Key Insights

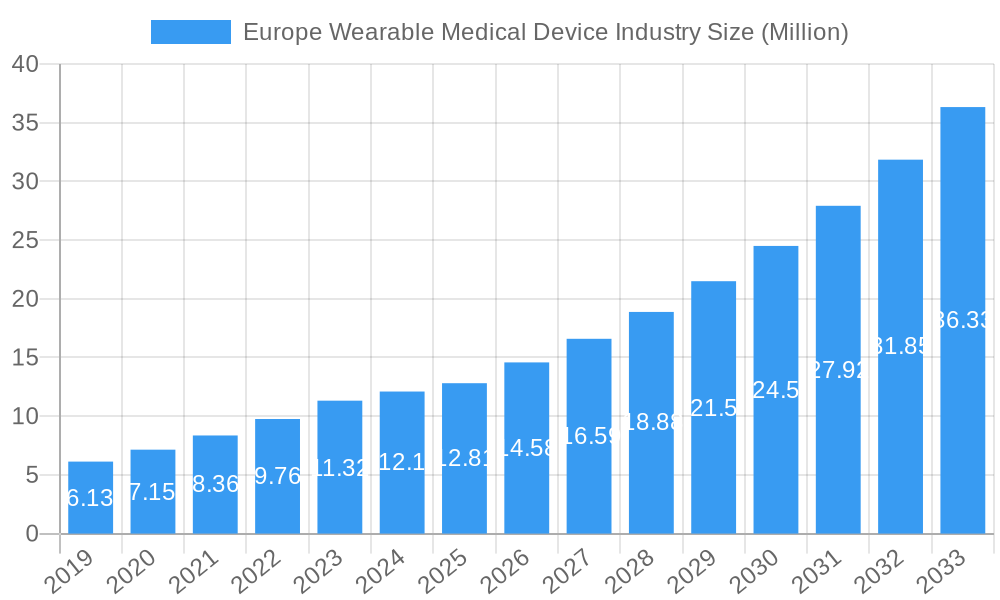

The European Wearable Medical Device market is poised for robust expansion, projected to reach an estimated market size of approximately USD 12.81 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 15.41% extending through 2033. This significant growth is underpinned by a confluence of powerful drivers, including the escalating prevalence of chronic diseases, a growing consumer demand for proactive health management solutions, and the continuous innovation in sensor technology and data analytics. The increasing adoption of remote patient monitoring and home healthcare services is also a major catalyst, empowering individuals to take greater control of their well-being and facilitating early detection and intervention. Furthermore, the integration of artificial intelligence and machine learning into wearable devices is enhancing their diagnostic capabilities and personalization, offering predictive insights and tailored health recommendations.

Europe Wearable Medical Device Industry Market Size (In Million)

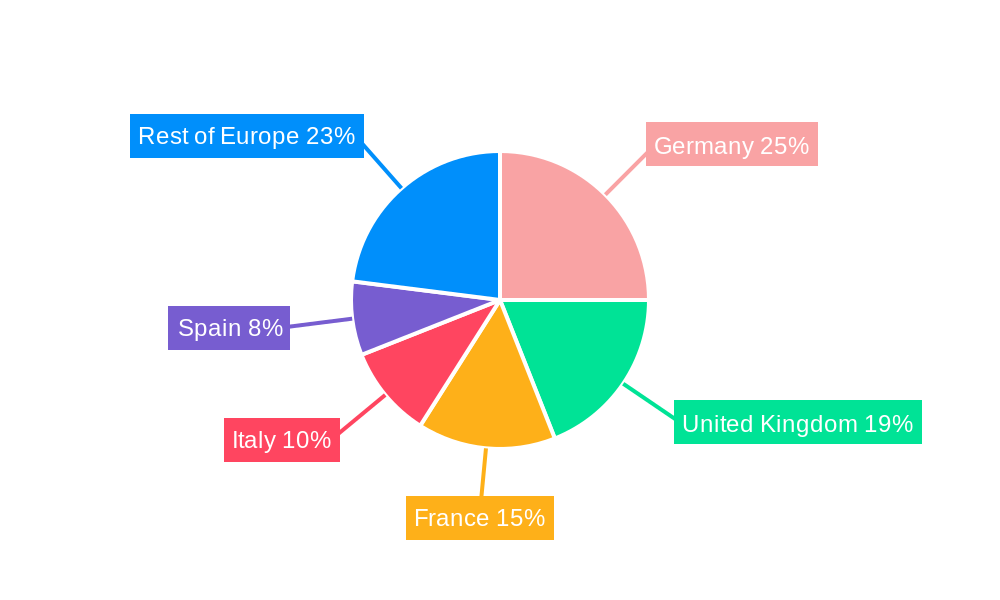

Key trends shaping the market landscape include the burgeoning demand for sophisticated monitoring devices, particularly vital sign monitors, sleep trackers, and sophisticated ECG devices, catering to a diverse range of health concerns. Therapeutic devices are also gaining traction, with a notable surge in pain management, rehabilitation, and respiratory therapy solutions designed for at-home use. The market is witnessing a significant shift towards product diversification, with smartwatches and wristbands leading the adoption, while ear-wear and other innovative form factors are emerging. Geographically, Germany, the United Kingdom, and France are expected to spearhead market growth, driven by advanced healthcare infrastructure, high disposable incomes, and strong government initiatives supporting digital health adoption. However, challenges such as data privacy concerns, regulatory hurdles for medical-grade devices, and the need for robust cybersecurity measures remain critical considerations that industry players must address to fully capitalize on the market's immense potential.

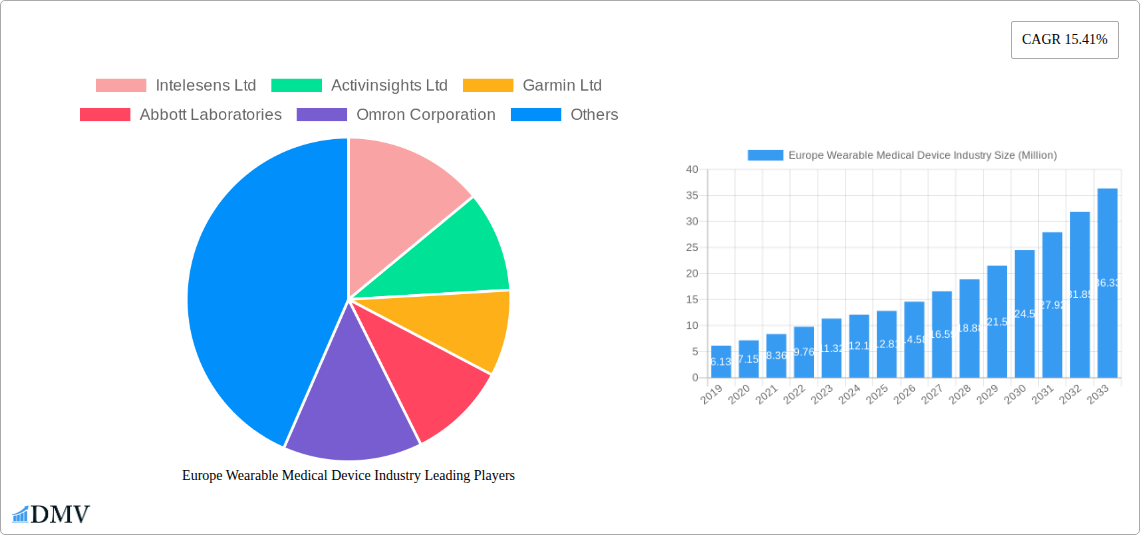

Europe Wearable Medical Device Industry Company Market Share

Gain unparalleled intelligence on the burgeoning Europe wearable medical device market, a sector poised for explosive growth driven by technological innovation and an increasing focus on proactive health management. This comprehensive report dissects the market landscape from 2019 to 2033, with a detailed analysis of the base year 2025 and a robust forecast period of 2025–2033, building upon the historical period of 2019–2024. Delve into critical segments, product types, and applications, understanding the impact of key industry developments and strategic initiatives by leading players such as Intelesens Ltd, Activinsights Ltd, Garmin Ltd, Abbott Laboratories, Omron Corporation, Polar Electro Oy, Fitbit Inc, Nuubo, and Koninklijke Philips NV. This report is your definitive guide to navigating the complexities and capitalizing on the opportunities within the European medical wearables market.

Europe Wearable Medical Device Industry Market Composition & Trends

The Europe wearable medical device industry is characterized by a dynamic market composition influenced by significant innovation catalysts and a maturing regulatory landscape. Market concentration is moderately fragmented, with a steady influx of new entrants alongside established giants. Innovation is being propelled by advancements in sensor technology, miniaturization, and the integration of artificial intelligence for enhanced data analytics. Substitute products, primarily traditional medical devices and manual health tracking methods, are gradually being overshadowed by the convenience and continuous monitoring capabilities of wearables. End-user profiles are diversifying, spanning from health-conscious individuals and athletes to patients managing chronic conditions and elderly populations benefiting from remote patient monitoring. Mergers and acquisitions (M&A) activities are on the rise, driven by companies seeking to expand their product portfolios, gain access to new technologies, and strengthen their market positions. For instance, M&A deals in recent years have collectively reached hundreds of Million, indicating robust investor confidence. Key metrics such as market share distribution and M&A deal values highlight strategic consolidations aimed at capturing a larger share of the growing wearable health tech Europe market.

- Market Concentration: Moderately fragmented with increasing strategic partnerships.

- Innovation Catalysts: AI-driven analytics, advanced sensor technology, miniaturization.

- Regulatory Landscape: Evolving but generally supportive of innovation, with an emphasis on data privacy and device efficacy.

- Substitute Products: Traditional medical devices, manual tracking methods, smartphone apps without dedicated sensors.

- End-User Profiles: Athletes, chronic disease patients, elderly individuals, general wellness enthusiasts, remote patient monitoring programs.

- M&A Activities: Increasing as companies seek to expand capabilities and market reach.

Europe Wearable Medical Device Industry Industry Evolution

The Europe wearable medical device industry has undergone a remarkable evolution, marked by significant market growth trajectories and profound technological advancements. From its nascent stages, the sector has transitioned from basic activity trackers to sophisticated medical-grade devices capable of continuous, non-invasive health monitoring. This evolution has been fueled by a confluence of factors, including increasing consumer awareness of personal health and wellness, the rising prevalence of chronic diseases requiring continuous management, and substantial investments in research and development. The adoption of wearable medical devices in Europe has seen a steady upward trend, with an estimated growth rate of XX% in the historical period, projected to accelerate further in the forecast period. Early iterations focused on steps and calorie counting, but the market has rapidly expanded to encompass a wide array of functionalities.

Technological advancements have been pivotal in this transformation. The miniaturization of sensors has enabled the integration of advanced monitoring capabilities into sleek, user-friendly form factors like watches and wristbands. The development of biosensors for vital sign monitoring, including heart rate, blood oxygen saturation (SpO2), and even electrocardiograms (ECGs), has been particularly impactful. Furthermore, the integration of AI and machine learning algorithms has empowered these devices to provide personalized health insights, early detection of anomalies, and actionable recommendations. This has shifted the paradigm from mere data collection to intelligent health management.

Shifting consumer demands have also played a crucial role. Europeans are increasingly proactive in managing their health, seeking tools that empower them to understand and control their well-being. The convenience of wearable health devices Europe offers, coupled with their ability to seamlessly integrate into daily life, has driven widespread adoption. The COVID-19 pandemic further accelerated this trend, highlighting the importance of remote health monitoring and early detection of symptoms. This has led to a growing demand for devices capable of monitoring sleep patterns, respiratory rate, and stress levels, contributing to the expansion of the sleep monitoring devices and vital sign monitoring devices segments. The market has moved beyond the realm of fitness enthusiasts to encompass individuals seeking to manage conditions like hypertension, diabetes, and cardiovascular diseases. This broadening appeal, supported by increasing data accuracy and clinical validation, positions the Europe wearable medical device market for sustained and significant growth, projected to reach hundreds of Million by 2025.

Leading Regions, Countries, or Segments in Europe Wearable Medical Device Industry

The Europe wearable medical device industry is a multifaceted ecosystem where specific regions, countries, and segments exhibit dominant characteristics, driven by a combination of investment trends, regulatory support, and unmet healthcare needs. Among the device types, Monitoring Devices are currently leading the charge, encompassing a broad spectrum of critical health indicators. Within this category, Vital Sign Monitoring Devices and Sleep Monitoring Devices are experiencing exceptionally high demand, reflecting the growing consumer and healthcare professional interest in continuous health oversight and the management of sleep-related disorders. The application of Sports and Fitness remains a significant market driver, however, Remote Patient Monitoring is rapidly emerging as a key growth area, propelled by aging populations and the need for efficient healthcare delivery. In terms of product type, the Watch form factor continues to dominate due to its versatility and user familiarity, but Wristbands also hold substantial market share.

Several factors contribute to the dominance of these segments. Investment trends in the European medical wearables sector are heavily skewed towards innovations that enhance diagnostic capabilities and enable proactive disease management. Regulatory bodies across Europe, while rigorous, are increasingly recognizing the value of digital health solutions, facilitating the approval and adoption of advanced wearable technologies. Countries like Germany, the UK, and France are at the forefront of this adoption, supported by strong healthcare infrastructures and a significant consumer base willing to invest in health-enhancing technologies.

The dominance of Monitoring Devices is intrinsically linked to the increasing prevalence of lifestyle-related diseases and the shift towards preventive healthcare. Vital Sign Monitoring Devices, such as those tracking heart rate, blood pressure, and blood oxygen levels, are becoming indispensable tools for individuals managing chronic conditions like cardiovascular disease and hypertension. Similarly, the growing awareness of the impact of sleep on overall health has propelled the Sleep Monitoring Devices segment. The ability to accurately track sleep stages, detect disturbances, and provide personalized recommendations offers a compelling value proposition for a wide demographic.

The rapid expansion of Remote Patient Monitoring applications is another critical factor. This is especially true in countries with an aging population and a strain on traditional healthcare services. Wearable medical devices allow healthcare providers to remotely monitor patients' vital signs and health status, reducing hospital readmissions and enabling timely interventions. This trend is further amplified by government initiatives and healthcare provider investments aimed at improving the efficiency and accessibility of healthcare. The Sports and Fitness application, while mature, continues to benefit from technological advancements that provide more sophisticated performance tracking and injury prevention tools, maintaining its strong market presence. The overall market size for these leading segments is projected to reach hundreds of Million by 2025, underscoring their strategic importance in the Europe wearable medical device industry.

- Dominant Device Type: Monitoring Devices (Vital Sign Monitoring Devices, Sleep Monitoring Devices)

- Key Application Growth Area: Remote Patient Monitoring

- Leading Product Type: Watch

- Key Drivers: Aging population, rise of chronic diseases, preventive healthcare focus, technological advancements in sensors, supportive regulatory frameworks in key European nations.

- Investment Trends: Focus on AI-driven diagnostics, non-invasive monitoring, and telehealth integration.

Europe Wearable Medical Device Industry Product Innovations

Product innovations in the Europe wearable medical device industry are rapidly transforming healthcare delivery. Recent advancements focus on enhanced accuracy and new sensing capabilities. For instance, the development of non-invasive glucose monitoring solutions remains a key area of research, promising to revolutionize diabetes management. Innovations in electrocardiograph (ECG) wearables now offer medical-grade accuracy for detecting arrhythmias like atrial fibrillation directly from the wrist, providing early warnings and enabling timely physician intervention. Furthermore, the integration of AI and machine learning algorithms into wearable devices is leading to more personalized health insights and predictive analytics, moving beyond simple data logging to actionable health recommendations. The wearable ECG monitors Europe market, for example, is witnessing significant growth due to these advancements.

Propelling Factors for Europe Wearable Medical Device Industry Growth

The Europe wearable medical device industry is propelled by a confluence of powerful factors. Technologically, the continuous miniaturization of sensors, advancements in battery life, and the integration of AI for data interpretation are driving innovation and expanding device capabilities. Economically, increasing disposable incomes and a growing willingness among consumers to invest in personal health and wellness are fueling market demand. Regulatory bodies are also playing a supportive role by creating pathways for the approval of innovative medical wearables, fostering a favorable environment for market expansion. The rising prevalence of chronic diseases like cardiovascular disease and diabetes necessitates continuous monitoring, creating a substantial and growing market for wearable solutions. Government initiatives promoting telehealth and remote patient monitoring further amplify this growth, making medical wearable devices Europe a critical component of modern healthcare.

Obstacles in the Europe Wearable Medical Device Industry Market

Despite its promising trajectory, the Europe wearable medical device industry faces several obstacles. Regulatory hurdles, particularly concerning data privacy and the stringent approval processes for medical-grade devices, can slow down market entry and product adoption. Supply chain disruptions, as evidenced in recent global events, can impact the availability and cost of essential components. Furthermore, fierce competitive pressures from both established technology giants and emerging startups necessitate constant innovation and strategic pricing. Consumer trust and the perceived accuracy of data from wearables are also critical factors that need continuous reinforcement through rigorous clinical validation and transparent communication. The significant upfront cost for some advanced wearable diagnostic devices Europe can also be a barrier to widespread adoption for certain consumer segments.

Future Opportunities in Europe Wearable Medical Device Industry

The Europe wearable medical device industry is brimming with future opportunities. The expansion of Remote Patient Monitoring platforms presents a significant avenue for growth, especially for managing chronic conditions and post-operative care. The burgeoning field of personalized medicine, where wearables can provide continuous data streams for tailoring treatments, offers immense potential. Furthermore, the integration of wearables with broader digital health ecosystems, including electronic health records and telehealth services, will create more comprehensive patient care solutions. Emerging technologies like advanced biosensors for non-invasive monitoring of a wider range of biomarkers, such as stress hormones and hydration levels, will unlock new applications and market segments, driving further growth in the wearable health tech Europe market.

Major Players in the Europe Wearable Medical Device Industry Ecosystem

- Intelesens Ltd

- Activinsights Ltd

- Garmin Ltd

- Abbott Laboratories

- Omron Corporation

- Polar Electro Oy

- Fitbit Inc

- Nuubo

- Koninklijke Philips NV

Key Developments in Europe Wearable Medical Device Industry Industry

- March 2022: Infineon Technologies AG, in collaboration with Sleepiz AG, launched Infineon XENSIV 60 GHz radar technology. Integrated into smart home and healthcare devices, this technology offers a great opportunity for healthcare applications by enabling accurate, non-contact measurement of vital signs such as heartbeat and breathing rate.

- February 2022: Oppo launched the Oppo Watch Free in the European market. This fitness tracker boasts monitoring for over 100 sports modes, including specialized activities like cricket, skiing, and badminton. It also offers automatic tracking for common exercises, SpO2 sensing for blood oxygen levels, a heart rate monitor with abnormal alerts, and advanced sleep tracking with snoring detection capabilities.

Strategic Europe Wearable Medical Device Industry Market Forecast

The strategic Europe wearable medical device market forecast indicates robust growth, driven by an increasing focus on preventive healthcare and the demand for sophisticated remote patient monitoring solutions. Advancements in sensor technology, particularly for non-invasive biomarker detection, alongside AI-powered analytics, will unlock new diagnostic and therapeutic applications. The growing integration of these devices into comprehensive digital health ecosystems and the supportive regulatory environment for digital therapeutics will further accelerate market penetration. The rising prevalence of chronic conditions and an aging population will continue to be significant market catalysts. Emerging opportunities in personalized medicine and proactive health management will solidify the Europe wearable medical device market's position as a critical component of future healthcare delivery, projected to reach hundreds of Million by 2025.

Europe Wearable Medical Device Industry Segmentation

-

1. Device Type

-

1.1. Monitoring Devices

- 1.1.1. Vital Sign Monitoring Devices

- 1.1.2. Sleep Monitoring Devices

- 1.1.3. Electrocardiographs, Fetal and Obstetric Devices

- 1.1.4. Neuromonitoring Devices

-

1.2. Therapeutic Devices

- 1.2.1. Pain Management Devices

- 1.2.2. Rehabilitation Devices

- 1.2.3. Respiratory Therapy Devices

- 1.2.4. Other Theraputic Devices

-

1.1. Monitoring Devices

-

2. Application

- 2.1. Sports and Fitness

- 2.2. Remote Patient Monitoring

- 2.3. Home Healthcare

-

3. Product Type

- 3.1. Watch

- 3.2. Wristband

- 3.3. Ear Wear

- 3.4. Other Product Types

Europe Wearable Medical Device Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Wearable Medical Device Industry Regional Market Share

Geographic Coverage of Europe Wearable Medical Device Industry

Europe Wearable Medical Device Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements and Innovation; Increasing Health Awareness; Ease of Use and Interpretation of Data

- 3.3. Market Restrains

- 3.3.1. Lack of Reimbursement Policies

- 3.4. Market Trends

- 3.4.1. Remote Patient Monitoring Segment is Expected to Grow Rapidly Over the Forecast Period in the Europe Wearable Medical Devices Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Wearable Medical Device Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Monitoring Devices

- 5.1.1.1. Vital Sign Monitoring Devices

- 5.1.1.2. Sleep Monitoring Devices

- 5.1.1.3. Electrocardiographs, Fetal and Obstetric Devices

- 5.1.1.4. Neuromonitoring Devices

- 5.1.2. Therapeutic Devices

- 5.1.2.1. Pain Management Devices

- 5.1.2.2. Rehabilitation Devices

- 5.1.2.3. Respiratory Therapy Devices

- 5.1.2.4. Other Theraputic Devices

- 5.1.1. Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sports and Fitness

- 5.2.2. Remote Patient Monitoring

- 5.2.3. Home Healthcare

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Watch

- 5.3.2. Wristband

- 5.3.3. Ear Wear

- 5.3.4. Other Product Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Spain

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Germany Europe Wearable Medical Device Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Monitoring Devices

- 6.1.1.1. Vital Sign Monitoring Devices

- 6.1.1.2. Sleep Monitoring Devices

- 6.1.1.3. Electrocardiographs, Fetal and Obstetric Devices

- 6.1.1.4. Neuromonitoring Devices

- 6.1.2. Therapeutic Devices

- 6.1.2.1. Pain Management Devices

- 6.1.2.2. Rehabilitation Devices

- 6.1.2.3. Respiratory Therapy Devices

- 6.1.2.4. Other Theraputic Devices

- 6.1.1. Monitoring Devices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Sports and Fitness

- 6.2.2. Remote Patient Monitoring

- 6.2.3. Home Healthcare

- 6.3. Market Analysis, Insights and Forecast - by Product Type

- 6.3.1. Watch

- 6.3.2. Wristband

- 6.3.3. Ear Wear

- 6.3.4. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. United Kingdom Europe Wearable Medical Device Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Monitoring Devices

- 7.1.1.1. Vital Sign Monitoring Devices

- 7.1.1.2. Sleep Monitoring Devices

- 7.1.1.3. Electrocardiographs, Fetal and Obstetric Devices

- 7.1.1.4. Neuromonitoring Devices

- 7.1.2. Therapeutic Devices

- 7.1.2.1. Pain Management Devices

- 7.1.2.2. Rehabilitation Devices

- 7.1.2.3. Respiratory Therapy Devices

- 7.1.2.4. Other Theraputic Devices

- 7.1.1. Monitoring Devices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Sports and Fitness

- 7.2.2. Remote Patient Monitoring

- 7.2.3. Home Healthcare

- 7.3. Market Analysis, Insights and Forecast - by Product Type

- 7.3.1. Watch

- 7.3.2. Wristband

- 7.3.3. Ear Wear

- 7.3.4. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. France Europe Wearable Medical Device Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Monitoring Devices

- 8.1.1.1. Vital Sign Monitoring Devices

- 8.1.1.2. Sleep Monitoring Devices

- 8.1.1.3. Electrocardiographs, Fetal and Obstetric Devices

- 8.1.1.4. Neuromonitoring Devices

- 8.1.2. Therapeutic Devices

- 8.1.2.1. Pain Management Devices

- 8.1.2.2. Rehabilitation Devices

- 8.1.2.3. Respiratory Therapy Devices

- 8.1.2.4. Other Theraputic Devices

- 8.1.1. Monitoring Devices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Sports and Fitness

- 8.2.2. Remote Patient Monitoring

- 8.2.3. Home Healthcare

- 8.3. Market Analysis, Insights and Forecast - by Product Type

- 8.3.1. Watch

- 8.3.2. Wristband

- 8.3.3. Ear Wear

- 8.3.4. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Italy Europe Wearable Medical Device Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Monitoring Devices

- 9.1.1.1. Vital Sign Monitoring Devices

- 9.1.1.2. Sleep Monitoring Devices

- 9.1.1.3. Electrocardiographs, Fetal and Obstetric Devices

- 9.1.1.4. Neuromonitoring Devices

- 9.1.2. Therapeutic Devices

- 9.1.2.1. Pain Management Devices

- 9.1.2.2. Rehabilitation Devices

- 9.1.2.3. Respiratory Therapy Devices

- 9.1.2.4. Other Theraputic Devices

- 9.1.1. Monitoring Devices

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Sports and Fitness

- 9.2.2. Remote Patient Monitoring

- 9.2.3. Home Healthcare

- 9.3. Market Analysis, Insights and Forecast - by Product Type

- 9.3.1. Watch

- 9.3.2. Wristband

- 9.3.3. Ear Wear

- 9.3.4. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Spain Europe Wearable Medical Device Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. Monitoring Devices

- 10.1.1.1. Vital Sign Monitoring Devices

- 10.1.1.2. Sleep Monitoring Devices

- 10.1.1.3. Electrocardiographs, Fetal and Obstetric Devices

- 10.1.1.4. Neuromonitoring Devices

- 10.1.2. Therapeutic Devices

- 10.1.2.1. Pain Management Devices

- 10.1.2.2. Rehabilitation Devices

- 10.1.2.3. Respiratory Therapy Devices

- 10.1.2.4. Other Theraputic Devices

- 10.1.1. Monitoring Devices

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Sports and Fitness

- 10.2.2. Remote Patient Monitoring

- 10.2.3. Home Healthcare

- 10.3. Market Analysis, Insights and Forecast - by Product Type

- 10.3.1. Watch

- 10.3.2. Wristband

- 10.3.3. Ear Wear

- 10.3.4. Other Product Types

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Rest of Europe Europe Wearable Medical Device Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 11.1.1. Monitoring Devices

- 11.1.1.1. Vital Sign Monitoring Devices

- 11.1.1.2. Sleep Monitoring Devices

- 11.1.1.3. Electrocardiographs, Fetal and Obstetric Devices

- 11.1.1.4. Neuromonitoring Devices

- 11.1.2. Therapeutic Devices

- 11.1.2.1. Pain Management Devices

- 11.1.2.2. Rehabilitation Devices

- 11.1.2.3. Respiratory Therapy Devices

- 11.1.2.4. Other Theraputic Devices

- 11.1.1. Monitoring Devices

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Sports and Fitness

- 11.2.2. Remote Patient Monitoring

- 11.2.3. Home Healthcare

- 11.3. Market Analysis, Insights and Forecast - by Product Type

- 11.3.1. Watch

- 11.3.2. Wristband

- 11.3.3. Ear Wear

- 11.3.4. Other Product Types

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Intelesens Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Activinsights Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Garmin Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Abbott Laboratories

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Omron Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Polar Electro Oy*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Fitbit Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nuubo

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Koninklinje Philips NV

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Intelesens Ltd

List of Figures

- Figure 1: Europe Wearable Medical Device Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Wearable Medical Device Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Wearable Medical Device Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Europe Wearable Medical Device Industry Volume K Units Forecast, by Device Type 2020 & 2033

- Table 3: Europe Wearable Medical Device Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Europe Wearable Medical Device Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 5: Europe Wearable Medical Device Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Europe Wearable Medical Device Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 7: Europe Wearable Medical Device Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Wearable Medical Device Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Europe Wearable Medical Device Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 10: Europe Wearable Medical Device Industry Volume K Units Forecast, by Device Type 2020 & 2033

- Table 11: Europe Wearable Medical Device Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Europe Wearable Medical Device Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 13: Europe Wearable Medical Device Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Europe Wearable Medical Device Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 15: Europe Wearable Medical Device Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Wearable Medical Device Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Europe Wearable Medical Device Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 18: Europe Wearable Medical Device Industry Volume K Units Forecast, by Device Type 2020 & 2033

- Table 19: Europe Wearable Medical Device Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Europe Wearable Medical Device Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 21: Europe Wearable Medical Device Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Europe Wearable Medical Device Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: Europe Wearable Medical Device Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Wearable Medical Device Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe Wearable Medical Device Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 26: Europe Wearable Medical Device Industry Volume K Units Forecast, by Device Type 2020 & 2033

- Table 27: Europe Wearable Medical Device Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Europe Wearable Medical Device Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 29: Europe Wearable Medical Device Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Europe Wearable Medical Device Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 31: Europe Wearable Medical Device Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Europe Wearable Medical Device Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Europe Wearable Medical Device Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 34: Europe Wearable Medical Device Industry Volume K Units Forecast, by Device Type 2020 & 2033

- Table 35: Europe Wearable Medical Device Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Europe Wearable Medical Device Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 37: Europe Wearable Medical Device Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Europe Wearable Medical Device Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 39: Europe Wearable Medical Device Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Europe Wearable Medical Device Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Europe Wearable Medical Device Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 42: Europe Wearable Medical Device Industry Volume K Units Forecast, by Device Type 2020 & 2033

- Table 43: Europe Wearable Medical Device Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Europe Wearable Medical Device Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 45: Europe Wearable Medical Device Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 46: Europe Wearable Medical Device Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 47: Europe Wearable Medical Device Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Europe Wearable Medical Device Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 49: Europe Wearable Medical Device Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 50: Europe Wearable Medical Device Industry Volume K Units Forecast, by Device Type 2020 & 2033

- Table 51: Europe Wearable Medical Device Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 52: Europe Wearable Medical Device Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 53: Europe Wearable Medical Device Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 54: Europe Wearable Medical Device Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 55: Europe Wearable Medical Device Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Europe Wearable Medical Device Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Wearable Medical Device Industry?

The projected CAGR is approximately 15.41%.

2. Which companies are prominent players in the Europe Wearable Medical Device Industry?

Key companies in the market include Intelesens Ltd, Activinsights Ltd, Garmin Ltd, Abbott Laboratories, Omron Corporation, Polar Electro Oy*List Not Exhaustive, Fitbit Inc, Nuubo, Koninklinje Philips NV.

3. What are the main segments of the Europe Wearable Medical Device Industry?

The market segments include Device Type, Application, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements and Innovation; Increasing Health Awareness; Ease of Use and Interpretation of Data.

6. What are the notable trends driving market growth?

Remote Patient Monitoring Segment is Expected to Grow Rapidly Over the Forecast Period in the Europe Wearable Medical Devices Market.

7. Are there any restraints impacting market growth?

Lack of Reimbursement Policies.

8. Can you provide examples of recent developments in the market?

IN March 2022, Infineon Technologies AG in collaboration with Sleepiz AG launched Infineon XENSIV 60 GHz radar technology, integrated into smart home and healthcare devices, that offers a great opportunity for healthcare applications as they allow to accurately measure vital signs such as heartbeat and breathing rate without touching the body.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Wearable Medical Device Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Wearable Medical Device Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Wearable Medical Device Industry?

To stay informed about further developments, trends, and reports in the Europe Wearable Medical Device Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence