Key Insights

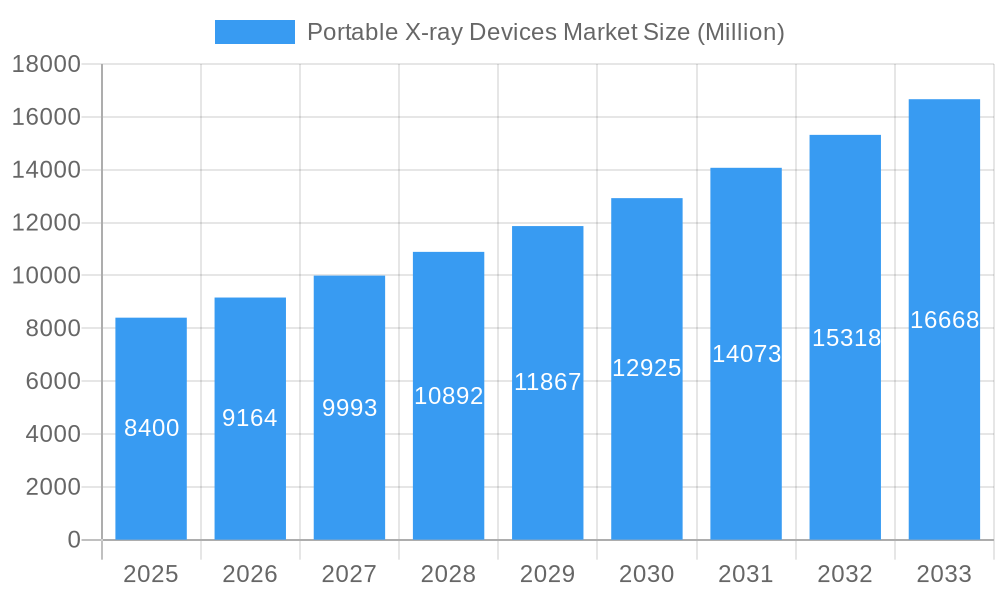

The global Portable X-ray Devices Market is poised for robust expansion, currently valued at an estimated $8.40 billion. This dynamic sector is projected to grow at a compound annual growth rate (CAGR) of 9.18% from 2025 to 2033, indicating substantial market opportunities. This impressive growth trajectory is fueled by several key drivers, including the increasing demand for advanced diagnostic imaging in remote and underserved areas, the growing prevalence of chronic diseases requiring frequent monitoring, and the continuous technological advancements leading to more compact, user-friendly, and sophisticated portable X-ray systems. The shift towards decentralized healthcare models and the rising adoption of these devices in emergency medical services and military applications further bolster market expansion. Furthermore, the increasing healthcare expenditure globally and the growing awareness among healthcare providers about the benefits of portable X-ray solutions in improving patient outcomes and operational efficiency are significant growth catalysts.

Portable X-ray Devices Market Market Size (In Billion)

The market is segmented across various technologies, applications, and modalities, offering diverse avenues for innovation and market penetration. Analog X-ray and Digital X-ray technologies both contribute to the market, with a notable trend towards the increasing adoption of digital solutions due to their superior image quality, reduced radiation exposure, and enhanced workflow efficiency. Key applications include dental X-ray, mammography, chest X-ray, and abdominal X-ray, each presenting unique growth potentials. The mobile X-ray devices and handheld X-ray devices segments are expected to witness particularly strong demand, driven by their adaptability in point-of-care settings and their ability to provide immediate diagnostic capabilities. Leading global companies like GE Healthcare, Siemens Healthineers AG, and Koninklijke Philips NV are at the forefront, investing heavily in research and development to introduce innovative products and expand their market reach across major regions such as North America, Europe, and the Asia Pacific. However, certain restraints, such as the high initial cost of advanced portable X-ray systems and stringent regulatory approvals for medical devices, may pose challenges to the market's unhindered growth.

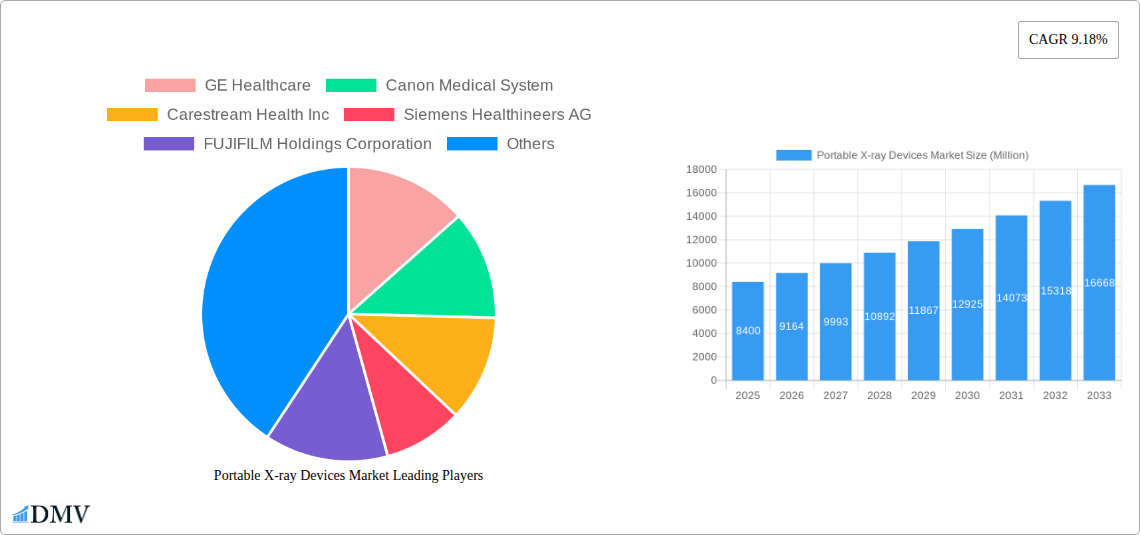

Portable X-ray Devices Market Company Market Share

Embark on a definitive exploration of the portable X-ray devices market, a sector experiencing robust expansion driven by technological innovation and escalating demand for accessible diagnostic imaging. This comprehensive report, meticulously crafted for the 2019–2033 study period, with a base year of 2025 and an extensive forecast period of 2025–2033, delves deep into market dynamics, emerging trends, and strategic opportunities. We provide granular insights into digital X-ray adoption, the burgeoning handheld X-ray devices segment, and the critical role of these technologies in dental X-ray, chest X-ray, and beyond. With an estimated market valuation set to reach $15,500 Million by 2025, and projected to surge to $28,200 Million by 2033, growing at a CAGR of 7.8%, this report is an indispensable resource for stakeholders seeking to navigate this dynamic landscape.

Portable X-ray Devices Market Market Composition & Trends

The portable X-ray devices market exhibits a moderately concentrated landscape, with key players like GE Healthcare, Canon Medical System, Carestream Health Inc, Siemens Healthineers AG, FUJIFILM Holdings Corporation, Koninklijke Philips NV, Envista Holdings Corporation (KaVo Dental GmbH), Shimadzu Corporations, and MinXray vying for market share. Innovation remains a paramount catalyst, with continuous advancements in digital X-ray technology and the development of more compact and efficient handheld X-ray devices. Regulatory frameworks, while crucial for ensuring safety and efficacy, also present a complex operating environment, influencing product development and market entry strategies. Substitute products, such as ultrasound and CT scans, exist; however, the unique advantages of portability, cost-effectiveness, and immediate diagnostic capabilities of X-ray devices ensure their continued relevance. End-user profiles span a diverse spectrum, including hospitals, clinics, dental practices, veterinary facilities, and emergency medical services, each with distinct imaging needs. Mergers and acquisitions (M&A) activities are anticipated to shape market consolidation, with recent deals in the broader medical imaging sector suggesting potential for strategic alliances and market expansion. The market share distribution is currently led by Digital X-ray technology, which is projected to command over 65% of the market by 2025, driven by its superior image quality and workflow efficiency compared to analog systems. M&A deal values in the medical imaging sector have ranged from $50 Million to over $500 Million in recent years, indicating significant investment activity.

Portable X-ray Devices Market Industry Evolution

The portable X-ray devices market has undergone a remarkable transformation, evolving from cumbersome analog systems to sophisticated, high-resolution digital X-ray solutions. The initial phase of the historical period (2019–2021) saw a steady but incremental adoption of portable units, primarily in specialized applications. However, the period between 2022 and 2024 witnessed an acceleration in growth, fueled by increased healthcare spending, a growing emphasis on point-of-care diagnostics, and the invaluable role these devices played during global health crises for rapid patient assessment. The shift towards digital X-ray technology has been a defining characteristic of this evolution. Digital detectors offer significant advantages over traditional film-based systems, including immediate image acquisition, enhanced image processing capabilities, reduced radiation exposure for patients, and streamlined digital archiving and retrieval. This transition has been instrumental in improving diagnostic accuracy and workflow efficiency across various medical disciplines.

Consumer demand has also played a pivotal role. Healthcare providers are increasingly seeking imaging solutions that offer greater flexibility, mobility, and affordability. Portable X-ray devices directly address these needs, enabling imaging at the patient's bedside, in remote locations, and in situations where moving a patient to a fixed X-ray suite is impractical or poses a risk. This demand is particularly pronounced in applications like chest X-ray for critical care units and dental X-ray for chairside diagnostics. The market has responded with a proliferation of innovative designs, from compact handheld X-ray devices for rapid screening to more robust mobile units capable of performing a wider range of diagnostic procedures. The average growth rate for the portable X-ray devices market in the historical period (2019–2024) was approximately 6.5% CAGR, with a notable surge in the last two years of this period due to heightened demand for decentralized imaging solutions. Adoption metrics for digital X-ray in portable units have climbed from approximately 55% in 2019 to an estimated 70% by 2024, underscoring the market's technological pivot.

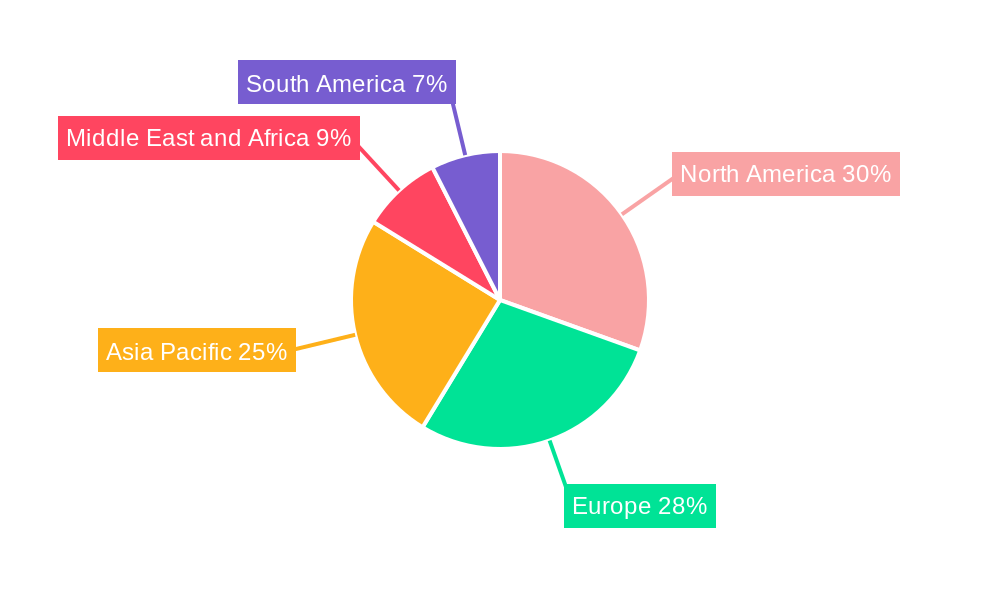

Leading Regions, Countries, or Segments in Portable X-ray Devices Market

North America currently stands as the dominant region in the portable X-ray devices market, propelled by substantial investments in healthcare infrastructure, a high prevalence of chronic diseases necessitating advanced diagnostic tools, and a strong presence of leading medical device manufacturers. The United States, in particular, leads the charge, with its advanced healthcare system and a proactive approach to adopting cutting-edge medical technologies.

- Dominant Segments and Their Drivers:

- Technology: Digital X-ray is the undisputed leader within the technology segment. Its dominance is driven by:

- Superior Image Quality and Resolution: Enabling more accurate diagnoses.

- Reduced Radiation Exposure: Enhancing patient safety and operator comfort.

- Faster Image Acquisition and Processing: Improving workflow efficiency in busy clinical settings.

- Digital Archiving and Connectivity: Facilitating easy sharing and integration with Picture Archiving and Communication Systems (PACS).

- Cost-Effectiveness over Time: Eliminating recurring costs associated with film and processing chemicals.

- Application: The Chest X-ray application segment holds significant sway, primarily due to:

- High Incidence of Respiratory Diseases: Including pneumonia, tuberculosis, and COPD, which require frequent imaging.

- Critical Care and Emergency Medicine: Essential for rapid assessment of lung conditions in intensive care units and emergency departments.

- Public Health Initiatives: Screening programs for infectious diseases often rely on portable chest X-ray units.

- Technological Advancements: Improved portability and imaging capabilities for use in diverse environments.

- Modality: Within the modality segment, Mobile X-ray Devices are currently leading, supported by:

- Versatility in Imaging: Capable of performing a wide range of diagnostic procedures across different body parts.

- Ease of Transportation: Designed for movement within hospitals, clinics, and even to remote locations.

- Integration with DR Detectors: Offering the benefits of digital imaging in a mobile format.

- Growing Demand in Veterinary Medicine: Providing imaging capabilities for animals at their stable or farm.

- Technology: Digital X-ray is the undisputed leader within the technology segment. Its dominance is driven by:

Europe follows closely, driven by an aging population, increasing healthcare expenditure, and stringent regulations that encourage the adoption of advanced diagnostic imaging techniques. Asia Pacific is emerging as a high-growth region, fueled by expanding healthcare access, increasing disposable incomes, and a burgeoning medical tourism industry. Investment trends in North America alone for advanced medical imaging equipment have surpassed $5,000 Million annually, with a significant portion allocated to portable solutions. Regulatory support in regions like the EU, through directives promoting innovation and patient care, further bolsters the market.

Portable X-ray Devices Market Product Innovations

Recent product innovations in the portable X-ray devices market are revolutionizing diagnostic capabilities. The development of lighter, more ergonomic handheld X-ray devices is enhancing usability and reducing operator fatigue. Advancements in battery technology are enabling longer operational times, crucial for field use and emergency response. Furthermore, the integration of Artificial Intelligence (AI) for image analysis and interpretation is beginning to enhance diagnostic accuracy and speed. A prime example is the FUJIFILM Holdings Corporation's FDR Cross, a hybrid C-arm and portable X-ray device launched in July 2022, offering superior fluoroscopic and static X-ray imaging for surgical and medical procedures, demonstrating a clear trend towards multi-functional portable imaging solutions.

Propelling Factors for Portable X-ray Devices Market Growth

The portable X-ray devices market is propelled by a confluence of powerful factors. Technological advancements, particularly in digital detector technology and miniaturization, have led to more compact, lightweight, and user-friendly devices. The increasing global prevalence of chronic diseases and the need for rapid diagnostics at the point-of-care are driving demand for accessible imaging solutions. Furthermore, growing healthcare expenditure in emerging economies and government initiatives aimed at improving healthcare access in rural and underserved areas are creating significant growth opportunities. The cost-effectiveness of portable X-ray devices compared to fixed installations also makes them an attractive option for budget-conscious healthcare providers.

Obstacles in the Portable X-ray Devices Market Market

Despite the promising growth trajectory, the portable X-ray devices market faces several obstacles. Stringent regulatory approvals for medical devices can lead to lengthy product launch timelines and increased development costs. Supply chain disruptions, particularly for critical electronic components, can impact production and availability. The high initial cost of advanced digital portable X-ray systems can also be a barrier for smaller clinics and healthcare facilities, especially in price-sensitive markets. Moreover, the need for specialized training for operators to ensure optimal image quality and patient safety can pose a challenge to widespread adoption.

Future Opportunities in Portable X-ray Devices Market

The future of the portable X-ray devices market is replete with exciting opportunities. The integration of AI and machine learning algorithms for automated image analysis and diagnostic support holds immense potential to enhance efficiency and accuracy. The expanding use of portable X-ray devices in veterinary medicine, home healthcare, and emergency response scenarios presents new market avenues. Furthermore, the development of even more compact and advanced handheld X-ray devices with extended battery life and improved imaging capabilities will cater to the growing demand for ultra-portable diagnostic tools. The exploration of new applications in specialized fields like industrial radiography and security screening could also open up novel revenue streams.

Major Players in the Portable X-ray Devices Market Ecosystem

- GE Healthcare

- Canon Medical System

- Carestream Health Inc

- Siemens Healthineers AG

- FUJIFILM Holdings Corporation

- Koninklijke Philips NV

- Envista Holdings Corporation (KaVo Dental GmbH)

- Shimadzu Corporations

- MinXray

Key Developments in Portable X-ray Devices Market Industry

- July 2022: Fujifilm Europe launched a new hybrid C-arm and portable x-ray device, the FDR Cross, designed to offer high-quality fluoroscopic and static x-ray images during surgery and other medical procedures.

- March 2022: Konica Minolta Inc. (Konica Minolta) launched AeroDR TX m01 in Japan. It is a portable X-ray system featuring a wireless dynamic digital radiography function, enhancing imaging flexibility and patient comfort.

Strategic Portable X-ray Devices Market Market Forecast

The strategic outlook for the portable X-ray devices market is exceptionally positive. Driven by relentless innovation in digital X-ray technology and the increasing global demand for accessible, point-of-care diagnostics, the market is poised for substantial expansion. The growing emphasis on early disease detection, coupled with the expanding healthcare infrastructure in emerging economies, will further fuel market growth. The development of smarter, more connected handheld X-ray devices integrated with AI capabilities will unlock new levels of diagnostic efficiency and accuracy, solidifying the indispensable role of portable X-ray solutions in modern healthcare delivery.

Portable X-ray Devices Market Segmentation

-

1. Technology

- 1.1. Analog X-ray

- 1.2. Digital X-ray

-

2. Application

- 2.1. Dental X-ray

- 2.2. Mammography

- 2.3. Chest X-ray

- 2.4. Abdomen X-ray

-

3. Modality

- 3.1. Handheld X-ray Devices

- 3.2. Mobile X-ray Devices

Portable X-ray Devices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Portable X-ray Devices Market Regional Market Share

Geographic Coverage of Portable X-ray Devices Market

Portable X-ray Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements; Growing Geriatric Population and Increasing Prevalence of Vascular Diseases; Huge Funding for R&D of Portable Technologies by Private Players and Governments

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Scenario; High Risk of Radiation Exposure

- 3.4. Market Trends

- 3.4.1. Digital X-ray Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Portable X-ray Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Analog X-ray

- 5.1.2. Digital X-ray

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dental X-ray

- 5.2.2. Mammography

- 5.2.3. Chest X-ray

- 5.2.4. Abdomen X-ray

- 5.3. Market Analysis, Insights and Forecast - by Modality

- 5.3.1. Handheld X-ray Devices

- 5.3.2. Mobile X-ray Devices

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Portable X-ray Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Analog X-ray

- 6.1.2. Digital X-ray

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dental X-ray

- 6.2.2. Mammography

- 6.2.3. Chest X-ray

- 6.2.4. Abdomen X-ray

- 6.3. Market Analysis, Insights and Forecast - by Modality

- 6.3.1. Handheld X-ray Devices

- 6.3.2. Mobile X-ray Devices

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Portable X-ray Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Analog X-ray

- 7.1.2. Digital X-ray

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dental X-ray

- 7.2.2. Mammography

- 7.2.3. Chest X-ray

- 7.2.4. Abdomen X-ray

- 7.3. Market Analysis, Insights and Forecast - by Modality

- 7.3.1. Handheld X-ray Devices

- 7.3.2. Mobile X-ray Devices

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Portable X-ray Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Analog X-ray

- 8.1.2. Digital X-ray

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dental X-ray

- 8.2.2. Mammography

- 8.2.3. Chest X-ray

- 8.2.4. Abdomen X-ray

- 8.3. Market Analysis, Insights and Forecast - by Modality

- 8.3.1. Handheld X-ray Devices

- 8.3.2. Mobile X-ray Devices

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Middle East and Africa Portable X-ray Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Analog X-ray

- 9.1.2. Digital X-ray

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dental X-ray

- 9.2.2. Mammography

- 9.2.3. Chest X-ray

- 9.2.4. Abdomen X-ray

- 9.3. Market Analysis, Insights and Forecast - by Modality

- 9.3.1. Handheld X-ray Devices

- 9.3.2. Mobile X-ray Devices

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. South America Portable X-ray Devices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Analog X-ray

- 10.1.2. Digital X-ray

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Dental X-ray

- 10.2.2. Mammography

- 10.2.3. Chest X-ray

- 10.2.4. Abdomen X-ray

- 10.3. Market Analysis, Insights and Forecast - by Modality

- 10.3.1. Handheld X-ray Devices

- 10.3.2. Mobile X-ray Devices

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GE Healthcare

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Canon Medical System

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Carestream Health Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens Healthineers AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FUJIFILM Holdings Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Koninklijke Philips NV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Envista Holdings Corporation (KaVo Dental GmbH)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shimadzu Corporations

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MinXray

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 GE Healthcare

List of Figures

- Figure 1: Global Portable X-ray Devices Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Portable X-ray Devices Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Portable X-ray Devices Market Revenue (Million), by Technology 2025 & 2033

- Figure 4: North America Portable X-ray Devices Market Volume (K Unit), by Technology 2025 & 2033

- Figure 5: North America Portable X-ray Devices Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Portable X-ray Devices Market Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America Portable X-ray Devices Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Portable X-ray Devices Market Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Portable X-ray Devices Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Portable X-ray Devices Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Portable X-ray Devices Market Revenue (Million), by Modality 2025 & 2033

- Figure 12: North America Portable X-ray Devices Market Volume (K Unit), by Modality 2025 & 2033

- Figure 13: North America Portable X-ray Devices Market Revenue Share (%), by Modality 2025 & 2033

- Figure 14: North America Portable X-ray Devices Market Volume Share (%), by Modality 2025 & 2033

- Figure 15: North America Portable X-ray Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Portable X-ray Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Portable X-ray Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Portable X-ray Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Portable X-ray Devices Market Revenue (Million), by Technology 2025 & 2033

- Figure 20: Europe Portable X-ray Devices Market Volume (K Unit), by Technology 2025 & 2033

- Figure 21: Europe Portable X-ray Devices Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Europe Portable X-ray Devices Market Volume Share (%), by Technology 2025 & 2033

- Figure 23: Europe Portable X-ray Devices Market Revenue (Million), by Application 2025 & 2033

- Figure 24: Europe Portable X-ray Devices Market Volume (K Unit), by Application 2025 & 2033

- Figure 25: Europe Portable X-ray Devices Market Revenue Share (%), by Application 2025 & 2033

- Figure 26: Europe Portable X-ray Devices Market Volume Share (%), by Application 2025 & 2033

- Figure 27: Europe Portable X-ray Devices Market Revenue (Million), by Modality 2025 & 2033

- Figure 28: Europe Portable X-ray Devices Market Volume (K Unit), by Modality 2025 & 2033

- Figure 29: Europe Portable X-ray Devices Market Revenue Share (%), by Modality 2025 & 2033

- Figure 30: Europe Portable X-ray Devices Market Volume Share (%), by Modality 2025 & 2033

- Figure 31: Europe Portable X-ray Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Portable X-ray Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Portable X-ray Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Portable X-ray Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Portable X-ray Devices Market Revenue (Million), by Technology 2025 & 2033

- Figure 36: Asia Pacific Portable X-ray Devices Market Volume (K Unit), by Technology 2025 & 2033

- Figure 37: Asia Pacific Portable X-ray Devices Market Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Asia Pacific Portable X-ray Devices Market Volume Share (%), by Technology 2025 & 2033

- Figure 39: Asia Pacific Portable X-ray Devices Market Revenue (Million), by Application 2025 & 2033

- Figure 40: Asia Pacific Portable X-ray Devices Market Volume (K Unit), by Application 2025 & 2033

- Figure 41: Asia Pacific Portable X-ray Devices Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Asia Pacific Portable X-ray Devices Market Volume Share (%), by Application 2025 & 2033

- Figure 43: Asia Pacific Portable X-ray Devices Market Revenue (Million), by Modality 2025 & 2033

- Figure 44: Asia Pacific Portable X-ray Devices Market Volume (K Unit), by Modality 2025 & 2033

- Figure 45: Asia Pacific Portable X-ray Devices Market Revenue Share (%), by Modality 2025 & 2033

- Figure 46: Asia Pacific Portable X-ray Devices Market Volume Share (%), by Modality 2025 & 2033

- Figure 47: Asia Pacific Portable X-ray Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Portable X-ray Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Portable X-ray Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Portable X-ray Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Portable X-ray Devices Market Revenue (Million), by Technology 2025 & 2033

- Figure 52: Middle East and Africa Portable X-ray Devices Market Volume (K Unit), by Technology 2025 & 2033

- Figure 53: Middle East and Africa Portable X-ray Devices Market Revenue Share (%), by Technology 2025 & 2033

- Figure 54: Middle East and Africa Portable X-ray Devices Market Volume Share (%), by Technology 2025 & 2033

- Figure 55: Middle East and Africa Portable X-ray Devices Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa Portable X-ray Devices Market Volume (K Unit), by Application 2025 & 2033

- Figure 57: Middle East and Africa Portable X-ray Devices Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Portable X-ray Devices Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Portable X-ray Devices Market Revenue (Million), by Modality 2025 & 2033

- Figure 60: Middle East and Africa Portable X-ray Devices Market Volume (K Unit), by Modality 2025 & 2033

- Figure 61: Middle East and Africa Portable X-ray Devices Market Revenue Share (%), by Modality 2025 & 2033

- Figure 62: Middle East and Africa Portable X-ray Devices Market Volume Share (%), by Modality 2025 & 2033

- Figure 63: Middle East and Africa Portable X-ray Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Portable X-ray Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Portable X-ray Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Portable X-ray Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Portable X-ray Devices Market Revenue (Million), by Technology 2025 & 2033

- Figure 68: South America Portable X-ray Devices Market Volume (K Unit), by Technology 2025 & 2033

- Figure 69: South America Portable X-ray Devices Market Revenue Share (%), by Technology 2025 & 2033

- Figure 70: South America Portable X-ray Devices Market Volume Share (%), by Technology 2025 & 2033

- Figure 71: South America Portable X-ray Devices Market Revenue (Million), by Application 2025 & 2033

- Figure 72: South America Portable X-ray Devices Market Volume (K Unit), by Application 2025 & 2033

- Figure 73: South America Portable X-ray Devices Market Revenue Share (%), by Application 2025 & 2033

- Figure 74: South America Portable X-ray Devices Market Volume Share (%), by Application 2025 & 2033

- Figure 75: South America Portable X-ray Devices Market Revenue (Million), by Modality 2025 & 2033

- Figure 76: South America Portable X-ray Devices Market Volume (K Unit), by Modality 2025 & 2033

- Figure 77: South America Portable X-ray Devices Market Revenue Share (%), by Modality 2025 & 2033

- Figure 78: South America Portable X-ray Devices Market Volume Share (%), by Modality 2025 & 2033

- Figure 79: South America Portable X-ray Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 80: South America Portable X-ray Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America Portable X-ray Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Portable X-ray Devices Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Portable X-ray Devices Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Portable X-ray Devices Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: Global Portable X-ray Devices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Portable X-ray Devices Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Portable X-ray Devices Market Revenue Million Forecast, by Modality 2020 & 2033

- Table 6: Global Portable X-ray Devices Market Volume K Unit Forecast, by Modality 2020 & 2033

- Table 7: Global Portable X-ray Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Portable X-ray Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Portable X-ray Devices Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Portable X-ray Devices Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 11: Global Portable X-ray Devices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Portable X-ray Devices Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Global Portable X-ray Devices Market Revenue Million Forecast, by Modality 2020 & 2033

- Table 14: Global Portable X-ray Devices Market Volume K Unit Forecast, by Modality 2020 & 2033

- Table 15: Global Portable X-ray Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Portable X-ray Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Portable X-ray Devices Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 24: Global Portable X-ray Devices Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 25: Global Portable X-ray Devices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Portable X-ray Devices Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Global Portable X-ray Devices Market Revenue Million Forecast, by Modality 2020 & 2033

- Table 28: Global Portable X-ray Devices Market Volume K Unit Forecast, by Modality 2020 & 2033

- Table 29: Global Portable X-ray Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Portable X-ray Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Portable X-ray Devices Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 44: Global Portable X-ray Devices Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 45: Global Portable X-ray Devices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 46: Global Portable X-ray Devices Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 47: Global Portable X-ray Devices Market Revenue Million Forecast, by Modality 2020 & 2033

- Table 48: Global Portable X-ray Devices Market Volume K Unit Forecast, by Modality 2020 & 2033

- Table 49: Global Portable X-ray Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Portable X-ray Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: India Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Australia Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Korea Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Portable X-ray Devices Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 64: Global Portable X-ray Devices Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 65: Global Portable X-ray Devices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 66: Global Portable X-ray Devices Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 67: Global Portable X-ray Devices Market Revenue Million Forecast, by Modality 2020 & 2033

- Table 68: Global Portable X-ray Devices Market Volume K Unit Forecast, by Modality 2020 & 2033

- Table 69: Global Portable X-ray Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Portable X-ray Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: GCC Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global Portable X-ray Devices Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 78: Global Portable X-ray Devices Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 79: Global Portable X-ray Devices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 80: Global Portable X-ray Devices Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 81: Global Portable X-ray Devices Market Revenue Million Forecast, by Modality 2020 & 2033

- Table 82: Global Portable X-ray Devices Market Volume K Unit Forecast, by Modality 2020 & 2033

- Table 83: Global Portable X-ray Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Global Portable X-ray Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Brazil Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Argentina Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Portable X-ray Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Portable X-ray Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Portable X-ray Devices Market?

The projected CAGR is approximately 9.18%.

2. Which companies are prominent players in the Portable X-ray Devices Market?

Key companies in the market include GE Healthcare, Canon Medical System, Carestream Health Inc, Siemens Healthineers AG, FUJIFILM Holdings Corporation, Koninklijke Philips NV, Envista Holdings Corporation (KaVo Dental GmbH), Shimadzu Corporations, MinXray.

3. What are the main segments of the Portable X-ray Devices Market?

The market segments include Technology, Application, Modality.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements; Growing Geriatric Population and Increasing Prevalence of Vascular Diseases; Huge Funding for R&D of Portable Technologies by Private Players and Governments.

6. What are the notable trends driving market growth?

Digital X-ray Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Scenario; High Risk of Radiation Exposure.

8. Can you provide examples of recent developments in the market?

July 2022: Fujifilm Europe launched a new hybrid C-arm and portable x-ray device. The device, called FDR Cross, is designed to offer high-quality fluoroscopic and static x-ray images during surgery and other medical procedures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Portable X-ray Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Portable X-ray Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Portable X-ray Devices Market?

To stay informed about further developments, trends, and reports in the Portable X-ray Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence