Key Insights

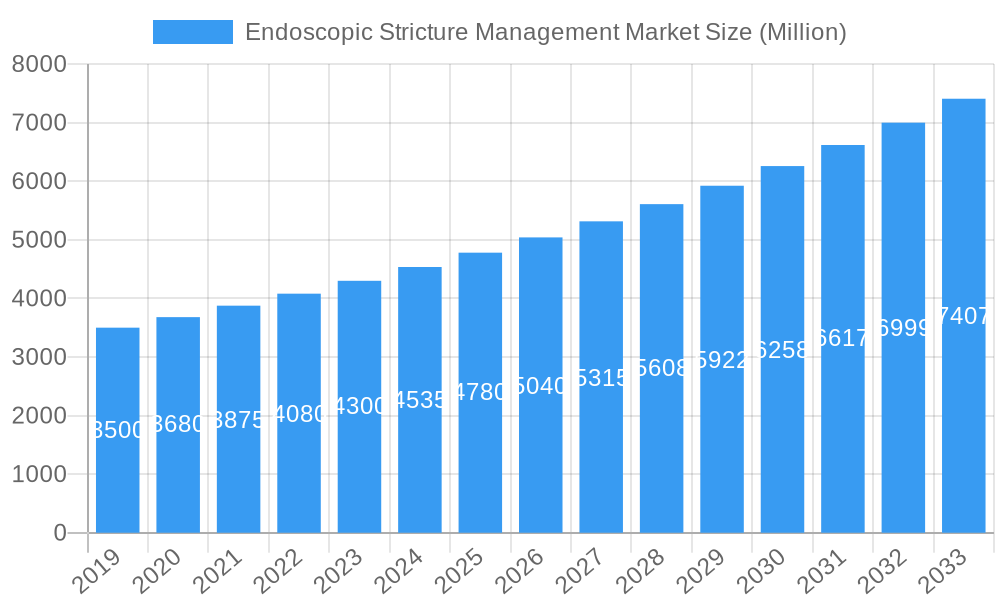

The Endoscopic Stricture Management Market is poised for robust growth, projected to surpass \$[Estimate a plausible market size based on CAGR and typical market values for medical devices, e.g., \$5,000] Million by 2025, and is expected to expand at a Compound Annual Growth Rate (CAGR) exceeding 6.01% during the forecast period of 2025-2033. This significant expansion is fueled by a confluence of factors, including the increasing prevalence of conditions leading to strictures, such as inflammatory bowel disease, gastroesophageal reflux disease (GERD), and post-operative complications. Advances in endoscopic technologies, leading to less invasive and more effective treatment options, are a primary driver. The growing demand for minimally invasive procedures, driven by patient preference for faster recovery times and reduced hospital stays, further propels market growth. Moreover, a rising global geriatric population, more susceptible to various chronic diseases that can cause strictures, contributes to the escalating need for specialized endoscopic management solutions.

Endoscopic Stricture Management Market Market Size (In Billion)

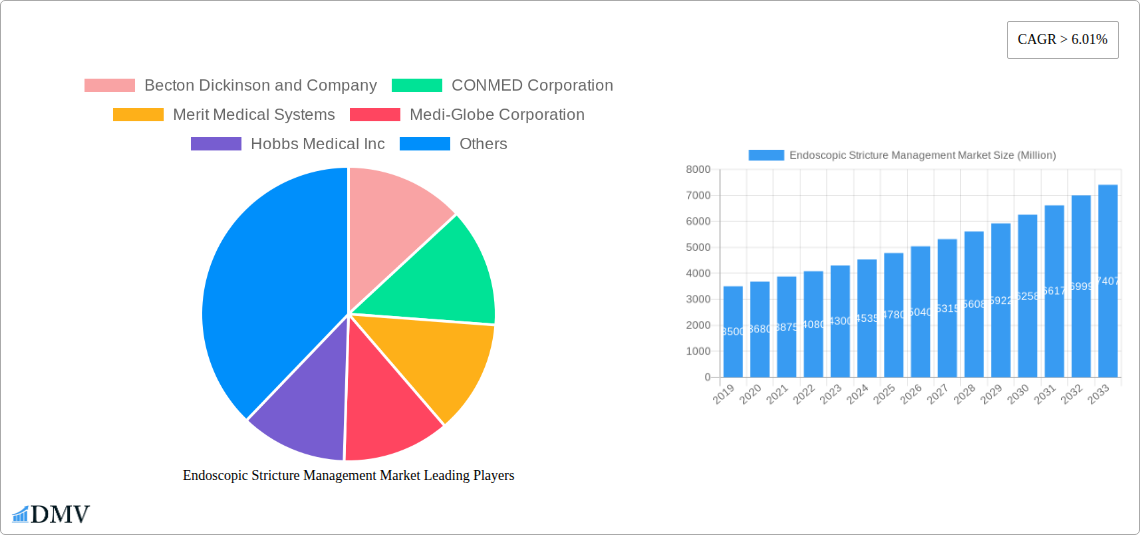

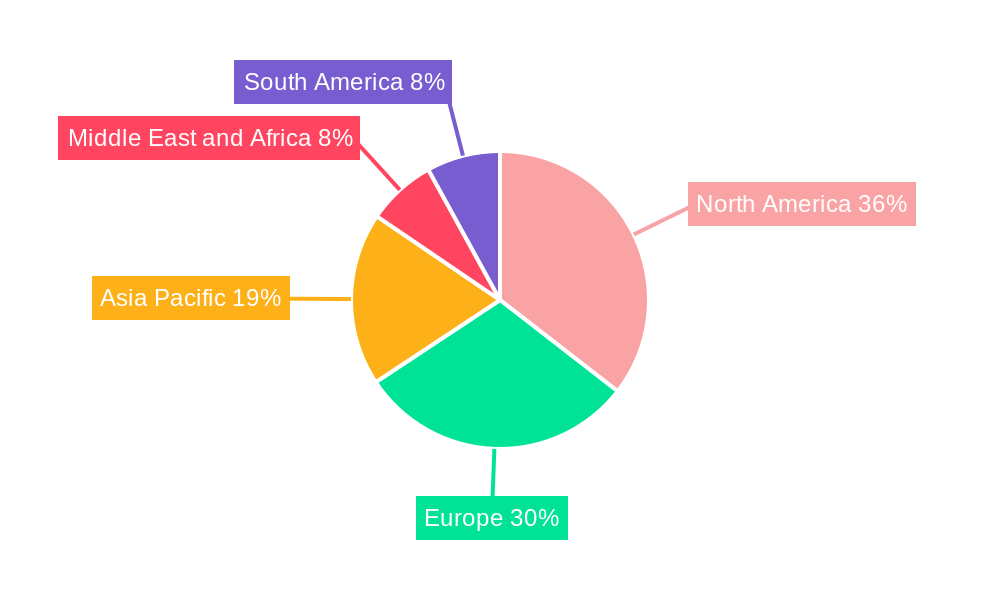

The market segmentation reveals key areas of opportunity and growth. In terms of product type, Balloon Dilators and Stents are anticipated to lead the market due to their widespread adoption in managing a variety of strictures. The Esophageal and Biliary segments are expected to dominate the application landscape, reflecting the high incidence of strictures in these critical anatomical regions. Hospitals and Ambulatory Surgical Centers will remain the primary end-users, driven by their advanced infrastructure and specialized medical teams. Geographically, North America and Europe are expected to hold substantial market shares owing to well-established healthcare systems and early adoption of advanced medical technologies. However, the Asia Pacific region is projected to exhibit the fastest growth, spurred by increasing healthcare expenditure, improving access to advanced medical facilities, and a growing awareness of endoscopic treatment options. The competitive landscape is characterized by the presence of established global players such as Becton Dickinson and Company, Boston Scientific Corporation, and Olympus Corporation, who are actively engaged in research and development to introduce innovative solutions and expand their market reach.

Endoscopic Stricture Management Market Company Market Share

This comprehensive Endoscopic Stricture Management Market report offers an in-depth analysis of the global market, providing crucial insights for stakeholders, including manufacturers, R&D professionals, investors, and policymakers. The report meticulously examines the market dynamics, trends, and future trajectory of endoscopic interventions for treating strictures across various anatomical locations. Our analysis covers the period from 2019 to 2033, with a detailed base year assessment in 2025 and a robust forecast period extending from 2025 to 2033, built upon a thorough review of historical data from 2019 to 2024. We employ advanced market research methodologies to deliver accurate projections and actionable intelligence on this rapidly evolving medical device sector.

Endoscopic Stricture Management Market Composition & Trends

The Endoscopic Stricture Management Market is characterized by a moderate level of concentration, with key players holding significant shares, yet innovation catalysts are continuously reshaping the competitive landscape. Regulatory frameworks play a pivotal role in market access and product approvals, influencing the adoption of advanced endoscopic dilators and endoscopic stents. The market is witnessing a surge in demand driven by an increasing prevalence of conditions leading to strictures, such as gastrointestinal cancers, inflammatory bowel disease, and post-surgical complications. Substitutes, primarily surgical interventions, are gradually being overshadowed by the minimally invasive and effective nature of endoscopic procedures. End-user profiles reveal a strong preference for hospitals and ambulatory surgical centers due to the specialized nature of these treatments. Mergers and acquisitions are notable, with strategic partnerships and acquisitions aimed at expanding product portfolios and geographical reach. For instance, the acquisition of M.I.Tech Co., Ltd. by Boston Scientific Corporation for an estimated value of $XXX Million underscores the consolidation trend. Market share distribution for key product categories like balloon dilators and stents indicates a growing demand for advanced stent technologies.

- Market Concentration: Moderate, with leading players dominating specific segments.

- Innovation Catalysts: Technological advancements in stent materials and delivery systems, alongside minimally invasive techniques.

- Regulatory Landscapes: FDA and EMA approvals are critical for market entry and growth.

- Substitute Products: Surgical interventions, though less preferred for non-complex cases.

- End-User Profiles: Predominantly hospitals and ambulatory surgical centers seeking efficient patient outcomes.

- M&A Activities: Strategic acquisitions to enhance product offerings and market presence. M&A deal values are estimated to be in the range of $XX to $XXX Million for significant transactions.

Endoscopic Stricture Management Market Industry Evolution

The Endoscopic Stricture Management Market has undergone significant evolution, marked by consistent growth trajectories fueled by technological advancements and shifting consumer demands for less invasive treatments. The market’s expansion is directly correlated with the increasing incidence of diseases and conditions that lead to luminal narrowing, such as esophageal strictures, biliary strictures, and ureteral strictures. Advancements in endoscopic techniques, including improved visualization, maneuverability of instruments, and precision in placement, have made endoscopic management a preferred alternative to open surgery for many patients. The development of novel materials for endoscopic stents, such as self-expanding nitinol and biodegradable polymers, has further enhanced treatment efficacy and patient comfort. For example, the introduction of conformable, non-vascular, self-expanding metal stents, like the HANAROSTENT technology, has revolutionized the treatment of complex strictures by offering better tissue apposition and reduced migration rates. Similarly, the integration of drug-eluting technologies within balloons and stents, as seen with the Optilume Urethral Drug-Coated Balloon (DCB), represents a significant leap in preventing restenosis and improving long-term outcomes. This innovation allows for targeted drug delivery directly to the site of stricture, reducing inflammation and promoting healing. The adoption metrics for these advanced technologies have shown a steady upward trend, with an estimated adoption rate of XX% for new stent technologies within the forecast period. The market has seen a compound annual growth rate (CAGR) of approximately X.X% over the historical period, driven by increasing healthcare expenditure, a growing aging population, and a rising awareness of the benefits of endoscopic procedures among both physicians and patients. Furthermore, the expansion of healthcare infrastructure in emerging economies is opening new avenues for market penetration and growth, making endoscopic stricture management more accessible globally. The shift towards outpatient procedures in ambulatory surgical centers also contributes to market expansion, offering cost-effectiveness and convenience for patients with less severe strictures.

Leading Regions, Countries, or Segments in Endoscopic Stricture Management Market

The Endoscopic Stricture Management Market is witnessing significant dominance by North America, driven by robust healthcare infrastructure, high adoption rates of advanced medical technologies, and a considerable patient pool suffering from conditions necessitating endoscopic interventions. Within this region, the United States stands out as a leading country due to substantial investments in medical R&D, favorable reimbursement policies, and a high concentration of specialized medical centers performing endoscopic procedures. The Esophageal segment, particularly for treating benign and malignant strictures, represents a key application driving growth, closely followed by the Biliary segment, addressing conditions like cholangiocarcinoma and post-cholecystectomy strictures.

Key drivers of dominance in North America include:

- Investment Trends: Significant private and public investments in healthcare innovation and advanced medical devices.

- Regulatory Support: A well-established regulatory framework (FDA) that facilitates timely approval of innovative products.

- Technological Adoption: High receptiveness to new and advanced endoscopic technologies, including sophisticated stents and balloon dilators.

- Physician Expertise: A large pool of highly trained gastroenterologists and surgeons proficient in endoscopic procedures.

- Healthcare Expenditure: High per capita healthcare spending, allowing for greater access to specialized treatments.

The Hospitals end-user segment is paramount, reflecting the complexity and critical nature of many stricture management procedures. However, the growing trend of outpatient care is also boosting the significance of Ambulatory Surgical Centers. In terms of product types, Stents are experiencing the fastest growth, owing to their efficacy in maintaining patency and managing complex strictures, especially in oncological cases. Balloon Dilators, while a staple, are increasingly being integrated with advanced features or used in conjunction with other modalities for enhanced outcomes. The market's growth is further propelled by the increasing prevalence of conditions like GERD, Barrett's esophagus, and inflammatory bowel disease, all of which can lead to esophageal strictures. Similarly, the rising incidence of pancreatic and biliary cancers contributes significantly to the demand for biliary stent placement. The continuous development of new stent designs, including biodegradable and drug-eluting options, is expected to further expand the market share of the stent segment.

Endoscopic Stricture Management Market Product Innovations

Product innovations in the Endoscopic Stricture Management Market are primarily focused on enhancing patient outcomes, reducing procedural complications, and improving ease of use for clinicians. Novel stent designs, such as fully covered, partially covered, and uncovered self-expanding metal stents (SEMS) with improved radial force and anti-migration features, are transforming the treatment landscape. The development of bioresorbable stents offers a temporary solution, eliminating the need for secondary removal procedures. Drug-coated balloons (DCBs) are gaining traction, delivering therapeutic agents directly to the stricture site to prevent inflammation and restenosis, as demonstrated by the Optilume Urethral DCB. Advanced delivery systems with enhanced precision and control are also crucial, facilitating accurate placement even in challenging anatomies. Performance metrics like patency rates, re-intervention rates, and complication rates are key indicators of these innovations' success.

Propelling Factors for Endoscopic Stricture Management Market Growth

The Endoscopic Stricture Management Market is propelled by several critical factors. The escalating global prevalence of chronic diseases such as gastrointestinal cancers, inflammatory bowel disease, and liver cirrhosis, all of which can lead to strictures, is a primary driver. Technological advancements in endoscopic devices, including high-resolution imaging, advanced stent materials like nitinol, and improved delivery systems, are making procedures safer and more effective. The increasing preference for minimally invasive procedures over traditional open surgeries, due to shorter recovery times and reduced patient trauma, significantly boosts demand. Furthermore, rising healthcare expenditure worldwide, particularly in emerging economies, is expanding access to advanced medical treatments. Favorable reimbursement policies for endoscopic interventions in many countries also play a crucial role in market expansion.

Obstacles in the Endoscopic Stricture Management Market Market

Despite its growth potential, the Endoscopic Stricture Management Market faces several obstacles. Stringent regulatory approval processes for novel medical devices can lead to lengthy market entry timelines and substantial development costs. The high cost of advanced endoscopic devices and stents can be a barrier to adoption in resource-limited healthcare settings, impacting affordability for patients and healthcare systems. Potential complications associated with endoscopic procedures, such as perforation, bleeding, and stent migration, can lead to patient apprehension and impact market growth. Intense competition among established players and emerging companies also exerts pressure on pricing and profit margins. Supply chain disruptions, exacerbated by global events, can also affect the availability of critical components and finished products, potentially delaying procedures.

Future Opportunities in Endoscopic Stricture Management Market

Emerging opportunities in the Endoscopic Stricture Management Market are significant. The development of biodegradable and bioresorbable stents offers a promising avenue for temporary stricture management, reducing the need for secondary procedures. The integration of artificial intelligence (AI) and advanced imaging techniques in endoscopic visualization and navigation can further enhance precision and outcomes. Expansion into emerging economies, where the demand for advanced healthcare solutions is growing rapidly, presents a substantial untapped market potential. The increasing focus on personalized medicine and targeted drug delivery within endoscopic interventions, exemplified by drug-coated balloons and stents, opens doors for novel therapeutic approaches. Furthermore, advancements in endoscopic ultrasound (EUS) guided interventions for stricture management are expected to drive future growth.

Major Players in the Endoscopic Stricture Management Market Ecosystem

- Becton Dickinson and Company

- CONMED Corporation

- Merit Medical Systems

- Medi-Globe Corporation

- Hobbs Medical Inc

- Cook Medical LLC

- PanMed US

- Boston Scientific Corporation

- Laborie Medical Technologies Inc.

- Olympus Corporation

- Micro-Tech Endoscopy

- STERIS

Key Developments in Endoscopic Stricture Management Market Industry

- June 2022: Boston Scientific Corporation entered into a definitive agreement with Synergy Innovation Co., Ltd, to purchase its majority stake (approximately 64%) of M.I.Tech Co., Ltd, a publicly traded Korean manufacturer and distributor of medical devices for endoscopic and urologic procedures. M.I.Tech is the creator of the HANAROSTENT technology, a family of conformable, non-vascular, self-expanding metal stents, which Boston Scientific has distributed in Japan since 2015. This strategic acquisition is poised to strengthen Boston Scientific's endoscopic portfolio, particularly in the area of gastrointestinal and biliary stenting.

- January 2022: Laborie Medical Technologies Inc., a diagnostic and therapeutic medical technology company, acquired a perpetual, exclusive license to the Optilume Urethral Drug-Coated Balloon (DCB) following approval from the Food and Drug Administration (FDA) in early December 2021. This development highlights the growing importance of drug-coated technologies in managing urethral strictures and represents a significant advancement in therapeutic endoscopy.

Strategic Endoscopic Stricture Management Market Market Forecast

The Endoscopic Stricture Management Market is projected for robust growth, driven by ongoing technological innovations and an increasing demand for minimally invasive treatment options. The strategic expansion of product portfolios through mergers and acquisitions, as exemplified by the recent developments, will continue to shape market dynamics. Investments in R&D for advanced materials, such as biodegradable stents and drug-eluting technologies, are expected to unlock new therapeutic avenues and improve patient outcomes. The growing awareness and accessibility of endoscopic procedures globally, coupled with favorable reimbursement policies, will further fuel market penetration, especially in emerging economies. The market's future trajectory is characterized by a strong emphasis on precision, efficacy, and patient-centric care, positioning it for sustained expansion in the coming years.

Endoscopic Stricture Management Market Segmentation

-

1. Type

- 1.1. Balloon Dilators

- 1.2. Stents

- 1.3. Bougie Dilators

-

2. Application

- 2.1. Esophageal

- 2.2. Biliary

- 2.3. Other Applications

-

3. End-user

- 3.1. Hospitals

- 3.2. Ambulatory Surgical Centers

- 3.3. Other End-users

Endoscopic Stricture Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Endoscopic Stricture Management Market Regional Market Share

Geographic Coverage of Endoscopic Stricture Management Market

Endoscopic Stricture Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Rise in Prevalence of GI Disorders; New Product Launches with Advanced Technologies and Preference for Minimally Invasive Procedures

- 3.3. Market Restrains

- 3.3.1. Highly Expensive GI Endoscopic Procedures and Troublesome Repayment Approaches; Lack of Trained and Skilled Healthcare Professionals in Endoscopic Stricture Technology

- 3.4. Market Trends

- 3.4.1. Stents Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Balloon Dilators

- 5.1.2. Stents

- 5.1.3. Bougie Dilators

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Esophageal

- 5.2.2. Biliary

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Hospitals

- 5.3.2. Ambulatory Surgical Centers

- 5.3.3. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Balloon Dilators

- 6.1.2. Stents

- 6.1.3. Bougie Dilators

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Esophageal

- 6.2.2. Biliary

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user

- 6.3.1. Hospitals

- 6.3.2. Ambulatory Surgical Centers

- 6.3.3. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Balloon Dilators

- 7.1.2. Stents

- 7.1.3. Bougie Dilators

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Esophageal

- 7.2.2. Biliary

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user

- 7.3.1. Hospitals

- 7.3.2. Ambulatory Surgical Centers

- 7.3.3. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Balloon Dilators

- 8.1.2. Stents

- 8.1.3. Bougie Dilators

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Esophageal

- 8.2.2. Biliary

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user

- 8.3.1. Hospitals

- 8.3.2. Ambulatory Surgical Centers

- 8.3.3. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Balloon Dilators

- 9.1.2. Stents

- 9.1.3. Bougie Dilators

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Esophageal

- 9.2.2. Biliary

- 9.2.3. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user

- 9.3.1. Hospitals

- 9.3.2. Ambulatory Surgical Centers

- 9.3.3. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Balloon Dilators

- 10.1.2. Stents

- 10.1.3. Bougie Dilators

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Esophageal

- 10.2.2. Biliary

- 10.2.3. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user

- 10.3.1. Hospitals

- 10.3.2. Ambulatory Surgical Centers

- 10.3.3. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CONMED Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merit Medical Systems

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Medi-Globe Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hobbs Medical Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cook Medical LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PanMed US

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boston Scientific Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Laborie*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Olympus Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Micro-Tech Endoscopy

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 STERIS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Endoscopic Stricture Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Endoscopic Stricture Management Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Endoscopic Stricture Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Endoscopic Stricture Management Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Endoscopic Stricture Management Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Endoscopic Stricture Management Market Revenue (Million), by End-user 2025 & 2033

- Figure 7: North America Endoscopic Stricture Management Market Revenue Share (%), by End-user 2025 & 2033

- Figure 8: North America Endoscopic Stricture Management Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Endoscopic Stricture Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Endoscopic Stricture Management Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Endoscopic Stricture Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Endoscopic Stricture Management Market Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Endoscopic Stricture Management Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Endoscopic Stricture Management Market Revenue (Million), by End-user 2025 & 2033

- Figure 15: Europe Endoscopic Stricture Management Market Revenue Share (%), by End-user 2025 & 2033

- Figure 16: Europe Endoscopic Stricture Management Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Endoscopic Stricture Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Endoscopic Stricture Management Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Endoscopic Stricture Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Endoscopic Stricture Management Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Endoscopic Stricture Management Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Endoscopic Stricture Management Market Revenue (Million), by End-user 2025 & 2033

- Figure 23: Asia Pacific Endoscopic Stricture Management Market Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Asia Pacific Endoscopic Stricture Management Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Endoscopic Stricture Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Endoscopic Stricture Management Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Endoscopic Stricture Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Endoscopic Stricture Management Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Endoscopic Stricture Management Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Endoscopic Stricture Management Market Revenue (Million), by End-user 2025 & 2033

- Figure 31: Middle East and Africa Endoscopic Stricture Management Market Revenue Share (%), by End-user 2025 & 2033

- Figure 32: Middle East and Africa Endoscopic Stricture Management Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Endoscopic Stricture Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Endoscopic Stricture Management Market Revenue (Million), by Type 2025 & 2033

- Figure 35: South America Endoscopic Stricture Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Endoscopic Stricture Management Market Revenue (Million), by Application 2025 & 2033

- Figure 37: South America Endoscopic Stricture Management Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Endoscopic Stricture Management Market Revenue (Million), by End-user 2025 & 2033

- Figure 39: South America Endoscopic Stricture Management Market Revenue Share (%), by End-user 2025 & 2033

- Figure 40: South America Endoscopic Stricture Management Market Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Endoscopic Stricture Management Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Endoscopic Stricture Management Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 4: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Endoscopic Stricture Management Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 8: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Endoscopic Stricture Management Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 15: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Endoscopic Stricture Management Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 25: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Endoscopic Stricture Management Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 35: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 40: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Endoscopic Stricture Management Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 42: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Endoscopic Stricture Management Market?

The projected CAGR is approximately > 6.01%.

2. Which companies are prominent players in the Endoscopic Stricture Management Market?

Key companies in the market include Becton Dickinson and Company, CONMED Corporation, Merit Medical Systems, Medi-Globe Corporation, Hobbs Medical Inc, Cook Medical LLC, PanMed US, Boston Scientific Corporation, Laborie*List Not Exhaustive, Olympus Corporation, Micro-Tech Endoscopy, STERIS.

3. What are the main segments of the Endoscopic Stricture Management Market?

The market segments include Type, Application, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Rise in Prevalence of GI Disorders; New Product Launches with Advanced Technologies and Preference for Minimally Invasive Procedures.

6. What are the notable trends driving market growth?

Stents Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Highly Expensive GI Endoscopic Procedures and Troublesome Repayment Approaches; Lack of Trained and Skilled Healthcare Professionals in Endoscopic Stricture Technology.

8. Can you provide examples of recent developments in the market?

June 2022: Boston Scientific Corporation entered into a definitive agreement with Synergy Innovation Co., Ltd, to purchase its majority stake (approximately 64%) of M.I.Tech Co., Ltd, a publicly traded Korean manufacturer and distributor of medical devices for endoscopic and urologic procedures. M.I.Tech is the creator of the HANAROSTENT technology, a family of conformable, non-vascular, self-expanding metal stents, which Boston Scientific has distributed in Japan since 2015.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Endoscopic Stricture Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Endoscopic Stricture Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Endoscopic Stricture Management Market?

To stay informed about further developments, trends, and reports in the Endoscopic Stricture Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence