled by advancements in instrument design, leading to enhanced dexterity and visualization for surgeons.

- Key Drivers for Laparoscopic Devices Dominance:

- Investment Trends: Significant capital allocation towards developing advanced laparoscopic instruments and systems by both domestic and international manufacturers.

- Regulatory Support: Favorable regulatory pathways for innovative laparoscopic technologies that demonstrate improved patient outcomes and cost-effectiveness.

- Surgeon Preference: Growing preference among surgeons for laparoscopic approaches due to reduced invasiveness and faster patient recovery.

- Technological Advancements: Continuous innovation in areas like high-definition imaging, articulation, and miniaturization of laparoscopic instruments.

In terms of applications, Gynecology and Urology are significant contributors to the demand for general surgical devices, with a high volume of procedures performed annually. The increasing prevalence of gynecological disorders and urological conditions, coupled with an aging population, fuels the need for advanced surgical solutions Japan.

- Dominance Factors in Gynecology and Urology Applications:

- High Procedure Volumes: A substantial number of minimally invasive procedures are performed in these specialties, creating consistent demand for specialized surgical devices.

- Focus on Patient Comfort and Recovery: The demand for less invasive procedures in these sensitive areas drives the adoption of advanced laparoscopic and other minimally invasive instruments.

- Technological Integration: The integration of advanced imaging and energy devices enhances precision and safety in gynecological and urological surgeries.

- Growing Awareness and Diagnostics: Increased awareness and improved diagnostic capabilities lead to earlier detection and intervention, boosting the demand for surgical devices.

The Other Applications segment, encompassing general surgery, bariatric surgery, and various other specialties, also represents a substantial market share, reflecting the broad applicability of general surgical devices across the healthcare spectrum. The Electro Surgical Devices segment, particularly in complex procedures, also holds considerable weight due to its crucial role in hemostasis and tissue dissection.

Japan General Surgical Devices Market Product Innovations

Product innovations in the Japan general surgical devices market are revolutionizing surgical practices. For instance, the development of advanced handheld surgical devices with enhanced ergonomics and precision is improving surgeon control. Furthermore, innovations in wound closure devices are focusing on faster healing and reduced scarring. The introduction of sophisticated trocars and access devices facilitates smoother entry into the abdominal cavity for minimally invasive procedures. These advancements collectively enhance surgical efficacy, patient safety, and recovery times, setting new benchmarks for medical device innovation Japan.

Propelling Factors for Japan General Surgical Devices Market Growth

Several factors propel the growth of the Japan general surgical devices market. The aging demographic and the increasing prevalence of lifestyle-related diseases necessitate a higher volume of surgical interventions. Technological advancements, particularly in minimally invasive surgery and robotic surgery, are driving demand for sophisticated surgical equipment Japan. Government initiatives promoting healthcare infrastructure development and the adoption of advanced medical technologies also play a crucial role. Furthermore, a growing awareness among the Japanese population regarding the benefits of less invasive procedures supports market expansion. The robust R&D investments by major players are consistently introducing novel and improved surgical solutions, further stimulating market growth in Japan's healthcare sector.

Obstacles in the Japan General Surgical Devices Market Market

Despite the positive outlook, the Japan general surgical devices market faces certain obstacles. Stringent regulatory approval processes can lead to longer lead times for new product introductions. The high cost of advanced surgical devices and the need for specialized training for surgeons can be a deterrent to widespread adoption, particularly in smaller healthcare facilities. Supply chain disruptions, exacerbated by global events, can impact the availability of critical components and finished products. Intense competition among domestic and international players also puts pressure on pricing and profit margins, posing a challenge for market growth.

Future Opportunities in Japan General Surgical Devices Market

The Japan general surgical devices market presents significant future opportunities. The growing demand for specialized surgical procedures in areas like oncology and cardiology will drive innovation in related device segments. The increasing adoption of AI and robotics in surgery offers a burgeoning area for market expansion. Furthermore, there is an untapped potential in remote and rural areas where access to advanced surgical care is limited, creating opportunities for the deployment of more accessible and cost-effective surgical solutions. The continuous evolution of healthcare technology Japan opens avenues for integrated diagnostic and therapeutic devices, further enhancing patient care.

Major Players in the Japan General Surgical Devices Market Ecosystem

- Medtronic PLC

- Olympus Corporations

- Conmed Corporation

- Johnson & Johnson

- B Braun Melsungen AG

- Stryker Corporation

- Boston Scientific Corporation

- Smith & Nephew Plc

- Maquet Holding BV & Co KG (Getinge AB)

- Integer Holdings Corporation

Key Developments in Japan General Surgical Devices Market Industry

- September 2022: Olympus Corporation, based in Japan, announced the launch of VISERA ELITE III, its newest surgical visualization platform that addresses the needs of healthcare professionals (HCPs) for endoscopic procedures across multiple medical disciplines.

- September 2021: Bolder Surgical announced the CoolSeal receives CE mark, Japan PMDA approval. The CoolSeal Vessel Sealing suite includes the 3 mm Mini and the 5 mm Trinity Sealer/Divider/Dissector. Both devices are powered with the gold-standard efficacy of advanced bipolar Radio Frequency vessel sealing technology.

Strategic Japan General Surgical Devices Market Market Forecast

The strategic Japan general surgical devices market forecast indicates sustained growth driven by technological innovation and an increasing focus on patient-centric care. The ongoing expansion of minimally invasive surgery, coupled with advancements in surgical robotics and AI-powered diagnostic tools, will be key growth catalysts. Furthermore, a proactive regulatory environment that encourages the adoption of novel medical devices Japan will foster market expansion. The rising healthcare expenditure and the persistent demand for high-quality surgical outcomes position the Japan general surgical devices market for significant potential and continued success through the forecast period.

Japan General Surgical Devices Market Segmentation

-

1. Product

- 1.1. Handheld Devices

- 1.2. Laproscopic Devices

- 1.3. Electro Surgical Devices

- 1.4. Wound Closure Devices

- 1.5. Trocars and Access Devices

- 1.6. Other Products

-

2. Application

- 2.1. Gynecology and Urology

- 2.2. Cardiology

- 2.3. Orthopaedic

- 2.4. Neurology

- 2.5. Other Applications

Japan General Surgical Devices Market Segmentation By Geography

- 1. Japan

Japan General Surgical Devices Market Regional Market Share

Geographic Coverage of Japan General Surgical Devices Market

Japan General Surgical Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Minimally Invasive Devices; Growing Cases of Injuries and Accidents

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Improper Reimbursement for Surgical Devices

- 3.4. Market Trends

- 3.4.1. Handheld Devices is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan General Surgical Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Handheld Devices

- 5.1.2. Laproscopic Devices

- 5.1.3. Electro Surgical Devices

- 5.1.4. Wound Closure Devices

- 5.1.5. Trocars and Access Devices

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gynecology and Urology

- 5.2.2. Cardiology

- 5.2.3. Orthopaedic

- 5.2.4. Neurology

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Medtronic PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Olympus Corporations

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Conmed Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Johnson & Johnson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 B Braun Melsungen AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Stryker Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Boston Scientific Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Smith & Nephew Plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Maquet Holding BV & Co KG (Getinge AB)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Integer Holdings Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Medtronic PLC

List of Figures

- Figure 1: Japan General Surgical Devices Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan General Surgical Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Japan General Surgical Devices Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Japan General Surgical Devices Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Japan General Surgical Devices Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Japan General Surgical Devices Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Japan General Surgical Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Japan General Surgical Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Japan General Surgical Devices Market Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Japan General Surgical Devices Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Japan General Surgical Devices Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Japan General Surgical Devices Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Japan General Surgical Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Japan General Surgical Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan General Surgical Devices Market?

The projected CAGR is approximately 8.93%.

2. Which companies are prominent players in the Japan General Surgical Devices Market?

Key companies in the market include Medtronic PLC, Olympus Corporations, Conmed Corporation, Johnson & Johnson, B Braun Melsungen AG, Stryker Corporation, Boston Scientific Corporation, Smith & Nephew Plc, Maquet Holding BV & Co KG (Getinge AB), Integer Holdings Corporation.

3. What are the main segments of the Japan General Surgical Devices Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Minimally Invasive Devices; Growing Cases of Injuries and Accidents.

6. What are the notable trends driving market growth?

Handheld Devices is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Improper Reimbursement for Surgical Devices.

8. Can you provide examples of recent developments in the market?

In September 2022, Olympus Corporation, based in Japan, announced the launch of VISERA ELITE III, its newest surgical visualization platform that addresses the needs of healthcare professionals (HCPs) for endoscopic procedures across multiple medical disciplines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan General Surgical Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan General Surgical Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan General Surgical Devices Market?

To stay informed about further developments, trends, and reports in the Japan General Surgical Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence